Introduction

Europe’s coffee culture has never been more dynamic. From artisan espresso bars in Rome to coworking cafés in London, coffee shops have evolved into multi-purpose venues where social interaction, creativity, and commerce intersect. The European coffee scene in 2025 showcases both tradition and innovation—a market balancing deep-rooted café heritage with modern-day consumer expectations for sustainability, technology, and personalization.

Through advanced analytics and modern digital tools, researchers can now Extract Coffee Shop Insights from Europe, identifying patterns that define consumer habits, beverage preferences, and operational strategies across regions. These insights enable coffee brands, franchise operators, and investors to make data-driven decisions in a competitive market.

Comprehensive datasets and market mapping methodologies also allow experts to Scrape Coffee Shop Data Across Europe, providing a granular view of how countries differ in coffee formats, consumption behavior, and brand presence. The ability to process such large-scale datasets gives businesses an unparalleled edge in identifying opportunities and understanding how local coffee culture is transforming.

Overview of Europe’s Coffee Shop Landscape

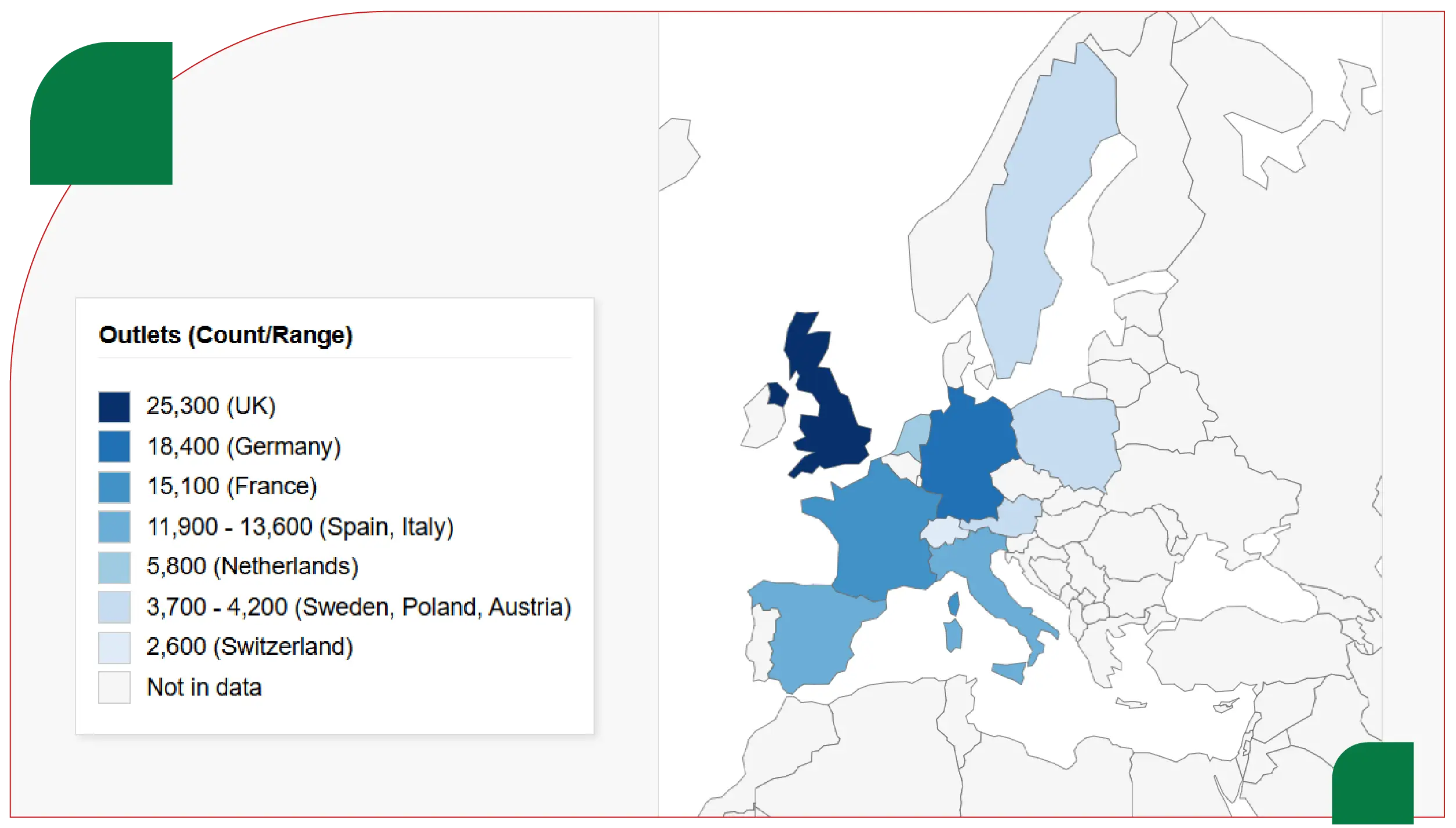

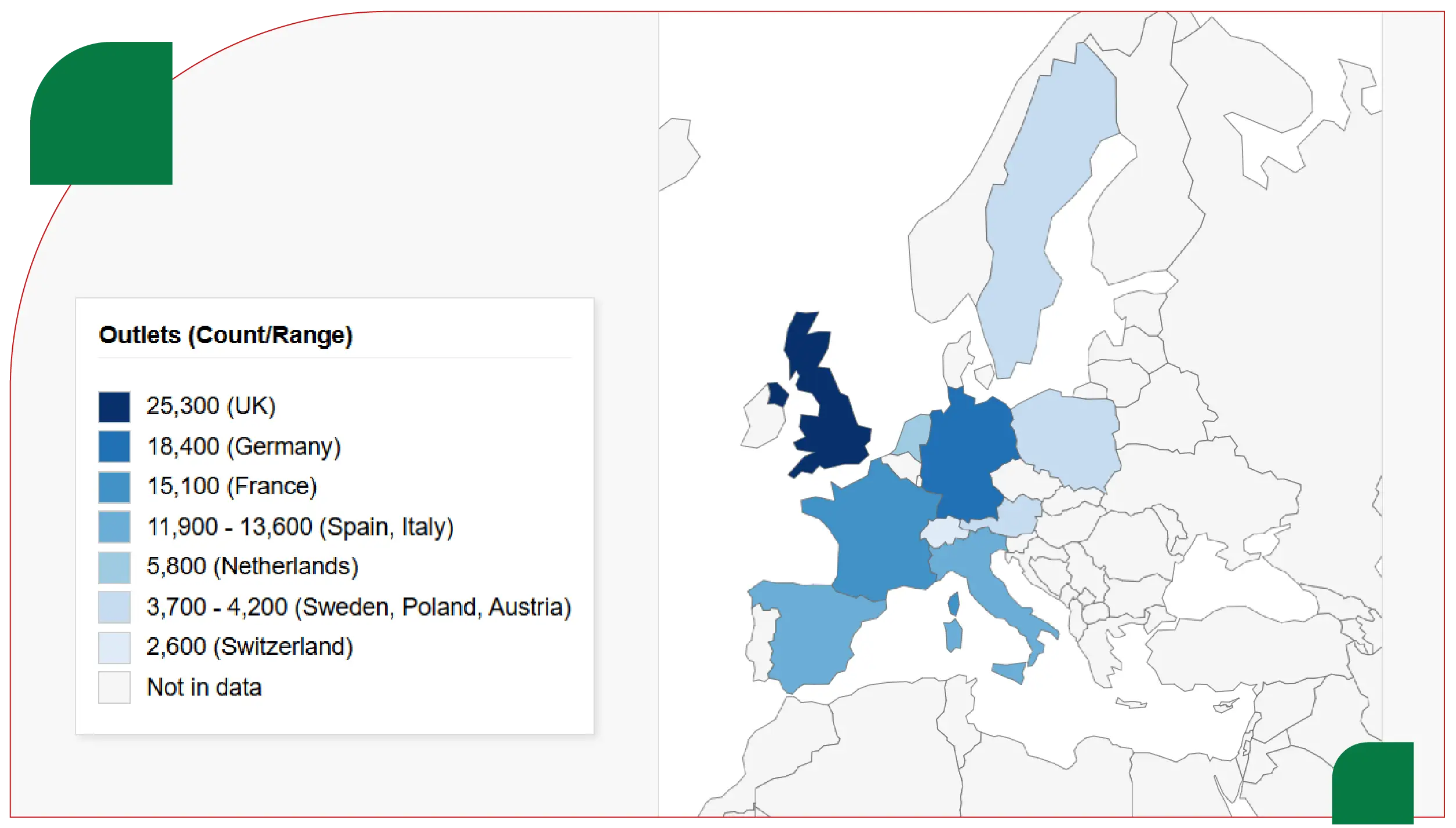

The European coffee shop industry represents one of the continent’s most vibrant and fast-evolving retail sectors. As of 2025, Europe hosts more than 150,000 cafés and coffee houses, spanning from traditional Parisian brasseries to global chains like Starbucks, Costa Coffee, and Pret A Manger. Market value across the EU coffee shop segment is estimated at €46 billion, with steady annual growth driven by urbanization, remote work culture, and the demand for premium beverage experiences.

