Introduction

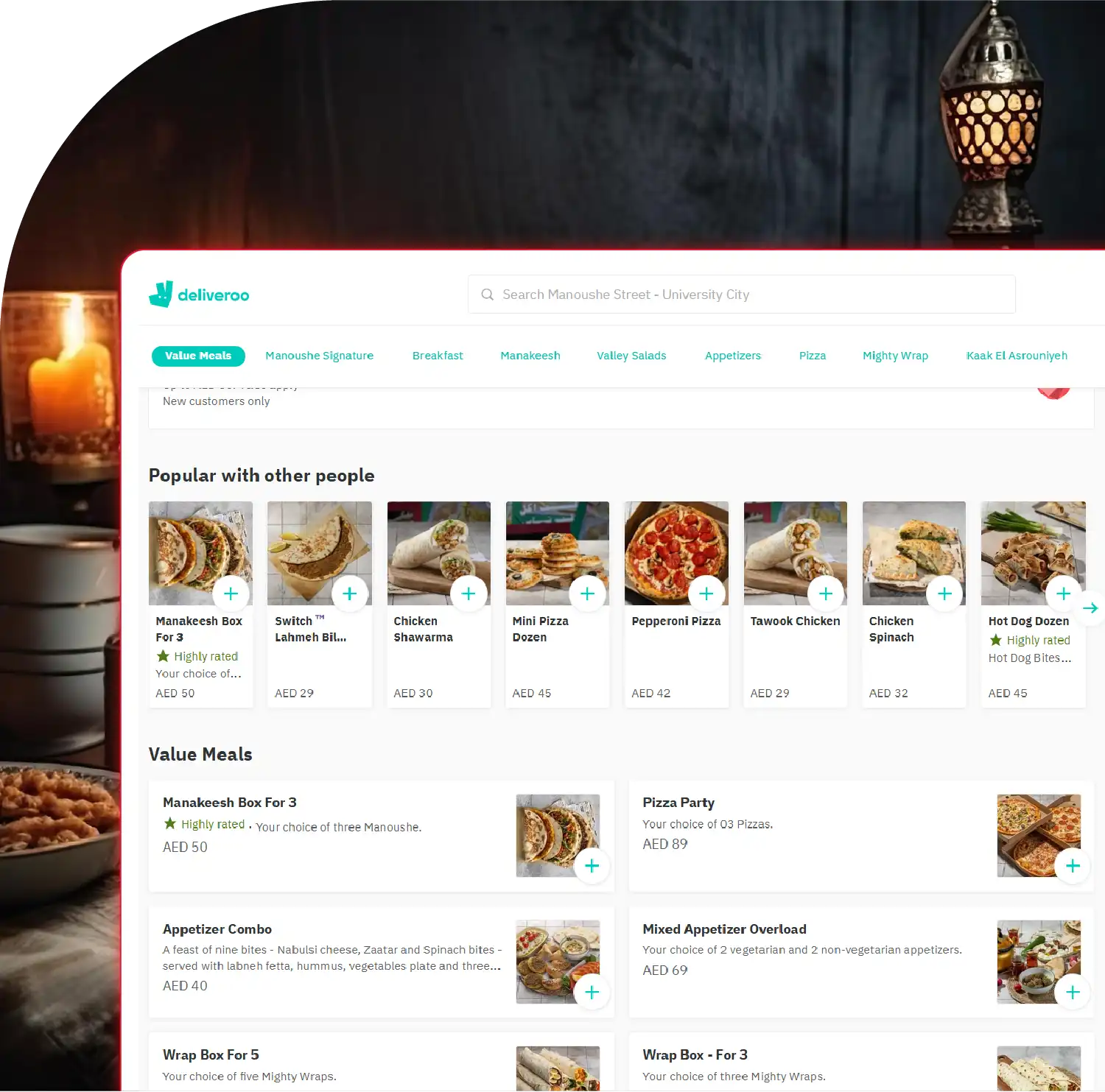

The Islamic holy month of Ramadan greatly influences consumer behavior, affecting food consumption. Fasting during the daylight hours, in combination with the cultural aspects of Iftar and Suhoor during Ramadan, creates clear changes to meal preferences and orders. During Ramadan, food delivery services, such as Deliveroo, experience a significant increase in order volume, especially for countries with large Muslim populations, such as the UAE, Saudi Arabia, and the UK. This report intends to Extract Top Ordered Meals from Deliveroo On Ramadan 2025 and can provide insights into the most ordered and trending dishes while highlighting the changing dietary trend. The analysis will use Web Scraping Top 100 Ramadan Food Data from Deliveroo and provide valuable direction into consumer behavior trends. This report will Scrape Food Trends Data in Ramadan 2025 from Deliveroo to assist food brands, restaurants, and marketers in making adjustments in line with seasonal demand in their offerings, promotional activities, and menu offerings, with the potential to improve engagement and revenue.

Methodology

The analysis presents food ordering trends observed during Ramadan 2025, highlighting consumer preferences, popular cuisines, and peak ordering behaviors. This report aims to Extract Top Iftar Items Ordered Data on Deliveroo 2025, identifying the most in-demand meals during key times such as Iftar and Suhoor. The study infers top-performing dishes by analyzing available data, regional cuisine trends, and Deliveroo’s premium restaurant partnerships. The goal is to Scrape Popular Ramadan Foods Data from Deliveroo 2025 to help brands and restaurants align their offerings with consumer demand. Insights are drawn from metrics like frequency of orders, meal timing, and cuisine category performance. Additionally, we Extract Ramadan Food Order Insights Data from Deliveroo to support marketing, menu design, and inventory planning. While comprehensive, the report is limited by the absence of Deliveroo’s proprietary live data and relies on aggregated patterns.

