The Client

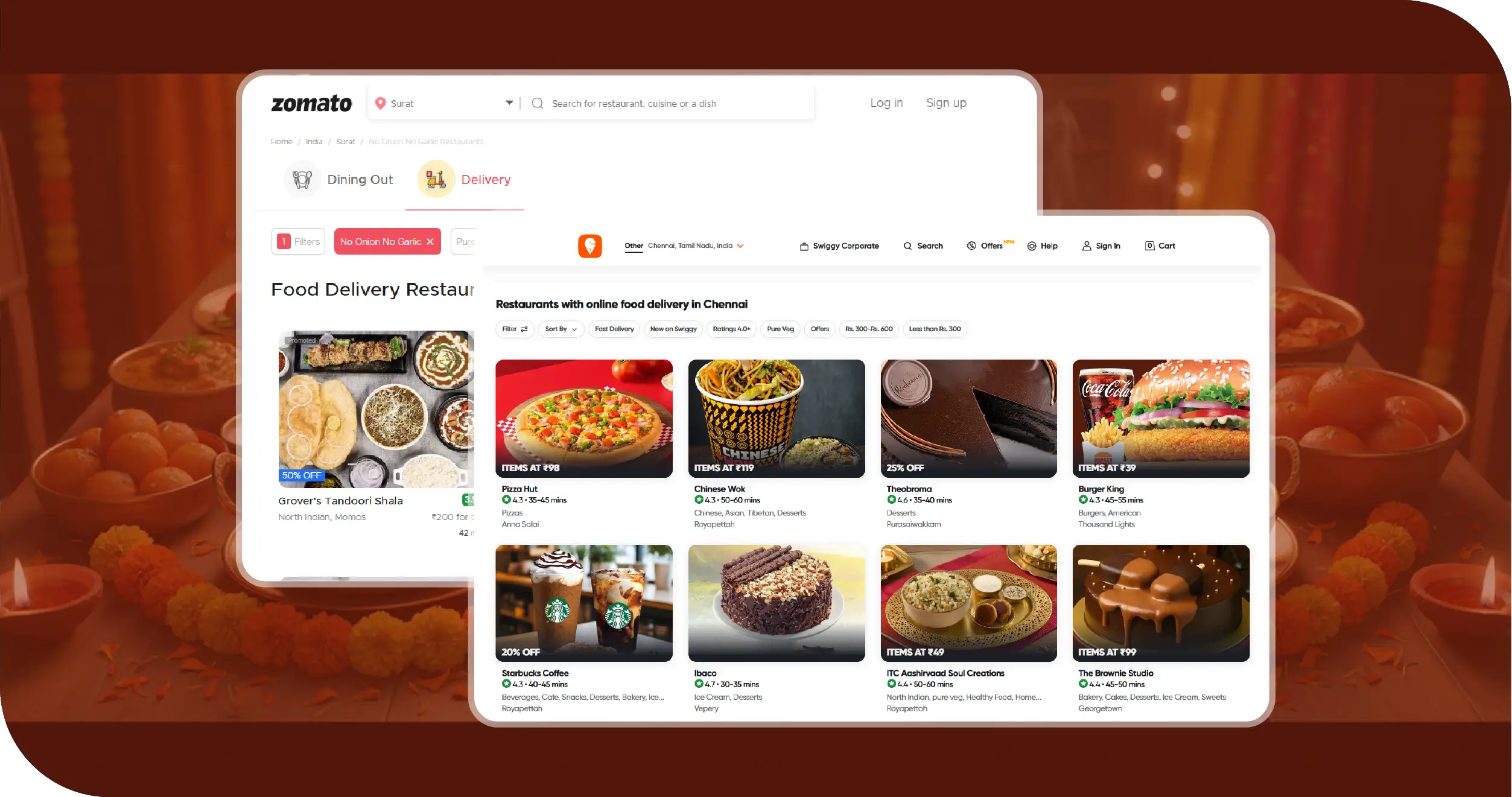

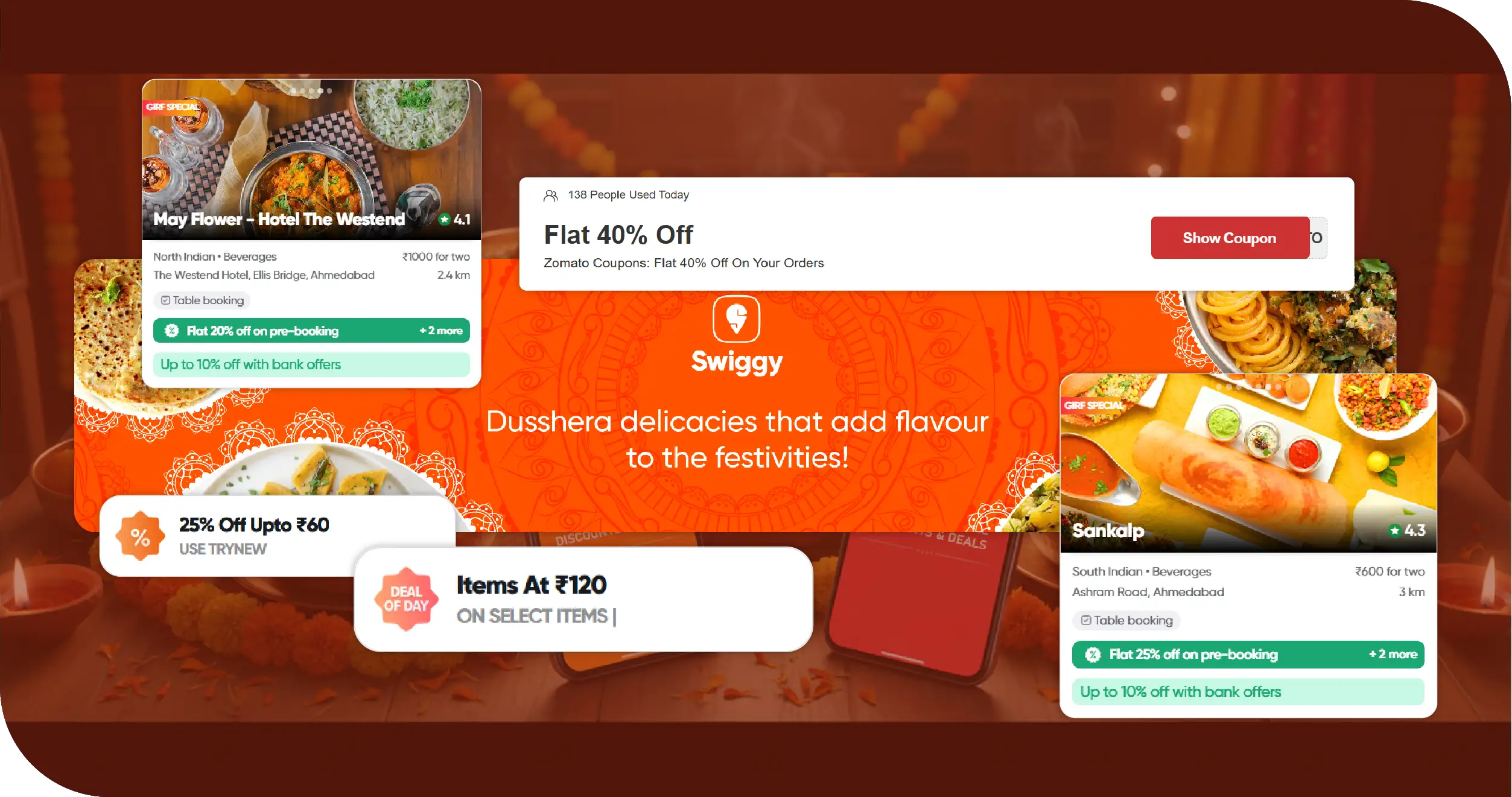

Our client is a multi-city restaurant group with operations in Ahmedabad, Bengaluru, Mumbai, and Delhi. Their portfolio includes casual dining restaurants and QSR outlets that serve a variety of cuisines. During regular months, the client maintains a competitive edge with moderate discounts, but during festivals like Dussehra, the competitive environment shifts dramatically. In 2024, the client faced difficulties in keeping up with rivals who launched city-specific festive promotions on Swiggy and Zomato. For example: In Ahmedabad, vegetarian combo offers were trending with up to 35% discounts. In Bengaluru, beverages and snack packs dominated festive sales. In Delhi, cashback-based deals on sweets and desserts pulled in large family orders. The lack of structured, comparable insights led to loss of customer share during the Dussehra period. The client realized that real-time competitor intelligence was critical for 2025. That’s when they partnered with Food Data Scrape to build a Dussehra Discount Intelligence Dashboard powered by live scraping and analytics.

Key Challenges

- Overwhelming Number of Festive Offers:

Both Swiggy and Zomato onboarded hundreds of restaurants with app-exclusive Dussehra promotions. Sifting through the sheer volume of deals was impractical for the client’s internal team.

- Dynamic & Volatile Discounts:

Offers changed frequently—sometimes hourly—making it impossible to manually track. Flash sales, coupon codes, and time-bound cashback added layers of complexity.

- City-Specific Discounting Patterns:

Discount structures were not uniform. Ahmedabad leaned towards bulk vegetarian combos, while Mumbai emphasized premium dining offers. Without local insights, the client risked over-discounting or under-discounting.

