Introduction

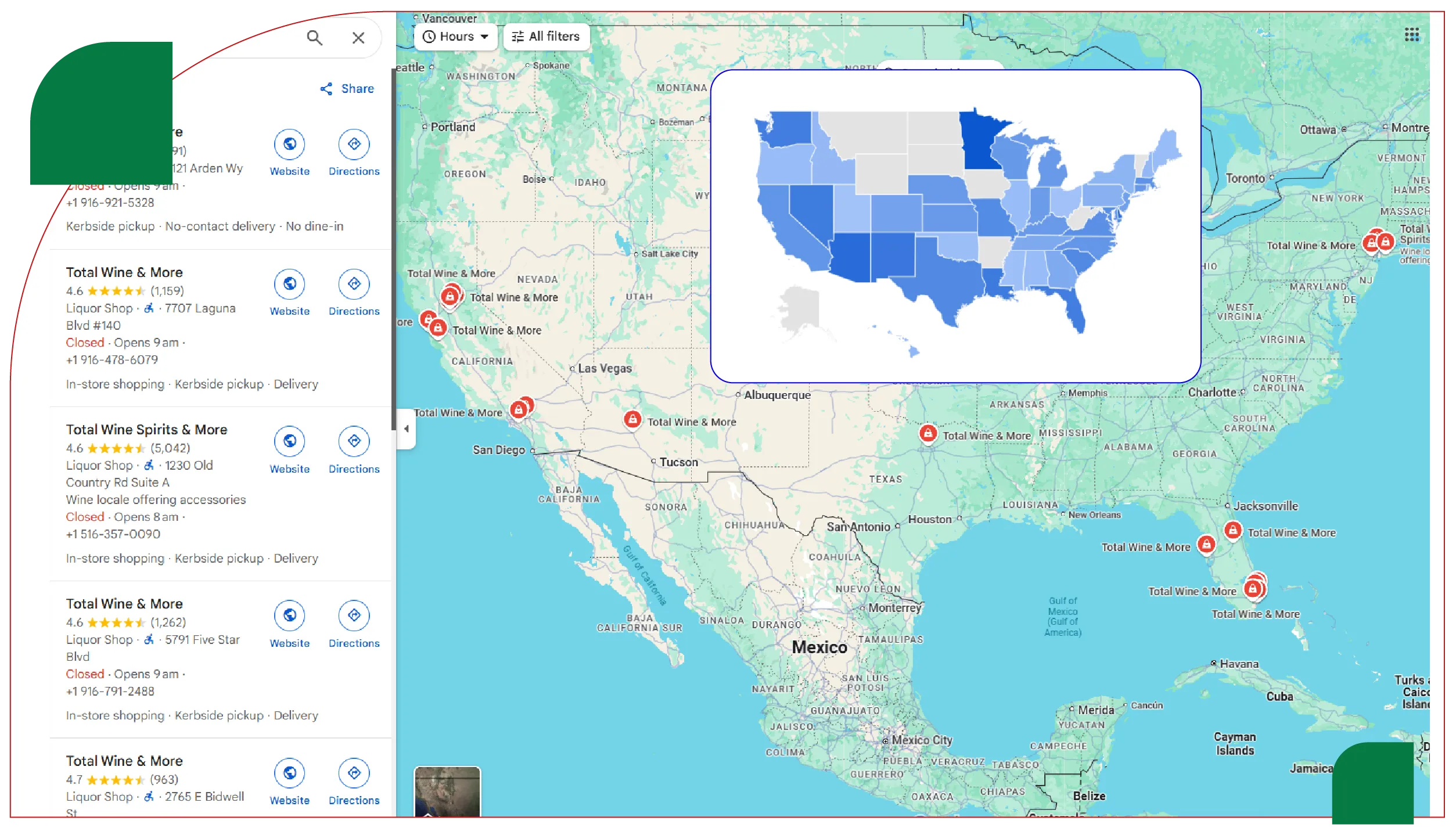

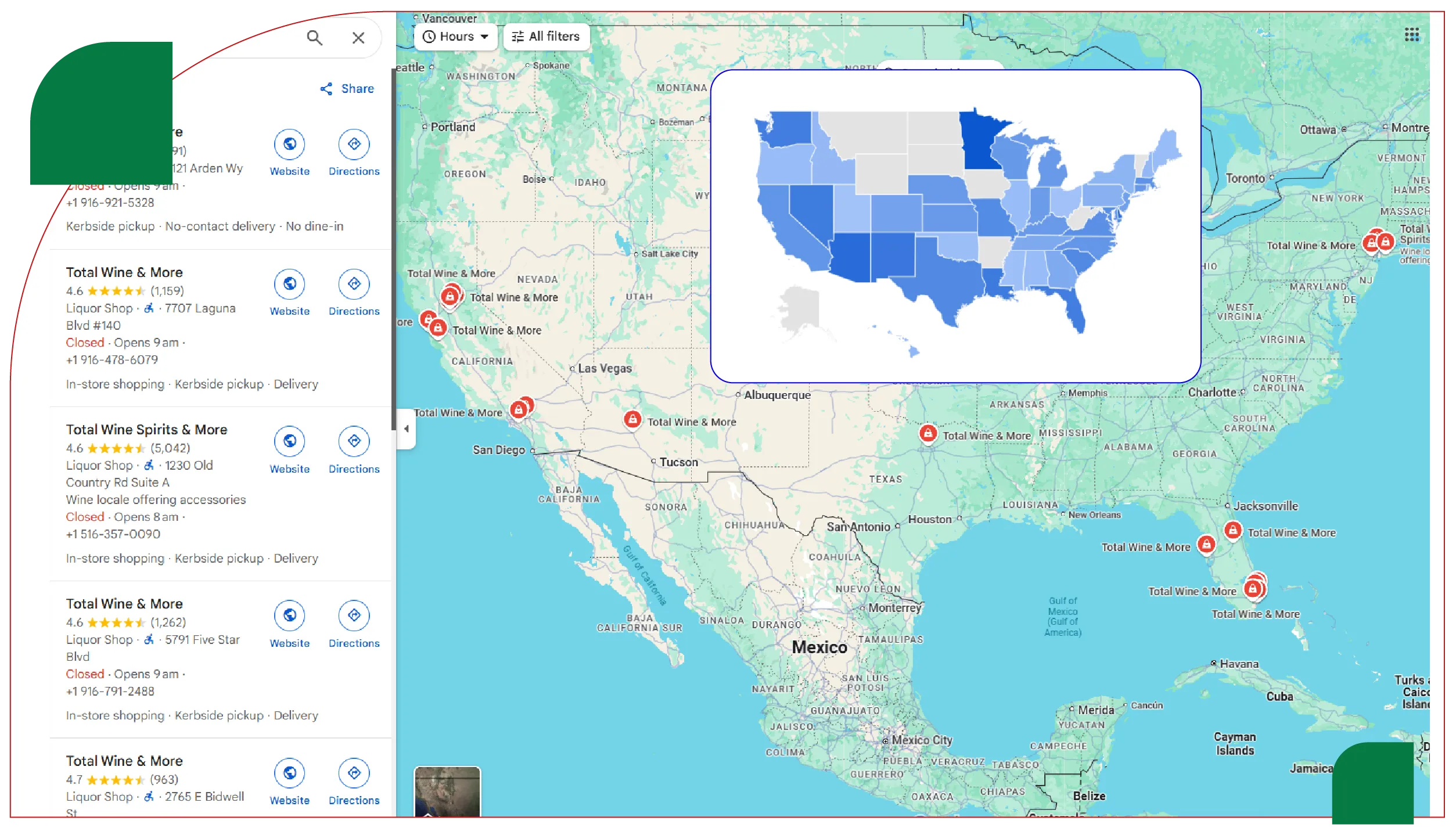

Total Wine & More has secured its position as the number one wine, beer, and spirits retailer across the United States, with 285 stores in 29 states. The company's ability to find deep penetration in the marketplace is attributed to three main objectives: smart geographic placement, a full range of alcoholic beverages, and a unique regional presence. This report for 2025 takes a look at the company's reach as a retailer across the country in detail. The report aims to Extract Total Wine & More Store Locations USA 2025 and put a pin in where the brand is strong and where there might be white space for growth opportunities.

