Introduction

The club sandwich has never needed hype to survive. It thrives on familiarity, structure, and execution. While flashy formats rotate in and out of social media cycles, the club remains a steady performer across diners, cafés, hotel menus, and delivery platforms. But understanding its real position in the market requires something deeper than surface chatter. It requires Web Scraping Club Sandwich Trend Data at scale.

Brands today don’t rely on guesswork. They Scrape Club Sandwich Trends Data from delivery platforms, restaurant websites, social platforms, and review aggregators to understand how the format is evolving. They Extract Club Sandwich Trend Data across regions to see where the format is stable, where it is declining, and where execution changes are driving performance.

This blog explores how web scraping helps foodservice operators, QSR chains, cloud kitchens, and CPG brands analyze club sandwich demand, ingredient shifts, pricing changes, and menu positioning.

Cheesecake Is Now a Platform, Not a Product

In current digital menu tracking, cheesecake accounts for 0.8% of total dessert mentions across QSR, fast casual, and full-service chains. That share may seem modest, but the growth rate and cross-category integration tell a bigger story.

Today’s cheesecake is appearing in:

- Ice cream swirls

- Stuffed cookies

- Dessert cups and shooters

- Protein snack bars

- Donut and churro hybrids

- Ready-to-eat mini packs

To effectively Scrape Dessert & Cheesecake Market Trends, brands must analyze not only flavor mentions but also format variations. The fastest growth is happening where cheesecake intersects with other high-performing dessert anchors like chocolate, cookie, and coffee.

Club Sandwich: A Stable Format in a Competitive Sandwich Market

Across digital restaurant menus and delivery platforms, the broader sandwich category consistently commands high menu presence. The club sandwich typically represents a smaller but steady share within that ecosystem.

Over the last 24 months, scraped menu data from major metropolitan markets shows:

- Sandwich category listings increased approximately 11% YoY.

- Burger listings increased around 18% YoY.

- Club sandwich listings declined modestly by 6–9% YoY.

- However, menu retention rates for club sandwiches remained above 82%, meaning most restaurants that offer a club keep it long term.

This tells a clear story: the club sandwich isn’t expanding aggressively, but it isn’t disappearing either. It behaves like a core format rather than a trend-driven item.

To validate this at scale, brands rely on Menu Data Scraping for Club Sandwich Performance, monitoring thousands of digital menus daily to track item retention, price changes, ingredient swaps, and naming variations.

Why Data Collection Matters More Than Social Buzz?

Social conversation can exaggerate small shifts. A minor increase in mentions can appear dramatic when baseline volume is low. That’s why businesses increasingly focus on operational data instead of just social media trends.

Through structured Club Sandwich Trend Data Tracking, analysts monitor:

- Frequency of club sandwich listings by city and region

- Protein combinations used in menu descriptions

- Pricing tiers across casual dining vs. QSR

- Combo meal bundling strategies

- Consumer rating performance

This granular insight reveals that while the club may not dominate trend headlines, it remains deeply embedded in everyday ordering behavior.

