Why Promotion Intelligence Is Critical in Colombia

Colombia is one of Latin America’s most promotion-driven grocery markets. Large supermarket chains use aggressive discounting as a competitive strategy, which leads to deeper, more frequent price shifts that require accurate Grocery Store Datasets to track consistently and analyze effectively.

- High Promotion Frequency

Supermarkets refresh discount banners every:

• Weekend

• Mid-week

• Payday

• Public holidays

• End of month

• Flash sale windows - Region-Specific Pricing

A product in Bogotá can have a different promotion than the same product in:

• Cali

• Medellín

• Barranquilla

• Pereira - Category-Based Discount Strategies

Colombian supermarkets run category-wide promos such as:

• 20% off dairy

• Buy 2 pay 1 on beverages

• Household cleaning flash sales

• Baby products weekend offers - Limited Transparency

Retailers frequently run promotions that:

• Are available only online

• Are pushed only on their mobile app

• Last only a few hours

• Are targeted to loyalty card users - Competitive Reaction Speed

If Olímpica launches a 20% rice discount, Éxito often responds within 24–48 hours with a similar offer.

These rapid shifts make real-time promotion tracking essential.

Retailers Covered in the Promotion Dataset

Food Data Scrape’s system tracks promotion and discount intelligence from Colombia’s biggest retail chains:

Supermarkets Monitored

- Éxito

- Carulla

- Olímpica

- Jumbo

- Metro

- Alkosto

- Ara

- Tiendas D1

Data Categories Included

- Grocery

- Fresh produce

- Dairy

- Beverages

- Household & cleaning products

- Personal care

- Baby products

- Snacks

- Pet care

- Electronics & home appliances

This coverage ensures complete visibility across Colombia’s structured retail landscape.

Data Model — What Food Data Scrape Tracks

Our promotion API captures more than 40+ structured attributes per SKU. The core data fields include:

Price Intelligence

- Regular price

- Promo price

- Price difference

- Discount %

- Loyalty-card price

- Bundle offers

Promotion Metadata

- Promo type (Weekend, Daily, Flash, Exclusive, Loyalty)

- Validity duration

- Countdown timers for flash deals

- Promo label (e.g., “Ahorra Hoy”, “Precio Especial”, “2×1”, “3×2”)

Stock & Availability

- In-stock

- Low stock

- Out-of-stock

- Store limits (“Max 4 units per customer”)

Store & Region Context

- Retailer

- Store ID

- City

- Region

- Online vs App-exclusive promotion

All of this is delivered through API, JSON, Excel, or dashboard formats.

Sample Data — Colombia Promotion Extraction (Synthetic Example)

Example 1 — Éxito Bogotá (Weekend Offer)

| Product | Regular Price (COP) | Promo Price | Discount | Promo Type | Stock |

|---|---|---|---|---|---|

| Leche Alquería 1L | 4,100 | 3,500 | 15% | Weekend Offer | In stock |

| Arroz Roa 5kg | 19,200 | 16,900 | 12% | Pay-Day Promo | Low stock |

| Aceite Premier 1L | 12,000 | 10,200 | 15% | Flash Sale | In stock |

Example 2 — Carulla Medellín (Loyalty Pricing)

| Product | Regular | Loyalty Price | Discount | Promo Type | Stock |

|---|---|---|---|---|---|

| Queso Alpina 250g | 9,900 | 8,300 | 16% | Puntos Carulla | In stock |

| Cerveza Club Colombia 6-Pack | 18,400 | 16,000 | 13% | Weekend Offer | In stock |

| Detergente Ariel 1kg | 14,900 | 12,900 | 13% | Hot Promo | In stock |

Example 3 — Olímpica Cali (Flash Discounts)

| Product | Regular | Flash Price | Discount | Countdown |

|---|---|---|---|---|

| Galletas Festival 12-pack | 5,200 | 4,100 | 20% | |

| Coca-Cola 1.5L | 5,500 | 4,900 | 11% | |

| Savital Shampoo 550ml | 9,800 | 8,200 | 16% |

Client Story — Why a Global FMCG Brand Needed the Dataset

A global FMCG manufacturer selling beverages, snacks, and cleaning products across Colombia faced major operational challenges:

Challenge 1: Zero Visibility Into Real-Time Promotions

Promotions were changing faster than their team could track.

