Introduction

The global food and beverage sector of 2025 is developing rapidly due to changes in consumer preferences, accelerated technology changes, and widespread changes in sustainability issues. Businesses are in a position to reassess and adapt their models of operating to respond to a consumer base that is rapidly changing behaviors that focus on health, sustainability, and digital integration with consumption processes. This report studies new themes such as plant-based nutrition, innovative packaging, personalized diets, and supply chain transparency. With live analytics becoming more sought after across any brand, organizations invested hundreds of thousands of dollars to develop mechanisms to Extract Global Food and Drink Trends Insights 2025 to get ahead of the pack. With the growing customer behavior and consumption transformations globally, the necessity to Scrape Global Food and Beverage Trends 2025 ensures that businesses are prepared for evolutions in consumption. This report's analysis and data tables will lend important insight, profiling, and segmenting into purchasing habits for geographic, preference, and market segmentation. 2025 Food and Drink Industry Data Scraping allows stakeholders to effectively and efficiently make real-time decisions in taking advantage of this highly volatile and rapidly evolving industry.

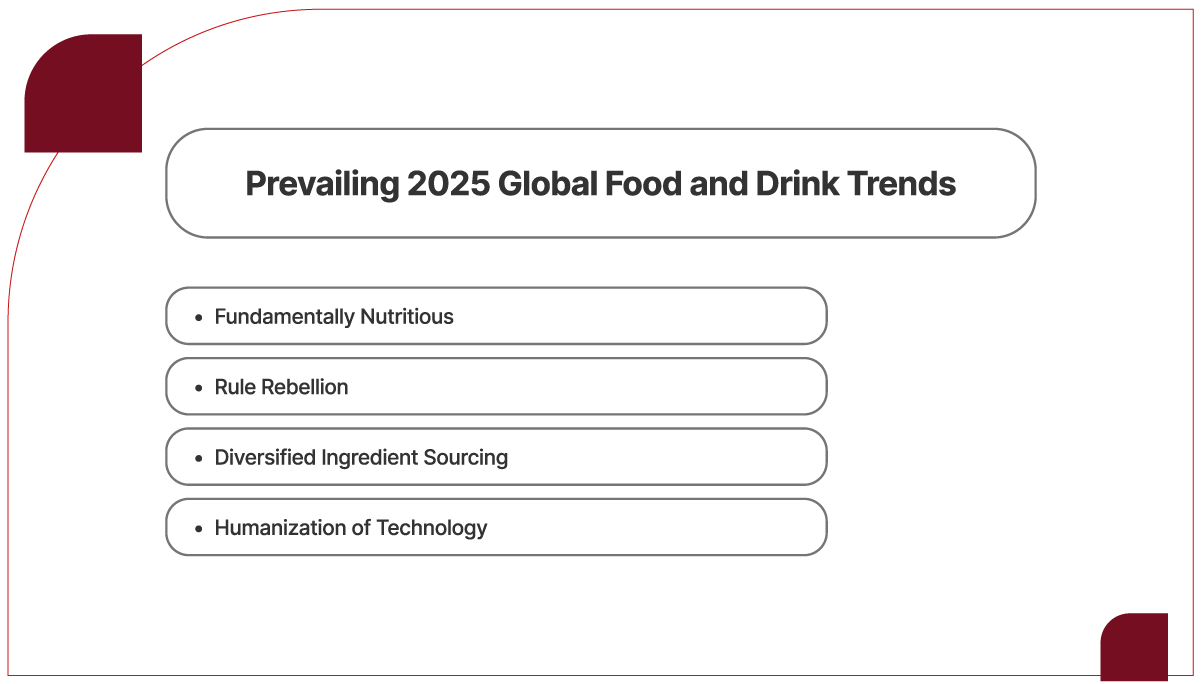

Prevailing 2025 Global Food and Drink Trends

Four key trends define the food and drink landscape in 2025. These trends reflect consumer desires for health, indulgence, sustainability, and innovation, navigating a complex interplay of personal and planetary priorities.

