Introduction

The festive season of Diwali is not only a peak period for sweets and gifts but also a critical time for liquor sales across India. With consumers actively looking for discounts, combo offers, and exclusive promotions on popular alcoholic beverages, understanding pricing trends becomes vital for liquor retailers, delivery platforms, and market analysts. Using Liquor Promotions Data Extraction for Diwali 2025, businesses can monitor competitor strategies, track pricing patterns, and assess promotional effectiveness across multiple delivery portals.

Our methodology also includes strategy to Scrape Liquor Competitor Pricing for Diwali 2025, enabling a detailed comparison of offers, discounts, and bundle deals from major liquor delivery apps. By leveraging Web Scraping Liquor Discount Trends for Diwali 2025, we gain insights into market positioning, consumer preferences, and price sensitivity during peak festive demand. This analysis using Diwali 2025 Liquor Pricing Tracker helps retailers optimize their pricing strategies, target promotions effectively, and maximize revenue during the high-demand Diwali period.

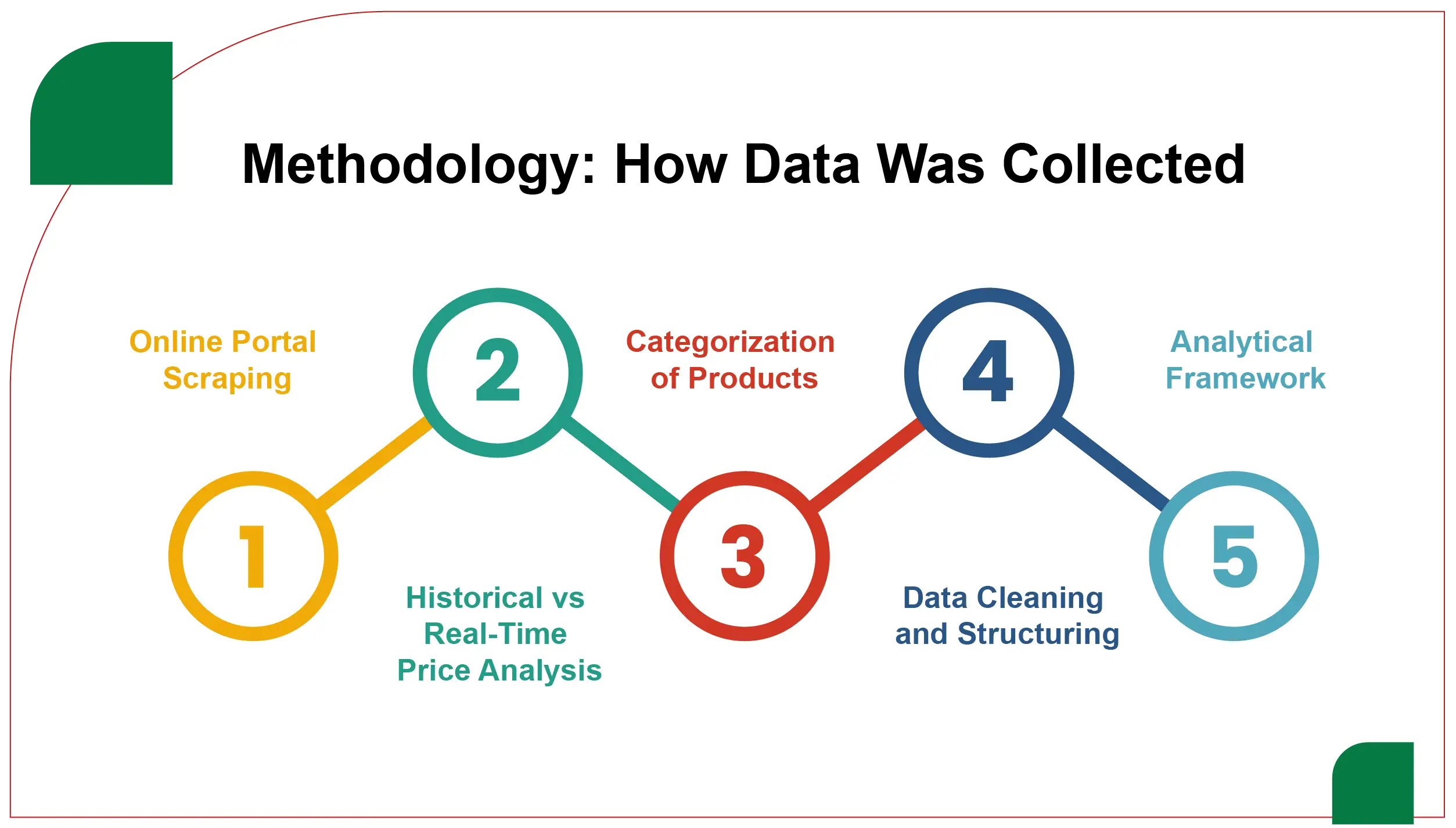

Methodology: How Data Was Collected

- Online Portal Scraping

We performed extensive scraping of popular liquor delivery platforms including BigBasket, Zepto, Swiggy Genie, and local alcohol delivery portals. Extract Liquor Prices & Deals for Diwali 2025 to gather real-time product prices, discounts, promotional offers, and availability across multiple cities.

- Historical vs Real-Time Price Analysis

By collecting historical data and real-time pricing, we could identify pricing trends, discount cycles, and promotional timing. Platforms frequently adjusted prices based on demand, inventory, and festive promotions, which we captured through Competitive Liquor Pricing Data Scraping for Diwali.

- Categorization of Products

Data was organized into categories: whiskey, vodka, rum, gin, wine, and beer. Each category was analyzed for average pricing, discount percentages, and volume-based offers to understand both market positioning and customer incentives.

- Data Cleaning and Structuring

Raw scraped data underwent validation to remove duplicates, correct inconsistencies, and ensure accuracy. This step ensured that insights derived were reliable and comparable across portals and cities.

- Analytical Framework

