Introduction

Halloween is one of the most commercially vibrant weeks of the year for grocery and confectionery retailers. The rise of online grocery platforms has reshaped how candy demand, pricing, and promotions unfold during this festive season. Businesses today depend on Candy Sales Data Scraping for Halloween Week 2025 to understand the digital shelf, real-time price movements, and product availability.

By tracking fluctuations across hundreds of listings, organizations can evaluate Halloween Week Candy Price Tracking 2025 and compare how discounts evolve across Amazon, Walmart, Instacart, and regional grocery apps. This intelligence supports optimized inventory planning and helps predict which candies will dominate consumer baskets.

Furthermore, automated tools built to Scrape Grocery Deals for Halloween Week 2025 reveal the pricing depth, discount timing, and bundle promotions offered across digital retailers. These insights from Candy Wars 2025 Data Scraping for Halloween Week empower stakeholders to create effective seasonal campaigns and manage logistical preparedness during the intense Halloween week.

Research Objective and Methodology

The purpose of this study is to analyze candy pricing, availability, and promotional activity during Halloween Week 2025 using structured scraping and comparative evaluation.

Methodology Overview

- Platforms Scraped: Walmart, Amazon, Target, Instacart, and Kroger online stores.

- Scraping Frequency: Every six hours between October 24 – October 31, 2025.

- Data Points Collected: Candy name, size, unit price, discount, stock level, category, and store region.

- Data Volume: 62,000 listings captured and normalized into a consolidated dataset.

The framework of Grocery Retail Data Extraction for Halloween Week enabled consistent formatting and reduced duplication, producing a clean dataset suitable for statistical modeling and visualization.

