Introduction

The holiday season—particularly Christmas—drives some of the world’s most complex and high‑volume consumer purchase behavior observable in the grocery sector. By applying data analytics to retail pricing and demand patterns, companies can Extract Global Christmas Grocery Market Data and timely insights that reflect consumer preferences, price elasticity, and competitive pricing strategies. Leveraging web scraping strategies to Scrape Global Christmas Grocery Pricing & Demand Data enables real‑time tracking of price fluctuations and demand peaks across key markets including the USA, Philippines, Canada, the UK, and Europe. Such Global Christmas Grocery Data Extraction is crucial for forecasting, pricing strategy, inventory planning, and optimizing promotional tactics during the most significant shopping period of the year.

Market Overview by Region

Across these global regions, seasonal demand spikes for traditional holiday foods such as turkey, sides, beverages, and specialty products create unique pricing dynamics and shopper behavior patterns. Companies that can analyze large datasets—often referred to as Large‑Scale Christmas Grocery Dataset—gain a competitive edge in predicting consumer behavior and optimizing product assortment during this high‑impact period. Additionally, retailers and analysts often rely on Scraped Christmas Grocery Market Insights Report to identify trends and gaps in seasonal product offerings.

United States

In the USA, holiday grocery spending is a major component of annual retail activity. Average consumer expenditure on Christmas celebration items—including food and gifts—stood close to USD 1,205 per person in 2023, with a notable portion attributed to food and grocery purchases. Retailers also rely on methods to Extract Global Christmas Grocery Sales & Pricing Data to monitor competitor pricing and adjust offerings in real time during pre‑holiday promotions such as Black Friday.

United Kingdom

The UK grocery market exhibits strong seasonal spikes in consumer spending leading up to Christmas. In 2024, the UK recorded record take‑home grocery sales of over GBP 13 billion during the holiday period, with average household grocery expenditure at around GBP 460. This phenomenon reflects increased shopper visits (nearly 17 visits per household during December) and intense competitive pricing strategies across supermarkets.

Europe

Across continental Europe, Christmas retail sales are forecast to reach high levels in major markets like Germany and France, with total seasonal retail sales (including food and non‑food) expected to exceed GBP 88 billion in the UK alone. Consumer focus varies by culture and tradition—such as wine and champagne in France or cured meats in Spain—but the volume of grocery transactions during Christmas seasons is broadly higher than the rest of the year.

Canada

Canadian holiday grocery spending trends show substantial investments in seasonal food items. Household budgets in Canada tend to be larger than in many other markets for Christmas festivities, influenced by extensive family celebrations that prioritize both seasonal meals and beverages.

Philippines

While data specific to the Philippines’ Christmas grocery spending is less extensive in global retail research, holiday food traditions (e.g., Noche Buena) command significant grocery purchases in December. Consumer price surveys show the Philippines experiences moderate annual increases in holiday costs, reflecting rising food prices as import and supply chain pressures persist.

Table 1: Seasonal Grocery Pricing Dynamics by Region (2025)

