Introduction

The global chocolate and confectionery market is evolving rapidly, driven by flavor experimentation, cross-format innovation, and strong regional demand signals. In this context, brands like KitKat are no longer defined solely by their core chocolate wafer bars but by their adaptability across desserts, beverages, seasonal launches, and localized flavors. Businesses seeking competitive intelligence increasingly rely on structured methods to Extract KitKat Flavor and Product Trend Data, enabling actionable insights across retail and foodservice ecosystems.

At the same time, KitKat Flavor Trend Data Extraction is empowering brands, retailers, and analysts to identify emerging variants and track flavor-level growth signals across regions.

In parallel, Scrape KitKat Dessert Formats Data to enable businesses monitor menu penetration, dessert integrations, and lifecycle expansion across foodservice channels.

The Data-Driven KitKat Ecosystem

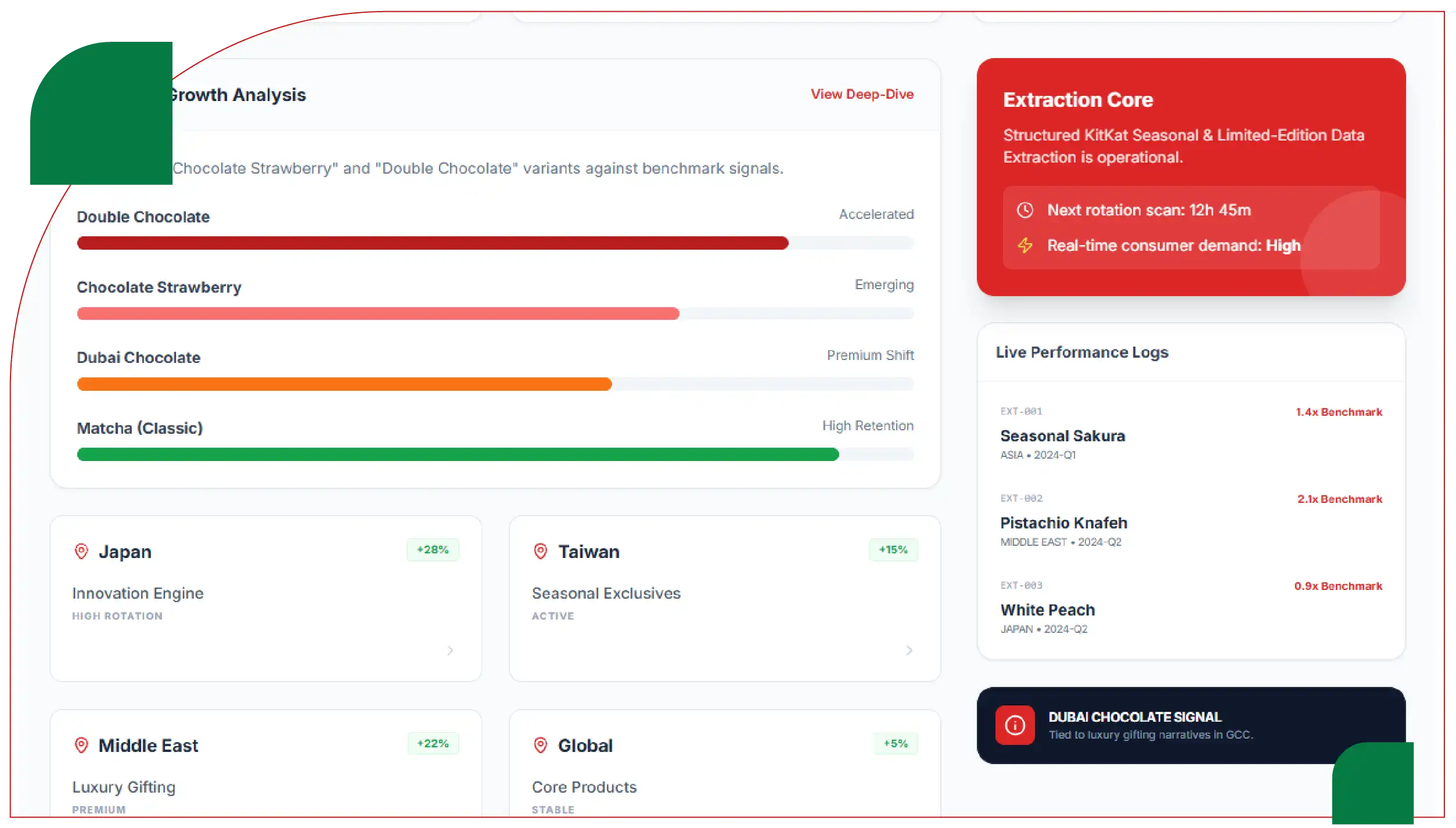

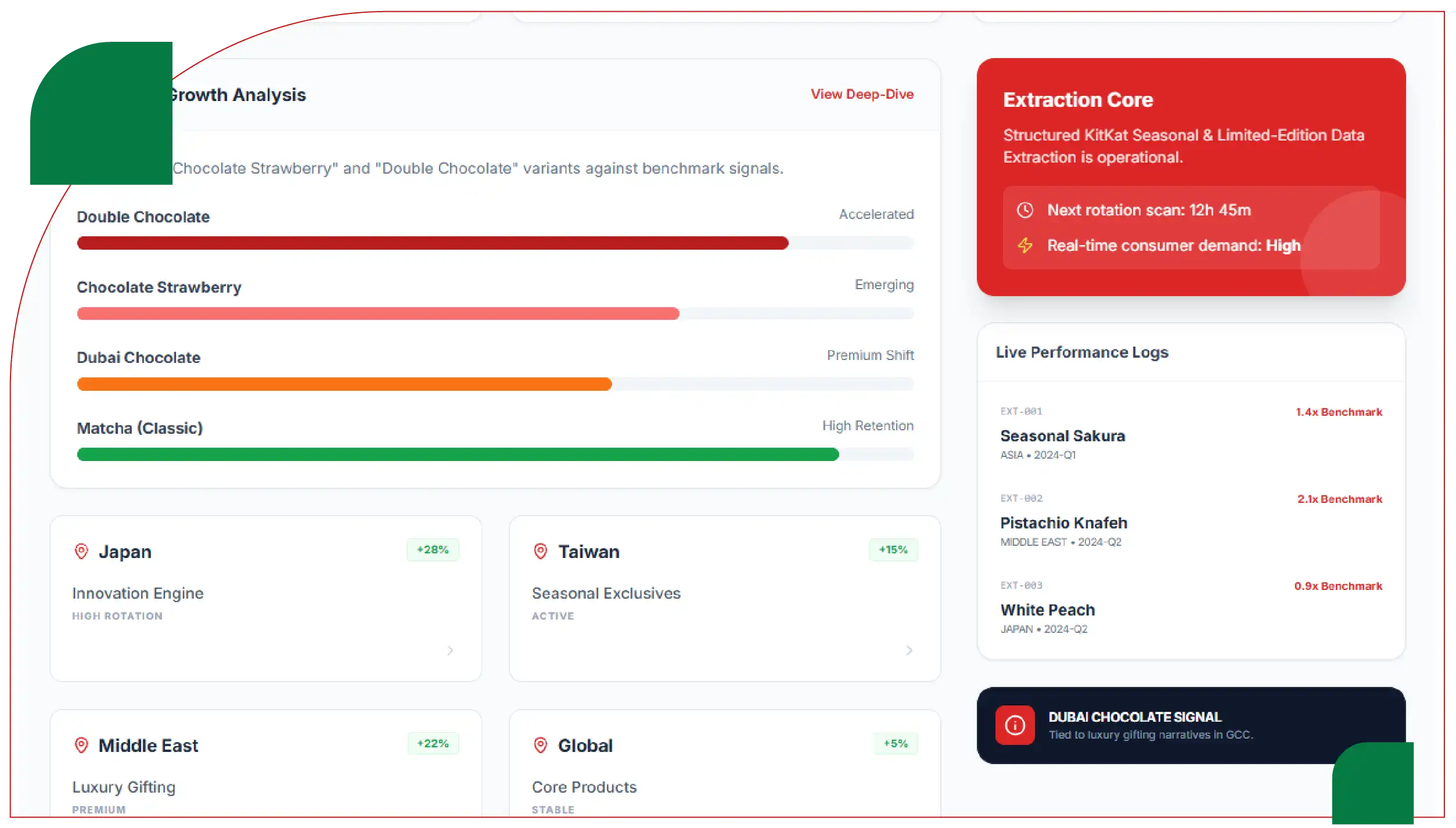

KitKat operates at the intersection of indulgence, novelty, and ingredient adaptability. Trend signals show that flavor-led innovation drives engagement more than broad brand chatter. Emerging variants such as chocolate strawberry and double chocolate demonstrate accelerated growth, particularly in Asia and premium Middle Eastern markets.

Asia—especially Japan and Taiwan—serves as the primary innovation engine. Seasonal exclusives, gifting packs, and culturally themed releases normalize rapid rotation and collectability. Meanwhile, “Dubai chocolate” signals premium positioning tied to luxury gifting narratives in the Middle East.