This report includes thorough research and retail analytics. It addresses a complete US Total Wine and More Store Locations Data Set that outlines the store distribution in each US state, city, and region. The report details growth states like California, Texas, and Florida but also continues to track the States of opportunity identified, notably Alaska, Mississippi, and Utah. Companies or analysts intending to Scrape Total Wine & More Store Count by State -2025 could gain relevant insights from this report. Suppose companies can utilize the Web Scraping Total Wine & More Retail Chain Data USA. In that case, they can better understand competitor preference and positioning, supply chain efficiencies, and location-based strategies defining Total Wine's retail dominance across the American alcohol landscape.

Company Overview

Founded in 1991, Total Wine & More is headquartered in Bethesda, Maryland, and has become one of America's most prominent alcohol retailers. Each location is a one-stop destination for wine, beer, and spirits enthusiasts, offering thousands of product options under one roof. Total Wine & More Store Data Extraction USA 2025 provides insights into the company's expansive and strategic retail footprint. Store sizes typically range from 20,000 to 50,000 square feet and often include tasting bars, event spaces, and knowledgeable staff to guide purchasing decisions. Scrape Total Wine & More Store Addresses in the USA 2025 to analyze the layout and structure of each retail outlet across major urban markets.

This immersive experience enhances customer loyalty and reflects the brand's dedication to alcohol education and service. Scrape Total Wine & More Store Addresses in the USA 2025 to gather accurate and location-specific data on store environments.

Growth Philosophy:

- Operates in states with flexible alcohol sales regulations.

- Targets high-income urban and suburban neighborhoods.

- Focuses on wine education, offering tasting classes and pairing advice.

Total Store Distribution Overview (2025)

As of mid-2025, Total Wine & More operates 285 store locations across the United States, reflecting steady and strategic growth over the past five years. The brand's expansion has been robust in high-consumption states like California, Texas, and Florida, where demand for premium alcoholic beverages remains consistently high. Total Wine Liquor Price Scrapinghas become essential for businesses monitoring pricing trends and competitor positioning in these markets. With a growing retail footprint and diverse pricing strategies, companies now seek to Extract Total Wine and More Liquor Price Data to better understand regional variations and promotional patterns.

Advanced users often rely on tools to Extract API For Total Wine Liquor Prices for real-time data collection and analytics integration.

Store Count by U.S. State (Top 10 States)

The following table presents the distribution of Total Wine & More stores across the top 10 states:

Table 1: Total Wine & More Stores by State

| State |

Number of Stores |

% of National Total |

| California |

46 |

16% |

| Florida |

40 |

14% |

| Texas |

39 |

14% |

| Virginia |

20 |

7% |

| North Carolina |

15 |

5% |

| Arizona |

14 |

5% |

| Washington |

14 |

5% |

| Minnesota |

11 |

4% |

| Missouri |

9 |

3% |

| Massachusetts |

8 |

3% |

Insight:

These 10 states collectively account for 76% of all Total Wine stores. The company's emphasis on these markets stems from population density, regulatory freedom, and purchasing behavior.

Store Presence by Major U.S. Cities

Several major metro areas across the United States host dense clusters of Total Wine & More outlets, especially in regions known for high footfall, strong retail ecosystems, and diverse, cosmopolitan consumers. These locations are carefully selected based on demographics, purchasing behavior, and proximity to other major retail chains.

Total Wine Liquor Prices Dataset from these urban centers reveals pricing strategies tailored to local demand and competition.

Retailers, analysts, and suppliers increasingly turn to Alcohol Price Data Scraping Services to monitor how Total Wine adjusts its prices across different cities.

By leveraging Liquor Price Data Scraping Services, businesses can analyze patterns, track promotions, and respond effectively to market fluctuations in these high-performance zones.

