Introduction

The global non-alcoholic drinks industry continues to expand at an extraordinary pace, expected to surpass $1.65 trillion by 2025, driven by innovation, health-conscious consumption, and premiumization. The rapid shift toward healthier lifestyles and alcohol-free alternatives is redefining how consumers perceive beverages. Using Non-Alcoholic Beverages Trends Data Scraping 2025, businesses can uncover evolving consumption habits, ingredient preferences, and category innovations shaping the future of this dynamic market.

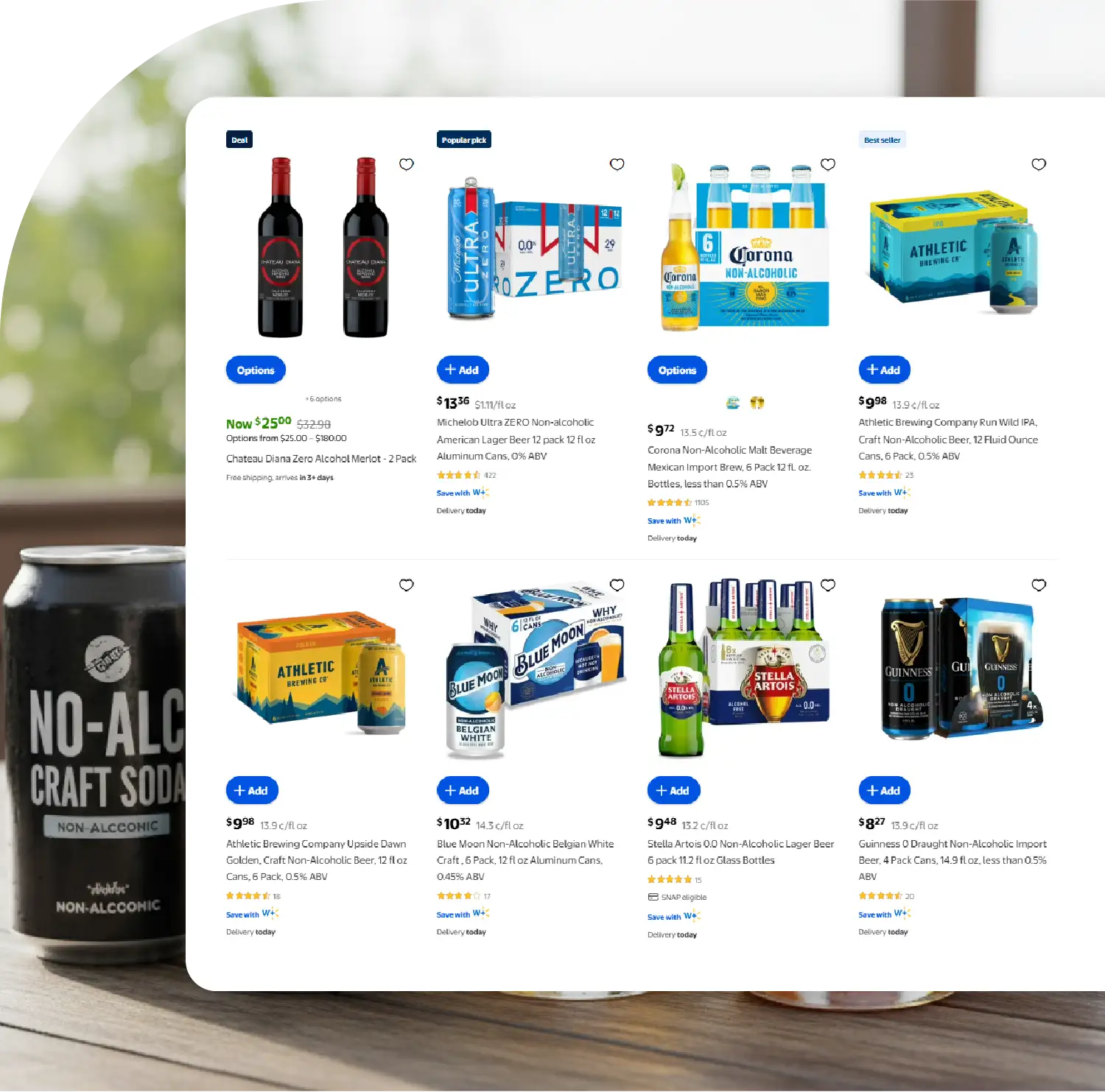

Through Web Scraping Non-Alcoholic Beverage Market Insights 2025, brands can analyze online shopper activity, study emerging flavor profiles, and monitor product availability across major e-commerce platforms. These insights using tool to Scrape Non-Alcoholic Beverages Trends Data 2025 provided an in-depth understanding of changing consumer behavior, enabling strategic product positioning and competitive intelligence.

The Non-Alcoholic Beverage Market Landscape 2025

The non-alcoholic beverage market in 2025 is characterized by functional health claims, clean-label demands, and lifestyle-driven consumption. Gen Z and millennials are leading this transformation, with over 60% preferring alcohol-free options in social settings. The rise of “sober-curious” consumers has turned once-niche products like zero-proof spirits and functional mocktails into mainstream choices.

In the U.S. alone, sales of non-alcoholic beer, wine, and spirits grew 26% year-over-year, surpassing $800 million in 2024. Globally, online data suggests an increasing preference for drinks that combine wellness benefits with premium experiences.

| Segment |

2024 Market Value (USD Bn) |

2025 Forecast (USD Bn) |

Growth Rate (%) |

| Non-Alcoholic Beer | 31.2 | 39.5 | 26.6 |

| Non-Alcoholic Spirits | 0.9 | 1.2 | 33.3 |

| Functional Beverages | 142 | 167 | 17.6 |

| Plant-Based Drinks | 19.3 | 23.1 | 19.6 |

This data highlights the surge of premium non-alcoholic alternatives driven by health, sustainability, and mindful drinking habits.

