Introduction

Black Friday 2025 is shaping up to be one of the most competitive and data-driven retail seasons in the global liquor industry. With digital platforms dominating alcohol sales, brands across the US, UK, and Canada are competing fiercely for market visibility and consumer loyalty. This research report focuses on Mapping the Hottest Liquor Brands in the US, UK & Canada, using data scraping as the primary tool for tracking performance trends, pricing dynamics, and promotional strategies during the Black Friday sales surge.

Through Black Friday Liquor Data Scraping Across US, UK & Canada, retailers and analysts can collect real-time insights from e-commerce portals, delivery apps, and online liquor stores. These insights reveal how discounts, customer ratings, and stock movements shape purchasing behaviors. Moreover, businesses can Extract Real-Time Liquor Brand Insights During Black Friday 2025 to evaluate competitive positioning, forecast demand, and identify emerging patterns in regional consumption habits.

Global Liquor Market Trends and Black Friday Dynamics

The global liquor industry continues to experience rapid digital transformation, with online sales accounting for a growing share of total alcohol purchases. The rise of e-commerce platforms such as Drizly, Total Wine, and The Whisky Exchange has made price transparency and product comparison more accessible than ever.

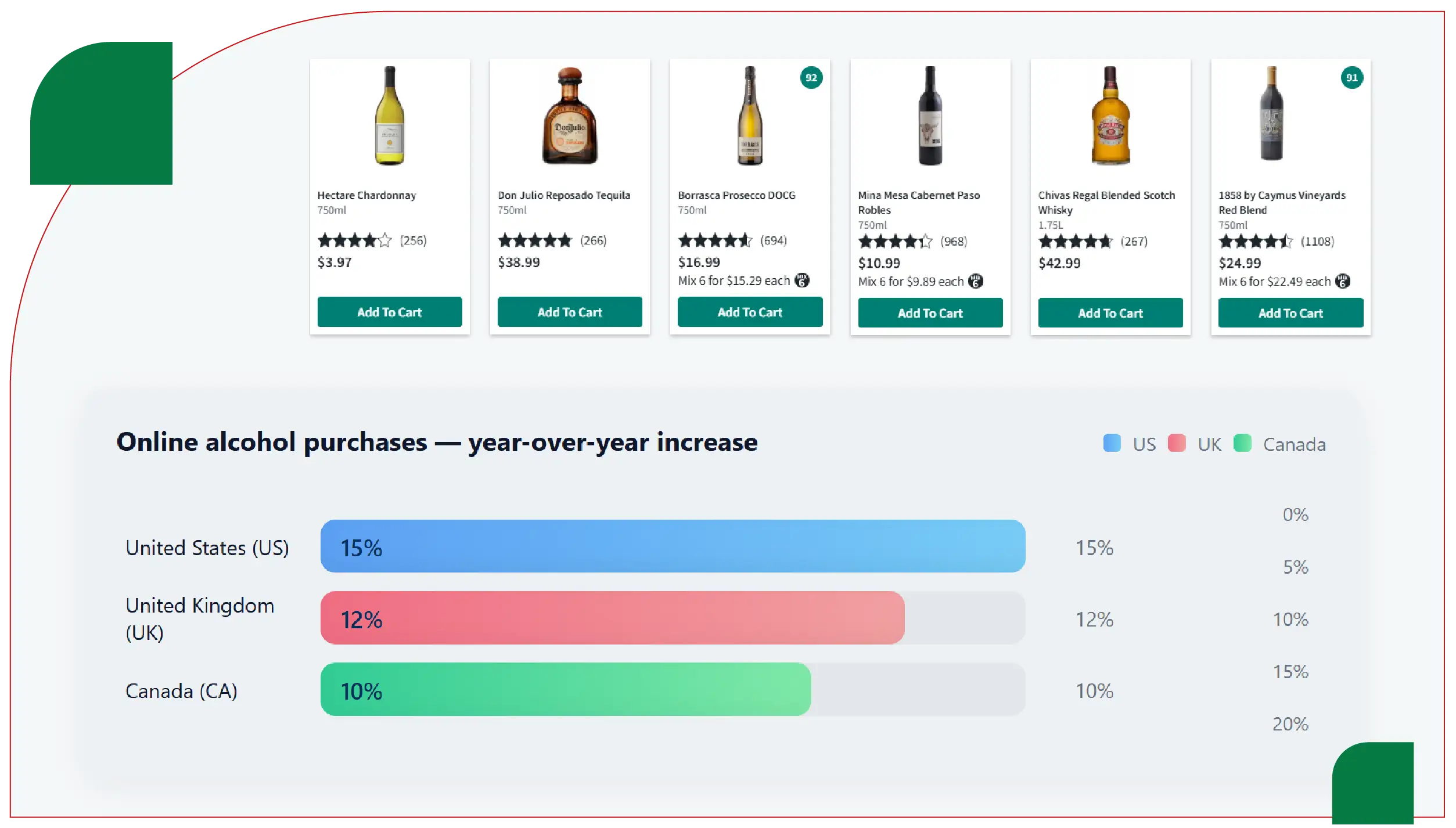

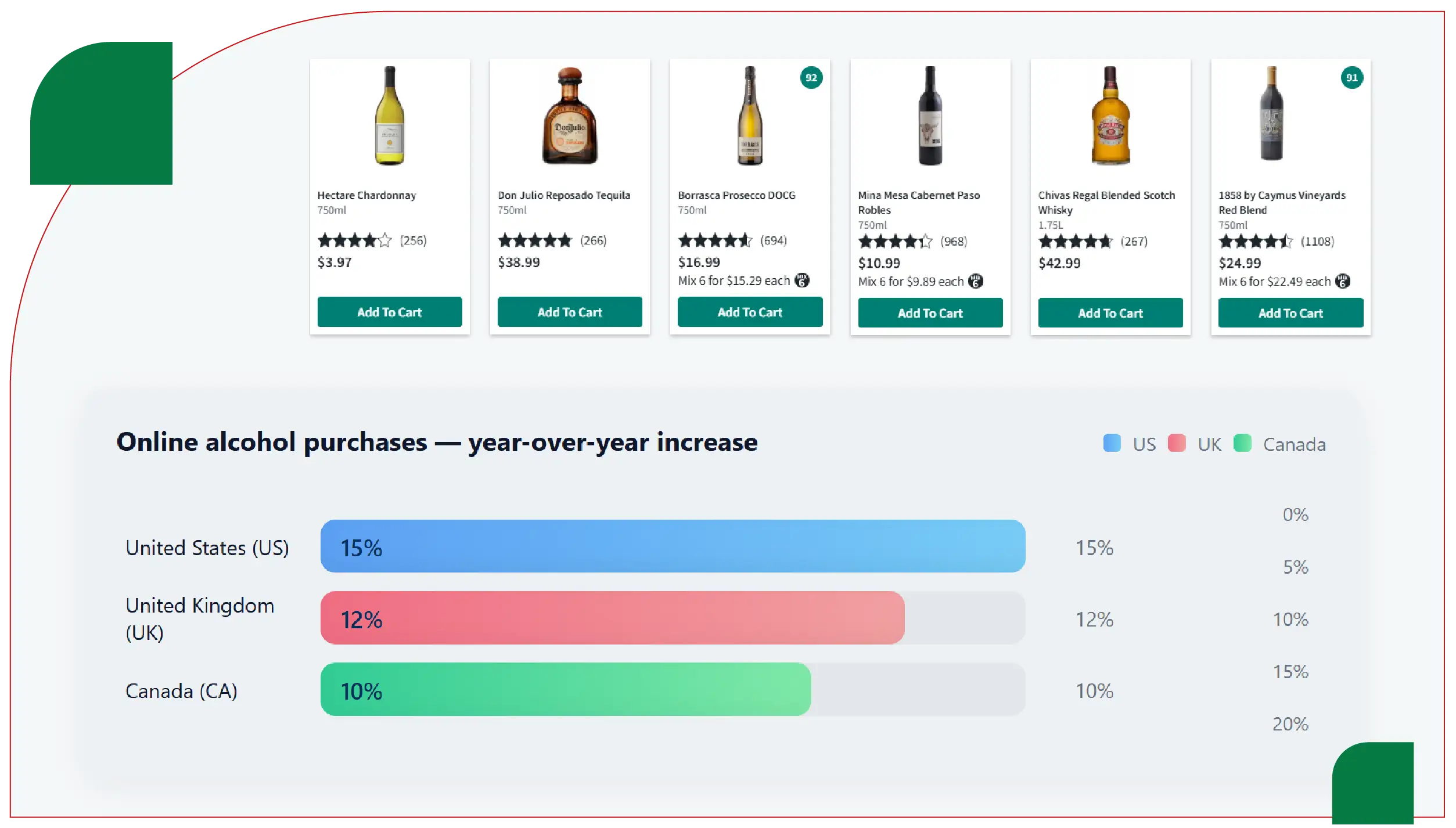

During Black Friday 2024, total online alcohol purchases increased by 15% in the US, 12% in the UK, and 10% in Canada. Premium spirits such as whiskey, gin, and vodka led these sales, largely driven by consumer demand for high-quality products at discounted prices. The upcoming Black Friday 2025 is expected to witness an even sharper increase as more consumers turn to digital channels for exclusive deals.

Comparative Overview of Liquor Market Performance

To understand category-specific trends, the table below outlines estimated Black Friday 2025 sales activity across key liquor types and regions.

| Region |

Top-Selling Liquor Category |

Average Discount Offered (%) |

Estimated Sales Growth (YoY) |

Leading Platforms |

| United States |

Whiskey |

20% |

+15% |

Drizly, Total Wine, ReserveBar |

| United Kingdom |

Gin |

18% |

+12% |

The Whisky Exchange, Master of Malt |

| Canada |

Vodka |

15% |

+10% |

LCBO Online, SAQ, Liquor Connect |

Whiskey continues to dominate the American market due to the popularity of bourbon and Tennessee varieties. In the UK, gin maintains its stronghold with craft distilleries and flavor innovations, while Canada’s vodka market shows consistent expansion, particularly among younger consumers and ready-to-drink cocktail enthusiasts.

