Introduction

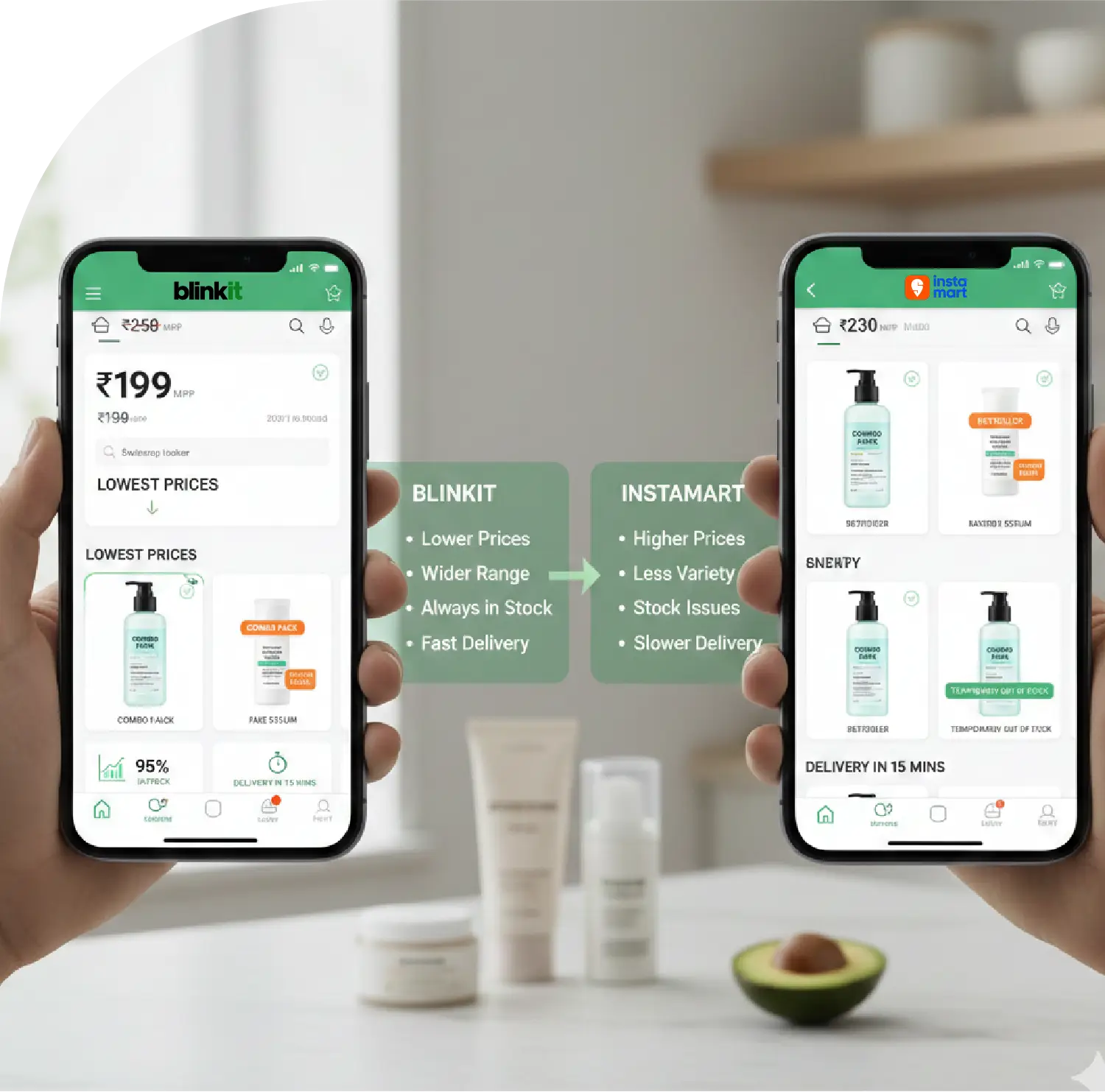

India’s quick commerce ecosystem has transformed how beauty brands compete in urban markets. For a science-backed skincare company like Minimalist, performance on fast-delivery platforms is no longer optional — it is a critical growth lever.

