Introduction

The Diwali festival of 2025 witnessed a remarkable surge in online grocery demand as consumers sought convenience, festive essentials, and competitive pricing. To analyze these shifts, we conducted an extensive study leveraging tools to Scrape Grocery Sales Data During Diwali Festival in India, focusing on product-level data across both Tier-1 and Tier-2 cities.

By employing Web Scraping Grocery Purchase Trends in Tier-1 & Tier-2 Cities India, we extracted granular insights on consumer behavior, purchase frequency, and high-demand product categories. Additionally, Tier-Wise Grocery Data Extraction During Diwali in India enabled tracking of stock levels, pricing trends, and replenishment patterns, providing actionable insights for retailers, suppliers, and e-commerce analysts.

This research provides a Web Scraping Grocery Trends During Diwali-based framework to understand how festive demand varies geographically, helping stakeholders make data-driven decisions for inventory allocation, promotional campaigns, and pricing optimization. Scrape Festive Demand Surge During Diwali in India to analyze consumer preferences, peak ordering trends, and promotional impact.

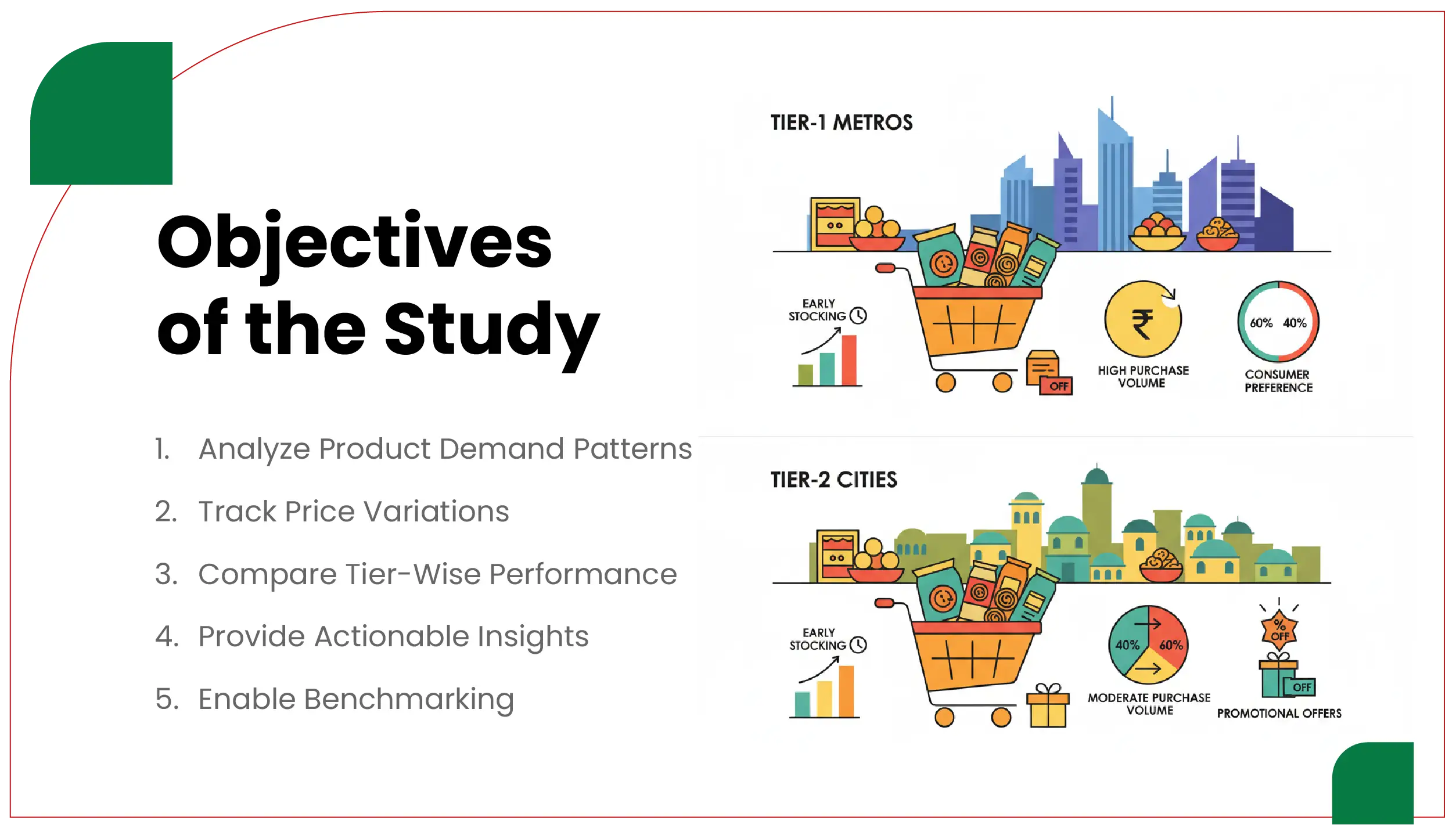

Objectives of the Study

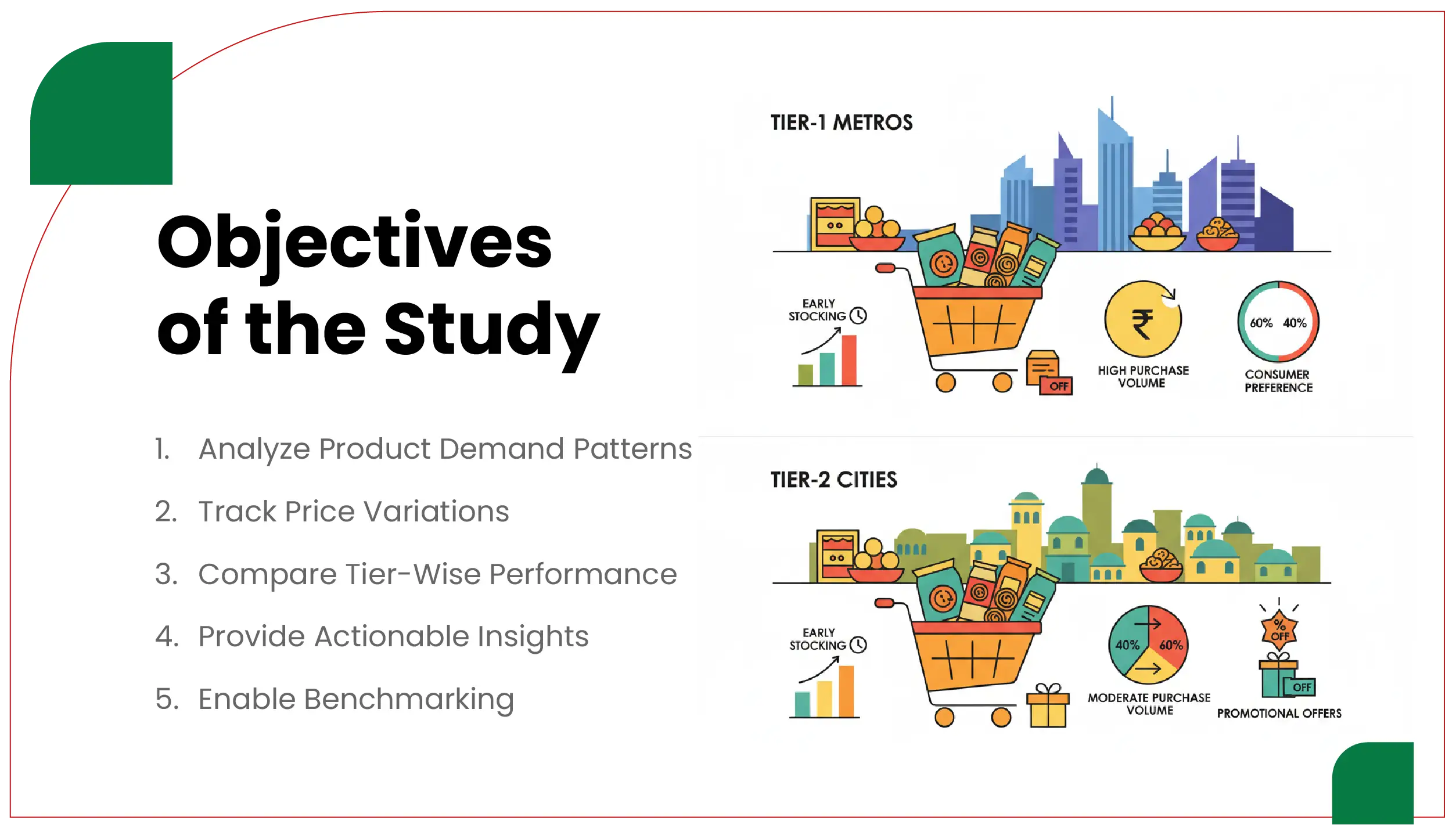

The primary objectives of this report were:

- Analyze Product Demand Patterns: Examine changes in product-level sales across Tier-1 and Tier-2 cities during Diwali.

