Introduction

The plant-based milk alternative (PBMA) market has witnessed explosive growth, driven by health-conscious, eco-friendly, and vegan consumers seeking sustainable alternatives to dairy milk. Among these, oat milk and almond milk have emerged as leading contenders, fueling debates in coffee shops, kitchens, and grocery aisles. This report provides a comprehensive analysis of oat milk versus almond milk, exploring their nutritional profiles, taste, texture, sustainability, and market trends. By leveraging advanced solutions to Scrape Oat Milk vs Almond Milk Market Trends Data, we aim to uncover key insights into consumer preferences. Additionally, Oat Milk vs Almond Milk Market Data Extraction informs our understanding of sales and consumption patterns, while the strategy to Scrape Plant-Based Milk Trends Data highlights broader market dynamics. This report evaluates which PBMA reigns supreme based on data-driven insights and consumer behavior.

What is Oat Milk?

Oat milk is a plant-based milk alternative crafted by soaking oats in water, blending the mixture, and straining it to produce a creamy, naturally sweet liquid. Its thick, frothy texture mimics dairy milk, making it a versatile choice for coffee beverages, baking, and cooking. Extract Oat Milk vs Almond Milk Product Info to reveal that oat milk’s dairy-like consistency and subtle sweetness have fueled its rise in café culture, particularly for lattes and cappuccinos. Its appeal spans younger demographics, who value its lactose-free profile, sustainability credentials, and relevance in modern tools like a Grocery Price Dashboard.

What is Almond Milk?

Almond milk, a pioneer in the PBMA market, is made by blending almonds with water and straining the mixture to create a light, nutty-flavored liquid. Its thin texture suits smoothies, cereals, and light recipes. Oat Milk vs Almond Milk Nutritional Data Extraction underscores almond milk’s low-calorie appeal, which has solidified its popularity among health-focused consumers. As one of the first PBMAs to gain traction in the United States, almond milk benefits from strong brand recognition and widespread availability.

Oat Milk vs. Almond Milk: A Comparative Analysis

While oat milk and almond milk share the goal of replacing dairy milk, their differences in nutrition, taste, texture, and environmental impact distinguish them. This section, informed by Oat Milk vs Almond Milk Competitor Data Scraping, dissects these factors to provide clarity for consumers and brands.

Nutritional Comparison

Nutrition is a critical driver of PBMA choices. Plant-Based Milk Popularity Data Extraction shows that consumers prioritize calorie content, protein, and micronutrients when selecting milk alternatives. The table below compares the nutritional profiles of unsweetened oat milk and almond milk.

| Nutrient |

Oat Milk |

Almond Milk |

| Calories |

120 kcal |

30-40 kcal |

| Carbohydrates |

16 g |

1-2 g |

| Protein |

3 g |

1 g |

| Fat |

5 g |

2.5 g |

| Fiber |

2 g |

0.5 g |

| Calcium (fortified) |

350 mg (27% DV) |

450 mg (35% DV) |

| Vitamin D (fortified) |

100 IU (25% DV) |

100 IU (25% DV) |

• Calories and Carbohydrates: Oat milk is higher in calories and carbohydrates due to its oat-based composition, which includes natural sugars and starches. This makes it less ideal for low-carb or keto diets but suitable for consumers seeking sustained energy. Almond milk’s low-calorie and low-carb profile appeals to weight-conscious individuals.

• Protein Content: Oat milk offers slightly more protein (3 g per cup) than almond milk (1 g per cup), though both lag behind dairy milk’s 8 g. Grocery App Data Scraping services indicate growing demand for protein-fortified almond milk, narrowing this gap.

• Fiber and Micronutrients: Oat milk provides soluble fiber, aiding digestion, while almond milk is often fortified with higher calcium and vitamin D levels, supporting bone health.

