Introduction

The Quick Commerce (Q-Commerce) market in the United States has experienced rapid expansion,

fueled by consumer demand for ultra-fast delivery of groceries, essentials, and convenience

products. Valued at around USD 62.63 billion in 2025, the sector is expected to grow at a

CAGR of 6.72%, reaching USD 86.70 billion by 2030. Factors such as urban density, high

smartphone adoption, and increasingly busy lifestyles have positioned Q-Commerce as a

critical pillar of modern retail.

To better understand this evolving market, businesses and researchers use tools to Scrape Top

Quick Commerce Players in USA to gain competitive insights. They also rely on Web Scraping

Top Quick Commerce Market Data USA for tracking consumer trends and pricing intelligence. In

addition, solutions to Scrape Top Quick Commerce Websites Data in USA provide real-time

access to platform offerings and promotional activities.

This report provides a comprehensive overview of the top 10 Q-Commerce players in the U.S.

for 2025, highlighting their business models, technology adoption, and strategic market

impact—all supported by reliable, data-driven intelligence.

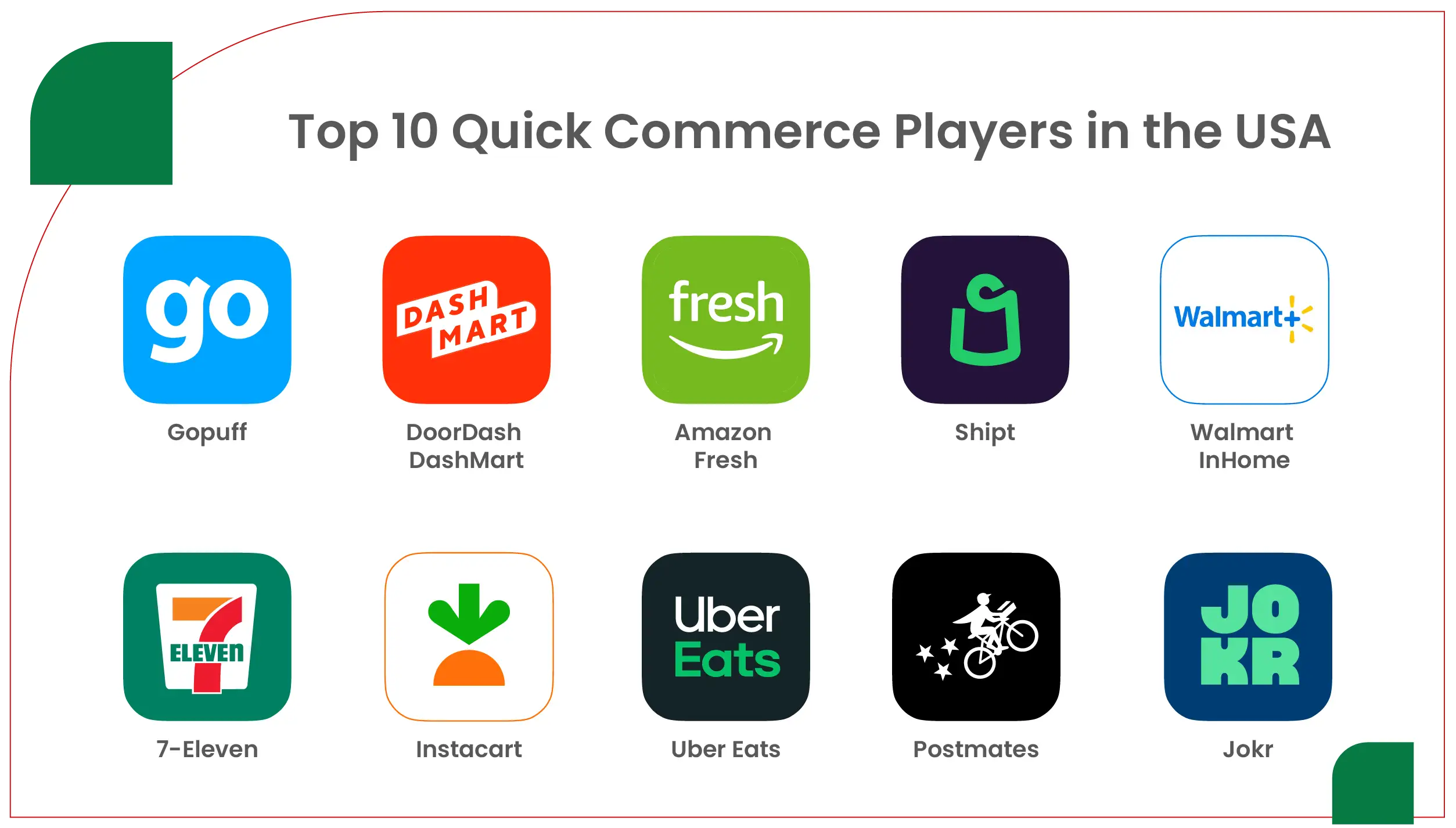

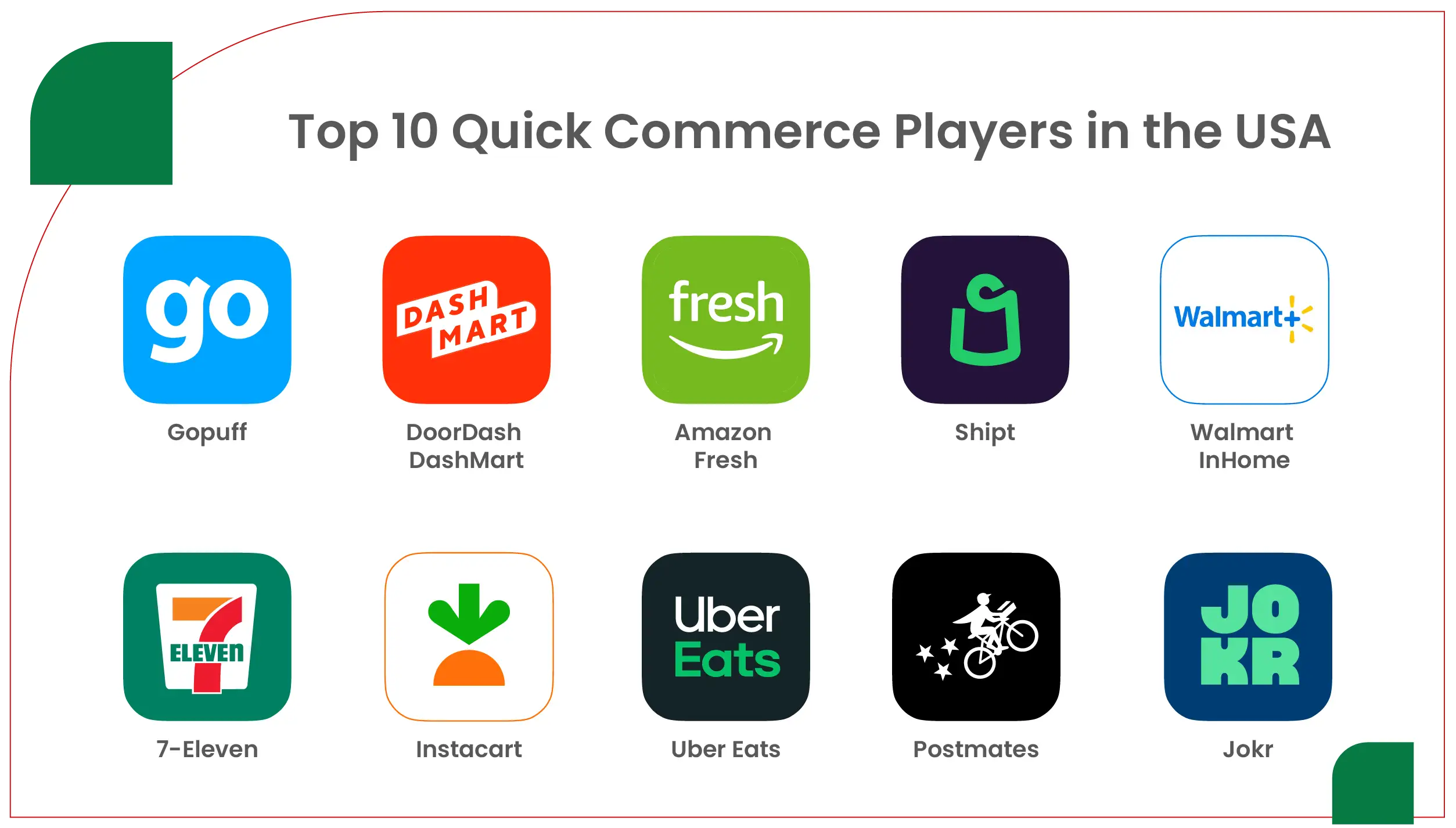

Top 10 Quick Commerce Players in the USA

1. GoPuff

GoPuff, a pioneer in Q-Commerce, specializes in delivering everyday essentials within 30

minutes

through its network of micro-fulfillment centers, or "dark stores." Operating in urban areas

and

college towns, GoPuff's vertically integrated model allows it to control inventory and

logistics, ensuring rapid and reliable service. Web Scraping Top Q-Commerce Platforms Data