- Track Price Variations: Monitor price trends for key grocery categories during the festival.

- Compare Tier-Wise Performance: Identify differences in consumer behavior and demand across metropolitan and emerging urban markets.

- Provide Actionable Insights: Offer recommendations for inventory management, marketing campaigns, and dynamic pricing strategies.

- Enable Benchmarking: Use extracted data to benchmark platform performance and track market trends in real time.

This study leveraged India Grocery Market Data Extraction Tier-wise to ensure comprehensive tier-level insights and accurate market representation.

Research Methodology

We employed advanced web scraping techniques and APIs to extract structured datasets across Tier-1 and Tier-2 cities.

- Data Sources: Leading grocery platforms including Blinkit, Zepto, BigBasket, and Dunzo.

- Extraction Tools: Utilized Tier-wise Grocery Price and Demand Data Scraping India APIs and custom scrapers to extract product-level information.

- Data Cleaning and Standardization: Standardized product names, SKUs, and categories to maintain consistency across platforms.

- Validation: Cross-checked with real-time app data to ensure accuracy and remove duplicates.

- Analysis: Structured datasets were analyzed to identify high-demand products, price fluctuations, and delivery patterns.

We employed Web Scraping for Diwali Grocery Sales Insights to extract, process, and visualize the data for actionable decision-making.

Key Product Categories Analyzed

The study focused on high-demand grocery categories during Diwali:

- Snacks & Sweets: Kaju Katli, Laddoos, Namkeen mixes, Chips.

- Staples: Rice, Wheat Flour (Atta), Sugar, Pulses.

- Beverages: Tea, Coffee, Juices, Soft Drinks.

- Dairy & Bakery: Milk, Paneer, Butter, Bread, Cakes.

- Packaged & Ready-to-Eat Foods: Instant noodles, Breakfast cereals, Sauces.

Each category was analyzed for purchase frequency, stock levels, pricing, and city-wise demand patterns, providing a comprehensive picture of Diwali shopping behavior.

Tier-Wise Sales Volume Analysis

We tracked product-level sales in Tier-1 cities (metros like Delhi, Mumbai, Bangalore, Hyderabad) and Tier-2 cities (emerging urban markets like Jaipur, Lucknow, Kochi, Surat).

| Product Category |

Tier-1 Cities Sales (Units) |

Tier-2 Cities Sales (Units) |

| Snacks & Sweets |

1,25,000 |

85,000 |

| Staples |

2,10,000 |

1,75,000 |

| Beverages |

90,000 |

60,000 |

| Dairy & Bakery |

1,10,000 |

75,000 |

| Packaged Foods |

80,000 |

55,000 |

Insights:

- Tier-1 cities exhibited higher sales across all categories due to dense urban populations and higher disposable income.

- Tier-2 cities demonstrated significant growth in staples and snacks, highlighting rising purchasing power and festive consumption patterns.

Price Variations Across Cities

Price monitoring revealed dynamic pricing behavior during the Diwali period.

- Snacks & Sweets: Tier-1 cities observed a 5–10% premium on premium sweets, whereas Tier-2 cities showed stable pricing.

- Staples: Slightly higher prices in Tier-2 cities due to logistics and lower stocking capacity.

- Beverages & Dairy: Price variations correlated with product availability and brand popularity.

- Packaged Foods: Discounted bundles were offered primarily in Tier-1 cities to capture volume sales.

The use of tools to Scrape Tier-1 & Tier-2 Grocery Trends India enabled real-time monitoring of these fluctuations, providing actionable insights for pricing optimization.

Delivery Coverage Analysis

Delivery coverage and speed were critical during Diwali, as high demand often caused delays.

| Platform |

Tier-1 Avg Delivery Time (Minutes) |

Tier-2 Avg Delivery Time (Minutes) |

| Blinkit |

35 |

50 |

| Zepto |

40 |

55 |

| BigBasket |

45 |

60 |

<,tr>

Dunzo |

30 |

55 |

Insights:

- Tier-1 cities experienced faster delivery due to denser delivery networks.

- Tier-2 cities faced longer delivery times, highlighting logistical challenges during peak festive demand.

- Dunzo and Blinkit were faster in metros, while BigBasket had better inventory consistency in Tier-2 cities.

