Introduction

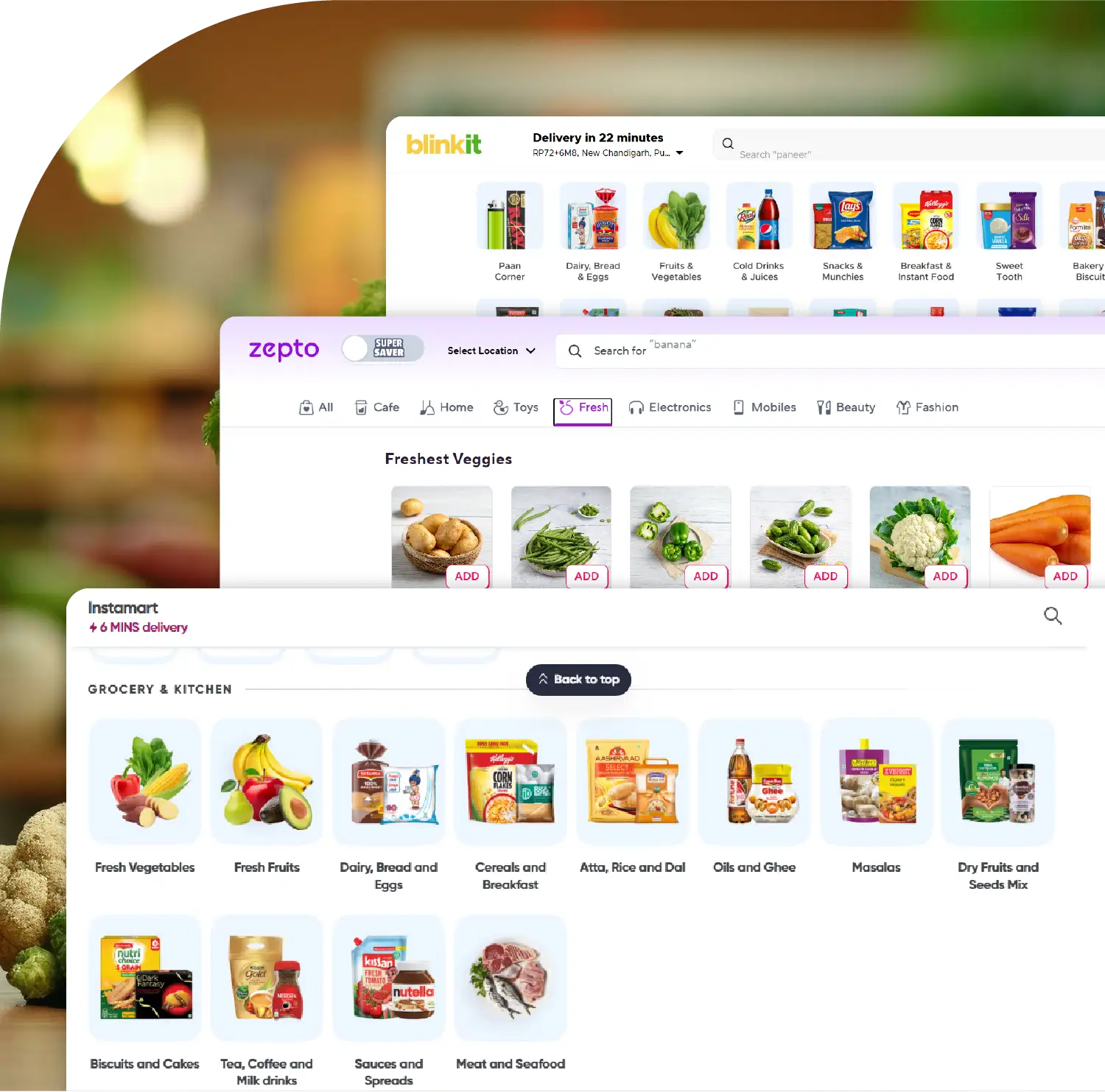

Quick commerce (Q-commerce) has emerged as a transformative force in urban retail, driven by the consumer demand for instant gratification. By leveraging tools to Extract Q-Commerce Data for Product & Price Insights, platforms are gaining a competitive edge in understanding market dynamics. Real-Time Q-Commerce Price Monitoring India enables businesses to track pricing trends instantly, ensuring alignment with consumer expectations. Instant Delivery Apps Data Scraping India provides critical insights into product availability and consumer preferences, particularly among Millennials and Gen Z, who prioritize speed and convenience. This research report explores how Q-commerce is reshaping urban retail by analyzing product offerings and pricing strategies. Examples from leading platforms like Blinkit, Zepto, and Swiggy Instamart in India, along with data-driven observations, will illustrate the impact of instant gratification on urban retail.

Methodology

This report synthesizes data from recent industry reports, academic studies, and market analyses available up to July 2025. Data was collected from reputable sources, focusing on market size, consumer behavior, and pricing strategies. Scrape Q-Commerce Platforms in India to gather real-time data on product availability and pricing. Two tables are included to present quantitative insights, supported by qualitative analysis of case studies from India’s Q-commerce market. The analysis also incorporates consumer behavior studies and operational strategies, such as dark store models, to understand how data drives Q-commerce success.