This research report presents a detailed analytical study of Minimalist’s performance across Blinkit and Swiggy Instamart, based on structured marketplace data collected between February 1–15, 2026, across Delhi NCR. The analysis framework is powered by method to Scrape Minimalist Data on Instamart vs. Blinkit methodologies to ensure marketplace-level precision.

The study evaluates assortment breadth, pricing logic, discount depth, stock stability, category dominance, digital shelf positioning, and delivery efficiency — offering a comprehensive understanding of how the same brand performs differently across two competing Q-commerce ecosystems. The insights are strengthened through a Minimalist Products Data Scraper on Instamart vs Blinkit, enabling SKU-level tracking and price benchmarking.

Assortment Architecture: Depth vs. Efficiency

In quick commerce, assortment strategy must balance two competing objectives:

- Wide SKU visibility

- High in-stock reliability

Unlike traditional e-commerce, Q-Comm prioritizes high-turnover SKUs over long-tail listings. Using structured systems to Track Minimalist Data Across Instamart & Blinkit, we observed clear operational differences.

Assortment Overview (Feb 2026)

| Metric |

Blinkit |

Instamart |

| Total SKUs Listed |

72 |

88 |

| Unique Face Care SKUs |

36 |

39 |

| Hair Care SKUs |

16 |

20 |

| Body Care SKUs |

9 |

13 |

| Kits & Bundles |

11 |

16 |

| In-Stock Rate (Top 30 SKUs) |

95% |

86% |

| In-Stock Rate (All SKUs) |

91% |

83% |

Key Interpretation

Instamart lists a broader assortment (88 SKUs), particularly in combo packs and secondary categories like body care. However, Blinkit demonstrates stronger stock reliability, especially for top-selling SKUs. These insights emerge from structured efforts to Extract Minimalist Data on Instamart vs. Blinkit across zones.

A wider assortment creates catalog depth, but inconsistent availability weakens shopper trust. Blinkit’s tighter SKU curation combined with higher replenishment accuracy ensures faster velocity for essential items like Vitamin C serums, barrier repair moisturizers, sunscreens, and cleansers.

In quick commerce, efficiency often beats scale — a conclusion reinforced through Web Scraping Minimalist Data on Instamart vs. Blinkit for real-time SKU audits.

Pricing Strategy: Everyday Value vs. Premium Cushion

Pricing behavior differs structurally between the two platforms. Insights derived from Minimalist Data Extraction on Instamart vs. Blinkit reveal consistent pricing gaps.

Average Price by Category

| Category |

Blinkit Avg. Price (₹) |

Instamart Avg. Price (₹) |

Price Gap (₹) |

| Face Care |

479 |

556 |

77 |

| Hair Care |

432 |

503 |

71 |

| Body Care |

361 |

408 |

47 |

| Kits & Combos |

795 |

882 |

87 |

| Overall Average |

497 |

569 |

72 |

Observations

Blinkit is cheaper across all categories. The largest pricing gap appears in combo kits.

Instamart maintains higher ASP (Average Selling Price), especially in bundled routines. This pricing intelligence is derived via the Instamart Grocery Delivery Scraping API, allowing structured price comparisons at SKU level.

Blinkit uses competitive pricing to drive faster checkout decisions. Platform-level cost tracking through the Blinkit Grocery Delivery Scraping API highlights stronger tactical pricing alignment.

For shoppers comparing identical SKUs, a ₹70–₹90 difference becomes significant, especially for repeat-use items. Structured Web Scraping Grocery Data confirms that consistent base pricing influences loyalty more than sporadic high discounts.

Discount Mechanics: Tactical Promotions vs. Controlled Incentives

Discount strategy reveals how aggressively each platform competes for basket share. This layer of analysis is powered by a structured Grocery Delivery Extraction API tracking daily price shifts.