Consumer Behavior Patterns

Web Scraping Quick Commerce Data revealed several key behavioral patterns:

- Early Festive Stocking: Consumers in Tier-1 cities purchased high-demand items like sweets and snacks earlier than Tier-2 cities.

- Staple Dependence: Tier-2 city consumers prioritized staples over luxury snacks, reflecting a mix of necessity and celebration.

- Brand Loyalty: Premium brands saw higher adoption in Tier-1 cities.

- Promotional Sensitivity: Tier-2 city consumers responded more actively to discounts and bundle offers.

- Multi-platform Usage: Consumers often switched between apps for price comparison and availability checks.

Operational Insights for Retailers

- Inventory Allocation: Allocate premium and high-demand products based on tier-specific demand patterns.

- Dynamic Pricing: Adjust pricing in real time using predictive analytics to respond to demand surges.

- Delivery Planning: Optimize delivery routes to handle peak festive load, especially in Tier-2 cities.

- Promotional Planning: Bundle offers and discounts strategically in Tier-2 cities to boost adoption.

- Platform Benchmarking: Monitor competitors’ inventory and pricing strategies to stay competitive.

Leveraging Grocery App Data Scraping services can automate inventory tracking and demand monitoring for better operational efficiency. Using Grocery Delivery Scraping API Services enables real-time updates on stock levels, delivery slots, and order fulfillment metrics.

High-Demand Products During Diwali

Snacks & Sweets: Kaju Katli, Laddoos, and premium namkeen mixes sold out rapidly.

Staples: Rice and Atta experienced consistent replenishment due to sustained demand.

Beverages: Soft drinks and juices saw spikes in pre-festive orders.

Dairy & Bakery: Milk, paneer, and butter were restocked multiple times during peak periods.

Packaged Foods: Ready-to-eat items experienced last-minute surges, particularly in Tier-1 cities.

Challenges Observed

- Stock-Out Risks: Sudden surges in demand caused frequent stock-outs for festive items.

- Dynamic Pricing Complexity: Continuous adjustments created tracking and analytical challenges.

- Delivery Constraints: Limited delivery slots in Tier-2 cities during peak hours.

- Data Accuracy: Ensuring real-time extraction of multiple SKUs across cities required robust automation.

- Inventory Imbalances: Misalignment between demand forecasts and actual sales led to shortages or excess in certain categories.

Recommendations

- Predictive Inventory Management: Use historical festive data to forecast demand and reduce stock-outs.

- Tier-Based Promotions: Customize discount strategies based on Tier-1 vs Tier-2 purchasing patterns.

- Delivery Optimization: Expand delivery networks in Tier-2 cities to reduce fulfillment time.

- Price Monitoring: Implement dashboards to track competitor pricing and consumer response.

- Data-Driven Strategy: Continuous data extraction for monitoring trends ensures timely operational adjustments.

Future of Tier-Wise Grocery Data Analysis

- Advanced analytics and Web Scraping Quick Commerce Data will enhance predictive stocking and demand forecasting.

- Integrating Grocery Price Dashboard allows real-time monitoring of inventory, pricing, and promotions.

- Tier-wise insights support better decision-making for both supply chain and marketing during peak festive periods.

- Leveraging Grocery App Data Scraping services helps track high-demand products and optimize replenishment schedules.

- Using Grocery Delivery Scraping API Services enables automated updates on stock availability and delivery performance.

- Historical sales data combined with analytics improves Tier-wise Grocery Price and Demand Data Scraping India predictions for upcoming festivals.

- Dynamic pricing models help maximize revenue and customer engagement.

- Monitoring competitor pricing ensures competitive positioning in key markets.

Conclusion

The Diwali 2025 analysis demonstrates that Tier-1 and Tier-2 cities exhibit distinct grocery demand patterns. Tier-1 cities drive high-volume sales with early festive stocking, while Tier-2 cities show strong demand for staples and promotional items.

By leveraging Grocery Price Tracking Dashboard, retailers can monitor price fluctuations and adjust strategies in real time.

Using Grocery Pricing Data Intelligence, suppliers can make informed decisions on dynamic pricing and promotional planning.

Structured Grocery Store Datasets enable efficient inventory allocation and delivery planning across different city tiers.

These insights provide actionable guidance to improve operational efficiency, enhance customer satisfaction, and maintain competitiveness during peak festive periods in India’s rapidly growing online grocery market.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.