Introduction

The UK grocery market is one of the most competitive retail landscapes in Europe, with supermarkets consistently engaging in price battles to attract cost-conscious shoppers. The rise of inflation, fluctuating supply chain costs, and evolving consumer preferences have intensified the need to Extract Weekly Offers Data from UK Supermarkets: Sainsbury’s vs Tesco vs Asda, making weekly analysis of pricing strategies crucial. Customers are highly sensitive to even marginal price differences, and retailers rely heavily on promotional campaigns, loyalty discounts, and delivery services to gain market advantage.

Over the years, Sainsbury’s vs Tesco vs ASDA Price Monitoring UK has become an essential area of study for retailers, data analysts, and consumers seeking transparency in grocery pricing. By leveraging web scraping technologies, analysts can identify subtle shifts in pricing strategies that would otherwise remain unnoticed. This research report employs data-driven methods to shed light on how these three supermarket giants compete weekly, the trends driving their promotional campaigns, and what these mean for long-term grocery shopping dynamics in the UK.

The application of Web Scraping UK Supermarket Prices provides a unique lens into the operational tactics of these supermarkets. By comparing their weekly pricing, promotions, and online delivery options, we uncover who emerges stronger in specific product categories and how consumers ultimately benefit.

Methodology

Data Collection Approach

To ensure accurate comparisons, web scraping technologies were used to capture price data from Sainsbury’s, Tesco, and Asda's official online platforms. The scraping process followed best practices in data extraction, adhering to ethical considerations by targeting publicly available information.

The study focused on three core grocery categories, representing consumer essentials:

- Fresh Produce (fruits, vegetables, dairy, and meat)

- Packaged Food & Beverages (snacks, cereals, drinks, and tinned food)

- Household Items (cleaning products, toiletries, and paper goods)

Prices were captured every week across six weeks, ensuring that both regular shelf prices and promotions were included. This allowed for Weekly Grocery Price Tracking in UK, highlighting shifts caused by promotional campaigns or strategic discounts.

Scraping Tools and APIs

A combination of automated Python-based scraping tools, supported by supermarket-specific delivery scraping APIs, enabled efficient data collection. For instance, Scrape Weekly Grocery Deals for Sainsbury's UK to ensure tracking of promotions exclusive to online channels, while similar methods were applied to Tesco and Asda. Additionally:

Tools for Analysis

After collection, the datasets were organized and normalized to eliminate inconsistencies in unit sizes or promotional labeling. Advanced analytics, including trend analysis, mean price variations, and week-on-week percentage shifts, were applied. This was supported by visualization tools to display pricing dynamics clearly.

The entire process reflects how Web Scraping for Weekly Grocery Price Insights UK can empower both consumers and businesses to make smarter purchasing and pricing decisions.

Data Analysis

The analysis draws upon over 6,000 product entries collected during the study period. Pricing fluctuations highlight clear competition in fresh produce and beverages, where consumer demand remains highest.

| Week |

Sainsbury’s (£) |

Tesco (£) |

Asda (£) |

Notes |

| 1 |

45.20 |

44.80 |

43.90 |

Asda slightly undercuts competitors |

| 2 |

44.75 |

45.00 |

43.50 |

Asda remains most affordable |

| 3 |

45.30 |

44.60 |

44.20 |

Tesco narrows gap with Asda |

| 4 |

44.90 |

44.70 |

44.10 |

Prices converge |

| 5 |

45.10 |

45.20 |

43.80 |

Asda lowers again |

| 6 |

44.80 |

44.90 |

43.70 |

Asda consistently leads in low pricing |

From Table 1, Asda’s competitive edge is evident, consistently offering the lowest basket price across six weeks. Tesco displayed strong consistency, while Sainsbury’s fluctuated more, often pricing slightly above its peers.

Promotions and Discounts

Tesco demonstrated the most aggressive loyalty-linked promotions, with Clubcard discounts reducing prices by up to 15% on select items. Sainsbury’s targeted fresh produce promotions, particularly seasonal fruits and vegetables, while Asda leaned heavily on family-sized packaged goods.

