Introduction

The Big Mac sits in a rare strategic position within QSR menus. Conversations remain steady year over year, yet usage formats continue to expand into new occasions, dishes, and meal structures. That balance between stability and evolution is exactly why brands are increasingly choosing to Scrape Big Mac Trends & Its Pickle-Forward Sauces to understand what actually drives long-term demand.

At a surface level, Big Mac mentions don’t spike like viral menu items. Underneath, however, the flavour system—especially its pickle-forward, creamy-tangy sauce profile—is migrating into wraps, bowls, salads, and home-cooked formats. Using Web Scraping Big Mac Menu Trends allows analysts to track this behaviour shift at scale instead of relying on campaign-level noise.

To go deeper than brand mentions, companies now Extract Big Mac Trends & Its Pickle-Forward Sauces across restaurants, recipes, dishes, and consumer posts, separating repeat behaviour from short-lived hype.

Stable Demand, Changing Usage Patterns

Big Mac demand behaves more like a staple than a trend cycle. Mentions fluctuate only slightly, signaling dependable baseline interest. That makes it valuable for foodservice and CPG teams planning repeatable menu decisions rather than one-off LTOs.

Yet format innovation tells a different story. While the classic burger format shows signs of maturity, Big Mac-style builds continue to appear across adjacent categories. This is where data teams increasingly Extract Burger Menu Ingredient Trends from QSR Chains to understand how signature flavours outlive individual SKUs.

Wraps, salads, burrito-style builds, and stacked variations preserve the same indulgent flavour payoff while fitting modern convenience and meal-prep behaviours.

Consumer Needs Favor Indulgence Over Health

Data consistently shows indulgence-first motivations behind Big Mac-inspired choices. Fried textures, rich sauces, and familiar American comfort cues dominate decision-making, while “healthy” considerations trail far behind.

This doesn’t mean better-for-you versions fail—it means they only work when the sensory experience stays intact. That insight becomes actionable when brands apply Big Mac Competitive Menu Benchmarking to see how flavour, texture, and portion cues are preserved across successful adaptations.

If the creamy, tangy, pickle-driven punch disappears, the Big Mac association disappears with it.

Formats Are the Growth Lever, Not the Burger Itself

The strongest growth around Big Mac-style eating is format-driven:

- Handheld wraps for portability

- Salad and bowl builds for low-carb or meal-prep framing

- Mexican-inspired mashups reflecting broader flavour crossover

- Double-stack builds tied to value and indulgence signaling

Tracking these shifts with a Big Mac Trends & Its Pickle-Forward Sauces Data Scraper helps brands validate which formats scale beyond social chatter into real menus and recipes.

For operators, this supports a clear playbook: keep the core burger for baseline demand, and rotate formats as LTOs without reinventing flavour systems.

