Introduction

Halloween has evolved beyond costume parties and candy consumption, becoming a significant seasonal driver for the alcohol market in Europe. Retailers and e-commerce platforms observe notable fluctuations in liquor prices, influenced by promotions, supply chain dynamics, and consumer demand spikes. Using advanced data extraction techniques, researchers can now analyze these shifts in real time. This report focuses on Scraping Alcohol Price Fluctuations Across Top European countries to benchmark pricing trends, compare country-level strategies, and provide actionable intelligence for market analysis firms.

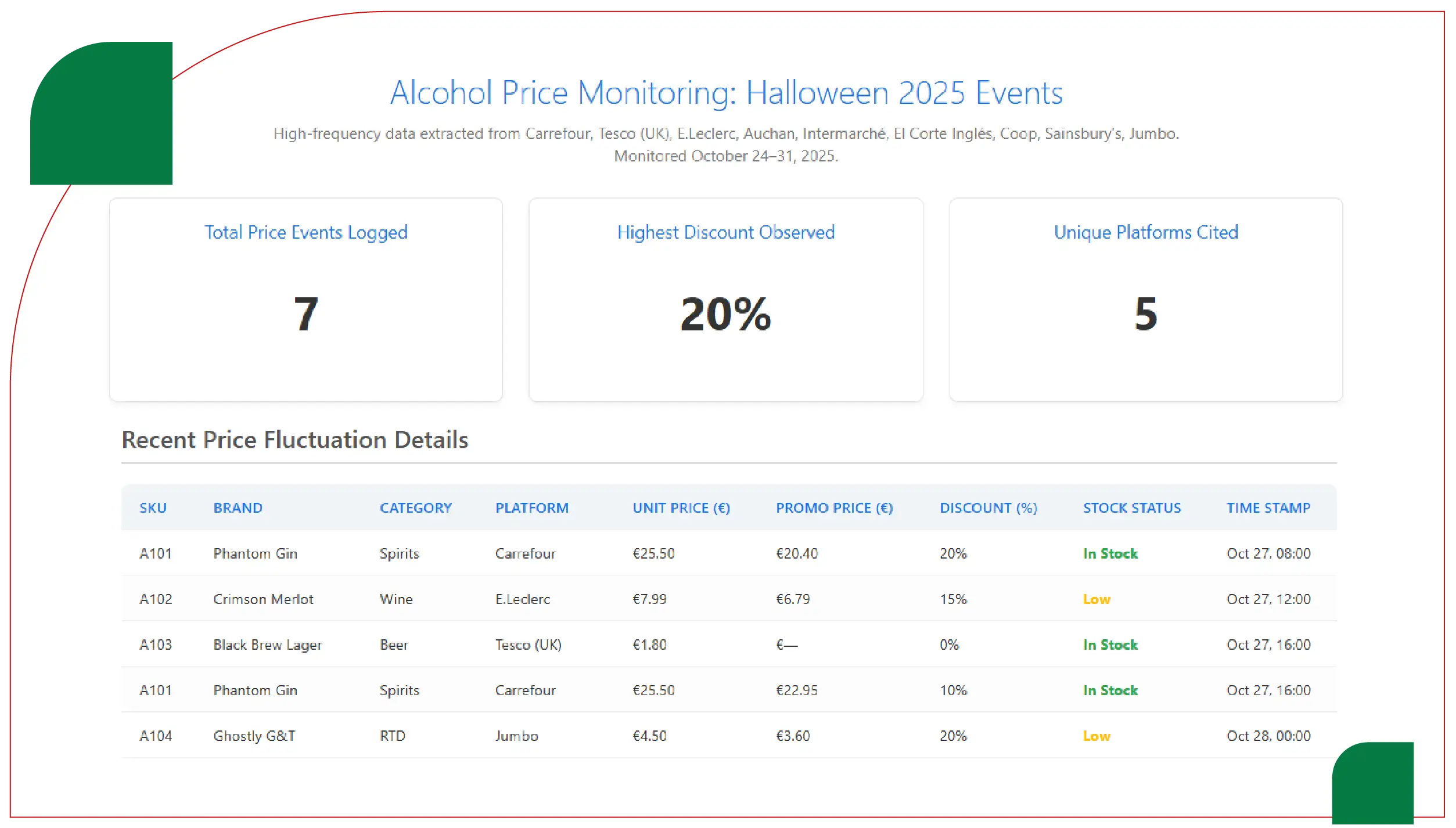

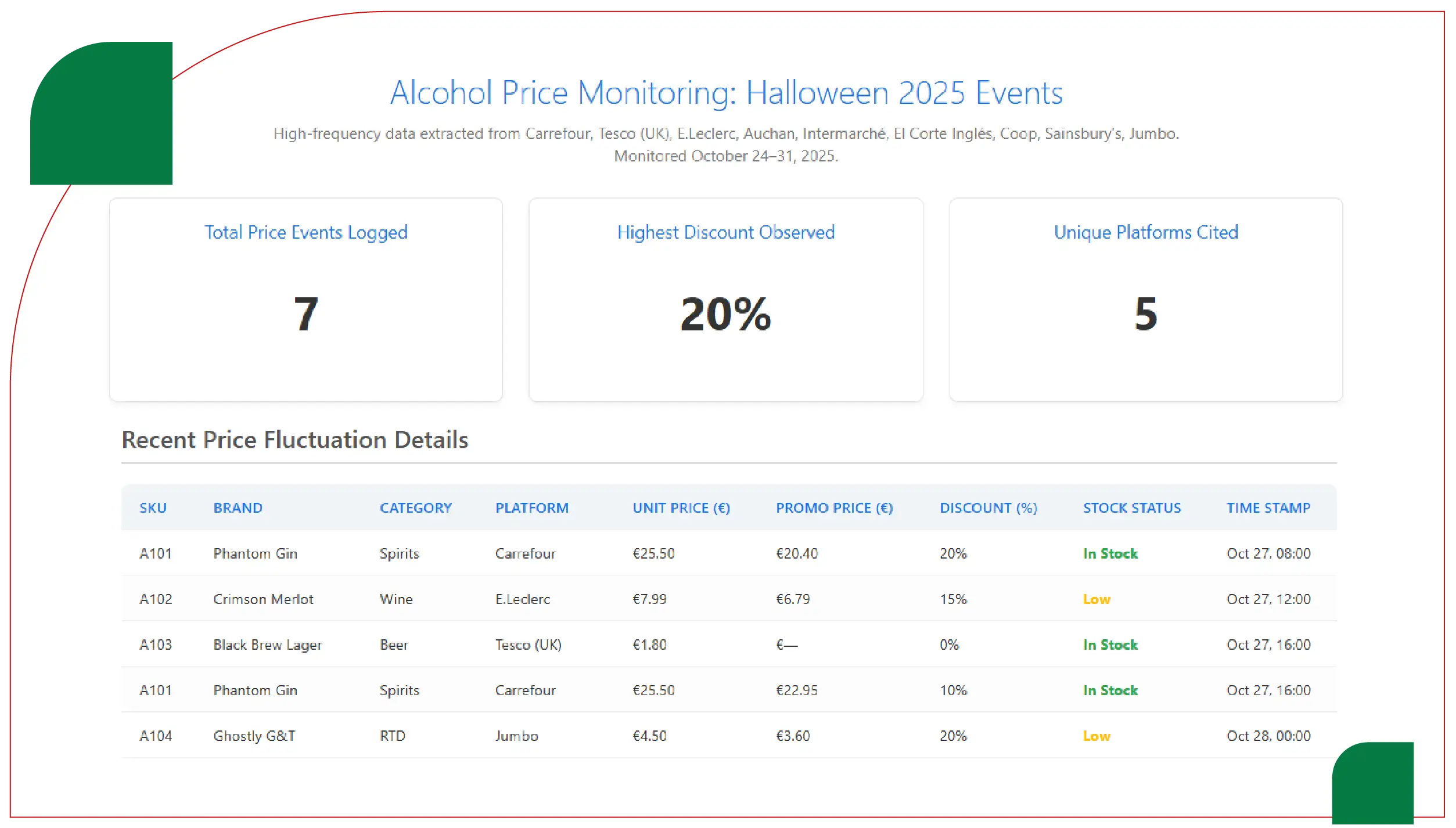

Through Halloween Week Alcohol Market Data Extraction – Europe 2025, we compiled comprehensive datasets covering spirits, wine, beer, and ready-to-drink beverages. Leveraging Web Scraping Alcohol Prices for Halloween Week 2025 in Europe, we monitored dynamic pricing and stock levels across multiple online grocery and liquor platforms, ensuring high-quality, cross-country comparability.

