Introduction

Halloween is not only a period of heightened candy sales and festive snacks but also a peak season for liquor consumption and alcohol-related purchases. Analyzing the seasonal patterns in liquor demand provides insights into regional consumer behavior, retail strategies, and delivery efficiency. Using advanced analytics and data extraction, researchers can Extract Cross-Country Liquor Demand Trends to evaluate consumption spikes, pricing strategies, and distribution patterns across multiple regions.

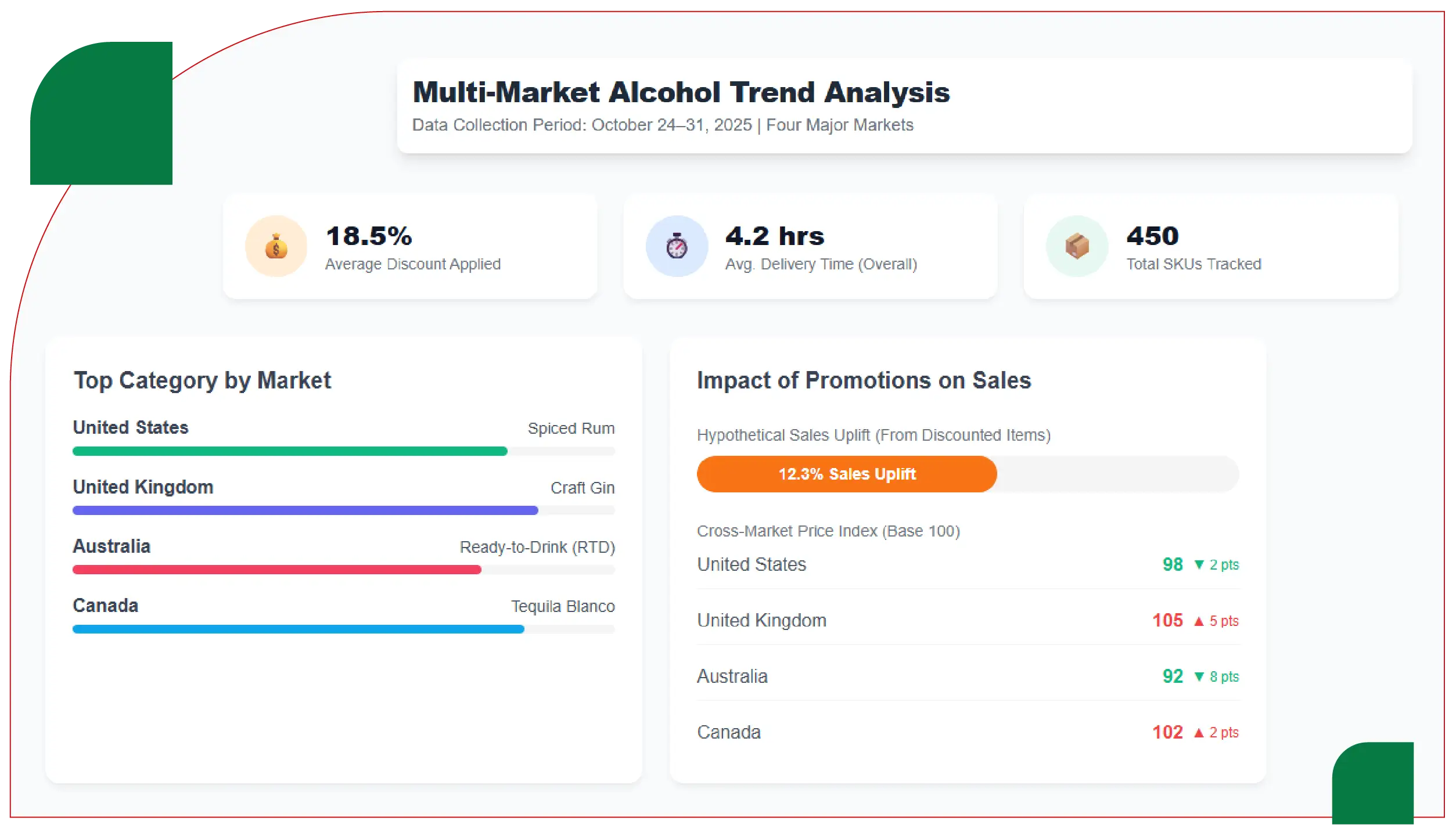

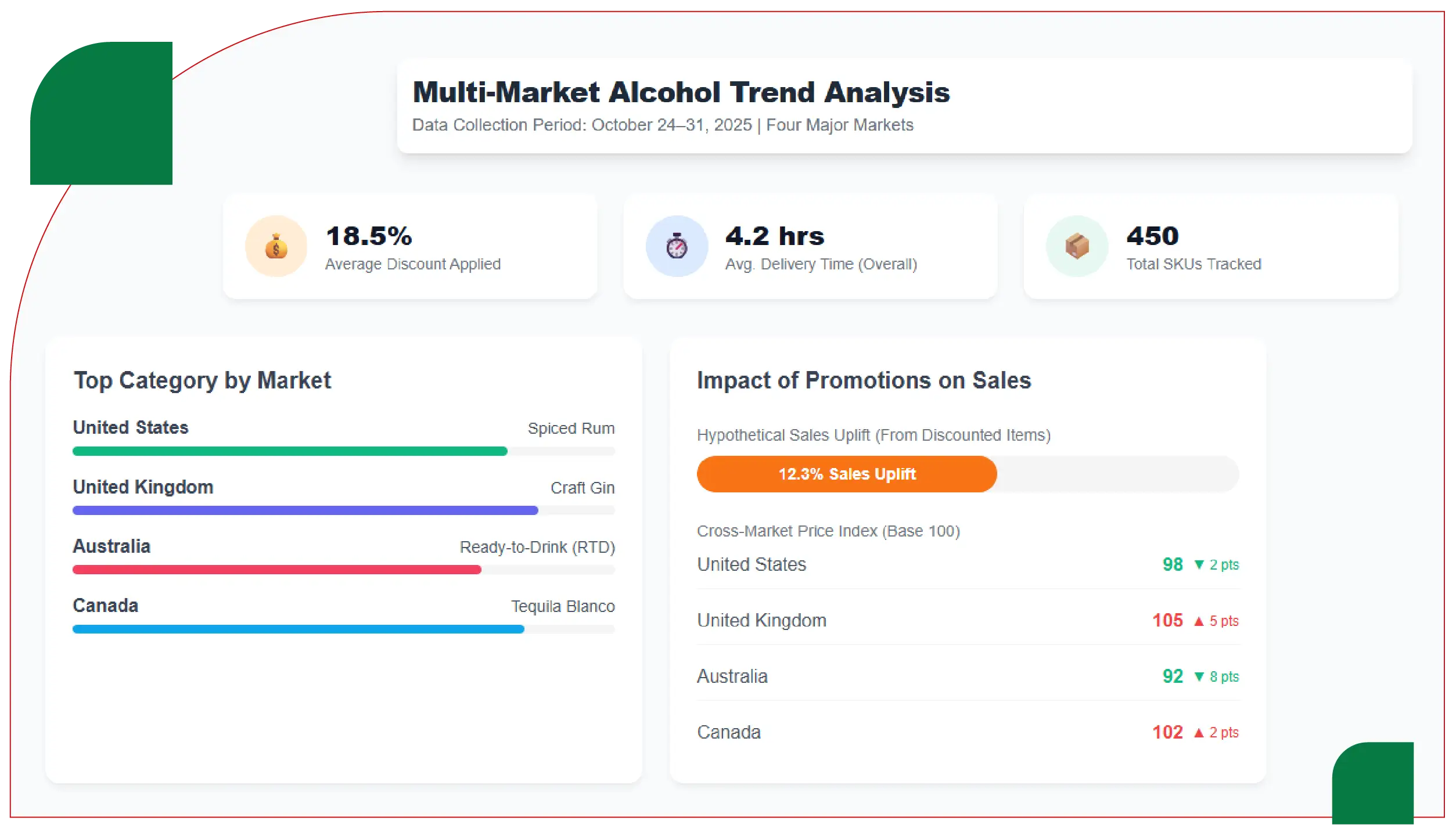

Through Cross-Country Liquor Data Scraping for Halloween, structured datasets were collected from online liquor retailers, e-commerce platforms, and quick-commerce apps in the USA, UK, Canada, and Australia. This comprehensive approach enabled the creation of the USA, UK, Canada & Australia Halloween Liquor Trends Dataset, facilitating cross-country comparisons of volume, price elasticity, and category preferences during the Halloween period.

Research Objective and Methodology

The primary objective of this study is to evaluate liquor consumption trends, pricing patterns, and delivery dynamics across four major markets during Halloween. Key goals include:

- Identifying the most popular liquor categories by region.

- Assessing the impact of promotions and discounts on sales.

- Comparing consumption patterns and delivery efficiency between countries.

- Highlighting cross-country differences in consumer preferences and pricing.

The methodology employed Multi-Country Liquor Demand Trends Scraping for Halloween, which included:

- Platforms Scraped: Drizly, Total Wine, BevMo, Tesco Alcohol, Dan Murphy’s, Liquorland.

