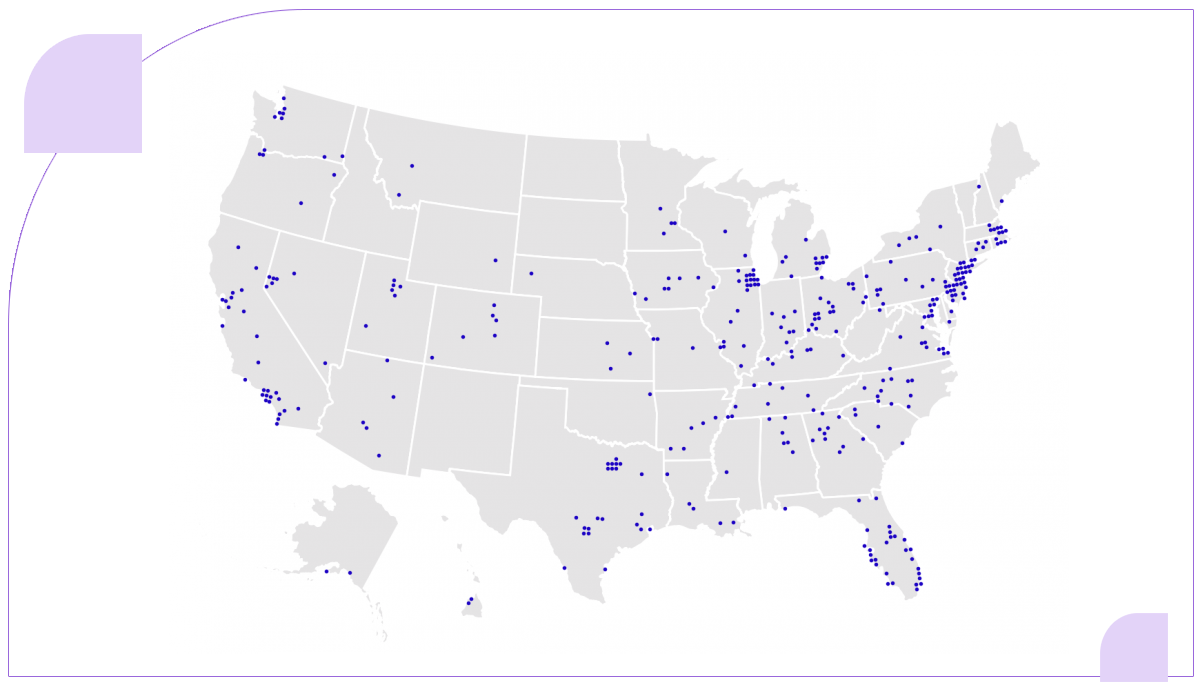

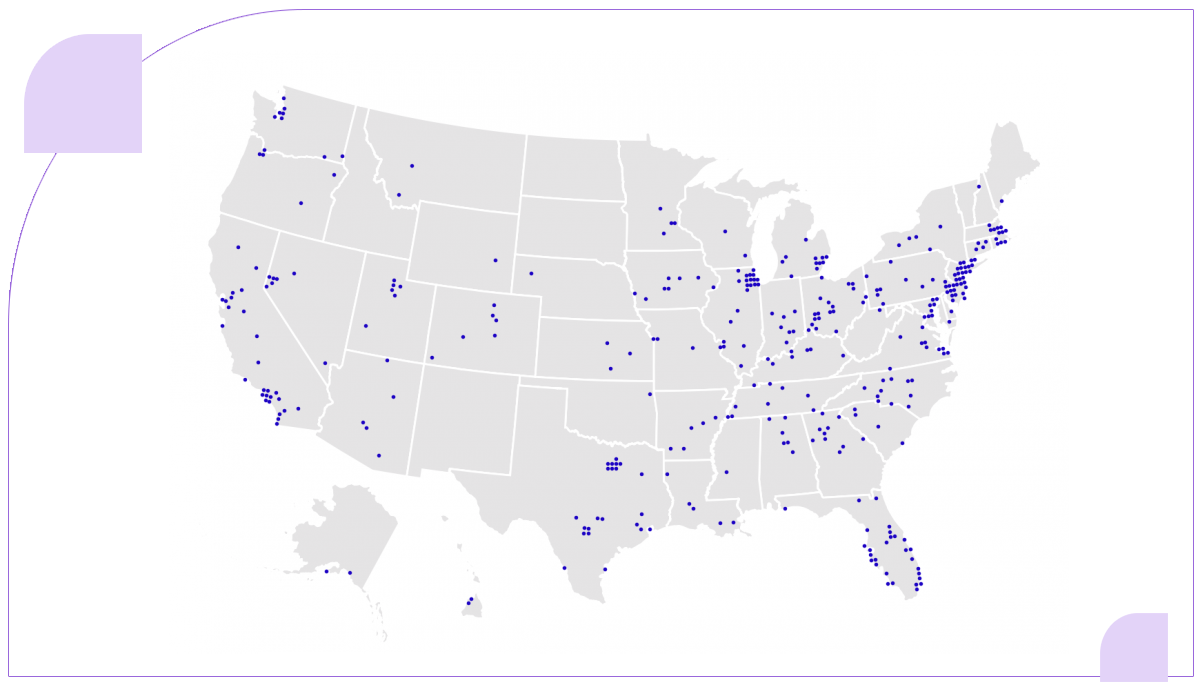

Food Data Scrape, a leading provider of grocery data scraping services, meticulously tracks the location data of over 133 department and grocery store brands across the United States. In the tumultuous year of 2024, a total of 563 closures were recorded within this sector nationwide. Among the hardest-hit states were New York, New Jersey, Florida, and California, each experiencing significant store closures.

