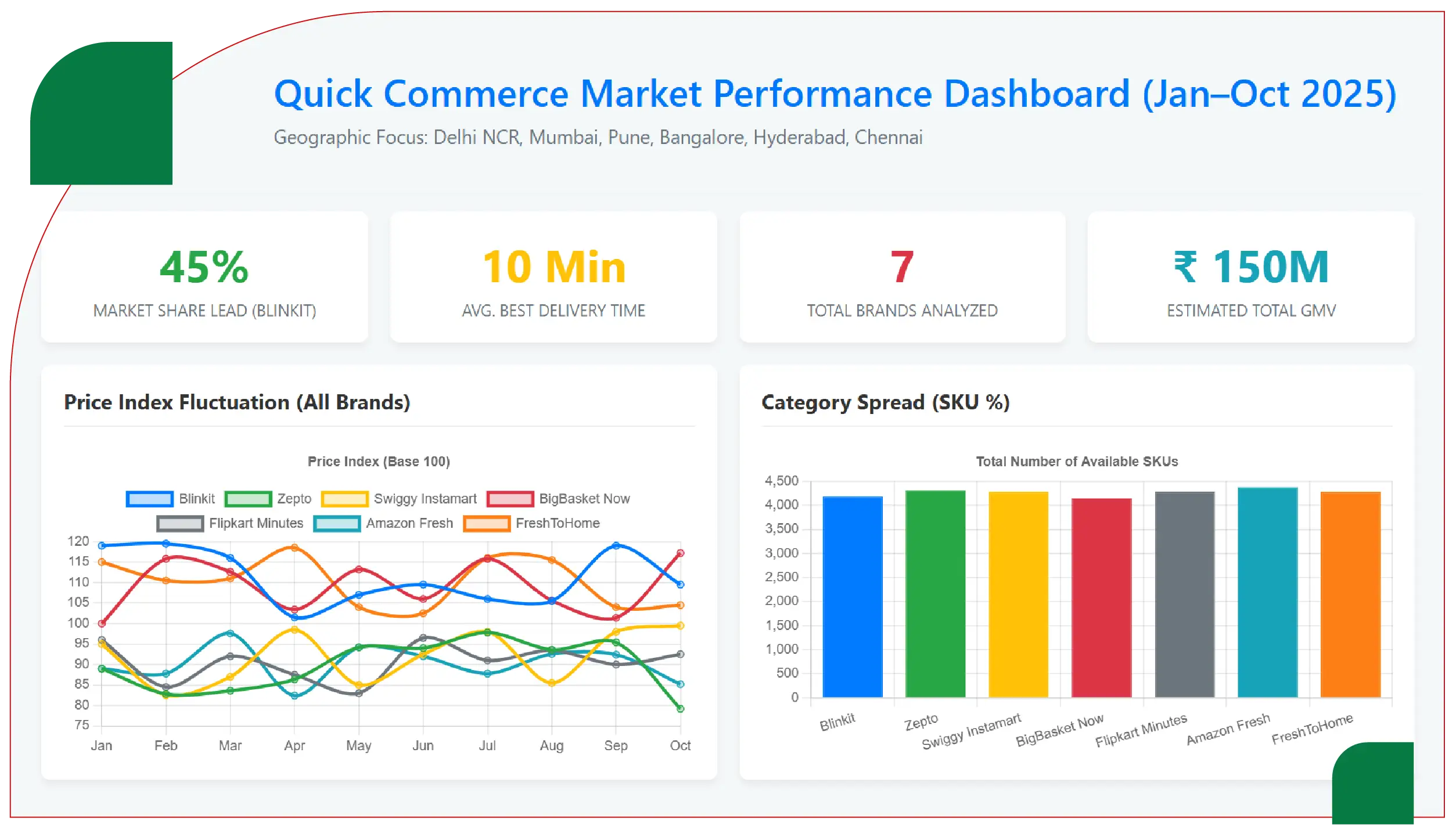

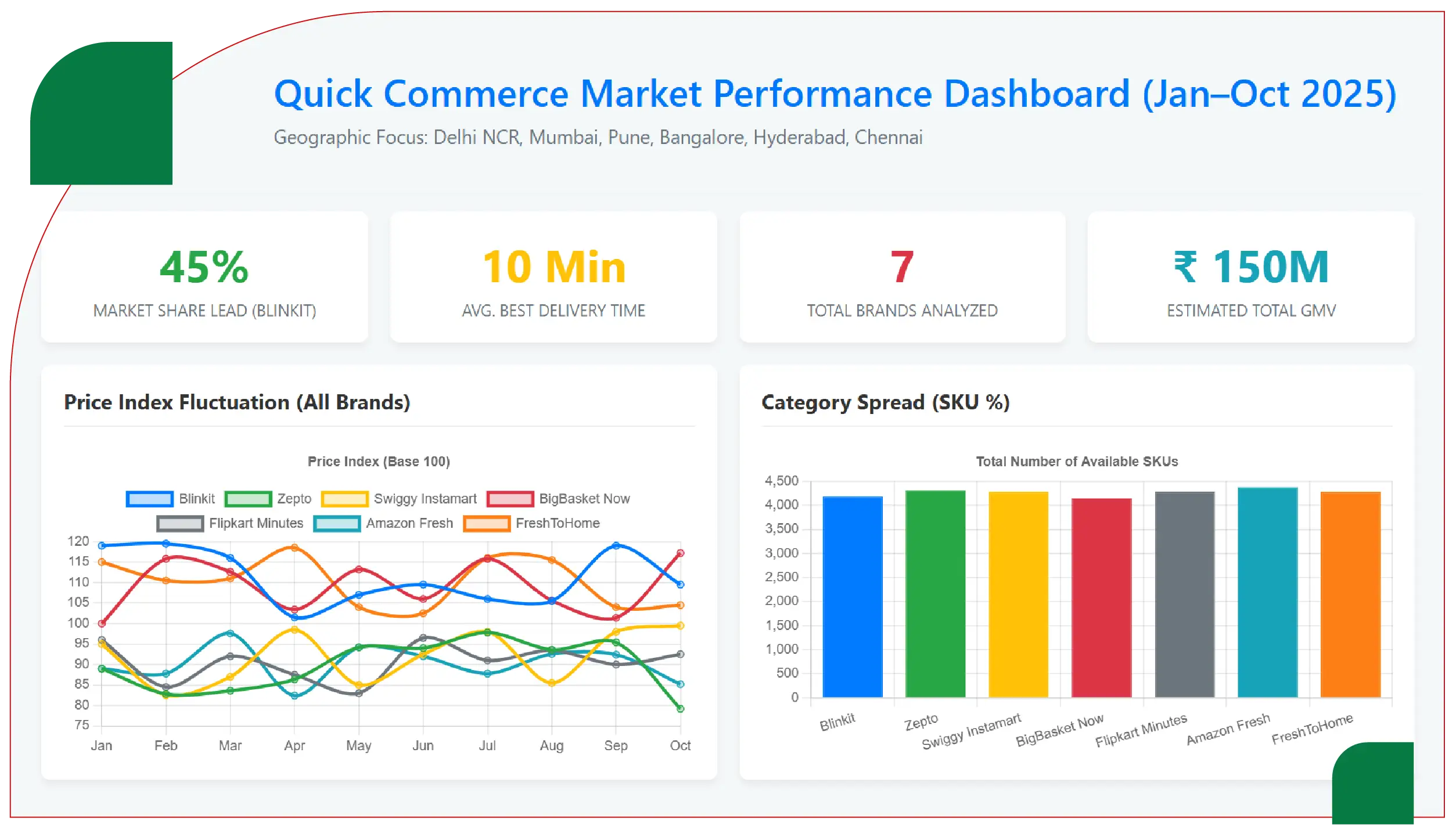

1. Introduction: The Rise of Instant Commerce in India

Quick commerce—defined by ultra-fast deliveries under 30 minutes—has evolved from convenience to necessity for India’s urban consumers. The Indian quick commerce market is projected to surpass USD 5.2 billion by 2025, driven by tech-savvy consumers, dense city clusters, and massive SKU availability. Businesses are now leveraging Quick Commerce Datasets to analyze demand trends, optimize delivery operations, and enhance customer experience across leading platforms.