- Data Collection Period: October 24–31, 2025.

- Data Points: Product name, brand, category, SKU, unit price, discount, stock availability, delivery time, and platform.

- Frequency: Updates every 6 hours to track dynamic pricing and stock changes.

Additionally, Web Scraping Liquor Market Trends for Halloween ensured that both online and app-based sales data were captured, providing a full picture of market dynamics.

Dataset Overview and Regional Distribution

The study collected over 45,000 listings across the four countries, including spirits, wine, beer, and pre-mixed cocktails. Regional data revealed that the USA led in total sales volume, while the UK showed the highest per-capita spending. Australia’s demand was concentrated in urban centers, whereas Canada demonstrated strong weekend peaks in Halloween liquor consumption.

| Country |

Avg Unit Price ($) |

Total Sales Volume (Units) |

Top Category |

Avg Discount (%) |

Stock Availability (%) |

| USA |

28.50 |

1,250,000 |

Spirits |

12 |

88 |

| UK |

31.20 |

580,000 |

Wine |

15 |

91 |

| Canada |

27.80 |

620,000 |

Spirits |

10 |

85 |

| Australia |

29.50 |

540,000 |

Beer & Cider |

13 |

82 |

Analysis:

- Spirits dominate in the USA and Canada, accounting for more than 40% of Halloween liquor consumption.

- Wine remains a strong performer in the UK, reflecting regional taste preferences.

- Australia demonstrates high beer and cider consumption, reflecting local cultural trends.

- Discounts ranged from 10–15% across regions, with the UK having the highest average promotional intensity.

Regional Consumer Behavior Insights

USA: Spirits-Driven Demand and Bulk Purchases

The USA exhibits high-volume liquor consumption during Halloween, particularly in urban areas and regions with active nightlife events. Scrape Halloween Liquor Trends in USA to reveal that:

- Bulk spirits packs and pre-mixed cocktails are in high demand.

- Online platforms such as Drizly and Total Wine dominate quick delivery orders.

- Sales peak on October 30–31, aligning with Halloween parties and gatherings.

- Promotions and flash discounts influence approximately 28% of total purchases.

UK: Wine Popularity and E-commerce Penetration

The UK consumer base emphasizes wine and premium spirits. By using tools to Extract UK Alcohol Trends Data for Halloween, the following patterns were observed:

- Wine purchases account for 45% of total liquor sales during the week.

- Online grocery and alcohol delivery apps like Tesco Alcohol and Majestic Wine show significant growth in traffic.

- Discount campaigns and bundle promotions drive approximately 32% of total sales.

Canada: Spirits Dominance with Weekend Peaks

Through Web Scraping Liquor Trends in Canada for Halloween, researchers identified:

- Spirits are the leading category, closely followed by beer.

- Consumer purchasing spikes on weekends, particularly October 30–31.

- Alcohol delivery apps demonstrate high engagement in metropolitan areas such as Toronto and Vancouver.

- Early-bird promotions lead to 20% of weekly sales.

Australia: Beer & Cider Preference in Urban Centers

In Australia, Liquor Trends Data Scraper in Australia for Halloween highlights:

- Beer and cider dominate urban center consumption during Halloween.

- Spirits and ready-to-drink cocktails have growing traction, especially among younger demographics.

- Local retailers including Dan Murphy’s and Liquorland report higher weekend demand.

- Quick commerce delivery platforms show a 25% increase in last-mile deliveries during peak hours.

Comparative Analysis of Liquor Categories

The following table provides a breakdown of category-wise consumption across the four countries.

| Category |

USA (%) |

UK (%) |

Canada (%) |

Australia (%) |

| Spirits |

42 |

38 |

44 |

28 |

| Wine |

25 |

45 |

22 |

21 |

| Beer & Cider |

20 |

10 |

18 |

38 |

| Pre-Mixed Cocktails |

8 |

5 |

10 |

7 |

| Other Alcoholic Beverages |

5 |

2 |

6 |

6 |

Insights:

- Spirits are universally popular in North America, while the UK shows a marked preference for wine.

- Beer and cider dominate in Australia due to cultural and seasonal preferences.

- Pre-mixed cocktails are gaining popularity, particularly among younger consumers seeking convenience.

- Promotional intensity correlates strongly with category growth, particularly for spirits and wine.

Delivery and Fulfillment Insights

Across all regions, delivery speed and availability significantly impact sales. Using tools to Extract Halloween Spirits Demand Data from Multiple Countries, the study found:

- USA quick commerce platforms fulfilled 72% of orders within 2 hours during peak times.