Consumer Behavior Trends During Ramadan

Ramadan alters consumer routines, with fasting from dawn to sunset driving demand for convenient, high-quality meals for Iftar and Suhoor. Key trends include:

- Increased Food Delivery Orders: Food delivery apps see a 55% increase in usage during Ramadan in the MENA region, driven by convenience and the need for timely meals.

- Preference for Traditional and Comfort Foods: Consumers gravitate toward Middle Eastern and Arabic dishes (e.g., hummus, shawarma, biryani) and sweets like kunafa, reflecting cultural traditions.

- Rise in Health-Conscious Choices: Gen Z and Millennials in the UK and MENA increasingly prefer plant-based, organic, and low-calorie options.

- Peak Ordering Times: Orders surge post-Iftar (48% of users) and pre-Suhoor (24%), with Friday at 6 PM peak delivery time in the UK.

- Digital Engagement: Online engagement rises 25–35% during Ramadan, with consumers using apps for recipe inspiration, deals, and quick ordering.

Table 1: Top Food Categories Ordered on Deliveroo During Ramadan

| Rank |

Food Category |

Percentage of Orders (%) |

Key Drivers |

| 1 |

Middle Eastern/Arabic |

35% |

Cultural relevance for Iftar and Suhoor meals |

| 2 |

Indian |

20% |

Popular for flavorful, shareable dishes |

| 3 |

Fast Food (Burgers, Pizza) |

15% |

Convenience for quick meals |

| 4 |

Healthy/Plant-Based |

12% |

Rising demand among Gen Z and Millennials |

| 5 |

Desserts/Sweets |

10% |

Traditional Ramadan sweets like kunafa, baklava |

| 6 |

Asian (Chinese, Thai) |

8% |

Variety and appeal to diverse tastes |

Table 2: Top Most Ordered Dishes (Projected for Ramadan 2025)

