Introduction

India’s quick commerce revolution is no longer confined to metropolitan hubs like Mumbai, Delhi, and Bengaluru. In 2026, the real acceleration is happening across Tier-2 cities such as Jaipur, Lucknow, Indore, Surat, Bhopal, Coimbatore, Chandigarh, Patna, Nagpur, Visakhapatnam, Vadodara, Mysuru, Kochi, and Bhubaneswar. Businesses, investors, and brands are increasingly looking to Scrape Quick Commerce Data in Tier-2 Cities – India 2026 to understand localized demand patterns, competitive pricing, delivery performance, and consumer behavior shifts.

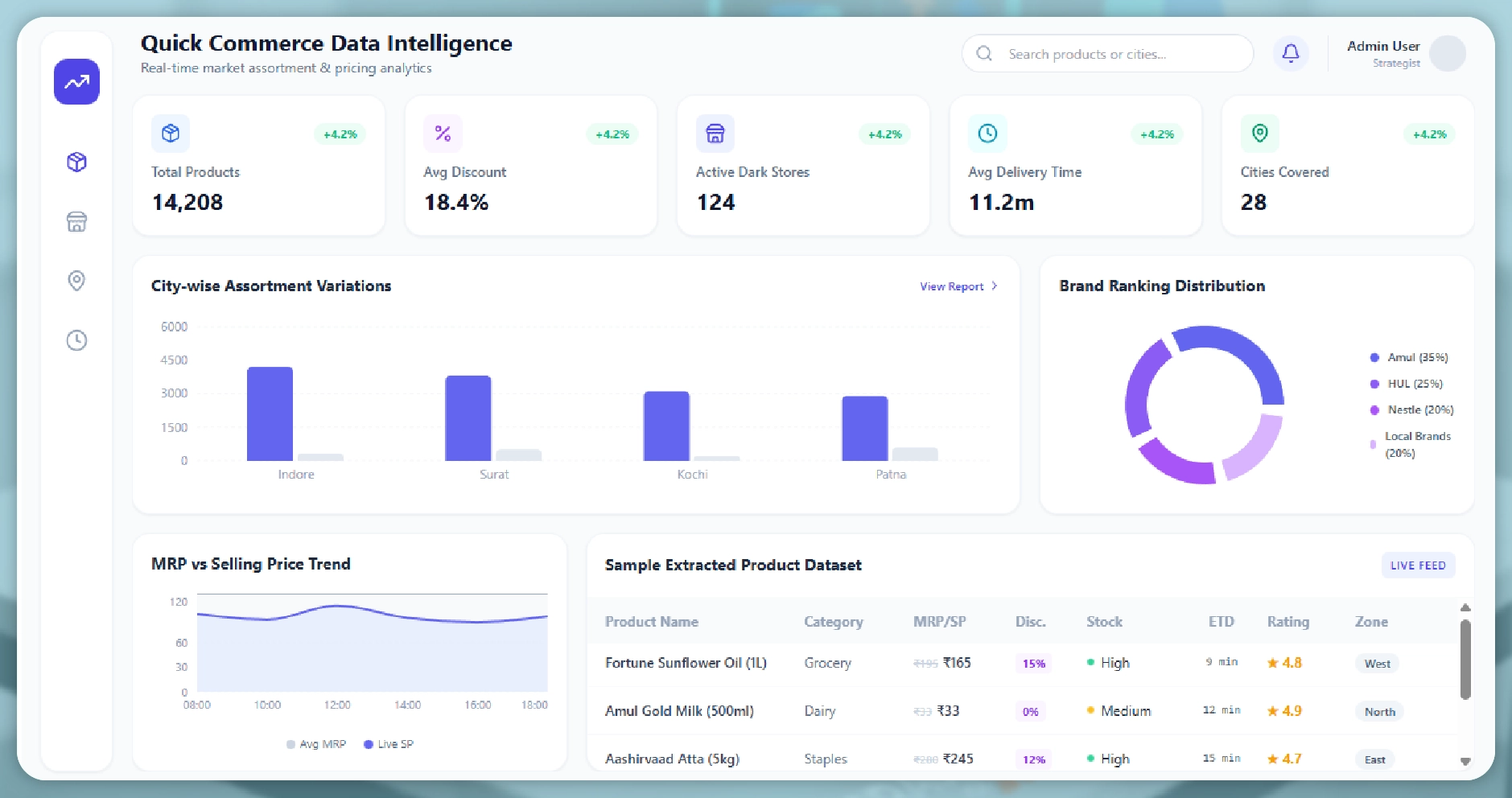

The rapid expansion of platforms like Blinkit, Zepto, Swiggy Instamart, BigBasket Now (BB Now), Flipkart Minutes, Dunzo Daily, Amazon Fresh, and JioMart Express into smaller cities has created a dynamic digital retail ecosystem. Through Quick Commerce Data Scraping In India Tier-2 Cities 2026, companies can track SKU-level pricing, stock availability, promotional campaigns, and hyperlocal assortment strategies that differ significantly from metro markets.

