Introduction

Inflation in the U.S. grocery sector has increasingly shifted from visible price hikes to subtler tactics that are harder for consumers to detect. One of the most prominent of these tactics is shrinkflation—where product sizes, weights, or counts are reduced while prices remain unchanged or rise marginally. This Shrinkflation Tracking Report – Walmart & Target Grocery Analysis examines how leading U.S. retailers quietly implement downsizing strategies across grocery categories, impacting real consumer value without obvious price signals.

To conduct this analysis at scale, the study leverages Walmart & Target Shrinkflation Data Scraping techniques that systematically capture SKU-level attributes such as net weight, pack size, unit count, and listed prices over time. By comparing historical and current product configurations, shrinkflation patterns that are invisible to traditional price tracking become measurable.

The ability to Extract Walmart & Target Shrinkflation Data enables analysts, retailers, and consumer watchdogs to detect hidden inflation that standard CPI metrics often miss, particularly in packaged foods, beverages, frozen items, and household essentials.

Understanding Shrinkflation in Modern Grocery Retail

Shrinkflation is driven by a combination of rising commodity costs, packaging inflation, labor shortages, and logistics volatility. Rather than increasing shelf prices—which can trigger consumer backlash—manufacturers and retailers reduce product quantity while maintaining psychological price thresholds. This strategy is especially effective in digital grocery environments, where shoppers prioritize speed and convenience over scrutinizing unit sizes.

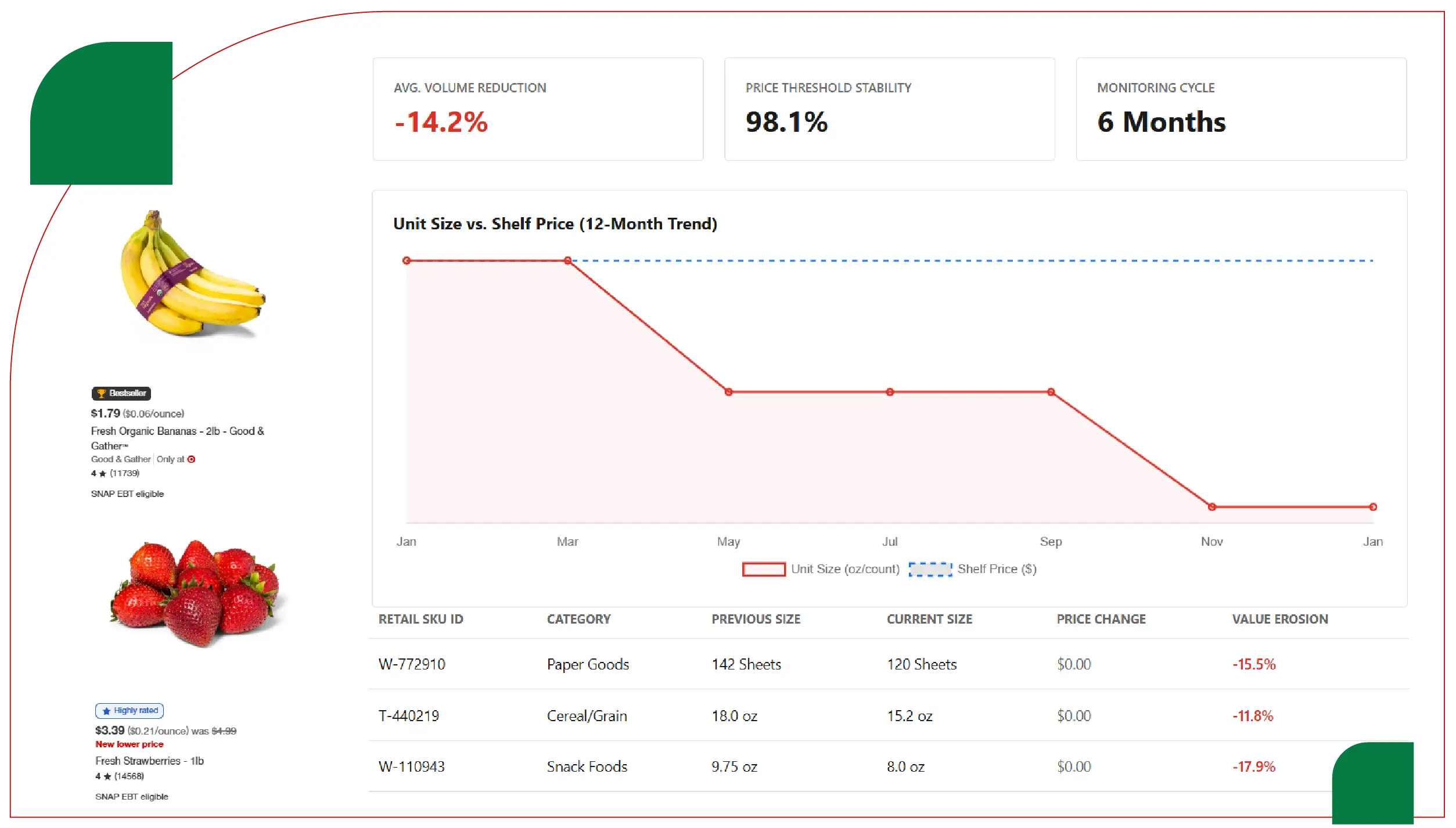

A detailed Walmart & Target Product Size & Price Analysis reveals that many SKUs undergo repeated downsizing cycles, often spaced six to twelve months apart, making cumulative value erosion significant over time. These reductions are rarely communicated clearly, reinforcing the need for systematic monitoring.