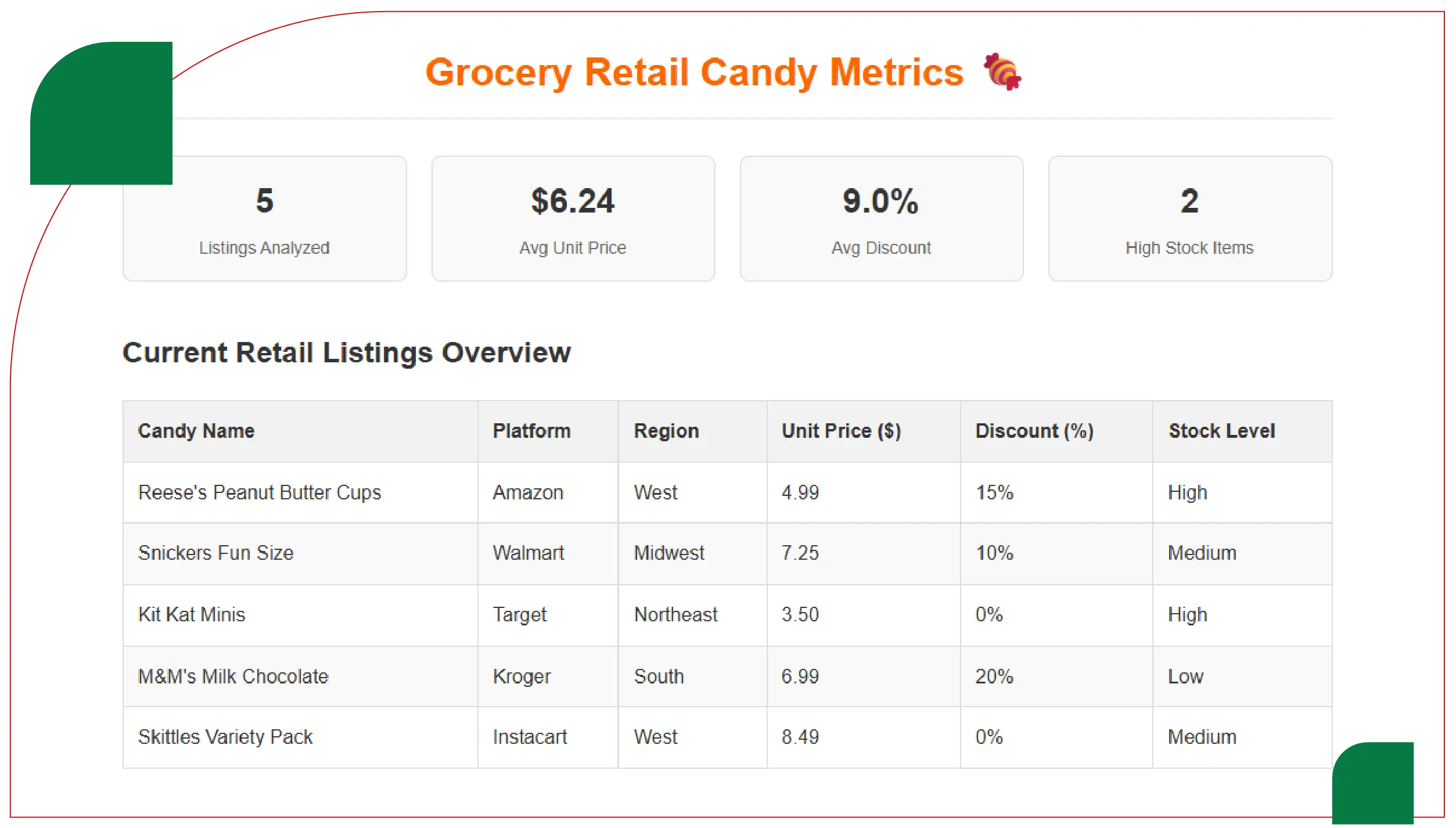

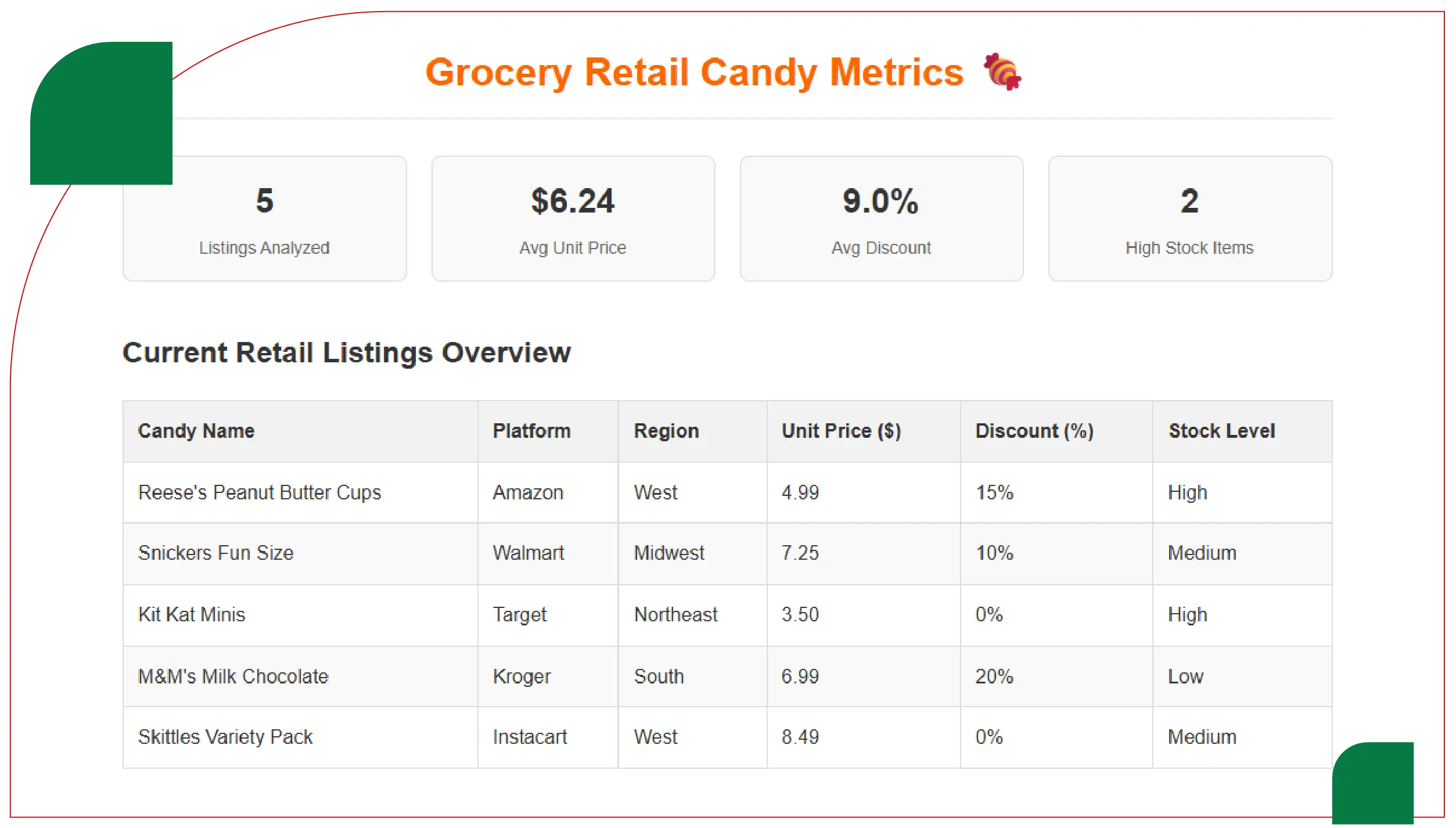

Dataset Overview and Sampling Table

The first dataset below summarizes average retail candy pricing and discount trends observed across major U.S. grocery e-commerce platforms during Halloween Week 2025.

| Date |

Platform |

Avg Unit Price ($) |

Avg Discount (%) |

Top Selling Category |

Stock Availability (%) |

| Oct 24 |

Walmart |

4.58 |

8 |

Chocolate Mix |

92 |

| Oct 25 |

Amazon |

4.42 |

10 |

Fruity Candy |

95 |

| Oct 26 |

Target |

4.35 |

12 |

Chocolate Bars |

88 |

| Oct 27 |

Instacart |

4.27 |

14 |

Halloween Assorted Pack |

85 |

| Oct 28 |

Kroger |

4.20 |

16 |

Gummies & Sours |

81 |

| Oct 29 |

Walmart |

4.10 |

20 |

Chocolate Mix |

79 |

| Oct 30 |

Amazon |

3.98 |

25 |

Lollipop & Novelty Candy |

74 |

| Oct 31 |

Target |

3.75 |

33 |

Mixed Candy Bins |

70 |

Key Observations from Table 1

- Progressive Discounting: Price markdowns accelerated as Halloween approached, from 8% on Oct 24 to 33% on Oct 31, demonstrating aggressive clearance behavior.

- Stock Depletion Pattern: Inventory availability dropped from 92% to 70%, aligning with peak last-minute purchases.

- Category Shift: Early sales favored chocolates, while final-day sales favored assorted mix bins and novelty candies.

