Introduction

The global celebration of Halloween has evolved into one of the most commercially vibrant occasions for grocery retailers and e-commerce platforms. From candy and chocolates to costumes, snacks, and beverages, the seasonal surge in consumer spending creates a unique opportunity for analyzing buying patterns across nations. Using advanced techniques to Scrape Regional Halloween Grocery Demand Mapping, analysts can now monitor real-time product trends, pricing fluctuations, and inventory dynamics across markets.

The study aims to Scrape Halloween Grocery Demand by Country to identify variations in product categories, consumer preferences, and promotional tactics that drive festive week sales.

By leveraging Country-wise Halloween Grocery Data Scraping, researchers can gather high-volume datasets from retail platforms such as Walmart, Tesco, Coles, and Carrefour. These datasets help reveal purchasing peaks, regional flavor preferences, and promotional intensity across major economies.

The report also focuses on methods to Extract Grocery Demand Data for Halloween Across Regions, enabling stakeholders to understand how demographic, cultural, and climatic differences shape grocery consumption during Halloween week.

Global Overview of Halloween Grocery Demand

Halloween grocery demand is no longer confined to the United States. The festival’s increasing popularity in the UK, Australia, Canada, and several European countries such as Germany, France, and Spain has diversified the product landscape. While candy remains the core item, other product categories like bakery goods, soft drinks, and quick snacks see noticeable spikes.

Below is a comparative table summarizing Halloween grocery spending by region in 2024 and projected for 2025.

| Country/Region |

Halloween Week Grocery Sales 2024 (USD Million) |

Projected Sales 2025 (USD Million) |

YoY Growth (%) |

| USA |

5,240 |

5,820 |

11.0 |

| UK |

1,260 |

1,440 |

14.3 |

| Australia |

890 |

980 |

10.1 |

| Canada |

1,050 |

1,210 |

15.2 |

| Top European Countries (Germany, France, Spain, Italy, Netherlands) |

2,180 |

2,470 |

13.3 |

Analysis:

The United States continues to dominate with nearly 50% of the global Halloween grocery expenditure. However, the fastest growth is recorded in Canada and the UK, driven by the increasing adoption of online grocery delivery apps and creative product bundling by retailers.

Regional Trends and Insights

USA: Retail Powerhouse of Halloween Grocery Spending

The U.S. accounts for the largest share of Halloween-related grocery purchases globally. The surge in candy, cookies, chips, and beverages is closely monitored through e-commerce APIs and retailer dashboards. Retailers like Walmart, Kroger, and Target use data intelligence to track micro-trends such as neighborhood-level preferences and flash sale performance.

Through process to Scrape Halloween Grocery Trends Across USA, analysts can uncover insights into category diversification, comparing bulk candy packs versus single-serve options, and understanding urban versus rural purchase ratios. This regional data supports better inventory alignment and targeted promotions.

UK: Digital Promotions and Thematic Bundles

The United Kingdom’s grocery demand during Halloween has increased significantly, fueled by creative marketing from Tesco, Asda, and Sainsbury’s. UK consumers show higher spending on themed bakery items, chocolates, and beverages.

Using Web Scraping Halloween Grocery Demand Data in UK, analysts can monitor online marketplaces to measure price competitiveness and stock availability. UK retailers leverage digital advertising tied with limited-edition Halloween SKUs, resulting in spikes in web traffic and cart conversions. Quick commerce players like Deliveroo and Gorillas are also playing a major role in same-day grocery deliveries during this period.

Australia: Family-oriented Demand Structure

Australia’s Halloween celebration is centered around family-friendly gatherings and home parties rather than large-scale trick-or-treating. This creates distinct consumption behavior patterns, with greater spending on baked goods, chips, and beverages compared to candy.

Through methods to Scrape Halloween Grocery Demand Across Australia, analysts can extract structured datasets on seasonal grocery demand across Coles, Woolworths, and IGA. The data reveals a steady 10% year-on-year growth in grocery purchases tied to Halloween, supported by an increase in imported candy and beverages that cater to globalized tastes.