For data-driven organizations, structured KitKat Seasonal & Limited-Edition Data Extraction is essential to quantify rotation cycles, regional exclusives, and time-bound product performance.

Systematic method to Extract KitKat Food Trend Data processes further help measure flavor growth, menu integration patterns, and shifting consumer demand signals.

Flavor Momentum and Growth Indicators

Flavor experimentation defines current KitKat demand. Chocolate strawberry and double chocolate are not merely line extensions—they represent modular flavor layers adaptable across formats such as milkshakes, McFlurries, and plated desserts.

Table 1: Emerging KitKat Flavor Growth Indicators

| Flavor Variant |

YoY Growth (%) |

Lifecycle Stage |

Key Regions |

Primary Usage Formats |

Consumer Drivers |

| Chocolate Strawberry |

+178% |

Emerging |

Japan, Taiwan, US |

Desserts, Drinks, Hybrid Bars |

Sweet, Novelty |

| Double Chocolate |

+115% |

Emerging |

US, UK, Asia |

Bars, Shakes, Ice Cream |

Indulgent |

| Matcha Chocolate |

+89% |

Growth |

Japan, Asia |

Seasonal Packs, Desserts |

Cultural Identity |

| White Chocolate Berry |

+76% |

Growth |

US, Middle East |

Premium Desserts |

Premiumization |

| Vegan Chocolate |

+64% |

Growth |

US, Europe |

Retail Bars, Recipes |

Plant-Based |

These insights are derived through structured Scraping KitKat Product Information for Trend Analysis, allowing analysts to track lifecycle transitions from Emerging to Growth stages.