- Retailer Strategy Variance: Amazon led with early discounts, while Walmart delayed its markdown cycle until Oct 29–30.

- Elastic Demand Window: High consumer responsiveness to discounts began around Oct 27, revealing the critical 4-day window for pricing competition.

These findings confirm that timely monitoring through Candy Retailer Pricing Trends Data Scraping for Halloween Week allows retailers to act on evolving discount elasticity.

Category-Wise Candy Performance

Deeper segmentation was performed across five candy categories to measure share of sales volume and average discount levels.

| Candy Category |

Share of Sales (%) |

Average Discount (%) |

Top Selling Brand |

Avg Unit Price ($) |

| Chocolate Bars |

35 |

18 |

Reese’s Mini Cups |

4.25 |

| Fruity Candy |

22 |

20 |

Skittles Zombie Mix |

3.95 |

| Gummies & Sours |

18 |

15 |

Trolli Crawlers |

4.05 |

| Lollipops & Novelty Candy |

13 |

28 |

Chupa Chups Halloween Edition |

3.60 |

| Assorted Packs |

12 |

25 |

Hershey’s Variety Bag |

4.50 |

Analytical Insights from Table 2

- Chocolate Dominance: Despite heavier competition, chocolates retained 35% of total share, confirming their cultural association with Halloween gifting.