Methodology: SKU-Level Shrinkflation Detection

Shrinkflation detection requires tracking more than just price changes. The analytical framework applied in this report focuses on SKU-level versioning, unit normalization, and historical comparisons to identify divergences between price stability and quantity reduction.

Using SKU-Level Shrinkflation Data Extraction from Walmart & Target, the study aligns identical SKUs across multiple time periods and recalculates unit pricing (per ounce, pound, or count). This approach highlights real cost increases even when listed prices remain unchanged, offering a far more accurate picture of inflationary pressure.

Table 1: Sample Shrinkflation Detection – Packaged Food SKUs

| Category |

Retailer |

SKU Name |

Old Size |

New Size |

Size Change (%) |

Old Price ($) |

New Price ($) |

Unit Price Increase (%) |

| Breakfast Cereal |

Walmart |

Brand A Corn Flakes |

18 oz |

15.6 oz |

-13.3% |

4.98 |

4.98 |

+15.3% |

| Snacks |

Target |

Brand B Potato Chips |

10 oz |

8.5 oz |

-15.0% |

4.49 |

4.59 |

+19.6% |

| Pasta |

Walmart |

Brand C Spaghetti |

16 oz |

14 oz |

-12.5% |

1.28 |

1.28 |

+14.3% |

| Frozen Meals |

Target |

Brand D Lasagna |

38 oz |

34 oz |

-10.5% |

9.99 |

9.99 |

+11.7% |

| Baking Goods |

Walmart |

Brand E Flour |

5 lb |

4.5 lb |

-10.0% |

3.24 |

3.24 |

+11.1% |

Category-Level Shrinkflation Trends

Shrinkflation does not affect all categories equally. Packaged snacks, frozen foods, and household staples show the highest frequency and magnitude of size reductions. These categories also experience frequent promotions, which helps mask downsizing through temporary discounts.

Insights from a US Grocery Shrinkflation Monitoring Dashboard indicate that shrinkflation adoption accelerates during periods of commodity volatility and slows only when consumer scrutiny intensifies through media coverage or regulatory pressure.

Table 2: Shrinkflation Intensity by Category (2023–2025)

| Category |

Avg Size Reduction (%) |

% SKUs Affected |

Avg Unit Price Increase (%) |

Walmart Impact |

Target Impact |

| Snacks |

14.8% |

62% |

18.9% |

High |

High |

| Frozen Foods |

11.2% |

48% |

13.6% |

Medium |

High |

| Beverages |

9.5% |

41% |

12.1% |

Medium |

Medium |

| Household Essentials |

16.4% |

58% |

21.3% |

High |

Medium |

| Personal Care |

8.9% |

36% |

10.4% |

Low |

Medium |

Role of Grocery Delivery Platforms in Shrinkflation Detection

Online grocery platforms are critical data sources because they present standardized, frequently updated product attributes. APIs and automated crawlers allow analysts to capture subtle changes that would be nearly impossible to track manually at scale.

For example, the Walmart Grocery Delivery Scraping API provides continuous access to product metadata, pricing, and pack-size changes across thousands of grocery SKUs. Similarly, the Target Grocery Delivery Scraping API enables structured extraction of variant-level data, supporting cross-retailer shrinkflation comparisons.

When combined with Grocery App Data Scraping services, analysts can also capture mobile-exclusive SKUs, digital-only pack sizes, and app-specific pricing strategies that further contribute to hidden inflation.

Table 3: Shrinkflation Signals from Grocery Delivery Data

| Detection Signal |

Method |

Business Insight |

| Silent Size Reduction |

Net weight comparison |

Downsizing without price change |

| SKU Replacement |

Version tracking |

Smaller pack introduced as “new” |

| Unit Price Drift |

$/unit recalculation |

Hidden inflation uncovered |

| Promotion Masking |

Discount overlap |

Shrinkflation concealed by offers |

| Platform Variance |

App vs web SKU |

Channel-specific downsizing |

Strategic Implications for Retail Intelligence

Shrinkflation analytics has become a core component of modern retail intelligence. By leveraging Grocery Delivery Scraping API Services, organizations can move from reactive analysis to proactive monitoring, identifying value erosion before it impacts brand trust or customer loyalty.

Insights generated through a Grocery Price Dashboard allow retailers, suppliers, and analysts to visualize not just price movement, but true cost per unit—enabling more transparent decision-making.

Conclusion

Shrinkflation represents a structural shift in how inflation manifests within U.S. grocery retail. Walmart and Target exemplify how large-scale retailers balance margin pressure with consumer price sensitivity by quietly reducing product sizes. Detecting these changes requires more than traditional analytics.

A robust Grocery Price Tracking Dashboard transforms raw SKU data into actionable insights, enabling stakeholders to see beyond surface-level pricing. When supported by advanced Grocery Pricing Data Intelligence, shrinkflation detection becomes a strategic asset rather than a reactive exercise.

Ultimately, high-quality Grocery Store Datasets form the foundation for long-term monitoring, competitive benchmarking, and transparent inflation analysis in an increasingly complex grocery ecosystem.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.