Table 2: Store Counts in Major U.S. Cities

| City |

State |

Store Count |

| Houston |

Texas |

6 |

| Miami |

Florida |

4 |

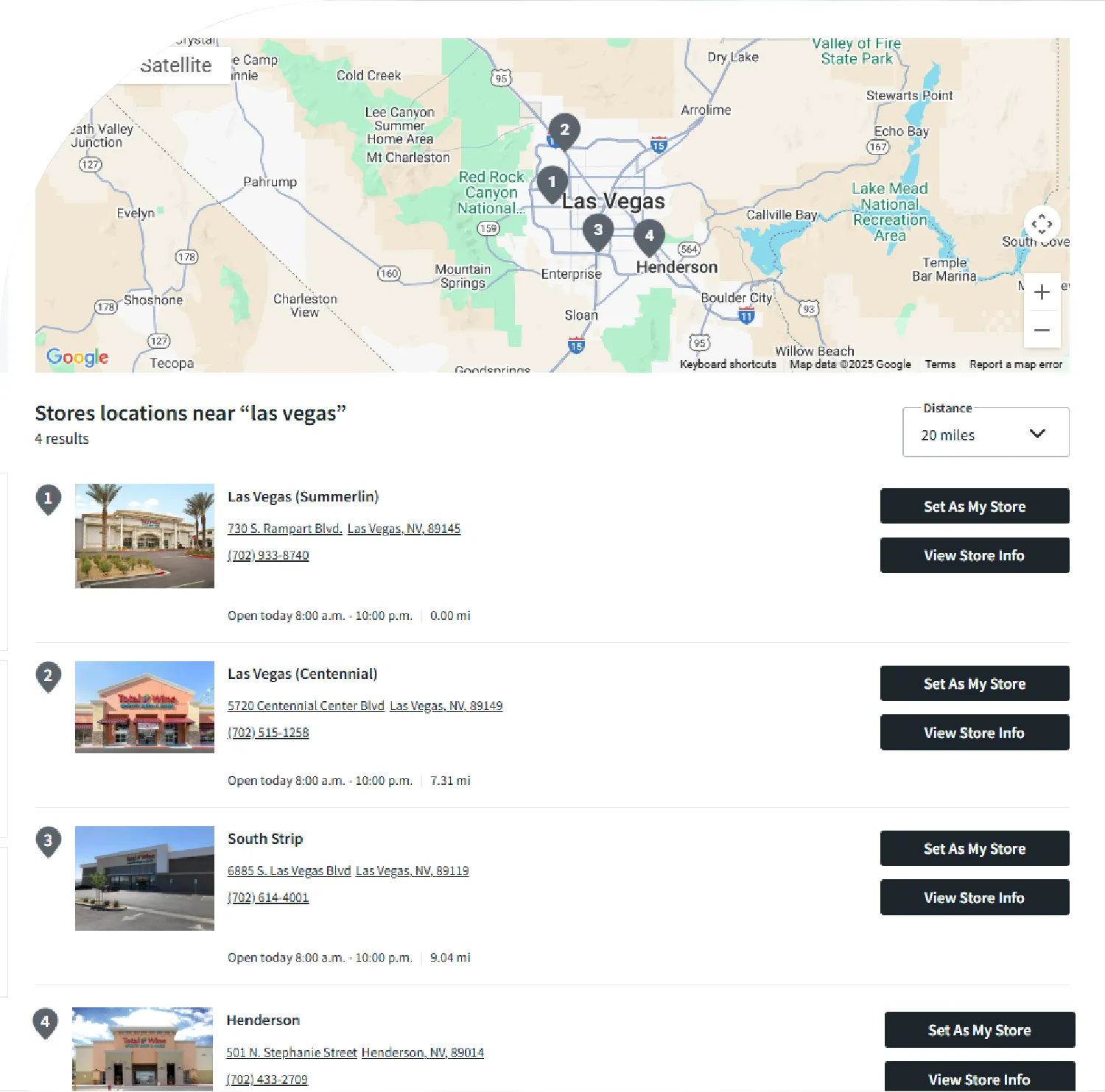

| Las Vegas |

Nevada |

3 |

| Seattle |

Washington |

3 |

| Charlotte |

North Carolina |

3 |

| Raleigh |

North Carolina |

3 |

| Kansas City |

Missouri |

3 |

| Plano |

Texas |

3 |

| Fort Worth |

Texas |

2 |

| Greensboro |

North Carolina |

2 |

Insight:

Texas cities dominate this list, especially Houston, which hosts the highest number of Total Wine outlets in a single U.S. city. This confirms the brand's appeal in urban areas with sophisticated customer bases.

