Introduction

The global ice cream category is no longer driven by constant novelty or rapid format disruption. Instead, it is entering a phase of consolidation, where demand concentrates around indulgence, familiarity, and visually compelling formats. For brands, aggregators, and analysts, this shift makes structured data more valuable than surface-level trend watching. To stay competitive, businesses increasingly Scrape Ice Cream Food Trend data across menus, delivery platforms, and social channels to understand what is actually sustaining demand.

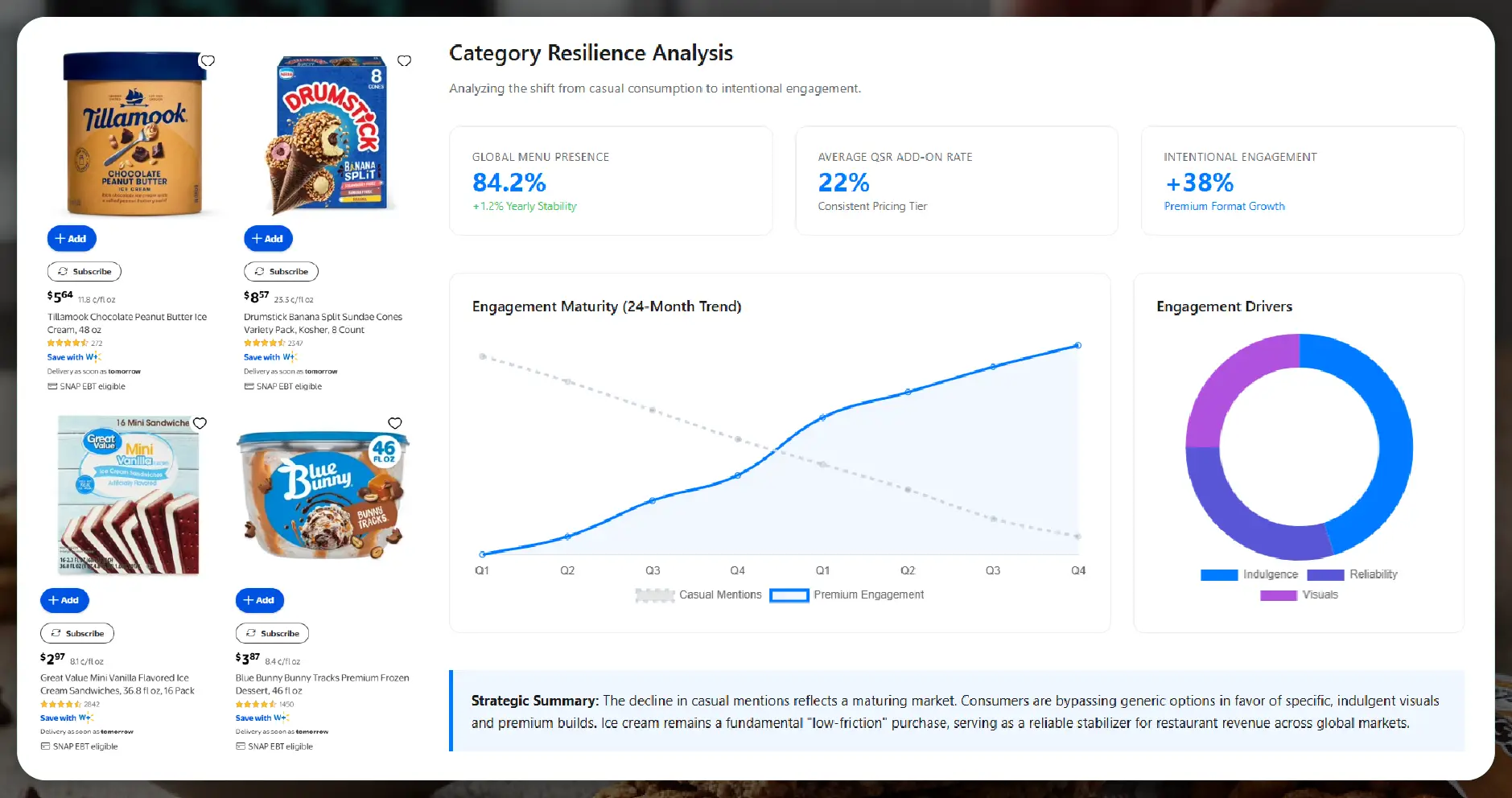

Ice Cream Food Trends Analysis 2026 shows a category that remains culturally relevant despite volatility in social chatter. While overall discussion volume fluctuates, year-over-year engagement continues to grow, signalling stronger intent around specific formats, flavours, and consumption moments rather than casual mentions.

To convert these signals into strategy, brands must Extract Ice Cream Food Trend Data across foodservice, retail, and digital touchpoints, turning fragmented behaviour into actionable intelligence.

Why Ice Cream Remains Relevant Despite Social Volatility?

Ice cream’s social presence has become more selective. Over the last two years, casual mentions have declined, but engagement tied to specific dishes, premium builds, and indulgent visuals has intensified. This indicates a maturing category where consumers are more intentional about when and why they engage.

Menu penetration further reinforces this stability. Ice cream appears across hundreds of thousands of restaurant menus globally, confirming its role as a reliable add-on rather than a trend-led feature. Pricing consistency across QSRs and dessert chains shows that ice cream is positioned as a low-friction purchase—easy to add, easy to justify.

For analysts, this environment rewards precision. Rather than tracking volume alone, teams must examine which formats, flavours, and contexts are driving meaningful engagement. That insight only becomes visible through structured data extraction.