Taste and Texture

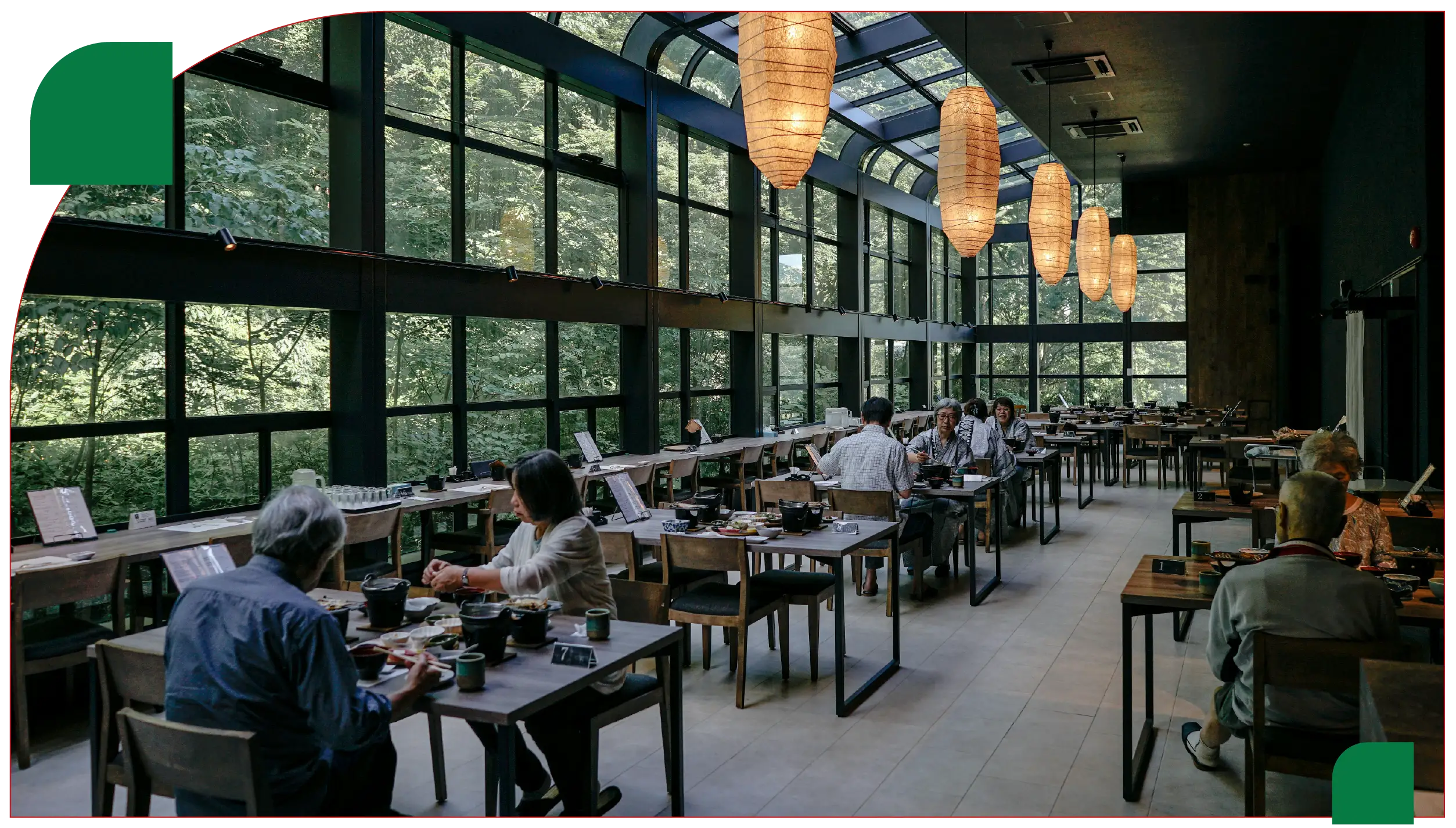

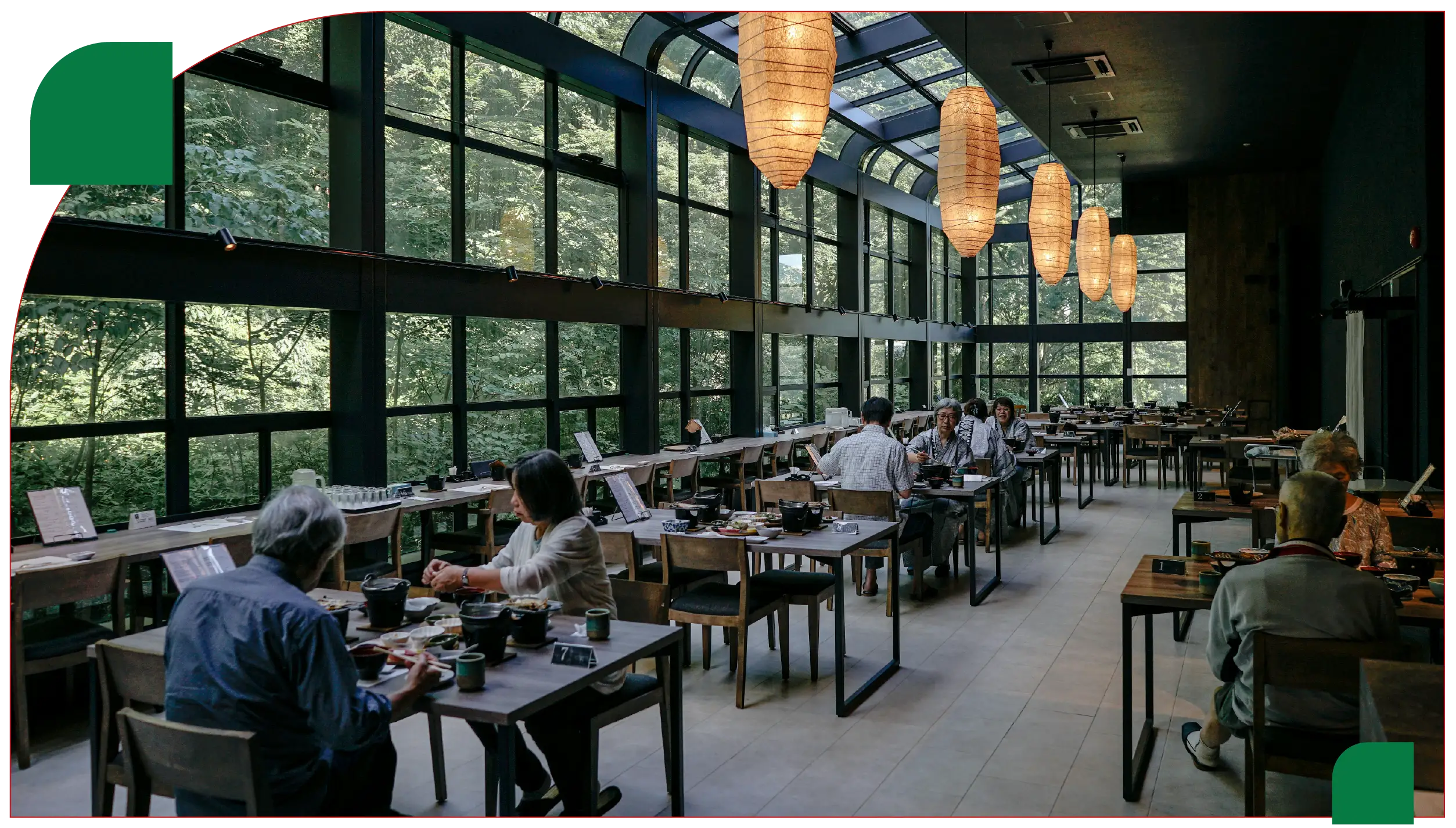

Taste and texture significantly influence consumer preferences. Oat milk’s naturally sweet, robust flavor and creamy consistency make it a top choice for coffee drinks and savory dishes. Extract Alcohol Prices Data to understand consumer behavior. It suggests oat milk’s dairy-like mouthfeel drives its café culture popularity. Almond milk, with its subtle, nutty flavor and lighter texture, excels in smoothies and recipes requiring a less heavy consistency. Real-Time Food Delivery Scraping API Services reveal that oat milk is preferred for frothy beverages, while almond milk is favored for its refreshing profile.

Sustainability

Sustainability is a key concern for eco-conscious consumers. Oat milk production relies on oats, which require minimal water and land, resulting in a lower environmental footprint. Almond milk production, however, is resource-intensive, particularly due to almond cultivation’s high water usage (15-20 gallons per almond). Oat Milk vs Almond Milk Competitor Data Scraping highlights oat milk’s sustainability advantage, aligning with consumer demand for eco-friendly products.

