Industry Context: Why Frozen Desserts Are a Pricing Battlefield

Frozen desserts behave very differently from shelf-stable grocery products. Key challenges include: Short consumption window: Impulse purchases driven by weather and time Cold-chain dependency: Stockouts trigger instant price hikes High promotion sensitivity: Discounts directly impact conversion Multiple pack-size competition: Same brand competes with itself On quick commerce apps, a ₹10 price change can decide whether a SKU sells out in two hours or remains unsold. Brands needed real-time competitive visibility, not weekly reports.

Business Problem Faced by Brands

Before working with Food Data Scrape, frozen dessert brands faced four core issues:

- No Real Brand vs Brand Visibility

Teams could see their own MRP and selling price but lacked consistent visibility into competitor pricing at the same time, same city, same pack size. - Delayed Discount Awareness

Promotions launched by competing brands often went unnoticed until sales dropped. - City-Level Price Fragmentation

A SKU priced competitively in Mumbai could be overpriced in Bengaluru or Gurgaon without teams realizing it. - Manual Tracking Was Not Scalable

Screenshot-based tracking or manual checks across apps was slow, inconsistent, and unreliable.

Objective of the Pricing Intelligence Program

Food Data Scrape was engaged to design a scalable frozen dessert pricing intelligence system with the following goals:

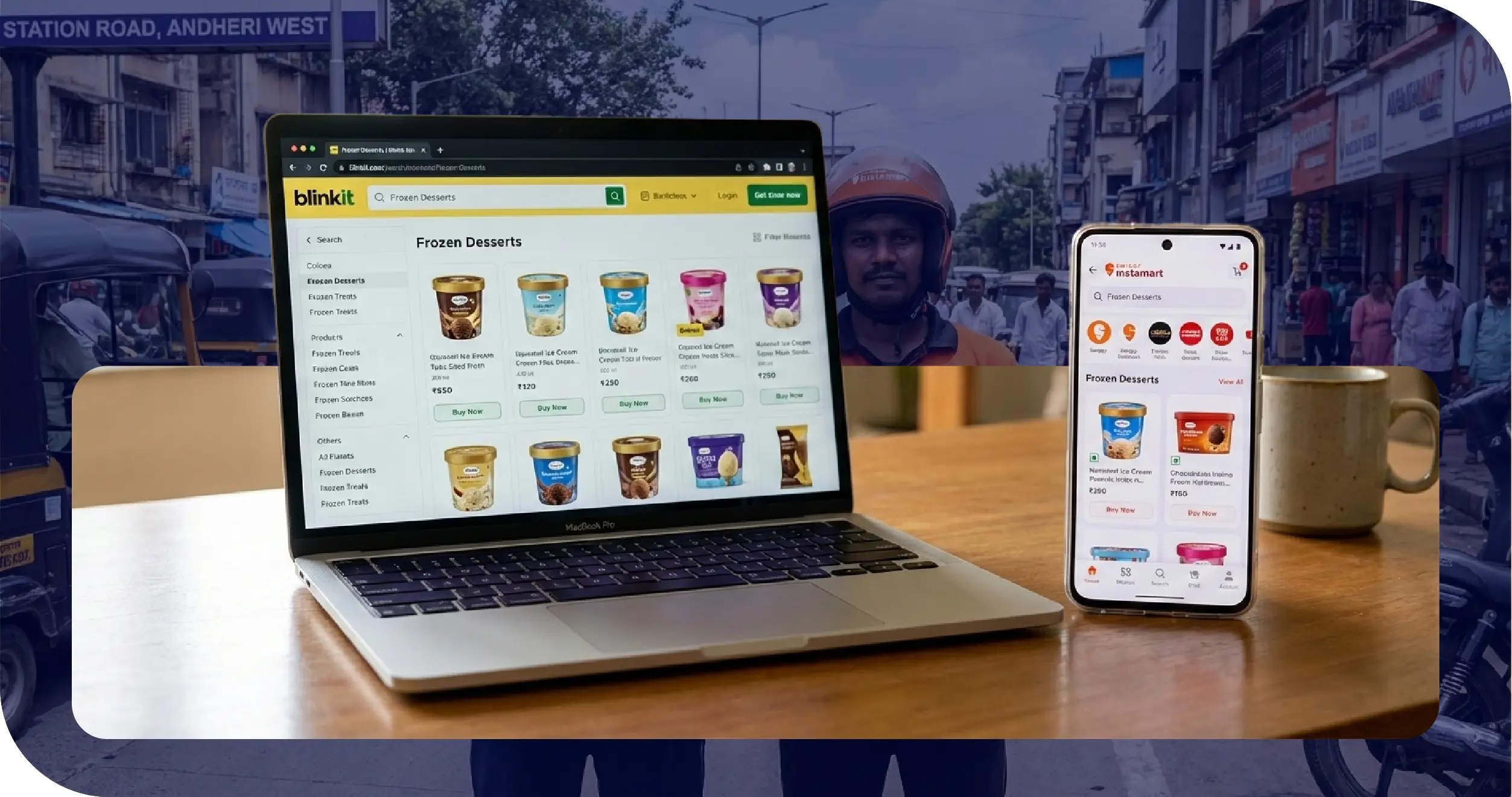

- Track prices across Blinkit and Instamart

- Enable SKU-to-SKU brand comparison

- Capture real-time discounts and offer mechanics

- Support quick discount-response decisions

- Deliver clean, analysis-ready datasets

Data Scope and Coverage

-

Platforms Covered

- Blinkit

- Swiggy Instamart

-

Product Category

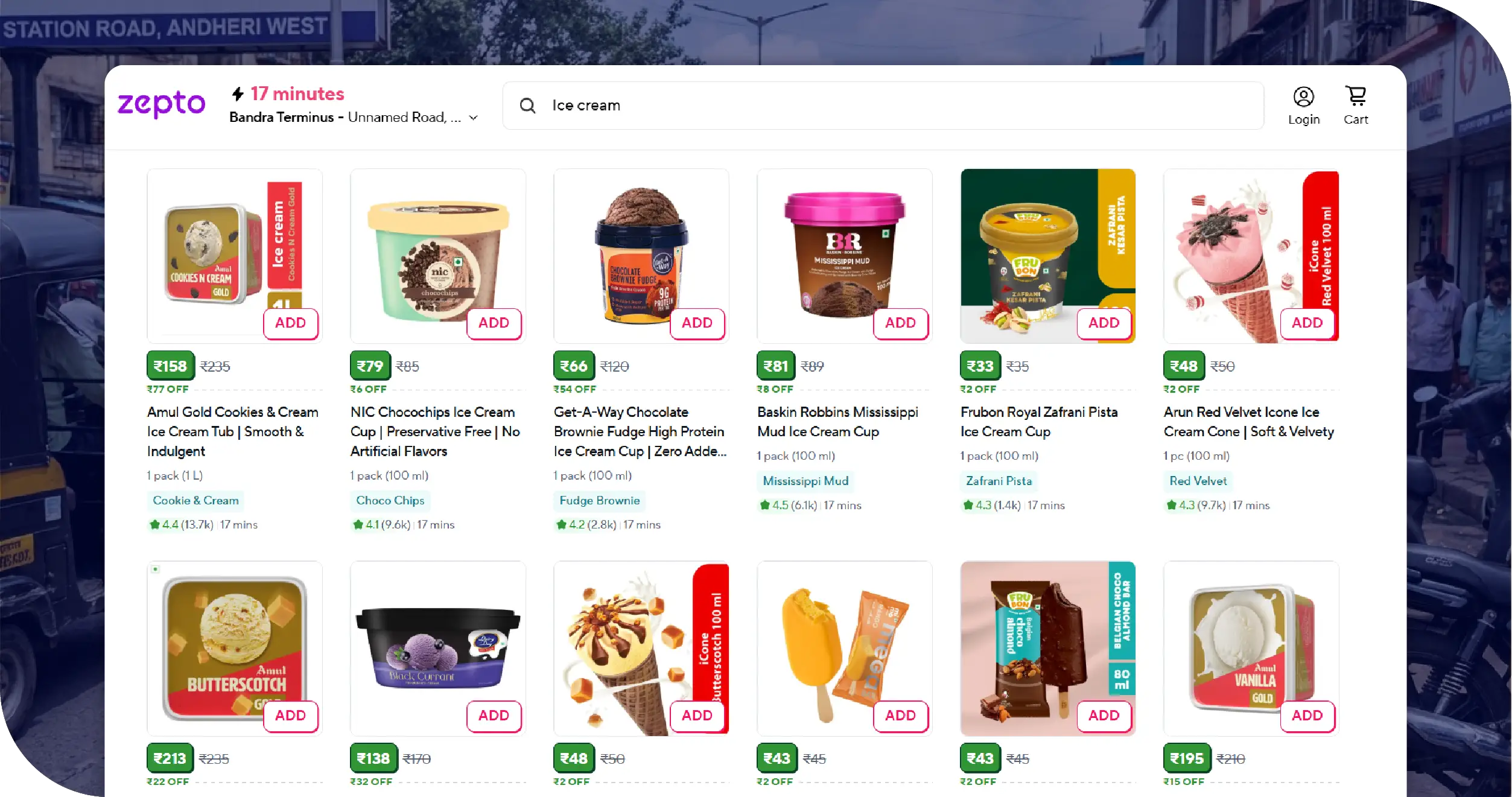

- Ice creams (cups, tubs, sticks)