- Non-Standardized Offer Formats:

On Swiggy, some restaurants provided flat percentage discounts, while on Zomato, cashback and “Buy 1 Get 1 Free” deals were dominant. Comparing these diverse structures required standardized data extraction.

- Consumer Influence on Buying Decisions:

Even a 5–10% difference in discounts could shift customer choices. Without clarity on competitor thresholds, the client could not confidently set its promotional budgets.

Key Solutions

- Comprehensive Festive Dataset: Food Data Scrape deployed automated crawlers for web scraping Zomato & Swiggy Dussehra food offers to collect real-time deals, discounts, and coupon codes across multiple cities. Each record was standardized to include restaurant name & location, discount type (flat %, cashback, BOGO, etc.), value of discount, food category (snacks, desserts, beverages, meals), minimum order value, and expiry date of the deal. This dataset eliminated guesswork and provided a clear picture of the competitive environment.

- Dussehra Discount Intelligence Dashboard: We built a custom dashboard where the client could compare their discounts vs. competitors in real time, monitor trending discount formats across Swiggy and Zomato, track category-level promotions (desserts vs. meals vs. beverages), and segment data by city (Ahmedabad, Bengaluru, Delhi, Mumbai). This tool gave decision-makers instant visibility and reduced the manual effort of monitoring multiple apps.

- Predictive Insights Using Last Year’s Trends: We analyzed Dussehra 2024 discounting data to create predictive models for 2025. Findings included beverages and desserts seeing the deepest discounts (up to 40%) as restaurants push volume, combo meals dominating Ahmedabad and Delhi to cater to family dining, and early offers (September 28–30) generating higher engagement than late offers. By overlaying these predictions with real-time scraped data, we provided the client with a strategic roadmap for pricing and promotion.

- Strategic Recommendations: Ahmedabad: Increase combo deals to 30% off to match vegetarian-heavy competition; Bengaluru: Push beverage discounts during evening hours (7–9 PM); Delhi: Leverage cashback deals to compete with dessert-heavy rivals; Mumbai: Position premium discounts (15–20%) on main course items to stand out.