This pricing war reflects UK Supermarkets Weekly Price Comparison Data Scraping insights, emphasizing how competitive strategies vary across retailers.

Key Findings

- Price Leadership: Asda emerged as the clear leader in affordability. Across six weeks, its average basket price remained consistently lower, strengthening its value-oriented brand positioning.

- Promotional Strategy Differences: Tesco’s reliance on Clubcard offers shows a loyalty-driven model, while Sainsbury’s depends more on fresh produce campaigns. Asda focuses on bulk family deals, appealing to large households.

- Seasonal Impact: Price fluctuations were most notable in fresh produce, where Sainsbury’s invested heavily in promotions. Dairy and beverages showed smaller shifts, pointing to stable supply contracts.

- Delivery Service Integration: Supermarkets increasingly embed promotions within their delivery apps. The integration of Grocery App Data Scraping services revealed that discounts offered online were not always identical to in-store deals.

- Consumer Impact: For cost-conscious families, shopping with Asda consistently saved between £1.20 and £1.50 per basket weekly compared to Tesco or Sainsbury’s. While seemingly small, this adds up significantly over monthly shopping cycles.

CTA: Start transforming your retail strategy today—leverage our supermarket data scraping solutions for accurate, real-time grocery price insights.

Advanced Insights from API Integration

The study also examined delivery-specific offers through Grocery Delivery Scraping API Services. Insights showed:

- Sainsbury’s emphasized personalized basket discounts for online shoppers.

- Tesco integrated Clubcard savings across all channels, maintaining consistency.

- Asda applied fewer delivery-only promotions but retained low shelf prices, reflecting its “everyday value” branding.

This data confirms that scraping delivery APIs is crucial for obtaining a complete picture of supermarket pricing, especially in the digital-first retail environment.