- Fundamentally Nutritious: The rise of GLP-1 weight-loss medications, such as Ozempic, has shifted consumer perceptions of "food as medicine." Rather than focusing on added functional ingredients, consumers are prioritizing nutrient-dense foods that meet essential daily needs, particularly protein and fiber. This trend is driven by a broader awareness of health and wellness, with 83% of Brazilian consumers seeking foods that keep them fuller for longer and 21% of German adults using glucose monitoring to manage weight. Brands respond by simplifying health claims, emphasizing protein quality, bioavailability, and digestibility. For instance, whey protein isolate is highlighted as a gold standard for its complete amino acid profile and high bioavailability. Web Scraping for Global Food and Drink Insights 2025 supports brands in tracking such evolving preferences.

- Rule Rebellion: Consumers are embracing a "perfectly imperfect" approach, seeking brands that allow them to break traditional food rules while balancing health and indulgence. This trend is evident in the demand for bold, sensory-rich experiences, with 43% of global consumers craving unique, indulgent creations. Examples include extravagant flavor combinations like oversized doughnuts with global-inspired toppings or salads with duck fat dressing. This aligns with the "Wildly Inventive" trend, where surprising mash-ups and textures, such as Del Monte's Bubble Fruit Gel with popping boba, captivate consumers. Real-time monitoring through Grocery Store Datasets can help brands anticipate demand for such creative innovations.

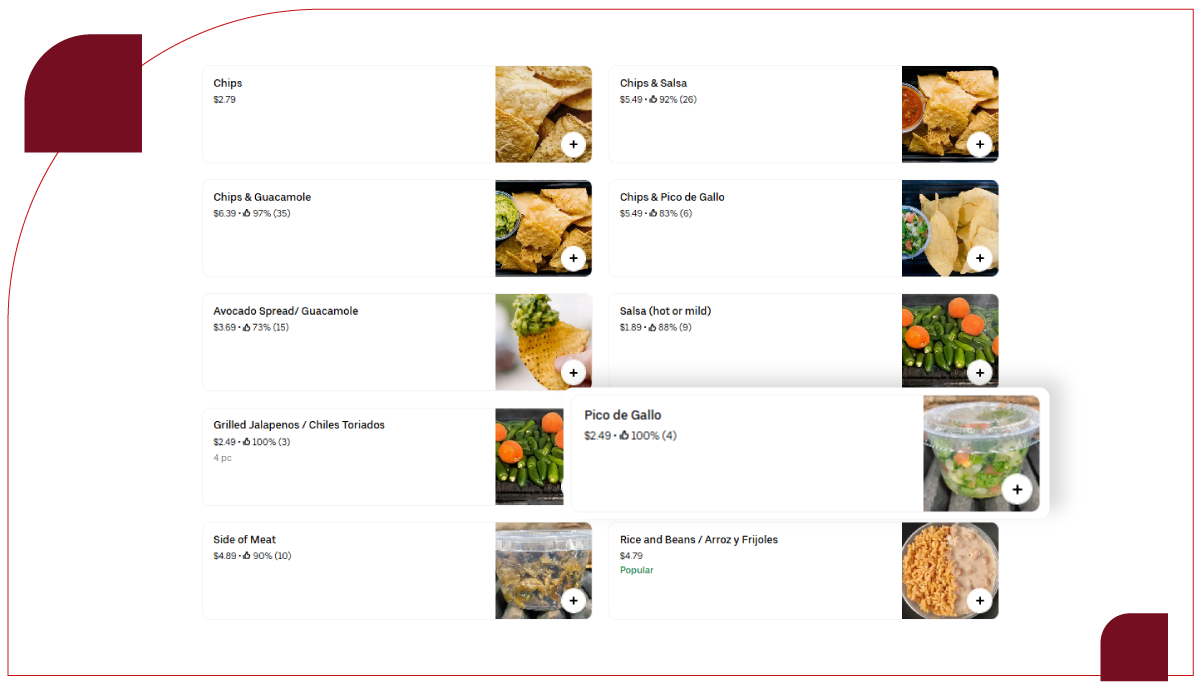

- Diversified Ingredient Sourcing: Climate change, geopolitical disruptions, and supply chain volatility push brands to diversify ingredient sourcing. Consumers increasingly accept new provenances, with 23% of Argentinian consumers avoiding unfamiliar ingredients but showing openness to trusted alternatives. This trend reflects a shift from earlier demands for total transparency (2018) to a pragmatic acceptance of supply chain adaptations. Brands are leveraging local and global sources to ensure consistency, with Southeast Asia seeing growth in functional beverages using local ingredients like lemongrass and ginger. Food Delivery Data Scraping Services play a role in understanding which ingredients are gaining popularity across delivery platforms.

