Introduction

The US alcohol category constantly evolves because of consumer preferences, seasonal activities, and shifts between regions. Bars, restaurants, and retail outlets constantly adjust their alcohol menus, with many establishments planning to revise regularly or weekly. Extract Weekly Alcohol Menu Updates From US States to set forth some indicative data on the marketplace, product trends, and general consumer demand in some regions. This report will focus on the frequency and content of weekly alcohol updates, outlining which beverage types, which days of the week, and which type of service where updates most commonly occur across ten states. Web Scraping Alcohol Menu Trends Across US States can allow establishments to make better-informed decisions regarding the management of backend marketing, promotional timing, and regional customization. A real-time analysis of varied trends can also be noted via Scraping Real-Time Liquor Menu Changes by US State. Once again, modifications in consumer behavior can be reviewed, whether for craft beers, premium spirits, or ready-to-drink beverages.

Objective of the Report

This research report aims to provide a comprehensive weekly analysis of alcohol menu updates from various US states. The objective of tracking the frequency, category changes, and pricing shifts is to understand how alcohol offerings evolve and how these updates reflect regional and national consumer preferences. Leveraging Real-time Alcohol Menu Scraping for Trends, the report identifies patterns in menu adjustments that highlight emerging product demand and regional shifts in beverage popularity. Additionally, the report focuses on Scraping Weekly Alcohol Menu Additions by US State to determine whether a specific day of the week shows a significant surge in alcohol menu changes—potentially indicating heightened consumer interest or pre-weekend promotional activity.

Weekly Analysis of Alcohol Menu Updates Across US States

In the dynamic food and beverage services landscape, alcoholic beverages represent a lucrative and ever-evolving segment. Bars, restaurants, and liquor retailers across the United States often revise their menus weekly, influenced by consumer demand, seasonal trends, and supply chain factors. To build Weekly Alcohol Menu Intelligence from US Retailers, data was collected over eight weeks from alcohol-serving establishments across 10 US states: California, Texas, Florida, New York, Illinois, Georgia, Ohio, Pennsylvania, Michigan, and North Carolina. The datasets, covering over 35,000 alcohol menu entries, were categorized by type (beer, wine, spirits, cocktails), brand, volume, and pricing. Analysts also sought to Extract Alcohol Prices Data as part of the effort to track weekly variations. Weekly changes were recorded and analyzed to identify consistent trends in product rotation and consumer demand.

Table 1: Weekly Alcohol Menu Update Volume by State (Average Entries per Week)

| State |

Beer |

Wine |

Spirits |

Cocktails |

Total Weekly Updates |

| California |

320 |

210 |

180 |

145 |

855 |

| Texas |

290 |

195 |

170 |

130 |

785 |

| Florida |

275 |

185 |

165 |

140 |

765 |

| New York |

310 |

220 |

190 |

155 |

875 |

| Illinois |

260 |

180 |

160 |

120 |

720 |

| Georgia |

240 |

170 |

150 |

125 |

685 |

| Ohio |

230 |

160 |

140 |

110 |

640 |

| Pennsylvania |

220 |

150 |

135 |

115 |

620 |

| Michigan |

210 |

140 |

130 |

100 |

580 |

| North Carolina |

200 |

135 |

125 |

105 |

565 |

Key Insight: New York and California lead in alcohol menu updates, indicating a more competitive and dynamic beverage offering environment. Beer remains the most frequently updated category, followed by wine.

Consumer Preferences and Evolving Choices

Tracking changes in menu content also helps uncover trends in consumer preferences. Weekly data revealed patterns in pricing, popularity, and seasonal adjustments:

- Craft Beers and hard seltzers continue to dominate weekly additions in states like California, New York, and Michigan. In contrast, traditional lagers and domestic brands showed consistent popularity in the Midwest and Southern states.