The Role of Data Scraping in Liquor Intelligence

Web scraping technologies have become essential for collecting data at scale across thousands of liquor listings. Businesses use automation tools to Extract Hottest Liquor Brand Performance Data for Black Friday, monitoring product pages in real time for fluctuations in pricing, inventory, and promotions.

Such systems help gather:

- Price changes and time-based discount updates

- Stock availability and delivery timelines

- Customer reviews and rating trends

- Promotional visibility on e-commerce platforms

- Comparative pricing across multiple retailers

By aggregating and cleaning this data, brands and distributors can identify which products are resonating most with consumers, enabling better supply chain planning and marketing optimization.

Cross-Market Consumer Behavior Analysis

Black Friday buying behavior varies significantly between regions. American consumers tend to prioritize whiskey and tequila, the UK market favors gin and Scotch whisky, while Canadians lean toward vodka and rum. Data scraping enables retailers to track these distinctions and craft targeted marketing campaigns.

Below is a table showing key liquor brand performance insights derived from data scraping predicted during Black Friday 2025:

| Brand |

Primary Market |

Top Product Category |

Average Discount (%) |

Online Rating (out of 5) |

| Jack Daniel’s |

US |

Whiskey |

22 |

4.7 |

| Tanqueray |

UK |

Gin |

18 |

4.6 |

| Grey Goose |

Canada |

Vodka |

16 |

4.8 |

| Johnnie Walker |

UK/US |

Scotch |

20 |

4.5 |

| Patron |

US |

Tequila |

19 |

4.6 |

The findings reveal that premium brands benefit from reputation and consistent online visibility, while mid-tier products compete through competitive discounting.

Pricing Trends and Dynamic Market Adjustments

Dynamic pricing has emerged as a major differentiator in online liquor retail. Retailers are increasingly turning to automation tools to Scrape Real-Time Liquor Pricing and Trend Data for Black Friday and adjust prices in response to competitor activity.

For instance, real-time scraping allows brands to monitor when competitors lower prices or introduce flash sales. These data points help inform rapid pricing decisions and promotional updates, improving market competitiveness and maximizing sales conversions during the limited-time Black Friday window.

In 2024, liquor retailers employing data-driven pricing strategies experienced up to a 9% increase in revenue compared to those using static pricing models. This reinforces how data analytics and automation have become central to liquor retail success.

The Power of Liquor Price Data Scraping Services

The adoption of Liquor Price Data Scraping Services allows businesses to operate with precision and agility during major shopping events like Black Friday. These services facilitate:

- Multi-platform price tracking for thousands of SKUs

- Real-time detection of market changes

- Aggregation of consumer sentiment data

- Monitoring of limited-edition product availability

- Integration with dashboards and analytics tools

This process transforms raw data into structured intelligence, enabling retailers and wholesalers to visualize market movements instantly.

Value of Alcohol and Liquor Datasets

Comprehensive Alcohol and Liquor Datasets enable detailed analysis of brand positioning, consumer engagement, and price elasticity. With millions of data points spanning pricing, availability, and ratings, such datasets help businesses identify which products gain the most traction during promotional periods.

These datasets also allow for predictive analytics—forecasting future trends based on historical performance. For example, analyzing multi-year data can show how certain brands consistently perform well under specific discount ranges, helping retailers calibrate future pricing strategies.

Regional Insights from Black Friday Liquor Data

- United States: Whiskey remains king, with bourbon and rye leading sales. Tequila, especially premium brands like Don Julio and Casamigos, continues to see double-digit growth.

- United Kingdom: Craft gins and aged Scotch whiskies dominate online searches. Limited-edition releases and gift bundles perform particularly well during Black Friday.

- Canada: Vodka and ready-to-drink beverages drive volume sales. Local craft distilleries are gaining traction due to their focus on sustainability and unique flavors.

The convergence of consumer trends and online discount campaigns has made Black Friday an ideal time for brands to reposition themselves and attract new demographics.

Challenges in Collecting and Managing Liquor Data

Although data scraping provides unmatched visibility, it comes with challenges. Regulations surrounding alcohol promotion differ widely across countries, affecting data accessibility. Websites also frequently update their structures, requiring adaptive scraping techniques.

Data quality assurance is critical—duplicate listings, missing values, and inconsistent currency conversions can distort analysis. Implementing automated validation scripts and normalization pipelines helps ensure the reliability of insights derived from scraped datasets.

Conclusion

As the 2025 holiday shopping season approaches, liquor retailers and brands are increasingly investing in technology-driven strategies to maximize Black Friday opportunities. The ability to Scrape Alcohol Price Data from multiple sources in real time has transformed how companies track pricing, promotions, and consumer preferences.

Interactive Liquor Price Tracking Dashboard solutions provide a visual and dynamic way to analyze market performance, guiding strategic decision-making throughout the sales period. Ultimately, advanced Liquor Data Intelligence Services enable brands to move beyond guesswork—unlocking precise, actionable insights that lead to higher profitability and stronger market positioning across the US, UK, and Canada.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.