- Humanization of Technology: As technology, including AI and precision fermentation, reshapes food production, consumers demand transparency and human-centric benefits. The integration of agriculture and technology (ag-tech) is gaining traction, with innovations like cultivated meats and protein from fungi like mycelium. Brands must communicate how these advancements enhance taste, nutrition, or supply reliability to overcome consumer apprehension. For example, companies are advancing precision fermentation for sustainable protein production, aligning with consumer interest in environmentally friendly options. Access to consumer trends through Food Delivery Scraping API Services enables better alignment with these tech-forward preferences.

Complementary Trends

In addition to core trends, other reports highlight related dynamics:

- Plant-Based Evolution: The "Plant-Based: Rethinking Plants" trend shows consumers seeking less processed, natural plant-based products. Fava bean, almond, and lentil proteins are gaining popularity, with a focus on clean-label formulations that avoid mimicking meat or dairy.

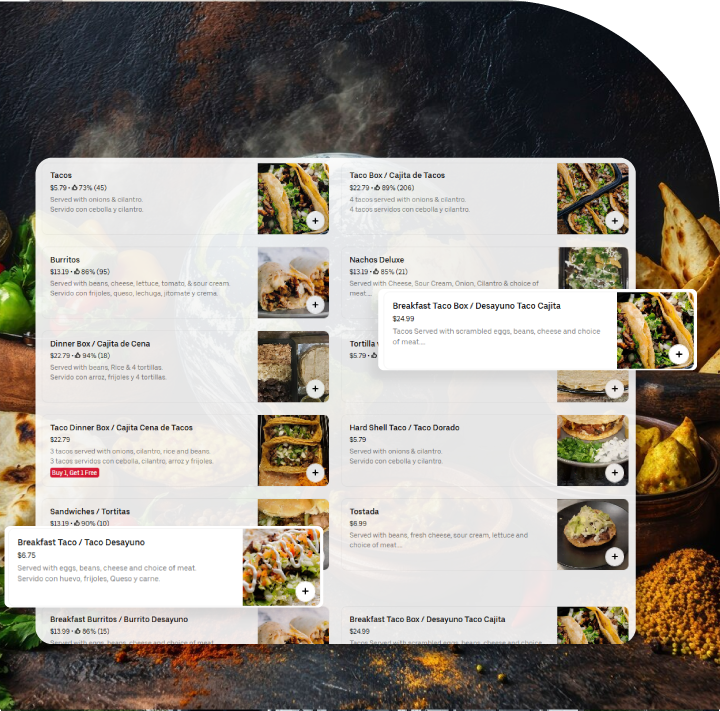

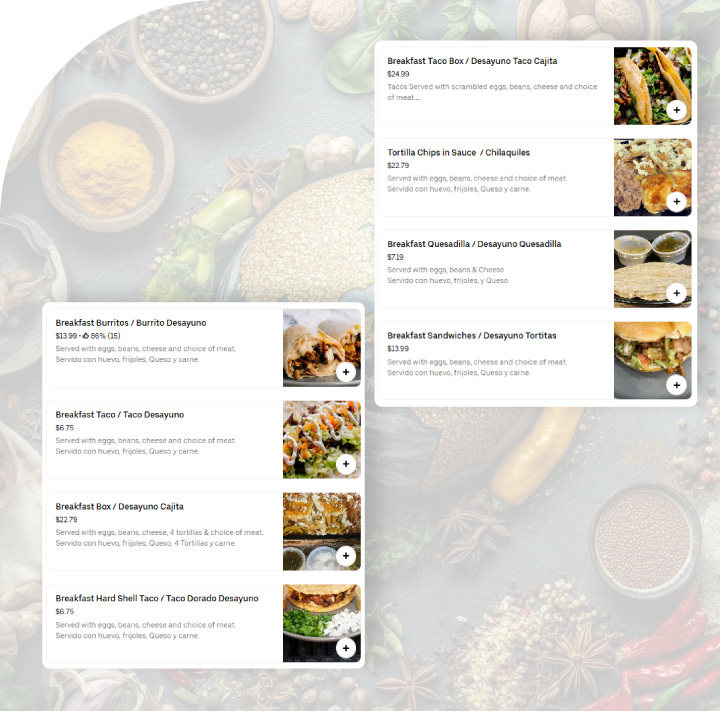

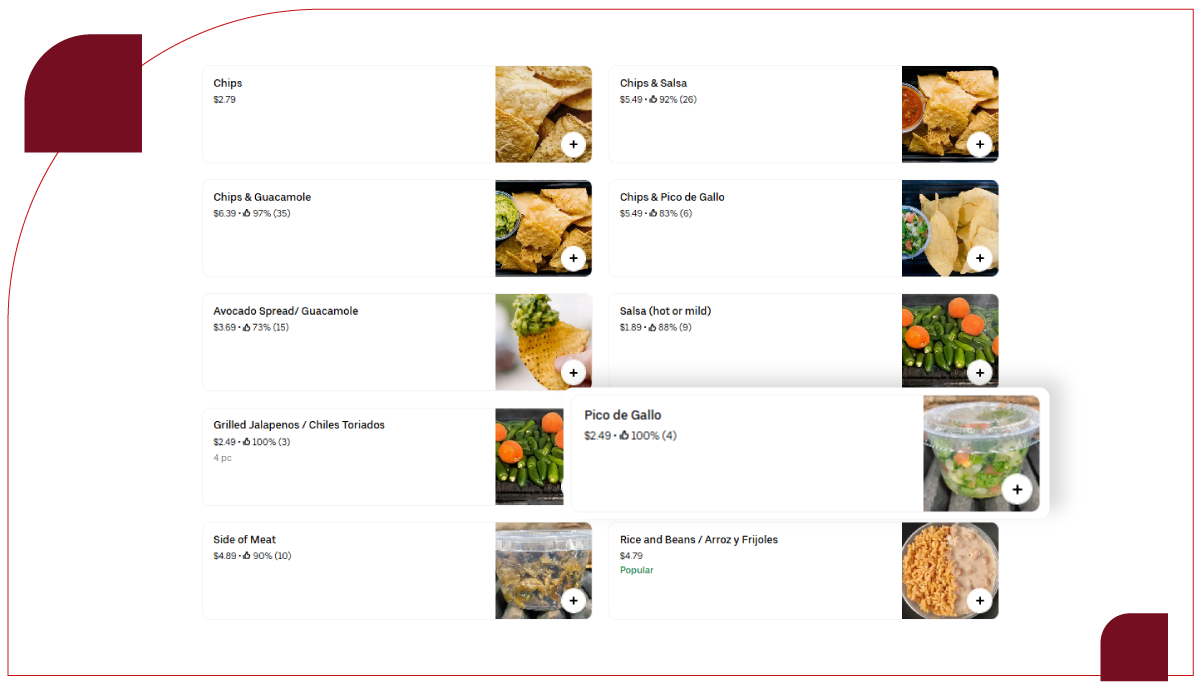

- Global Flavors and Fusion: There is a surge in demand for bold, global cuisines, particularly Southeast Asian (e.g., Filipino, Vietnamese) and Mexican-ish fusion, such as Pakistani-Mexican tacos. This aligns with 55% of UK consumers exploring new flavors when eating out.

- Little Treat Culture: Gen Z's preference for small, indulgent pick-me-ups, like single-serve cakes or RTD coffee drinks, drives impulse purchases. Hot chocolate is also emerging as a cost-effective indulgence, with 38% of consumers viewing it as a treat.

- Sustainability and Clean Labels: The backlash against ultra-processed foods (UPFs) has fueled demand for clean-label products with recognizable ingredients. Over 60% of consumers aim for planet-positive habits, and 32% avoid environmentally harmful ingredients.

Market Data and Insights

These trends are projected to drive the global food and beverage market's growth significantly. Below are two data tables summarizing key metrics and consumer behaviors.