- Frozen desserts

- Kulfi and regional frozen SKUs

-

Data Granularity

- SKU-level

- Brand-level

- City-level

- Time-stamped snapshots

-

Cities Tracked

- Mumbai

- Delhi NCR

- Bengaluru

- Hyderabad

- Pune

- Chennai

Key Data Points Extracted

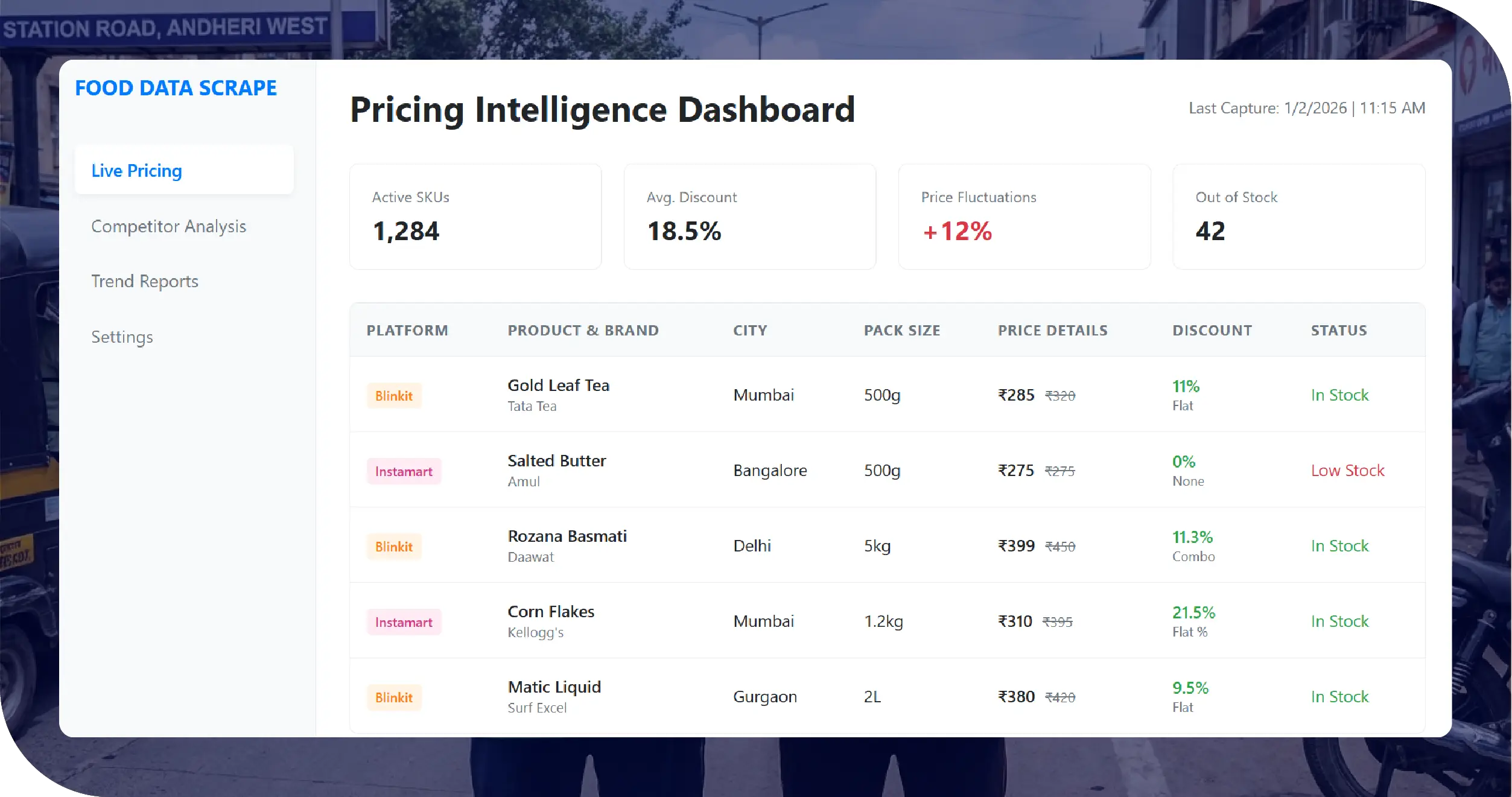

Food Data Scrape designed a structured schema tailored for pricing intelligence teams:

| Data Field | Description |

|---|---|

| Platform | Blinkit / Instamart |

| City | Delivery city |

| Brand | Brand name |

| Product Name | Exact listing title |

| Pack Size | ML / grams |

| MRP | Listed MRP |

| Selling Price | Current price |

| Discount % | Calculated discount |

| Offer Type | Flat / % / combo |

| Stock Status | In stock / low stock |

| Timestamp | Capture time |

Sample Data Snapshot

| Platform | City | Brand | Pack Size | MRP | Price | Discount |

|---|---|---|---|---|---|---|

| Blinkit | Mumbai | Brand A | 500 ml | ₹250 | ₹199 | 20% |

| Instamart | Mumbai | Brand B | 700 ml | ₹320 | ₹279 | 13% |

| Blinkit | Bengaluru | Brand C | 100 ml | ₹60 | ₹55 | 8% |

| Instamart | Delhi NCR | Brand A | 1 L | ₹450 | ₹399 | 11% |

This data was refreshed multiple times daily during peak hours.

Brand vs Brand Comparison Framework

Food Data Scrape implemented a like-for-like comparison model, ensuring accuracy.

Comparison Logic Used

- Same city

- Same pack size (or normalized to per-100 ml)

- Same time window

- Active SKUs only

Insights Generated

- Which brand is cheapest per 100 ml

- Which brand uses deeper discounts vs lower MRP

- Which brands avoid discounting but rely on premium positioning

This eliminated misleading comparisons and enabled clean competitive benchmarks.

Discount Response Strategy Design

Frozen dessert sales spike during short windows. Brands needed to react within hours, not days. Food Data Scrape enabled:

-

Discount Detection Triggers

Automated alerts when:

- A competitor drops price beyond a threshold

- A new offer appears in a specific city

- A pack-size-specific discount goes live

-

Time-to-Response Measurement

Brands measured:

- How long competitors kept discounts live

- Sales velocity during discount windows

- Post-discount price normalization patterns

-

Defensive vs Offensive Discounting

Teams differentiated between:

- Defensive discounts to protect share

- Offensive discounts to capture visibility

City-Level Pricing Intelligence

One of the most valuable outcomes was city-wise pricing clarity.

Observations Identified

- Bengaluru showed deeper discounts but shorter duration

- Mumbai relied more on MRP anchoring than discounts

- Delhi NCR saw aggressive weekend-based offers

Brands adjusted pricing rules city by city instead of applying national strategies blindly.

Impact on Business Decisions

Food Data Scrape’s pricing intelligence directly influenced:

Pricing Teams

- Faster approval cycles

- Reduced panic discounting

- Better margin control

Sales & Category Teams

- Improved visibility in search and listing order

- Optimized pack-size focus per city

Marketing Teams

- Promotion timing aligned with competitor behavior

- Clear ROI measurement on discount campaigns

Measurable Outcomes

Within weeks of deployment:

- 18–25% improvement in discount effectiveness

- Reduced unnecessary discounting during low competition windows

- Faster competitive reaction time by more than 60%

- Stronger price consistency across cities

Why Food Data Scrape

What differentiated Food Data Scrape in this engagement:

- Deep Q-commerce platform understanding

- Clean SKU normalization logic

- Scalable data pipelines

- Business-ready datasets, not raw dumps

Most importantly, the solution was designed around decision-making, not just data collection.

Use Cases Beyond Frozen Desserts

The same framework now supports:

- Dairy and frozen foods

- Quick commerce snacks

- Ready-to-eat products

- Beverage pricing intelligence

Conclusion

In Q-commerce, frozen desserts are not priced weekly. They are priced hourly. This case study shows how Food Data Scrape enabled brands to move from reactive pricing to intelligent, competitive pricing strategies across Blinkit and Instamart. With accurate brand vs brand comparison and real-time discount response mechanisms, frozen dessert brands gained control over one of the most volatile categories in quick commerce.