Introduction

In the competitive world of confectionery, Reese’s and Hershey’s have long been two of the most iconic brands in the chocolate industry. Both brands boast loyal consumer bases and a wide variety of products, especially on e-commerce platforms like Amazon. Analyzing the online market dynamics between these two chocolate giants reveals not only consumer preferences but also pricing strategies, popularity trends, and market positioning. In this comprehensive report, we scrape Reese’s vs. Hershey’s chocolate trends on Amazon, providing an in-depth comparison through data-driven insights.

Leveraging Reese’s & Hershey’s chocolate trends analysis on Amazon enables stakeholders—retailers, marketers, and manufacturers—to make informed decisions based on real-time market intelligence. Through web scraping Reese’s Hershey’s product listings on Amazon, we gathered valuable data on top-selling products, pricing, ratings, and availability, reflecting the current consumer landscape. This report further demonstrates how businesses can scrape Reese’s vs. Hershey’s chocolate data on Amazon for comparison to optimize their inventory, pricing, and marketing strategies.

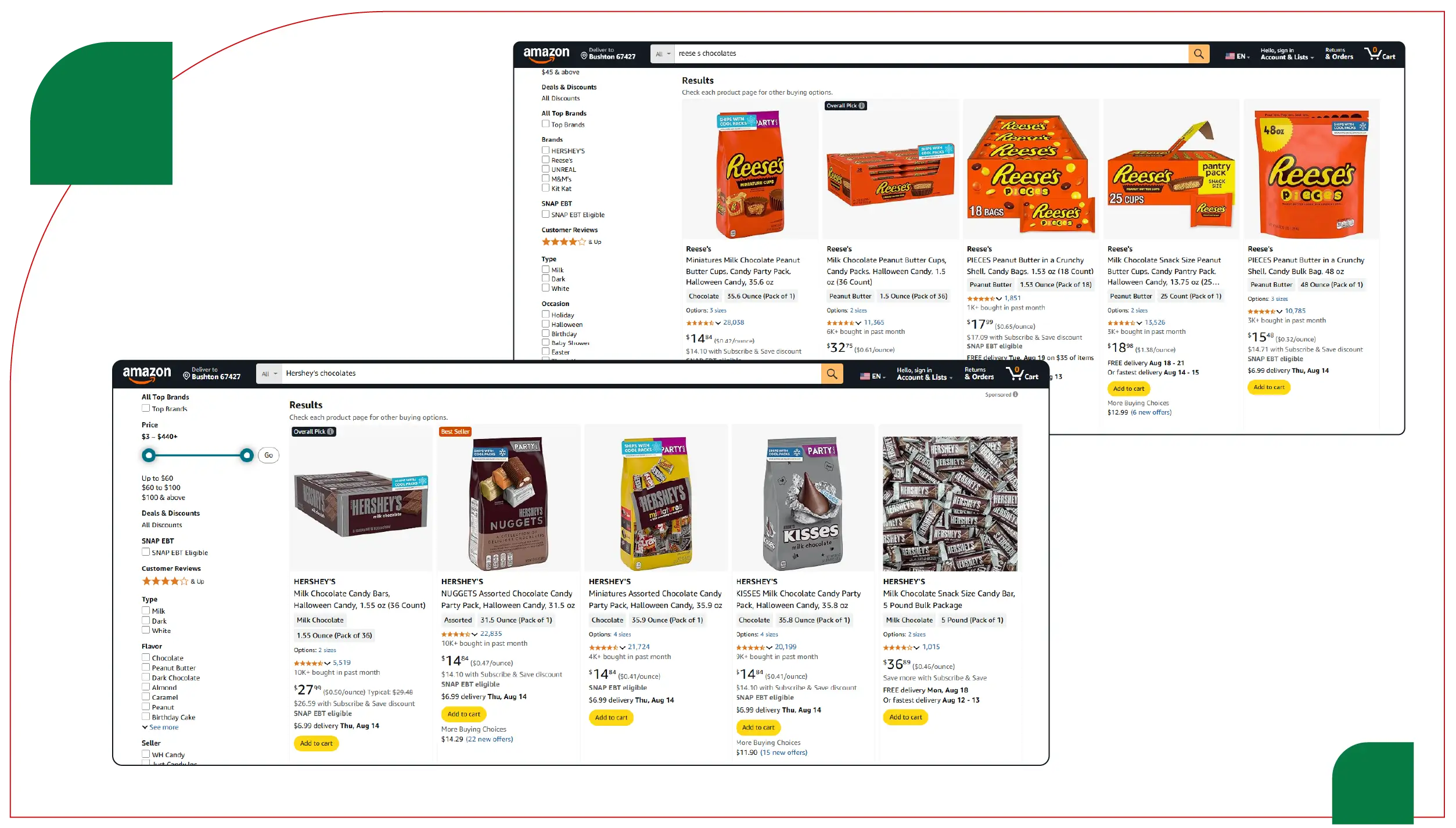

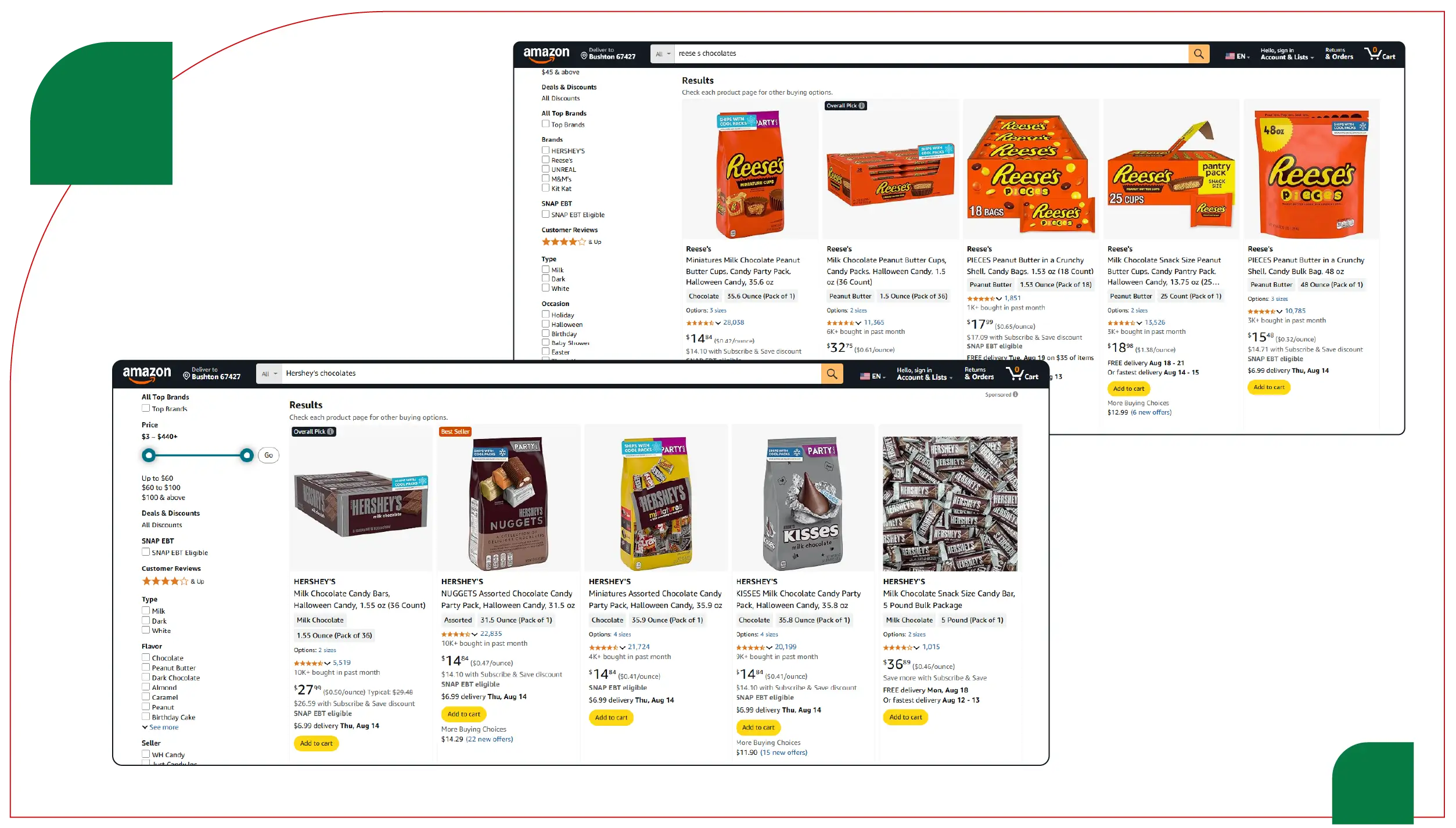

Market Overview: Reese’s vs. Hershey’s on Amazon

Amazon’s platform is a crucial sales channel for chocolates, attracting a broad customer base with diverse budget preferences. Both Reese’s and Hershey’s enjoy a strong presence, offering hundreds of SKUs that range from small, bite-sized treats to large bulk packs. To determine which brand is dominating the “chocolate game” on Amazon, it is essential to analyze multiple factors:

- Sales volumes and bestselling products

- Pricing tiers and overall affordability

- Customer ratings and perceptions of product quality

Our comprehensive analysis examines these aspects by leveraging tools to extract Reese’s chocolate pricing data from Amazon.

