Introduction

The global coffee industry is undergoing a noticeable transformation, with consumers increasingly drawn to chilled alternatives over traditional hot brews. Among these, iced coffee and iced lattes have emerged as standout favorites. Through the process to Scrape Iced Coffee vs Iced Latte Trends Data, it is evident that demand for these beverages continues to grow, driven by lifestyle shifts, warmer climates, and the influence of café culture.

This report takes a deeper look at how these categories are evolving by applying Iced Coffee vs Iced Latte Trend Data Scraping to capture valuable insights. By analyzing product launches, pricing, and availability across platforms, businesses gain a clear understanding of consumer behavior and competitive landscapes. Additionally, Web Scraping Iced Coffee and Iced Latte Market Trends allows for the examination of taste preferences, from classic brews to innovative flavored varieties, revealing which options resonate most with different demographics.

Drawing on data sources such as online menus, social media discussions, and industry reports, the study identifies key factors driving the rise of iced coffee and iced lattes. These insights empower food and beverage brands to refine product strategies, enhance marketing campaigns, and better align with consumer demand.

Methodology

This research utilizes web scraping and data analytics to collect and analyze data from various sources, including social media platforms, e-commerce websites, restaurant menus, and industry reports. Tools such as Python, Beautiful Soup, and PyTrends were employed to Extract Iced Coffee vs Iced Latte Popularity Data from platforms like Google Trends, X, and food delivery services. The data was processed to identify trends in consumer behaviour, flavour preferences, and market penetration. Two tables are included to summarise key findings, focusing on market size and flavour trends.

Market Overview

Iced Coffee and Iced Latte: Definitions and Differences

Iced coffee is typically brewed hot and then cooled, served over ice, and often customized with minimal milk or sweeteners. In contrast, an iced latte is an espresso-based drink, consisting of one-third espresso and two-thirds cold milk, resulting in a creamier texture. Web Scraping Iced Coffee vs Iced Latte Insights Data highlights that iced coffee appeals to consumers seeking a bold coffee flavor, while iced lattes attract those preferring a smoother, milkier experience. These differences influence their respective market positioning and consumer demographics.

Market Size and Growth

The iced coffee market is experiencing robust growth. According to industry data, the global iced coffee market was valued at $13.16 billion in 2024 and is projected to reach $21.18 billion by 2033, with a compound annual growth rate (CAGR) of 5.43%. Iced Coffee vs Iced Latte Coffee Data Analytics reveals that ready-to-drink (RTD) iced coffee dominates, accounting for over 55% of the market share, equivalent to 780 million liters sold in 2023. Iced lattes, while a smaller segment, are carving a niche among younger, health-conscious consumers due to their customizable nature and photogenic appeal on social media platforms like Instagram and TikTok.

Consumer Preferences and Trends

Demographic Insights

Extract Iced Coffee & Iced Latte Coffee Data to indicate that younger demographics, particularly Gen Z and millennials, are driving the popularity of iced coffee and iced lattes. A survey by the National Coffee Association (NCA) found that 45% of coffee drinkers aged 18–24 consumed a cold coffee drink daily in 2024, with 60% of Gen Z preferring iced coffee over hot variants. Iced lattes are particularly popular among health-conscious consumers, with a 9.73% growth in social discussions compared to a 6.25% increase for iced coffee.

Flavor Profiles and Innovations

Coffee Flavors & Ingredient Insights reveal that caramel, vanilla, hazelnut, salted caramel, and chocolate are the top flavors for both iced coffee and iced lattes across regions. In the UK, caramel-flavored iced coffee launches have risen by 8% over the past year, with a 28% CAGR in flavored product launches over four years. Iced lattes are experiencing a surge in plant-based options, with oat, almond, and soy milk leading the way in innovations. For instance, Starbucks’ Iced Brown Sugar Oat Shaken Espresso has become a default option in some markets. Seasonal flavors like pumpkin spice and peppermint mocha are also gaining traction, particularly in iced lattes, driven by social media trends.