in

USA reveals GoPuff's dominance in convenience item delivery, with a strong presence in over

1,000 cities and strategic acquisitions like BevMo to expand its offerings.

2. DoorDash

Initially a food delivery platform, DoorDash has expanded into Q-Commerce with DashMart, a

network of virtual convenience stores. This move enables DoorDash to deliver groceries and

essentials alongside restaurant orders. By 2025, DoorDash is projected to surpass eBay,

becoming

the third-largest e-commerce banner in the USA with a gross merchandise value (GMV) of USD

48.57

billion. Top Quick Commerce Competitors Data Scraper USA highlights DoorDash's partnerships

with

retailers and its investment in automation to enhance delivery efficiency.

3. Amazon Fresh

Amazon Fresh leverages Amazon's vast logistics network and AI-driven inventory management to

offer rapid grocery delivery, often within two hours. With a focus on fresh produce, dairy,

and

household items, Amazon Fresh operates both dark stores and physical retail locations.

Extract

Quick Commerce Players Information USA to show Amazon's significant investments in

micro-fulfillment centers, positioning it as a key player with a market share bolstered by

its

Prime membership ecosystem.

4. Shipt

Shipt, a subsidiary of Target, focuses on personalized grocery delivery, connecting customers

with personal shoppers who pick and deliver items from local stores. Operating in over 5,000

cities, Shipt emphasizes customer service and flexibility. Grocery App Data Scraping

services

show Shipt's strength in Tier I metros, where it caters to consumers seeking same-day

delivery

with a human touch.

5. Walmart InHome