This approach to scrape Hershey’s chocolate pricing data from Amazon ensures we capture a complete picture of each brand’s market performance. The resulting granular insights enable a nuanced comparison, helping identify trends and consumer preferences shaping the competitive landscape between these two iconic chocolate brands.

Data Collection Methodology

Our team employed sophisticated grocery app data scraping services to gather real-time, comprehensive data directly from Amazon’s product listings. This meticulous grocery delivery scraping API services targeted key product details such as pricing, customer ratings, stock availability, packaging variations, and ongoing promotional offers. By collecting this wide range of data points, we ensured a thorough and accurate dataset that captures the dynamic nature of the online chocolate market. This rich information forms the foundation for detailed analysis, enabling us to track trends, compare product performance, and understand consumer behavior in real time. Our approach guarantees that stakeholders receive actionable insights supported by up-to-date and reliable data, critical for making informed business decisions in the competitive e-commerce landscape.

Top-Selling Reese’s and Hershey’s Products on Amazon

Top-selling products represent what customers prefer and buy most frequently. Our web scraping process focused on capturing the top 10 best-selling items from each brand’s Amazon listings, reflecting a mix of seasonal favorites, classic chocolates, and innovative products.

Table 1: Top-Selling Reese’s and Hershey’s Products on Amazon

| Rank |

Reese’s Product |

Price (₹) |

Rating |

Hershey’s Product |

Price (₹) |

Rating |

| 1 |

Reese’s Peanut Butter Cups (Pack of 12) |

800 |

4.7 |

Hershey’s Milk Chocolate Bar (Pack of 10) |

750 |

4.6 |

| 2 |

Reese’s Pieces Candy (Pack of 6) |

650 |

4.5 |

Hershey’s Kisses Milk Chocolates (Pack of 12) |

900 |

4.8 |

| 3 |

Reese’s Big Cup (Pack of 8) |

780 |

4.6 |

Hershey’s Cookies ‘n’ Creme Bar (Pack of 8) |

800 |

4.5 |

| 4 |

Reese’s Minis (Pack of 20) |

900 |

4.8 |

Hershey’s Special Dark Chocolate Bar (Pack of 6) |

850 |

4.7 |

| 5 |

Reese’s Sticks (Pack of 10) |

700 |

4.4 |

Hershey’s Nuggets Milk Chocolate (Pack of 15) |

950 |

4.6 |

| 6 |

Reese’s White Creme Cups (Pack of 6) |

680 |

4.5 |

Hershey’s Milk Chocolate with Almonds (Pack of 7) |

850 |

4.6 |

| 7 |

Reese’s Nutrageous Bar (Pack of 6) |

750 |

4.4 |

Hershey’s Symphony Milk Chocolate (Pack of 6) |

920 |

4.5 |

| 8 |

Reese’s Chocolate Lovers Pack |

1200 |

4.9 |

Hershey’s Milk Chocolate Almond Bar (Pack of 5) |

800 |

4.4 |

| 9 |

Reese’s Pieces (Bulk, 1 kg) |

1800 |

4.6 |

Hershey’s Milk Chocolate Bulk Pack (1 kg) |

1750 |

4.7 |

| 10 |

Reese’s Fast Break Bar (Pack of 8) |

700 |

4.5 |

Hershey’s Miniatures Assortment (Pack of 20) |

1100 |

4.8 |

Affordable Reese’s and Hershey’s Products

Price sensitivity is critical in the grocery and confectionery market. Our analysis includes an overview of affordable product options, helping budget-conscious customers and retailers identify high-value items.

