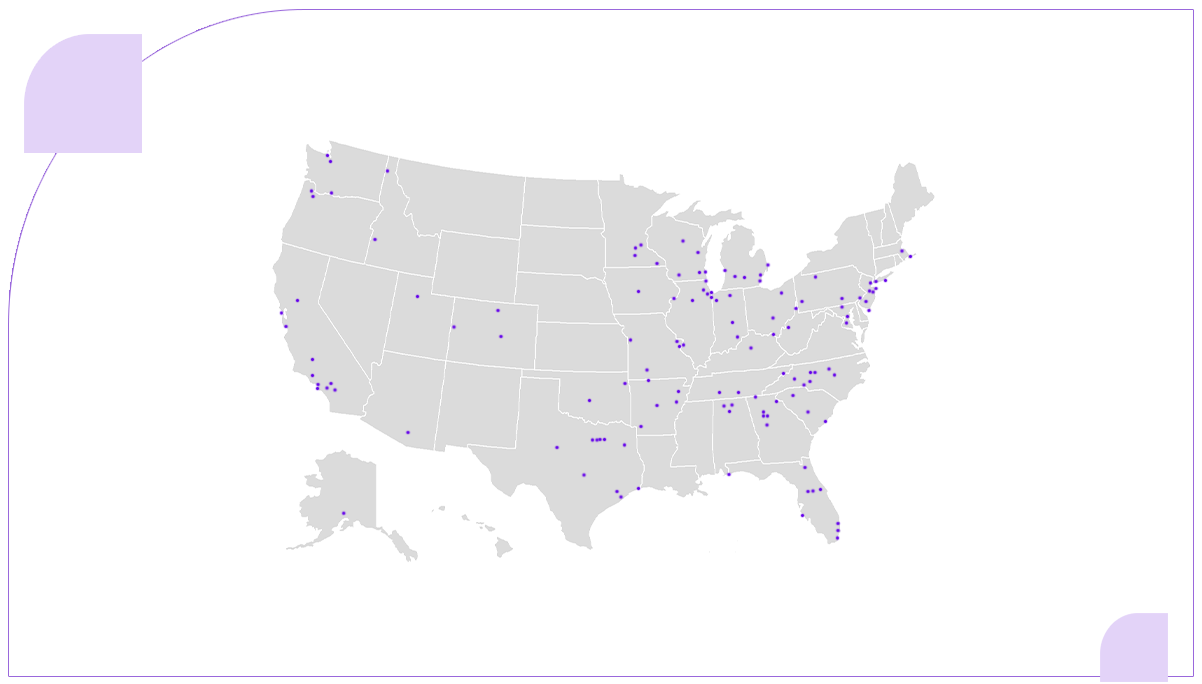

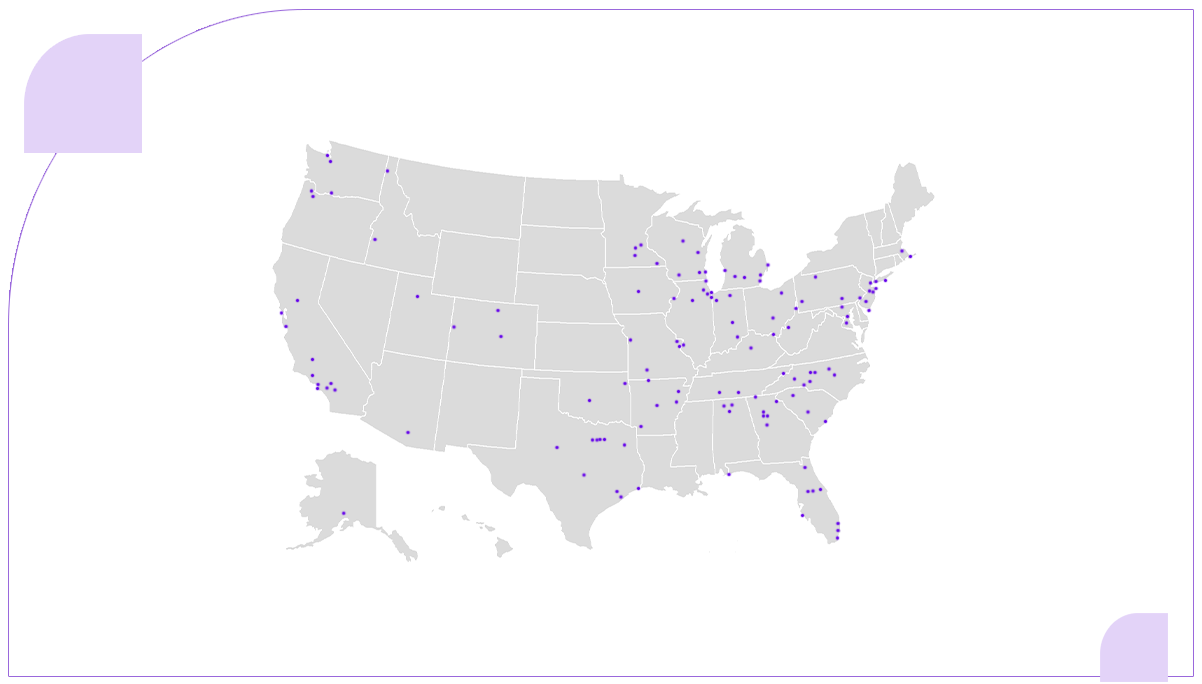

In August 2024, the United States witnessed a notable trend in the grocery and supermarket industry, marked by a total of 84 closures across the nation. Florida, Illinois, Missouri, and Michigan stood out among the states affected, each experiencing 8 closures, indicating significant challenges within these regions.

Food Data Scrape Data Store, a leading provider of supermarket grocery data scraping services, meticulously monitors the activities of 90 prominent grocery and supermarket brands nationwide. Its August 2024 analysis revealed 19 of these brands shuttered stores during this period. This data underscores the dynamic nature of the grocery market and the importance of leveraging grocery data scraping to stay informed about industry trends and developments. Such insights enable stakeholders to adapt strategies, navigate challenges, and make informed decisions in an ever-evolving market landscape.

Leveraging Supermarket Grocery Data Scraping Services for Comprehensive Insights

In our efforts to provide comprehensive insights into the grocery and supermarket industry, we offer the convenience of downloading a detailed Excel file containing the complete list of store closures. This file includes geocoded addresses, phone numbers, and providers for each closure, ensuring thorough analysis and informed decision-making.

The dataset comprises closures from prominent supermarket chains such as 7eleven, ACME, ALDI, Dollar General, Dollar Tree, Publix, Associated Food Stores, Family Dollar, Pick n Save, Food Lion, Jewel Osco, Hy-Vee, Kroger, Walmart, Save A Lot, Schnucks, and Wawa. Additionally, it encompasses closures from other relevant chains like Aarons, Bed Bath and Beyond, Purple, Chevron ExtraMile, BigLots, Fastenal, Francescas, Macy's, Ace Hardware, Rainbow Shops, Saloom, and Sleep Number.

By leveraging our supermarket grocery data scraping services, businesses gain access to valuable insights essential for strategic planning, market analysis, and competitive intelligence, empowering them to thrive in the dynamic landscape of the grocery industry.

Analyzing Grocery and Supermarket Store Closures Across States: Insights from Scraped Data