Health and Functional Drivers

Health remains the most significant driver behind the non-alcoholic beverages boom. Approximately 41% of U.S. consumers choose alcohol-free beverages for their health benefits. Through Web Scraping Non-Alcoholic Product Reviews & Prices, analysts can track which ingredients, formulations, and claims resonate most with shoppers.

Functional drinks enriched with adaptogens, vitamins, or plant-based ingredients are becoming core growth segments. For instance, beverages containing ashwagandha, magnesium, or CBD attract younger consumers seeking energy, relaxation, or mental clarity.

| Top Functional Ingredients (2025) |

Share of New Launches (%) |

| Ashwagandha | 19 |

| Magnesium | 14 |

| CBD & Hemp | 12 |

| Probiotics | 10 |

| Collagen | 8 |

This data suggests that consumers are no longer buying beverages for refreshment alone—they’re demanding tangible functional benefits.

Generational Influence: Gen Z and Millennial Shift

The younger generations are reshaping how the world drinks. Only 39% of Gen Z consider alcohol a default social drink, compared with 57% of Gen X. Social drinking now revolves around connection, wellness, and creativity rather than intoxication.

With method to Extract Functional Drink Trends Data 2025, brands can identify what functional and alcohol-free beverages resonate most with this demographic. E-commerce data reveals that sparkling teas, kombuchas, and functional sodas rank among the top-searched products in the non-alcoholic segment.

These findings are crucial for beverage manufacturers seeking to align product portfolios with generational values such as authenticity, sustainability, and self-care.

Rise of the “Sober-Curious” Movement

The “sober-curious” movement represents a cultural and behavioral shift. Roughly 49% of U.S. consumers plan to reduce alcohol intake, prioritizing balance and wellness over indulgence. This evolution is transforming digital shelves, where searches for “mocktails” and “zero-proof spirits” continue to rise.

By using tools to Extract Non-Alcoholic Beverages Trends Data 2025, brands can monitor trending keywords, assess seasonal demand, and analyze review sentiments to identify opportunities for innovation. The expansion of alcohol-adjacent categories—particularly non-alcoholic spirits and beers—demonstrates consumers’ growing desire for premium, sophisticated alternatives that retain the social appeal of traditional drinks.

Premiumization and Product Sophistication

Approximately 90% of non-alcoholic spirits are now sold in premium or ultra-premium segments. High-quality packaging, complex flavor profiles, and storytelling-based branding dominate this sector.

E-commerce analytics reveal that premium-positioned products have 35% higher conversion rates, driven by perception of craftsmanship and exclusivity. Brands leveraging Alcohol-Free Drinks Market Data Extraction Services gain visibility into pricing dynamics, review trends, and category placement, allowing them to identify premium gaps in the market.

Furthermore, 2025 Drink Trends Data Extraction API can automate data collection across platforms like Amazon, Walmart, and Target—enabling real-time tracking of product rankings, pricing shifts, and ingredient mentions.

The Role of Clean Labels and Plant-Based Ingredients

Transparency and natural formulation are now non-negotiable in beverage innovation. Over 52% of consumers actively analyze product labels to avoid synthetic colors, artificial sweeteners, or preservatives.

With Liquor Price Data Scraping Services, businesses can evaluate not just alcohol markets but also their alcohol-free counterparts, comparing category pricing, promotional activity, and positioning strategies. Plant-based beverages such as pistachio milk, barley drinks, and botanical infusions (hibiscus, lavender) are gaining popularity due to their perceived purity and functionality.

E-commerce data suggests that clean-label beverages receive 23% more reviews and higher average ratings compared to those with artificial additives. Brands that emphasize sustainability and ingredient integrity are thus poised for higher long-term loyalty.

Digital Shelf Analytics: Turning Data into Strategy

In the era of online commerce, Alcohol and Liquor Datasets serve as a foundation for understanding cross-category shifts. Digital shelf monitoring enables beverage companies to identify which non-alcoholic products appear in top search results for alcohol-related keywords, reflecting a merging of social and sober drinking occasions.

By continuously tracking search rankings, click-through rates, and consumer reviews, brands can anticipate category momentum and optimize listings for visibility and conversions. Real-time data extraction empowers beverage manufacturers to measure performance metrics such as pricing elasticity, consumer sentiment, and emerging subcategory interest.

Future Outlook

The non-alcoholic beverage category’s trajectory in 2025 underscores a long-term transformation rather than a passing trend. The convergence of health, lifestyle, and digital consumer engagement presents immense potential for brands ready to innovate and adapt.

Brands that invest in data scraping and analysis can gain granular insights into shifting preferences, allowing them to respond faster with targeted formulations and relevant marketing messages. As more consumers embrace mindful drinking, opportunities will continue to expand in zero-proof cocktails, plant-based functional drinks, and natural wellness beverages.

Conclusion

The global non-alcoholic drinks revolution in 2025 reflects a cultural reset—where balance, well-being, and sophistication drive demand. The ability to Scrape Alcohol Price Data and parallel non-alcoholic beverage data reveals how interconnected the entire drinks ecosystem has become.

A comprehensive Liquor Price Tracking Dashboard enables companies to monitor price differentials, cross-promotional strategies, and category trends between alcoholic and non-alcoholic beverages. Leveraging Liquor Data Intelligence Services allows organizations to integrate insights from multiple datasets—ranging from e-commerce reviews to pricing analytics—into a unified, actionable strategy.

In essence, the future of the beverage industry lies not just in production but in intelligent data extraction—transforming raw consumer signals into predictive intelligence for sustainable market growth.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.