Market Trends and Consumer Preferences

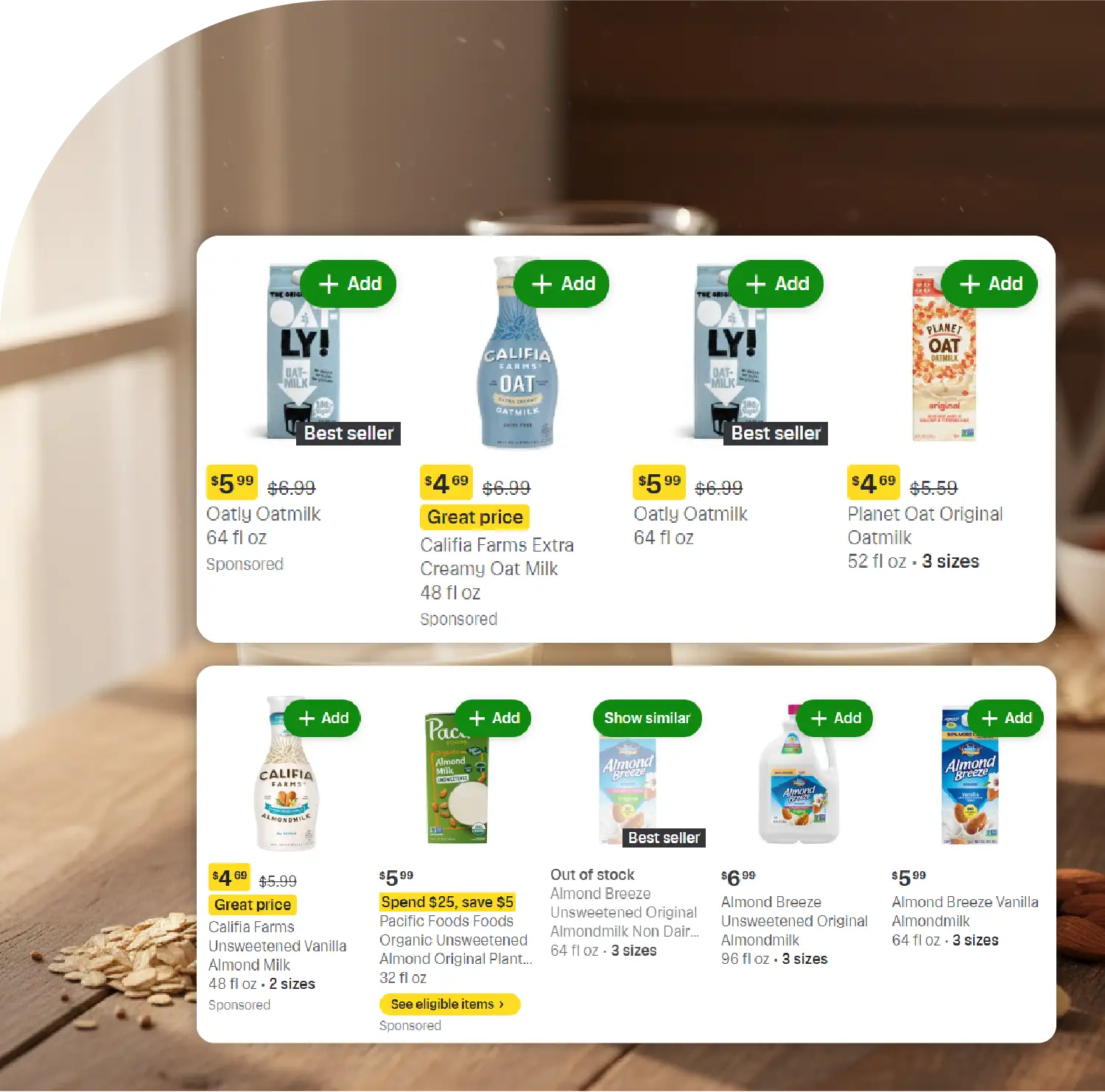

The PBMA market is booming, with almond milk and oat milk leading the charge. Plant-Based Milk Popularity Data Extraction provides critical insights into sales and consumption trends:

- Almond Milk: As the most popular PBMA in the U.S., almond milk accounted for $10.89 billion in global market value in 2023. Its appeal lies in its low-calorie profile and established brand loyalty, particularly among health-conscious consumers seeking “unsweetened” and “high-protein” options.

