Introduction

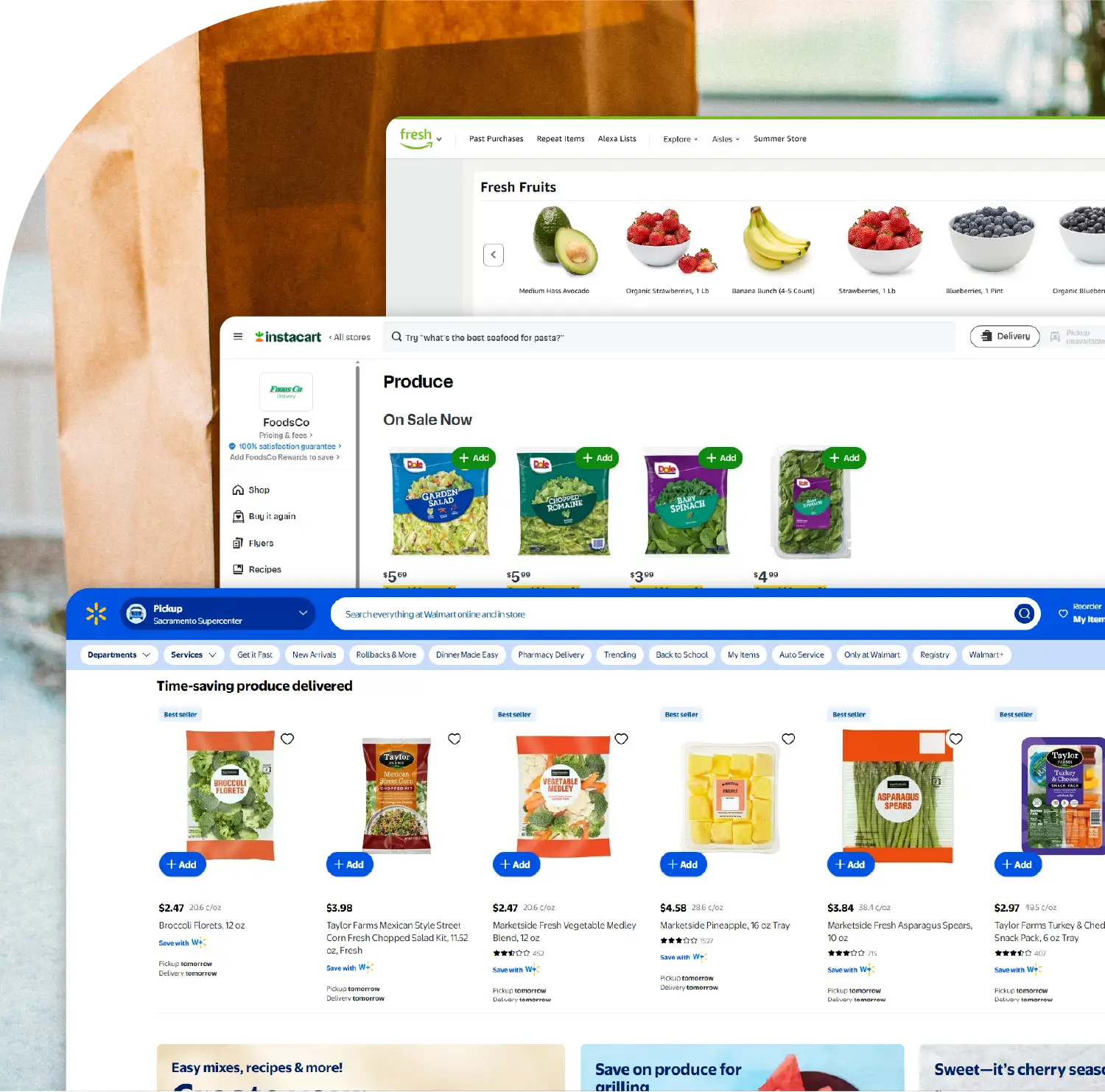

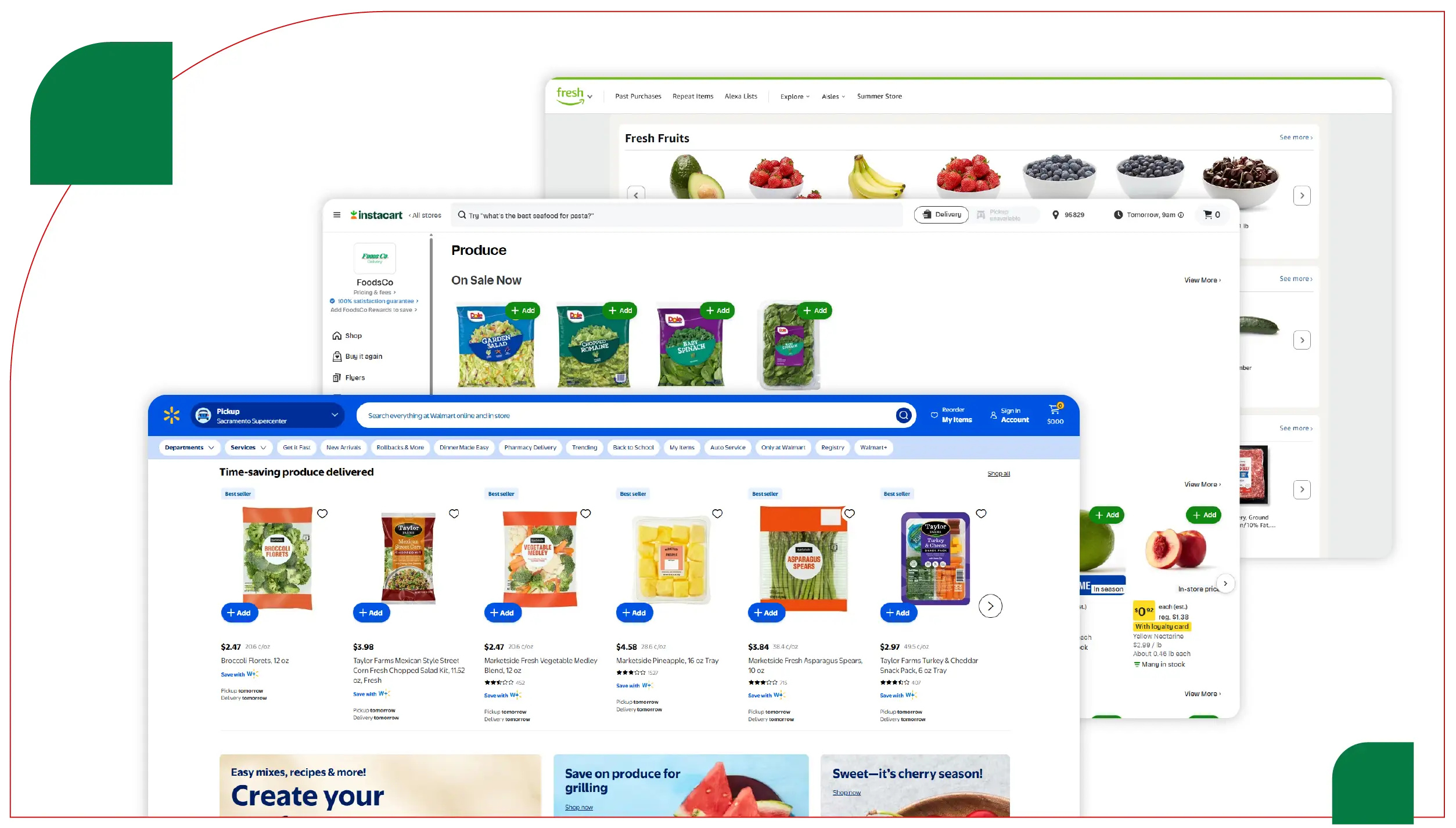

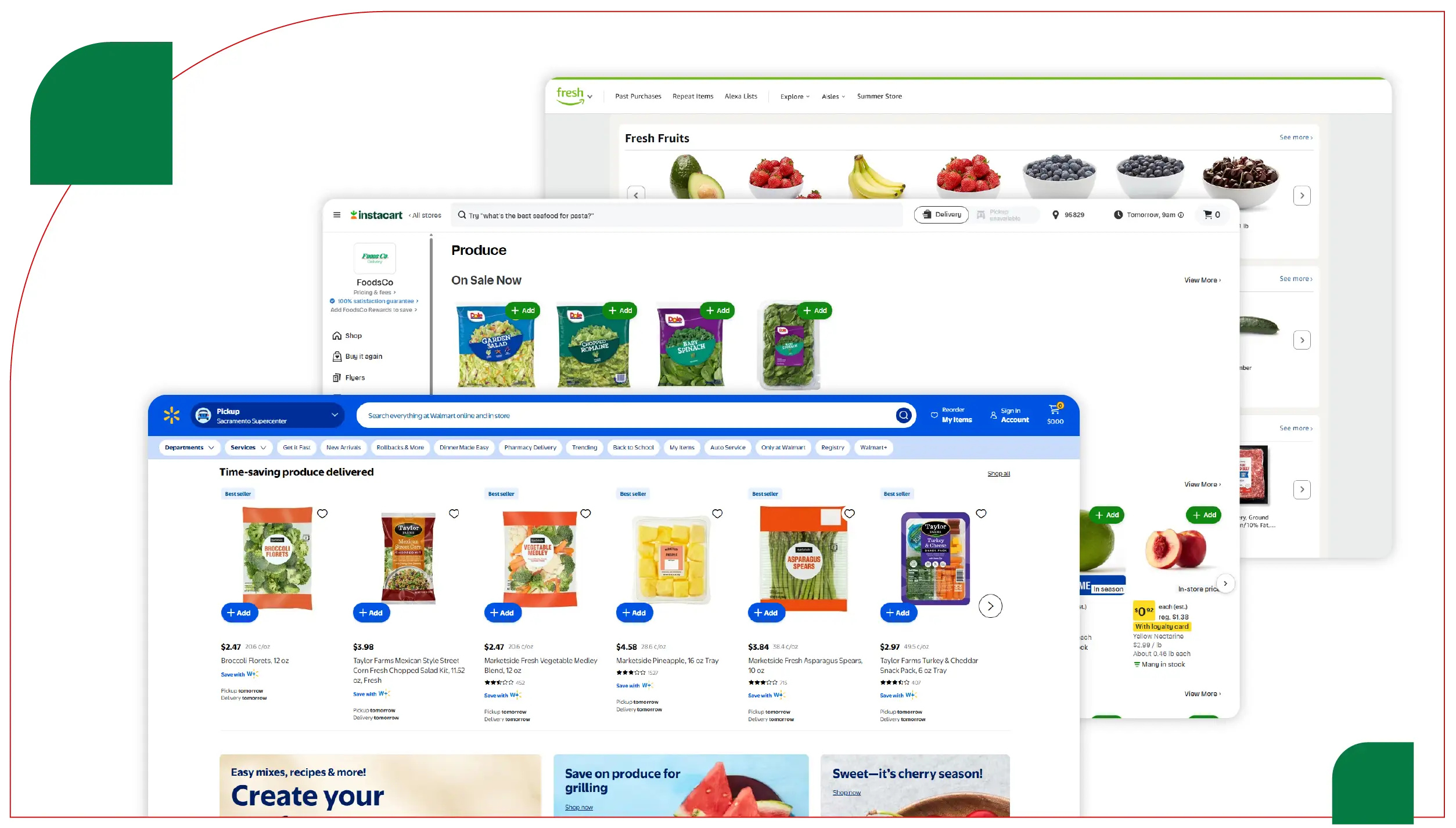

The online grocery space has been a core part of modern retail in a short amount of time due to increased customer demand for convenient access, real-time display of pricing data, and a greater variety of fresh options available to consumers. Pricing intelligence is critical to competing in this fast-moving and highly competitive market, giving organizations the level of context required to remain agile in their customer-facing roles. An increasing number of organizations are engaging in sophisticated data extraction techniques when they need to Track Weekly Vegetable & Fruit Prices with Web Scraping API to obtain continuous, detailed insights around market changes.

This report looks into Weekly Fruits and Vegetables Price Data Scraping from three of the largest online grocery operations in the United States – Instacart, Amazon Fresh, and Walmart Grocery – throughout July 2025. With access to a multi-source data scraping framework, the report can incorporate a greater number of price data points for fruits and vegetables which help provide a comprehensive understanding of retail pricing activity with regards to fresh produce.