Regional Demand Patterns

Regional ecosystems shape KitKat’s innovation pipeline:

- Asia: Rapid experimentation, limited-edition culture, and gift-centric consumption.

- United States: Strong dessert integration and menu presence (approx. 6.94% of restaurants offer KitKat-based dishes).

- Middle East: Premium chocolate narratives, including Dubai-inspired formats.

- Europe: Gradual plant-based and indulgent flavor adoption.

By implementing KitKat Product Trend Monitoring, brands can compare SKU availability, limited-edition frequency, and pricing dispersion across markets.

Dessert & Beverage Format Expansion

KitKat’s transformation into an ingredient-led brand is most visible in dessert and beverage formats. Rather than single-bar consumption, usage clusters around hybrid builds.

Table 2: KitKat Dessert & Beverage Format Performance

| Format Type |

Engagement Index |

Average Menu Price (USD) |

Social Media Engagement (Likes) |

Format Growth Trend |

| KitKat Milkshake |

141X |

5.99 – 8.50 |

100K–400K+ |

High Growth |

| KitKat McFlurry Style |

131X |

3.99 – 6.99 |

150K–350K |

High Growth |

| KitKat Cheesecake |

118X |

6.50 – 12.00 |

80K–200K |

Moderate Growth |

| KitKat Latte |

104X |

4.50 – 7.00 |

60K–150K |

Emerging |

| KitKat Soft-Serve |

97X |

3.50 – 5.50 |

50K–120K |

Emerging |

The ability to KitKat Products & Flavor Data Scraping across restaurant menus, QSR chains, and creator platforms allows businesses to identify format-specific spikes.