Table 1: Top Flavors for Iced Coffee and Iced Latte (2024)

| Flavor |

Iced Coffee (% of Launches) |

Iced Latte (% of Launches) |

| Caramel |

28% |

25% |

| Vanilla |

20% |

22% |

| Hazelnut |

15% |

14% |

| Salted Caramel |

12% |

10% |

| Chocolate |

10% |

12% |

Data Scraping Techniques and Applications

Web Scraping for Market Insights

Food Delivery Data Scraping Services have been instrumental in collecting real-time data from food delivery platforms like Uber Eats, DoorDash, and Deliveroo. By scraping restaurant menus and customer reviews, businesses can identify which iced coffee and latte variants are most ordered and rated. For example, Restaurant Menu Data Scraping shows that 16.05% of U.S. restaurants now include iced coffee on their menus, while only 2.6% offer iced lattes, reflecting the broader appeal of iced coffee.

API-Driven Data Collection

Food Delivery Scraping API Services enable automated data extraction from food delivery platforms, providing insights into pricing, promotions, and consumer preferences. These APIs track dynamic pricing trends, revealing that iced lattes are often priced higher due to their espresso base and milk content. For instance, an iced latte at Starbucks typically costs 10–15% more than an iced coffee, reflecting its premium positioning. Restaurant Data Intelligence Services further enhance this data by analyzing customer reviews and social media sentiment, identifying trends like the growing demand for nitro cold brew and plant-based iced lattes.

