Introduction

Diwali is one of the most significant festive seasons in India, and it extends beyond sweets, gifts, and home celebrations—alcohol consumption experiences a substantial surge during this period. Scraping India’s Festive Liquor Demand Index 2025 reveals that consumers actively seek discounts, combo offers, and premium festive packs, making it critical for liquor retailers, e-commerce delivery platforms, and market analysts to track market trends effectively. By leveraging tools to Scrape India Liquor Market Data 2025 – Festive Demand Insights, businesses can capture a comprehensive view of the competitive landscape, pricing patterns, and stock availability across multiple cities and platforms.

This research integrates Festive Season Liquor Data Scraping in India 2025 to analyze category-specific trends for whisky, vodka, rum, and wine, before and during Diwali. Using Liquor Market Dataset India – Festive Demand 2025, the study provides actionable insights into pricing strategies, consumer preferences, and operational planning to help businesses optimize revenue and meet high festive demand.

Methodology: Comprehensive Data Collection Approach

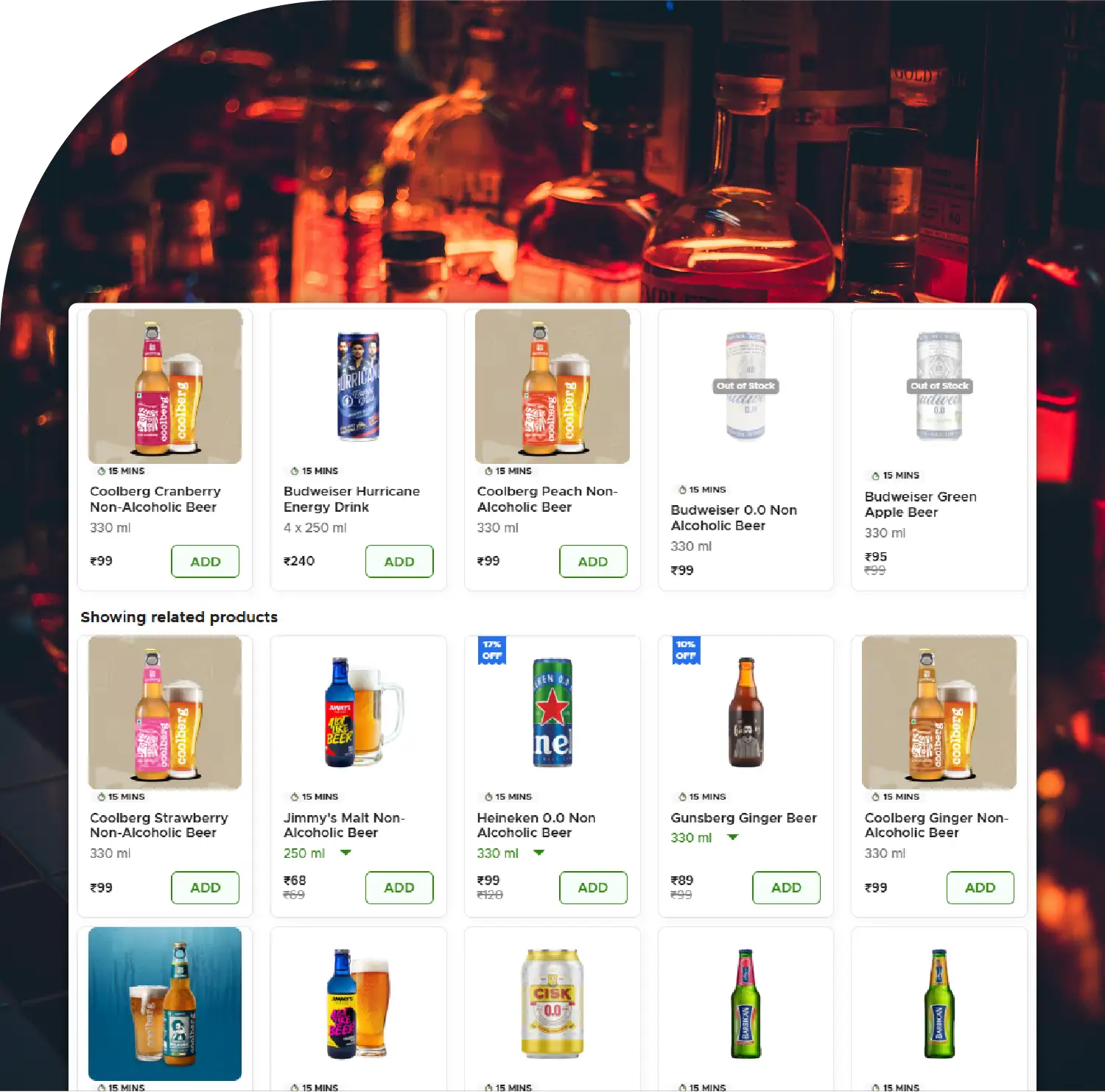

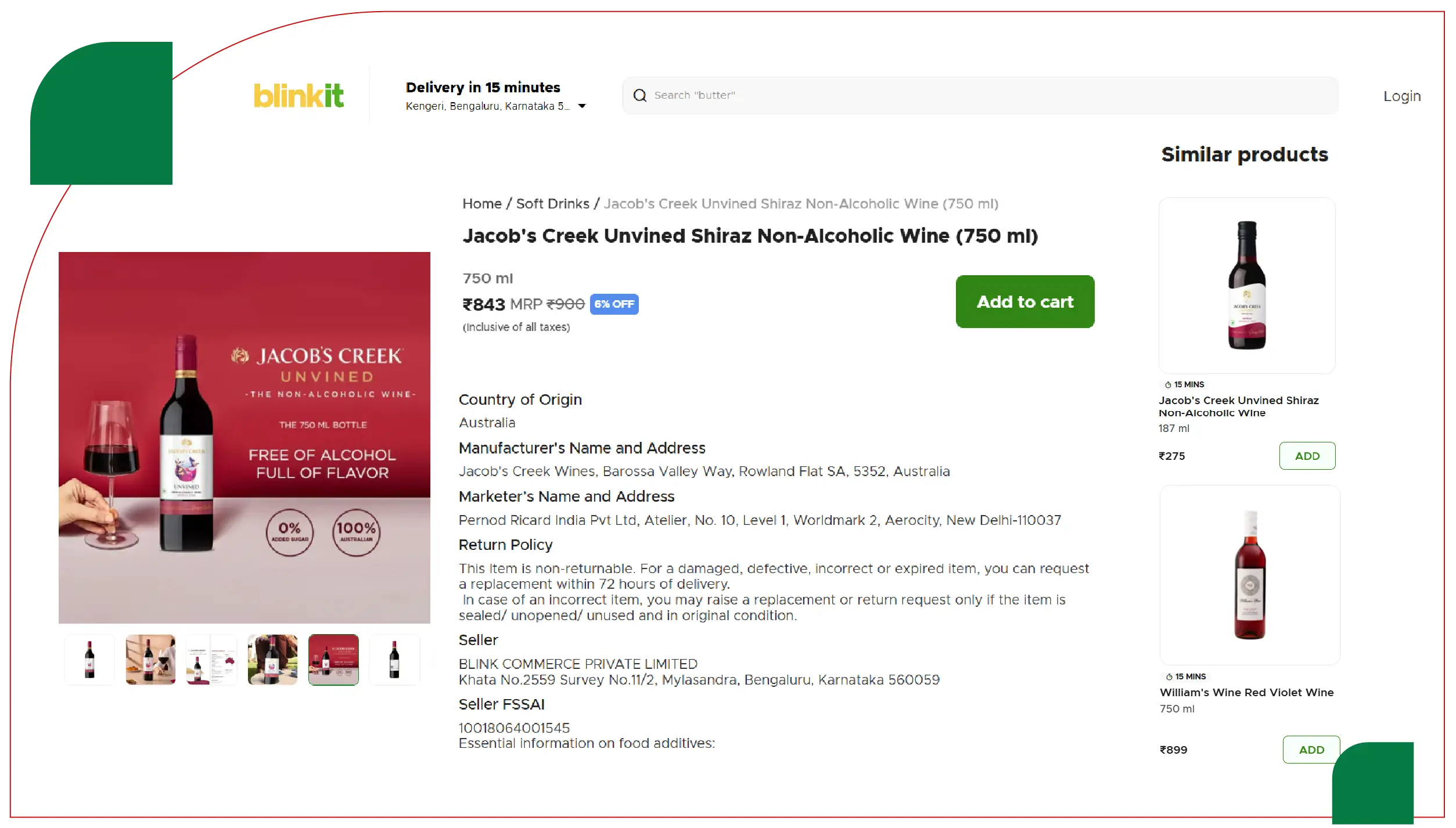

- Online Portal Scraping