Table 2: Affordable Reese’s and Hershey’s Products

| Product |

Price (₹) |

Brand |

Rating |

| Reese’s Pieces Candy (Pack of 6) |

650 |

Reese’s |

4.5 |

| Reese’s Sticks (Pack of 10) |

700 |

Reese’s |

4.4 |

| Hershey’s Milk Chocolate Bar (Pack of 10) |

750 |

Hershey’s |

4.6 |

| Hershey’s Symphony Milk Chocolate (Pack of 6) |

920 |

Hershey’s |

4.5 |

| Reese’s White Creme Cups (Pack of 6) |

680 |

Reese’s |

4.5 |

| Hershey’s Milk Chocolate Almond Bar (Pack of 5) |

800 |

Hershey’s |

4.4 |

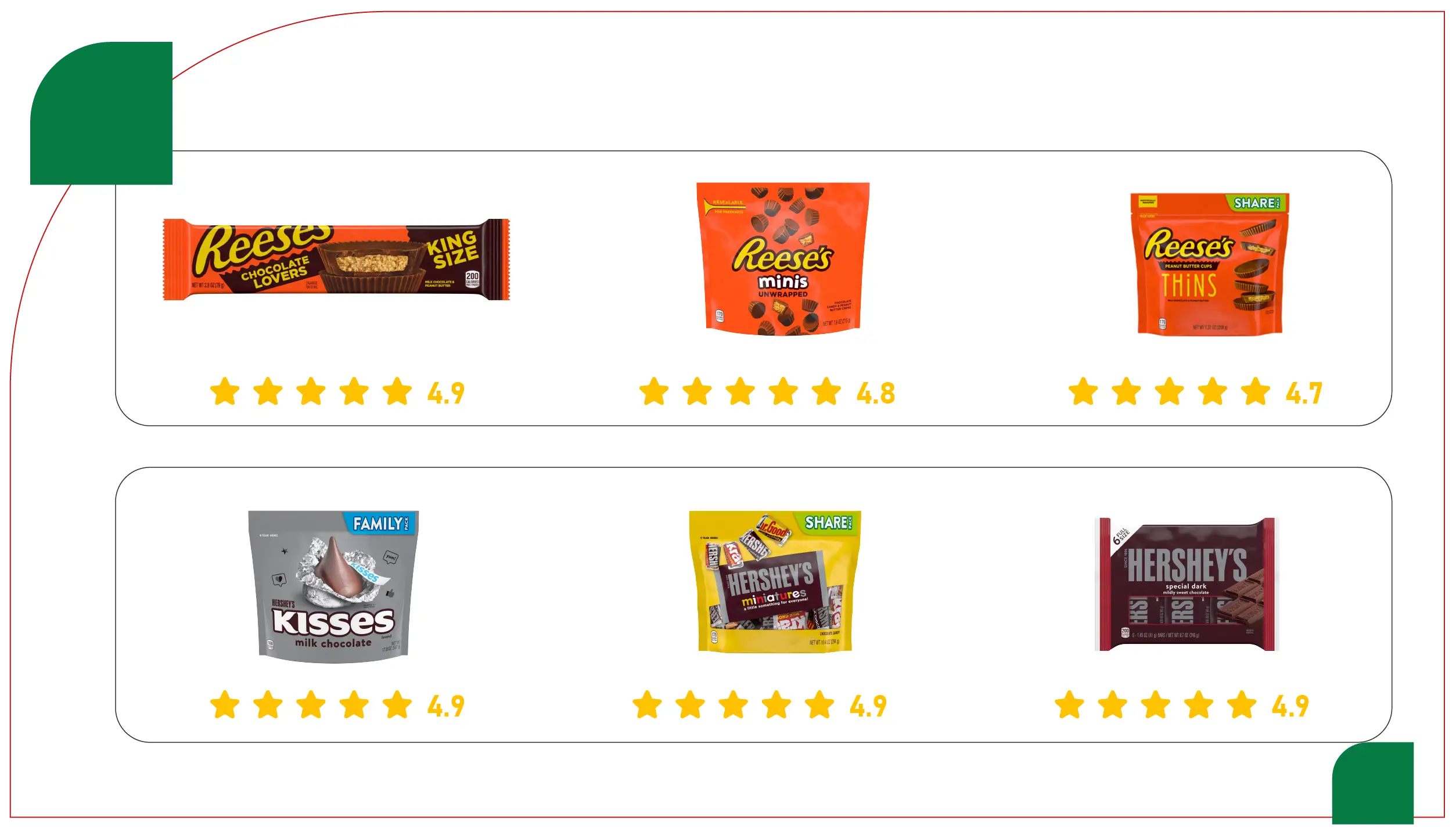