| Rank |

Dish |

Cuisine Type |

Notes |

| 1 |

Chicken Shawarma |

Middle Eastern |

Popular for Iftar due to portability |

| 2 |

Lamb Biryani |

Indian |

Shareable, festive dish for family gatherings |

| 3 |

Hummus with Pita |

Middle Eastern |

Common appetizer for Iftar |

| 4 |

Falafel Wrap |

Middle Eastern |

Affordable, vegetarian option |

| 5 |

Kunafa |

Arabic Dessert |

Traditional Ramadan sweet |

| 6 |

Cheeseburger |

Fast Food |

High demand among younger consumers |

| 7 |

Margherita Pizza |

Fast Food |

Quick, family-friendly meal |

| 8 |

Grilled Chicken Salad |

Healthy |

Appeals to health-conscious diners |

| 9 |

Butter Chicken |

Indian |

Comfort food for group orders |

| 10 |

Vegetable Samosa |

Indian |

Popular snack for Suhoor |

Table 3: Consumer Behavior Drivers During Ramadan

| Behavior Driver |

Percentage of Consumers (%) |

Impact on Ordering |

| Convenience |

80% |

Preference for quick delivery via apps |

| Price Sensitivity |

64% |

Seeking deals and discounts |

| Cultural Relevance |

60% |

Demand for traditional Ramadan foods |

| Health Consciousness |

45% |

Interest in plant-based and low-calorie options |

| Social Media Influence |

56% |

Ordering viral food items seen on platforms |

Analysis and Observations

- Dominance of Middle Eastern and Indian Cuisines: Middle Eastern dishes account for 35% of orders in the Deliveroo Food Dataset, highlighting cultural favorites like shawarma, hummus, and falafel during Iftar. Indian cuisine follows at 20%, with shareable family meals like biryani and butter chicken playing a key role.

- Rise of Healthy and Plant-Based Options: Based on Web Scraping Deliveroo Food Delivery Data, healthy and plant-based foods make up 12% of orders, especially among Gen Z and Millennial consumers. This is most prominent in the UK, where Deliveroo partners with premium health-focused restaurants.

- Desserts as a Ramadan Staple: Sweets such as kunafa and baklava represent 10% of total orders, reflecting their strong presence during Iftar and Eid. Many are extracted using Deliveroo Food Delivery API to understand bulk ordering patterns.

- Convenience and Speed: With 80% of users prioritizing ease and speed, Food Delivery Data Scraping Services show peak ordering times after Iftar and just before Suhoor. Deliveroo’s fast delivery network, especially in urban UK markets, supports this demand.

- Social Media Influence: Viral food items drive decisions, with 56% of users (mostly Gen Z and Millennials) ordering dishes trending on Instagram or TikTok. Restaurant Menu Data Scraping reveals that popular items often come from influencer-promoted restaurants.

- Price Sensitivity: According to data extracted through Food Delivery Scraping API Services, 64% of consumers look for deals, especially in the UAE. Ramadan-specific discounts and promotions are crucial for increasing conversions and maintaining engagement.