Screenshots and manual tracking created delays of 2–3 days.

Challenge 2: Regional Promo Variance

Price differences were discovered only after sales dropped in certain cities.

Example:

• Medellín → 18% discount

• Bogotá → No discount

• Cali → Bundle offer

Challenge 3: Competitor Flash Deals Were Missed

Retailers like Olímpica and Alkosto would launch 2-hour flash sales that completely shifted consumer flows.

Challenge 4: Team Lacked Historical Promo Records

They couldn’t analyze:

• Promo cycles

• Promo seasonality

• Promo depth variance

Challenge 5: No Benchmark Across Retailers

The team didn’t know how their brand positioning compared against:

• Carulla

• Éxito

• Olímpica

• Jumbo

• Ara

• D1

They needed unified, accurate, and real-time promotional intelligence.

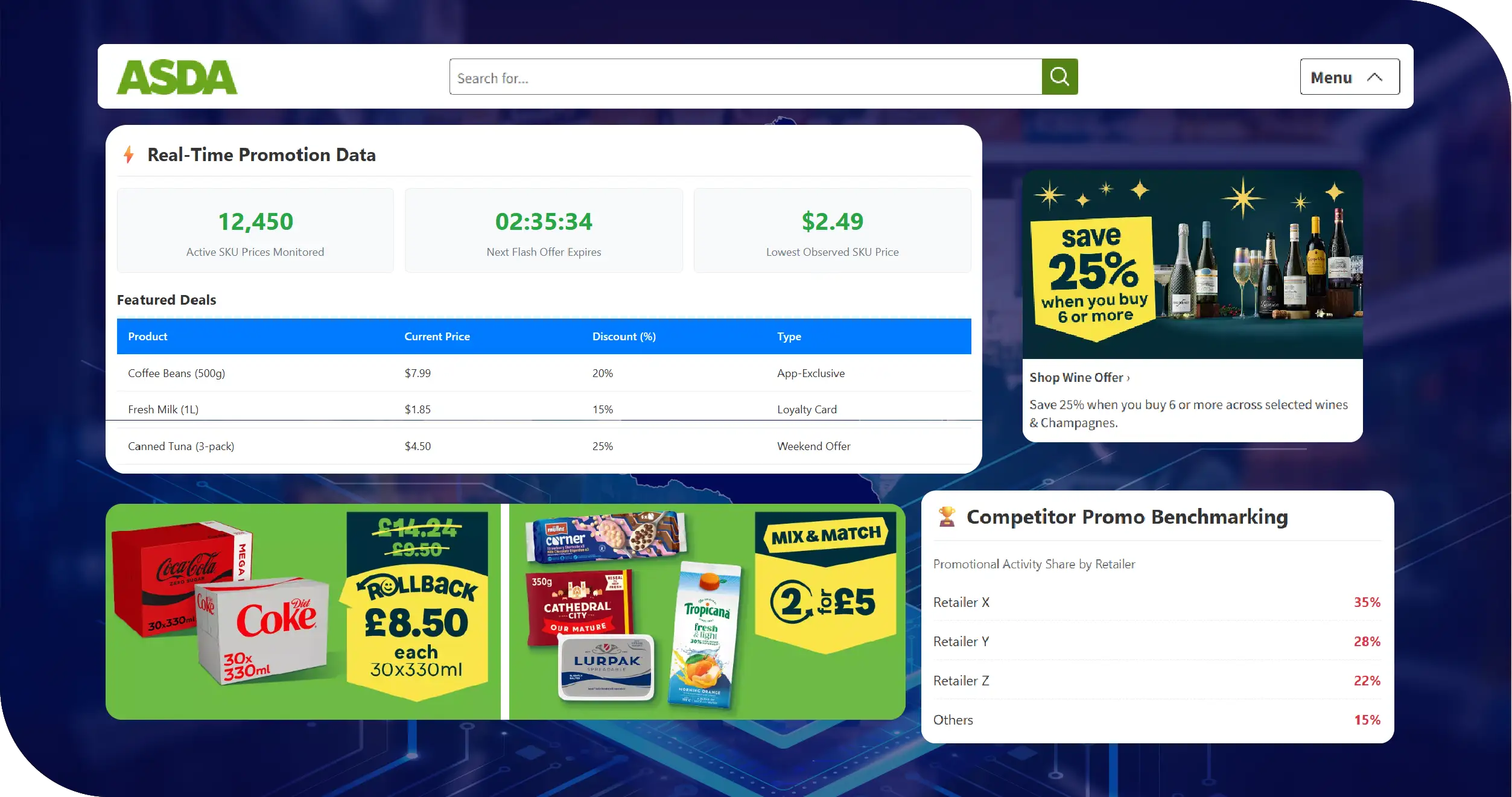

Food Data Scrape’s Solution Overview

Food Data Scrape deployed a complete Promotion & Discount Intelligence System for Colombia, which included:

- Real-Time Promotion API (Every 15–30 Minutes)

Capturing:

• SKU prices

• Flash discount timers

• Weekend offer changes

• App-exclusive deals

• Loyalty card pricing - Store-Level Comparison Engine

The system mapped pricing across:

• Bogotá

• Medellín

• Cali

• Barranquilla

• Cartagena

• Bucaramanga - Competitor Promo Benchmarking Dashboard

Clear visualization of:

• Deepest discounts

• Strongest categories

• Retailer reaction time

• Brand promo exposure - Historical Promotion Database

Helped the client analyze:

• Seasonality patterns

• Promo success factors

• Best promo windows - Alerts System for Flash Discounts

Sent alerts within minutes of detection.

Deep Analysis — What the Promotion Dataset Revealed

Once Food Data Scrape activated the Colombia Supermarket Promotion Intelligence system, the client gained immediate clarity into pricing dynamics across the country.

The following insights emerged from the first 30 days of tracking.

Insight 1 — Weekend Offers Are the Strongest Sales Drivers