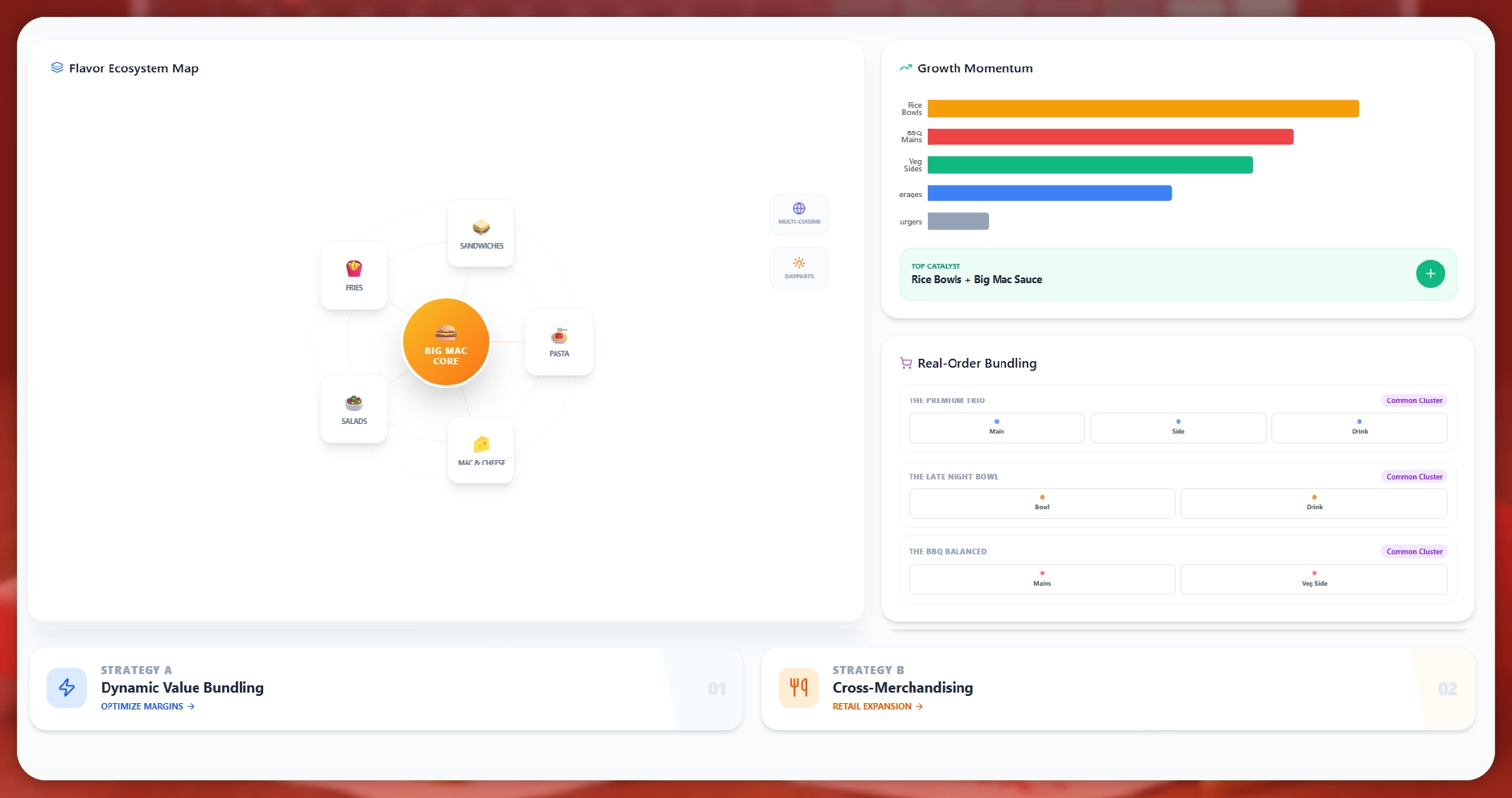

The Ecosystem Is Larger Than Burgers

Big Mac flavour connects naturally to broader comfort food categories—pasta, mac and cheese, salads, fries, and sandwiches. This wide footprint explains why the trend adapts so easily across cuisines and dayparts.

At the same time, the fastest-growing related dishes aren’t burgers at all. Rice bowls, BBQ-driven mains, vegetables, and beverage pairings are gaining momentum. Brands leveraging Web Scraping Food Delivery Data can see how these items bundle together in real orders, not just menus.

This bundling logic is critical for both value meals and retail cross-merchandising strategies.

Cooking Methods Reinforce the Flavour Promise

Even at home, Big Mac-style builds rely on cooked and fried preparation cues. Pan-seared proteins, crisp textures, and sauce-forward assembly dominate recipes. Health-forward remixes still lean on rich sauces as dressings or drizzles.

These insights become far clearer when teams Extract Restaurant Menu Data across chains, delivery platforms, and recipe ecosystems to observe how preparation methods reinforce flavour expectations.

Turn real-time menu, ingredient, and delivery data into confident growth decisions with our scalable food data scraping intelligence.

Proteins Change, Sauce Stays Constant

Chicken now outpaces beef in Big Mac-inspired ingredient usage, signaling flexibility in protein choice. Pork and seafood variants also appear, especially in bowl and salad formats.

What doesn’t change is the sauce system. Pickle relish, ketchup-mayo blends, thousand island-style dressings, mustard, and sweet-tangy profiles form the non-negotiable core. Tracking these correlations through a Food Delivery Scraping API helps CPG brands identify which condiment profiles travel best across categories.

Spice-forward sauces, by contrast, show decline—confirming that heat isn’t the driver here. Creamy, tangy familiarity is.

From Brand Adjacency to Remix Culture

Big Mac remains the anchor within the McDonald’s ecosystem, closely paired with chicken items, fries-adjacent sides, and dessert add-ons. But consumer behaviour increasingly remixes the flavour outside its original context.

This is where Restaurant Data Intelligence becomes critical. It reveals how a legacy menu item evolves into a flavour platform, influencing baskets, bundles, and at-home recreation far beyond its original SKU.

Strategic Takeaways for Foodservice and CPG

Big Mac trends aren’t asking for reinvention. They’re asking for translation.

Foodservice teams can:

- Deploy Big Mac-style sauces across wraps, bowls, and salads

- Pair them with high-growth sides and meal anchors

- Preserve fried and cooked texture cues to match indulgence needs

CPG teams can:

- Launch pickle-forward sauces and dressings inspired by proven flavour stacks

- Build meal kits that enable home remixing

- Extend confidently into chicken and alternative proteins

How Food Data Scrape Can Help You?

-

Actionable Market Trend Visibility

Our data scraping services uncover real-time menu, recipe, and delivery trends, helping you identify stable demand signals, emerging formats, and flavor shifts before they appear in traditional market reports. -

Competitive Menu & Pricing Intelligence

We track competitor menus, pricing changes, portion strategies, and bundling patterns at scale, enabling smarter benchmarking, faster reactions, and data-backed decisions across QSR, casual dining, and CPG categories. -

Ingredient & Flavor System Tracking

By scraping ingredient-level data, we reveal which flavors, sauces, and proteins drive repeat usage, helping brands optimize formulations, extend successful flavor systems, and reduce risk in new product development. -

Food Delivery & Consumer Behavior Insights

Our scraping captures delivery platform behavior, combo preferences, and side pairings, giving visibility into how consumers actually order, bundle, and consume—not just what brands intend to sell. -

Scalable Intelligence for Growth Teams

We deliver structured, analysis-ready datasets that integrate seamlessly into dashboards, forecasting models, and strategy workflows, supporting faster insights, clearer priorities, and confident expansion decisions across markets.

Conclusion

The Big Mac name may cool slightly, but the flavour system continues to spread. Brands that track this evolution through Food Delivery Intelligence gain an edge in predicting where comfort-driven demand will move next.

When integrated into a Food Price Dashboard, these insights support smarter pricing, bundling, and promotion strategies. Structured Food Datasets make it possible to move beyond assumptions and act on real behaviour.

In short, scraping Big Mac trends isn’t about chasing nostalgia—it’s about understanding how a pickle-forward flavour architecture keeps winning, even as the formats keep changing.

If you are seeking reliable data scraping services, Food Data Scrape is at your service. We specialize in Food Data Aggregation and Mobile Restaurant App Scraping, delivering high-quality data analysis to support strategic decision-making.