Food Data Scrape’s advanced web crawling tools track these variables daily, mapping real-time price shifts, category trends, and out-of-stock events across leading platforms.

2. Methodology

Parameters analyzed:

- SKU availability and category spread

- Price fluctuations and discounts

- Delivery time and dynamic slots

- Regional coverage

- Product freshness, stock updates, and substitutions

Timeframe: January–October 2025

Geographic Focus: India (Delhi NCR, Mumbai, Pune, Bangalore, Hyderabad, Chennai)

3. Market Overview

Quick commerce platforms in India fall under three categories:

- Hyperlocal grocery specialists – Blinkit, Zepto, BigBasket Now

- Aggregator-based services – Swiggy Instamart, Flipkart Minutes

- Direct-to-consumer brands – FreshToHome, MilkBasket

Data scraping reveals SKU duplication across platforms has reached 58%, indicating overlapping supplier networks but varying pricing and packaging. By leveraging a Quick Commerce Data Scraping API, businesses can monitor product overlaps, analyze competitive pricing, and identify SKU-level discrepancies across Blinkit, Zepto, and Swiggy Instamart in real time.

4. Blinkit: The Data-Driven Urban Giant

Key Insights:

- Average delivery time: 12–15 minutes

- Average basket size: ₹480

- SKU refresh rate: every 3 hours

- Price fluctuation (monthly): ±8%

Sample Data Snapshot (Blinkit)

| Category |

SKU Count |

Avg Price (₹) |

Delivery Time |

Price Change (30 Days) |

| Dairy & Bakery |

950 |

68 |

10–12 min |

+4% |

| Snacks |

1200 |

92 |

12 min |

-6% |

| Beverages |

870 |

115 |

14 min |

+3% |

| Household Essentials |

640 |

85 |

15 min |

±0% |

5. Zepto: Speed Meets Smart Pricing

Key Insights:

- Discount volatility: 5–18% week-to-week

- Average rating: 4.3 stars

- Peak demand hours: 8–11 PM

Sample Data (Zepto)

| Category |

Avg Discount |

Avg Delivery Time |

Stock Refresh |

Region |

| Beverages |

12% |

9 min |

2 hrs |

Mumbai |

| Personal Care |

15% |

11 min |

4 hrs |

Bangalore |

| Snacks |

9% |

10 min |

3 hrs |

Delhi NCR |

| Frozen Food |

10% |

13 min |

6 hrs |

Pune |

6. Swiggy Instamart: The Lifestyle Convenience Hub

Key Insights:

- Dynamic delivery slots: 7–22 minutes

- Price parity with Blinkit: 89% overlap

- Top brands: Amul, PepsiCo, ITC, HUL

Sample Data (Swiggy Instamart)

| Product Type |

Avg Price |

Delivery |

Discount |

Stock Accuracy |

| Snacks |

₹98 |

14 min |

8% |

97% |

| Beverages |

₹110 |

12 min |

10% |

95% |

| Household Items |

₹89 |

16 min |

6% |

98% |

7. Amazon Fresh: Data-Driven Precision

Highlights:

- 7,200 SKUs with stable pricing (variation ±3%)

- Delivery window: 30–45 minutes

- Top in satisfaction among professionals

Sample Data (Amazon Fresh)

| Category |

SKU Count |

Avg Price (₹) |

Discount |

Delivery Mode |

| Groceries |

2700 |

120 |

5% |

Scheduled |

| Beverages |

1150 |

130 |

7% |

Scheduled |

| Personal Care |

1600 |

95 |

4% |

Same-day |

| Fresh Produce |

1750 |

80 |

6% |

Express |

8. BigBasket Now: The Legacy Player Adapts

Key Insights:

- 9,000+ SKUs

- Delivery time: 20–25 minutes

- Top city: Bangalore

Sample Data (BigBasket Now)

| Category |

SKU Count |

Avg Price (₹) |

Avg Discount |

Delivery Time |

| Grocery Staples |

2800 |

75 |

4% |

22 min |

| Fruits & Veg |

1600 |

110 |

5% |

18 min |

| Household |

1400 |

90 |

6% |

21 min |

| Beverages |

1000 |

105 |

7% |

25 min |

9. Flipkart Minutes: The New Challenger

Highlights:

