Introduction

In the fiercely competitive UK grocery market, understanding the pricing gap between branded products and private label (store-brand) goods has become critical for brands, retailers, and analysts alike.

Consumers are increasingly turning to private labels amid rising costs and inflation. For manufacturers and retailers, this raises key questions:

- How do Tesco, ASDA, and Sainsbury’s price branded goods compared to their own labels?

- Are discounts or promotions favoring private labels?

- Where do price gaps shrink or widen across categories?

Enter Food Data Scrape, a leader in AI-based grocery price intelligence. We help businesses track, compare, and forecast pricing trends across brand vs private label products across the UK’s top supermarkets.

Why This Matters in 2025

Private labels are no longer a budget-only option. They’re:

- Competing in quality and packaging

- Gaining shelf share in premium and organic segments

- Drawing price-sensitive consumers rapidly

Brands must monitor pricing gaps closely to stay competitive, align promotional strategies, and protect their share of wallet.

With AI-powered price scraping, Food Data Scrape delivers these insights in real time.

How AI Powers Brand vs Private Label Analysis

Unlike manual price checks or limited-scope scrapers, our AI Grocery Price Scraping UK solution enables:

- SKU-to-SKU comparison across brands and private labels

- Category-level pricing averages

- Promotion and discount detection

- Daily and hourly data refresh

- Regional and store-level variance analysis

Our system uses:

- NLP for product name standardization

- ML for grouping similar SKUs

- Time-series analysis for spotting price trends and promotional patterns

Sample Dataset: Brand vs Private Label Pricing Snapshot

| Platform | Category | Brand Product | Brand Price | Private Label Product | Private Price | % Price Difference |

|---|---|---|---|---|---|---|

| Tesco | Milk (1L) | Cravendale Semi-Skimmed | £1.75 | Tesco Semi-Skimmed 1L | £1.15 | -34.3% |

| ASDA | Bread (Whole) | Warburtons Wholemeal | £1.35 | ASDA Wholemeal Bread | £1.05 | -22.2% |

| Sainsbury’s | Butter | Lurpak Butter (250g) | £2.60 | Sainsbury’s Butter 250g | £1.79 | -31.1% |

| Tesco | Orange Juice | Tropicana Smooth 1L | £3.00 | Tesco Orange Juice Smooth | £1.85 | -38.3% |

Use Case: FMCG Brand vs Supermarket Private Label

A well-known dairy brand aimed to analyze its pricing compared to private label products across top UK retailers—Tesco, ASDA, and Sainsbury’s. To gain accurate insights, the brand used Tesco Grocery Delivery Data Scraping to extract product prices and promotions in real time. Additionally, it leveraged Asda Grocery Data Scraping techniques to monitor private label pricing trends. For a complete competitive analysis, the team also opted to Scrape Online Sainsbury's Grocery Delivery App Data, enabling them to assess pricing strategies and customer offers. These combined insights helped the brand optimize pricing, enhance product positioning, and remain competitive across all platforms. Using Food Data Scrape, they:

- Mapped 38 private label dairy SKUs across 3 platforms

- Found an average discount of 26% in private label offerings

- Adjusted promotions to coincide with private label markdowns

- Improved sell-through by 14% on their own branded line after realignment

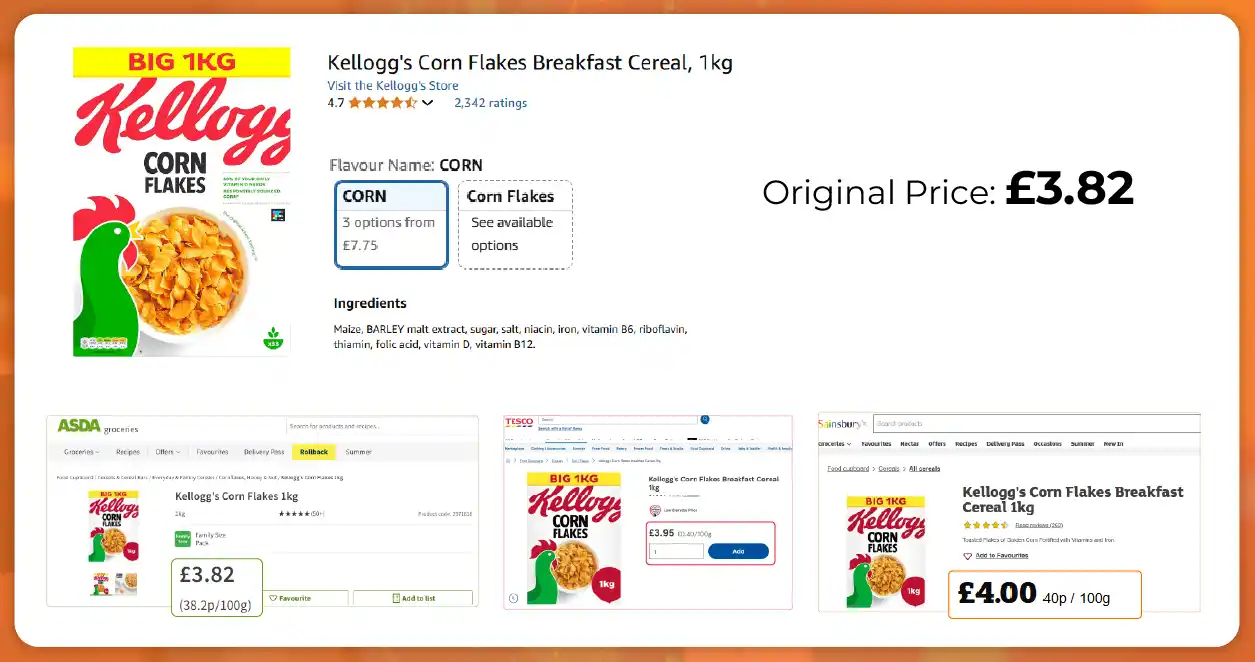

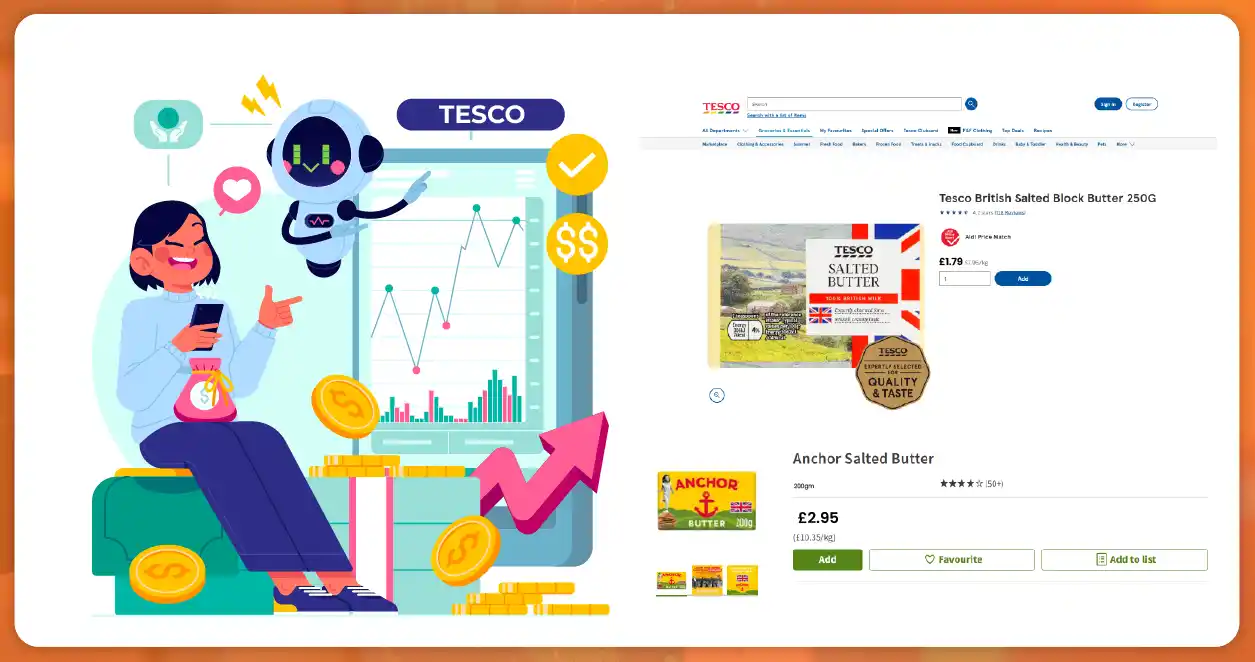

Tesco Price Intelligence: Key Observations

- Tesco heavily promotes private label in dairy, juices, and bakery

- Discounts are most aggressive during seasonal campaigns (e.g., “Back to School”)

- Clubcard pricing often favors store brands with extra savings

Example:

- Tesco Butter 250g: £1.79 with Clubcard

- Anchor Butter 250g: £2.95 — no discount

Insight: For dairy and spreads, Tesco’s private label undercuts by 30–40% on average.

