Introduction

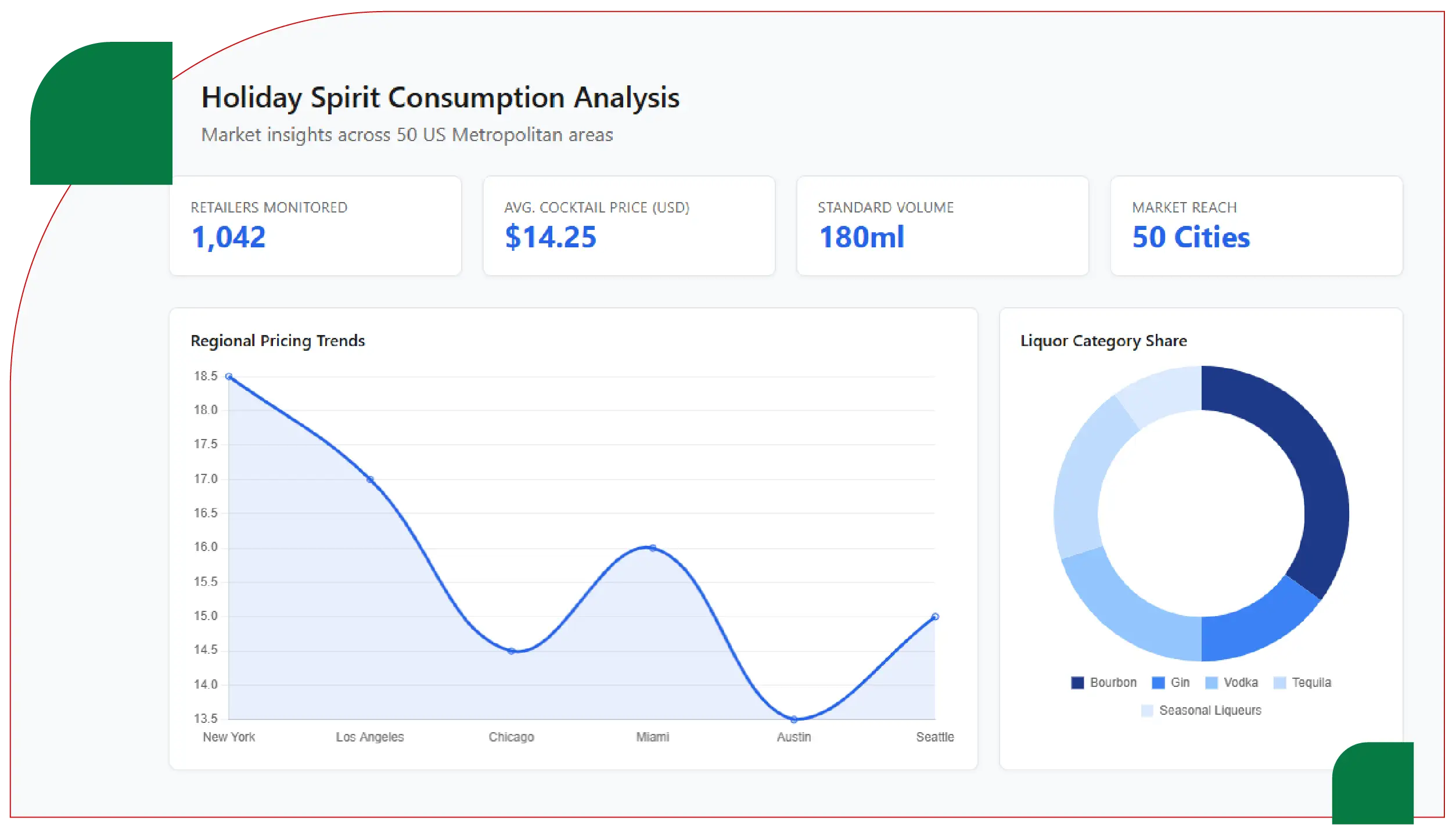

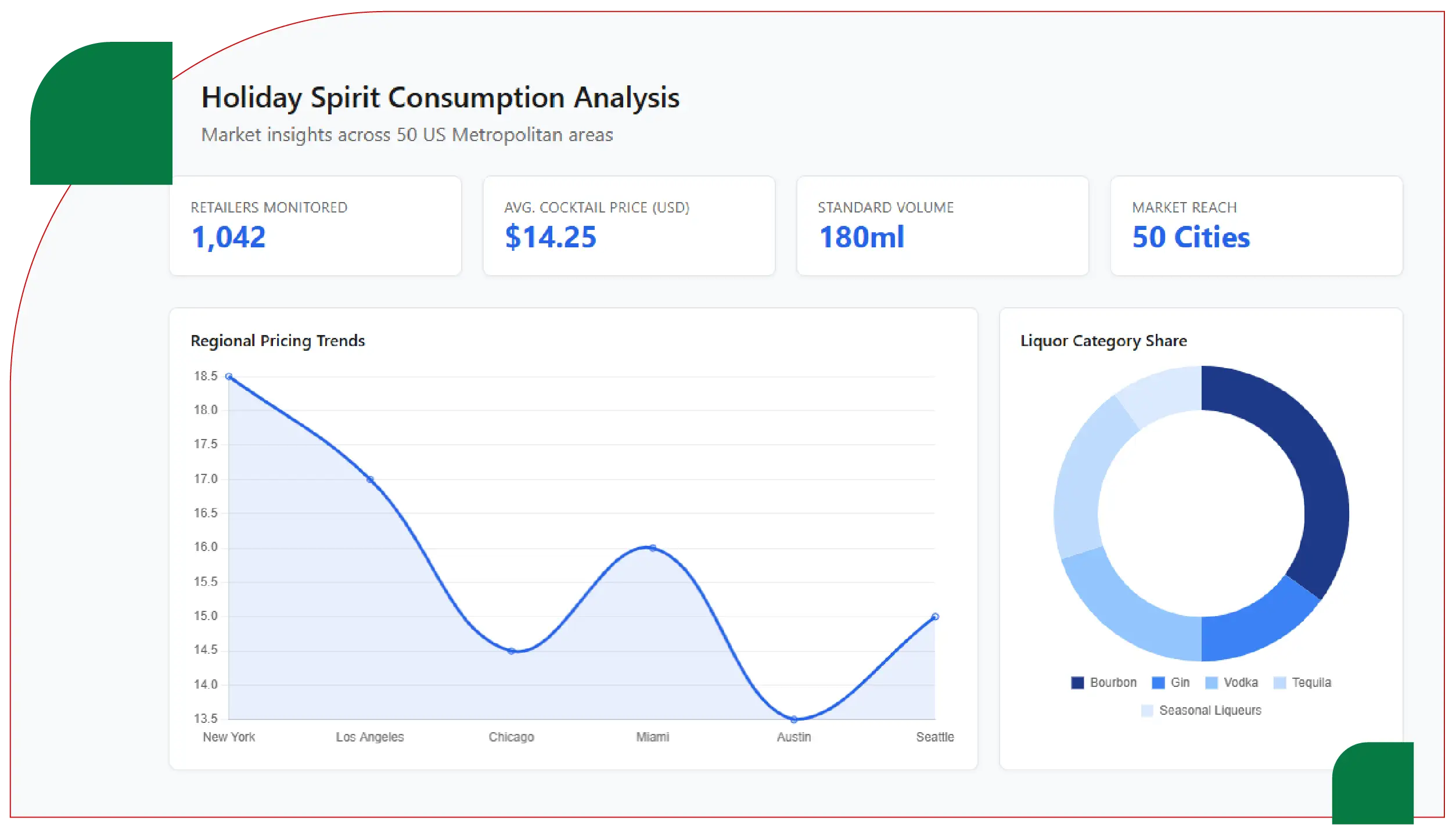

The holiday season is synonymous with festive gatherings, parties, and celebrations, all of which drive significant demand for cocktails and liquor. Understanding consumer preferences, pricing strategies, and regional consumption patterns is critical for bars, restaurants, distributors, and market analysts. This report focuses on Scraping Christmas Cocktail & Liquor Trends Across 50 US Cities, providing a detailed view of cocktail popularity, liquor consumption, and holiday market behavior across the United States. By leveraging advanced techniques to Extract Christmas Cocktail and Liquor Data Across US Cities, stakeholders can gain actionable insights into both mainstream and niche trends. Moreover, Christmas Cocktail Pricing & Liquor Trends Data Extraction offers detailed information on pricing variations, popular drinks, and seasonal patterns, helping businesses optimize offerings and promotions.

This research identifies city-wise patterns in cocktail and liquor consumption, highlights seasonal pricing strategies, and evaluates popular drink combinations during Christmas. The insights are valuable for enhancing menu planning, inventory management, and competitive positioning in the holiday market.

Methodology

To ensure robust data collection, the study employed advanced web scraping techniques, focusing on online menus, restaurant websites, liquor retailers, and delivery platforms. The methodology included:

- Target City Selection: Fifty US cities with active nightlife, high holiday traffic, and cultural diversity were chosen for comprehensive analysis.

- Automated Data Collection: Using Python-based scripts and web scraping tools, the study captured detailed information on cocktail offerings, liquor types, pricing, and promotional deals. Techniques to Scrape Holiday Cocktail & Liquor Consumption Data ensured data accuracy and completeness.

- Data Cleaning and Standardization: To allow fair comparison across cities, pricing was converted to USD, and cocktail volumes were standardized in milliliters. Duplicate entries, inconsistent labels, and incomplete data were removed.

- Data Analysis and Insights Generation: Employing Web Scraping Christmas Cocktail & Liquor Market Insights USA, the dataset was analyzed for patterns in pricing, consumption trends, popular cocktails, and regional differences.