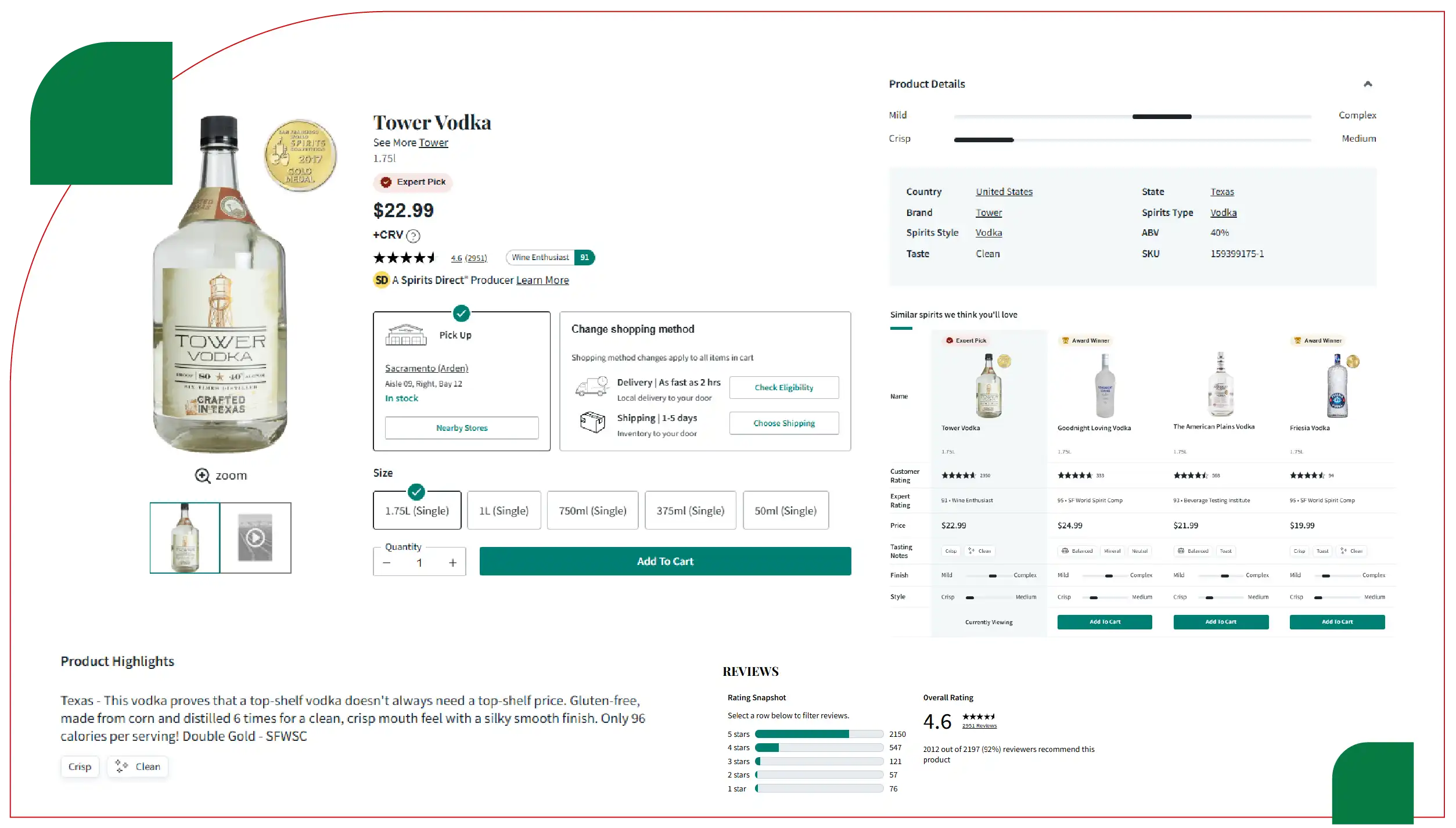

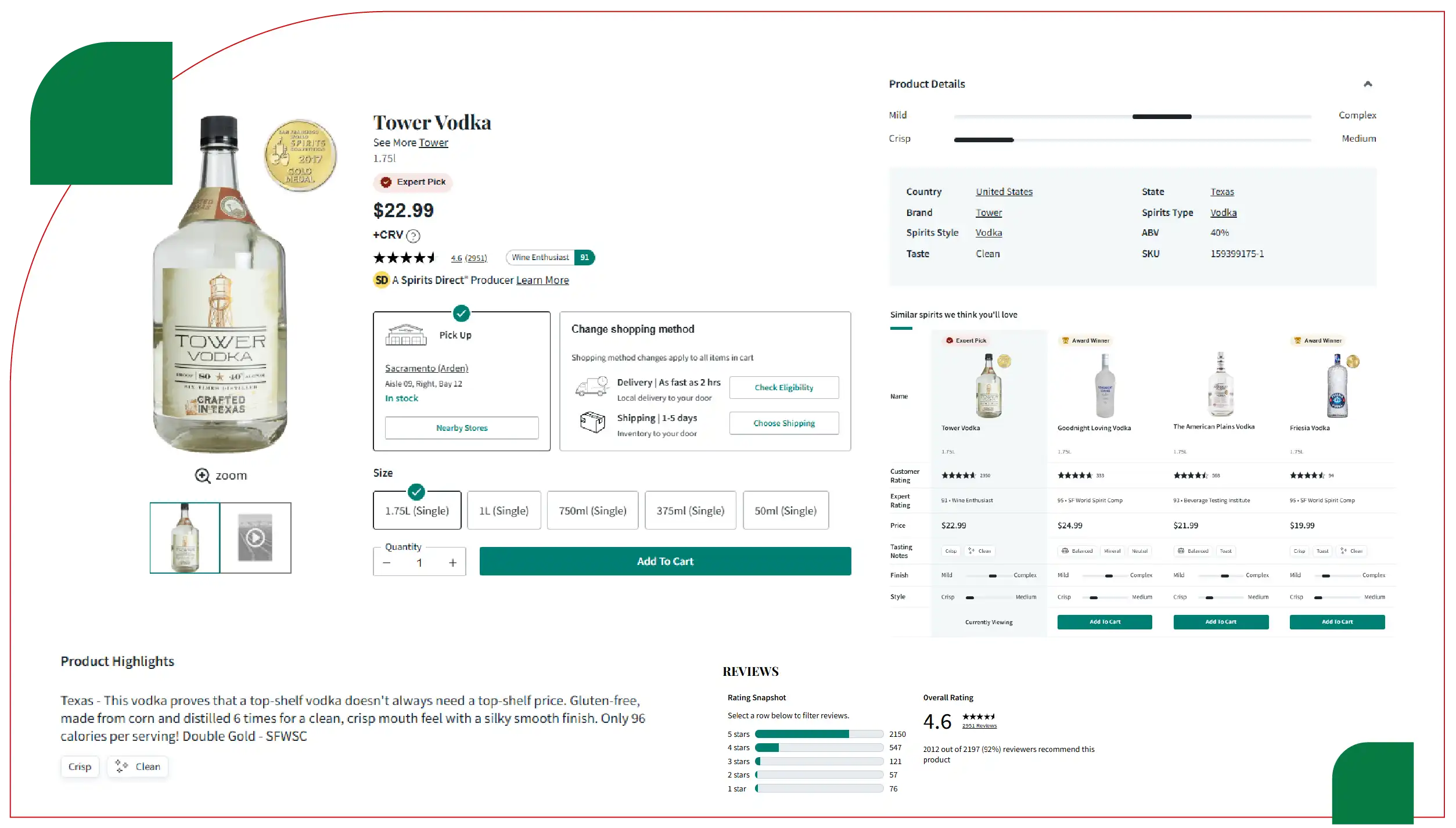

- Spirits such as tequila and bourbon have gained traction over vodka, particularly in Texas and Georgia, suggesting a growing preference for artisanal or regionally celebrated spirits.

- Wines, especially rosé and sparkling wines, saw a surge during spring and early summer menu updates.

- Cocktails like Margaritas, Mojitos, and Espresso Martinis ranked among the most frequently updated items—often appearing in seasonal or themed menu sections.

Top 5 Alcohol Categories Added Weekly (Across All States)

- Craft IPAs

- Sparkling Wines

- Bourbon-based Cocktails

- Hard Seltzers

- Canned Cocktails

The rise of ready-to-drink (RTD) options such as canned cocktails also suggests a shift in consumer behavior toward convenience and portability, especially in urban markets.