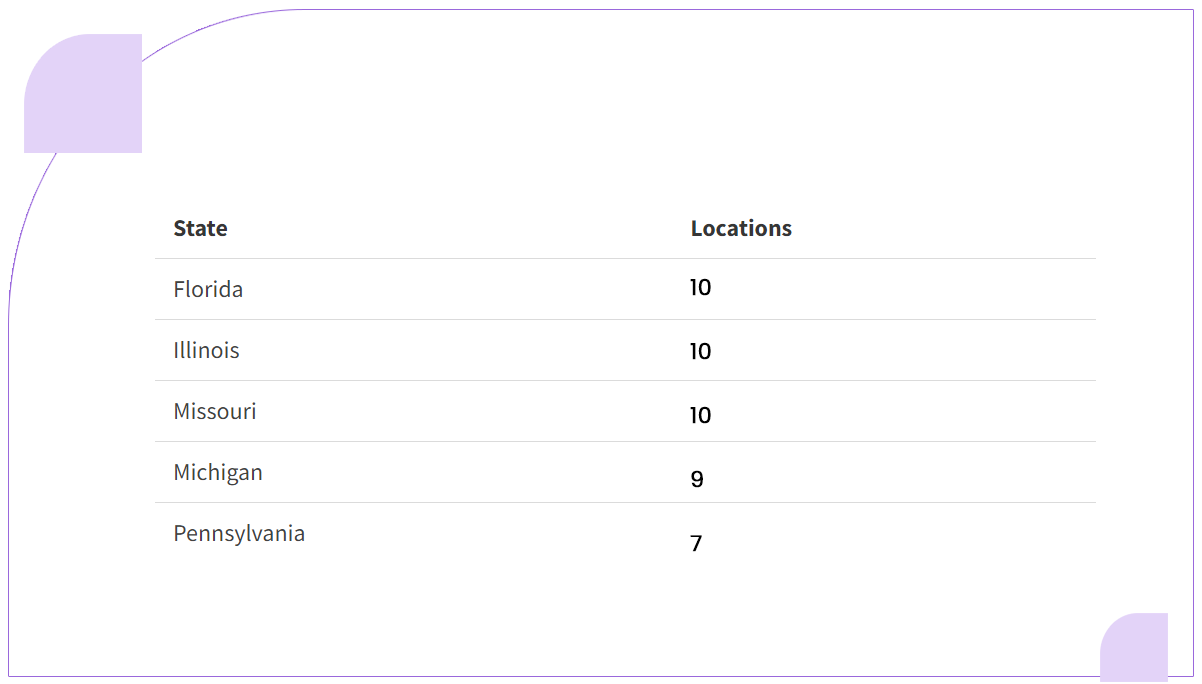

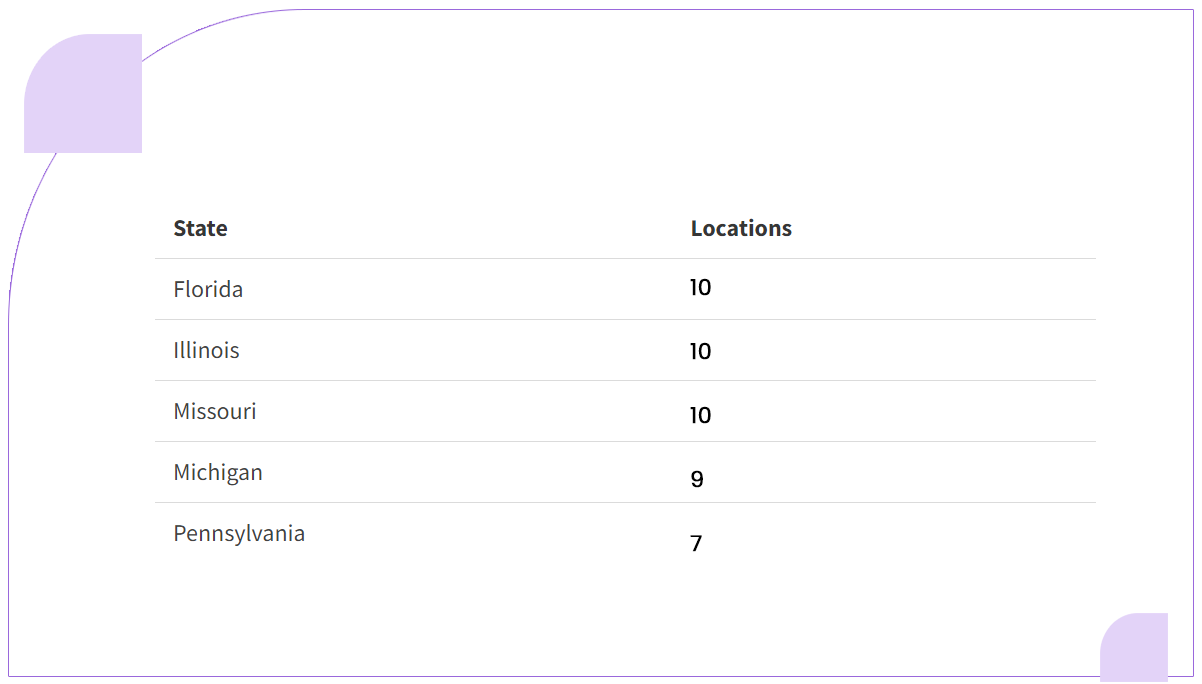

An in-depth analysis of grocery and supermarket store closures across states reveals notable trends in the US market. Scrape supermarket grocery data to find that Florida, Illinois, Missouri, and Michigan emerge as the states with the highest number of closures, with each state experiencing 7 closures. Collectively, these states account for 35.5% of the total closures nationwide. This data, obtained through meticulous scraping of supermarket grocery data, sheds light on regional challenges within the industry and underscores the importance of monitoring market dynamics for strategic decision-making and industry analysis.