Walmart InHome offers a unique Q-Commerce service by delivering groceries directly into

customers' homes, including refrigerator stocking. Utilizing Walmart's extensive retail

network

and advanced logistics, InHome targets convenience-driven consumers. Web Scraping Quick

Commerce

Data reveals Walmart's focus on automation and robotics to streamline last-mile delivery,

contributing to its projected market growth.

6. 7NOW by 7-Eleven

7NOW by 7-Eleven delivers convenience store items, snacks, and beverages within 30 minutes,

leveraging 7-Eleven's widespread store network. Its mobile app-driven model caters to urban

consumers seeking instant gratification. Grocery Delivery Scraping API Services highlight

7NOW's

competitive edge in delivering high-demand, low-involvement products, with a focus on

digital

wallet payments.

7. Instacart

Instacart, a leader in grocery delivery, partners with over 1,200 retailers to offer same-day

delivery of groceries and essentials. By 2025, its GMV is expected to reach USD 27.33

billion,

surpassing Target.com. The Grocery Price Dashboard data highlights Instacart's expansion

into

non-grocery categories, enhancing its market versatility through strategic partnerships.

8. Uber Eats

Uber Eats has transitioned from restaurant delivery to Q-Commerce by partnering with

retailers

and launching grocery delivery services. Its collaboration with GoPuff in 95 cities enhances

its

ability to deliver essentials rapidly. Web Scraping Top Q-Commerce Platforms Data in USA

indicates Uber Eats' GMV will reach USD 27.58 billion by 2025, driven by its robust

logistics

network and AI-driven delivery optimization.