Unlike the standardized café models seen in North America, Europe’s coffee landscape is regionally distinct. Northern Europe leans toward modern coffee chains, while Southern Europe favors independent family-owned cafés. The continent’s diverse geography allows for unique coffee identities—from the robust espresso culture in Italy to the frothy cappuccino craze in the UK.

The following table provides an overview of the largest coffee shop markets in Europe by estimated 2025 figures.

| Country |

Number of Outlets |

Market Value (€ Billion) |

Annual Growth Rate (2024–25) |

Dominant Format |

| United Kingdom |

25,300 |

12.5 |

5.8% |

Chain-driven |

| Germany |

18,400 |

7.2 |

4.9% |

Mixed |

| France |

15,100 |

6.8 |

4.2% |

Café/Bistro |

| Spain |

13,600 |

5.7 |

5.4% |

Traditional café |

| Italy |

11,900 |

5.3 |

3.9% |

Independent |

| Netherlands |

5,800 |

2.2 |

5.1% |

Chain & artisanal |

| Sweden |

4,200 |

1.9 |

5.6% |

Modern café |

| Poland |

3,900 |

1.4 |

5.0% |

Chain & bakery café |

| Austria |

3,700 |

1.3 |

4.6% |

Classic coffeehouse |

| Switzerland |

2,600 |

1.1 |

3.8% |

Independent |

Across Europe, the top five markets—UK, Germany, France, Spain, and Italy—account for nearly 75% of total coffee shop sales. However, smaller markets in Scandinavia and Eastern Europe are showing faster year-on-year growth, signaling future expansion zones for chains and boutique operators.