The study also outlines the applications of these datasets for market intelligence, competitive analysis, and strategic decision-making by retailers and analytics firms.

Research Objectives and Scope

The primary objective of this research is to analyze alcohol price fluctuations during Halloween Week 2025 across leading European markets. Key goals include:

- Benchmarking pricing strategies for spirits, wine, and beer.

- Identifying countries with the highest seasonal price volatility.

- Understanding promotional patterns and discount intensity.

- Highlighting dataset applications for market analysis firms in forecasting, competitive intelligence, and pricing strategy optimization.

Data was collected using automated web scraping tools and APIs from leading European e-commerce retailers and liquor marketplaces. The countries analyzed include Germany, France, Spain, Italy, and the Netherlands, representing a broad spectrum of market sizes, consumer preferences, and retail practices.

Data Sources and Methodology

The research employed methods to Extract Alcohol Price Fluctuations in Europe – Halloween 2025, capturing a wide array of pricing data points:

- Platforms Scraped: Carrefour, Tesco (UK), E.Leclerc, Auchan, Intermarché, El Corte Inglés, Coop, Sainsbury’s, Jumbo.

- Data Points: Product SKU, brand, category, unit price, promotional price, discount percentage, stock availability, and delivery options.

- Frequency: Data collected every 4–6 hours during October 24–31, 2025, to capture rapid price changes.

- Categories Covered: Spirits, wine, beer, ready-to-drink beverages, and specialty liquors.

By utilizing Alcohol Price Fluctuations Data Scraper for Halloween 2025, researchers ensured the collection of high-frequency, structured datasets suitable for advanced analytics, cross-country comparisons, and forecasting.

European Market Overview

European liquor markets exhibit considerable diversity in consumption patterns and pricing dynamics during Halloween Week. The key observations include:

- Germany: High consumption of spirits and premium beer, with moderate discounts.

- France: Wine dominates, with aggressive promotional campaigns on both spirits and wine.

- Spain: A mix of beer and wine, with smaller but frequent discounts.

- Italy: Focus on mid-range spirits and wine bundles for Halloween gatherings.

- Netherlands: Balanced demand across spirits and beer, with early-week price drops to stimulate purchases.

This heterogeneous landscape emphasizes the importance of strategy to Scrape Alcohol Prices Across Europe for Halloween Week 2025 for benchmarking strategies and understanding country-specific promotional impacts.

Price Benchmarking Analysis

Price fluctuations were analyzed across product categories, focusing on average price changes, discount intensity, and volatility during the week.

| Country |

Avg Unit Price (€) |

Avg Promotional Discount (%) |

Top-Selling Category |

Stock Availability (%) |

| Germany |

24.50 |

10 |

Spirits |

90 |

| France |

26.80 |

15 |

Wine |

88 |

| Spain |

22.30 |

12 |

Beer |

85 |

| Italy |

25.10 |

11 |

Spirits |

87 |

| Netherlands |

23.70 |

13 |

Beer |

89 |

Analysis:

- France exhibits the highest discount intensity, reflecting competitive wine promotions.

- Spirits dominate Germany and Italy, whereas beer leads in Spain and the Netherlands.

- Stock levels remain high (>85%) across all countries, ensuring availability during peak demand.

Temporal Price Fluctuations

Using Alcohol Price Fluctuation Data Scraping in Europe, hourly and daily price variations were tracked. Key trends include:

- Most countries reduced prices at the beginning of the week to capture early buyers.

- Germany and France showed significant mid-week price adjustments for spirits and wine.

- Netherlands and Spain applied gradual discounts through the week, peaking on October 31.

- Last-minute price reductions often coincided with high consumer activity on e-commerce and quick-commerce platforms.

These patterns demonstrate the value of real-time pricing data for optimizing stock and maximizing revenue during the Halloween period.

Country-Specific Pricing Insights

Germany

- Spirits account for 42% of Halloween liquor purchases.

- Premium and craft spirits experienced higher price volatility (up to 18%).