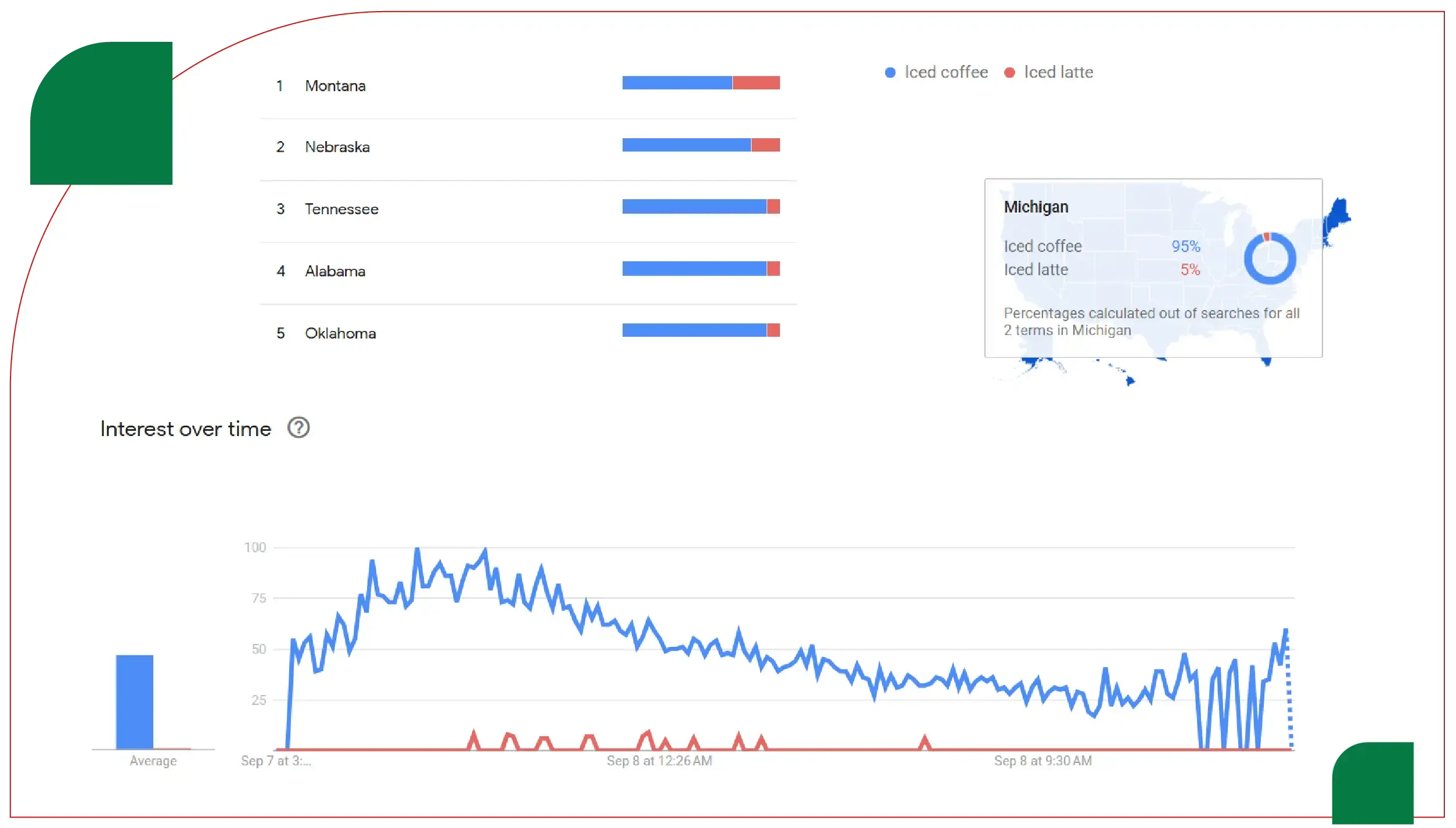

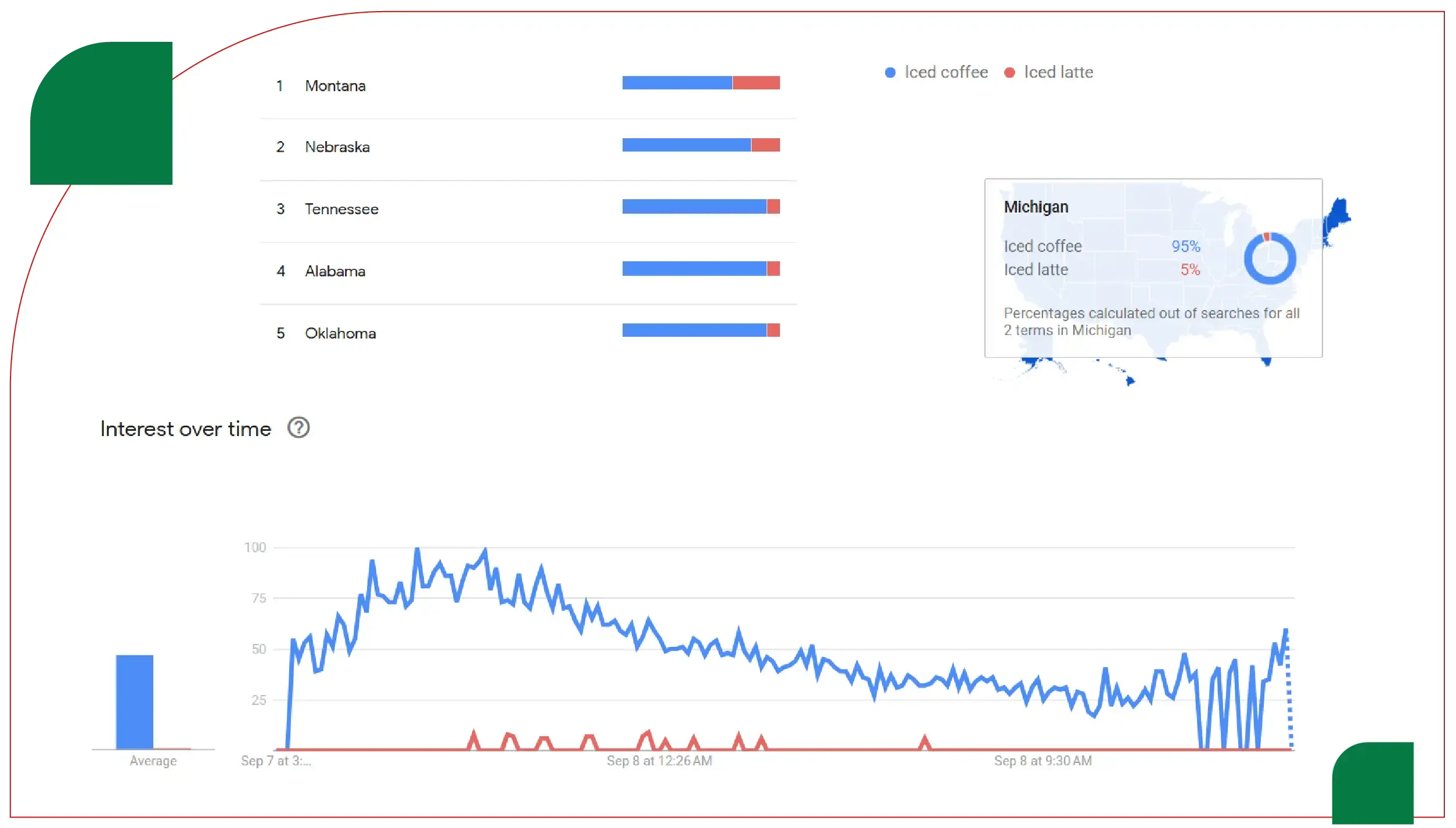

Google Trends Analysis

Using Web Scraping Iced Coffee vs Iced Latte Insights Data, Google Trends data was scraped to analyze search interest over the past 12 months. The term “iced coffee” consistently outperformed “iced latte” in search volume, with a peak interest in summer months (June–August 2024). However, “iced latte” showed a sharper increase in interest during seasonal events like the launch of pumpkin spice lattes. This data underscores the broader appeal of iced coffee but highlights the niche, trend-driven popularity of iced lattes.

Regional Trends

North America

In the U.S. and Canada, iced coffee dominates, accounting for 90% of iced coffee subcategory launches. Iced Coffee vs Iced Latte Coffee Data Analytics shows that 31% of consumers in these regions consume iced coffee for an energy boost, with brands like Starbucks and Dunkin’ leading with RTD options. Gluten-free and vegan claims are prominent, with 52% of consumers favoring familiar flavors like caramel and vanilla. Iced lattes are gaining traction among younger consumers, with a 45% increase in cold brew latte consumption since 2023.

Europe

In Europe, iced coffee is the third-largest market globally, with Nestlé leading launches. Extract Iced Coffee & Iced Latte Coffee Data indicates that 64% of European consumers prioritize inclusivity, driving demand for lactose-free and vegan iced lattes. The UK shows a preference for low/no/reduced fat claims, while Germany and Spain favor gluten-free options. Caramel and vanilla remain top flavors, with emerging cross-category flavors like brownie and smores gaining popularity.

Asia-Pacific

The Asia-Pacific region exhibits the highest growth rate, with South Korea reporting that 55% of coffee sold in cafes is iced. Japan’s convenience stores sold 140 million liters of iced coffee in 2023, driven by RTD options. Iced lattes are popular among urban consumers, with flavors like matcha and hojicha emerging as regional favorites.