A comprehensive analysis revealed that 40 prominent brands within the department and grocery store industry had to shutter their doors in 2024. This data underscores the profound impact of economic challenges, shifting consumer behaviors, and other factors that contributed to the closure of numerous retail establishments throughout the year.

Key Insights:

In 2024, the retail landscape witnessed significant upheaval, with 563 closures affecting 40 department and grocery store brands. Leading the pack in closures was 7-Eleven, with a staggering 187 stores shutting down during the year. New York emerged as the hardest-hit state, with 59 closures, followed closely by New Jersey, Florida, and California. Cook County, Illinois, bore the brunt at the county level, experiencing 15 closures. Notably, New York, New Jersey, Florida, and California collectively accounted for 23% of all closures in this sector during 2024.

Trends in Department and Grocery Store Closures

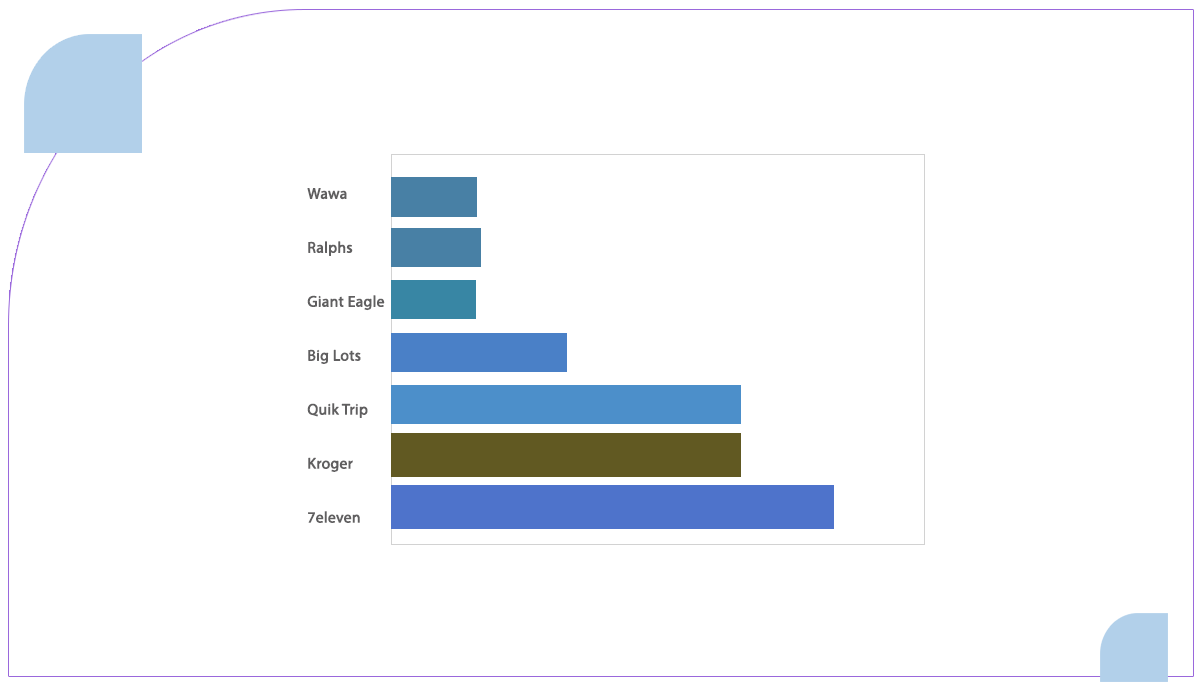

The animated bar chart depicts the trajectory of store closures throughout 2024, focusing on different grocery store brands. Initially, Save A Lot consistently led in closures, but in September, 7-Eleven surged ahead and ultimately claimed the title for the most closures in 2024.