Top States for Grocery and Supermarket Store Closures

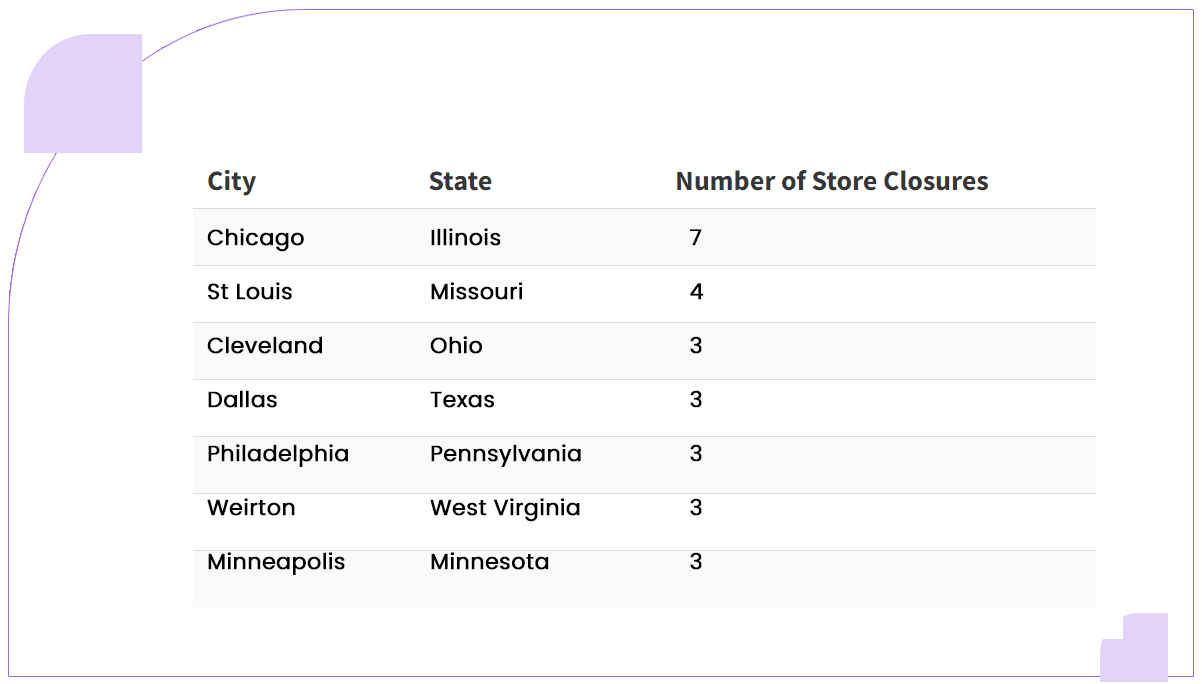

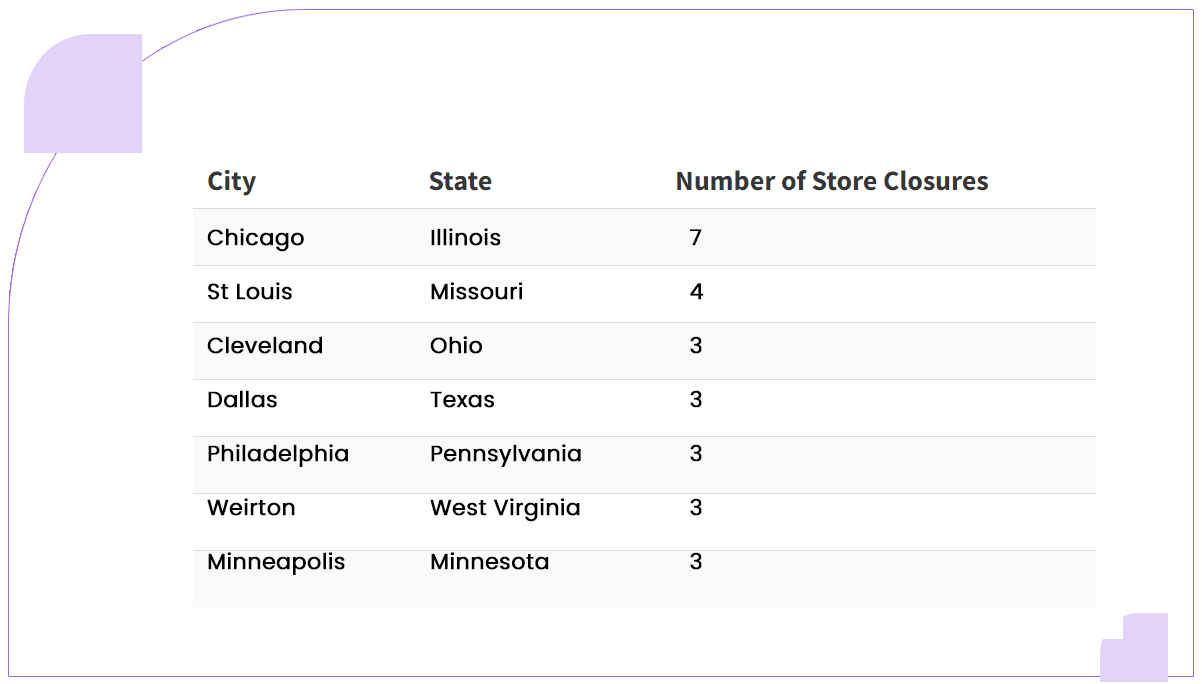

Cities Leading in Grocery and Supermarket Store Closures

