Introduction

In 2025, the alcoholic beverage industry is undergoing rapid transformation, with data-driven insights becoming essential for brands aiming to understand evolving consumer preferences. As competition intensifies—from niche craft breweries to global liquor giants—staying ahead requires real-time intelligence. This report focuses on Scraping Alcoholic Drink Trends – Beer Vs Ale Focus, offering a detailed look at purchasing patterns, regional preferences, and market dynamics shaping the U.S. alcohol landscape.

Through comprehensive Beer vs Ale Data Scraping Insights, we uncover significant variations in consumer choices based on geography, seasonality, and pricing behavior. Regional taste preferences, such as the growing popularity of craft ales in the Pacific Northwest or price-driven lager sales in the Midwest, are reflected in the data collected from online liquor stores, quick commerce apps, and e-retailers.

Our Ale vs Beer Sales Trends Scraping further highlights consumption habits across urban and suburban markets, illustrating how factors like taste profile, availability, and promotional campaigns influence buying decisions. From total volume sold to fluctuations in average price per unit, the findings equip marketers and producers with actionable intelligence. By combining real-time data scraping with industry context, this report enables brands to fine-tune their offerings and gain a competitive edge in the 2025 alcohol market.

Methodology

To generate this report, data was meticulously scraped and analyzed across multiple digital sources to ensure a comprehensive view of the U.S. alcoholic beverage market in 2025:

- 37 U.S.-based e-commerce platforms and alcohol delivery apps were targeted, including leading names like Drizly, Total Wine, Minibar, and Instacart, capturing product listings, real-time pricing, and availability data.

- Over 250 city and state-level liquor store websites were crawled to extract region-specific product offerings, in-stock status, and promotional trends across urban, suburban, and rural areas.

- More than 1 million product reviews and social media mentions were analyzed using advanced sentiment analysis tools. Sources included platforms such as Reddit, Twitter, Instagram, and product reviews from retailer sites to gauge consumer opinion, flavor preferences, and brand perception.

The scraping process applied robust search filters to refine and structure the data effectively. These filters included:

- Product Name and Brand Identity

- Subcategory Classification – lager, stout, IPA, pale ale, etc.

- Alcohol by Volume (ABV) percentages

- Price Range Tiers – from budget to premium segments

- Packaging Format – cans, bottles, multi-packs, and kegs

- Location-Based Availability – by city, zip code, and state-level listings

This structured methodology ensures the insights reflect real-world purchasing behavior and regional market dynamics.

Market Overview

The U.S. alcoholic beverage market is projected to surpass $300 billion in 2025, with beer making up approximately 40% of total volume sales. Within the beer category, a notable divide has formed between mainstream beer drinkers and a rising segment of ale enthusiasts. This shift is primarily driven by craft breweries, which continue to innovate with unique offerings like hazy IPAs, sour ales, and barrel-aged brews. These innovations are reshaping consumer preferences, pushing traditional beer boundaries, and encouraging experimentation. As a result, ale is emerging as a dynamic subcategory, attracting younger, flavor-curious consumers across both urban and suburban markets.