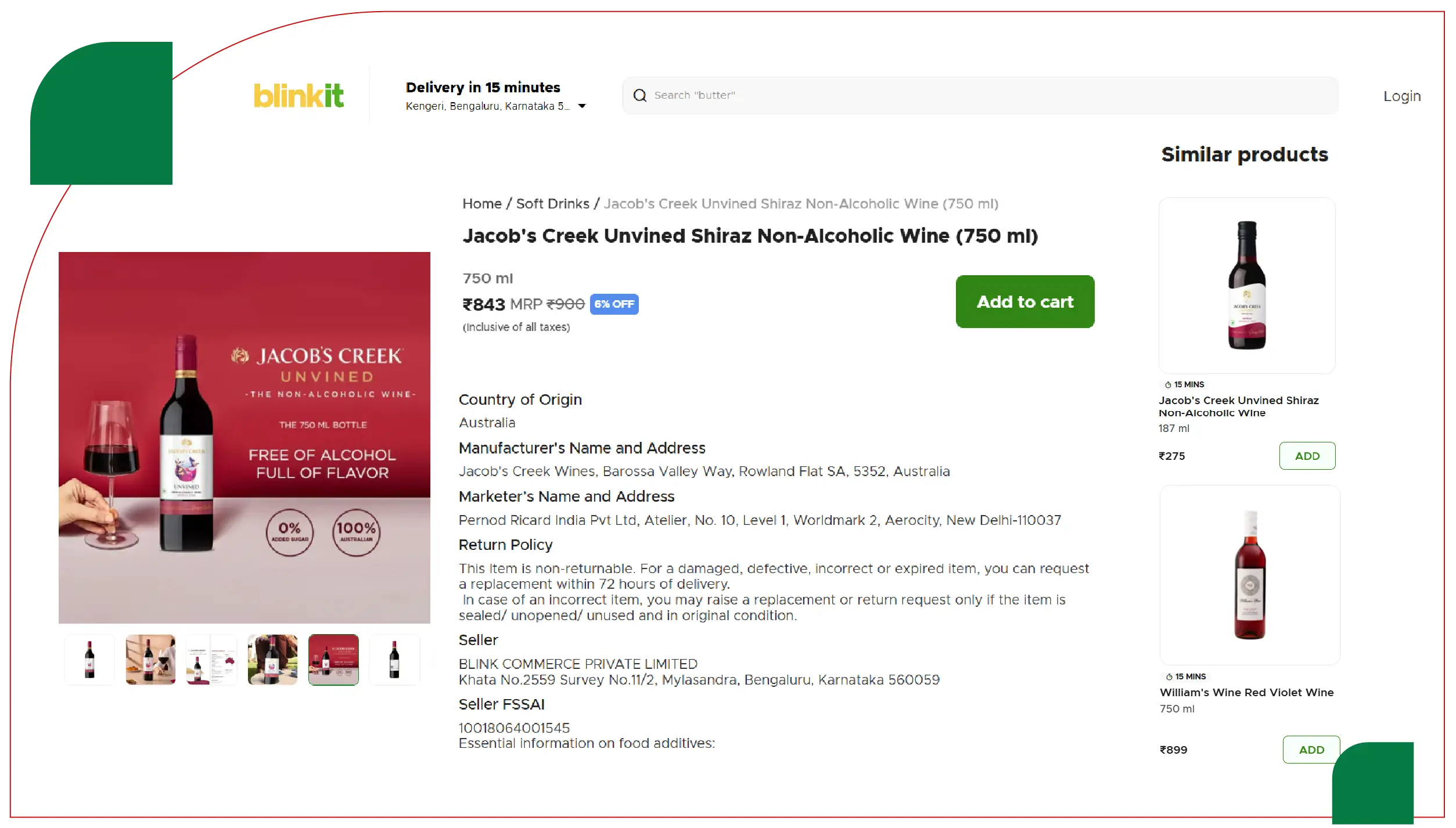

We conducted structured Festive Liquor Price & Availability Data Scraping India across major liquor delivery platforms, including BigBasket, Zepto, Swiggy Genie, and other regional services. The data captured included product name, category, bottle size, pricing, available discounts, stock levels, and estimated delivery times. This multi-platform approach ensures coverage of both metro and Tier 2 city markets.

- Historical vs Real-Time Analysis

To detect trends accurately, Web Scraping Festive Liquor Trends India 2025 was performed on historical Diwali data from 2022–2024 and compared with live 2025 data. This comparison enabled identification of recurring demand patterns, emerging consumer preferences, and fluctuations in pricing and discount intensity during peak festive periods.

- Liquor Categorization & Segmentation

The analysis focused on four primary categories: whisky, vodka, rum, and wine. Each category was segmented further by bottle size (e.g., 375ml, 750ml, 1L) and price tier (budget, mid-range, premium). This granularity allowed for in-depth evaluation of price elasticity, promotional impact, and regional consumption variations.

- Data Cleaning & Validation

