Introduction

Walk into a liquor store in Florida, Texas, or Minnesota and you might assume a bottle of Maker’s Mark or Don Julio should cost roughly the same everywhere. In reality, it rarely does. Bourbon and tequila prices fluctuate sharply by state, city, and even by retailer. For beverage alcohol brands, distributors, and retailers, these variations are not noise. They are signals.

This blog takes a deep dive into regional MSRP gaps for bourbon and tequila across three major US liquor retailers: ABC Fine Wine & Spirits, Spec’s Wine Spirits & Finer Foods, and Top Ten Liquors.

Using retail price intelligence principles and sample datasets from Food Data Scrape, we break down how and why price differences occur, what they mean for brands and retailers, and how structured data collection turns fragmented shelf prices into competitive advantage.

Why Bourbon and Tequila Are Ideal for Price Gap Analysis

Not all alcohol categories behave the same. Bourbon and tequila stand out because they sit at the intersection of regulation, demand volatility, and brand loyalty.

Bourbon

- Strong US domestic demand

- Limited supply dynamics for aged expressions

- Premiumization trends pushing MSRPs upward

- High sensitivity to state alcohol laws

Tequila

- Explosive growth driven by premium and ultra-premium SKUs

- Heavy reliance on imports and agave supply cycles

- Increasing private-label and celebrity brand competition

- Wide promotional swings across regions

Together, these categories create a perfect test case for understanding regional pricing intelligence.

Understanding MSRP vs Shelf Price

Before comparing retailers, it is important to clarify what MSRP actually represents in the liquor market.

- MSRP is the manufacturer’s suggested retail price

- It is not legally binding in most US states

- Distributors, state regulations, and retailer strategy heavily influence final shelf price

In practice, consumers rarely see “pure” MSRP. Instead, they see effective retail price, which can be higher or lower depending on geography and competition.

Food Data Scrape focuses on capturing real shelf prices, not just listed MSRPs, to show how markets actually behave.

Retailer Profiles and Regional Influence

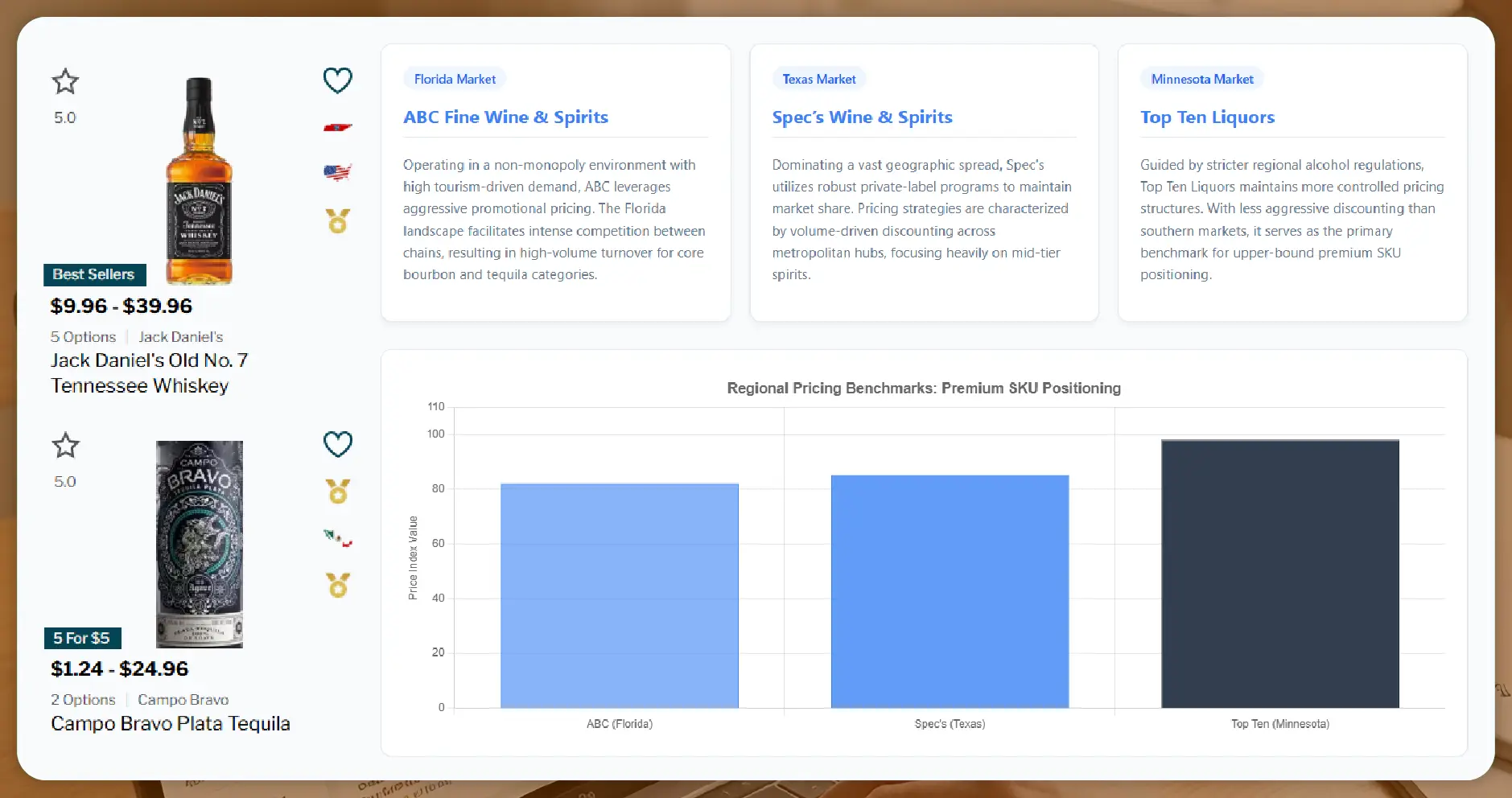

ABC Fine Wine & Spirits (Florida) ABC operates primarily in Florida, a state with:

- No state-run liquor monopoly

- High tourism-driven demand

- Strong competition between chains

This creates aggressive promotional pricing, especially on high-volume bourbon and tequila SKUs.