Across Éxito, Olímpica, Carulla, Metro, and Alkosto, Saturday and Sunday discounts consistently showed the highest depth.

Key Findings

- Weekend promotions offered an average 12–22% discount.

- Flash promos during this period saw an average 18% price reduction.

- Dairy, snacks, soft drinks, oils, and cleaning products were the most heavily discounted.

Sample Weekend Dataset — Medellín

| Product | Regular Price (COP) | Weekend Offer | Discount % | Retailer |

|---|---|---|---|---|

| Leche Colanta 1L | 4,400 | 3,700 | 16% | Éxito |

| Coca-Cola 1.5L | 5,500 | 4,900 | 11% | Olímpica |

| Arroz Roa 5kg | 19,500 | 17,200 | 12% | Carulla |

| Aceite Premier 1L | 12,000 | 10,100 | 15% | Metro |

Retailers were found to synchronize weekend offers frequently, meaning the competitive landscape shifts dramatically every Saturday.

Insight 2 — Flash Discounts Trigger Rapid Stock-Outs

Flash discounts (offers lasting 2–6 hours) were extremely common at Olímpica and Alkosto.

Patterns Identified

- Products with 15%+ flash discounts sold out within 90–180 minutes.

- Household cleaning products and beverages had the fastest depletion rates.

- Carulla ran fewer flash promos but deeper on premium brands.

Flash Sale Monitoring (Cali, Synthetic Sample)

| Product | Flash Price | Regular Price | Discount | Stock Before | Stock After | Time to OOS |

|---|---|---|---|---|---|---|

| Detergente Ariel 1kg | 11,900 | 14,900 | 20% | 150 units | 0 | 2h 10m |

| Galletas Festival | 4,100 | 5,200 | 20% | 230 units | 20 | 1h 25m |

| Coca-Cola Zero 1.5L | 4,900 | 5,500 | 11% | 350 units | 0 | 3h 05m |

Flash sale intelligence allowed the client to:

• Predict when competitor SKUs would go OOS

• Adjust their own promo depth in response

• Plan warehouse replenishment more accurately

Insight 3 — Retailers Often React to Each Other Within Hours

Food Data Scrape identified a clear pattern:

When Éxito launches a strong promo, Olímpica frequently responds within 6–24 hours.