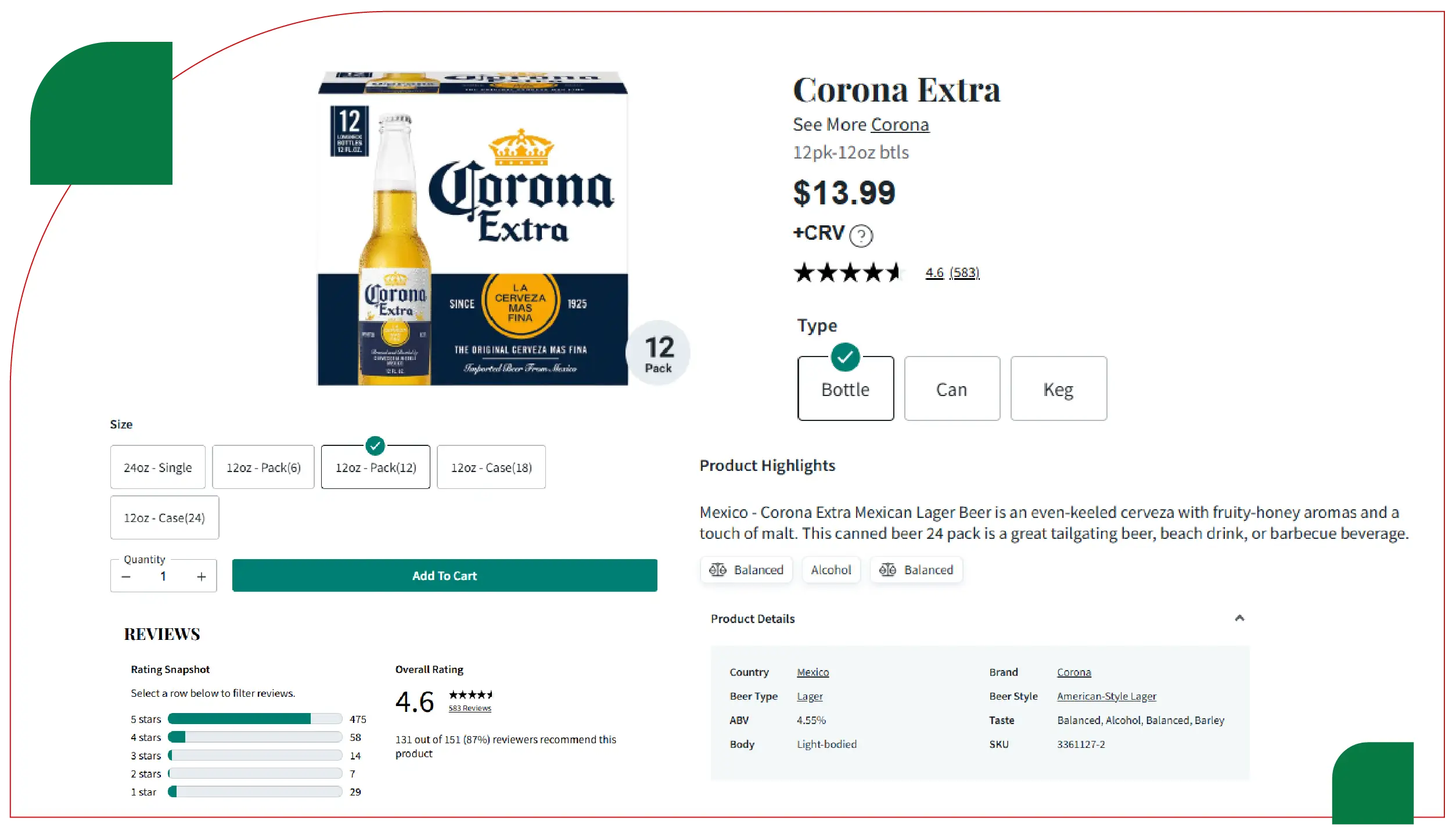

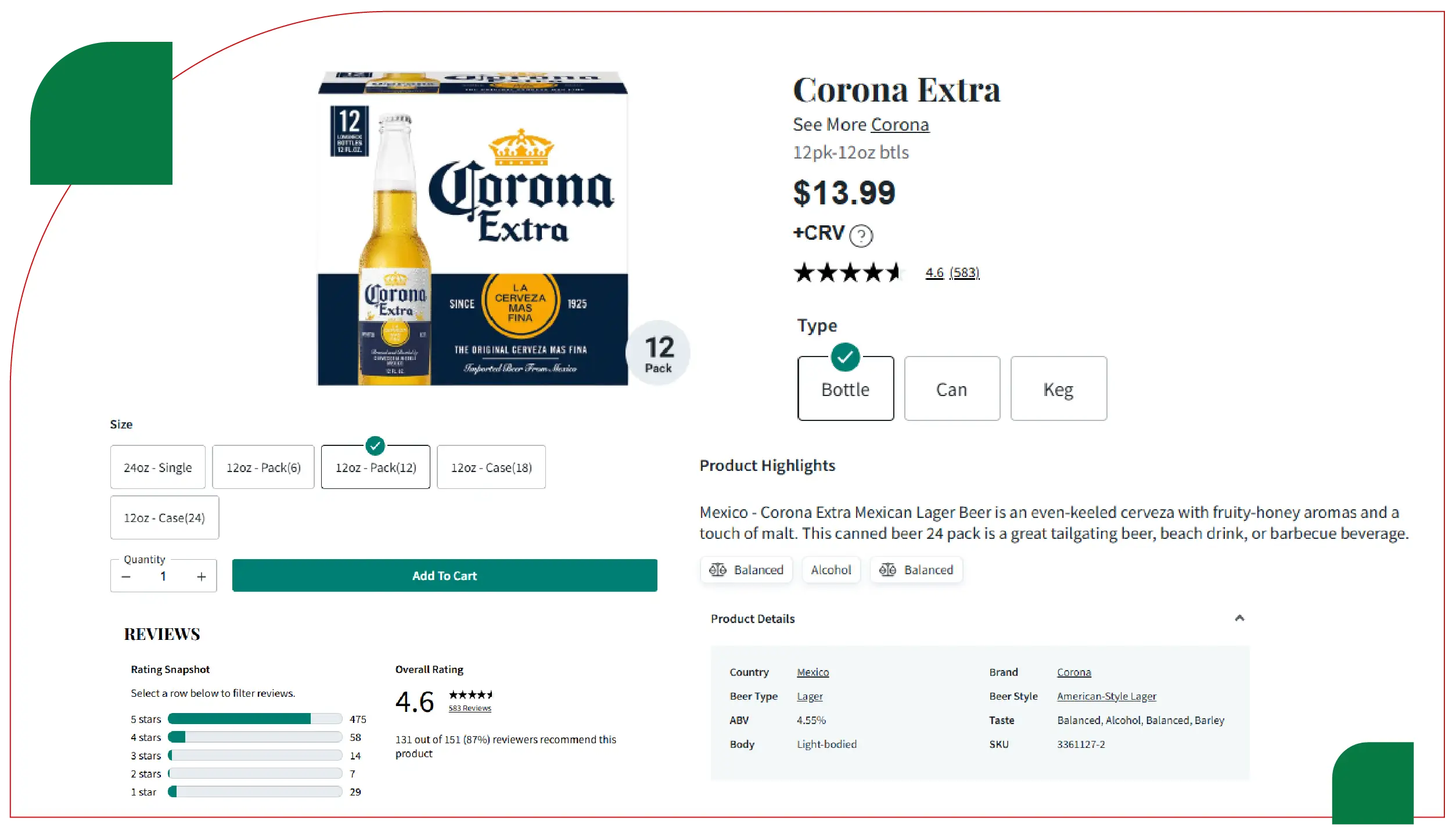

Scraping Beer & Ale Retail Pricing Data reveals interesting pricing patterns:

Table 1: Average Retail Price Per Unit (12oz can/bottle)

| Category |

National Average |

Peak Season Price |

Low Season Price |

| Mainstream Beer |

$1.49 |

$1.65 |

$1.35 |

| Craft Ale (IPA) |

$2.15 |

$2.40 |

$1.85 |

| Pale Ale |

$1.95 |

$2.10 |

$1.75 |

| Stout |

$2.25 |

$2.50 |

$2.00 |

Regional Demand Insights

When we Compare Beer vs Ale Popularity with Data Scraping it showed:

Table 2: Top 5 States by Sales Volume

| State |

Beer Sales (in Mn units) |

Ale Sales (in Mn units) |

Dominant Product Type |

| California |

48.5 |

32.1 |

Pale Ale |

| Texas |

42.3 |

18.4 |

Lager |

| New York |

30.2 |

25.6 |

IPA |

| Florida |

28.7 |

16.2 |

Light Beer |

| Oregon |

14.5 |

21.7 |

Stout |

Comparative Trends Table

Comparison: Beer vs Ale - Trends at a Glance

| Feature |

Beer |

Ale |

| Dominant Age Group |

25–35 |

30–45 |

| Purchase Drivers |

Price, availability |

Flavor, craftsmanship |

| Seasonality |

Summer, sports season |

Winter, holidays |

| Popular Subcategories |

Lager, Light Beer |

IPA, Pale Ale, Stout |

| Growth Rate (2024–25) |

3.1% |

6.7% |

| Preferred Packaging |

Cans, multipacks |

Bottles, variety packs |

Consumer Behavior and Social Trends

Web Scraping Alcoholic Beverage Trends

Web Scraping Alcoholic Beverage Trends reveals a noticeable increase in social engagement around new ale releases, experimental IPAs, and low-alcohol stouts. Ale consumers are highly active in craft beer tasting communities, often following local microbreweries for limited-edition updates and exclusive drops. Data from tools to Extract Craft Beer vs Ale Market Data further indicates that craft ale brands enjoy stronger customer loyalty, with higher retention rates and repeat purchase behavior compared to mainstream beer labels. Influencer-led promotions focused on small-batch and artisanal ales are gaining significant traction on platforms like Instagram and TikTok, particularly among consumers aged 30 to 40. These campaigns are consistently outperforming traditional beer ads in both engagement metrics and purchase conversion rates.