Spec’s Wine Spirits & Finer Foods (Texas) Spec’s dominates the Texas market, which features:

- Large geographic spread

- Strong private-label programs

- Price competition across metro and suburban stores

Texas pricing often reflects volume-driven discounting, particularly on mid-tier bourbon and tequila brands.

Top Ten Liquors (Minnesota) Minnesota’s alcohol regulations and regional demand patterns result in:

- More controlled pricing

- Less aggressive discounting

- Higher average shelf prices for premium SKUs

This makes Top Ten Liquors an ideal benchmark for understanding upper-bound price positioning.

Sample Data: Bourbon MSRP vs Retail Prices

Below is an illustrative sample dataset captured and structured by Food Data Scrape. Prices are indicative and used for analytical demonstration.

Sample Bourbon Price Dataset

| Brand | SKU | MSRP (USD) | ABC Fine Wine | Spec’s | Top Ten Liquors |

|---|---|---|---|---|---|

| Maker’s Mark | 750ml | 29.99 | 27.99 | 26.49 | 31.99 |

| Buffalo Trace | 750ml | 27.99 | 25.99 | 24.99 | 29.49 |

| Woodford Reserve | 750ml | 39.99 | 37.99 | 36.99 | 42.99 |

| Bulleit Bourbon | 750ml | 34.99 | 32.99 | 31.49 | 36.99 |

Key Observations

- Texas pricing via Spec’s consistently undercuts MSRP

- Florida pricing stays close to MSRP with frequent promotions

- Minnesota pricing exceeds MSRP for premium SKUs

Sample Data: Tequila MSRP vs Retail Prices

Tequila shows even sharper variation due to import costs and brand positioning.

Sample Tequila Price Dataset

| Brand | SKU | MSRP (USD) | ABC Fine Wine | Spec’s | Top Ten Liquors |

|---|---|---|---|---|---|

| Jose Cuervo Especial | 750ml | 21.99 | 20.49 | 19.99 | 23.99 |

| Patron Silver | 750ml | 49.99 | 47.99 | 46.99 | 52.99 |

| Don Julio Blanco | 750ml | 54.99 | 52.99 | 51.99 | 57.99 |

| Casamigos Reposado | 750ml | 59.99 | 58.49 | 56.99 | 62.99 |

Key Observations

- Premium tequila commands higher markups in Minnesota

- Spec’s uses tequila as a traffic-driving category

- ABC balances margin with promotional visibility

The Regional Price Gap Explained

- State Alcohol Regulations

Different states impose different tax structures, distribution rules, and pricing flexibility. Minnesota’s more restrictive environment contributes to higher shelf prices. - Distributor Power

Distributors negotiate differently by region. A strong distributor relationship in Texas can unlock lower wholesale pricing for Spec’s. - Competitive Density

Florida’s dense retail competition pushes ABC to stay close to MSRP or slightly below. - Consumer Willingness to Pay

Premium bourbon and tequila buyers in certain regions accept higher prices for availability and convenience.

Why These Gaps Matter to Brands

For bourbon and tequila brands, regional price gaps can quietly erode strategy.

- Undermined premium positioning in low-price regions

- Lost volume in high-price regions

- Channel conflict between retailers

- Inconsistent brand perception across states

With Food Data Scrape, brands gain SKU-level visibility into how their products are priced in real markets.

Retailer Strategy Insights from Price Intelligence

Retailers also benefit directly from structured price data.

ABC Fine Wine & Spirits

- Optimize promotional cadence by city

- Identify SKUs where margin can be protected

- Monitor competitor undercutting in tourist zones

Spec’s

- Use price leadership to drive foot traffic

- Balance private-label and national brands

- Detect over-discounting risks

Top Ten Liquors

- Justify premium pricing with assortment depth

- Identify SKUs vulnerable to cross-border shopping

- Adjust pricing on high-elasticity items

How Food Data Scrape Collects Liquor Price Data

Food Data Scrape uses scalable, compliant data extraction frameworks to capture:

- Product name and SKU

- Bottle size and alcohol type

- MSRP where available

- Actual shelf price

- Promotion flags

- Store location and region

- Date and time of capture

Data is normalized across retailers, enabling apples-to-apples comparison even when listings differ in format.

Use Cases for Bourbon and Tequila Price Datasets

Brand Teams

- Regional MSRP compliance monitoring

- Price corridor analysis

- Distributor performance benchmarking

Retailers

- Competitive price intelligence

- Promotion optimization

- Margin leakage detection

Investors and Analysts

- Category pricing trends

- Premiumization signals

- Regional demand indicators

The Bigger Picture: From Shelf Prices to Strategy

What looks like a few dollars difference on a bottle of bourbon or tequila is actually a window into regional economics, consumer behavior, and competitive dynamics.

Without structured data, these insights remain anecdotal. With Food Data Scrape, they become measurable, actionable, and scalable.

Conclusion

The regional price gap between bourbon and tequila across ABC Fine Wine & Spirits, Spec’s, and Top Ten Liquors is not accidental. It is the outcome of regulation, competition, distribution, and consumer demand.

By leveraging retail price intelligence from Food Data Scrape, brands and retailers can move beyond guesswork. They can track real shelf prices, understand regional variance, and make pricing decisions grounded in data rather than assumptions.

In a market where margins are tight and loyalty is fragile, price visibility is power.