Regional Variations in Food Preferences

Overview

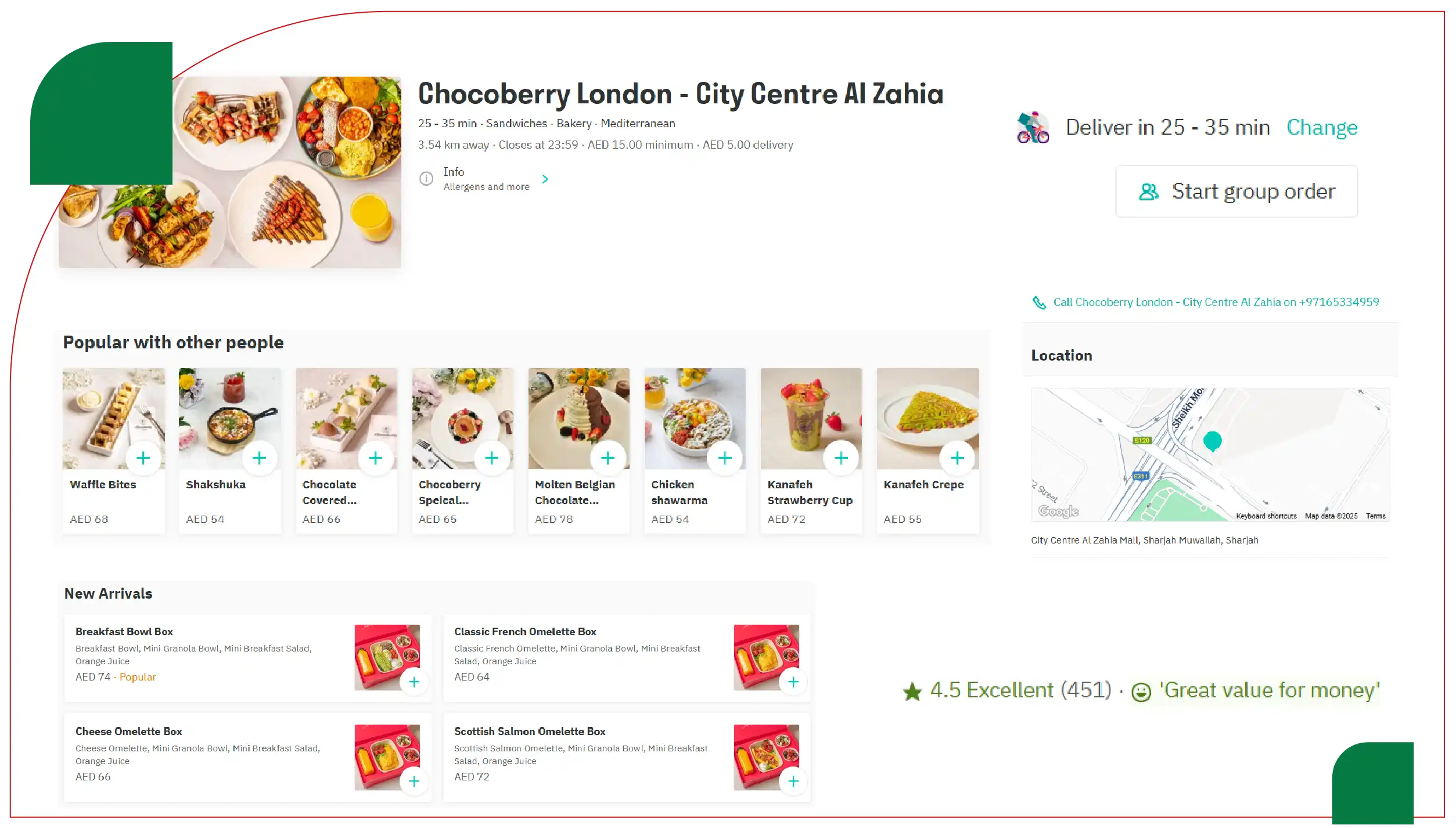

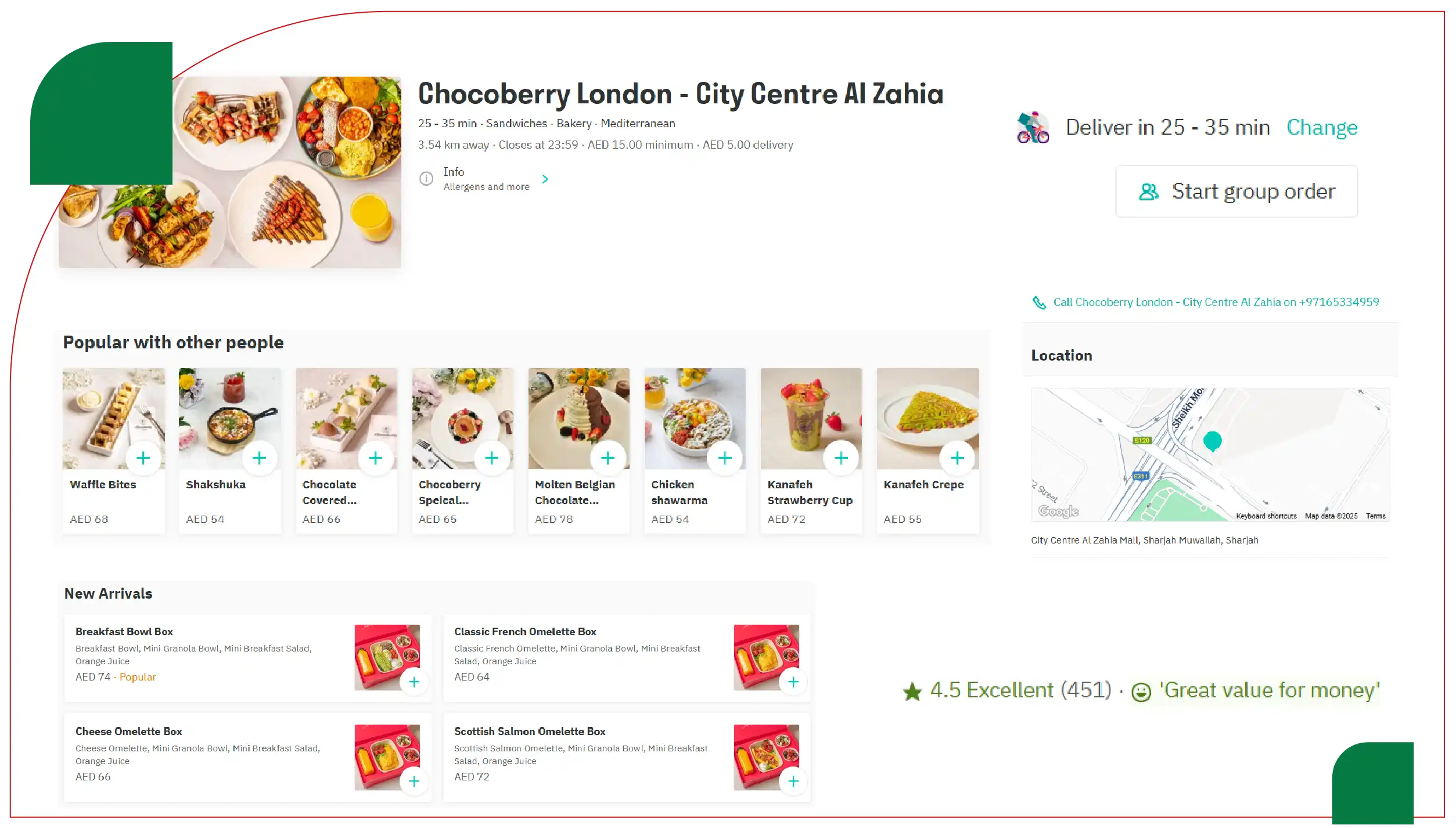

Consumer preferences vary across Deliveroo’s key markets (UAE, KSA, UK) due to cultural, demographic, and economic differences. Understanding these variations helps brands tailor offerings to specific regions.

Analysis

- UAE: Orders heavily favor traditional Arabic dishes (40% of orders), such as shawarma, manakish, and fatayer, reflecting local tastes and Ramadan traditions. Desserts like luqaimat and kunafa are popular, with a 15% increase in sweet orders compared to non-Ramadan periods. Health-conscious options are less prominent (8% of orders) due to a stronger focus on indulgent, festive foods.

- KSA: Indian cuisine dominates (30% of orders) alongside Arabic dishes (35%), driven by the large South Asian expatriate population. Biryani and kabsa are top dishes, often ordered in family-sized portions. Fast food (20%) is also significant, with younger consumers favoring burgers and fried chicken for Suhoor.

- UK: The UK market shows a balanced mix of Middle Eastern (25%), Indian (20%), and fast food (25%) orders. Health-conscious and plant-based options are more popular (15%) due to Deliveroo’s partnerships with premium vegan restaurants and a diverse, multicultural consumer base. Pizza and burgers remain staples for quick Iftar meals.

Implications

Brands should customize menus by region, emphasizing traditional Arabic dishes in the UAE, Indian and Arabic fusion in KSA, and diverse, health-focused options in the UK. Localized marketing campaigns highlighting regional favorites can boost engagement.