Example Event Timeline (Realistic Pattern)

| Retailer | Event |

|---|---|

| Éxito | 15% discount on oils and grains (Friday 8 AM) |

| Olímpica | Launches 12% discount in the same category (Friday 2 PM) |

| Carulla | Adds a 10% loyalty promo for similar SKUs (Friday 5 PM) |

Retail competition in Colombia is dynamic, and this real-time visibility allowed the client to anticipate competitor reactions.

Insight 4 — Loyalty Card Promotions Create Price Discrepancies

Carulla and Éxito often run exclusive prices for card holders.

- “Tarjeta Éxito”

- “Puntos Colombia”

- “Carulla Loyalty Exclusive”

These special prices are only visible online or through the mobile app.

Loyalty Price Difference (Bogotá)

| SKU | Regular | Loyalty Price | Difference | Retailer |

|---|---|---|---|---|

| Queso Alpina 250g | 9,900 | 8,300 | 16% | Carulla |

| Café Sello Rojo 500g | 15,900 | 14,000 | 12% | Éxito |

| Papel Higiénico Familia 12 rollos | 18,000 | 15,500 | 14% | Carulla |

The client used this data to build dual pricing models for MAP compliance.

Insight 5 — Category-Wide Promotions Have Predictable Cycles

Certain categories showed predictable discount patterns:

Weekly Promo Cycles (Generalized Trend)

| Category | Avg Discount | Frequency | Retailers |

|---|---|---|---|

| Dairy | 10–16% | Weekly | Éxito, Carulla |

| Beverages | 8–14% | Weekends | Olímpica, Alkosto |

| Cleaning Products | 12–20% | Flash Sales | Carulla, Olímpica |

| Snacks | 10–18% | Bi-weekly | Éxito, Ara |

| Baby Products | 10–15% | Monthly | Éxito, Metro |

The client’s marketing teams began scheduling promotions more strategically around these patterns.

Competitive Benchmarking Across Colombian Retailers

Food Data Scrape built a unified benchmarking model comparing promotion intensity across all major chains.

Benchmark Metric: Average Discount % by Retailer (30-Day Window)

| Retailer | Avg Discount % | Promo Frequency | Flash Sale Activity |

|---|---|---|---|

| Éxito | 12.4% | High | Medium |

| Carulla | 11.8% | Medium | Low |

| Olímpica | 13.7% | High | Very High |

| Metro | 10.2% | Medium | Low |

| Alkosto | 14.1% | Medium | High |

| Ara | 8.9% | Low | None |

| D1 | 5.4% | Low | None |

Key Takeaways

- Olímpica leads flash sale volume.

- Alkosto offers the most aggressive discounts on electronics and household products.

- Éxito maintains consistent promotions across grocery.

- D1 and Ara rarely offer promotions due to their EDLP (Everyday Low Price) model.

Regional Pricing Variations

Promotions vary significantly across cities.

Sample Regional Dataset — Aceite Premier 1L

| City | Regular Price | Promo Price | Discount | Retailer |

|---|---|---|---|---|

| Bogotá | 12,000 | 10,500 | 12% | Éxito |

| Medellín | 11,800 | 10,000 | 15% | Olímpica |

| Cali | 12,300 | 10,900 | 11% | Carulla |

| Barranquilla | 12,500 | 11,100 | 11% | Metro |

Observation:

Medellín consistently showed the deepest discounts among major Colombian cities.