Raw scraped data underwent rigorous cleaning, removing duplicate entries, correcting inconsistencies, and standardizing units of measurement. This ensured that the dataset was reliable, enabling accurate cross-platform and cross-city comparisons.

- Analytical Integration

The validated dataset was integrated into business intelligence tools to visualize trends and track high-demand SKUs. Festive Liquor Market Data Extraction India 2025 facilitated the detection of peak ordering times, regional pricing variations, and category-specific popularity, allowing businesses to make data-driven operational and promotional decisions.

Category-Wise Demand Insights

Analysis revealed that whisky and vodka dominate festive season consumption, while rum and wine occupy niche segments. Each category demonstrated distinct trends before and during Diwali:

- Whisky: Continues to be the top choice for gifting and celebrations, especially premium brands.

- Vodka: Popular among younger urban consumers, often purchased in cocktail bundles or party packs.

- Rum: Moderate demand, with increased sales through bundle promotions and festive combos.

- Wine: Premium segment, lower overall volume but consistent growth in gifting and celebratory purchases.

| Category |

Pre-Diwali Avg. Orders/Day |

Diwali Week Avg. Orders/Day |

% Growth |

| Whisky |

3,500 |

5,800 |

65% |

| Vodka |

2,100 |

3,500 |

66.7% |

| Rum |

1,400 |

2,100 |

50% |

| Wine |

800 |

1,100 |

37.5% |

Insights:

- Whisky and vodka experienced the largest spike in demand, highlighting their central role in festive celebrations.

- Rum's growth was moderate but significant, largely due to combo packs and mixer deals.

- Wine saw steady but smaller increases, reflecting a niche but loyal consumer segment.

Pricing Trends and Discount Analysis

Festive Season Liquor Data Analytics India revealed key insights into how pricing varied across categories and platforms:

- Premium whisky brands offered discounts ranging from 20–25%, often combined with promotional gifts like mixers or glasses.

- Vodka and rum promotions typically ranged from 12–18%, designed to encourage volume purchases.

- Wine discounts were modest, generally 5–10%, emphasizing brand integrity and premium positioning.

| Category |

BigBasket Discount (%) |

Zepto Discount (%) |

Swiggy Genie Discount (%) |

Average Discount (%) |

| Whisky |

22 |

20 |

18 |

20 |

| Vodka |

16 |

18 |

15 |

16.3 |

| Rum |

14 |

15 |

13 |

14 |

| Wine |

7 |

8 |

6 |

7 |

Insights:

- Metro cities like Delhi and Mumbai observed the most aggressive discounting strategies.