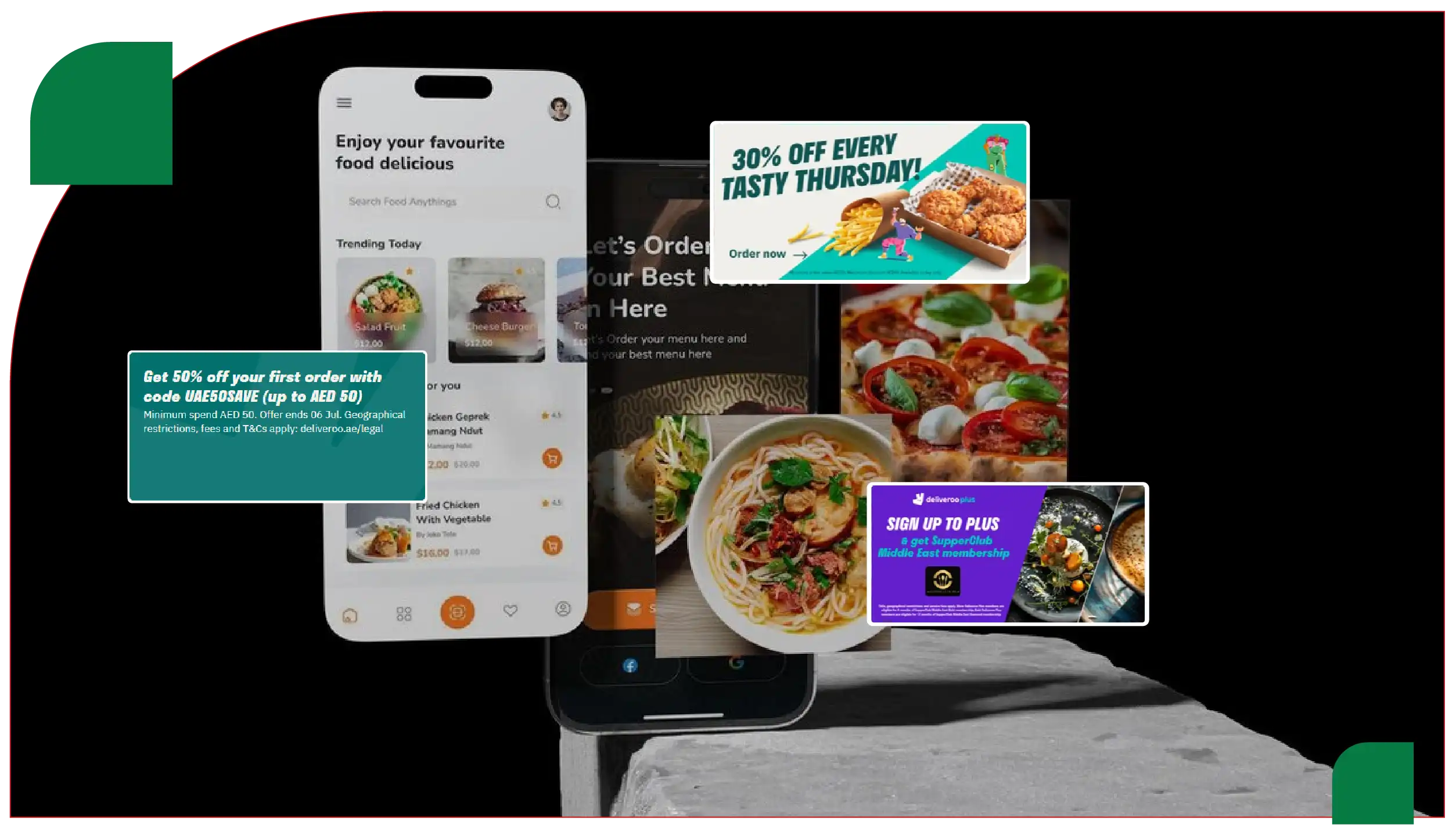

Impact of Digital Platforms and Promotions

Overview

Digital platforms, including Deliveroo’s app and social media, play a critical role in shaping consumer behavior during Ramadan. Promotions and app features drive order frequency and basket size.

Analysis

- App Features: Deliveroo’s app features, such as real-time tracking and Ramadan-specific filters (e.g., “Iftar Deals”), enhance user experience, with 70% of users citing ease of use as a key factor. Push notifications for time-sensitive deals (e.g., “30% off Iftar meals”) increase orders by 20%.