- Oat Milk: Oat milk holds 24% of the U.S. PBMA market and is gaining ground due to its creamy texture and sustainability credentials. Its popularity in coffee shops, driven by terms like “lactose-free” and “unsweetened,” reflects its alignment with café culture and vegan trends.

| Metric |

Almond Milk |

Oat Milk |

| U.S. Market Share (2023) |

40% |

24% |

| Global Market Value (2023) |

$10.89 billion |

$5.2 billion |

| Sales Volume (July 2023-July 2024) |

$1.7 billion |

$1.15 billion |

| Consumer Search Terms |

“High-protein,” “Unsweetened” |

“Lactose-free,” “Creamy” |

| Primary Demographic |

Health-conscious |

Gen Z, Millennials |

Popularity and Audience

Oat milk appeals to younger demographics, particularly Gen Z and Millennials, who prioritize sustainability and café culture. Its creamy texture makes it a staple in artisanal coffee beverages, aligning with espresso trends. Almond milk, conversely, attracts fitness-focused consumers seeking low-carb, calorie-friendly options. Grocery App Data Scraping services show that almond milk consumers frequently search for “fat-free” and “healthy,” while oat milk fans prioritize “lactose-free” and “sustainable.”

Which is Better?

The oat milk vs. almond milk debate hinges on individual preferences and dietary needs:

- Oat Milk: Excels in creaminess, taste, and sustainability, making it ideal for coffee enthusiasts and eco-conscious consumers. Its higher calorie and carb content may deter those on restrictive diets.

- Almond Milk: Wins for calorie control, keto-friendliness, and accessibility, appealing to health-focused individuals. Its lighter texture suits smoothies, but its environmental footprint is a drawback.

For most consumers, the choice isn’t binary. Both PBMAs can complement a balanced diet, serving different purposes based on taste, texture, and nutritional goals.

Challenges and Opportunities for Brands

Brands must navigate evolving consumer preferences to capitalize on the PBMA market. Almond milk benefits from established loyalty but faces competition from oat milk’s rapid growth. Extract Oat Milk vs Almond Milk Product Info to suggest that fortifying almond milk with protein and promoting its low-calorie benefits can maintain its edge. Oat milk brands should emphasize sustainability and café-friendly applications to attract younger consumers. Real-Time Food Delivery Scraping API Services indicate that partnerships with coffee shops and vegan restaurants can boost oat milk’s visibility.

Future Outlook

The plant-based milk alternative (PBMA) market is set for continued expansion, as U.S. dairy milk sales decline and PBMA sales reach $2.85 billion from July 2023 to July 2024. Scrape Plant-Based Milk Trends Data to predict that oat milk will continue gaining market share, driven by its creamy texture, sustainability, and versatility.

Almond milk remains popular among health-conscious consumers, maintaining its position as a staple in many households. Grocery Pricing Data Intelligence allows retailers to track pricing patterns, promotions, and consumer preferences for plant-based milk products.

Innovations such as fortified varieties, eco-friendly packaging, and new flavors are shaping the future of PBMAs. Grocery Store Datasets provide analysts with structured data to monitor market trends, competitor activity, and make strategic decisions effectively.

Conclusion

The oat milk vs. almond milk debate reflects broader shifts in consumer priorities, from health and taste to sustainability and lifestyle. Oat milk’s creamy texture and eco-friendly profile make it a favorite among younger, sustainability-focused consumers, while almond milk’s low-calorie appeal and established market presence cater to health-conscious audiences. Web Scraping Quick Commerce Data provides real-time insights into pricing and consumer trends, enabling brands to stay competitive. By monitoring these trends via Grocery Price Tracking Dashboard, companies can adapt to evolving demands. Ultimately, neither oat milk nor almond milk is universally superior; the choice depends on individual preferences, dietary needs, and values. As the PBMA market continues to evolve, leveraging Grocery Delivery Scraping API Services suggest that both alternatives will play pivotal roles in shaping the future of dairy-free beverages.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.