The cleaned data was integrated into BI tools for detailed visualization and analysis. Diwali Liquor Price Monitoring API enabled trend detection, price fluctuation mapping, and competitive benchmarking.

Key Findings: Price and Discount Analysis

Our analysis revealed distinct trends in liquor pricing and promotional strategies during Diwali 2025:

- Whiskey and vodka brands dominated promotions with high visibility on delivery portals.

- Combo offers including mixers or additional bottles were popular among premium brands.

- Discount ranges varied by category: beers typically offered 10–15%, while premium whiskeys saw up to 25% discounts.

- Urban metro cities had more dynamic pricing and aggressive promotional campaigns compared to smaller towns.

| Liquor Category |

BigBasket Discount (%) |

Zepto Discount (%) |

Swiggy Genie Discount (%) |

Average Discount (%) |

| Whiskey |

20 |

22 |

18 |

20 |

| Vodka |

15 |

18 |

16 |

16.3 |

| Rum |

12 |

14 |

13 |

13 |

| Gin |

10 |

12 |

11 |

11 |

| Wine |

8 |

10 |

9 |

9 |

| Beer |

10 |

12 |

11 |

11 |

Insights:

- Whiskey promotions were the most aggressive, reflecting consumer preference for premium spirits during festivals.

- Vodka and rum maintained moderate discount levels to encourage volume-based purchases.

- Beer and wine had smaller discounts but often came in festive combo packs.

Competitor Analysis: Offers & Promotions

Using Liquor Competitor Price Tracking for Diwali 2025, we compared promotional strategies across portals:

- BigBasket: Heavy focus on combo offers and free delivery above certain cart values.

- Zepto: Short-term flash discounts and app-only exclusive deals.

- Swiggy Genie: Targeted location-based discounts and express delivery promotions.

The analysis highlighted how each platform tailored promotions to capture different consumer segments. Urban metros saw higher discount intensity, while smaller cities had fewer but more targeted promotions.

| Brand |

BigBasket Offer |

Zepto Offer |

Swiggy Genie Offer |

| Johnnie Walker |

1L + Mixer free, 20% off |

1L 18% off, app-exclusive |

1L 15% off, free delivery over 2000 INR |

| Chivas Regal |

750ml 25% off |

750ml 22% off |

750ml 20% off, combo packs |

| Absolut Vodka |

700ml + 2 cocktail glasses free |

700ml 18% off |

700ml 16% off, festival bundle |

| Bacardi Rum |

750ml 15% off + mixer |

750ml 14% off |

750ml 13% off, festive combo |

Insights:

- Bundled offers with mixers or glasses were consistently used to increase perceived value.