Consumer Behavior: Coffee as a Lifestyle

Europe’s coffee drinkers view their daily brew as an experience rather than a simple beverage. Datassential’s March 2025 study found that 40% of Europeans enjoy hot beverages outside the home, with coffee leading the segment. Espresso remains king in Southern Europe, while milk-based drinks such as cappuccinos and lattes dominate Northern and Western Europe.

Cultural nuances shape each market. For instance:

- France favors espresso and long coffee, often consumed during short café visits.

- UK consumers prefer larger, creamier drinks like cappuccinos and lattes.

- Spain enjoys social coffee moments centered around the latte or cortado.

- Italy maintains its espresso ritual, emphasizing tradition and authenticity.

- Germany blends tradition with modern coffee culture, balancing espresso and milk-based beverages.

Understanding these patterns allows companies to tailor menus and product launches more effectively, using advanced European Coffee Shop Market Data Scraping Services to interpret large datasets of beverage preferences, price ranges, and customer ratings across cities.

The Rise of Hybrid Coffee Spaces

Coffee shops in Europe have undergone a major transformation. Once limited to quick-service cafés or social meeting points, they now serve as multi-functional spaces. Coworking zones, art exhibitions, and event nights are becoming increasingly common features in cafés across metropolitan centers like Berlin, Madrid, and Amsterdam.