Leveraging our Fruits & Vegetables Price Tracker – Instacart, Walmart, and Amazon Fresh - we extracted structured data reflecting SKU-level price changes, promotional shifts, and geographical price differences. This information not only helps stakeholders track market volatility but also supports decision-making in procurement, assortment planning, and dynamic pricing strategies. Importantly, the data acquisition process adhered strictly to ethical scraping protocols and aligned with the respective platforms’ terms of use and data privacy regulations. This level of pricing transparency enables retailers, supply chain professionals, and researchers to gain a deeper understanding of how digital grocery pricing fluctuates over time and across regions, particularly during key shopping periods and seasonal cycles.

Methodology

The data was collected from Instacart, Amazon Fresh, and Walmart Grocery using specialized APIs and web scraping tools optimized for real-time extraction of grocery prices. The project focused on Web Scraping Weekly Grocery Prices from Top Websites, with a targeted scope on fresh produce categories—namely apples, bananas, carrots, and spinach. Coverage included three major U.S. metropolitan areas: New York, Los Angeles, and Chicago. Data scraping was conducted on a weekly basis from July 1st to July 20th, 2025, enabling detailed monitoring of price changes, availability, and promotional activity. Following extraction, the data was cleaned, structured, and analyzed to identify pricing patterns. Results are presented in both tabular and analytical formats.

Data Overview

Below are two tables showing the average weekly prices per pound for select fruits and vegetables on the three platforms during the target period across sampled regions:

Table 1: Average Weekly Prices for Fruits (1st–20th July 2025)

| Week |

Item |

Instacart |

Amazon Fresh |

Walmart Grocery |

| July 1–7 |

Apples |

$2.15 |

$2.05 |

$1.95 |

| July 1–7 |

Bananas |

$0.89 |

$0.85 |

$0.80 |

| July 8–14 |

Apples |

$2.20 |

$2.10 |

$2.00 |

| July 8–14 |

Bananas |

$0.92 |

$0.87 |

$0.83 |

| July 15–20 |

Apples |

$2.25 |

$2.15 |

$2.05 |

| July 15–20 |

Bananas |

$0.95 |

$0.90 |

$0.85 |

Table 2: Average Weekly Prices for Vegetables (1st–20th July 2025)

| Week |

Item |

Instacart |

Amazon Fresh |

Walmart Grocery |

| July 1–7 |

Carrots |

$1.45 |

$1.40 |

$1.35 |

| July 1–7 |

Spinach |

$3.20 |

$3.10 |

$3.00 |

| July 8–14 |

Carrots |

$1.50 |

$1.45 |

$1.40 |

| July 8–14 |

Spinach |

$3.25 |

$3.15 |

$3.05 |

| July 15–20 |

Carrots |

$1.55 |

$1.50 |

$1.45 |

| July 15–20 |

Spinach |

$3.30 |

$3.20 |

$3.10 |

Key Observations

1. Price Consistency and Variation

Using Scraping Fruit & Vegetable Pricing Trends, we observed that Walmart Grocery consistently offered the lowest prices for both fruit and vegetable SKUs. Apples ranged from $1.95 to $2.05, compared to Instacart’s $2.15 to $2.25. Banana prices were also lower on Walmart, ranging between $0.80 and $0.85.

2. Weekly Price Increases

All three platforms showed a gradual price increase over the three-week period, with apples rising ~5% and spinach ~3%. This uptick may be linked to seasonal supply fluctuations or early summer demand shifts.

3. Regional Price Differences

Using Online Grocery Price Scraper Weekly for Fruits & Vegetables, we found that prices in New York were consistently 5–10% higher than in Los Angeles and Chicago. This disparity likely reflects delivery surcharges and warehouse operational costs in higher-cost urban centers.

4. Promotional Activity

Through the tools to Extract Fruits & Vegetables Prices Weekly from Top Grocery Platforms process, we noted that Amazon Fresh ran more frequent promotions—particularly on vegetables during the second week of July. Instacart followed with moderate discounts, while Walmart held fewer sales but offered the lowest base prices.

Analysis

The data—gathered through the Instacart Grocery Delivery Scraping API—offers essential insights into weekly fruit and vegetable pricing dynamics across leading e-commerce grocery platforms.