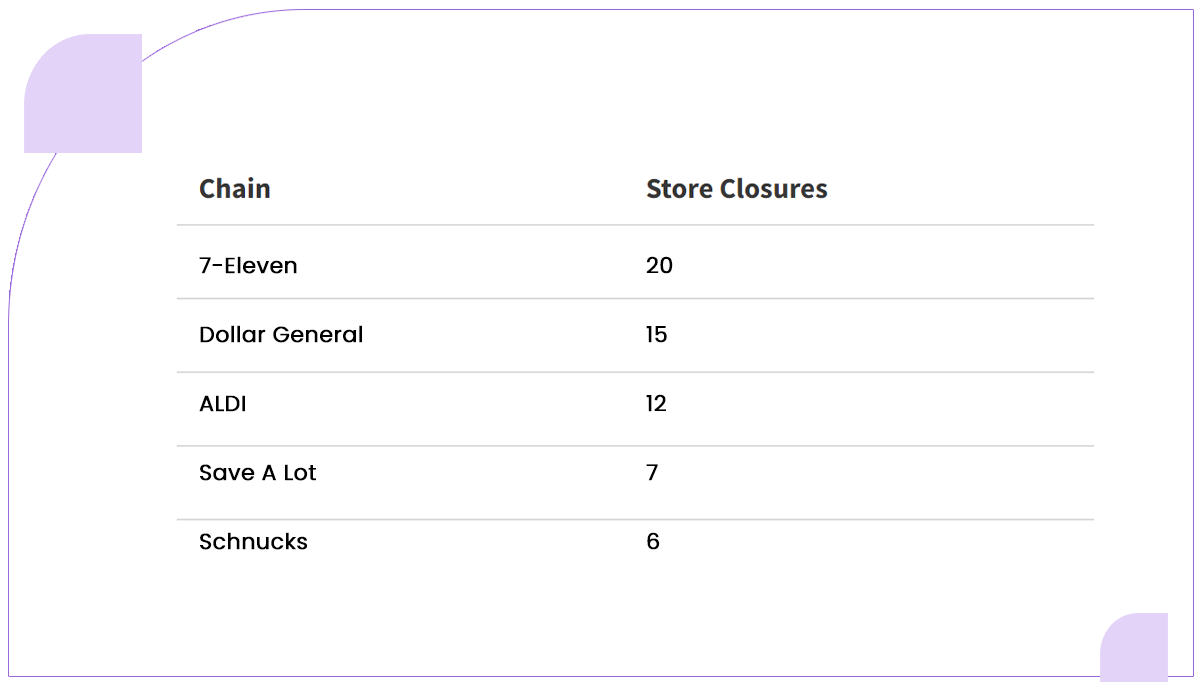

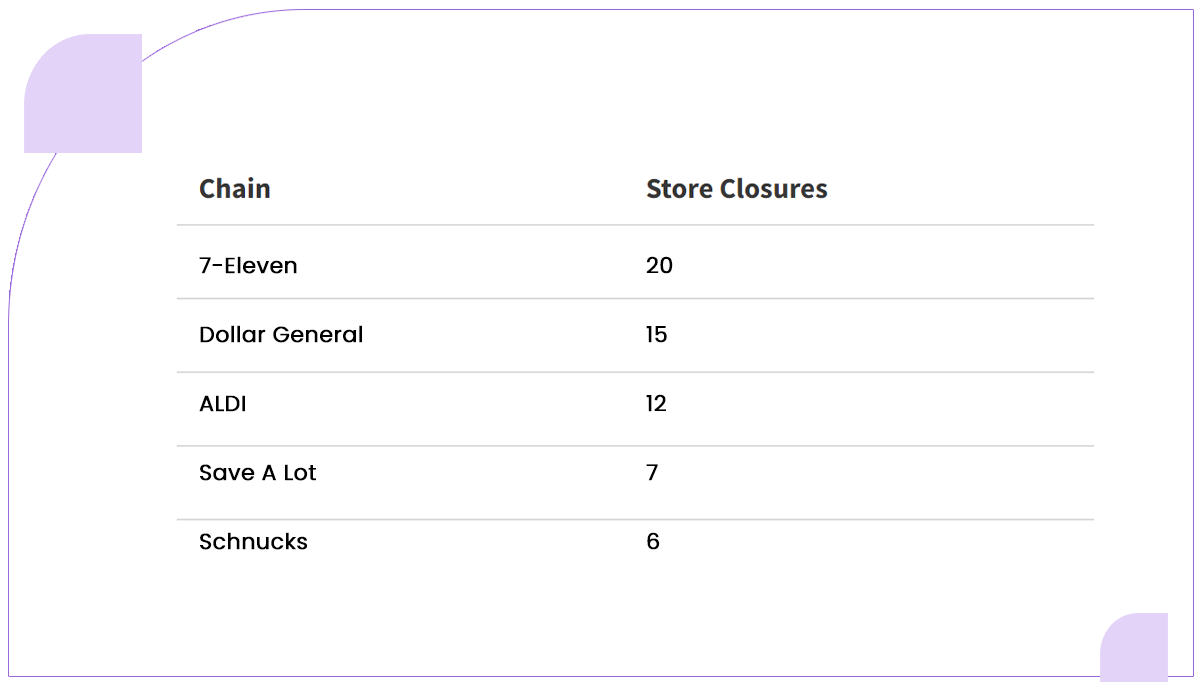

Primary Grocery and Supermarket Chains Affected by Closures in August 2024

In August, 7-Eleven witnessed the highest number of closures, totaling 20 stores. Following closely behind is Dollar General, which experienced 15 store closures, and ALDI, which experienced 12 store closures during the same period.