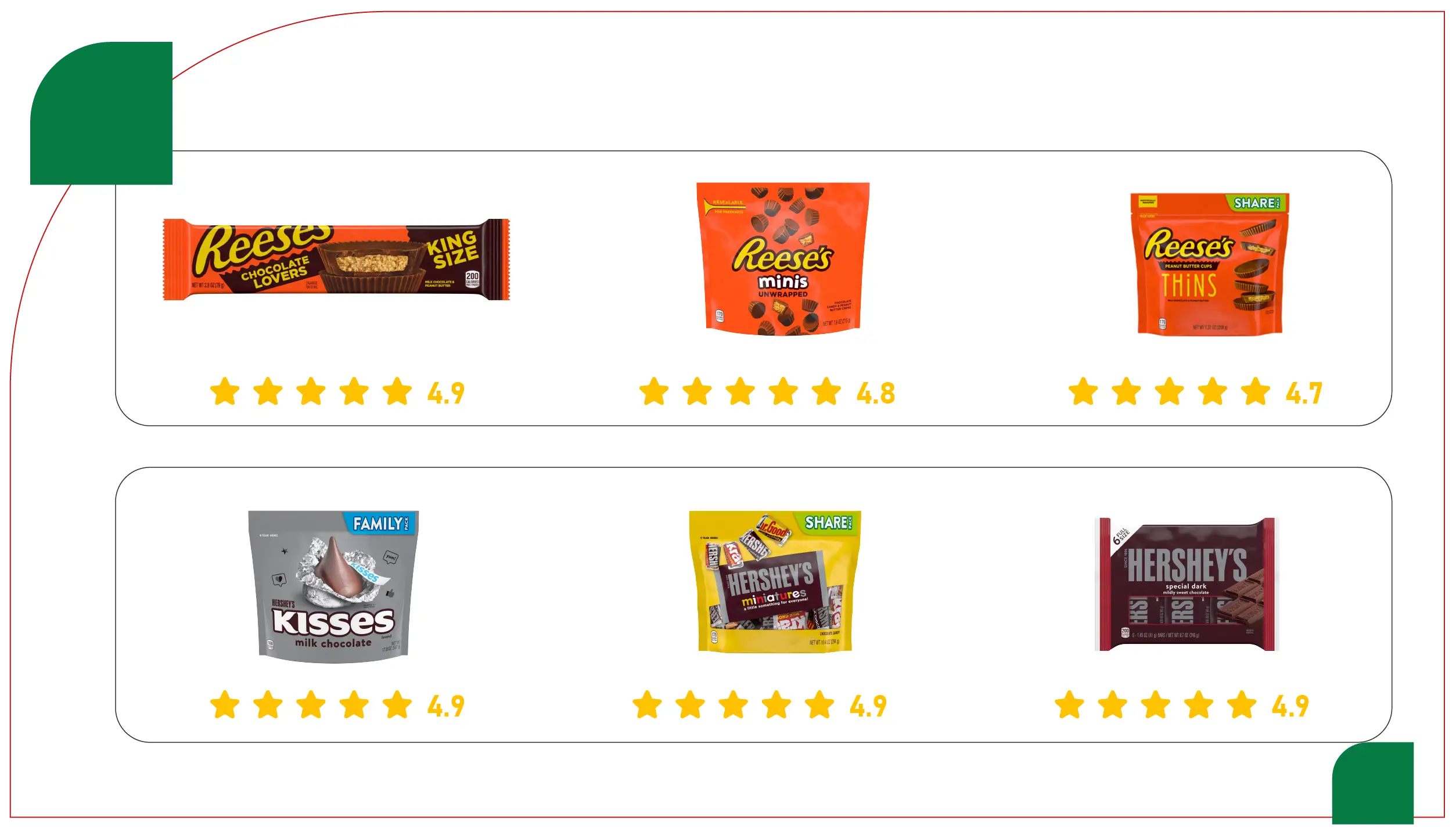

Top-Rated Reese’s and Hershey’s Products

Customer ratings reveal perceived product quality and satisfaction. Highlighting the highest-rated chocolates provides insights into which products delight consumers most.

- Reese’s Top-Rated Products: Reese’s Chocolate Lovers Pack (4.9), Reese’s Minis (4.8), and Reese’s Peanut Butter Cups (4.7) stand out for taste and value.

- Hershey’s Top-Rated Products: Hershey’s Kisses (4.8), Hershey’s Miniatures Assortment (4.8), and Hershey’s Special Dark Chocolate (4.7) earn praise for flavor and texture.