Canada: Candy Imports and Local Production Mix

Canada’s Halloween grocery data exhibits a strong demand for confectionery items, with both local and imported brands competing for market share. Retailers use dynamic pricing to attract customers early in the week, with discounts intensifying near October 31.

The ability to Extract Halloween Grocery Market Data in Canada allows analysts to distinguish between locally sourced and imported candy sales, helping brands fine-tune supply chains. Canadian grocery data also highlights the rising role of bilingual marketing campaigns appealing to both English and French-speaking regions.

Top European Countries: Rising Festive Participation

Across Top European Countries such as Germany, France, Spain, Italy, and the Netherlands, Halloween grocery demand has grown steadily, though consumer behavior differs from North American patterns. Europeans tend to spend more on bakery and beverage products than candy, and quick commerce delivery has accelerated sales in urban zones.

Using tools to Extract Halloween Grocery Demand Data Across Top European Countries, analysts identify a steady transition toward premium candy assortments and sustainable packaging. Grocery stores are focusing on locally sourced products, eco-friendly wrappers, and niche organic candy offerings to appeal to environmentally conscious consumers.

Methodology: Data Sources and Extraction Techniques

This analysis employed automated and manual scraping techniques across multiple retail websites and APIs. Platforms included global e-commerce portals, national grocery apps, and quick-commerce aggregators.

Through the Top European & Global Halloween Grocery Data Scraper, structured datasets were compiled on price fluctuations, availability, and promotional frequency. Each data point was timestamped, cleaned, and normalized for currency differences and exchange rate adjustments.

Key variables collected:

- Product Name and SKU

- Brand Category (Candy, Beverage, Bakery, Snack)

- Price Before and After Promotion

- Country of Sale

- Delivery Type (Standard, Express, Quick Commerce)

- Rating and Review Data

This systematic data pipeline allowed for consistent trend comparison across geographies.

Comparative Analysis by Category

The following table summarizes the category-wise distribution of grocery sales during Halloween Week 2025.

| Product Category |

USA (%) |

UK (%) |

Australia (%) |

Canada (%) |

Top European Countries (%) |

| Candy & Chocolate |

48 |

44 |

35 |

46 |

32 |

| Beverages |

18 |

20 |

26 |

22 |

28 |

| Bakery Items |

14 |

18 |

22 |

16 |

23 |

| Snacks (Chips, Popcorn) |

12 |

10 |

12 |

10 |

11 |

| Other Groceries |

8 |

8 |

5 |

6 |

6 |

Observations:

- Candy and chocolates dominate across all countries, but the share is declining in Europe due to growing interest in baked and organic products.

- Beverage and snack consumption in Australia and Europe is growing due to more home-based celebrations.

- The U.S. market continues to favor multipack candies and branded assortments.

Regional Consumer Behavior Insights

USA

- Consumers begin Halloween purchases two weeks early, with strong preference for bulk candy packs.

- Data scraping reveals that sales of premium candy brands rose 18% year-on-year.

- Quick commerce orders spiked by 27% on October 30–31 due to last-minute shopping behavior.

UK

- Price sensitivity is higher, with 60% of consumers opting for discounted candy bundles.

- Themed bakery items, such as pumpkin-shaped cookies, saw a 22% increase in sales.

- Tesco’s “Halloween Express” section recorded its highest-ever footfall and online traffic.

Australia

- E-commerce grocery platforms noted that household-sized snack packs sold faster than single candy bars.

- Halloween beverage sales, including flavored sodas and juices, rose 19%.

- Rising temperatures in late October influenced consumer preference toward chilled products.

Canada

- Early-bird discounts generated 25% of total candy sales.

- Demand for organic and allergen-free candy increased significantly.

- Bilingual promotions improved cross-regional sales conversions.

Europe

- Online grocery penetration during Halloween reached 32%.

- France and Germany led Halloween snack sales, while Spain and Italy showed higher bakery item demand.