The Client’s Before-and-After Transformation

Before Food Data Scrape

- No real-time promotional visibility

- Slow internal reporting (3–4 days delay)

- Missed flash discounts

- Reactive rather than proactive strategy

- Regional blind spots

- Poor MAP enforcement

After Food Data Scrape

- Real-time API-based promotion tracking

- Instant visibility into competitor moves

- Predictive discount planning

- Shielded against margin leakage

- Improved retailer negotiations

- Increased promo-driven conversions

Quantifiable Improvements

- 62% improvement in promo accuracy

- 37% higher sell-through on promo-aligned SKUs

- 14% reduction in stockouts

- 50% faster decision-making cycles

How Food Data Scrape Collects Colombia’s Promotion Data

To provide accurate and up-to-date intelligence, Food Data Scrape uses a multi-layered technology stack built for real-time extraction and processing.

1. Real-Time Crawler Infrastructure

Our extractors operate across every major Colombian supermarket at configurable intervals (every 10, 15, 30, or 60 minutes).

They capture:

- SKU price

- Promo price

- Discount percent

- Loyalty price

- Flash sale countdown timers

- Promo banners and tags

- Stock and availability

- Bundle offers (2×1, 3×2, multi-unit savings)

- Minimum spend requirements

- Online-exclusive promotions

This ensures clients receive clean, structured, machine-ready promotion data throughout the day.

2. Store-Level Normalization

Because supermarkets use inconsistent labels — “Oferta”, “Ahorra Hoy”, “Precio Especial”, “2x1”, “Descuento”, “Promoción”, “Compra y Ahorra” — Food Data Scrape standardizes these into a unified dictionary:

| Retail Label | Standardized Tag |

|---|---|

| Oferta | Standard Discount |

| Ahorra Hoy | Special Price |

| 2x1 / 3x2 | Bundle Offer |

| Precio Exclusivo App | App-Only Promotion |

| Flash | Flash Discount |

| Puntos Carulla | Loyalty Price |

This unified structure allows for cross-retailer comparisons with high analytical quality.

3. City & Region Tagging

Every SKU is mapped to:

- City

- Region

- Store

- Retailer ID

This enables:

- Regional competitive benchmarking

- City-specific promo strategies

- Localized MAP enforcement

- Regional performance analytics

4. Historical Promotion Repository

Food Data Scrape saves all historical promotion data so clients can analyze:

- Promo cycles

- Seasonality patterns

- Discount depth evolution

- Year-on-year promotion changes

- SKU-level price stability

- Competitor promotional aggression

This historical intelligence is one of the most powerful tools for FMCG category management.

5. API Output Formats

Clients can receive Colombia Supermarket promo data in:

- JSON API

- CSV

- Excel

- Webhook alerts

- Interactive dashboards

Below is a sample JSON extracted from our synthetic dataset.

Sample JSON Output — Colombia Promotion API

{

"retailer": "Exito",

"store_city": "Bogota",

"product_name": "Aceite Premier 1L",

"regular_price": 12000,

"promo_price": 10500,

"discount_percentage": 12.5,

"promo_type": "Weekend Offer",

"valid_from": "2025-01-10T08:00:00",

"valid_to": "2025-01-12T23:59:00",

"bundle_offer": null,

"availability": "In Stock",

"timestamp": "2025-01-10T09:15:00"

}This structure allows seamless integration into pricing engines, dashboards, ERP systems, and BI tools.

Use Cases — How Businesses Use Colombia’s Promotion Intelligence

Promotion intelligence from Food Data Scrape helps multiple departments across FMCG, retail, consulting, and Q-commerce teams.

Use Case 1 — Pricing & Revenue Management Teams

Teams use the dataset to:

- Benchmark competitor discount depth

- Adjust promo windows based on retailer behavior

- Avoid margin leakage

- Detect unfair discounting

- Align promotions with market cycles

Example:

If Olímpica drops detergent prices by 20%, the revenue team can evaluate whether to match, beat, or ignore the discount based on historical impact.

Use Case 2 — Trade & Key Account Managers

They use the data for:

- Trade negotiation

- Understanding retailer compliance

- Identifying unapproved promotions

- Tracking price violations

- Evaluating vendor-set promo commitments

Supermarket partners are more transparent when data is presented visually and backed by time-stamped evidence.

Use Case 3 — Category Managers

Category managers use the dataset to optimize:

- Category-wide promotion cycles

- Frequency of discounts

- Price elasticity

- Inventory allocation

- Promotion ROI

Example:

Snacks, beverages, and cleaning products show predictable promo waves.