Discount Spread Analysis

| Discount Bracket |

Blinkit (% SKUs) |

Instamart (% SKUs) |

| 0–5% |

15% |

38% |

| 6–10% |

29% |

36% |

| 11–15% |

33% |

18% |

| 16–20% |

18% |

6% |

| 21%+ |

5% |

2% |

Blinkit applies mid-to-high tier discounts (11–20%) more frequently. Instamart’s majority of SKUs remain under 10% discount. These insights feed into a real-time Grocery Price Dashboard for tactical monitoring.

Blinkit’s effective checkout prices are often ₹90–₹130 lower than Instamart for bundled purchases. Longitudinal tracking via a Grocery Price Tracking Dashboard highlights sustained promotional leadership.

Category Leadership: Face Care as Revenue Engine

Face care remains the dominant driver of sales across both platforms. Broader Grocery Data Intelligence confirms that high-frequency essentials outperform specialty categories in Q-Comm.

Category Share by SKU Count

| Category |

Blinkit Share |

Instamart Share |

| Face Care |

50% |

44% |

| Hair Care |

22% |

23% |

| Body Care |

12% |

15% |

| Kits & Combos |

16% |

18% |

While Instamart has more kits, Blinkit prioritizes face-care singles. SKU-level benchmarking using structured Grocery Datasets shows that daily-use categories deliver stronger velocity than occasional routines.

Face-care SKUs show higher search visibility, stronger homepage placements, and better stock consistency — confirming their role as the Q-Comm revenue backbone.

Delivery Speed: The Ultimate Differentiator

Quick commerce is defined by speed. Even a 5–8 minute difference impacts platform preference.

Delivery Time Comparison (Delhi NCR)

| Zone |

Blinkit Avg. Time |

Instamart Avg. Time |

| Central Delhi |

10.8 mins |

18.4 mins |

| South Delhi |

12.3 mins |

20.2 mins |

| East Delhi |

13.0 mins |

21.8 mins |

| West Delhi |

11.9 mins |

19.6 mins |

| Overall Average |

12.0 mins |

19.8 mins |

Blinkit maintains sub-13-minute fulfillment across major zones. Instamart averages close to 20 minutes.

In urgent replenishment scenarios — sunscreen before stepping out, cleanser after stock-out — this gap directly influences platform selection. Speed reduces purchase hesitation and increases impulse conversion rates.

Stock Stability & Algorithmic Visibility

Frequent stockouts reduce digital shelf ranking.

Blinkit’s top 20 SKUs remain continuously available for 94% of the observed period. Instamart shows intermittent stockouts in combo kits and secondary variants.

Consistent availability improves search ranking stability, add-to-cart rate, and repeat purchase probability. Stock health is one of the strongest hidden drivers of Q-Comm performance.

Behavioral Buying Patterns

Data signals suggest two distinct consumer behaviors:

Blinkit Buyers:

- Faster checkout decisions

- Smaller basket sizes

- Urgent or reactive purchases

- High repeat frequency

Instamart Buyers:

.

- Slightly larger baskets

- More combo exploration

- Less urgency-driven

The same brand can win differently depending on platform architecture.

Strategic Recommendations for Brands

Based on comparative analysis:

- Maintain competitive base pricing on fast-delivery platforms.

- Protect top 25 SKUs with 95%+ stock availability.

- Use bundles strategically — not excessively.

- Monitor discount depth to avoid margin erosion.

- Track delivery speed zone-wise to protect impulse conversions.

- Align promotions with replenishment cycles (face care > specialty kits).

Conclusion: Data-Led Quick Commerce Execution

Structured marketplace tracking across Blinkit and Instamart reveals how platform dynamics shape brand performance beyond pricing alone.

Key findings show:

- Blinkit leads in pricing competitiveness and speed.

- Instamart leads in assortment depth.

- Face care remains the primary revenue engine.

- Stock consistency strongly influences digital shelf strength.

- Delivery time directly impacts conversion behavior.

For skincare brands like Minimalist, quick commerce success depends on precision — not just presence.

Winning in Q-Comm is no longer about being listed everywhere.

It’s about executing better than competitors on pricing clarity, promotion timing, stock reliability, and fulfillment speed — every single day.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.