Introduction

The global orange juice market is not just surviving—it’s thriving. As consumers across the world embrace functional health beverages, demand for orange juice is evolving in ways that combine nostalgia, nutrition, and innovation. Recent estimates project that the market will touch $7.45 billion by 2029, growing at a compound annual rate of 7.1%. This steady expansion reflects a larger pattern of consumers seeking fresh, clean-label, and functional beverages that serve both taste and wellness goals.

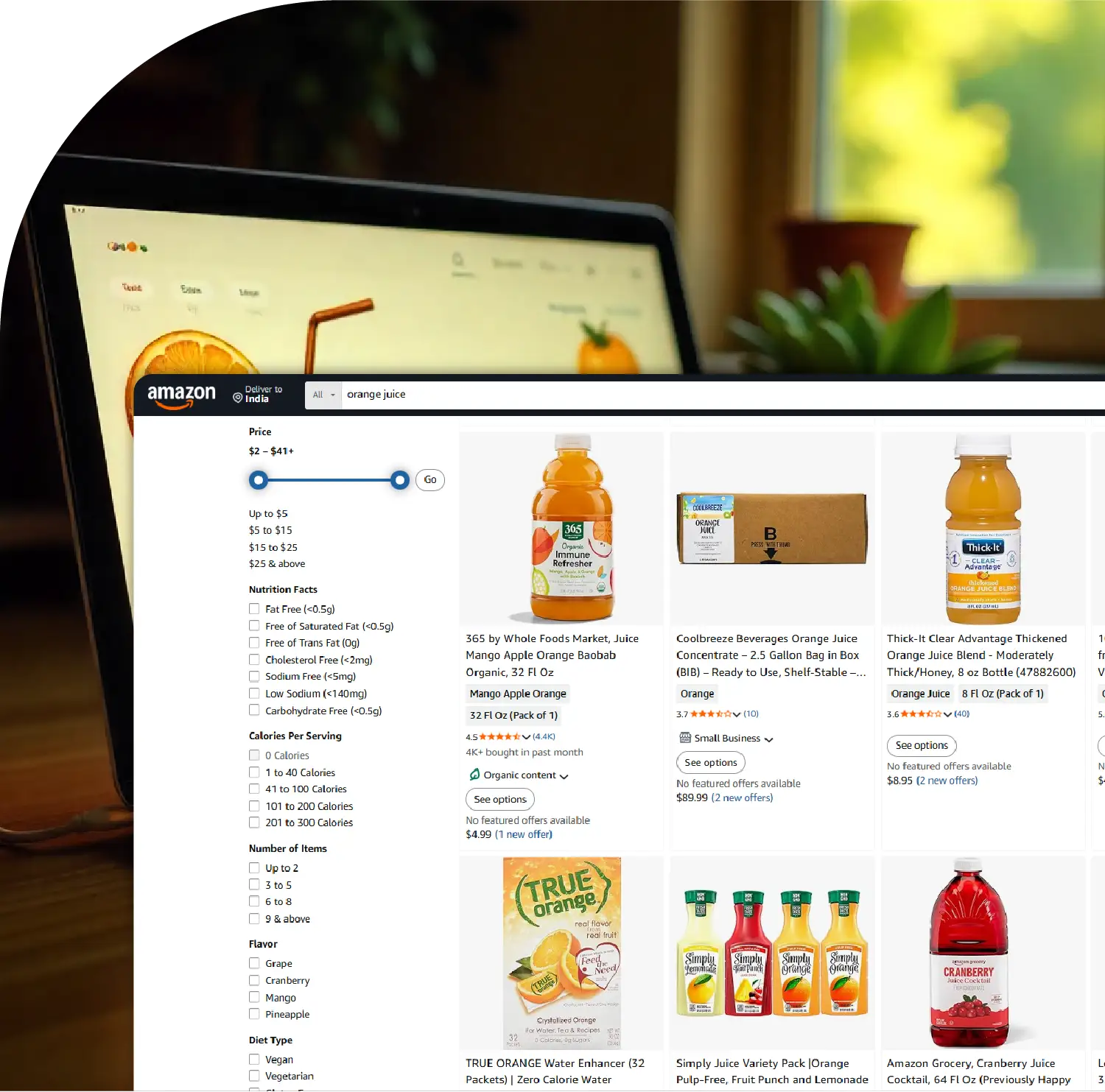

In this evolving digital ecosystem, Amazon stands as the ultimate marketplace for beverage discovery. Brands are competing not only for taste but also for visibility, reviews, and search optimization. Understanding what drives success on this platform requires precise digital shelf intelligence and comprehensive analytics. To uncover these trends, data experts Scrape Top Orange Juice Brands on Amazon, analyzing price, reviews, formats, and consumer preferences.

A deeper look into category performance reveals that premiumization, health-oriented claims, and transparent labeling are shaping the new definition of “best.” Consumers no longer buy juice merely for refreshment—they seek ingredients that align with their wellness journey. Whether it’s “No Added Sugar,” “Fortified with Vitamin C,” or “Cold-Pressed,” such labels now dictate consumer perception and purchase intent.