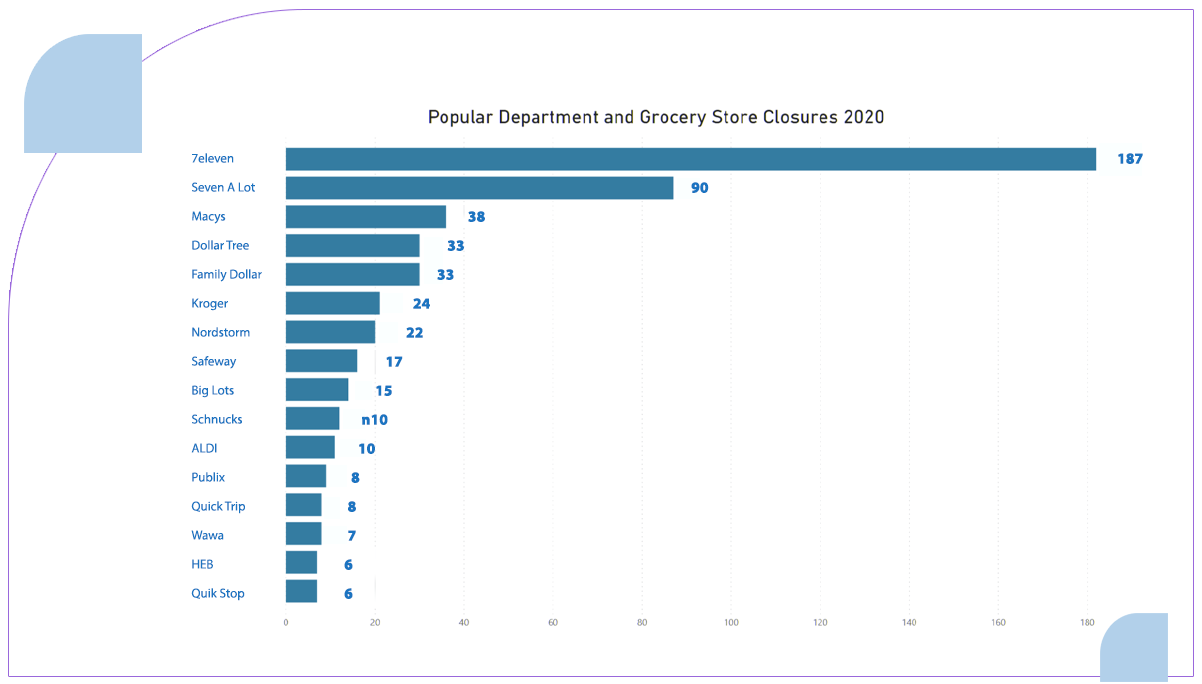

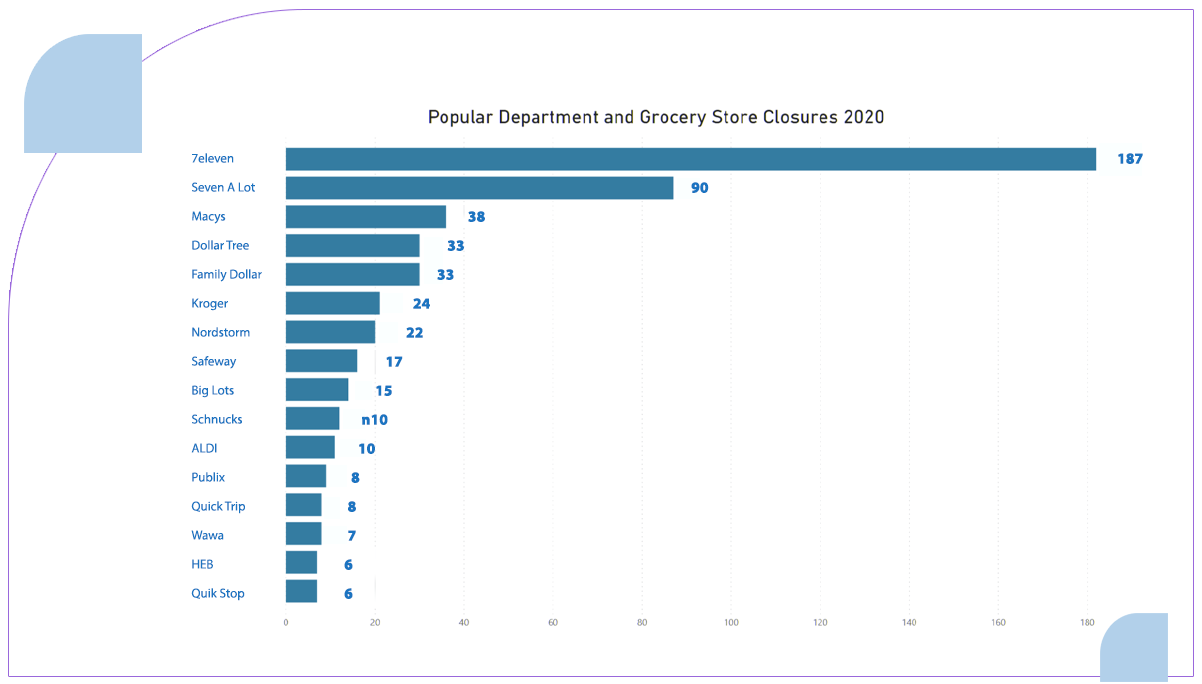

Among the grocery stores experiencing the highest closures, 7-Eleven topped the list with 187 closures. Save A Lot followed closely with 90 closures, while Macy’s reported 36 closures. This data underscores the significant impact of closures within the grocery retail sector over the year. These insights from scraping grocery data shed light on the shifting dynamics and challenges faced by various store brands, reflecting broader trends in consumer behavior and economic conditions during 2024.

The bar chart illustrates the prominent store brands that experienced the highest number of closures throughout 2024.