- Online promotions led to higher sales volume in urban regions.

France

- Wine sales dominate, contributing 48% of total liquor transactions.

- Discounts ranged from 10–20% across spirits and wine.

- Bundled promotions increased multi-item purchases, particularly for family gatherings.

Spain

- Beer represents 45% of alcohol sales.

- Smaller, frequent discounts maintain consumer engagement.

- Delivery options influenced last-minute purchase behavior.

Italy

- Mid-range spirits and wine bundles are popular.

- Discounts are modest but coupled with free delivery or gift promotions.

- Online ordering peaks on Halloween Eve.

Netherlands

- Beer and spirits are nearly equally consumed.

- Early-week discounts drive initial sales, while late-week promotions target last-minute buyers.

- Stock levels are carefully managed to prevent shortages.

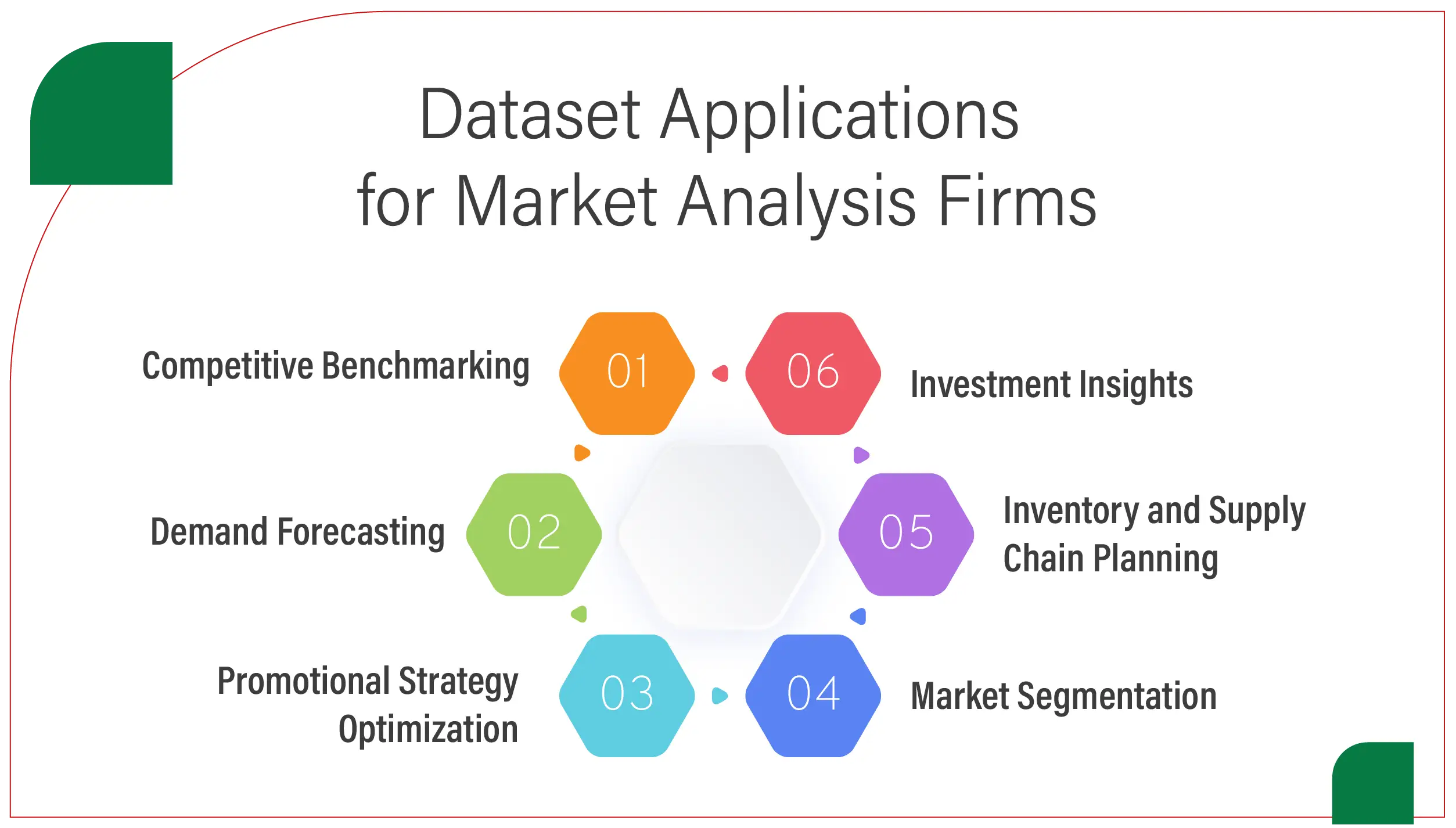

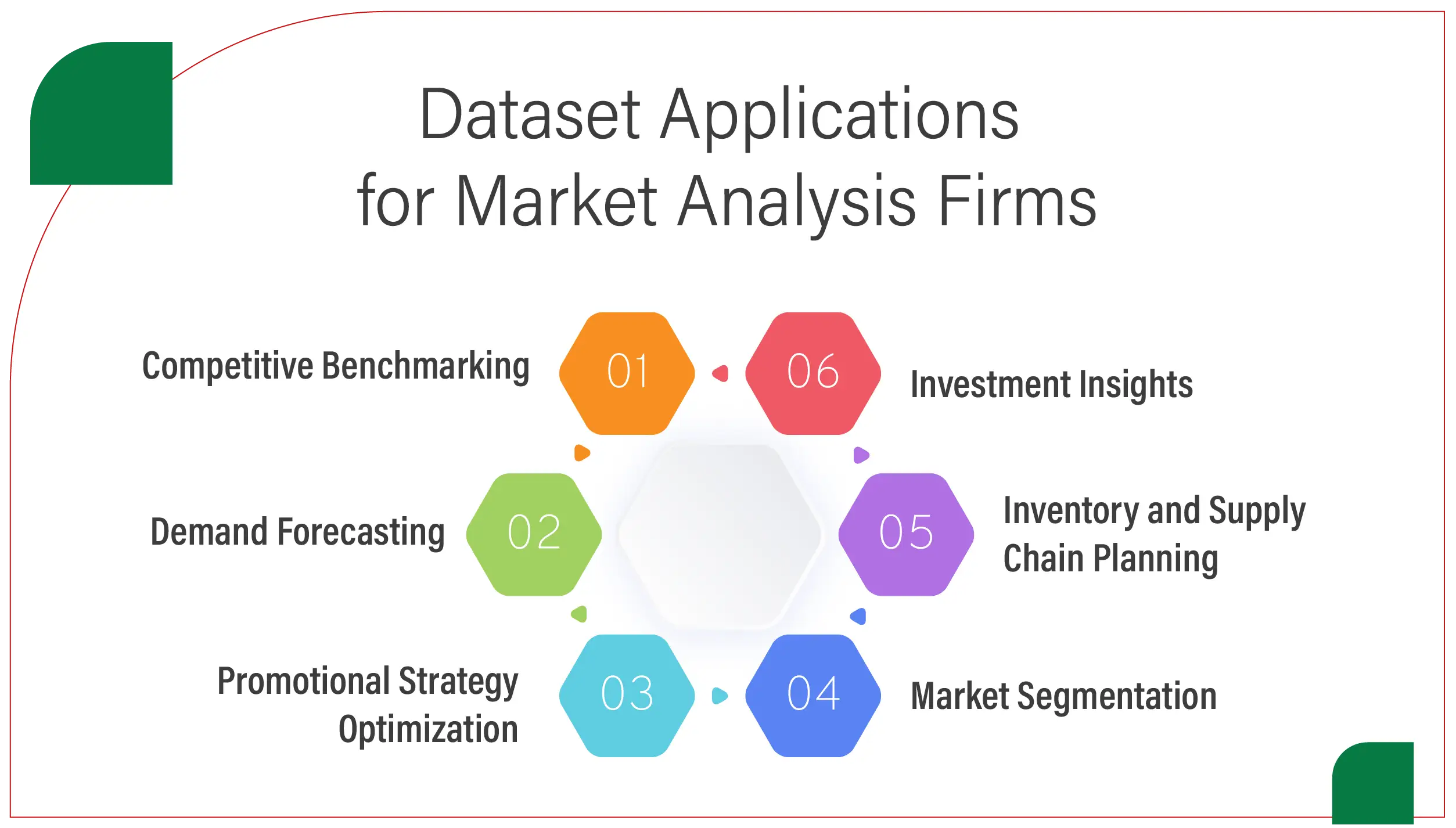

Dataset Applications for Market Analysis Firms

The structured datasets generated through steps to Extract Alcohol Price Fluctuations Across Top European countries have significant applications:

- Competitive Benchmarking: Compare pricing and promotional strategies across countries to identify best practices.