- UK retailers leveraged integrated delivery services, ensuring 85% same-day fulfillment.

- Canadian urban centers saw higher late-week demand, with average delivery times of 3–4 hours.

- Australia reported logistical challenges in regional areas but maintained high urban delivery efficiency.

These delivery patterns highlight the importance of last-mile logistics in maximizing seasonal liquor sales.

Pricing Dynamics and Promotional Strategies

By using steps to Extract Alcohol Consumption Trends Across Countries for Halloween, several key observations emerged:

- USA retailers use tiered discounts to encourage bulk purchases of spirits and pre-mixed cocktails.

- The UK favors bundle offers, particularly for wine and premium spirits.

- Canadian stores implement early-week promotions to capture early buyers.

- Australian retailers emphasize weekend flash discounts on beer and cider assortments.

The analysis confirms that pricing and promotional strategies are tailored to local consumer behaviors, directly impacting sales volume and revenue.

Comparative Liquor Consumption Insights

The study highlights significant cross-country differences in Halloween liquor consumption:

- Volume Leaders: USA leads in total units sold due to population size and strong urban consumption.

- Per-Capita Leaders: The UK shows the highest per-capita spending on wine and premium spirits.

- Category Leaders: Spirits dominate in USA and Canada; wine in the UK; beer & cider in Australia.

- Promotional Impact: Discounts and bundles boost volume by 15–30%, with regional variation.

- Delivery Sensitivity: Quick delivery significantly drives last-minute purchases across all regions.

These insights emphasize the need for region-specific strategies in pricing, inventory, and delivery during peak seasonal demand.

Analytical Discussion

- Cross-Country Patterns: Data scraping revealed similar temporal spikes in all regions, with Halloween Eve and Day being the peak periods.

- Consumer Behavior: North American consumers exhibit higher preference for spirits and pre-mixed cocktails, while the UK leans toward wine.

- Logistics Influence: Rapid delivery improves customer satisfaction and increases the likelihood of impulse purchases.

- Promotional Elasticity: Discounts directly influence category performance; higher discounts correlate with higher sales growth, particularly in high-volume categories.

- Forecasting: Multi-country data scraping enables predictive modeling for future seasonal campaigns, improving stock allocation and marketing effectiveness.

Methodology Evaluation and Data Quality

- Data Sources: Online liquor retailers, grocery apps, and quick-commerce platforms provided high-volume listings.

- Data Cleaning: Removed duplicates, normalized currency, and adjusted for regional pricing differences.

- Frequency of Collection: Every 6 hours to capture dynamic pricing and stock changes.

- Data Reliability: Validated using platform API checks and cross-referenced with historical sales data.

Using Liquor Price Data Scraping Services and integrated dashboards ensures high-quality datasets suitable for predictive modeling and cross-country comparison.

Practical Applications

- Retail Strategy: Optimize promotions and inventory allocation based on regional demand patterns.

- Marketing Campaigns: Targeted campaigns can focus on high-demand categories such as spirits or wine.

- Delivery Planning: Quick commerce insights enable efficient last-mile fulfillment.

- Pricing Optimization: Dynamic pricing models informed by scraped data maximize seasonal revenue.

- Cross-Country Benchmarking: Comparative datasets allow global liquor brands to evaluate market performance.

Key Observations Summary

| Theme |

Observation |

Implication |

| Peak Consumption |

Highest on October 30–31 |

Ensure adequate stock for final days |

| Category Dominance |

Spirits in USA & Canada; Wine in UK; Beer in Australia |

Tailor promotions per region |

| Discount Impact |

10–15% discounts increased sales volume |

Use tiered discount strategy |

| Delivery Efficiency |

Quick commerce boosted last-minute orders |

Enhance urban delivery infrastructure |

| Cross-Country Insights |

Significant variation in preferences and pricing |

Customize marketing and pricing strategies |

Conclusion

This report demonstrates how the method provides critical intelligence for understanding Halloween-related alcohol consumption in the USA, UK, Canada, and Australia. Using Alcohol and Liquor Datasets, analysts captured dynamic pricing, category preferences, and delivery patterns to create the Liquor Price Tracking Dashboard.

The study highlights:

- The role of Liquor Data Intelligence Services to find regional differences in consumer preference, with spirits dominating North America and wine in the UK.

- The importance of delivery speed and last-mile logistics in driving peak sales.

- Effective use of promotions and discounts to boost category performance.

Integrating these insights with methods to Scrape Alcohol Price Data ensures that retailers and brands can optimize inventory, pricing, and marketing strategies for future seasonal campaigns.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.