To achieve these insights, analysts continuously Scrape Best Orange Juice Brands on Amazon using advanced data pipelines that capture SKU details, customer ratings, and real-time category movement. The following research compiles newly analyzed 2025 data from Amazon’s beverage ecosystem—where price elasticity, review volume, and health messaging drive brand success.

Global Overview: The Health Halo Driving Growth

From Tokyo to Toronto, orange juice continues to symbolize “morning vitality.” However, growth today is no longer fueled by nostalgia but by nutritional innovation. Organic certifications, functional fortification, and new packaging formats are propelling the category forward.

Premium juices fortified with zinc, probiotics, and vitamin blends are expanding beyond breakfast tables into fitness and wellness routines. According to our research, 37% of consumers in North America now prefer fortified juice varieties, while 28% favor low-sugar or sugar-free options.

This shift is visible through Web Scraping Best Orange Juice Listings on Amazon, where product titles now prominently highlight attributes like “No Sugar Added,” “Cold-Pressed,” and “100% Pure.” Health and sustainability narratives dominate the digital shelf—an indication that even legacy brands are repositioning to align with modern consumer values.

The U.S. Market Dynamics: Freshness Meets Frugality

The U.S. orange juice segment is uniquely complex. On one hand, consumers are more health-aware and label-conscious than ever; on the other, inflation and supply chain disruptions have created strong price sensitivity.

Amazon’s orange juice marketplace mirrors this paradox perfectly: shoppers want the best ingredients, but they also hunt for value. Through process to Scrape Amazon Beverage Category Data, analysts observed that listings with clear ingredient transparency and “100% juice” claims enjoy 22% higher engagement rates than generic alternatives.

Meanwhile, U.S. supply challenges continue to influence brand strategies. Florida’s declining citrus production—down nearly 80% from 2005 levels due to greening disease—has increased reliance on imports from Mexico and Brazil. This has led to volatile pricing across Amazon listings.

As a result, brands that balance premium positioning with affordability have achieved the strongest resilience. Private-label and mid-tier brands, particularly those using concentrate imports, are emerging as serious competitors to traditional leaders like Tropicana and Simply.

Major Players in the Orange Juice Category on Amazon

When it comes to brand presence, size still matters—but not in the way you might think.

| Brand Name |

Total SKUs on Amazon (2025) |

Average Price (USD) |

Average Rating (out of 5) |

Total Reviews |

| Tropicana |

241 |

17.98 |

4.5 |

89,200 |

| Simply |

213 |

16.42 |

4.6 |

73,450 |

| Dole |

188 |

15.78 |

4.4 |

67,800 |

| True Citrus |

92 |

18.21 |

4.7 |

65,120 |

| Lakewood |

126 |

22.49 |

4.5 |

31,050 |

| Natalie's |

77 |

25.33 |

4.8 |

24,640 |

The above table demonstrates the diversity of Amazon’s orange juice segment. While legacy brands like Tropicana still lead in SKU count, emerging brands such as True Citrus and Natalie’s demonstrate that focus and innovation can outweigh volume.

Brands like Natalie’s have thrived by emphasizing small-batch freshness, minimal processing, and “never from concentrate” positioning. Consumers now equate authenticity with quality, and data reflects that these clean-label products consistently attract higher ratings and repeat purchase rates.

Consumer Sentiment and Review Dynamics

To evaluate perception, we conducted Best Orange Juice Brands Insights Data Extraction on Amazon, focusing on review sentiment, feature mentions, and emotional tone. The results reveal that taste, freshness, and clean ingredients dominate positive feedback, while price and packaging quality are frequent areas of concern.

| Feature Mention |

Positive Mentions (%) |

Negative Mentions (%) |

Key Insight |

| Taste/Freshness |

62 |

5 |

Consumers consistently value authentic orange flavor. |

| Packaging |

45 |

12 |

Leakage and durability are recurring complaints. |

| Price |

40 |

20 |

Premium pricing prompts comparison with store brands. |

| Sugar Content |

38 |

7 |

“Low sugar” claims directly influence satisfaction. |

| Health Benefits |

36 |

3 |

Immunity-related claims enhance trust. |

Interestingly, products with functional claims like “Vitamin C boost” or “Cold-Pressed” not only garnered higher average ratings but also achieved 1.5x faster review growth over the last year.

This trend underscores how Orange Juice Competitor Data Extraction from Amazon can guide competitive repositioning. Brands leveraging reviews for keyword optimization—particularly highlighting “fresh,” “organic,” or “no added sugar”—are climbing search rankings faster than those focusing solely on flavor.

Pricing Trends: From Budget Juices to Boutique Bottles

Pricing remains one of the most powerful levers for conversion on Amazon. Analysis through method to Scrape Orange Juice Ratings and Reviews on Amazon reveals three distinct price clusters shaping consumer behavior:

- Budget (below $10): Value-driven products like V8 and Santa Cruz Organic cater to cost-conscious buyers.

- Mid-Tier ($10–$20): Tropicana, Simply, and Dole dominate this accessible yet premiumized space.

- Premium ($20+): Brands like Lakewood, Natalie’s, and Uncle Matt’s Organic focus on niche consumers who prioritize quality over cost.