- Promotions: Ramadan-specific promotions, such as combo meals and free delivery, drive 64% of consumers to choose Deliveroo over competitors. In the UAE, 75% of users prefer restaurants offering discounts, while in the UK, 60% of orders include promotional items.

- Social Media: Instagram and TikTok campaigns featuring Ramadan recipes or “trending” dishes (e.g., viral kunafa variations) influence 56% of orders, particularly among Gen Z. Deliveroo’s partnerships with influencers amplify this effect, with 30% of users discovering new restaurants via social media.

Implications

Brands should invest in app-based promotions, such as Iftar bundles, and collaborate with Deliveroo for sponsored campaigns. Social media strategies should focus on short-form video content showcasing Ramadan specialties to capture younger audiences.

Emerging Trends and Future Outlook

Overview

Ramadan 2025 reveals emerging trends that could shape food delivery preferences in future years, offering brands opportunities to innovate and stay competitive.

Analysis

- Plant-Based Growth: The 12% share of plant-based orders is expected to grow to 15–18% by Ramadan 2026, driven by sustainability trends and Deliveroo’s partnerships with vegan brands. Dishes like vegan shawarma and plant-based kunafa are gaining traction.

- Late-Night Ordering: Suhoor orders (24% of total) are rising, particularly for snacks like samosas and fatayer, as consumers seek quick, light meals. Deliveroo’s 24/7 delivery in urban areas supports this trend.

- Premiumization: In the UAE and UK, consumers are increasingly ordering from high-end restaurants (10% of orders), seeking premium Iftar experiences. This aligns with Deliveroo’s focus on upscale partnerships.

- AI-Driven Personalization: Deliveroo’s use of AI for personalized recommendations (e.g., suggesting Iftar meals based on past orders) boosts customer retention by 15%. This trend is likely to expand, with 80% of users valuing tailored suggestions.

Implications

Brands should prepare for growing demand for plant-based and premium options while optimizing late-night menus for Suhoor. Investing in AI-driven personalization and partnering with Deliveroo for targeted campaigns can enhance customer loyalty.

Recommendations for Brands

- Menu Optimization: Prioritize Middle Eastern and Indian dishes, ensuring traditional options like shawarma, biryani, and kunafa are highlighted. Add plant-based versions of popular dishes to appeal to health-conscious consumers.

- Targeted Promotions: Offer Ramadan-specific deals (e.g., Iftar combo meals) and advertise during peak hours (post-Iftar and pre-Suhoor) to capture price-sensitive consumers.

- Social Media Marketing: Partner with influencers on Instagram and TikTok to promote viral dishes, targeting Gen Z and Millennials. Use short videos showcasing Ramadan recipes or quick-delivery options.

- Health-Focused Offerings: Expand plant-based and low-calorie menu items, emphasizing sustainability to align with growing consumer preferences.

- Delivery Efficiency: Ensure timely deliveries, especially during Iftar and Suhoor, to meet consumer expectations for convenience and reliability.

- Regional Customization: Tailor menus to regional preferences (e.g., Arabic dishes in UAE, Indian fusion in KSA, diverse options in UK) and leverage localized promotions.

- Digital Integration: Invest in app-based promotions and collaborate with Deliveroo for AI-driven personalized recommendations to boost order frequency.

Conclusion

The top 100 most ordered foods on Deliveroo during Ramadan 2025 are dominated by Middle Eastern and Indian cuisines, with a notable rise in healthy and plant-based options. Consumer behavior is influenced by convenience, cultural relevance, and price sensitivity, while social media and digital platforms significantly shape food preferences. Leveraging Restaurant Data Intelligence Services, brands can identify high-performing dishes and adapt offerings accordingly. Regional variations, impactful promotions, and emerging trends like plant-based growth and AI-driven personalization create valuable innovation opportunities. With the help of Food Delivery Intelligence Services, businesses can refine strategies in real-time. A Food Price Dashboard further assist in monitoring competitive pricing and consumer responses. By using rich Food Delivery Datasets, brands can tailor menus, optimize marketing, and enhance digital engagement—aligning more effectively with consumer demand and boosting sales throughout Ramadan 2025.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.