The integration of technology, such as mobile ordering, digital loyalty apps, and online payment options, has further redefined convenience and accessibility. Through Web Scraping European Café Trends and Consumer Data, analysts can map the correlation between technology adoption and customer retention, identifying which innovations drive repeat visits or higher sales volumes.

Hybrid cafés—part workspace, part leisure zone—are particularly appealing to millennials and Gen Z consumers. They combine ambience with digital connectivity, promoting longer stays and higher average spends per customer.

Coffee Chains vs. Independent Cafés

The European coffee shop market remains a battleground between multinational chains and independent operators. Chains dominate in scale and standardization, while independents thrive through creativity, authenticity, and community engagement.

The UK continues to lead in chain concentration, with global brands like Costa Coffee, Starbucks, and Pret A Manger controlling over 75% of sales volume. Conversely, Italy’s market is 90% independent, deeply rooted in local café traditions and daily rituals.

| Country |

Chain Units (%) |

Independent Units (%) |

Sales Share (Chains) |

Sales Share (Independents) |

| UK |

46% |

54% |

78% |

22% |

| Germany |

44% |

56% |

54% |

46% |

| France |

29% |

71% |

57% |

43% |

| Spain |

22% |

78% |

45% |

55% |

| Italy |

10% |

90% |

11% |

89% |

| Netherlands |

38% |

62% |

63% |

37% |

| Poland |

41% |

59% |

58% |

42% |

These proportions show that while major brands dominate revenue, independent cafés remain vital cultural touchpoints. Independent venues continue to attract loyal local audiences through sustainability practices, artisanal roasting, and creative beverage experimentation.

Coffee Consumption Trends by Region

Each European region displays unique coffee consumption habits and beverage preferences.

- Southern Europe (Italy, Spain, Portugal): Espresso, cortado, and macchiato dominate, often consumed quickly while standing at the bar.

- Western Europe (France, Belgium): Café culture emphasizes ambiance and leisurely experiences, with long coffees and cappuccinos leading consumption.

- Northern Europe (UK, Scandinavia): Milk-based drinks and takeaway options reflect fast-paced, on-the-go lifestyles.

- Eastern Europe (Poland, Hungary, Czech Republic): Rapidly modernizing markets adopting Western coffee trends and global chain formats.

In such an environment, data-driven analysis through Europe Coffee Industry Data Extraction allows companies to pinpoint high-growth cities, beverage trends, and emerging product categories such as cold brew and plant-based alternatives.

Evolving Coffee Preferences and Product Innovation

Innovation within Europe’s coffee scene goes beyond drink recipes—it’s about presentation, experience, and values.

Key Beverage Trends in 2025:

- Cold Coffee Growth: Iced coffee, nitro cold brew, and frappé beverages gaining double-digit growth among younger consumers.

- Plant-Based Revolution: Oat, almond, and soy milk now account for 22% of milk use in cafés.

- Functional Coffee: Adaptogen-infused or protein-enriched coffee blends gaining momentum.

- Aesthetic Presentation: Layered lattes, latte art competitions, and glassware innovation enhancing visual appeal.

- Sustainability Focus: Fairtrade sourcing, reusable cups, and carbon-neutral roasting becoming mainstream.

Advanced analytics and Café Market Trends Extraction Across European Cities enable brands to monitor how such innovations perform across local markets, aligning new menu launches with region-specific consumer behavior.

Coffee Flavors, Pairings, and Ingredients

Flavor profiles are diversifying as consumers experiment with new combinations of sweetness, texture, and aroma. Through Coffee Flavors & Ingredient Insights, market analysts can categorize ingredient demand across Europe—tracking the rise of vanilla, caramel, and hazelnut syrups in Northern Europe, and dark-roast intensity preferences in Southern Europe.

Pairings are also evolving: pastries, plant-based snacks, and locally sourced desserts complement coffee menus. This intersection of bakery and beverage culture has driven collaboration between roasteries, patisseries, and bakery cafés.

Technology and Digital Transformation in Coffee Retail

Digital integration defines the future of Europe’s coffee shops. Nearly 70% of major chains and 45% of independent cafés have introduced mobile ordering, loyalty programs, or delivery options. Many rely on advanced backend systems that gather transactional and behavioral data.