Even before the onset of the coronavirus pandemic, American retailers were grappling with challenging circumstances. However, the pandemic exacerbated these difficulties, particularly for traditional brick-and-mortar stores. Retailers reduce their physical footprint as consumer behavior shifts towards online shopping. Macy's, for instance, initiated significant downsizing efforts, mainly targeting underperforming stores within struggling malls. Additionally, Nordstrom's decision to seek Chapter 11 Bankruptcy protection in May 2024 led to the closure of several full-line department stores. Moreover, chains like Kroger have also opted to shut down stores as a preemptive measure against impending pay mandates, which would inevitably escalate labor costs. These strategic maneuvers reflect the evolving landscape of retail, heavily influenced by changing consumer preferences and economic dynamics.

2024's Peak Months: High Store Closure Trends

Throughout 2024, June, December, and July emerged with the highest store closures. Specifically, June saw 80 closures, followed closely by December with 77 closures and July with 62 closures. These statistics underscore the tumultuous nature of the retail landscape during the year, reflecting various economic and operational challenges store brands face across different sectors.

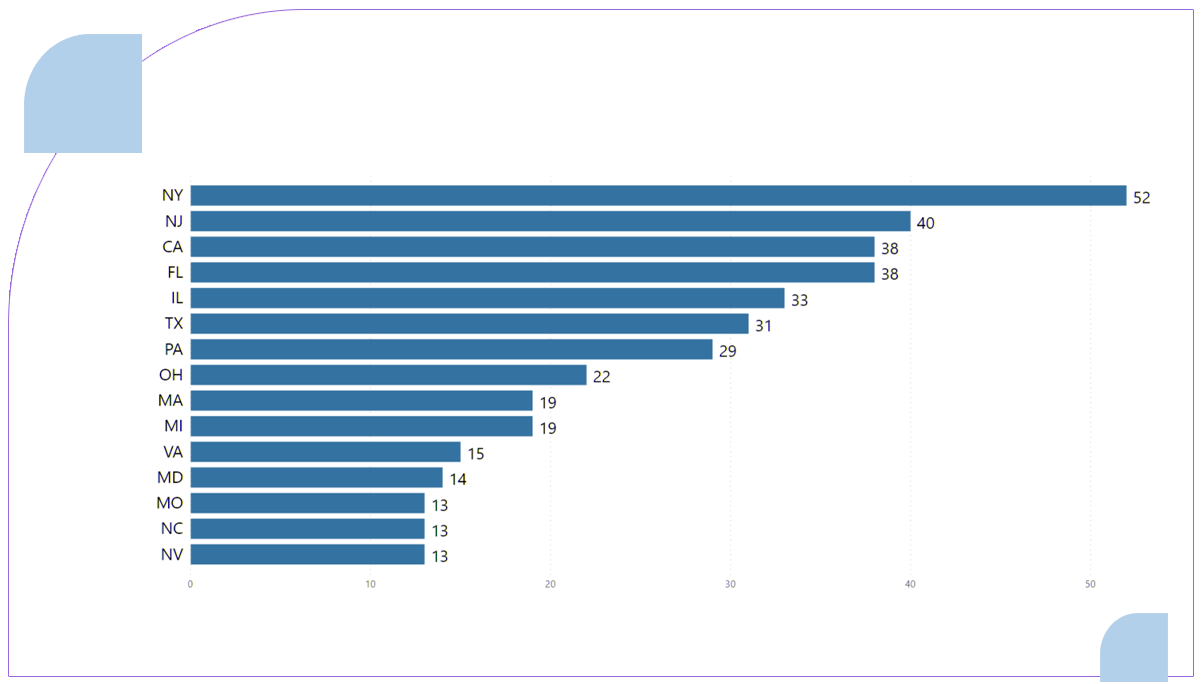

Insights from Grocery Data Scraping: Key States Leading Department and Grocery Store Closures in 2024

