Introduction

The rapid expansion of quick-commerce platforms in India has transformed the way consumers purchase everyday essentials, especially packaged snacks. The surge in real-time consumption behaviour is driven by convenience, impulse buying, increasing penetration of hyperlocal delivery networks, and robust tech-enabled retail infrastructure. Businesses integrating Real-Time Snacks Growth Monitoring on Quick-Commerce benefit from granular visibility into pricing actions, on-shelf availability, promotional behaviour, and brand-level competitive intelligence. The demand for snack categories such as chips, namkeen, biscuits, energy bars, and baked snacks has intensified with accelerated delivery timelines of 10–20 minutes.

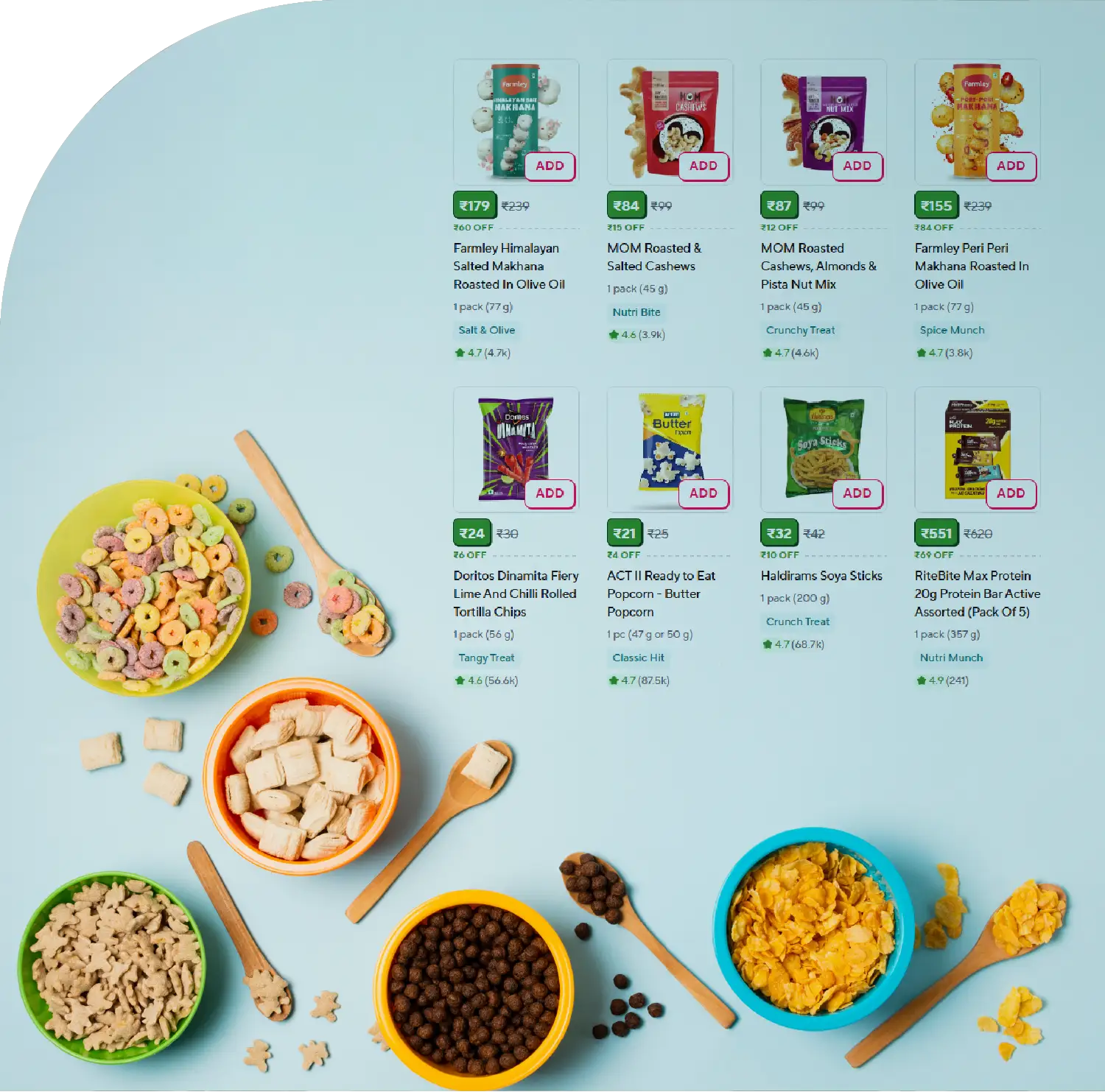

To decode evolving demand cycles across cities and customer segments, companies rely on Chips, Namkeen & Biscuit Sales Data Scraping, which enables structured intelligence collection from top Q-commerce apps including Blinkit, Zepto, Swiggy Instamart, and BigBasket Now. Using automated intelligence workflows for Q-Commerce Snack Product Trend Analysis, organizations gain access to SKU-level real-time stock tracking, product assortment variation, pricing dynamics, competition mapping, and stock-out prediction.

Evolving Dynamics of Snack Consumption on Q-Commerce

The shift from weekly grocery shopping to instant fulfilment has changed snack market fundamentals. Availability and visibility now influence conversion more than traditional brand loyalty. Consumers increasingly purchase snacks during peak hours associated with entertainment, social activities, and unplanned cravings. This transition has created opportunities for real-time trend forecasting and predictive analysis.