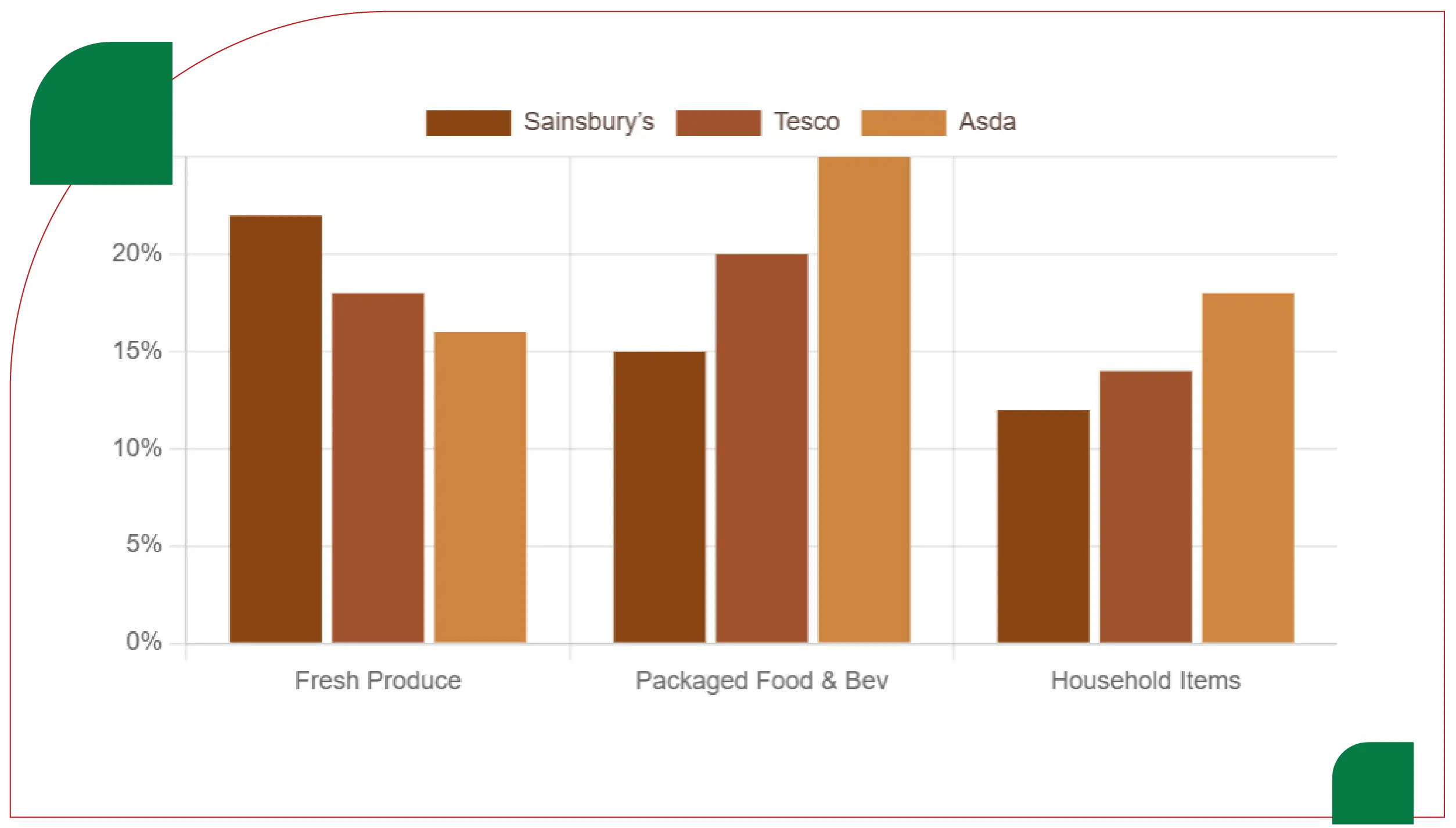

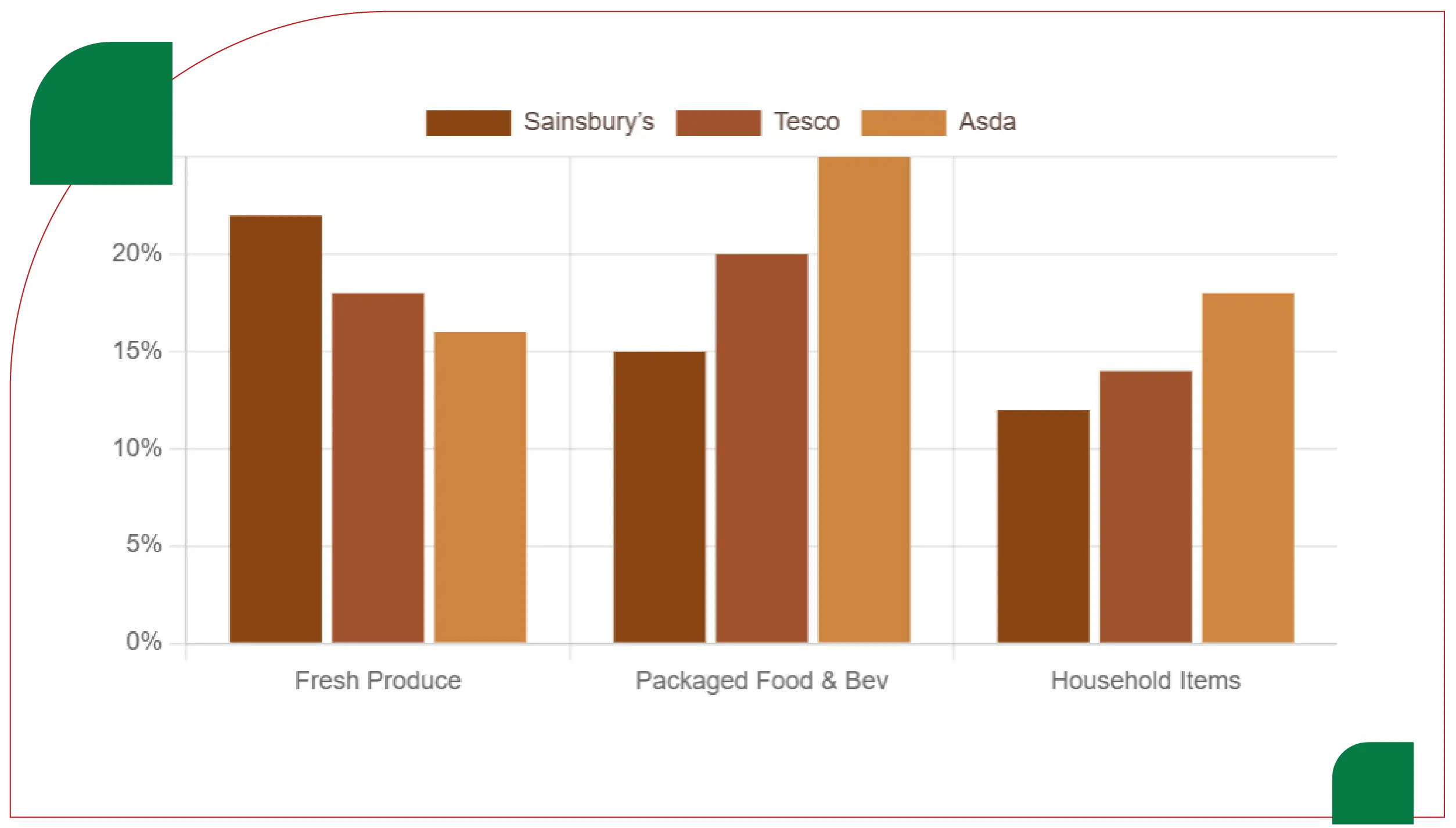

| Category |

Sainsbury’s |

Tesco |

Asda |

Insights |

| Fresh Produce |

22% |

18% |

16% |

Sainsbury’s most aggressive here |

| Packaged Food & Bev |

15% |

20% |

25% |

Asda leads in bulk goods |

| Household Items |

12% |

14% |

18% |

Asda dominates in family categories |

The data shows how each supermarket plays to its strengths: Sainsbury’s with fresh produce, Tesco with loyalty promotions, and Asda with household and bulk product discounts.

Implications for the UK Grocery Market

The ongoing price wars demonstrate the central role of digital price intelligence in shaping retail strategies. With consumers increasingly shopping online, visibility into weekly pricing is more important than ever. By using advanced dashboards, analysts can transform scraped data into actionable insights.

The introduction of a Grocery Price Dashboard allows businesses to monitor competitor activity in near real-time. Retailers can track price adjustments, identify promotional strategies, and respond with countermeasures faster than through traditional methods.

For consumers, the transparency offered by web scraping creates opportunities to identify the cheapest retailer for their weekly basket, enhancing choice and reducing grocery bills.

How Food Data Scrape Can Help You?

- Comprehensive Data Extraction: We scrape product details, prices, promotions, availability, and delivery options across leading UK supermarkets.

- Custom API Solutions: Our supermarket scraping APIs allow seamless integration with business systems for real-time price and offer tracking.

