Introduction

Halloween 2025 has emerged as a significant event for the global restaurant and food delivery industry, with themed menus and special promotions driving both dine-in and online orders. This report aims to analyze seasonal trends in menu innovation, pricing strategies, and delivery patterns across the USA, UK, Ireland, Australia, and Canada. Using advanced data extraction techniques, researchers can Scrape Global Halloween Restaurant Trends 2025 to capture customer preferences, menu variations, and delivery insights, enabling restaurants and analytics firms to make data-driven decisions.

Through Global Restaurant Menu Data Scraping for Halloween 2025, we compiled datasets covering restaurant menus, seasonal offerings, pricing, and food delivery metrics. Additionally, Global Halloween Food Delivery Insights Extraction 2025 provided critical information on order volume, delivery times, and consumer engagement, offering a comprehensive view of market behavior during this festive period.

Research Objectives and Scope

The main objective of this study is to provide actionable insights on global Halloween restaurant trends, focusing on menu innovation, food delivery patterns, and regional preferences. The key goals include:

- Identifying popular Halloween-themed menu items across countries.

- Analyzing food delivery order patterns and average delivery times.

- Evaluating regional differences in menu pricing and promotions.

- Highlighting opportunities for restaurants to enhance offerings and optimize delivery efficiency.

- Providing datasets and dashboards for market intelligence and competitive benchmarking.

Data was collected from major online restaurant platforms, food delivery apps, and quick-commerce services, enabling cross-country comparisons and high-resolution trend analysis.

Methodology and Data Collection

To provide comprehensive insights, the study employed multiple data extraction techniques.

- Menu Data Extraction: Leveraged tools to Scrape Halloween-Themed Menus Across Top Countries 2025 to capture menu items, pricing, category, and portion size.

- Regional Focus:

- USA: Extract Restaurant Menu Trends in USA for Halloween 2025 from Uber Eats, DoorDash, and Grubhub.

- UK: Web Scraping Halloween-Themed Menus from UK 2025 including Deliveroo and Just Eat.

- Ireland: Halloween-Themed Menus Data Scraper from Ireland 2025 through local platforms like Deliveroo and Bite.

- Australia: Scrape Halloween-Themed Menus from Australia 2025 from Menulog and Uber Eats.

- Canada: Halloween-Themed Menus Data Scraping from Canada 2025 via SkipTheDishes, Uber Eats, and DoorDash.

- Food Delivery Metrics: Collected using tools to Scrape Halloween Food Trends Across Top Countries 2025, including delivery time, peak order hours, and order frequency.

- Frequency: Data scraping was conducted daily from October 24–31, 2025.

- Categories Covered: Appetizers, mains, desserts, beverages, and limited-time seasonal items.

Data validation included cross-referencing multiple platforms, verifying price consistency, and removing duplicates to ensure accuracy.

Dataset Overview and Regional Distribution

The dataset comprises over 50,000 unique menu items across the five regions. Insights include average price per item, category popularity, and delivery metrics. Key observations include:

- USA: Dominated by themed desserts and specialty cocktails; high adoption of app-based delivery.

- UK: Strong preference for themed mains and combo deals; delivery volume peaks during evening hours.

- Ireland: Smaller market but high per-order spend on desserts and premium items.

- Australia: Mix of family-oriented menus and quick-service themed snacks.

- Canada: Popularity of bundles and ready-to-eat Halloween meals; efficient delivery networks in urban centers.

| Country |

Avg Menu Price ($/£/€) |

Total Orders (Units) |

Top Category |

Avg Delivery Time (mins) |

| USA |

14.20 |

1,520,000 |

Desserts |

32 |

| UK |

12.80 |

890,000 |

Mains |

30 |

| Ireland |

13.50 |

210,000 |

Desserts |

28 |

| Australia |

14.00 |

450,000 |

Snacks |

33 |

| Canada |

13.90 |

380,000 |

Mains |

31 |

Analysis:

- Dessert items dominate in the USA and Ireland due to seasonal treats and confectionery trends.

- Mains and combo meals are more popular in the UK and Canada, reflecting consumer preference for meal deals.

- Average delivery times range between 28–33 minutes, indicating efficient logistics across top urban areas.

Menu Innovation Trends

Halloween-themed menu innovation drives consumer engagement. Key observations include:

- Visual Appeal: Restaurants focus on creative plating, themed shapes (e.g., pumpkins, ghosts), and colorful presentations.

- Limited-Time Offers (LTOs): Special Halloween meals and drinks available for one week encourage urgency and higher sales.

- Desserts and Beverages: Seasonal desserts, pumpkin-flavored beverages, and themed cocktails dominate, especially in the USA and Ireland.