- App-exclusive promotions boosted mobile engagement and repeat purchases.

- Competitor tracking shows a clear differentiation in strategy across portals, with price, bundle, and delivery incentives used in tandem.

Regional and City-Wise Trends

Analysis across cities revealed differences in pricing and discounts:

- Delhi & Mumbai: Highest promotional intensity for premium whiskey and vodka brands.

- Bangalore & Hyderabad: Moderate discounts with emphasis on combo packs.

- Tier 2 Cities: Smaller, focused discounts, usually tied to limited-time offers.

Consumers in metro areas were more price-sensitive and likely to compare multiple portals before purchasing. Smaller cities relied more on local delivery convenience rather than discounts alone.

Insights from Alcohol Sales Data

By analyzing Diwali Liquor Discount Web Scraper 2025 outputs, key insights include:

- Premium spirits account for 55–60% of total festival sales.

- Volume-based promotions increase basket size by 12–15%.

- Early festive-week promotions result in higher overall engagement compared to last-minute offers.

- Platforms with dynamic pricing models see higher conversion rates among price-conscious buyers.

Extract Alcohol Prices Data to identify patterns in discount cycles, helping retailers predict when and which brands to push for maximum impact.

Impact of Promotions on Consumer Behavior

Promotions and discounts significantly influenced consumer behavior during Diwali 2025:

- Flash discounts drove immediate spike in orders, often concentrated over weekends.

- Combo offers encouraged bulk purchases and repeat ordering for parties and gatherings.

- Limited-time app-only deals created urgency and increased mobile app engagement.

By combining historical trends and real-time monitoring, retailers can optimize promotional timing, product placement, and inventory planning to maximize revenue and customer satisfaction.

Operational Insights for Retailers and Delivery Platforms

- Dynamic pricing strategies, combined with inventory monitoring, help balance supply and demand.

- Location-based promotions improve last-mile delivery efficiency.

- Bundled offers reduce delivery costs per order by consolidating shipments.

- Predictive analytics ensures top-selling brands remain in stock during peak hours.

This operational intelligence ensures timely delivery, increased customer satisfaction, and higher sales efficiency during high-demand festive periods.

Predictive Analytics and Future Planning

By leveraging Liquor Price Data Scraping Services, retailers can monitor pricing trends and track competitor offers effectively.

Using Alcohol and Liquor Datasets, platforms can analyze consumer behavior, identify top-selling categories, and plan inventory for high-demand periods:

- Forecast top-selling brands for future festive seasons.

- Determine optimal discount levels to drive maximum revenue without eroding margins.

- Plan inventory for high-demand cities and regions.

- Predict consumer preference shifts for emerging brands or product variants.

These predictive capabilities enhance strategic planning for both short-term Diwali campaigns and long-term market positioning.

Conclusion

The Diwali 2025 liquor pricing analysis demonstrates the importance to Scrape Alcohol Price Data in tracking competitor pricing and market trends.

A well-designed Liquor Price Tracking Dashboard enables retailers to visualize discounts, promotions, and pricing patterns across multiple platforms.

Leveraging Liquor Data Intelligence Services helps understand consumer behavior, optimize promotional strategies, and enhance inventory management. Retailers and delivery platforms that monitor competitor offers, implement dynamic promotions, and plan inventory based on real-time insights are best positioned to maximize festive revenue.

Key takeaways include:

- Premium spirits are the most responsive to discounts and combo promotions.

- Metro cities show higher price sensitivity and require more aggressive promotions.

- Bundle offers with mixers or additional items increase perceived value and basket size.

- Dynamic monitoring across multiple portals ensures competitive pricing and better consumer engagement.

- Predictive analytics enables efficient inventory planning and optimized campaign timing for future festive seasons.

By combining competitor pricing insights, promotional tracking, and predictive analytics, liquor retailers and delivery platforms can maximize revenue, enhance customer satisfaction, and maintain a competitive edge during high-demand periods like Diwali.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.