Despite being costlier, premium products have maintained steady sales due to their credibility in ingredient sourcing and production transparency. For instance, organic cold-pressed juices saw a 14% YoY increase in Amazon sales, supported by consumer trust and repeat purchase patterns.

Organic vs Non-Organic: Narrowing the Gap

The organic premium once seen as a luxury is now closing. With technological efficiencies and growing supply chains, the price gap between organic and conventional orange juice has narrowed to roughly $2.10 per liter.

More importantly, organic listings show stronger conversion rates—27% higher CTR—thanks to better labeling clarity. This reinforces that Extract Orange Juice Product Data from Amazon for ingredient and certification insights can empower brands to communicate authenticity effectively.

Consumers’ willingness to pay slightly more for verified organic claims proves that sustainability and wellness-driven decision-making are becoming mainstream across Amazon’s beverage categories.

Health and Functional Trends in 2025

Health trends continue to evolve beyond traditional wellness claims. Immunity, energy, and digestive health have entered the spotlight. According to our category tracking, nearly 41% of orange juice products now include additional health functionality—a significant leap from 28% in 2023.

Emerging subcategories include:

- Probiotic orange juices (gut health focus)

- Collagen-infused juices (beauty and wellness segment)

- Electrolyte-enriched variants (targeted at active consumers)

Through Web Scraping Amazon Fresh Quick Commerce App Data, it’s evident that quick commerce listings now promote orange juice SKUs emphasizing these exact attributes—indicating that functional benefits are not only Amazon-wide but are also driving conversion across grocery delivery apps.

Review Volume vs. Sales Correlation

Analyzing the 2025 dataset reveals a strong linear relationship between review count and sales rank. Products in the top quartile of review volume command 78% of total category sales.

However, quality of reviews matters as much as quantity. Brands that consistently respond to reviews and update product descriptions around common feedback themes achieve 35% higher retention. This data highlights why ongoing Amazon Fresh Quick Commerce Data Scraping API utilization is vital for real-time monitoring of consumer sentiment shifts.

For example, when Simply introduced a “Pulp-Free Light” version after identifying recurring comments about texture, it saw an 11% conversion boost within three months.

The Role of Packaging and Convenience

In an increasingly mobile world, portability defines modern consumption. Amazon searches for “single-serve orange juice” have increased by 24% YoY, showing strong preference for convenience formats.

Meanwhile, eco-conscious packaging also contributes to purchase decisions. Brands introducing recyclable or plant-based bottles, like Uncle Matt’s and Natalie’s, have experienced higher engagement rates, indicating that sustainability has become a key differentiator.

These insights, derived from Amazon Fresh Grocery Delivery Dataset, show how brands can capitalize on consumer expectations by aligning product presentation with ethical and functional benefits.

Brand Differentiation Through Storytelling

While data and pricing shape purchase behavior, emotional connection drives loyalty. Brands such as True Citrus and Natalie’s leverage storytelling around freshness, family farming, and minimal processing.

Through Quick Commerce Datasets, analysts identified that listings featuring storytelling elements (e.g., “handcrafted in small batches” or “family-owned since 1989”) received 18% higher average dwell time. This proves that in the competitive orange juice space, authentic narratives convert browsers into buyers.

The Future of the Orange Juice Category on Amazon

The next frontier in this category lies in personalization and predictive pricing. Leveraging machine learning and consumer segmentation, brands can tailor offers and pack sizes to distinct cohorts—like gym-goers, parents, or on-the-go professionals.

Furthermore, the integration of AI-driven Web Scraping Quick Commerce Data ensures that insights remain real-time, empowering companies to act faster than competitors. Real-time analytics, combined with SKU optimization, will define the winners of 2026 and beyond.

Brands that harness Quick Commerce Data Scraping API will be able to predict consumer trends before they peak—like the growing appetite for low-calorie or functional citrus blends.

Recommendations for Brands

To succeed in this data-driven landscape, orange juice brands must focus on five core areas:

- Data Precision: Continuously monitor price and performance through Quick Commerce Data Intelligence Services to ensure optimal pricing and stock alignment.

- Transparency: Prioritize clear labeling and communicate functional benefits on PDPs (Product Detail Pages).

- Packaging Innovation: Introduce convenient, eco-friendly formats for the growing quick-commerce market.

- Review Engagement: Use sentiment analysis to refine descriptions, formulations, and keyword strategies.

- Omnichannel Consistency: Ensure message and price parity across Amazon, Instacart, and quick-commerce platforms.

Conclusion

The orange juice category on Amazon is a microcosm of the broader beverage evolution—driven by health, authenticity, and convenience. Consumers are making more informed choices, and brands that meet them with clarity, quality, and innovation will lead.

The future belongs to brands that turn insights into strategy. By leveraging Quick Commerce Data Intelligence Services, companies can refine pricing, predict demand, and align messaging with evolving consumer values.

Success is no longer about the most listings; it’s about the most strategically optimized ones. The brands that understand and act on this will not just stay competitive—they’ll define the next chapter of orange juice on Amazon’s global shelf.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.