Third-party intelligence platforms, often developed using Grocery App Data Scraping services, are now being adapted for the café industry. They monitor customer purchasing patterns, pricing strategies, and digital engagement metrics to optimize product offerings and marketing campaigns.

Additionally, Grocery Delivery Scraping API Services have found crossover applications in tracking coffee delivery demand, particularly for chains expanding into at-home brewing or packaged beverage segments.

Business Opportunities in Europe’s Coffee Market

- Expansion in Emerging Cities: Eastern European capitals like Warsaw, Prague, and Bucharest offer untapped franchise potential.

- Local Roastery Partnerships: Collaboration with artisanal roasters adds authenticity and boosts brand storytelling.

- Coworking & Hybrid Models: Multi-functional cafés targeting remote workers are expanding in Berlin, Amsterdam, and Lisbon.

- Tech-Enabled Loyalty: Personalized promotions driven by AI-based analytics enhance repeat visits.

- Sustainability Differentiation: Transparency in sourcing, reusable packaging, and waste reduction attract eco-conscious customers.

Market entrants can gain competitive advantages by continuously monitoring operational data, customer sentiment, and regional preferences through real-time scraping technologies and business dashboards.

Cultural Importance of Coffee Shops

European cafés serve not just as beverage outlets but as cultural institutions. In Italy, they embody daily rituals; in France, they symbolize intellectual exchange; in the UK, they act as informal workspaces. This social integration transforms coffee shops into essential lifestyle destinations.

From Viennese coffee houses to modern Scandinavian cafés, each location represents a blend of history and innovation. The challenge for operators is maintaining authenticity while embracing technology and evolving customer expectations.

Sustainability and Ethical Sourcing

Sustainability is now central to European coffee operations. Nearly 60% of coffee shops claim to use ethically sourced beans, while 45% have adopted eco-friendly packaging. Brands are investing in carbon offset programs and renewable energy to align with EU Green Deal goals.

Sustainable sourcing isn’t only ethical—it’s profitable. Consumers across Europe are increasingly willing to pay premiums for responsibly produced coffee. The trend reinforces the value of transparent supply chains, regional roasting partnerships, and traceable bean origins.

The Economics of Coffee Pricing

Price transparency and affordability play critical roles in customer loyalty. In 2025, the average price of a cappuccino across Europe ranges between €2.80 and €4.10, depending on the country and establishment type. Data analytics tools such as Grocery Price Dashboard are now being used beyond supermarkets to monitor beverage pricing fluctuations, ensuring brands stay competitive while maintaining margins.

Dynamic pricing models—adjusting costs by time of day, demand, or season—are also being tested in urban centers. Technology-driven pricing strategies derived from data scraping can identify peak demand hours, supporting efficient staffing and inventory control.

Future Outlook: European Coffee Market 2026–2030

The European coffee shop industry is expected to exceed €60 billion by 2030, driven by international franchising, sustainability integration, and growing consumer demand for premium beverages. Market maturity will lead to consolidation in saturated regions but strong expansion in emerging cities.

Investments in automation, AI-based customer personalization, and mobile-first strategies will define the next growth phase. The interplay between data intelligence, technology, and café culture will continue to reshape the landscape.

Operators focusing on experience-driven models—incorporating art, music, and community interaction—will likely lead the next decade of European coffee evolution.

Conclusion

Europe’s coffee shops are more than retail spaces—they are social, cultural, and economic landmarks. The continent’s 2025 café market reflects diversity, adaptability, and technological progress. Success now depends on understanding local nuances, integrating innovation, and aligning with sustainability and digital transformation trends.

Modern data solutions, such as Grocery Price Tracking Dashboard, are helping coffee brands and franchise networks forecast market trends and pricing changes in real time. Meanwhile, Grocery Pricing Data Intelligence supports operators in benchmarking costs, managing suppliers, and improving profitability. The use of Grocery Store Datasets further enhances market comparison and investment decisions by mapping retail overlaps and consumer behaviors.

As Europe’s coffee culture continues to evolve, the blend of heritage and innovation will define the next generation of cafés—where quality, community, and experience meet the power of data-driven insight.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.