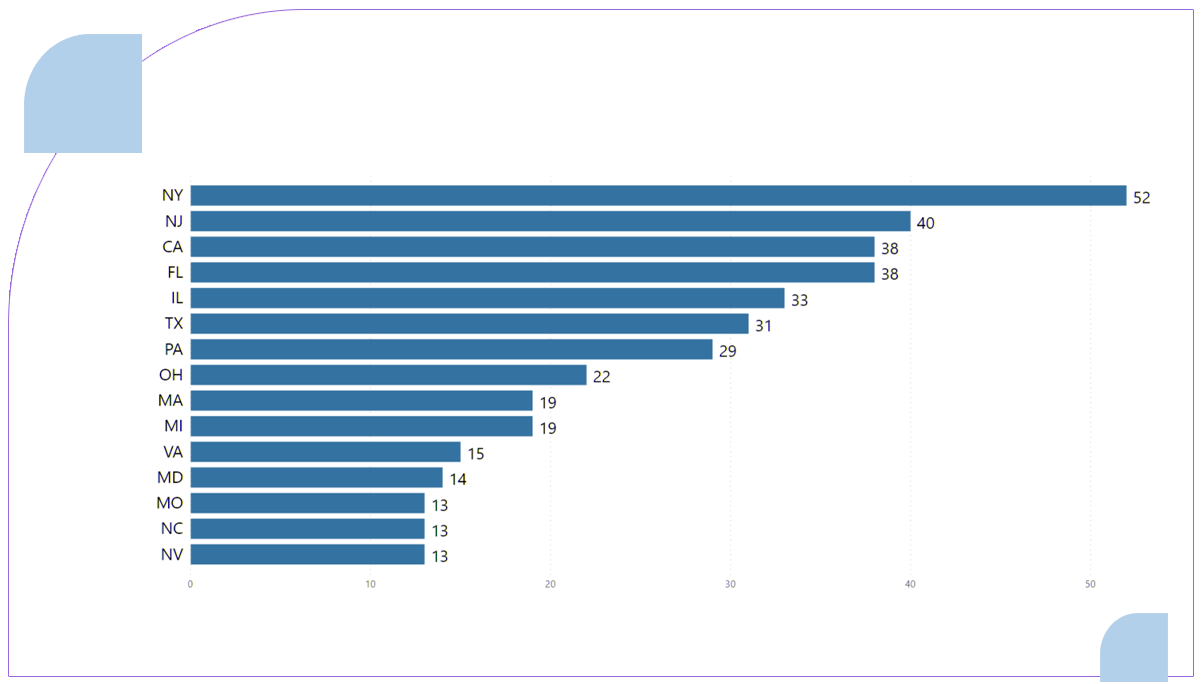

The analysis unveils the pivotal states witnessing the highest closures in the department and grocery chains during 2024 through meticulous grocery data scraping. New York emerged as the frontrunner, experiencing a notable 58 closures, followed closely by New Jersey with 40 closures. Notably, California and Florida recorded 38 closures each, reflecting the widespread impact across diverse geographical regions. This comprehensive examination, facilitated by grocery data scraping, highlights the profound ramifications of economic shifts and consumer behavior on retail landscapes. The accompanying bar chart delineates the top 15 states affected by closures, elucidating the spatial distribution of this phenomenon and providing invaluable insights for stakeholders navigating the dynamic grocery retail sector.