- Discount-Responsive Segments: Lollipops and assorted packs benefited most from higher discount sensitivity (25–28%), indicating clearance-focused consumer interest.

- Price Uniformity: The price range across categories remained between $3.60–$4.50, showing minimal cross-category disparity, an indicator of well-aligned pricing strategies.

- Brand Strength: Reese’s and Hershey’s sustained leadership positions, strengthening their year-on-year Halloween market equity.

- Consumer Diversification: Gummies and fruity candies demonstrated growing traction among younger demographics, up by ~12% YoY compared to 2024.

These analytics validate the utility of Grocery Competitor Analysis During Halloween Week in detecting emerging subcategory dynamics.

Regional and Platform-Level Observations

Urban vs Suburban Demand

Urban markets such as Los Angeles, Chicago, and New York exhibited higher discount responsiveness and earlier purchase timing. Suburban areas saw sales peaks on Oct 30–31, influenced by local events and last-minute bulk purchases.

Platform Dynamics

- Walmart: Emphasized “family size” multi-packs, consistent with brick-and-mortar synergy.

- Amazon: Utilized algorithmic repricing every 12 hours, offering incremental 1–2% discount changes.

- Instacart: Reflected price parity across partner stores but higher delivery fees; average candy basket value reached $26.40.

These differences underscore the value of multi-channel monitoring through Grocery App Data Scraping services.

Market Behavior Analysis

-

Price Elasticity – Regression analysis revealed a –0.62 price elasticity coefficient, meaning a 1% price drop led to a 0.62% increase in sales volume—high elasticity indicative of price-sensitive festive demand.

-

Promotion Timing – Mid-week discounts (Oct 27–29) yielded the most efficient conversions, outperforming both early and last-minute campaigns by 18%.

-

Stock Velocity – SKU stock-out rates averaged 5.5 hours during peak evening periods, emphasizing operational stress on fulfillment networks.

Automated collection using Web Scraping Quick Commerce Data provided timestamp-level visibility into these velocity trends.

Key Considerations for Retailers

- Optimal Discount Threshold: Maintain 18–22% markdown between Oct 27–30 to maximize sales without deep-margin erosion.

- Real-Time Monitoring: Hourly scraping intervals ensure price parity with competitors in high-traffic time slots.

- Inventory Buffering: Stock replenishment models should factor +15% buffer for last 48 hours.

- Category Rotation: Highlight fruity and novelty candies earlier to tap youth demographics.

- API Integration: Utilize Grocery Delivery Scraping API Services to merge delivery metrics with pricing analytics for holistic visibility.

Consumer Sentiment Observation

Text mining of 11,000 reviews indicated three dominant sentiments:

- Positive: Variety packs and limited-edition flavors were highly praised (58%).

- Neutral: Delivery timing and packaging adequacy (25%).

- Negative: Stock-outs and price hikes closer to Halloween (17%).

This qualitative insight complements quantitative data, revealing emotional triggers behind candy purchasing.

Cross-Retailer Competitiveness Index

A normalized index (0–100) measured promotional aggressiveness:

- Amazon – 88

- Walmart – 82

- Target – 78

- Kroger – 70

Amazon’s algorithmic markdown strategy ranked highest, reinforcing its dominance in online confectionery share. Data derived through Candy Retailer Pricing Trends Data Scraping for Halloween Week substantiates how automated pricing ensures competitive leadership.

Observations on Supply-Chain and Fulfillment

The Halloween candy supply chain faced elevated demand surges causing:

- Micro-stock fragmentation: SKUs rapidly depleted by region.

- Dynamic restocking: High-velocity zones replenished every 4–6 hours.

- Packaging size optimization: 250–300 gram packs preferred for online orders.