- Demand Forecasting: Historical price fluctuations combined with consumer behavior data enable predictive modeling for future Halloween weeks.

- Promotional Strategy Optimization: Analyze discount patterns to determine the most effective timing and intensity for campaigns.

- Market Segmentation: Segment consumers by category preference, purchase timing, and regional tendencies.

- Inventory and Supply Chain Planning: Identify high-demand products and anticipate stock shortages using trend data.

- Investment Insights: Inform stakeholders and investors about market potential and seasonal revenue opportunities.

Market analysis firms can leverage these datasets to create actionable reports, dashboards, and strategic recommendations for retailers and liquor brands.

Advanced Analytics and Dashboards

Retailers can integrate the datasets into analytics platforms using Halloween Week Alcohol Pricing Scraper Europe 2025 to visualize trends, compare across categories, and evaluate real-time market positioning. Key dashboard features include:

- Price volatility charts for spirits, wine, and beer.

- Discount impact on sales volume.

- Regional comparisons across countries and product categories.

- Last-minute sales monitoring to optimize promotions.

Using Liquor Price Data Scraping Services, firms can automate these dashboards, ensuring they are updated dynamically during Halloween week to support fast, data-driven decisions.

Comparative Category Analysis

| Category |

Germany |

France |

Spain |

Italy |

Netherlands |

| Spirits |

±12% |

±10% |

±8% |

±11% |

±9% |

| Wine |

±8% |

±15% |

±7% |

±10% |

±6% |

| Beer |

±7% |

±6% |

±12% |

±5% |

±10% |

| Ready-to-Drink |

±9% |

±8% |

±10% |

±7% |

±9% |

Insights:

- Wine exhibits the highest volatility in France, indicating aggressive promotional competition.

- Beer prices are more volatile in Spain and the Netherlands due to higher seasonal demand.

- Spirits maintain moderate fluctuations across all countries, with urban areas experiencing sharper discounts.

Market Implications and Strategic Recommendations

- Dynamic Pricing: Retailers should adopt real-time pricing models based on demand forecasts and competitor behavior.

- Promotion Timing: Early-week promotions capture pre-Halloween shoppers, while last-minute discounts boost final-week sales.

- Category Focus: Targeted campaigns for high-volatility categories (wine in France, beer in Spain) maximize ROI.

- Inventory Optimization: Using scraped price and stock data ensures sufficient supply while minimizing overstock risk.

- Cross-Country Insights: Benchmarking across markets allows multinational retailers to refine strategies and tailor offerings to regional consumer preferences.

By leveraging Alcohol and Liquor Datasets, firms can continuously refine their operational and marketing decisions during peak festive periods.

Observations and Key Takeaways

- France and Germany show the highest pricing fluctuations for spirits and wine.

- Spain and the Netherlands have consistent price adjustments throughout the week, targeting last-minute buyers.

- Bundle offers and discounts correlate strongly with increased multi-item purchases.

- High-frequency scraping provides granular insights that are otherwise unavailable through conventional market research.

- Datasets can be integrated into dashboards for continuous monitoring and predictive analytics.

The insights derived from Alcohol Price Fluctuation Data Scraping in Europe enable a proactive approach to market strategy and competitive positioning.

Conclusion

This Halloween Week Price Benchmarking Report 2025 highlights how we were able to Scrape Alcohol Price Data provides comprehensive intelligence for retailers, brands, and market analysis firms. Using Liquor Data Intelligence Services, the study captures pricing trends, category-specific volatility, and promotional dynamics across five major European markets.

By employing Liquor Price Tracking Dashboard, businesses can optimize pricing, forecast demand, and plan inventory effectively. These datasets are invaluable for competitive benchmarking, strategic planning, and enhancing operational efficiency during high-demand periods, ensuring market leaders stay ahead in the dynamic European alcohol market.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.