As the competition intensifies, Tier-2 Cities Quick Commerce Data Extraction – India 2026 becomes essential for brands aiming to optimize inventory planning, distributor alignment, and city-specific pricing models. The Tier-2 opportunity is no longer emerging—it is mainstream and strategically critical.

The Rise of Quick Commerce in Tier-2 India

Tier-2 cities are witnessing a rapid transformation in digital adoption due to improved internet penetration, smartphone usage, and digital payment acceptance. Cities like Surat and Indore have become logistics-friendly hubs, while Jaipur and Lucknow demonstrate strong FMCG and grocery consumption patterns. Platforms such as Zepto and Blinkit are aggressively expanding dark stores in cities like Chandigarh and Nagpur to capture rising demand for 10–20 minute deliveries.

Unlike metro markets, where consumer behavior is already mature, Tier-2 cities exhibit hybrid shopping habits—combining traditional kirana loyalty with quick commerce convenience. This creates unique data-driven opportunities. Businesses that Extract Quick Commerce Data In Tier-2 Cities India can analyze localized SKU preferences, regional brand loyalty, festival-driven demand spikes, and price sensitivity differences.

For example:

- In Coimbatore and Kochi, dairy and fresh produce dominate quick commerce baskets.

- In Patna and Bhopal, packaged staples and personal care products show higher frequency orders.

- In Mysuru and Bhubaneswar, promotional discounts heavily influence purchase behavior.

Understanding these patterns through structured datasets allows brands to align supply chain decisions with actual ground realities.

Key Platforms Driving Tier-2 Expansion

- Blinkit Expanding aggressively into cities like Lucknow, Jaipur, and Surat, Blinkit focuses on high-velocity SKUs and localized assortment customization.

- Zepto Zepto’s rapid dark store deployment model has made it popular in Chandigarh, Indore, and Nagpur, where young working professionals drive app-based consumption.

- Swiggy Instamart Swiggy leverages its food delivery ecosystem to scale Instamart in cities like Visakhapatnam and Vadodara, offering bundled grocery + food ecosystem advantages.

- BigBasket Now (BB Now) BB Now combines scheduled delivery and instant delivery models, targeting households in Coimbatore, Kochi, and Mysuru.

- Flipkart Minutes Flipkart’s integration with its broader e-commerce infrastructure strengthens inventory depth in cities like Patna and Bhubaneswar.

- Amazon Fresh & JioMart Express These platforms utilize extensive warehousing networks to offer competitive pricing in emerging Tier-2 markets.

Through Web Scraping Q-Commerce Data In Indian Tier-2 Cities, businesses can benchmark how each platform differs in:

- Delivery timelines

- Discount structures

- Assortment depth

- Private label strategies

- Product bundling

Why Data Scraping Matters in 2026?

Tier-2 markets are hyperlocal and highly dynamic. A product that performs strongly in Jaipur may not show the same traction in Bhopal. Pricing strategies in Surat can differ from Lucknow due to regional distributor margins and supply chain costs.

A structured Tier-2 Quick Commerce Market Trends Data Scraper India enables companies to track:

- SKU-level price fluctuations

- Real-time stock availability

- Dark store mapping

- Promotional frequency

- Brand positioning

- Private label penetration

- Consumer rating analysis

For FMCG brands, this means real-time competitive intelligence. For investors, it means understanding platform penetration and market saturation. For logistics companies, it means identifying dark store density and supply demand ratios.

Types of Data Extracted from Quick Commerce Platforms

By building structured Quick Commerce Datasets, businesses can collect:

- Product name and category

- MRP and selling price

- Discount percentage

- Stock availability status

- Estimated delivery time

- City-wise assortment variations

- Brand ranking within category

- Consumer reviews and ratings

- Bundle offers and combo deals

- Dark store coverage zones

These datasets provide granular visibility into how consumer demand differs across Indore versus Surat or Kochi versus Patna.