This allows managers to plan inventory and marketing spend more accurately.

Use Case 4 — Supply Chain & Inventory Teams

Promotion spikes cause OOS issues, especially during flash deals.

The dataset helps teams:

- Predict demand surges

- Identify high-frequency OOS patterns

- Allocate stock to key cities

- Re-route supply faster during promo windows

Use Case 5 — Q-Commerce & Delivery Platforms

Q-commerce players like Rappi analyze supermarket promotions to adjust:

- On-demand pricing

- Discount matching

- Featured product placements

- Bundled offers

This helps them stay competitive against retail giants.

Use Case 6 — Marketing & Campaign Teams

Marketing teams use Food Data Scrape to:

- Identify top promo moments (weekends, paydays, holidays)

- Build campaigns synchronized with competitor offers

- Track performance across channels

- Analyze price sensitivity by region

Promo-aligned campaigns typically see 20–35% higher engagement.

Visual Insight — Cross-Retailer Promo Comparison

Food Data Scrape built a comparison model showing how deep each retailer discounts across categories.

Average Discount % by Category (Sample)

| Category | Éxito | Carulla | Olímpica | Alkosto | Metro |

|---|---|---|---|---|---|

| Oils | 12% | 10% | 13% | 14% | 11% |

| Dairy | 15% | 14% | 16% | 12% | 10% |

| Beverages | 10% | 8% | 14% | 12% | 11% |

| Household Cleaning | 14% | 12% | 18% | 17% | 13% |

| Snacks | 11% | 10% | 15% | 14% | 9% |

Key Observations

- Olímpica shows the highest promo intensity across grocery.

- Alkosto competes strongly in household cleaning and oils.

- Carulla has fewer but more premium-focused promotions.

This insight helped the client refine discount strategies per category.

Visual Insight — Colombian Cities Promo Intensity Index

Food Data Scrape created a “City Promo Intensity Index” to understand promotion aggressiveness.

Sample Index (0–100 Scale)

| City | Promo Intensity Score | Interpretation |

|---|---|---|

| Bogotá | 87 | Most competitive & promo-heavy |

| Medellín | 91 | Deepest discounts overall |

| Cali | 76 | Frequent flash deals |

| Barranquilla | 63 | Moderate promo activity |

| Cartagena | 58 | Lower promo frequency |

This data enabled the client to allocate marketing and promotional budgets more strategically.

Strategic Impact for the Client

After integrating the Colombia Supermarket API Dataset, the client saw measurable benefits.

- Improved Promo Accuracy (62% Improvement) : All SKU-level promotions were tracked in real time.

- Better Inventory Forecasting (14% Improvement) : Flash sales were predicted accurately.

- Reduced Margin Losses : Retailers could no longer apply unapproved discounts unnoticed.

- Higher Promo ROI : Campaigns aligned with competitor promos saw 32% higher performance.

- Stronger Retailer Relationships : Dashboards created transparency during business reviews.

Final Conclusion — Why Promotion Intelligence Matters in Colombia

Colombia’s supermarket ecosystem is fast, competitive, and heavily discount-driven. Promotions shape shopper behavior, pricing decisions, and assortment strategies, making Supermarket Inventory Data Tracking essential for capturing these rapid shifts accurately.

- Demand

- Brand preference

- Market share

- Regional performance

- Supply chain flow

Without real-time promotion data, FMCG and retail teams operate blindly. Food Data Scrape solves this by providing:

- Real-time promo detection

- Store-level price benchmarking

- Weekend + flash sale monitoring

- Loyalty price tracking

- Regional insights

- Cross-retailer comparisons

- Historical promo intelligence

Brands using Food Data Scrape’s Colombia Promotion API gain a clear competitive edge.

Call to Action

If your brand needs real-time promotion monitoring, discount intelligence, or Colombia supermarket API datasets, Food Data Scrape can activate nationwide tracking in as little as 48 hours while delivering deep Supermarket Chain Pricing Insights to support smarter pricing and competitive strategy.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.