Collected using the Walmart Grocery Delivery Scraping API, the data highlights Walmart’s consistent price leadership across a wide range of fresh produce categories.

This competitive edge supports the retail giant’s expected dominance in U.S. online grocery sales, projected to surpass $71 billion by 2025.

Leveraging the Amazon Fresh Grocery Delivery Scraping API, the dataset also uncovers pricing trends, promotional shifts, and regional pricing variations that reflect evolving digital consumer behavior.

These three APIs combined enable businesses to act on real-time pricing intelligence, optimize their inventory strategies, and align with the fast-paced nature of the online grocery market.

Conversely, Amazon Fresh focuses on value via Prime member deals and rapid delivery. Instacart, sourcing from premium grocers, exhibited higher prices but greater variety and convenience—appealing to urban, high-income consumers.

Data from our Grocery App Data Scraping Services shows that price changes are influenced by a mix of supply availability, regional purchasing trends, and time-sensitive promotions. For example, spinach’s gradual increase may reflect limited mid-July harvest yields.

These insights, made possible by Web Scraping Quick Commerce Data, can guide strategic adjustments in retail pricing and promotional design.

Consumer Behavior Insights

Our Grocery Delivery Scraping API Services revealed distinct consumer preferences:

- Walmart attracts cost-sensitive buyers looking for everyday low pricing.

- Amazon Fresh caters to convenience-focused shoppers, especially Prime subscribers.

- Instacart users prioritize variety and same-day delivery, often accepting higher price points.

Regional pricing data reinforces the value of ZIP-level pricing strategies, especially in competitive, high-density markets like New York.

Implications for Stakeholders

Retailers

- Scraping Fruit & Vegetable Pricing Trends enables dynamic price optimization, inventory control, and promotion timing across geographic markets.

- Competitors may be forced to counter Walmart’s base pricing with deeper discounts, as reflected in Amazon Fresh’s mid-July vegetable promos.

Consumers

- Budget-focused households benefit from Walmart’s consistency, while those prioritizing convenience may lean toward Instacart or Amazon Fresh.

Business Intelligence Teams

- Data from Grocery Pricing Data Intelligence empowers analysts to refine pricing models, benchmark SKUs, and respond to competitors in real-time.

Future Outlook

The ongoing digitalization of grocery commerce—expected to draw 148+ million U.S. users in 2025—underscores the need for robust price intelligence. Innovations in AI, dynamic pricing, and Web Scraping Quick Commerce Data will shape how retailers respond to consumer expectations and seasonal fluctuations.

Our tech stack will continue evolving to offer even deeper insights using historical datasets, forecasting algorithms, and market simulation models.

How Food Data Scrape Can Help You?

- Automated Weekly Scheduling: Our systems are configured for automated weekly data extraction, ensuring consistent and timely updates without manual intervention. This helps clients stay informed with the most current datasets every week.

- Scalable Infrastructure: We handle large-scale weekly scraping across multiple platforms and product categories, allowing businesses to track pricing, availability, and promotions with precision.

- Error-Resistant Pipelines: Our advanced scraping frameworks include validation layers that reduce data duplication and capture errors, ensuring each weekly dataset is clean, reliable, and analysis-ready.

- Customizable Data Outputs: Clients receive structured weekly data in preferred formats (CSV, JSON, API feeds), tailored to their business logic or platform integrations for seamless workflow automation.

- Insight-Driven Dashboards: We integrate scraped weekly data into business intelligence tools, enabling clients to visualize trends, detect anomalies, and make timely strategic decisions based on fresh, actionable insights.

Conclusion

This study demonstrates how Grocery Store Datasets across Instacart, Amazon Fresh, and Walmart Grocery provides unmatched transparency into produce pricing in the U.S. market. By deploying tools like our Grocery Price Tracking Dashboard, stakeholders can visualize real-time trends, regional differences, and promotional strategies.

Our Grocery Pricing Data Intelligence services offer clients a data-driven edge—highlighting Walmart’s pricing dominance, Amazon’s promotion-heavy approach, and Instacart’s convenience-first model. As online grocery competition accelerates, efficient and ethical data scraping will remain essential to strategic pricing, assortment planning, and customer satisfaction.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.