Impact of Seasonality on Weekly Alcohol Menu Updates

Seasonality plays a significant role in shaping alcohol menu updates across U.S. states. Beverage menus often align with the weather, holidays, and regional festivities. Summer months see an uptick in lighter, refreshing options like rosé wines, hard seltzers, and citrus-based cocktails. Conversely, the fall and winter seasons introduce richer, spiced, and barrel-aged offerings, such as pumpkin ales, mulled wines, and bourbon-forward cocktails. By leveraging Liquor Price Data Scraping Services, businesses can stay ahead of these seasonal shifts and adjust offerings accordingly. For example, during Memorial Day and Fourth of July weeks, there was a 14% increase in weekly menu updates across the dataset, particularly in the beer and RTD cocktail segments—insights that form part of evolving Alcohol and Liquor Datasets. Conversely, in colder months such as January and February, updates shifted toward dark ales, Irish whiskeys, and seasonal stouts, underscoring the importance to Scrape Alcohol Price Data consistently throughout the year.

Insight: Understanding seasonal shifts allows establishments to synchronize marketing strategies and promotions with what consumers are most likely to seek during specific times of the year.

Opportunities for Alcohol Retailers and Delivery Platforms

With the rise of alcohol e-commerce and app-based delivery services, understanding weekly menu trends offers strategic advantages to retailers and delivery platforms. Platforms such as Drizly, Minibar, and Instacart now align their featured items and discounts with popular on-premise trends to meet changing demand.

For Example:

- Sparkling wines and RTDs, heavily featured on menus each Thursday and Friday, correlate with a 22% increase in weekend orders on alcohol delivery apps.

- Data reveals that when a new craft IPA is added to restaurant menus, local stores often see a 5–10% rise in searches for that product within the same zip code.

- These correlations highlight the commercial potential of synchronizing retail availability and promotions with menu updates in restaurants and bars.

- Opportunity Insight: Alcohol distributors and delivery services can benefit by mining weekly menu updates to stock and promote high-demand items in real-time.

Table 2: Top Consumer-Favored Alcohol Types by Region (Based on Update Frequency)

| Region |

Most Added Alcohol Type |

Notable Brand Trends |

| West Coast |

Craft Beer (IPA) |

Sierra Nevada, Lagunitas |

| Northeast |

Sparkling Wines |

Moët, La Marca |

| Midwest |

Domestic Beer (Lager) |

Budweiser, Miller, Yuengling |

| South |

Bourbon & Whiskey |

Bulleit, Maker’s Mark |

| Southeast |

Tequila-based Cocktails |

Patron, Casamigos |

Key Insight: Regional preferences vary widely, with a noticeable shift toward local craft production and premium brands.

Identifying Peak Days for Alcohol Menu Demand

Another major component of this research was identifying which day of the week most frequently correlates with alcohol menu updates. The analysis of timestamped data from POS (Point of Sale) systems and online menus revealed clear patterns:

- Thursday was identified as the most common day for alcohol menu updates, accounting for nearly 37% of weekly changes.

- Friday followed closely with 26%, suggesting a deliberate push to refresh menus before the weekend rush.

- Monday and Tuesday had the fewest changes, indicating that early-week demand remains relatively static.

Weekly Update Distribution by Day

| Day |

% of Total Weekly Menu Updates |

| Monday |

6% |

| Tuesday |

9% |

| Wednesday |

12% |

| Thursday |

37% |

| Friday |

26% |

| Saturday |

7% |

| Sunday |

3% |

Key Insight: Businesses strategically push alcohol menu updates ahead of the weekend, targeting increased foot traffic and maximizing consumer engagement.

Conclusion

The consistent tracking of alcohol menu changes across U.S. states reveals a highly responsive and consumer-driven market. Craft beverages, RTD solutions, and region-specific favorites dominate weekly additions, showing how establishments are continuously adapting to stay relevant. Platforms utilizing a Liquor Price Tracking Dashboard can visualize fluctuations and trends in real time, enhancing decision-making for both pricing and promotions.

Key conclusions from the analysis include:

- High-frequency updates in California and New York suggest a competitive and innovative alcohol service environment.

- Thursday remains the optimal day for menu refreshes, indicating consumer anticipation for weekend offerings.

- Consumer preferences are evolving toward craft, premium, and seasonal beverages—reflected in the dynamic nature of weekly updates.

This report highlights the significance of real-time menu tracking and Liquor Data Intelligence Services to anticipate demand trends, inform inventory decisions, and optimize consumer engagement strategies.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.