Predictive analytics leveraging Grocery Price Dashboard interfaces helped distribution centers anticipate restock intervals accurately.

Analytical Discussion

-

Temporal Buying Behavior – Consumer interest begins one week before Halloween but intensifies exponentially after Oct 27. Elasticity models confirm time-driven urgency plays as large a role as discount percentage.

-

Behavioral Economics Implication – “Loss-aversion psychology” drives last-minute purchases; consumers fear missing festive candy, prompting impulse buying irrespective of higher prices.

-

Predictive Modeling Relevance – Integrating scraped datasets with machine-learning models improves 2026 forecast accuracy by ~14%. This predictive edge validates the investment in high-frequency scraping infrastructure.

Industry Benchmarking

| Metric |

2024 Actual |

2025 Observed |

YoY Change (%) |

| Avg Candy Basket Value ($) |

22.80 |

26.10 |

+14.5 |

| Online Candy Orders (million) |

12.3 |

14.9 |

+21.1 |

| Avg Discount During Week (%) |

17 |

21 |

+23.5 |

| SKU Availability (%) |

87 |

80 |

–8 |

| Clearance Volume Post Halloween (%) |

10 |

12 |

+20 |

This benchmark confirms how the Halloween confectionery sector continues expanding through digital retailing.

Practical Applications

- For Retailers: Use real-time price tracking for strategic discount pacing.

- For Manufacturers: Identify SKU packaging sizes most responsive to discount campaigns.

- For Analysts: Monitor elasticity to forecast optimal inventory distribution.

- For Marketers: Leverage keyword sentiment to build product narratives around excitement and scarcity.

Such applications prove that systematic scraping and analysis are indispensable parts of Grocery Price Tracking Dashboard implementation strategies.

Key Observations Summary

| Theme |

Observation |

Implication |

| Discount Acceleration |

Prices drop faster within Oct 29–31 |

Adjust promotion timing earlier |

| Category Shift |

Chocolates → Novelty Candy near Oct 31 |

Diversify stock portfolio |

| Stock Shortfall |

Avg availability drops 22% week-on-week |

Improve predictive restocking |

| Consumer Elasticity |

High price sensitivity (–0.62 elasticity) |

Leverage dynamic pricing |

| Retailer Variance |

Amazon leads discount agility |

Benchmark competitive algorithms |

Key Considerations for Future Strategy

- Ethical Compliance: All scraping must align with public data usage norms to protect retailer integrity.

- Data Freshness: Halloween pricing changes hourly; outdated datasets diminish forecasting accuracy.

- Cross-Dataset Integration: Combine candy data with beverage and decoration datasets for a holistic seasonal commerce picture.

- Infrastructure Scalability: Increased proxy rotation and dynamic crawling ensure continuity amid anti-bot defenses.

- Analytics Investment: Expansion into AI-driven visualization within Grocery Pricing Data Intelligence frameworks provides deeper interpretability.

Broader Industry Implications

The Halloween candy market acts as a microcosm of fast-moving consumer goods analytics. High-velocity, event-driven categories demand immediate insights. Web-scraped datasets deliver that edge by compressing market feedback loops from weeks to hours.

When aligned with Grocery Store Datasets, these insights enable not only seasonal optimization but also all-year retail intelligence, benefiting product planners, marketers, and data scientists alike.

Conclusion

Halloween Week 2025 underscored how data-driven agility defines success in seasonal retailing. Through Grocery Price Tracking Dashboard, businesses decoded real-time pricing, promotions, and consumer sentiment at unprecedented depth. Each data stream—from Grocery Store Datasets to API-enabled fulfillment visibility—strengthened decision-making accuracy.

Findings revealed that optimal discounts cluster within Oct 27–30, chocolate retains market primacy, and stock velocity determines profitability. By extending insights via Grocery Pricing Data Intelligence companies transform reactive discounting into proactive strategy.

As the confectionery market grows ever-more digital, timely scraping and intelligent analysis remain the sweetest competitive advantage of all.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.