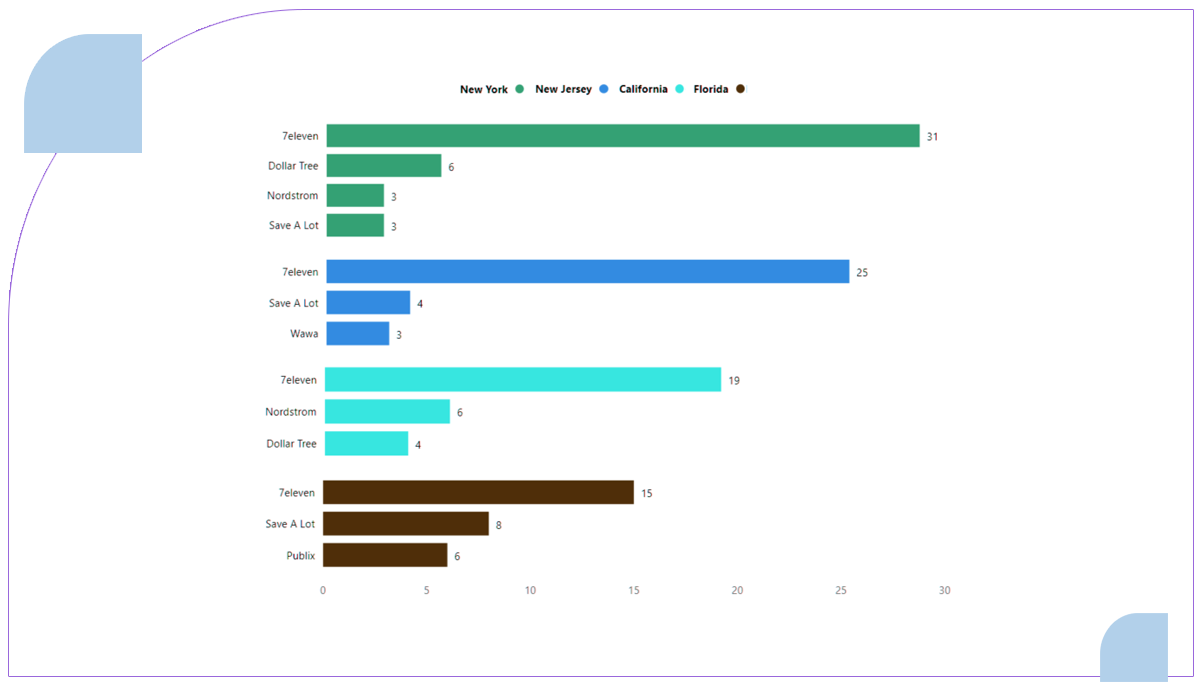

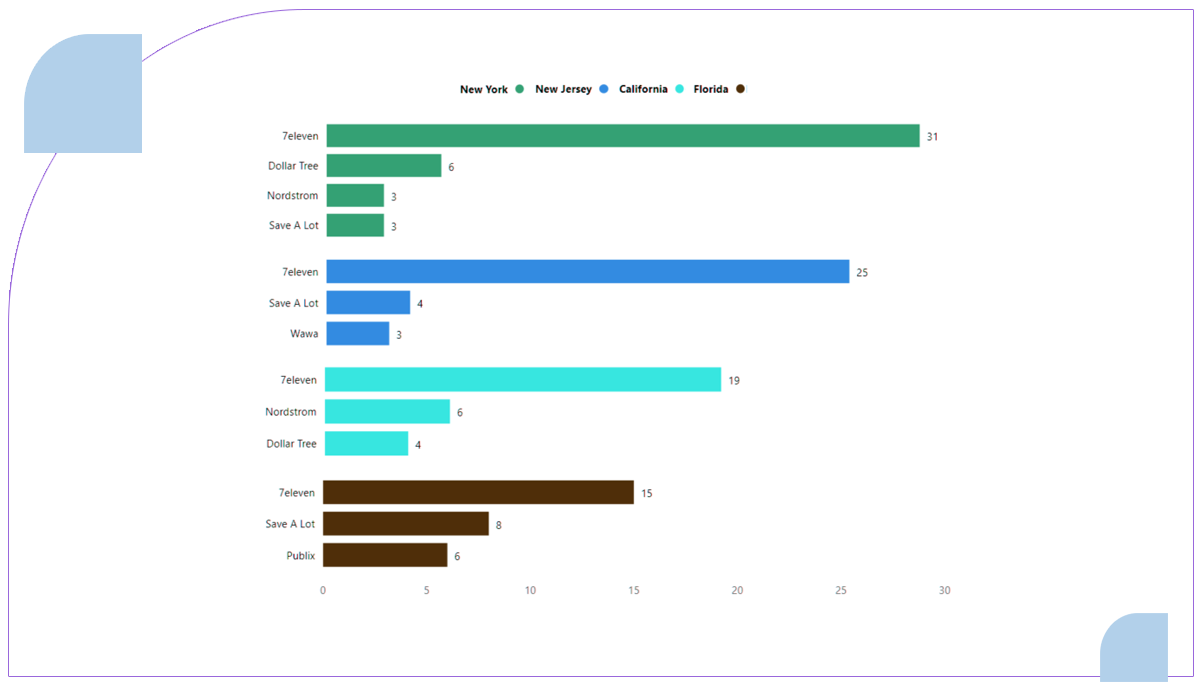

Scraping grocery data revealed that New York, New Jersey, Florida, and California collectively contributed 23% of total department and grocery store closures nationwide 2024. Among them, New York experienced closures from 11 out of the 39 store brands, while New Jersey, Pennsylvania, and Illinois each saw closures from 10 brands. The accompanying bar chart illustrates the leading store brands with closures in these key states—New York, New Jersey, California, and Florida—providing critical insights into the regional dynamics of the grocery retail landscape during the tumultuous year of 2024.

Among the states with the highest store closures, 7-Eleven has themost number of store closures.