Use Cases of Quick Commerce Data in Tier-2 Cities

- Competitive Pricing Intelligence

Brands can compare how their products are priced across Blinkit, Zepto, and Swiggy Instamart in cities like Lucknow and Chandigarh. - Assortment Optimization

Companies can identify which SKUs are consistently stocked in Coimbatore but missing in Bhubaneswar. - Promotion Monitoring

By tracking discount cycles in Jaipur and Nagpur, brands can evaluate competitor campaign effectiveness. - Supply Chain Optimization

Stock-out frequency analysis in Mysuru or Vadodara helps optimize distributor-level inventory allocation. - Market Entry Strategy

Investors and retailers can evaluate dark store density and order fulfillment patterns before entering a new Tier-2 city.

Challenges in Tier-2 Quick Commerce Data Collection

Data extraction in Tier-2 markets comes with complexities:

- Dynamic pricing variations across micro-locations

- Geo-based inventory differences

- App-only visibility limitations

- Frequent UI updates

- Anti-bot mechanisms

Advanced scraping frameworks use rotating proxies, geo-targeted scraping nodes, structured APIs, and automation workflows to ensure accurate and compliant data collection. Businesses must ensure ethical and responsible data handling aligned with platform terms and legal regulations.

- Market Trends in 2026: Several trends define Tier-2 quick commerce in India:

- Hyperlocal Brand Penetration: Regional brands are competing strongly with national FMCG giants in cities like Indore and Patna.

- Private Label Growth: Blinkit and Swiggy Instamart private labels are gaining traction in Nagpur and Jaipur.

- Price Sensitivity & Discount-Driven Demand: Tier-2 consumers remain value-conscious, making discount tracking critical.

- Fresh Category Expansion: Dairy, fruits, and vegetables dominate consumption in Kochi and Coimbatore.

- Faster Delivery Promise Standardization: 10–15 minute deliveries are becoming the norm across Chandigarh and Surat.

Businesses leveraging structured data analytics gain a measurable competitive advantage in capturing these shifts early.

Unlock real-time quick commerce insights today—partner with us to turn Tier-2 market data into your competitive advantage.

Strategic Advantages of Data-Driven Quick Commerce Monitoring

Companies that invest in real-time data intelligence can:

- Improve pricing accuracy

- Strengthen distributor negotiations

- Detect emerging regional competitors

- Identify private label threats

- Enhance inventory forecasting

- Align marketing campaigns with city-specific buying behavior

Tier-2 cities represent the next 200 million digital consumers in India. Without data-backed insights, brands risk misallocation of inventory and missed revenue opportunities.

How Food Data Scrape Can Help You?

- Real-Time Competitive Price Monitoring

We continuously track product pricing across multiple quick commerce platforms and Tier-2 cities. This helps you adjust your pricing strategy instantly, stay competitive against rivals, and respond quickly to discount campaigns, flash sales, and regional price fluctuations. - City-Level Assortment & SKU Intelligence

Our scraping solutions provide detailed SKU-level insights across cities like Jaipur, Lucknow, Indore, and Surat. You can identify which products are trending, frequently out of stock, or missing—allowing smarter assortment planning and improved regional inventory alignment. - Promotion & Discount Tracking

We monitor platform-wide offers, combo deals, bundled discounts, and seasonal campaigns. This enables you to evaluate competitor marketing strategies, measure promotion effectiveness, and design data-backed campaigns that resonate with Tier-2 consumers. - Stock Availability & Demand Analysis

Our services help you analyze stock-out frequency, replenishment cycles, and demand spikes across multiple locations. With these insights, you can optimize supply chain decisions, reduce lost sales opportunities, and improve fulfillment efficiency. - Custom Data Feeds & Scalable API Integration

We deliver structured datasets and API-ready data streams tailored to your business needs. Whether you require daily reports, dashboard integration, or large-scale automated monitoring, our scalable scraping infrastructure ensures reliable, accurate, and actionable insights.

Conclusion

The expansion of Blinkit, Zepto, Swiggy Instamart, BB Now, Flipkart Minutes, Amazon Fresh, and JioMart Express into cities like Jaipur, Lucknow, Indore, Surat, Bhopal, Coimbatore, Chandigarh, Patna, Nagpur, and Bhubaneswar has transformed India’s retail landscape in 2026. Businesses that leverage Web Scraping Quick Commerce Data gain unmatched visibility into SKU pricing, stock patterns, consumer demand, and competitive positioning.

By integrating a scalable Quick Commerce Data Scraping API, enterprises can automate real-time monitoring across multiple platforms and cities, ensuring accurate and actionable intelligence.

Ultimately, companies that adopt advanced Quick Commerce Data Intelligence Services will lead the Tier-2 growth wave—turning raw data into strategic advantage and sustainable expansion across India’s fastest-growing digital markets.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.