- Tier 2 cities focused more on bundle promotions rather than direct price cuts.

- Wine maintained a premium pricing approach to protect brand perception while still driving festive sales.

Regional and City-Wise Analysis

Using Festive Season Liquor Market Data Extraction India 2025, city-specific demand and pricing patterns were observed:

- Delhi & Mumbai: High demand for whisky and vodka; extensive discount campaigns; wide SKU availability.

- Bangalore & Hyderabad: Moderate discount intensity; higher emphasis on bundle deals for premium and mid-tier brands.

- Tier 2 Cities: Focused promotions targeting specific consumer segments; smaller discount rates; convenience-driven purchases dominate.

Urban consumers are highly price-sensitive and compare multiple platforms, while smaller cities prioritize fast delivery and convenience over heavy discounting.

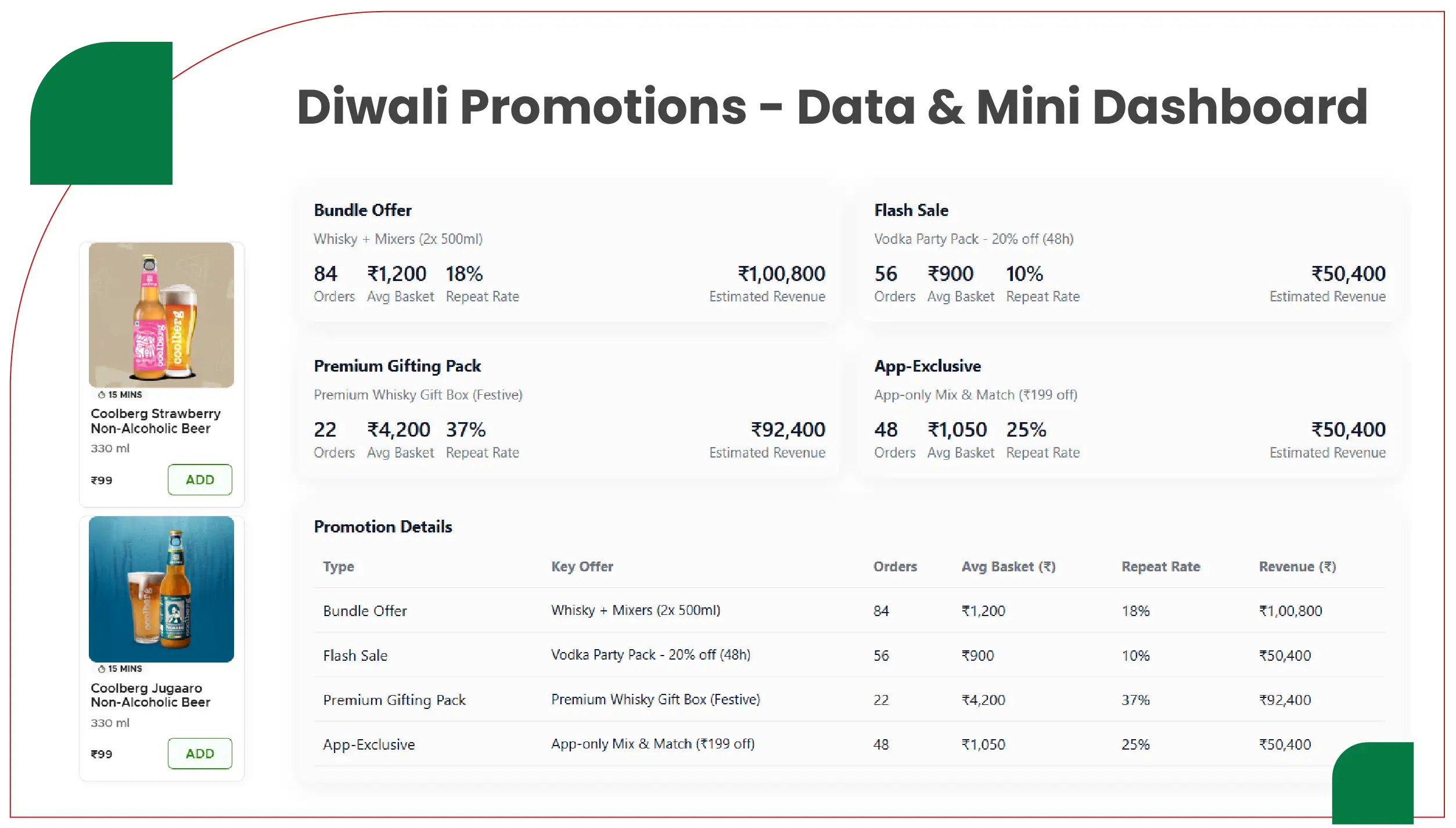

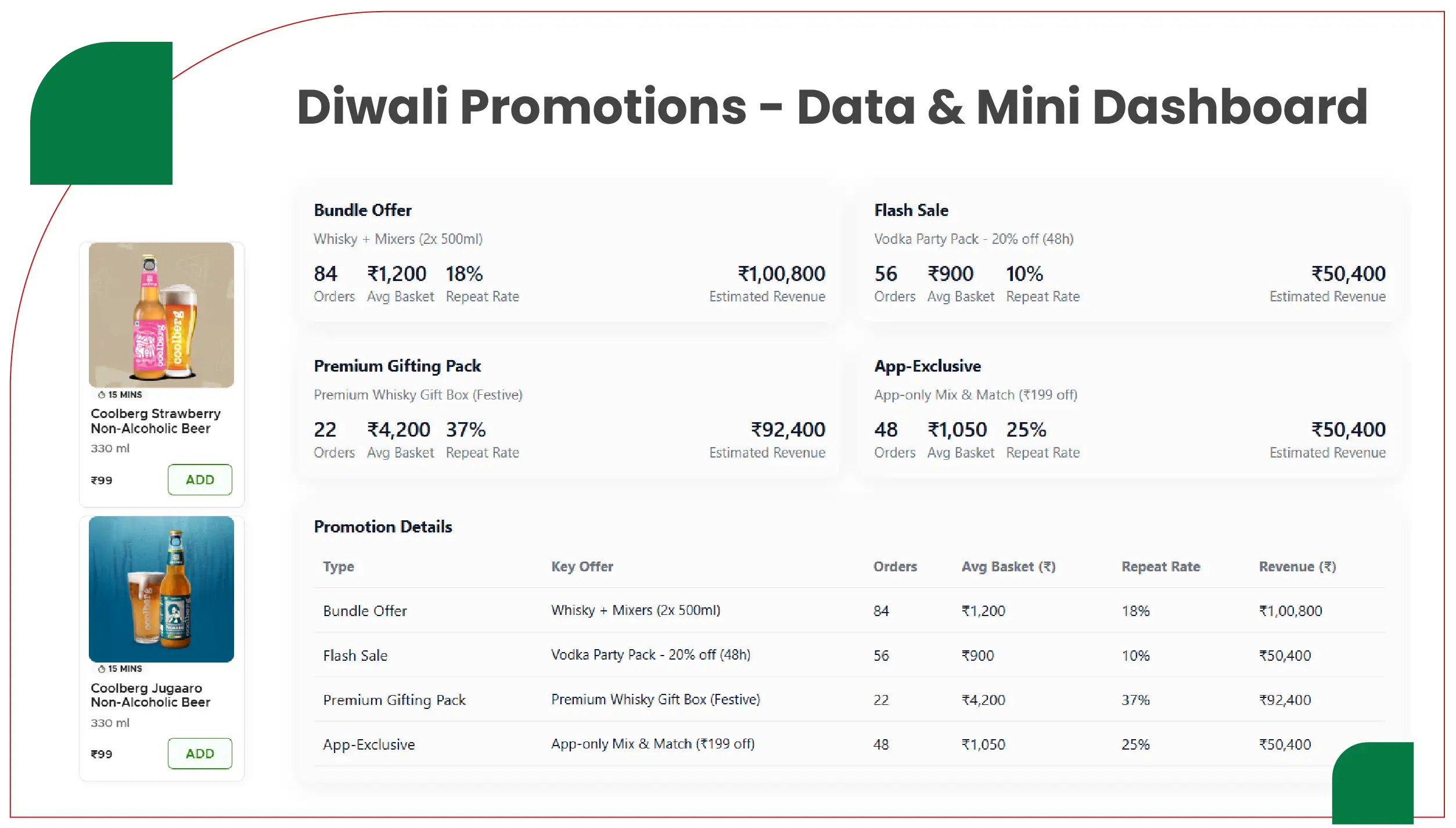

Promotions and Bundle Strategies

Data from Festive Season Liquor Data Analytics India highlighted effective promotional strategies during Diwali:

- Bundle Offers: Whisky with mixers or vodka party packs increased perceived value and basket size.

- Flash Sales: Short-term Diwali discounts spiked order volumes, especially during weekends.

- Premium Gifting Packs: Attractive festive packaging encouraged repeat orders among premium consumers.

- App-Exclusive Deals: Enhanced mobile engagement and boosted repeat purchases.