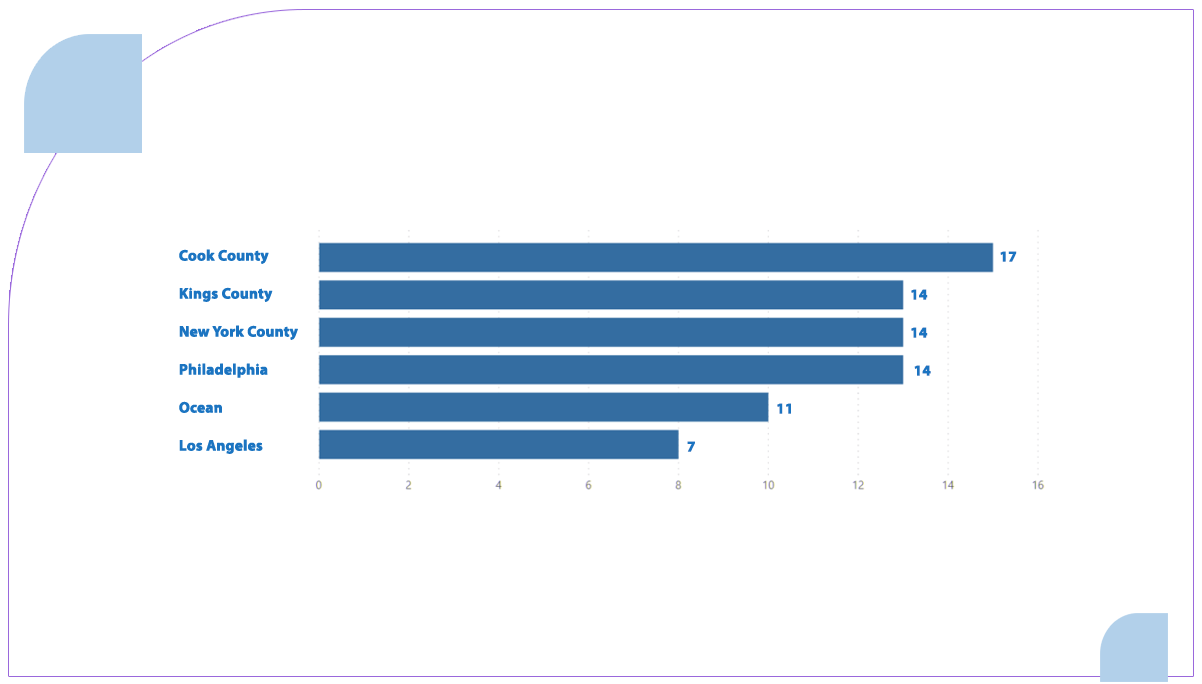

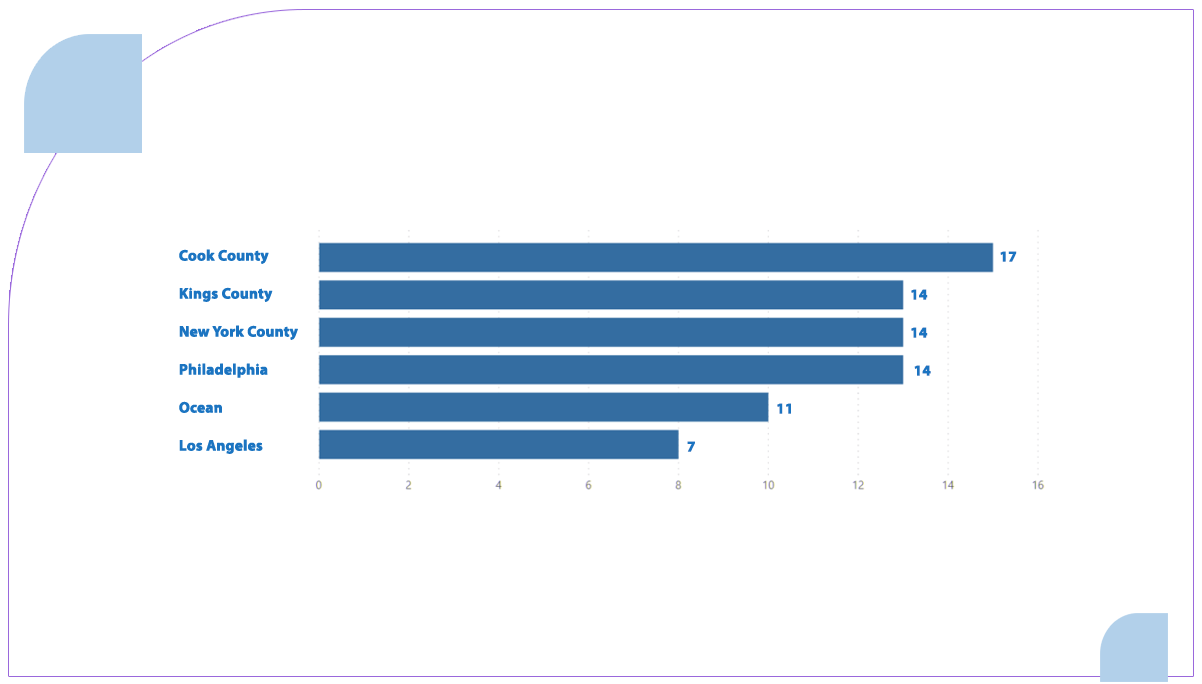

Top Counties Affected by Department and Grocery Store Closures

Cook County in Illinois led with 17 store closures, while Kings and New York counties in New York each saw 14 closures.