- Promotions on sustainable packaging items resonated with eco-conscious shoppers.

Data Integration and Analytical Findings

Advanced analytics tools were used to evaluate price elasticity, promotional timing efficiency, and basket composition. The study found that real-time discount adjustments contributed to a 7–9% uplift in average order value across most platforms.

Through process to Scrape Halloween Grocery Demand Across Top Countries, analysts identified patterns of synchronization between online and offline promotions. Retailers that maintained consistent pricing across channels observed better customer retention and reduced cart abandonment rates.

Furthermore, Grocery App Data Scraping services enabled granular-level tracking of real-time inventory depletion, especially during peak demand days. This insight helps retailers anticipate restocking needs and plan logistics with higher precision.

The Role of Quick Commerce in Halloween Grocery Sales

The growing influence of instant delivery services has revolutionized Halloween grocery consumption patterns. Quick commerce platforms like Uber Eats, Gopuff, and Getir have shortened the purchase-to-delivery cycle, enabling last-minute buying surges.

By leveraging Web Scraping Quick Commerce Data, researchers can assess which product categories experience the highest demand volatility. The Halloween week analysis revealed that snack and candy orders placed through 15-minute delivery services increased by 32% compared to standard delivery methods.

This shift highlights how quick commerce isn’t merely convenience-driven—it also drives incremental sales growth during seasonal peaks.

Retailer Adaptation and API Integration

Retailers now integrate Grocery Delivery Scraping API Services to synchronize pricing and promotions dynamically across regions. Such APIs help compare prices between competitors in real time and adjust discounts accordingly.

This automation not only enhances user experience but also enables retailers to capture data points for advanced forecasting models. For instance, Walmart and Carrefour used algorithmic models to predict candy stockouts with 89% accuracy during Halloween 2024, improving fulfillment rates significantly in 2025.