Market Overview

The Q-commerce market in India, valued at US$5.3 billion in 2025, is projected to reach US$12.59 billion by 2030, with a CAGR of 18.9%. Quick Commerce Pricing Intelligence India reveals how platforms use competitive pricing to capture market share. Globally, markets like China lead with a projected revenue of US$92,680 million in 2025. Still, India’s rapid adoption, driven by smartphone penetration and a young, tech-savvy population, positions it as a pioneer. Real-Time Quick Commerce Trends Scraping in India highlights urban areas, particularly metro cities like Bengaluru, Delhi NCR, and Mumbai, as epicenters of growth, with 70% of Gen Z shoppers making impulse purchases. Q-commerce platforms operate on a hyperlocal model, utilizing dark stores to ensure rapid fulfillment, catering to last-minute needs for groceries, personal care items, and electronics.

Key Observations

- Consumer Behavior Shift: Extract Data from India’s Quick Commerce Apps to know that 75% of Indian consumers reported increased unplanned purchases in 2025, such as India team jerseys during the Cricket World Cup Final.

- Category Diversification: Platforms are expanding beyond groceries to include beauty and electronics, with Zepto Data Scraper revealing new product categories driving sales.

- Pricing Strategies: Competitive pricing, obtained by tools to Scrape Blinkit Data, allows platforms to adjust prices based on demand and competitor rates.

- Operational Efficiency: Dark stores and AI-driven logistics, supported by Extract Swiggy Instamart Data, enable rapid delivery and cost optimization.

- Impact on Traditional Retail: Scrape BigBasket Data to indicate that 46% of Q-commerce users have reduced purchases from local kirana stores.

Data Insights

The following tables provide quantitative insights into Q-commerce trends and their impact on urban retail.

Table 1: Q-Commerce Market Growth in India (2023–2029)

| Year |

Market Size (US$ Billion) |

CAGR (%) |

User Penetration (%) |

Average Revenue Per User (US$) |

| 2023 |

2.3 |

- |

1.8 |

120.50 |

| 2025 |

5.3 |

16.07 |

2.7 |

137.20 |

| 2027 (Predicted) |

7.5 |

16.07 |

3.2 |

145.00 |

| 2029 (Predicted) |

9.8 |

16.07 |

4.0 |

161.60 |

Table 2: Consumer Behavior in Q-Commerce (2025)

| Behavior |

Percentage (%) |

Key Example |

| Impulse Purchases |

75 |

Buying snacks during late-night study sessions |

| Orders >5 per Month |

53 |

Regular grocery top-ups via Blinkit |

| Average Order Value >₹400 |

67 |

Bundling essentials with beauty products |

| Reduced Kirana Store Spending |

46 |

Shifting to Zepto for daily essentials |

Analysis

Consumer Demand for Instant Gratification

The success of Q-commerce hinges on fulfilling the desire for instant gratification. Quick Commerce Data Intelligence Services enable platforms like Blinkit to predict demand patterns, ensuring high-demand items are stocked in dark stores. For instance, during festive seasons, Blinkit reported a surge in gift item orders, with AI-driven recommendations increasing basket sizes.

Pricing and Product Visibility

Dynamic pricing, supported by Quick Commerce Data Insights, is critical for competitiveness. Zepto uses real-time data to monitor competitor pricing and offer discounts on high-demand items like dairy products. Strategic product placement, informed by Grocery App Data Scraping Services, boosts visibility, as users rarely browse beyond initial search results.

Operational Innovations

Dark stores are pivotal, with Swiggy Instamart operating over 500 dark stores stocked with 2,000–3,000 SKUs tailored to local demand. Web Scraping Quick Commerce Data ensures minimal stockouts and optimized delivery routes, enhancing sustainability by reducing long-distance transportation.

Challenges and Opportunities

Challenges include regulatory concerns around data protection and labor laws. However, Grocery Delivery Scraping API Services offer opportunities to enhance personalization, while expansion into tier 2 and tier 3 cities presents growth potential.

Examples

- Blinkit’s Event-Driven Sales: Scrape Blinkit Data to reveal that there was a 300% surge in sales of India team jerseys during the 2023 Cricket World Cup Final, driven by targeted promotions.

- Zepto’s Dynamic Pricing: Zepto Data Scraper showed a 20% increase in order frequency in 2025 due to dynamic pricing on essentials like milk.

- Swiggy Instamart’s Category Expansion: Extract Swiggy Instamart Data to highlight how adding electronics and beauty products increased market share by 15% in metro cities.

Key Findings

- Q-commerce thrives on impulse buying, with Quick Commerce Data Insights revealing that 75% of customers make unplanned purchases—highlighting the need for real-time analytics to understand shifting consumer behavior.

- Quick Commerce Data Intelligence Services are transforming operations by using data analytics to optimize pricing, forecast demand, and manage inventory more effectively—driving efficiency across platforms in the ultra-fast delivery sector.

- The move from traditional kirana shops to digital platforms, supported by tools that Scrape BigBasket Data, reflects a broader trend of digitization in India’s fast-evolving retail landscape.

- Q-commerce’s expansion into non-grocery segments and smaller cities opens major growth avenues, offering vast opportunities for brands to tailor strategies using localized insights and hyper-targeted Quick Commerce Data Solutions.

Conclusion

Q-commerce is revolutionizing urban retail by leveraging Grocery Delivery Scraping API Services to meet consumer demands for instant gratification. Platforms like Blinkit, Zepto, and Swiggy Instamart use Grocery Price Tracking Dashboard tools to ensure competitive pricing and operational efficiency. Grocery Store Datasets reveal that hyperlocal delivery and AI-driven personalization are setting new standards for convenience. However, challenges like regulatory compliance and sustainability must be addressed to sustain growth. As Q-commerce expands, its ability to adapt to consumer preferences through data insights will shape the future of urban retail.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.