Using Menu Intelligence to Decode Ice Cream Demand

One of the most valuable sources of ice cream trend insight is menu data. By applying Web Scraping Ice Cream Menus, Flavors & Offers, businesses can map how formats evolve, which flavours persist, and where premium perception is being built.

Current menu intelligence highlights three dominant patterns:

- Sundaes and soft serve dominate QSR menus due to speed, cost efficiency, and familiarity

- Gelato appears more frequently in premium and speciality concepts

- Customisable formats outperform fixed SKUs, especially where toppings and mix-ins increase perceived value

This confirms that innovation in ice cream is happening through layering, presentation, and combination—not through entirely new frozen bases.

From Static Reports to Continuous Monitoring

Ice cream demand is not seasonal alone; it is moment-driven. Late-night desserts, celebration add-ons, comfort snacking, and social sharing moments all influence performance. Capturing this requires Real-Time Ice Cream Food Trend Intelligence, not quarterly snapshots.

Real-time monitoring allows teams to:

- Track flavour momentum before menu saturation

- Identify early signals around emerging ingredient pairings

- Compare social velocity with menu adoption lag

- Spot regional flavour bias before national rollout

This is especially critical in a category where flavour growth can spike rapidly and decline just as fast if overused.

Ice Cream Consumer Needs Driving Format Stability

Unlike many food categories chasing wellness or functionality, ice cream demand is anchored in sensory payoff. The strongest consumer needs associated with ice cream remain taste-led and emotion-driven.

Key need clusters include:

- Tasty and indulgent as primary purchase justifications

- Sweet as a non-negotiable expectation

- Fun and visual appeal as engagement amplifiers

Notably absent are health-driven needs. Reduced sugar, plant-based, or functional positioning rarely leads mainstream performance unless indulgence remains front and centre. For brands, this means better-for-you innovation must still deliver on richness, texture, and familiarity to succeed.

Delivery Platforms as Ice Cream Demand Accelerators

Food delivery has fundamentally changed how ice cream is consumed. What was once an in-store impulse buy is now a bundled, on-demand add-on. By applying Web Scraping Food Delivery Data, businesses gain visibility into real purchase behaviour, not just aspiration.

Delivery data reveals:

- Ice cream frequently added post-meal rather than ordered standalone

- Strong performance of bundled desserts and limited-choice formats

- Consistent pricing compression across platforms, reinforcing add-on status

Understanding these patterns requires structured access to menu placement, availability, and pricing across apps.

Turn ice cream trends into clear business actions—start leveraging real-time data scraping to stay ahead of demand, pricing, and flavor shifts.

Turning Menus Into Competitive Intelligence Assets

Menus are no longer static brand statements; they are dynamic demand signals. When businesses Extract Restaurant Menu Data, they unlock insight into how competitors adapt formats, pricing, and portioning in response to consumer behaviour.

Menu scraping enables:

- Tracking SKU longevity versus short-term tests

- Identifying which flavours transition from LTO to core

- Monitoring price bands across comparable concepts

- Understanding how ice cream is positioned relative to other desserts

This level of insight transforms menu analysis from benchmarking into predictive intelligence.

APIs and Scalable Ice Cream Data Collection

At scale, manual tracking is no longer viable. Automated pipelines powered by a Food Delivery Scraping API allow teams to continuously ingest structured ice cream data across geographies and platforms.

API-driven collection supports:

- Daily updates on pricing and availability

- Real-time flavour and format changes

- Regional comparisons at city or neighbourhood level

- Integration with internal BI and forecasting tools

For multi-market brands, this approach ensures consistency, speed, and accuracy in trend detection.

Ice Cream as a Lens Into Broader Restaurant Strategy

Ice cream may be a dessert, but it functions as a strategic signal. When analysed correctly, it reveals how consumers respond to indulgence, pricing psychology, and visual appeal. This makes ice cream a powerful input for broader Restaurant Data Intelligence strategies.

Insights derived from ice cream trends often inform:

- Portion strategy across other desserts

- Add-on pricing models

- Visual merchandising decisions

- Seasonal promotion planning

In this sense, ice cream acts as a low-risk testing ground for indulgence-led innovation.

How Food Data Scrape Can Help You?

- Identify true market demand by continuously scraping ice cream menus, flavors, pricing, and social signals to understand what consumers actively choose, not just what trends appear popular online.

- Track competitor strategies at scale by monitoring restaurant menu changes, new product launches, limited-time offers, and format shifts across food delivery platforms in real time.

- Improve pricing and promotion decisions using scraped data on price ranges, discounts, bundles, and add-ons, helping you position ice cream products as high-conversion, low-friction purchases.

- Spot emerging flavors early by analyzing ingredient growth rates, lifecycle stages, and regional adoption patterns before new combinations reach peak visibility or market saturation.

- Enable smarter analytics and forecasting with structured, reliable datasets that integrate easily into dashboards, reports, and models for long-term planning and performance optimization.

Conclusion

The ice cream category is no longer about chasing viral novelty. It is about understanding stability, familiarity, and visual indulgence—and responding with precision. Brands that rely on anecdotal trends risk misreading a category that is quietly consolidating around proven formats and flavour architectures.

By leveraging Food delivery Intelligence, teams can see how ice cream performs in real purchase environments, not just in social conversation.

When paired with a Food Price Dashboard, this intelligence reveals how value perception is created through format rather than price escalation.

Finally, structured Food Datasets allow organisations to move beyond observation and into forecasting—anticipating which flavours, formats, and moments will sustain demand next.

In a mature category like ice cream, the winners are not those who launch the loudest innovation, but those who read the data most clearly—and act before the market catches up.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.