These findings demonstrate that timing, creative packaging, and platform-specific promotions play a pivotal role in consumer decision-making during festive periods.

Operational Insights for Retailers and Platforms

- Dynamic Pricing: Real-time pricing adjustments balance supply, demand, and competitiveness.

- Inventory Optimization: Forecasting high-demand SKUs ensures availability during peak festive hours.

- Delivery Efficiency: Targeted, location-based promotions improve last-mile delivery and reduce fulfillment delays.

- SKU Performance Tracking: Monitoring category-level sales allows targeted marketing and better inventory management.

Predictive Analysis and Future Planning

Businesses can leverage tools to Extract Alcohol Prices Data to monitor market trends and competitive pricing. Companies benefit from Liquor Price Data Scraping Services to track product availability and optimize sales strategies.

- Forecast top-selling brands and categories for upcoming festive periods.

- Optimize discount levels to maximize revenue without sacrificing margins.

- Plan inventory effectively across metro and Tier 2 cities to prevent stockouts.

- Identify emerging product trends, e.g., premium vodka packs or new whisky variants.

Alcohol and Liquor Datasets can further support scenario modeling, helping retailers simulate pricing strategies and forecast consumer behavior to enhance planning for future festivals.

Consumer Behavior Insights

- Whisky remains the preferred choice for gifting and premium consumption.

- Vodka is more popular among younger, urban consumers seeking party packs and cocktails.

- Rum is bought in bulk, often paired with mixers during festivities.

- Wine purchases are premium-driven, steady, and typically smaller in volume.

By understanding these patterns, retailers can tailor their promotions, bundles, and pricing strategies to increase both engagement and sales.

Conclusion

The 2025 Festive Liquor Demand Index highlights the importance to Scrape Alcohol Price Data to monitor competitor offers and market trends.

A robust Liquor Price Tracking Dashboard enables retailers to visualize prices, discounts, and inventory across multiple platforms in real-time.

Leveraging Liquor Data Intelligence Services allows for enhanced consumer insights, optimized inventory, and more effective promotional planning.

Key Takeaways:

- Whisky and vodka dominate festive demand and offer significant promotional opportunities.

- Tier 1 cities show aggressive discount patterns, whereas smaller cities focus on convenience-based strategies.

- Combo packs and festive gift bundles increase basket values and encourage repeat purchases.

- Real-time monitoring across platforms ensures competitive pricing and improved consumer engagement.

- Predictive analysis allows for accurate inventory planning and optimized promotional timing for future festive seasons.

Integrating competitor analysis, pricing insights, and predictive analytics helps retailers maximize revenue, enhance customer satisfaction, and maintain a competitive edge during high-demand festive periods.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.