Geographic Gaps: U.S. States and Territories Without Total Wine Stores

Despite its growth, there are 27 U.S. states and territories where Total Wine has no presence. The reasons range from restrictive alcohol sales laws to lack of strategic market size.

Table 3: U.S. States & Territories Without Total Wine & More Stores

| No Stores in These States/Territories |

| Idaho, Alaska, Hawaii, Utah, Mississippi, South Dakota, Connecticut, Oregon |

| Maine, Rhode Island, Montana, Vermont, West Virginia, New Hampshire |

| North Dakota, Iowa, Alabama, Arkansas, Oklahoma, Pennsylvania, Wyoming |

| District of Columbia, Puerto Rico, Guam, American Samoa, U.S. Virgin Islands |

| Northern Mariana Islands |

Insight:

Several of these regions operate under state-controlled alcohol distribution systems, which limit the entry of private alcohol retailers. In some cases, geographic or logistic constraints also influence the company’s expansion decisions.

Market Strategy & Store Placement Criteria

Total Wine & More selects store locations based on a combination of:

- State-level regulatory landscape – focusing on states with flexible liquor licensing.

- Demographics – targeting zip codes with high-income households and wine consumption.

- Retail zoning and size availability – preferring large-footprint locations in retail corridors.

- Proximity to competitors – entering markets where competitors like BevMo or local chains exist.

Store Growth Trends (2020–2025)

Between 2020 and 2025, Total Wine & More added 58 new stores, averaging 11–12 new openings per year. The most significant expansions were in:

- Florida (+12 stores)

- Texas (+10 stores)

- North Carolina (+7 stores)

- California (+5 stores)

This reflects the company’s sustained investment in high-consumption and growth-oriented states.

Economic Impact and Local Partnerships

Total Wine & More contributes to local economies by:

- Creating 1,000+ jobs annually across stores and distribution.

- Partnering with local wineries and breweries to offer regional products.

- Sponsoring community events, charity tastings, and educational seminars.

This community-oriented approach enhances brand loyalty and positions Total Wine as a stakeholder in the beverage economy of each region.

Future Outlook (2025–2030)

Based on current trends, Total Wine & More is projected to:

- Reach 325+ stores by 2030

- Expand into Pennsylvania and Oregon, pending regulatory shifts

- Introduce hybrid digital + physical store models for enhanced customer experience

Additionally, the brand may explore urban micro-store formats and delivery-only hubs to cater to evolving urban shopping habits.

Conclusion

Total Wine & More has established a formidable national footprint, commanding a majority share of the specialty wine and spirits retail market. With 285 stores across 29 states, the brand is strategically positioned for ongoing expansion in the U.S. market. Scrape Liquor Price Data from Total Wine & More to uncover region-specific trends, competitive benchmarks, and pricing models.

The company’s data-driven approach to store placement and extensive product catalog has enabled it to thrive in key urban centers while maintaining strong profitability. However, regulatory restrictions continue to hinder complete nationwide presence. Businesses, investors, and distributors can benefit from accessing Alcohol and Liquor Datasets to map growth opportunities.

By using Web Scraping Liquor Prices Data, stakeholders gain valuable insights into Total Wine’s pricing dynamics and retail influence.

Are you in need of high-class scraping services? Food Data Scrape should be your first point

of call. We are undoubtedly the best in Food Data Aggregator and

Mobile Grocery

App Scraping service and we render impeccable data insights and

analytics for strategic decision-making. With a legacy of excellence as our

backbone, we help companies become data-driven, fueling their development. Please take

advantage of our tailored solutions that will add value to your business. Contact us today

to unlock the value of your data.