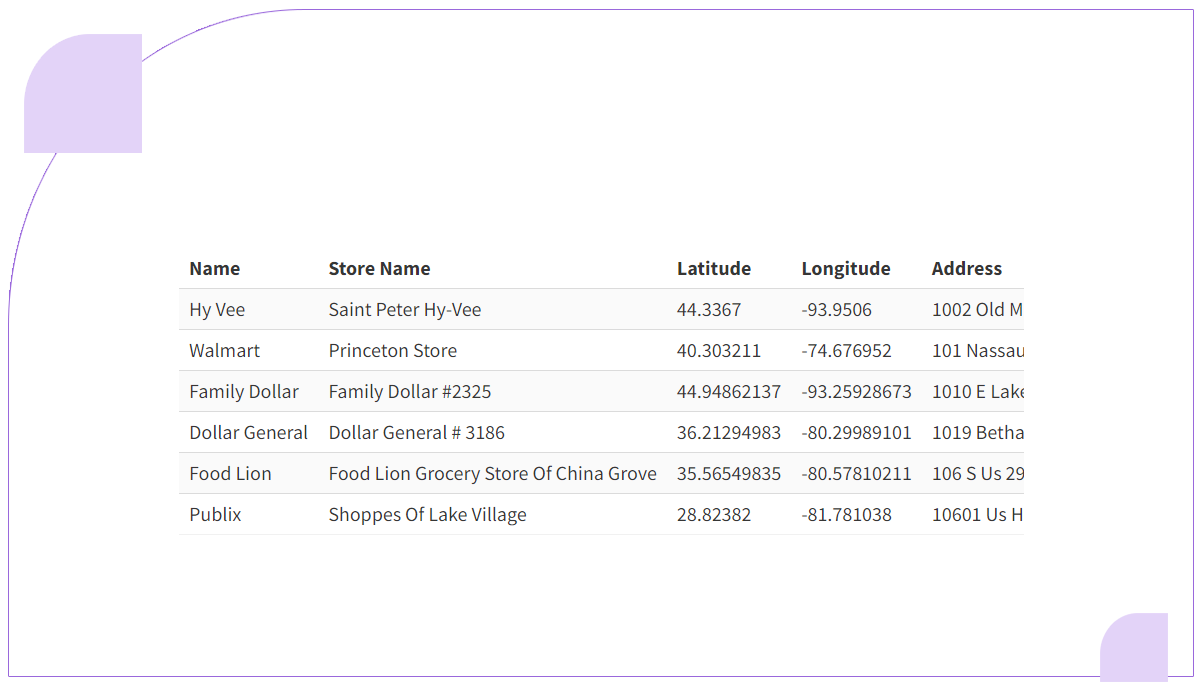

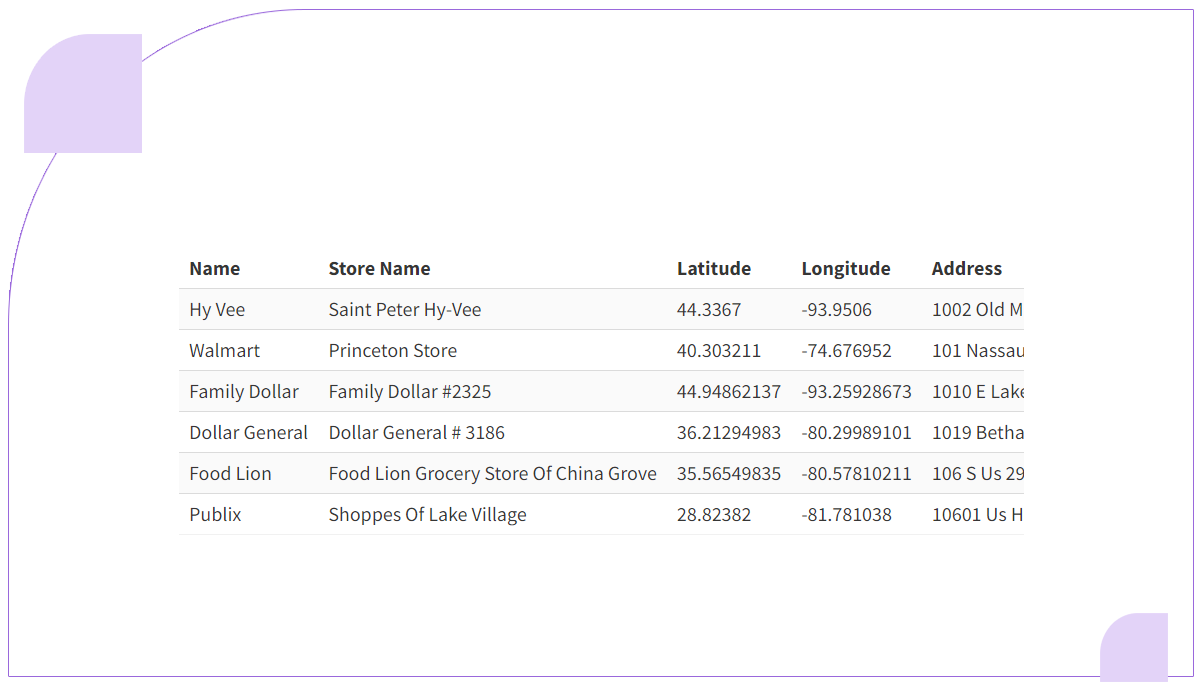

You can download the complete dataset from our data store to access the complete dataset utilized for this analysis. Below is a random and condensed sample of records showcasing the fields and data we provide for your reference.

Revolutionizing Retail: The Role of Grocery Data Scraping in Mall Transformations

Amidst the shift towards online sales, retailers are reimagining their brick-and-mortar stores as mini-distribution hubs. Simon Property Group, the largest mall owner in the US, is reportedly in discussions with Amazon to repurpose struggling department stores into open warehouses. If finalized, this collaboration could pave the way for Amazon to expand its grocery footprint, leveraging vacant mall spaces for initiatives like Whole Foods Markets.

This strategic pivot comes amidst the profound impact of the COVID-19 pandemic on the retail landscape. Mall owners like Simon are grappling with the challenge of repurposing retail spaces in the face of dwindling foot traffic and a shrinking pool of growing retailers. For Amazon, capitalizing on mall space presents an opportunity to streamline logistics, bringing distribution centers closer to residential areas and enhancing efficiency. This innovative approach underscores the evolving dynamics of the retail sector and highlights the importance of adapting to changing consumer behavior. As retailers and property owners navigate the post-pandemic landscape, grocery supermarket data scraping could be pivotal in informing strategic decisions and optimizing operations to meet evolving consumer demands.

Unlock the potential of your business strategies with Food Data Scrape, your trusted ally in accessing profound insights. Our expertise lies in Food Data Aggregation and Mobile Grocery App Scraping, providing you with extensive data analytics—partner with us to elevate your decision-making process, paving the way for success through data-driven intelligence. Contact us today to tap into the power of aggregated data, empowering you to make informed decisions that differentiate your business in the competitive landscape. Don't miss out on the opportunity to stay ahead of the curve and drive your business towards unparalleled success.