Table 2: Iced Coffee and Iced Latte Market Size by Region (2024–2033)

| Region |

Iced Coffee Market Size (2024, USD Billion) |

Projected Size (2033, USD Billion) |

CAGR (%) |

| North America |

8.5 |

13.7 |

5.6 |

| Europe |

3.2 |

5.1 |

5.3 |

| Asia-Pacific |

1.8 |

3.6 |

6.1 |

| Global |

13.16 |

21.18 |

5.43 |

Challenges and Opportunities

Challenges in Data Scraping

Scraping data from dynamic platforms poses challenges, including rate limits and anti-scraping measures. Food Delivery Data Scraping Services must employ proxy rotation and ethical scraping practices to avoid bans. Additionally, standardizing data from diverse sources, such as restaurant menus and social media, requires robust preprocessing techniques to ensure accuracy.

Opportunities for Businesses

The rise of iced coffee and iced lattes presents opportunities for innovation. Brands can leverage Coffee Flavors & Ingredient Insights to develop new flavors, such as pistachio or fruity profiles like cherry and blueberry, which are gaining traction on TikTok. Restaurant Data Intelligence Services can help optimize menu offerings by identifying high-demand variants and pricing strategies. For example, offering plant-based iced lattes can attract health-conscious consumers, while RTD iced coffee can target convenience-driven markets.

Conclusion

The iced coffee and iced latte market is thriving, driven by evolving consumer preferences and innovative product offerings. Food Delivery Intelligence Services provide critical insights into consumer behavior, enabling businesses to tailor their strategies. The development of a Food Price Dashboard can help track pricing trends and optimize promotions, while Food Delivery Datasets offer a wealth of information for market analysis. By leveraging web scraping and data analytics, businesses can stay ahead in this dynamic market, capitalizing on the growing demand for iced coffee and iced lattes. This report underscores the importance of data-driven strategies in navigating the competitive landscape of the coffee industry.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.