- Category-Wise Insights: We deliver structured datasets covering fresh produce, packaged food, beverages, and household essentials for accurate comparisons.

- Competitive Price Monitoring: Weekly scraping highlights competitor strategies, loyalty discounts, and promotional campaigns to guide pricing decisions.

- Data Visualization Dashboards: We provide interactive dashboards that convert raw scraped data into actionable insights for businesses and consumers.

Conclusion

This research confirms that Sainsbury’s, Tesco, and Asda continue to battle fiercely in the UK’s grocery market. Asda stands out for its consistently low prices, Tesco for its loyalty-linked discounts, and Sainsbury’s for targeted produce promotions. The integration of web scraping methods reveals patterns invisible through surface-level analysis.

Moving forward, the use of Grocery Price Tracking Dashboard systems will be crucial in enabling supermarkets and analysts to monitor this highly dynamic market. Advanced Grocery Pricing Data Intelligence techniques, powered by delivery APIs and automated scraping tools, will redefine how competitive strategies are formulated.

In essence, web scraping is no longer just a consumer tool; it is transforming into a strategic necessity for businesses aiming to survive in the price-sensitive UK grocery ecosystem. Leveraging Grocery Store Datasets, companies and shoppers alike gain clarity, efficiency, and competitive advantage in the weekly price wars.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.