Growth trends indicate an average 28–35% y-o-y rise in quick-commerce snack orders, driven particularly by high-frequency metropolitan clusters and expanding Tier-2 markets. By implementing Real-Time Q-Commerce Snack Product Monitoring, companies analyze the competitive landscape for both established FMCG giants like PepsiCo, Nestlé, ITC and emerging D2C brands such as Too Yumm, Haldiram’s, Bingo, Epigamia, and Whole Truth.

Businesses leverage Q-Commerce Snack Market Data Extraction to track micro-level variations within the snack supply chain. This includes frequent price adjustments, discount-based promotional shifts, new product introductions, and cross-selling strategies.

Table 1: Real-Time Snack Demand Growth by Category (Sample 2025 Market Data)

| Snack Category |

Monthly Avg Order Growth % (Urban) |

Monthly Avg Order Growth % (Tier-2) |

Key Consumer Insight |

| Potato Chips | 32% | 22% | Higher impulse buying in metros |

| Namkeen (Traditional Snacks) | 28% | 41% | Strong cultural preference in Tier-2 |

| Biscuits & Cookies | 25% | 30% | Daily essential & convenience item |

| Baked Snacks | 35% | 18% | Younger urban health-conscious buyers |

| Popcorn & Nachos | 30% | 12% | Entertainment & weekend-driven spike |

| Protein & Energy Bars | 37% | 11% | Premium lifestyle adoption in metros |

Analysis of Table 1

The data indicates a notable variation between metropolitan and Tier-2 city consumption patterns. Urban consumers demonstrate higher adoption of premium, health-oriented and international snack categories, whereas Tier-2 demand is stronger for traditional salty snacks such as bhujia, sev, and mixtures. Biscuits maintain stable demand across region types due to multi-purpose consumption and affordability. Baked snacks and protein bars, although niche, show high expansion potential in young metro clusters. This insight supports strategic targeting and diversified product placement across delivery platforms.

To understand SKU-based granular trends, organizations deploy strategy to Scrape Chips, Namkeen & Biscuit SKUs on Q-Commerce Apps, enabling real-time catalog monitoring and deeper market penetration strategies.

Pricing Intelligence & Availability Fluctuation Monitoring

Real-time fulfilment models depend heavily on warehouse-level inventory accuracy. Fluctuations in product availability and pricing updates across cities influence demand elasticity. By implementing Real-Time Snack Product Tracking on Quick-Commerce Platforms, players access updated price charts, promotional discounts, and order frequency data.

Leading retailers leverage automation-enhanced Grocery App Data Scraping services to gather critical decision-making data including:

- Price revisions across multiple delivery apps

- Stock availability & demand-linked price surges

- Delivery time slot variances

- Brand visibility placements & category page ranking

- Promotional campaigns and bundling strategies

Businesses utilize Grocery Delivery Scraping API Services for continuous and scalable extraction pipelines that support omnichannel sales strategies and instant market reactions.

Table 2: Average Price Comparison of Popular Snack SKUs Across Q-Commerce Platforms (Sample 2025 Data)

| Brand / SKU |

Blinkit (₹) |

Zepto (₹) |

Instamart (₹) |

BigBasket Now (₹) |

Price Insight |

| Lay’s Classic Salted (95g) | ₹45 | ₹42 | ₹44 | ₹43 | Zepto most price-competitive |

| Bingo Mad Angles (80g) | ₹40 | ₹38 | ₹39 | ₹39 | ₹1–₹2 difference impacts impulse orders |

| Haldiram Bhujia (400g) | ₹85 | ₹80 | ₹82 | ₹84 | Tier-2 regions show higher conversions |

| Parle-G (800g Family Pack) | ₹88 | ₹85 | ₹86 | ₹87 | Price stability supports volume growth |

| Too Yumm Multigrain Chips (55g) | ₹55 | ₹49 | ₹52 | ₹53 | Premium category discount-driven |

| Britannia Good Day (600g) | ₹115 | ₹112 | ₹112 | ₹113 | Consistent pricing enables repeat sales |

Analysis of Table 2

The pricing evaluation highlights strong competitive pricing strategies across Q-commerce brands. Zepto demonstrates the lowest average price positioning, giving it an edge for high-frequency impulse snack products. Promotions significantly affect consumer switching behaviour in premium and health-focused categories like multigrain chips. Parle-G and Haldiram maintain stable pricing due to brand loyalty and bulk-pack preference, making them reliable volume drivers in both metro and Tier-2 markets. Understanding these price differentials supports better precision planning and margin optimization.

To visualize pricing patterns, operational teams employ analytics dashboards such as Grocery Price Dashboard, enabling comparison of SKU performance across platforms.

Future Outlook of the Q-Commerce Snack Retail Space

The Indian Q-commerce market is projected to grow to $10.8 billion by 2027, with snack products driving 33% of order volume. Key growth drivers include:

- Expansion of dark-store networks to Tier-2 and Tier-3 cities

- AI-powered recommendation engines influencing impulse snack purchases

- Brand partnerships for exclusive Q-commerce launches

- Demand prediction using neural forecasting models

- Consumer shift toward healthier snacking options

Increased dependency on real-time retail intelligence will intensify the need for automated scraping technologies and predictive analytics models.

Conclusion

Real-time snack demand intelligence is shaping the future of Q-commerce competition. Businesses that adopt real-time SKU monitoring, pricing analysis, and demand forecasting will achieve superior market positioning. Intelligent toolsets such as Grocery Price Tracking Dashboard support precision analytics for pricing and inventory optimization. By integrating advanced Grocery Pricing Data Intelligence pipelines and leveraging structured datasets such as Grocery Store Datasets, brands and retailers can unlock scalable growth, strengthen profitability models, and respond instantly to evolving consumer behaviour across diverse urban and Tier-2 markets.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.