Table 1: Global Food and Beverage Market Projections (2024–2029)

| Segment |

2024 Market Size (USD Billion) |

2029 Projected Market Size (USD Billion) |

CAGR (%) |

| Overall Food & Beverage |

273.2 |

427.5 |

9.4 |

| Beverage Market |

235.7 |

380.4 |

10.05 |

| Plant-Based Milk |

29.18 |

54.6 |

12.6 |

| Plant-Based Seafood |

0.758 |

1.4 |

30.0 |

| Protein Market |

27.5 |

47.4 |

11.5 |

This table illustrates the robust growth expected across key segments. The beverage market, driven by health-conscious and functional drinks, is projected to grow at a CAGR of 10.05%, with Asia-Pacific leading due to rising health awareness. Plant-based markets, particularly seafood, show explosive growth potential, reflecting consumer interest in sustainable alternatives.

Table 2: Consumer Behavior Trends (2025)

| Consumer Preference |

Percentage (%) |

Region |

| Seeking bold, unique food experiences |

43 |

Global |

| Prioritizing ingredient quality |

58 |

Global |

| Want nostalgic flavors |

18 |

Global |

| Exploring new flavors when eating out |

55 |

UK |

| Avoiding environmentally harmful ingredients |

32 |

Global |

| Interested in nutritionally personalized food |

67 |

Indonesia |

| Using social media for healthcare knowledge |

64 |

China |

This table highlights the global consumer shift toward quality, indulgence, and sustainability. The high percentage of Indonesian consumers interested in personalized nutrition underscores the growing role of data-driven food solutions, while Chinese consumers’ reliance on social media reflects the influence of digital platforms on health decisions.

Industry Implications

The 2025 trends have significant implications for food and beverage brands:

- Product Development: Brands must innovate with nutrient-dense, clean-label products that balance health and indulgence. For example, incorporating high-quality proteins like whey or plant-based options like fava bean can appeal to health-conscious consumers. Leveraging Grocery App Data Scraping Services can help identify trending ingredients in real time.

- Marketing Strategies: Simplified, transparent health claims and storytelling around ingredient sourcing will build trust. Highlighting the human benefits of technology, such as improved taste or sustainability, is critical to overcoming consumer skepticism.

- Sustainability Focus: With 60% of consumers adopting planet-positive habits, brands should invest in sustainable packaging and deforestation-free ingredients to align with regulations like the EU Deforestation Regulation. Tools like a Grocery Price Dashboard help benchmark sustainable options across markets.

- Global and Local Fusion: The popularity of global flavors offers opportunities for brands to create fusion products that cater to adventurous palates, particularly in markets like the UK and Asia-Pacific. A Grocery Price Tracking Dashboard and Grocery Pricing Data Intelligence can support pricing strategies and product positioning.

Regional Insights

- Asia-Pacific: This region is the fastest-growing beverage market, driven by health-conscious consumers and e-commerce growth. Functional beverages with local ingredients, like Thai herbal teas, are thriving.

- North America: The US sees strong demand for plant-based milks (40% of households purchase them) and protein-focused products, with whey and plant-based proteins leading innovation.

- Europe: UK consumers are embracing global cuisines, while EU regulations like the Corporate Sustainability Reporting Directive push brands toward transparency and sustainability.

Conclusion

The global food and drink industry in 2025 is navigating a dynamic landscape shaped by health, indulgence, sustainability, and technology. The “Fundamentally Nutritious” trend emphasizes essential nutrients, while “Rule Rebellion” celebrates bold, indulgent experiences. Diversified ingredient sourcing and the humanization of technology address supply chain challenges and consumer trust in innovation. With increasing interest in Web Scraping Plant-Based Food Trends 2025, brands can better understand shifts toward healthier and eco-conscious diets. Supported by robust market growth projections and evolving consumer behaviors, companies must Extract Food and Drink Market Data 2025 to inform strategic decisions. Transparent marketing, sustainable practices, and data-driven product innovation are now critical for brand relevance. The rise of Food and Beverage Industry Trends Web Scraping enables real-time monitoring of emerging trends and competitor performance. The data tables underscore the industry’s growth potential and the diverse consumer preferences driving these trends, offering actionable insights for stakeholders across global markets.

Are you in need of high-class scraping services? Food Data Scrape should be your first point

of call. We are undoubtedly the best in Food Data Aggregator and

Mobile Grocery

App Scraping service and we render impeccable data insights and

analytics for strategic decision-making. With a legacy of excellence as our

backbone, we help companies become data-driven, fueling their development. Please take

advantage of our tailored solutions that will add value to your business. Contact us today

to unlock the value of your data.