| Region |

Typical Grocery Price Change (%) |

Popular Seasonal Category |

Demand Trend |

| USA |

+10–12% |

Dairy, Meat, Beverages |

High online & in‑store demand |

| UK |

+9–11% |

Turkey, Seasonal sweets |

Frequent repeat visits |

| Canada |

+8–10% |

Local fruit/vegetables, meats |

Strong family meal focus |

| Europe |

+8–12% |

Wine & specialty products |

Mixed by country culture |

| Philippines |

+4–7% |

Traditional holiday food |

Festive household staples |

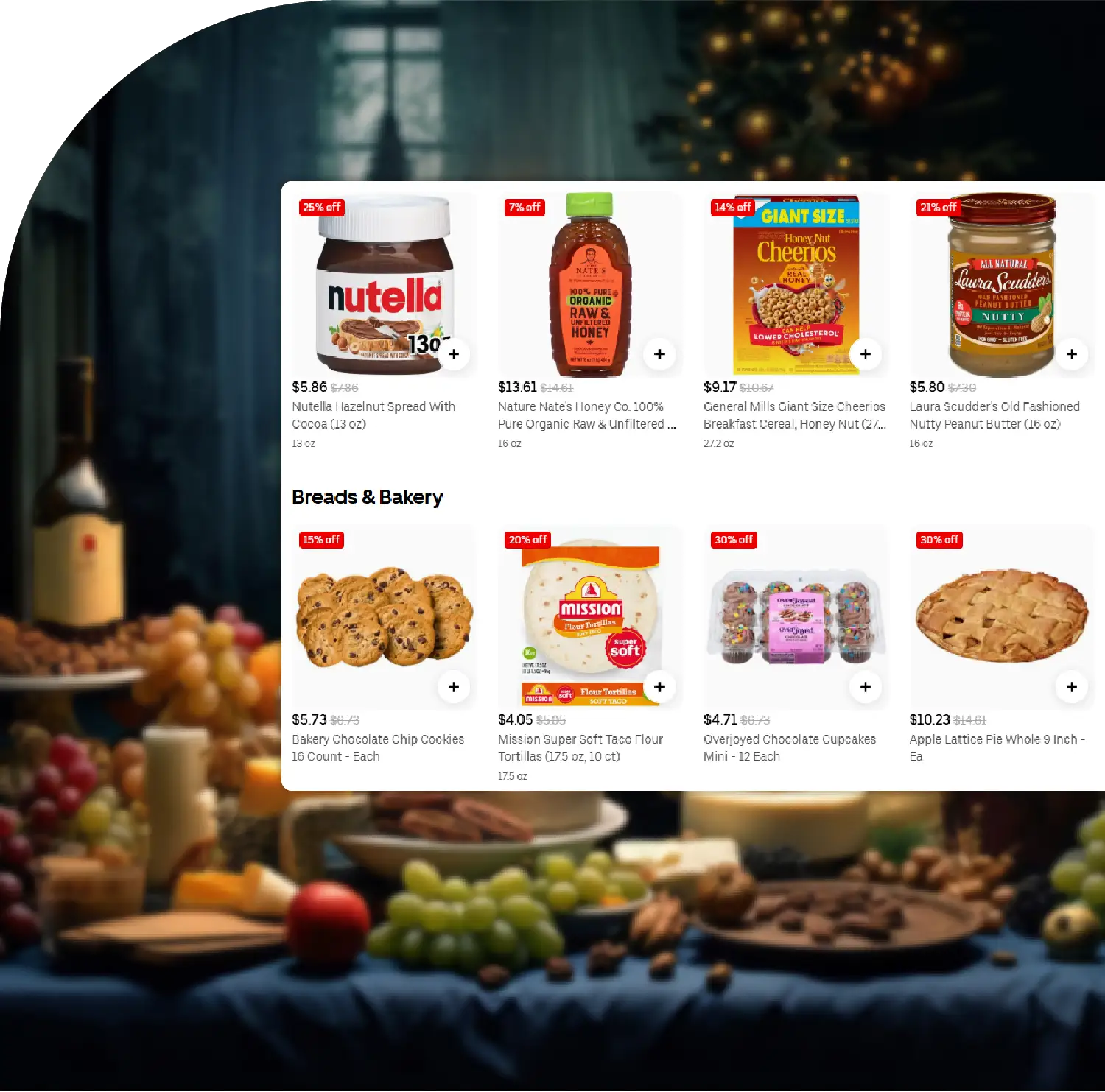

Pricing and Discount Trends

Seasonal pricing trends reflect widespread discounting and promotional activity. Data collected using Grocery App Data Scraping services from festive holiday price around Christmas 2025 reveal that beverages, snacks, and grocery staples experienced average global discounts of approximately 25%, with liquor categories (spirits, wine) often seeing deeper markdowns of 30% or more depending on market. This suggests a common retailer strategy to balance between enticing volume growth and protecting margins during the most competitive selling season.

Table 2: Grocery & Liquor Discounts During Christmas Season 2025

| Category |

USA Discount (%) |

UK Discount (%) |

Canada Discount (%) |

EU Discount (%) |

Global Avg (%) |

| Spirits & Whiskey |

35 |

28 |

30 |

27 |

30 |

| Wine |

33 |

25 |

28 |

29 |

29 |

| Beer |

32 |

24 |

25 |

27 |

27 |

| Snacks & Beverages |

30 |

22 |

23 |

25 |

25 |

| Frozen Foods |

26 |

20 |

22 |

23 |

23 |

| Dairy & Bakery |

24 |

18 |

20 |

22 |

21 |

Data Extraction Methods and Industry Applications

Globally, extracting Christmas grocery data often relies on advanced scraping techniques applied to online supermarket catalogs and price feeds. By automating data collection across multiple retailers’ digital channels, businesses can construct Large-Scale Christmas Grocery Dataset structures that enable demand forecasting, competitor price comparisons, and holiday trend prediction models. These datasets can then feed into analytics tools such as Grocery Price Tracking Dashboard, providing real-time insights into price fluctuations and consumer demand trends across regions.

Typical methods include:

- Web Crawling Retail Sites: Automates the harvesting of price, inventory status, and promotional data from retailer websites.

- API Integration: Uses Grocery Delivery Scraping API Services to collect real‑time pricing and availability data from grocery delivery platforms.

- App Data Scraping Services: Monitors competitor promotions and dynamic pricing within grocery mobile and web apps.

These data streams feed into machine learning and predictive analytics systems, enabling stakeholders to optimize pricing, promotion planning, supply chain allocation, and seasonal demand estimation.

Consumer Behavior Insights

Several common behaviors emerge from Christmas grocery data analytics:

- Increased Visit Frequency: For example, UK consumers made an average of 17 grocery trips in December 2024—far above typical monthly averages—reflecting continuous preparation and last‑minute shopping behavior.

- Competitive Price Sensitivity: Discount offerings and competitive basket pricing (e.g., lowest cost full holiday meal set) can significantly impact consumer choice and retailer market share.

- Online vs. In‑Store Mix: While in‑store visits remain significant, online channels are gradually capturing larger shares due to convenience and targeted promotions.

Conclusion

Leveraging holiday grocery datasets provides actionable insights for retailers, analysts, and supply chain managers. Implementing tools such as Grocery Price Dashboard enables real-time monitoring of pricing trends, while Grocery Pricing Data Intelligence supports predictive analysis of demand and competitor activity. Furthermore, maintaining comprehensive Grocery Store Datasets allows businesses to model sales forecasts, optimize inventory allocation, and plan targeted promotions for future Christmas seasons.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.