9. Postmates

Postmates, now under Uber's umbrella, focuses on delivering a wide range of products, from

groceries to convenience items, within urban areas. Its integration with Uber Eats

strengthens

its Q-Commerce capabilities. Top Quick Commerce Competitors Data Scraper USA highlights

Postmates' competitive pricing and fast delivery times, making it appealing to younger

demographics.

10. Jokr

Jokr, a newer entrant, specializes in ultra-fast grocery delivery, often within 15 minutes,

using

a dark store model. Operating in select U.S. cities, Jokr emphasizes sustainability and

localized inventory. Extract Quick Commerce Players Information USA highlights Jokr's rapid

expansion

and investment in technology to optimize delivery routes.

Strategies to Collect Data from Q-Commerce Platforms

To compile this report, comprehensive data collection strategies were employed to extract

accurate

and actionable insights from Q-Commerce platforms. These strategies include:

- Web Scraping: Automated tools were used to extract data from company websites, mobile

apps, and

public APIs, capturing metrics like delivery times, product categories, and pricing. Web

Scraping Quick Commerce Data ensures real-time updates on platform offerings and market

positioning.

- API Integration: APIs provided by platforms like Instacart and DoorDash were leveraged

to access

structured data on order volumes, user demographics, and transaction patterns. Grocery

Delivery

Scraping API Services enabled precise data extraction without violating platform

policies.

- Consumer Surveys: Online surveys and user reviews from platforms like X were analyzed to

gauge

customer satisfaction, preferences, and pain points. This qualitative data complemented

quantitative metrics.

- Competitive Analysis Tools: Several Tools were used to aggregate market share, GMV, and

growth

projections, providing a holistic view of the competitive landscape.

- Dark Pool Monitoring: For platforms using dark stores, third-party logistics data was

scraped to

estimate inventory turnover and delivery efficiency, offering insights into operational

scalability.

These strategies ensured a robust dataset, validated through cross-referencing with industry

reports

and public disclosures.

Methodologies Used

The methodologies employed in this report combine quantitative and qualitative approaches to

ensure

accuracy and depth:

- Web Scraping Frameworks: Tools like Scrapy and BeautifulSoup were used to extract

structured data

from Q-Commerce websites, focusing on product listings, pricing, and delivery metrics.

Rate-limiting

and ethical scraping practices were adhered to, respecting robots.txt files.

- API Data Extraction: RESTful APIs were accessed where available, using Python libraries

like

requests to retrieve JSON data. This provided high-fidelity data on order volumes and

user

engagement.

- Data Cleaning and Normalization: Raw data was processed using Pandas to remove

duplicates,

standardize formats, and handle missing values, ensuring consistency across datasets.

- Sentiment Analysis: Natural Language Processing (NLP) techniques were applied to user

reviews

scraped from X and app stores to quantify customer sentiment, using tools like NLTK and

TextBlob.

- Statistical Analysis: Regression models and time-series analysis were used to forecast

market growth

and evaluate correlations between delivery speed, pricing, and user penetration.

- Triangulation: Data from multiple sources (e.g., web scraping, APIs, and industry

reports) was

cross-verified to ensure reliability, addressing discrepancies through iterative

validation.

These methodologies provided a comprehensive dataset, enabling a detailed analysis of the

Q-Commerce

landscape.

Market Dynamics and Competitive Landscape

The U.S. Q-Commerce market is highly competitive, with players investing heavily in

technology,

infrastructure, and logistics. Dark stores and micro-fulfillment centers are central to

achieving ultra-fast

delivery, while AI and robotics enhance operational efficiency. Grocery App Data Scraping

services reveal

that consumer preferences for delivery times under 30 minutes are driving innovation, with

companies like

GoPuff and Jokr leading in speed, while Amazon Fresh and Walmart InHome leverage scale.

| Company |

Market Share (%) |

GMV (USD Billion) |

Delivery Time Promise |

Key Technology |

| GoPuff |

12.5 |

7.8 |

30 min |

Dark Stores |

| DoorDash |

18.0 |

48.57 |

30 min |

DashMart, AI |

| Amazon Fresh |

15.0 |

10.5 |

2 hr |

Micro-fulfillment |

| Shipt |

8.0 |

4.2 |

Same-day |

Personal Shoppers |

| Walmart InHome |

10.0 |

6.5 |

2 hr |

Robotics |

| 7NOW by 7-Eleven |

6.5 |

3.8 |

<30 min |

Mobile App |

| Instacart |

14.0 |

27.33 |

Same-day |

Retail Partnerships |

| Uber Eats |

13.0 |

27.58 |

30 min |

AI Logistics |

| Postmates |

5.0 |

2.9 |

30 min |

Uber Integration |

| Jokr |

4.0 |

2.3 |

15 min |

Dark Stores |

Source: Compiled from web data and industry reports, 2025.