- Bundle Deals: Combos featuring appetizer, main, dessert, and beverage encourage higher per-order value, notably in the UK and Canada.

- Cultural Variations: Australia emphasizes family-oriented meals, while the USA highlights indulgent treats and snack combos.

Through Food Delivery & Menu Trends Data Scraping for Halloween 2025, restaurants can identify which innovations drive orders and plan menu adjustments in real-time.

Food Delivery Insights

Delivery trends offer insights into consumer behavior and operational efficiency:

- Peak order times occur between 6 PM–9 PM in all regions.

- Quick-service restaurants achieve higher order volumes with app-exclusive promotions.

- Urban areas show faster delivery times due to proximity and higher driver availability.

- Weekend and Halloween Eve see spikes in delivery demand, often exceeding weekday averages by 35–40%.

- Average delivery time across all regions remains under 35 minutes, ensuring customer satisfaction.

Using Food Delivery Data Scraping Services, restaurants can optimize fleet management, anticipate peak times, and enhance delivery speed.

Regional Consumer Behavior Insights

USA

- Desserts: Pumpkin pies, themed cupcakes, and candy-inspired treats.

- Beverages: Seasonal mocktails, pumpkin spice lattes, and Halloween cocktails.

- High app adoption, with 65% of orders placed via food delivery apps.

UK

- Mains: Halloween-themed burgers, pasta, and combo meals dominate.

- Promotions emphasize value bundles.

- Evening delivery peak aligns with family dinners and social gatherings.

Ireland

- Desserts: Premium desserts, cupcakes, and chocolate-based treats.

- Smaller market size but higher per-order spending on specialty items.

Australia

- Snacks: Pumpkin pies, themed finger foods, and small-bite items.

- Delivery trends show higher family meal orders than single-serving items.

Canada

- Mains and Bundles: Popular for group or family celebrations.

- Efficient urban delivery networks ensure timely fulfillment even during peak Halloween hours.

Comparative Menu and Delivery Patterns

Data reveals common and divergent trends across countries:

- Dessert Preference: USA and Ireland lead in dessert orders.

- Bundle Meals: UK and Canada prioritize combo deals for Halloween.

- Family-Oriented Menus: Australia focuses on shared meals and snacks.

- Delivery Efficiency: Average times remain consistent across urban centers, with minor variations due to geography and logistics.

| Category |

USA (%) |

UK (%) |

Ireland (%) |

Australia (%) |

Canada (%) |

| Desserts |

45 |

30 |

50 |

25 |

28 |

| Mains |

25 |

40 |

20 |

30 |

42 |

| Snacks |

15 |

15 |

15 |

30 |

15 |

| Beverages |

10 |

10 |

10 |

10 |

10 |

| Specialty Items |

5 |

5 |

5 |

5 |

5 |

Observations:

- Desserts dominate in the USA and Ireland.

- Mains and bundle deals are crucial in the UK and Canada.

- Snacks gain importance in Australia due to family-oriented Halloween celebrations.

- Beverages and specialty items remain a smaller but essential component of themed menus.

Pricing and Promotional Strategies

- Restaurants leverage dynamic pricing for seasonal menus, adjusting prices based on demand, peak times, and order volume.

- Limited-time offer discounts are common across all regions to incentivize higher purchase volume.

- Combo deals increase average order value, particularly in regions like the UK and Canada.

- The integration of menu scraping enables real-time price monitoring and rapid adjustments to match competitor offerings.