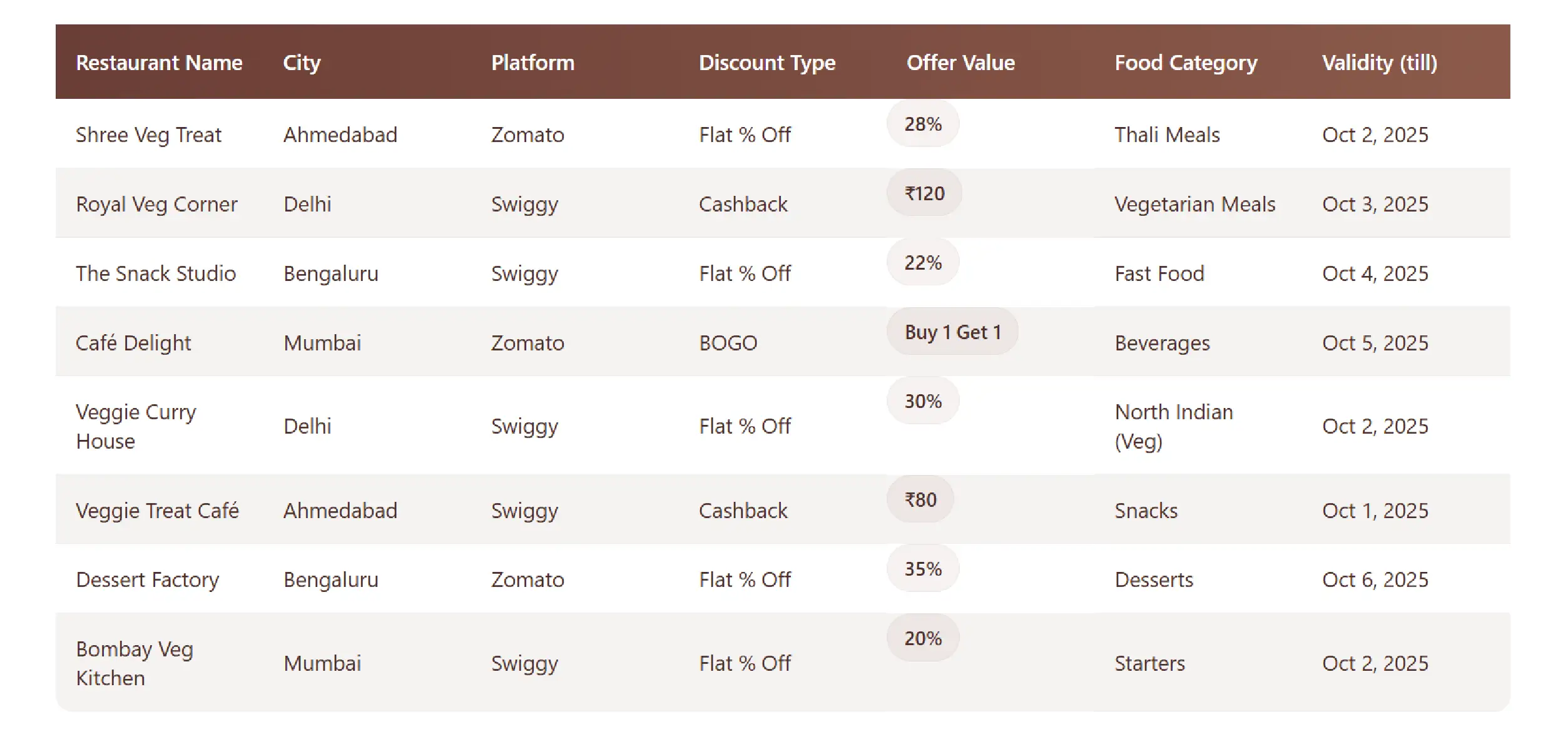

Standalone Section – Sample Data Table

Dussehra Festive Discount Analysis (Swiggy & Zomato, Sep 28–29, 2025)

Methodologies Used

- Systematic Data Collection: We deployed automated crawlers using Zomato Food Delivery Scraping API and Swiggy Food Delivery Scraping API to capture restaurant-level offers from Swiggy and Zomato across multiple cities, including Ahmedabad, Bengaluru, Delhi, and Mumbai. The scraping extracted details such as restaurant name, city, and cuisine type, type of offer (flat % off, BOGO, cashback, combo), value of discount, minimum order value, and validity date, ensuring that no deal was missed during the festive window.

- Normalization & Standardization: Since offers varied in format (cashback, flat %, BOGO), we created a standardized schema for comparison. For example, a “Buy 1 Get 1 Free” pizza deal was converted into an equivalent percentage discount based on item pricing. This helped the client make apples-to-apples comparisons across platforms.

- Trend Analysis & Benchmarking: We analyzed patterns across categories (snacks, beverages, desserts, meals) and across cities. By benchmarking competitor discounts, we identified thresholds of customer attraction. For instance, dessert deals below 20% rarely converted into orders, while beverage discounts above 30% consistently boosted sales.

- Visualization & Reporting: All scraped data was pushed into an interactive dashboard with city-wise segmentation, real-time updates, and competitor comparisons. This allowed the client to quickly identify gaps in their offers and make timely adjustments.

Standalone Section – Second Sample Data Table

Multi-City Festive Discount Comparison (Swiggy & Zomato, Sep 29–30, 2025)

Advantages of Collecting Data Using Food Data Scrape

- Comprehensive Market Visibility:

By monitoring Swiggy and Zomato simultaneously, the client gained a 360-degree view of all active Dussehra deals, eliminating blind spots.

- Real-Time Competitive Benchmarking:

The dashboard enabled instant competitor comparisons, helping the client decide whether to match, exceed, or undercut specific offers.

- Consumer Behavior Insights:

By analyzing redemption-heavy categories (desserts, beverages), the client understood where discount sensitivity was highest.

- Informed Budget Allocation:

Instead of running flat discounts across all outlets, the client used insights to allocate promotions strategically in cities where competition was fiercest.

- Improved ROI on Promotions:

With data-driven strategies, the client reduced unnecessary overspending on discounts and improved revenue per order.

Client’s Testimonial

“Partnering with Food Data Scrape transformed our festive pricing strategy. For the first time, we had real-time visibility into competitor discounts across Swiggy and Zomato. Their dashboard allowed us to identify gaps quickly and adjust our promotions. The predictive analysis based on last year’s Dussehra data was spot on – we could plan ahead instead of reacting late. Thanks to these insights, our festive campaigns this year are more efficient, competitive, and profitable.”

— Head of Marketing, Multi-City Restaurant Group

Final Outcomes:

The project delivered tangible improvements in the client’s festive performance: 30% improvement in promotional efficiency by reallocating discounts strategically. 15% higher redemption rates for offers, driven by better targeting of high-demand categories. Faster decision-making as the dashboard updated competitor data in real time. Reduced overspending by avoiding unnecessary deep discounts in low-competition markets. Most importantly, the client was able to seize early opportunities as Dussehra offers started rolling out in late September, ensuring they stayed ahead before the October 2nd festive peak. Looking ahead, the insights gained from this project will also support Diwali and Christmas campaigns, where the competitive intensity is expected to be even higher.