Introduction: Why Valentine’s Day 2026 Matters for the Liquor Industry

Valentine’s Day has steadily evolved into one of the most commercially influential short-duration events for the global liquor market. Unlike festivals that emphasize bulk consumption, Valentine’s Day is driven by intentional, experience-focused purchasing behavior. Consumers are not simply buying alcohol; they are curating moments—romantic dinners, intimate celebrations, premium gifting, and social experiences.

This shift makes data visibility critical. Valentine’s Day Liquor Data Scraping enables liquor brands, retailers, bars, and delivery platforms to capture real-time insights into how pricing, availability, and offers shift during one of the most emotionally driven purchasing windows of the year. Static sales reports fail to capture these rapid changes, especially when pricing strategies differ by city, channel, and product category.

As digital alcohol commerce expands further in 2026, Liquor Sales Data Extraction for Valentine’s Day 2026 becomes essential for identifying which products see accelerated demand, which price points convert best, and how promotional strategies evolve across Valentine’s Week. Businesses that actively Scrape Liquor Discounts & Offers for Valentine’s Day gain a competitive advantage by reacting to market signals as they occur, rather than after the event concludes.

Understanding the Unique Nature of Valentine’s Day Liquor Demand

Valentine’s Day liquor demand is structurally different from other seasonal events. Scraping Sales & Offer Data from Bars and Online Stores consistently show three defining characteristics:

- Premium Over Volume Consumers demonstrate a higher willingness to pay for visually appealing, premium-positioned products such as champagne, rosé wine, and craft spirits. Price sensitivity decreases when products align with romantic symbolism or gifting expectations.

- Planned Purchasing Behavior Unlike impulsive festival buying, Valentine’s liquor purchases are often planned several days in advance. This results in earlier demand peaks and increased pre-order activity, particularly on online liquor platforms.

- Experience-Led Product Selection Alcohol is chosen based on how well it complements food, ambiance, and presentation. Cocktail compatibility, packaging design, and pairing suggestions significantly influence buying decisions.

These characteristics make Valentine’s Day Alcohol Sales Analytics a high-value exercise for understanding premium consumer behavior.

Liquor Category Performance During Valentine’s Week

Scraped Valentine’s Day 2026 Liquor Demand Insights from bars, online liquor stores, and delivery platforms show clear category-level demand patterns during Valentine’s Week.

Table 1: Liquor Category Demand Growth (Valentine’s Week vs Average Week)

| Liquor Category |

Demand Growth |

Consumer Motivation |

| Sparkling Wine & Champagne |

40–45% |

Romantic association, gifting |

| Rosé Wine |

32–36% |

Aesthetic appeal, social sharing |

| Flavored Vodka & Gin |

25–30% |

Home cocktail creation |

| Cream & Dessert Liqueurs |

28–33% |

Dessert pairing |

| Ready-to-Drink Cocktails |

35–42% |

Convenience and spontaneity |

This data highlights a consistent preference for low-effort, high-experience alcohol formats, particularly those that photograph well and feel occasion-specific.

Pricing Trends and Promotional Behavior During Valentine’s Day

Pricing during Valentine’s Day follows a more nuanced approach compared to other retail events. Instead of deep discounting, sellers focus on protecting brand value while enhancing perceived benefits.

Valentine’s Day Liquor Pricing & Offer Tracking reveals that premium products often experience controlled price increases, while mid-range categories rely on bundled value propositions rather than outright discounts.

Table 2: Average Price Movement by Product Segment

| Product Segment |

Typical Price Movement |

Offer Strategy |

| Champagne |

+8–12% |

Premium anchoring |

| Rosé Wine |

+5–7% |

Bundle pricing |

| Flavored Spirits |

Stable |

Complimentary mixers |

| RTD Cocktails |

−6–10% |

Multi-pack incentives |

This pricing behavior reflects a deliberate attempt to maintain margins while still appealing to Valentine’s-specific demand drivers.

Bars vs Online Liquor Stores: Channel-Level Demand Differences

Valentine’s Day liquor consumption varies significantly by channel, reflecting different consumer motivations.

Table 3: Channel-Wise Demand Characteristics

| Channel |

Primary Consumer Intent |

Commercial Implication |

| Bars & Lounges |

Experiential dining |

High-margin cocktails |

| Online Liquor Stores |

Planned gifting |

Premium bottle sales |

| Alcohol Delivery Apps |

Convenience |

Fast-moving SKUs |

| Restaurants |

Upselling |

Cocktail pairing |

Bars benefit from higher per-unit margins, while online platforms capture a larger share of pre-planned purchases.

Valentine’s Week: A Multi-Day Demand Window

Data clearly indicates that Valentine’s Day has expanded into a week-long commercial event. Demand typically begins rising 5–7 days before February 14 and peaks on the evening of Valentine’s Day.

Using method to Extract Valentine’s Day Alcohol Offer Data, several patterns emerge:

- Early-week purchases skew toward wine and champagne

- Mid-week demand increases for cocktail-friendly spirits

- February 14 sees peak sales of RTDs and fast-delivery items

- Post-Valentine pricing corrections occur within 48–72 hours

Businesses that recognize this extended demand window outperform those focusing only on a single-day spike.

Promotion Types and Their Real Impact on Sales

Not all promotions perform equally during Valentine’s Day. Scraped offer data reveals that experience-enhancing promotions outperform price-led discounts.

Valentine’s Week Alcohol Offers Scraping shows:

- Bundled products increase conversion by over 40%

- Free add-ons protect margins while improving perceived value

- Flat discounts lose effectiveness beyond 15%

- Limited-edition positioning drives urgency and exclusivity

These findings suggest that emotional alignment matters more than price cuts during Valentine’s Day.