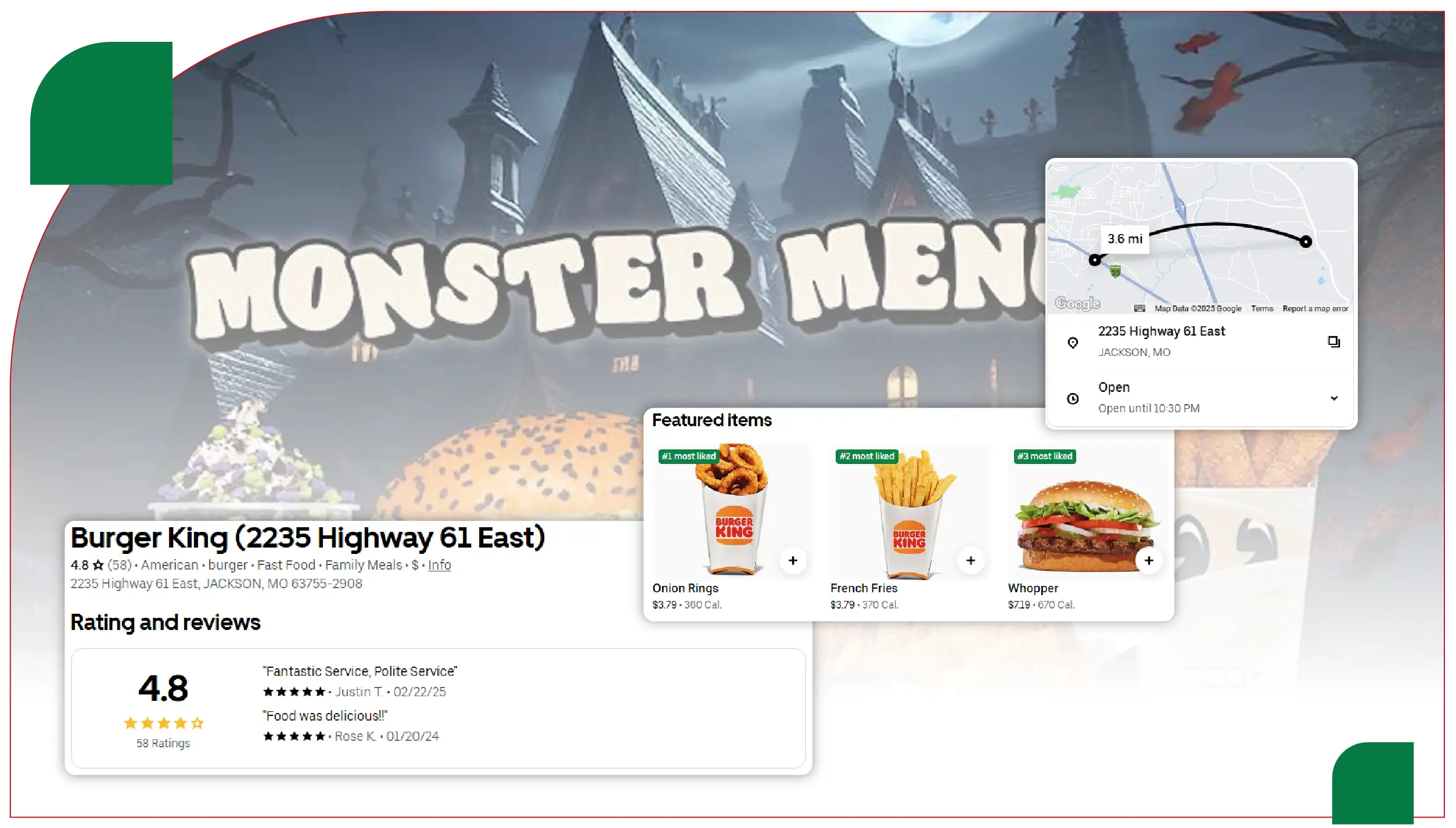

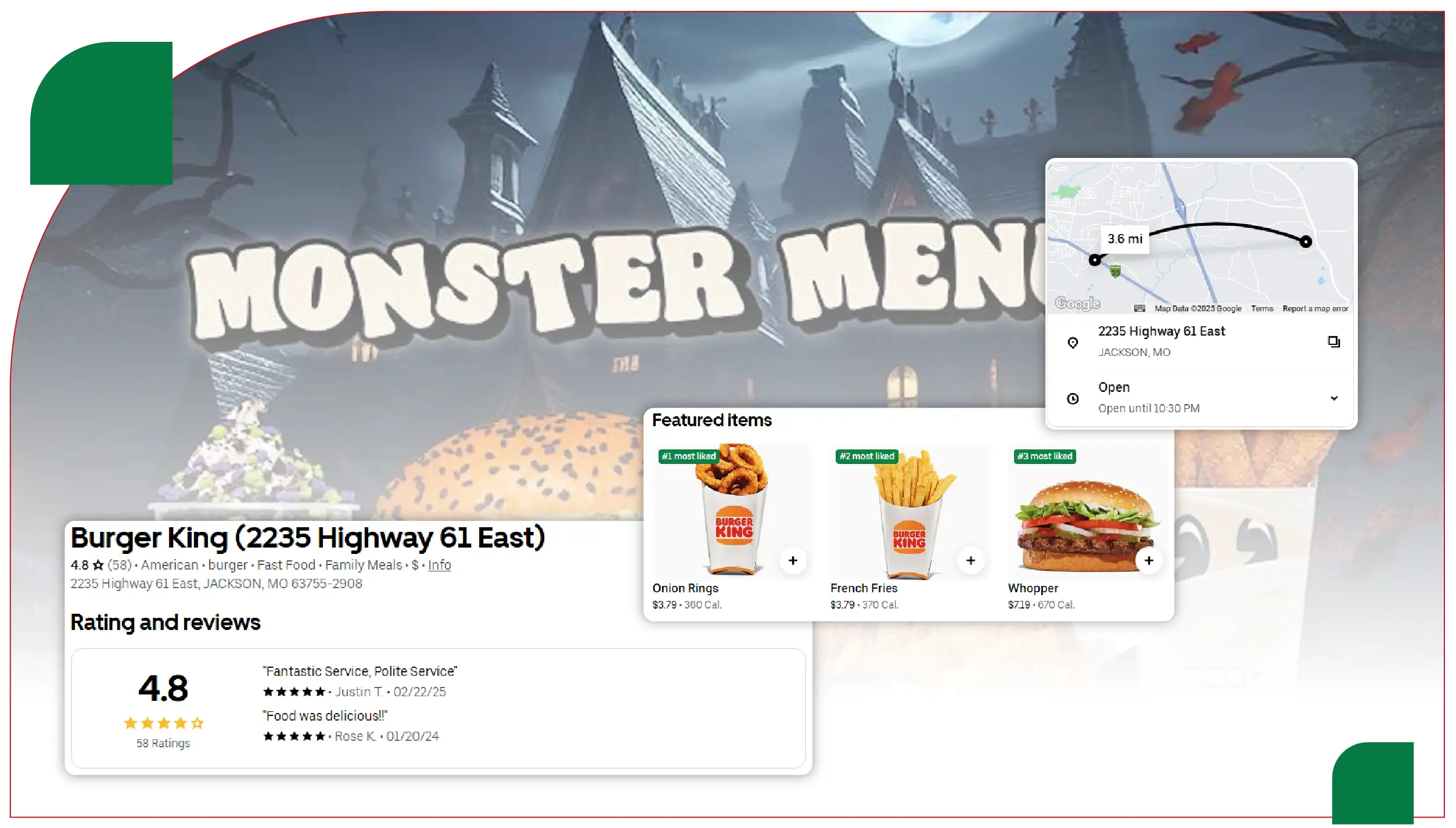

Dataset Applications for Market Analysis Firms

The scraped data offers multiple applications for restaurant chains, delivery platforms, and analytics firms:

- Competitive Benchmarking: Compare menu items, pricing, and promotions across countries.

- Trend Analysis: Identify popular Halloween dishes and beverages to inform menu planning.

- Consumer Insights: Understand order volume, peak times, and delivery preferences.

- Forecasting: Use historical Halloween data to predict demand, staffing, and inventory requirements.

- Operational Optimization: Enhance delivery logistics and menu offerings based on real-time insights.

- Investment Decisions: Provide data-driven recommendations for expansion, marketing, and partnerships.

By integrating Restaurant Menu Data Scraping, firms can continuously track evolving food trends, seasonal dishes, and promotional innovations across regions.

By leveraging Food Delivery Scraping API Services, companies can monitor real-time order volumes, delivery times, and platform performance for improved operational insights.

Observations and Key Insights

- Halloween-themed desserts dominate in North America and Ireland, while mains and bundles lead in UK and Canada.

- Delivery demand peaks in the evening and on Halloween Eve across all countries.

- Themed menus with visual appeal and limited-time offers significantly increase consumer engagement.

- Efficient delivery networks are crucial for maintaining customer satisfaction during peak seasonal demand.

- Real-time scraping enables restaurants and analytics firms to respond quickly to market trends and consumer behavior.

Analytical Discussion

- Cross-Country Comparison: Regional preferences reflect cultural and dietary differences, affecting menu design and delivery patterns.

- Menu Innovation Impact: Novel offerings drive engagement and higher order volume, especially desserts and themed beverages.

- Operational Efficiency: Delivery insights inform fleet management, peak-time staffing, and route optimization.

- Promotional Influence: Discounts and combo deals enhance order volume and customer retention.

- Data Integration: Scraped datasets enable predictive analytics, visualization dashboards, and continuous market monitoring.

Conclusion

This report demonstrates how Food Delivery Intelligence Services provides actionable intelligence for restaurants, food delivery platforms, and market analysis firms. Using Restaurant Data Intelligence Services, the study captures pricing trends, menu innovations, and delivery patterns across the USA, UK, Ireland, Australia, and Canada.

Integrating Food Price Dashboard allows businesses to optimize menu offerings, plan inventory efficiently, and enhance operational performance. These insights from Food Delivery Datasets enable competitive benchmarking, informed marketing campaigns, and real-time adaptation to seasonal consumer behavior, ensuring success during the high-demand Halloween period.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.