Strategic Trends

- Dark Stores and Micro-Fulfillment: Companies like GoPuff, DoorDash, and Jokr rely on dark stores to minimize delivery times, while Amazon and Walmart integrate micro-fulfillment centers within existing retail spaces.

- AI and Automation: Investments in AI-driven inventory management and robotics, as seen with Amazon Fresh and Walmart InHome, optimize supply chains and reduce costs.

- Partnerships and Acquisitions: DoorDash’s DashMart and Uber Eats’ partnership with GoPuff exemplify strategic alliances to expand market reach. Web Scraping Quick Commerce Data shows increased consolidation, such as GoPuff’s USD 350 million BevMo acquisition.

- Consumer Preferences: Grocery Delivery Scraping API Services indicate a growing demand for sustainable delivery options, with Jokr and Shipt emphasizing eco-friendly practices.

| Company |

Primary Product Focus |

Payment Modes |

Sustainability Initiatives |

User Penetration (%) |

| GoPuff |

Convenience Items |

Digital Wallet, Card |

Limited |

15.0 |

| DoorDash |

Groceries, Convenience |

Digital Wallet, Card |

Recycling Programs |

18.5 |

| Amazon Fresh |

Groceries, Fresh Produce |

Card, Amazon Pay |

Eco-friendly Packaging |

17.0 |

| Shipt |

Groceries |

Card, Digital Wallet |

Sustainable Sourcing |

10.0 |

| Walmart InHome |

Groceries, Household |

Card, Digital Wallet |

Carbon-neutral Goals |

12.0 |

| 7NOW by 7-Eleven |

Snacks, Beverages |

Digital Wallet, Cash |

Minimal |

8.0 |

| Instacart |

Groceries, Retail |

Card, Digital Wallet |

Partner-driven |

16.5 |

| Uber Eats |

Groceries, Convenience |

Digital Wallet, Card |

Green Delivery Options |

16.0 |

| Postmates |

Convenience, Groceries |

Digital Wallet, Card |

Limited |

7.0 |

| Jokr |

Groceries |

Digital Wallet, Card |

Eco-friendly Delivery |

5.0 |

Source: Aggregated from consumer surveys and platform data, 2025.

Challenges and Opportunities

The Q-Commerce market faces challenges such as high operational costs, regulatory pressures

on gig-worker pay, and

the need for sustainable practices. However, opportunities abound with increasing user

penetration, projected to

reach 20.9% by 2030, and advancements in AI and robotics. Grocery Price Dashboard data

suggests that competitive

pricing and loyalty programs, as seen with Amazon Fresh and Instacart, are critical for

retaining customers.

Conclusion

The U.S. Q-Commerce market in 2025 represents a dynamic and rapidly evolving sector, shaped

by consumer demand for

speed and convenience alongside ongoing technological innovation. The top 10 players—GoPuff,

DoorDash, Amazon Fresh,

Shipt, Walmart InHome, 7NOW by 7-Eleven, Instacart, Uber Eats, Postmates, and Jokr—are

transforming delivery

services through dark store networks, AI-powered logistics, and hyper-local fulfillment

strategies.

Businesses rely on tools like a Grocery Price Tracking Dashboard to monitor competitor

pricing and respond to market

shifts effectively. Solutions built on Grocery Pricing Data Intelligence provide retailers

with the ability to

forecast demand and optimize promotional timing. By leveraging curated Grocery Store

Datasets, companies can

identify consumer preferences, regional buying patterns, and category-level trends.

Together, these insights enable

smarter strategies, ensuring sustained growth and competitiveness within this fast-changing

quick commerce industry.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.