SKU-Level Attributes That Drive Higher Conversion

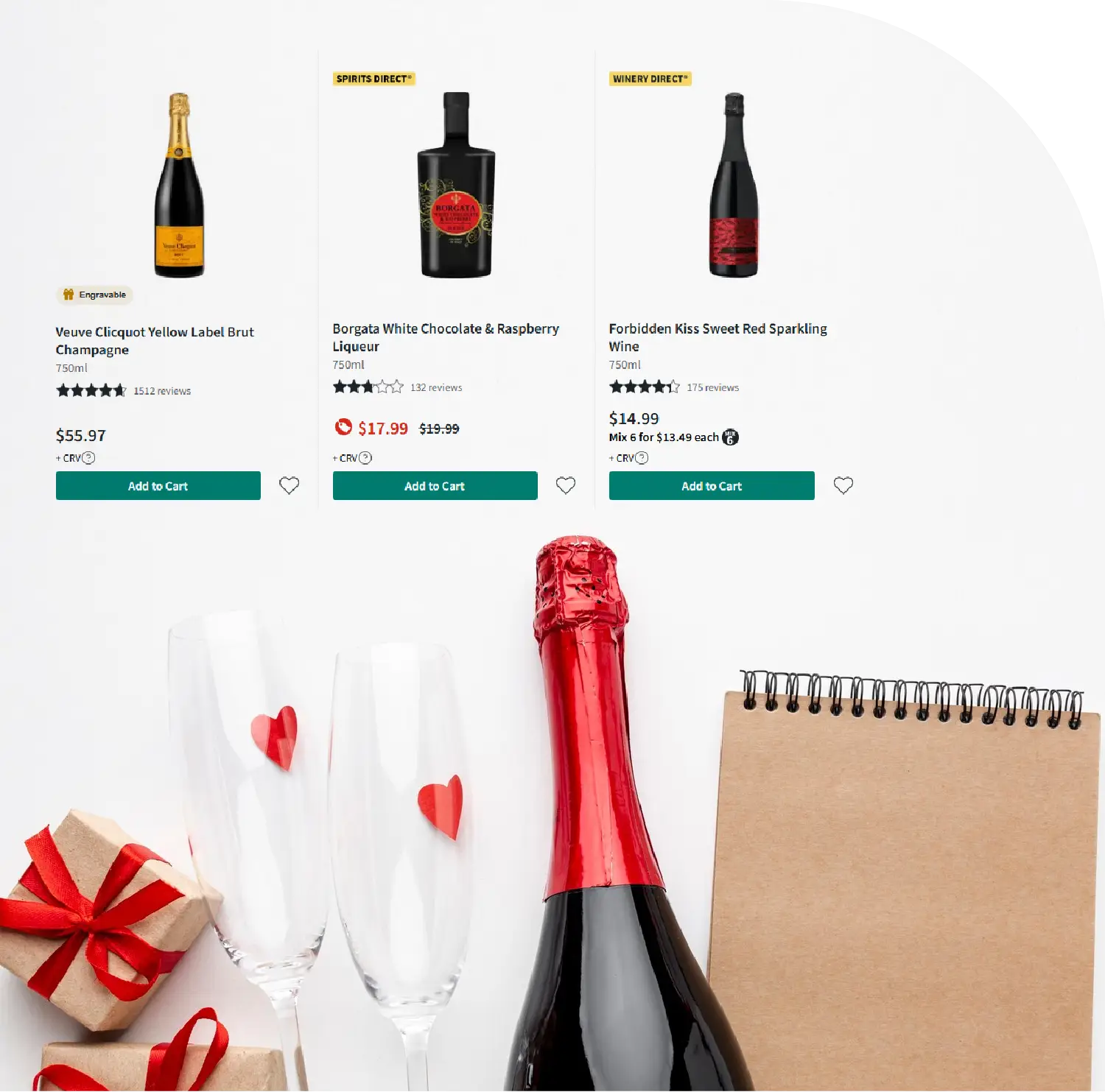

Product-level analysis reveals consistent traits among top-performing Valentine’s Day SKUs:

- Gift-friendly 750ml formats

- Elegant or romantic packaging

- Clear food and cocktail pairing suggestions

- Seasonal or limited-edition labeling

Discounting poorly presented products rarely compensates for lack of gifting appeal.

Inventory Availability and Stockout Signals

Availability scraping provides early warnings of inventory stress. During Valentine’s Week:

- Champagne stockouts increase by approximately 20% by February 13

- Rosé wine shortages appear in metro-heavy markets

- RTDs maintain stronger availability due to faster replenishment

Retailers leveraging Liquor Price Data Scraping Services often adjust pricing dynamically when availability declines, preserving profitability.

Strategic Importance of Aggregated Liquor Intelligence

Consolidated Alcohol and Liquor Datasets allow stakeholders to:

- Forecast demand more accurately

- Optimize pricing at a regional level

- Benchmark competitors in real time

- Improve promotion timing

- Reduce inventory risk

Valentine’s Day acts as a high-signal environment where consumer behavior is easier to decode through data.

Conclusion

Valentine’s Day 2026 represents more than a seasonal sales opportunity—it is a strategic testing ground for premium pricing, promotion design, and demand forecasting. Businesses that Scrape Alcohol Price Data gain real-time insight into how consumers respond to emotional and experiential cues.

When these insights are consolidated into a Liquor Price Tracking Dashboard, decision-makers can quickly identify pricing gaps, demand spikes, and competitive threats. Ultimately, sustained success during high-intent occasions depends on advanced Liquor Data Intelligence Services that transform raw market data into actionable commercial strategy.

Valentine’s Day is no longer just about celebration—it is about precision, timing, and intelligence-led growth.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.