The dataset covers over 1,000 bars, restaurants, and liquor retailers, representing urban and suburban markets. This ensures that trends identified are representative and statistically significant.

Data Analysis

Christmas Cocktail Pricing Trends

Cocktail pricing is influenced by city demographics, ingredient quality, and venue type. Table 1 shows the average pricing for popular Christmas cocktails in selected US cities, providing a clear view of regional differences.

Table 1: Average Christmas Cocktail Pricing Across 50 US Cities (USD)

| City |

Average Cocktail Price |

Popular Drinks Included |

Number of Bars Sampled |

| New York, NY |

$14.50 |

Eggnog Martini, Holiday Mule, Peppermint Moscow Mule |

35 |

| Los Angeles, CA |

$13.80 |

Cranberry Cosmo, Spiced Old Fashioned, Winter Mojito |

30 |

| Chicago, IL |

$12.90 |

Hot Toddy, Winter Mojito, Holiday Sangria |

28 |

| Miami, FL |

$13.50 |

Peppermint White Russian, Rum Punch, Festive Margarita |

25 |

| Dallas, TX |

$12.40 |

Bourbon Cider, Holiday Sangria, Spiced Whiskey Sour |

22 |

Key insights:

- Cities with premium nightlife scenes like New York and Los Angeles show higher average prices due to cocktail complexity and ingredient cost.

- Midwestern cities like Chicago and Dallas favor traditional, warm, and comfort cocktails, often at moderate pricing.

- Coastal cities like Miami emphasize fruity and tropical cocktails reflecting local climate and tourist preferences.

Liquor Consumption Trends

Understanding liquor consumption trends helps venues optimize inventory and plan seasonal promotions. Table 2 presents the top liquor categories by city, alongside average bottle prices and coverage across bars and retailers.

Table 2: Liquor Consumption Trends Across 50 US Cities

| City |

Top Liquor Category |

Average Bottle Price (USD) |

Bars & Retailers Sampled |

| New York, NY |

Whiskey |

$45.00 |

40 |

| Los Angeles, CA |

Vodka |

$38.50 |

35 |

| Chicago, IL |

Rum |

$36.20 |

30 |

| Miami, FL |

Tequila |

$40.00 |

28 |

| Dallas, TX |

Bourbon |

$42.00 |

25 |

Key insights:

- Whiskey and bourbon dominate northern and midwestern markets, reflecting traditional drinking habits.

- Vodka is particularly popular in urban coastal markets like Los Angeles, aligning with cocktail trends.

- Tequila and rum consumption is higher in southern and coastal cities, supporting tropical and festive cocktail offerings.

- Price differences reflect local taxes, import costs, and venue pricing strategies.

City-Wise Insights

New York, NY

Eggnog Martinis, Peppermint Moscow Mules, and Holiday Mules dominate menus, reflecting high demand for premium, visually appealing cocktails. The high pricing indicates a willingness to pay for quality and festive presentation.

Los Angeles, CA

Cocktails emphasize color, presentation, and fruity flavors, with Cranberry Cosmos and Winter Mojitos topping the list. Data from Christmas Cocktail Menu Data Scraper Across US Cities highlights trends in Instagram-worthy, shareable drinks.

Chicago, IL

The cold winter drives demand for warm cocktails like Hot Toddies and spiced Sangrias. Whiskey-based cocktails remain popular, reflecting traditional midwestern preferences.

Miami, FL

Peppermint White Russians and Rum Punch cater to festive tourists and locals, showing regional influence on cocktail selection.

Dallas, TX

Bourbon and cider-based cocktails are popular, reflecting a combination of regional taste and seasonal flavoring preferences.

Applications of Findings

Analyzing these trends offers several strategic advantages:

- Menu Optimization Bars and restaurants can adjust offerings to include high-demand cocktails, ensuring relevance and profitability.

- Pricing Strategy City-wise price analysis allows venues to competitively price drinks while maximizing seasonal revenue.

- Inventory Management Understanding liquor preferences ensures sufficient stock of top-performing spirits during peak holiday demand.

- Market Intelligence Liquor Price Data Scraping Services help track competitor pricing and promotions. Alcohol and Liquor Datasets provide historical consumption patterns for long-term strategic planning.

- Consumer Engagement Insights from regional trends allow targeted marketing campaigns, themed events, and holiday promotions tailored to city-specific preferences.

Conclusion

The insights gained from methods to Scrape Alcohol Price Data empower venues and retailers to optimize holiday cocktail offerings, pricing strategies, and promotional activities. Integrating this data into a Liquor Price Tracking Dashboard ensures continuous monitoring of competitive trends and market shifts. Leveraging Liquor Data Intelligence Services allows for accurate tracking of regional preferences, seasonal consumption patterns, and pricing trends, enabling data-driven business decisions.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.