Consumer Needs and Cultural Signals

Consumer demand clusters around three primary emotional drivers:

- Sweet (9%)

- Indulgent (8%)

- Tasty (8%)

However, cultural needs such as “Japanese” (7%) and “Asian” (7%) are equally influential. This indicates that KitKat is positioned not only as a chocolate snack but also as a cultural novelty product.

Data-backed insights from Web Scraping Grocery Data and recipe platforms reveal strong engagement with Vegan KitKat builds, suggesting demand for dietary adaptations even without official product extensions.

Ingredient-Level Correlations

Ingredient growth provides predictive signals for future KitKat innovation.

Table 3: Ingredient & Dish Lifecycle Correlations

| Ingredient / Dish |

YoY Growth (%) |

Lifecycle Stage |

Associated Formats |

Innovation Potential |

| Sweet Cream |

+227% |

Emerging |

Cheesecakes, Milkshakes |

High |

| Oatmeal |

+144% |

Emerging |

DIY Bars, Vegan Recipes |

Moderate |

| Matcha |

+112% |

Growth |

Asian Desserts |

High |

| Berry Mix |

+96% |

Growth |

Strawberry Variants |

High |

| Vanilla Milk Foam |

+82% |

Emerging |

Coffee & Latte Builds |

Moderate |

Monitoring these correlations via a Grocery Delivery Extraction API enables structured capture of SKU-level ingredient changes in retail environments.

Retail Intelligence & Pricing Analytics

Retail integration demonstrates KitKat’s versatility:

- Ice cream inclusions

- Shake toppings

- Premium plated desserts

- Vegan recipe adaptations

Pricing ranges from mass-market QSR ($3.99) to premium plated desserts ($12+). A real-time Grocery Price Dashboard helps businesses monitor regional price dispersion and promotional activity.

Key measurable factors include:

- SKU frequency by retailer

- Limited-edition rotation cycles

- Discount intensity

- Regional stock availability

- Private-label wafer competitors

These indicators provide forward-looking signals for market entry and product development decisions.

Seasonal & Limited-Edition Strategy

Seasonality plays a crucial role in sustaining engagement:

- Sakura-themed launches in Japan

- Valentine’s strawberry editions

- Ramadan gift packs in Middle Eastern markets

- Winter double-chocolate indulgence builds

Structured KitKat Seasonal & Limited-Edition Data Extraction allows companies to:

- Measure rotation velocity

- Compare seasonal sell-through rates

- Track limited-edition lifecycle duration

- Identify high-return flavor themes

Such intelligence is especially valuable for forecasting repeat seasonal demand.

Strategic Business Applications

Organizations leveraging Extract KitKat Food Trend Data can apply insights across:

- Product Development

Launching regionally adapted flavors.

- Menu Engineering

Adding high-index dessert integrations.

- Pricing Optimization

Monitoring competitor margins.

- Plant-Based Expansion

Capitalizing on Vegan KitKat demand.

- Global Export Strategy

Scaling successful Asian exclusives internationally.

Additionally, Scraping KitKat Product Information for Trend Analysis supports SKU benchmarking against competitor chocolate wafer brands.

Conclusion

The KitKat ecosystem demonstrates how flavor innovation, cultural localization, and dessert integration reshape a legacy confectionery brand. Growth in chocolate strawberry, double chocolate, and matcha variants highlights flavor modularity, while dessert and beverage formats redefine usage occasions.

For businesses seeking long-term visibility, integrating trend tracking into a Grocery Price Tracking Dashboard ensures real-time oversight of SKU performance, promotional intensity, and regional adoption cycles.

Combined with structured Grocery Data Intelligence, organizations can convert raw flavor experimentation into meaningful, insight-driven strategies. Continuously updated Grocery Datasets further enable measurable competitive advantage in the rapidly evolving confectionery market.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.