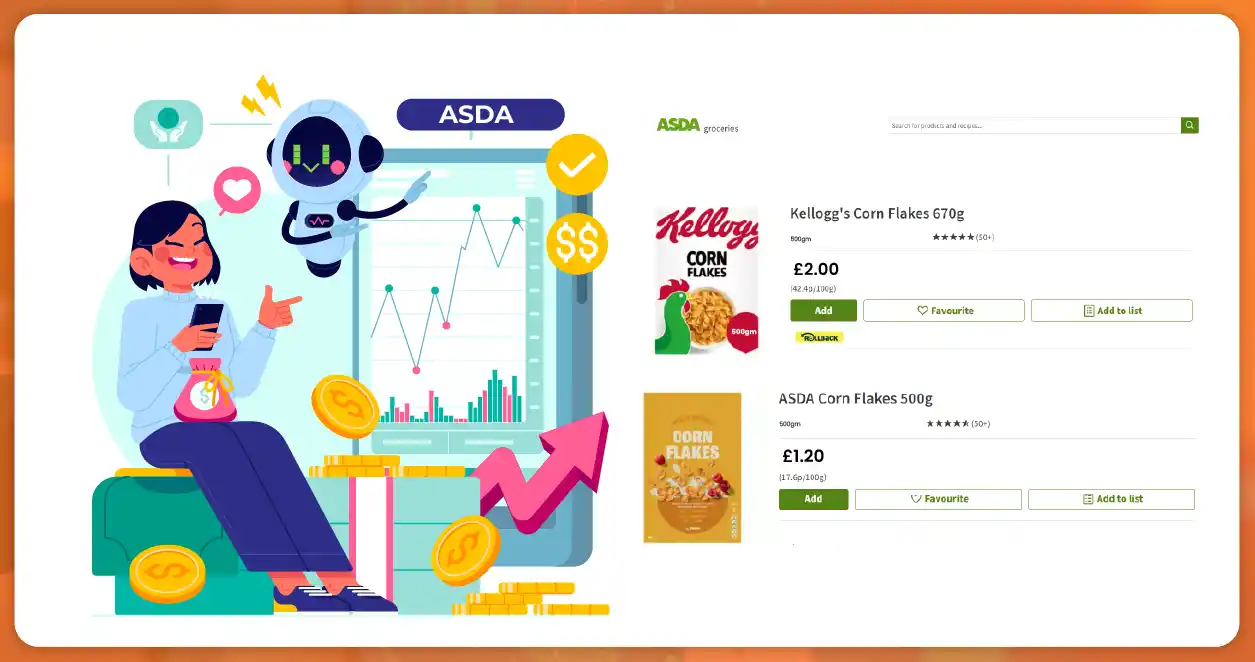

ASDA Private Label Pricing Strategy

- ASDA’s “Smart Price” and “Just Essentials” lines dominate price-sensitive categories

- Frequent bundle deals (e.g., 3 for £3 on cereals, snacks)

- Health-conscious categories (low-sugar, gluten-free) also pushed under private label

Example:

- Kellogg’s Corn Flakes 500g: £2.00

- ASDA Corn Flakes 500g: £1.20

Price Difference: -40%

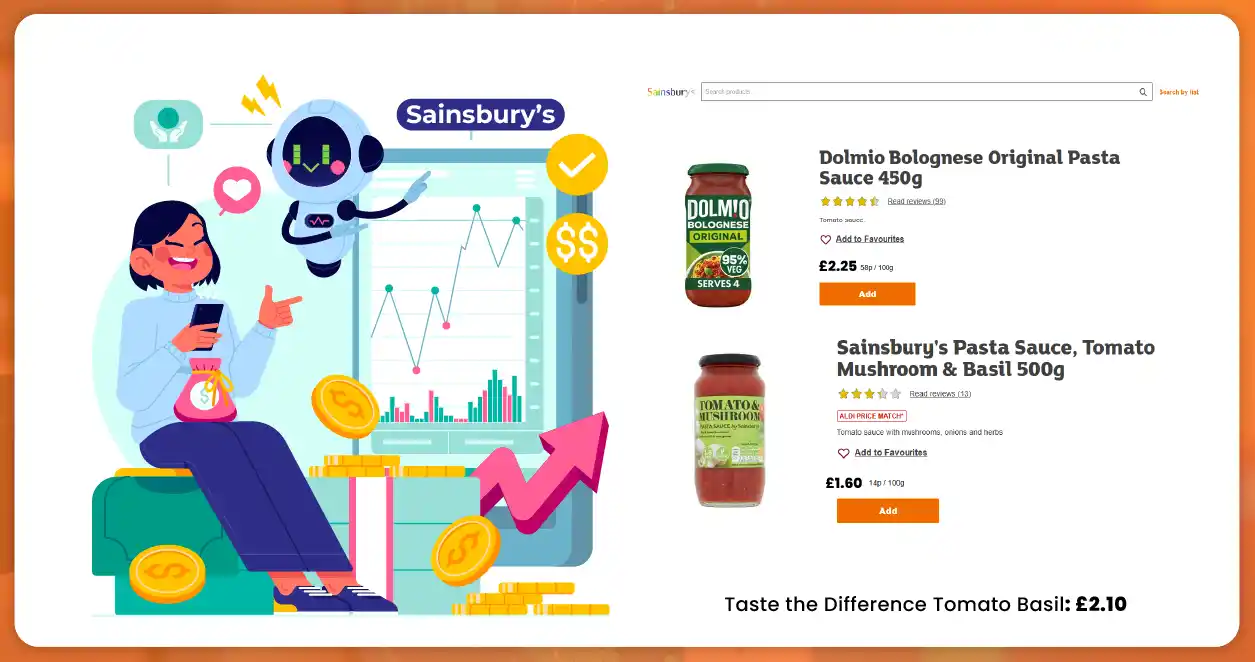

Sainsbury’s Brand vs Own Label Analysis

Sainsbury’s follows a dual strategy:

- Competing on price in daily essentials

- Competing on quality in premium lines (e.g., “Taste the Difference”)

Example:

- Dolmio Pasta Sauce 500g: £2.25

- Sainsbury’s Tomato Basil 500g: £1.60

- Taste the Difference Tomato Basil: £2.10

Insight: They bridge the gap by offering 3 tiers — value, mid, and premium.

Dynamic Pricing Events: Holiday & Weekday Variance

We analyzed pricing over a 60-day window and found:

| Day Type | Avg. Brand Discount | Avg. Private Label Discount |

|---|---|---|

| Weekdays | 7.5% | 11.2% |

| Weekends | 9.3% | 13.5% |

| Holidays (Easter, Bank) | 15.7% | 19.4% |

Private labels become even more competitive during weekend and holiday campaigns, particularly in snacks, bakery, and beverages.

Platform Comparison: Brand vs Store Brand Insights

| Metric | Tesco | ASDA | Sainsbury’s |

|---|---|---|---|

| Avg. Brand Premium (%) | +32% | +28% | +25% |

| Promo Frequency (Private Label) | High | Very High | Moderate |

| Category with Max Gap | Dairy | Cereals | Sauces |

| Own Label Tiering | Yes | Yes | Yes (3-tier) |

Retail Pricing Intelligence Tools: Features

Food Data Scrape offers enterprise-grade tools for grocery data analysis:

- Real-Time Price Monitoring – Hourly to daily tracking

- Branded vs Private Label SKU Matching – AI-model-based

- Location-based Pricing – Across UK cities/stores

- Discount & Promo Tag Extraction – “Clubcard Price”, “Smart Price”

- API + Dashboard Access – Custom filters, exports, reports

Sample API Output:

Who Uses This Data?

- FMCG Brands: Track pricing battles & react to undercutting

- Retailers: Benchmark against competitor chains

- Analysts & Consultants: Study market share shifts & pricing influence

- Consumer Apps: Power comparison tools for savings apps

- R&D Teams: Plan product differentiation beyond pricing

Key Takeaways for Pricing Strategy

- Use real-time Tesco Price Intelligence to stay promotion-aware

- Counter ASDA Private Label Pricing with matched-value bundles

- Analyze Sainsbury’s tiered pricing to position premium SKUs

- Focus on holidays/weekends to optimize visibility vs price gap

- Use Retail Pricing Intelligence Tools to stay ahead of weekly shifts

Final Thoughts

The price gap between branded and private label products isn’t just about saving pence — it reflects deeper shifts in shopper behavior, retail margin goals, and brand value perception

With AI Grocery Price Scraping UK from Food Data Scrape, brands and retailers can:

- Uncover true pricing deltas

- Spot opportunities in real-time

- Act decisively to protect margins and grow market share

In a world where every pound matters, price intelligence is no longer optional — it’s a strategic necessity. To stay ahead in today’s competitive grocery market, accurate and timely data is critical.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.