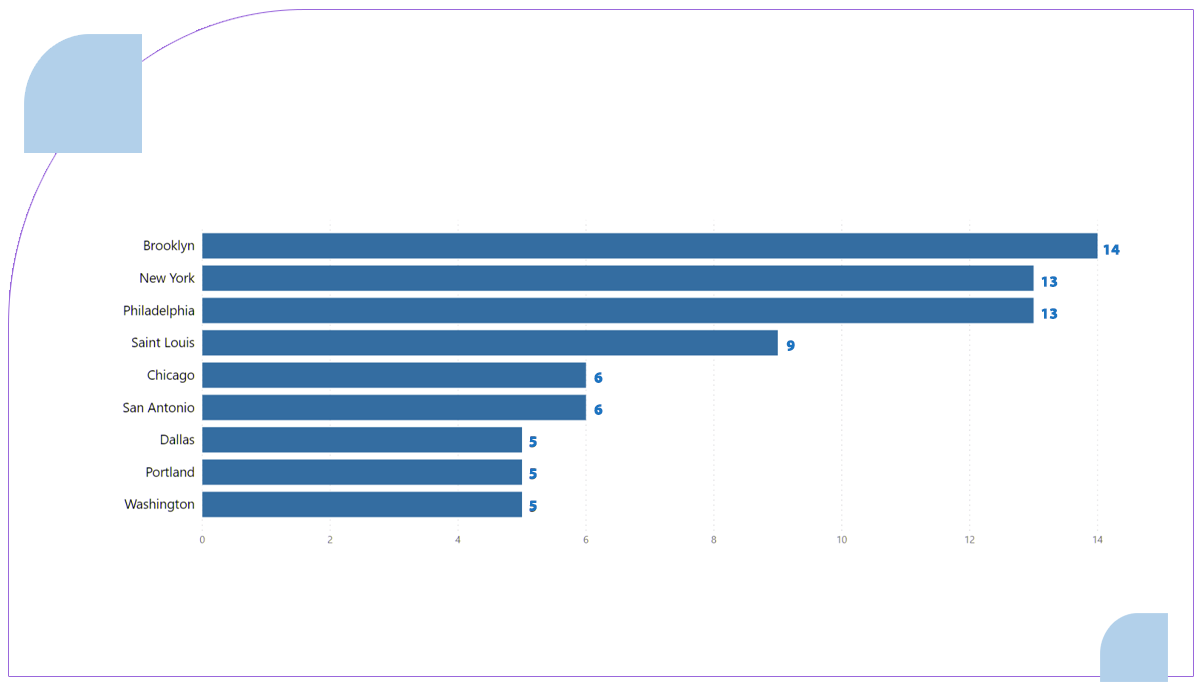

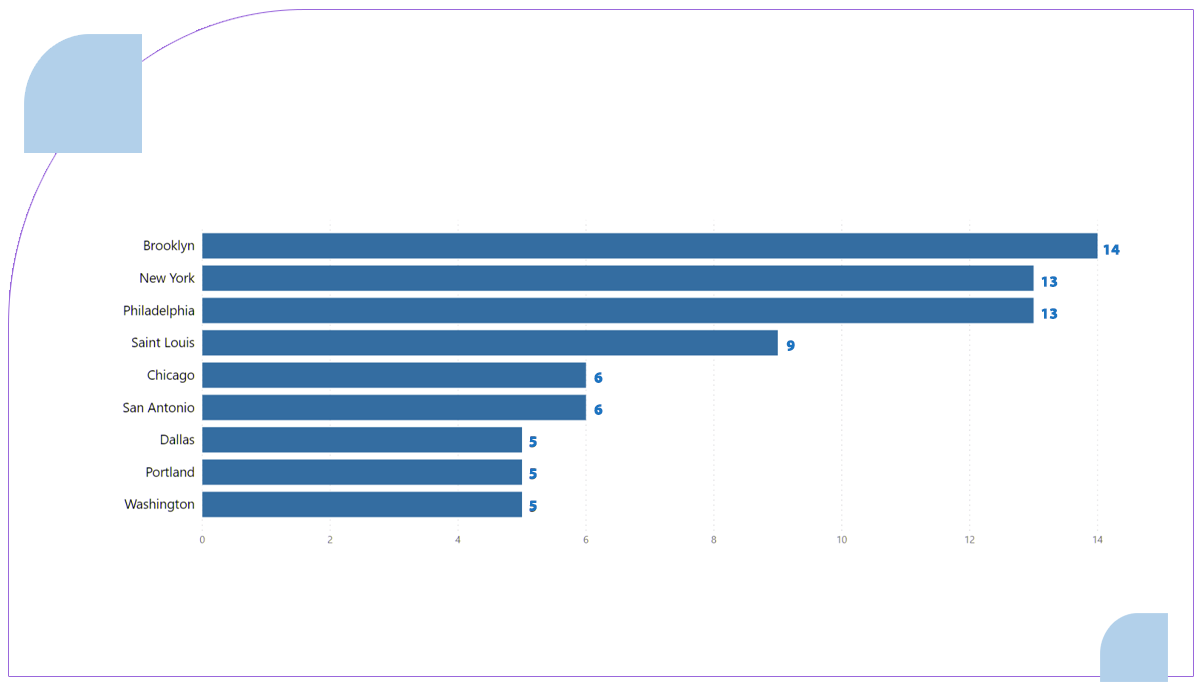

Cities Experiencing the Highest Number of Department and Grocery Store Closures

The depicted chart highlights the top 5 cities with the highest number of closures, with Brooklyn leading the pack, followed closely by New York City and Philadelphia.

Interestingly, while no city in New Jersey experienced more than 5 store closures individually, the state witnessed closures across 33 cities. In contrast, despite leading in total closures, New York saw store closings in only 23 cities. This nuanced comparison underscores the broader impact of closures across different urban centers within the respective states, reflecting varying degrees of economic challenges and retail dynamics at the city level spanning various industries, including Automotive, Healthcare, Fast Food, and more. Subscribers gain access to datasets featuring valuable information such as store closures, oopenings, parking availability, in-store pickup choices, services, holdings, nearest competitor stores, and additional relevant data points.

Conclusion:

The impact of the COVID-19 pandemic has accelerated the trend of store closures, with 2024 witnessing a surge in retail closures and bankruptcies. This trend appears poised to persist throughout 2021 as the global economy grapples with the coronavirus pandemic's ongoing effects. Retail establishments, in particular, have been significantly affected by the economic downturn, facing challenges such as dwindling sales, mounting debt, and operational inefficiencies.

Department stores, in particular, face heightened vulnerability, with iconic retailers like Neiman Marcus and JCPenney succumbing to the pressures of the pandemic. The decline in foot traffic at malls, coupled with the shift to online shopping and increased spending on essential goods, has further exacerbated the challenges faced by brick-and-mortar retailers. Despite efforts to adapt, such as transitioning to online and curbside pickup services, 2021 may continue the record-breaking pace of store closures.

Unlock powerful insights for your business with Food Data Scrape, your trusted ally in comprehensive food data aggregation and mobile grocery app scraping. Our specialized services provide deep data analytics, empowering informed decision-making for your success in a competitive market. Connect with us today to leverage aggregated data and propel your business forward with data-driven intelligence. Reach out to transform your strategies and stand out in the bustling marketplace.