- Average order value: ₹430

- Delivery time: 15–25 minutes

- SKU coverage: 3,800+ in beta

Sample Data (Flipkart Minutes)

| City |

SKU Coverage |

Delivery Time |

Price vs Blinkit |

Category |

| Bangalore |

4100 |

17 min |

-4% |

Snacks |

| Delhi NCR |

3800 |

18 min |

-3% |

Beverages |

| Pune |

3500 |

21 min |

-5% |

Household |

10. FreshToHome: The Protein Specialist

Key Insights:

- 950 SKUs across poultry & seafood

- Delivery: 35–40 minutes

- Price variance: 12% between metros

Sample Data (FreshToHome)

| Category |

Avg Price (₹/kg) |

Turnover (hrs) |

City |

Discount |

| Chicken |

245 |

12 |

Delhi |

5% |

| Seafood |

520 |

8 |

Bangalore |

3% |

| Ready-to-Cook |

310 |

10 |

Pune |

7% |

11. Market Insights from Food Data Scrape

A. Price Uniformity vs. Surge

Urban areas maintain price gaps under 5%, while tier-2 cities see higher variance.

B. Category Dominance

Top 5 selling categories:

- Beverages: 18%

- Snacks: 16%

- Dairy: 14%

- Produce: 12%

- Household: 10%

C. Delivery Insights

| Platform |

Delivery |

Cities |

Stock Accuracy |

| Blinkit |

13 min |

25 |

96% |

| Zepto |

10 min |

20 |

94% |

| Swiggy Instamart |

15 min |

28 |

97% |

| BigBasket Now |

22 min |

18 |

95% |

| Amazon Fresh |

40 min |

30 |

98% |

12. Technological Backbone: Data Scraping for Market Intelligence

Food Data Scrape automates:

- Real-time web crawling for SKUs & prices

- Geo-tagged datasets

- Historical archives

- Competitor mapping dashboards

- API integrations (Tableau, Power BI)

13. Key Trends in 2025

- AI-Powered Dynamic Pricing

- Private Label Expansion

- Subscription Commerce

- Local Sourcing

- Predictive Delivery Optimization

14. Use Cases for Food Data Scrape Clients

- Retail Brands: Benchmark competitor pricing

- FMCG: Track visibility and in-stock ratios

- Market Analysts: Study category evolution

- Investors: Identify expansion-ready cities

Example: Food Data Scrape detected 19% price variance for identical SKUs, helping brands correct MAP violations.

15. Challenges Observed

- Inconsistent stock data

- Limited API transparency

- Dynamic pricing complexity

- High SKU duplication

16. Conclusion

India’s quick commerce industry is entering a data-driven phase. With Blinkit and Zepto dominating, Swiggy Instamart expanding, and Flipkart Minutes pushing competition, data is the true differentiator.

Food Data Scrape empowers businesses with real-time insights, standardized datasets, and competitive intelligence.

Sample Dataset Example

| Platform |

SKU ID |

Product |

Price (₹) |

Category |

Delivery (min) |

City |

Timestamp |

| Blinkit |

BLK124 |

Amul Milk 1L |

68 |

Dairy |

12 |

Mumbai |

2025-10-12 |

| Zepto |

ZPT340 |

Pepsi 750ml |

45 |

Beverage |

10 |

Delhi |

2025-10-12 |

| Swiggy |

SWG220 |

Maggi 6-Pack |

90 |

Snacks |

14 |

Pune |

2025-10-12 |

| BigBasket |

BB251 |

Tata Salt 1kg |

25 |

Grocery |

22 |

Bangalore |

2025-10-12 |

| Amazon Fresh |

AMF910 |

Dove Shampoo 180ml |

155 |

Personal Care |

40 |

Hyderabad |

2025-10-12 |

Are you ready to dominate quick commerce with real-time data? Contact Food Data Scrape for custom scraping solutions, APIs, and competitive intelligence dashboards.