Pricing Strategy Comparison

Reese’s pricing strategy primarily emphasizes volume packs and mid-range affordability, catering to customers who prefer buying in bulk to maximize value. This approach targets families and frequent buyers who look for cost-effective options without compromising on taste. In contrast, Hershey’s adopts a more diversified, tiered pricing model that includes both premium and budget-friendly products. This allows Hershey’s to appeal to a wider audience—from casual snackers seeking affordable treats to premium buyers looking for specialty chocolates. By offering varied packaging sizes and price points, Hershey’s can capture multiple market segments, enhancing its reach and competitiveness across different consumer preferences and purchasing behaviors.

Consumer Sentiment and Reviews

Analyzing customer feedback using natural language processing on scraped Amazon reviews reveals distinct sentiment patterns for both brands. Reese’s products are frequently praised for their signature peanut butter flavor, creamy texture, and satisfying taste, which consistently delight consumers. Many customers express strong brand loyalty and appreciation for Reese’s unique chocolate-peanut butter combination. Hershey’s, meanwhile, receives positive reviews for its classic chocolate taste and variety of offerings, appealing to traditional chocolate lovers. However, some Hershey’s products face occasional criticism related to packaging durability and product freshness. Understanding these sentiments allows brands to address concerns and strengthen customer satisfaction through product improvements and communication.

Seasonal and Promotional Trends

Historical pricing data scraped from Amazon shows clear seasonal trends for Reese’s and Hershey’s products, especially during major shopping festivals like Diwali, Christmas, and Valentine’s Day. Both brands strategically reduce prices and offer promotions during these peak periods to boost sales volume. They leverage Amazon’s promotional tools such as lightning deals, discount coupons, and bundle offers to attract bargain hunters and gift shoppers. These seasonal price dips not only drive higher purchase frequency but also increase brand visibility on the platform. Careful timing of promotions in sync with festivals and holidays has proven effective in capturing impulse buyers and increasing overall revenue during high-traffic shopping windows.

Supply and Availability Insights

Using grocery delivery scraping API services, we monitored stock levels and availability of Reese’s and Hershey’s chocolates on Amazon. The data revealed that popular bulk packs and best-selling variants sometimes experience stockouts due to sudden demand spikes, especially during holiday seasons and special promotions. Delays in restocking can negatively affect customer satisfaction and lead to lost sales opportunities. Timely inventory replenishment is crucial for maintaining brand reliability and ensuring a seamless shopping experience. Retailers and brands that closely monitor supply fluctuations and coordinate with Amazon’s logistics can better meet consumer demand, reduce stockout instances, and build trust with shoppers seeking uninterrupted product availability.

Impact of Quick Commerce on Chocolate Sales

The rapid growth of fast grocery delivery services has significantly transformed consumer purchasing behaviors, especially in the chocolate segment. Our analysis of web scraping quick commerce data reveals a noticeable increase in last-minute chocolate purchases through platforms like Amazon Prime Now and other quick delivery apps. Consumers are increasingly opting for smaller pack sizes to satisfy immediate cravings or for convenient gifting, rather than buying in bulk. This trend highlights the importance of on-demand availability and speedy delivery in today’s fast-paced lifestyle. For chocolate brands and retailers, adapting to this shift means optimizing inventory for quick commerce channels and offering diverse packaging options tailored to impulse buys. Leveraging data from fast delivery platforms allows businesses to better anticipate demand surges, enhance customer satisfaction, and capitalize on the convenience-driven market segment.

Recommendations for Stakeholders

- For Retailers: Use insights from grocery price dashboard tools to optimize stock and pricing strategies according to consumer demand and seasonal trends.

- For Marketers: Target campaigns highlighting top-rated and affordable options, leveraging sentiment insights to tailor messaging.

- For Brands: Continuously monitor competitor pricing and product availability via web scraping to maintain competitive advantage.

Conclusion

Both Reese’s and Hershey’s demonstrate strong market performance on Amazon, with distinct strengths:

- Reese’s dominates in peanut butter chocolate variants and affordability.

- Hershey’s excels in classic milk chocolate assortments and premium options.

- Both brands maintain high customer satisfaction and competitive pricing.

By leveraging grocery pricing data intelligence tools, stakeholders can harness real-time insights to enhance product offerings, optimize pricing, and improve customer engagement. Integrating grocery price tracking dashboard into operational workflows will further solidify a brand’s competitive edge.

Grocery store datasets gathered through continuous scraping efforts form the backbone of actionable market intelligence, ensuring brands stay ahead in a rapidly evolving e-commerce environment.

Contact for Scraping Services

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.