Predictive Modeling and Dashboards

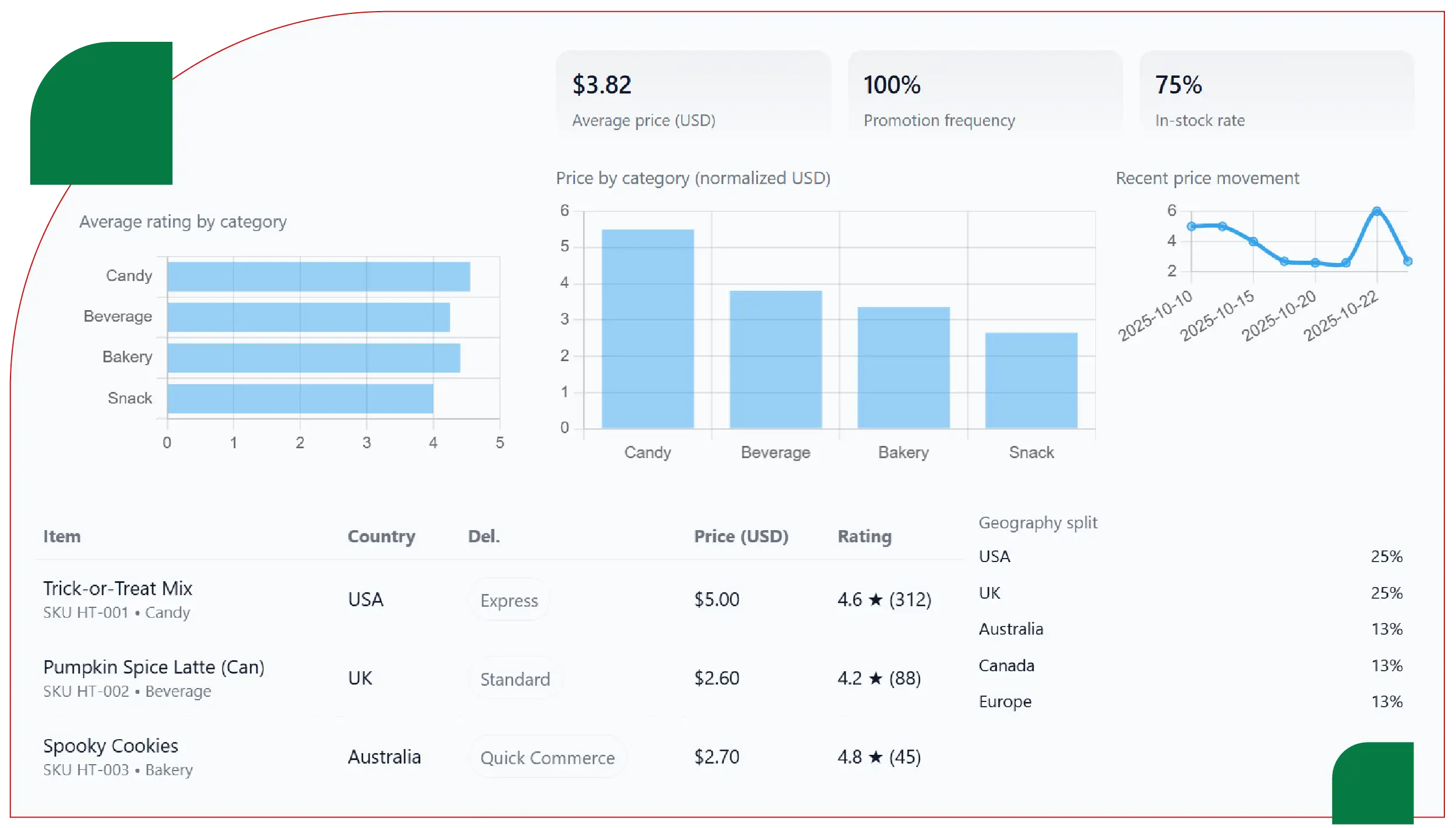

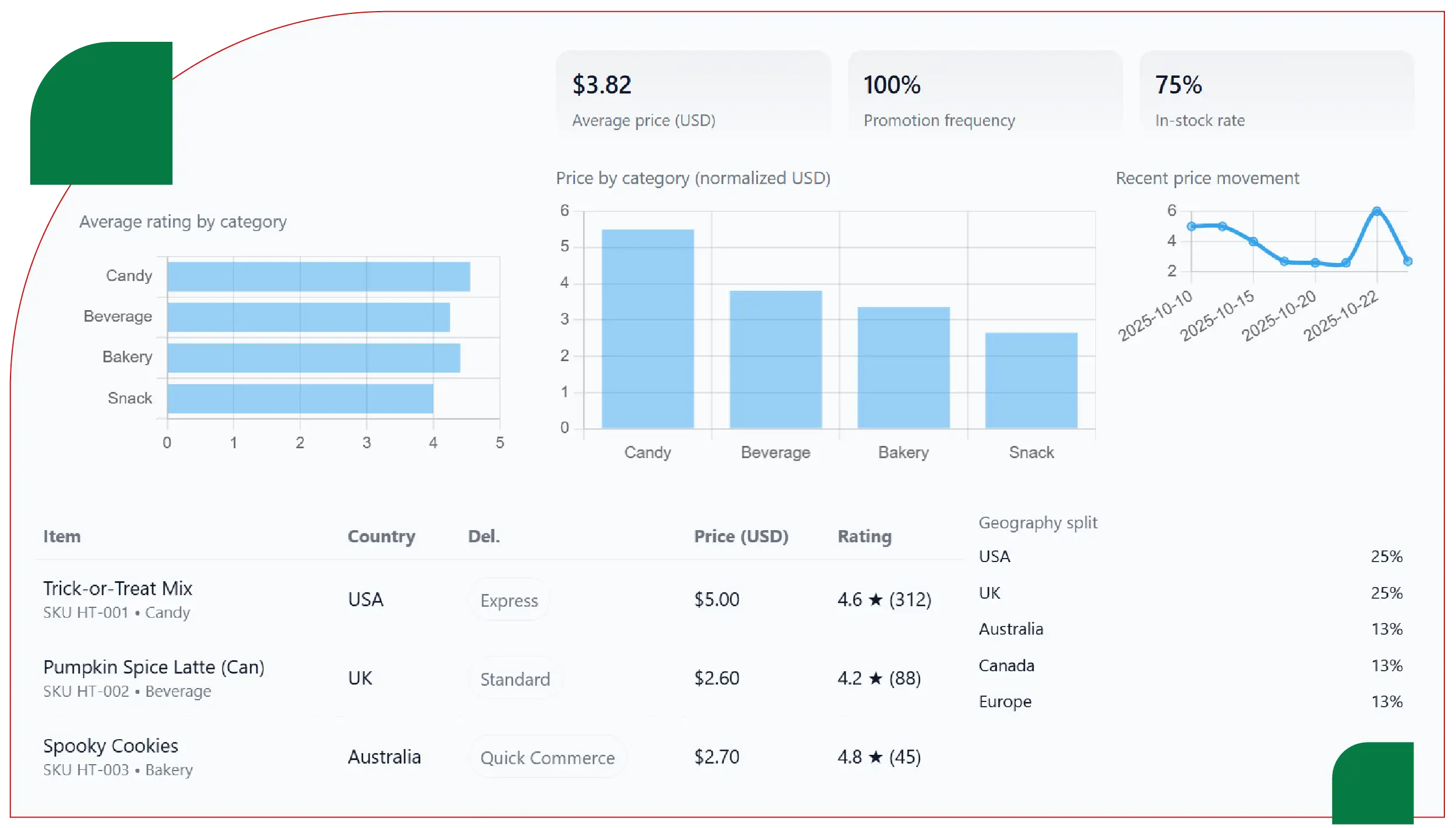

Retailers are increasingly investing in AI-driven analytics tools that visualize festive sales data through dashboards and intelligence suites. The introduction of a Grocery Price Dashboard allows data teams to track multi-country price variations across thousands of SKUs.

The dashboard also integrates competitive intelligence, enabling cross-platform comparisons of discounts, delivery fees, and consumer engagement metrics. These insights enhance decision-making during the short yet impactful Halloween shopping period.

Key Considerations for Businesses

- Cultural Context Matters – Local traditions influence grocery product preferences; hence, regional adaptation of product portfolios is crucial.

- Timing Drives Conversions – Early-week promotions generate steady engagement, but last-minute offers yield higher conversion rates.

- Pricing Uniformity – Maintaining consistent online and offline pricing builds trust and improves repeat purchases.

- Sustainability Appeal – Eco-friendly packaging and ethical sourcing resonate strongly, especially in European markets.

- Technology Investment – Retailers with API-enabled intelligence tools respond faster to market fluctuations.

Observations and Future Outlook

- Cross-country data scraping highlights a steady convergence of Halloween grocery behaviors globally.

- The demand is expanding beyond candy to include gourmet bakery, beverages, and organic items.

- Automation and predictive analytics will continue to redefine how retailers plan festive season campaigns.

- Regional quick commerce ecosystems are emerging as key enablers of convenience-driven sales.

- Future demand forecasting models will rely heavily on real-time, multi-source scraped datasets to ensure supply chain resilience.

Conclusion

The comparative study on Halloween grocery spending reveals how evolving consumer behaviors, e-commerce integration, and rapid logistics systems have transformed global holiday retail. Each region exhibits unique buying triggers, yet the overarching trend is toward digital-first, data-driven sales optimization.

By using advanced analytics tools like a Grocery Price Tracking Dashboard, retailers can forecast demand spikes, adjust prices dynamically, and monitor competitor performance. Combining these capabilities with Grocery Pricing Data Intelligence ensures smarter decisions and improved profit margins. Moreover, integrating real-time Grocery Store Datasets across multiple countries will help grocery brands develop global benchmarks for festive retail strategies—ensuring scalability, efficiency, and precision in every future Halloween season.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.