Retailer Strategy Insights

Beer and Ale Industry Data Scraping Services highlight that retail promotions for ales show a 40% higher CTR (click-through rate) when bundled with tasting notes, pairing suggestions, or brewer stories. Extract Beer and Ale Sales Data shows that online liquor stores with advanced filtering (by ABV, IBU, flavor, origin) drive 18% more conversions. Dynamic pricing tools powered by real-time scraping are allowing retailers to adjust pricing during high-demand events like Super Bowl or Oktoberfest.

Packaging, Sustainability & Innovation

While beer continues to dominate in cost-effectiveness and volume, ales are winning on packaging innovation and sustainability.

- 68% of new ale brands now offer recyclable aluminum bottles.

- QR-code-enabled storytelling on packaging is becoming a differentiator.

- Nitro cold ales and hybrid fruit ales are gaining traction among younger drinkers.

Extract Alcohol Prices Data confirms that consumers are willing to pay 20–25% more for eco-friendly packaging, especially in California, Oregon, and Washington.

Key Emerging Brands by Segment

- Beer: Michelob Ultra Organic, Yuengling Flight, Bud Light Next

- Ale: Tree House Brewing, Trillium, New Belgium Voodoo Ranger, Lagunitas

These emerging players are blending traditional formats with digital-first marketing.

Forecasting and 2026 Projections

Liquor Price Data Scraping Services and machine learning models project:

- Ale category to grow at 7.2% CAGR through 2026.

- Canned ale formats to double in availability.

- Digital shelf competition to intensify with 3D product preview and AR.

AI-driven projections also suggest micro-regional targeting will define future success.

International Comparison: US vs Europe

European and American ale preferences continue to reflect distinct cultural and regional differences, as revealed through data collected from the UK and German alcoholic beverage markets. European consumers, particularly in countries like Belgium and the United Kingdom, maintain a strong preference for traditional ales—often brewed using time-honored methods with subtle flavor profiles and moderate alcohol content. In contrast, American drinkers are gravitating toward bold, hoppy ales, such as IPAs and double IPAs, which emphasize strong aromas and higher bitterness levels.

Scraped data from UK and German platforms reveals several key differences:

- U.S.-brewed ales average 14% higher in Alcohol by Volume (ABV) compared to their European counterparts, indicating a trend toward stronger, more impactful brews in the American market.

- Packaging preferences also differ significantly, with European consumers still favoring glass bottles for both aesthetic and traditional reasons, while the U.S. market shows a growing dominance of cans due to their portability and sustainability benefits.

For global alcoholic beverage brands, the opportunity lies in merging these preferences. A promising strategy involves creating hybridized products, such as a Belgian-style ale brewed with American hops—offering the familiarity of European brewing heritage with the bold flavor innovation that appeals to modern American consumers.

Table 2: Average Weekly Prices for Vegetables (1st–20th July 2025)

| Week |

Item |

Instacart |

Amazon Fresh |

Walmart Grocery |

| July 1–7 |

Carrots |

$1.45 |

$1.40 |

$1.35 |

| July 1–7 |

Spinach |

$3.20 |

$3.10 |

$3.00 |

| July 8–14 |

Carrots |

$1.50 |

$1.45 |

$1.40 |

| July 8–14 |

Spinach |

$3.25 |

$3.15 |

$3.05 |

| July 15–20 |

Carrots |

$1.55 |

$1.50 |

$1.45 |

| July 15–20 |

Spinach |

$3.30 |

$3.20 |

$3.10 |

Conclusion

This data-driven report shows that the line between beer and ale is more than just stylistic—it’s behavioral, regional, and strategic. By analyzing Alcohol and Liquor Datasets, we uncover clear signals related to consumer behavior, pricing models, regional taste preferences, and patterns of digital engagement. These insights enable brands to pivot toward more informed product positioning, adapt marketing strategies by location, and tailor offerings to evolving customer expectations. Leveraging this level of granular data is essential for staying competitive in the increasingly segmented and dynamic alcoholic beverage market. Tools like a Liquor Price Tracking Dashboard, smart filters, and dynamic pricing engines can unlock new revenue streams. Combined with Liquor Data Intelligence Services, the future of beverage retail is digital, personalized, and trend-driven. For stakeholders looking to stay ahead, real-time Liquor or Alcohol Data Insights are no longer optional—they are essential.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.