Ingredient Patterns from Scraped Menu Data

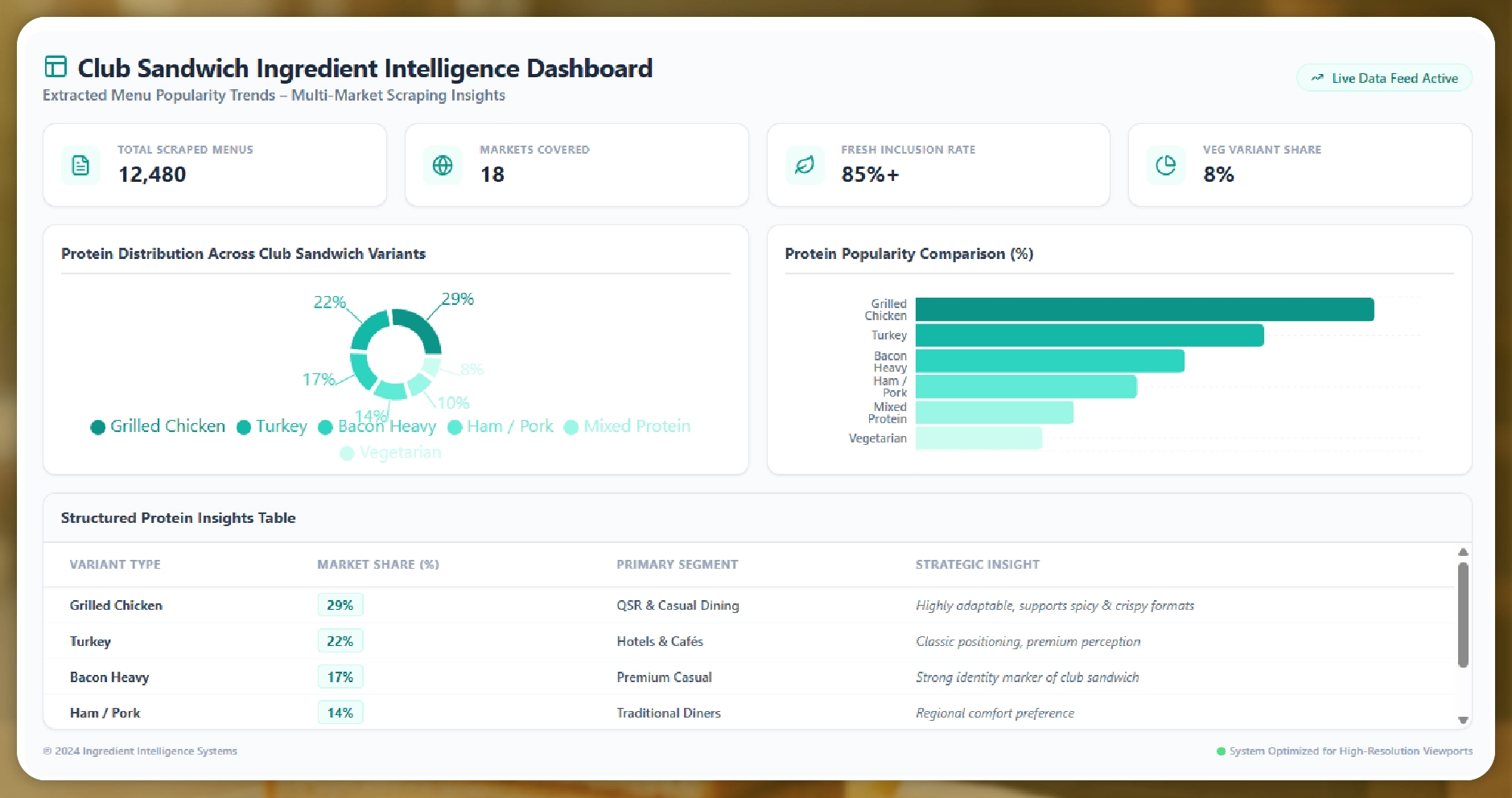

When brands Extract Menu Popularity Trends for Club Sandwiches, protein composition emerges as a critical signal.

Recent multi-market scraping projects show the following protein distribution across club-style builds:

- Grilled chicken variants: ~29%

- Turkey-based builds: ~22%

- Bacon-heavy stacked versions: ~17%

- Ham or pork variations: ~14%

- Mixed protein triple-stack builds: ~10%

- Vegetarian reinterpretations: ~8%

Fresh components such as lettuce and tomato remain standard inclusions across more than 85% of scraped menu descriptions.

Regional Demand Signals from Delivery Platforms

Beyond static menus, delivery platforms offer deeper behavioral insights. Through Restaurant Menu Intelligence for Classic Sandwich Trends, operators identify how clubs perform in real-time ordering environments.

- Club sandwiches perform strongest during lunch hours (12–3 PM).

- Average order value increases when clubs are bundled with fries and beverages.

- Premium pricing tolerance is higher in business districts than residential clusters.

- Spicy chicken club variants outperform classic turkey versions in urban centers.

Scraped delivery data across Tier 1 and Tier 2 cities reveals

- Club sandwiches perform strongest during lunch hours (12–3 PM).

- Average order value increases when clubs are bundled with fries and beverages.

- Premium pricing tolerance is higher in business districts than residential clusters.

- Spicy chicken club variants outperform classic turkey versions in urban centers.

Using Web Scraping Food Delivery Data, businesses track price elasticity, discount frequency, and rating performance. For example, restaurants offering crispy chicken clubs saw rating improvements of 0.3–0.5 stars compared to standard grilled builds in competitive markets.

Menu Naming Strategy: “Chicken Club” vs “Club Sandwich”

Data scraping also uncovers naming dynamics. Many restaurants no longer lead with the term “club sandwich” alone. Instead, they emphasize the protein-first identity:

- Crispy Chicken Club

- Smoked Turkey Club

- Double Bacon Club Melt

- Spicy Grilled Chicken Club

When businesses Extract Restaurant Menu Data, they discover that protein-led naming drives stronger discoverability on delivery search results.

Price Benchmarking and Margin Insights

One of the strongest use cases for scraping is pricing intelligence. With a structured Food Delivery Scraping API, brands can monitor:

- Average club sandwich price across regions

- Discount depth during promotions

- Combo meal pricing strategy

- Competitor upsell patterns

Recent scraped datasets indicate:

- Average QSR club sandwich price: $6.50–$8.20

- Casual dining average: $10.00–$14.00

- Hotel dining: $14.00–$19.00

Ingredient Correlation Patterns

Ingredient correlation analysis reveals which components truly define the club format.

- Lettuce

- Bacon

- Tomato

- Toasted bread (often triple-layered)

- Mayonnaise-based spread

This type of correlation mapping supports strategic menu engineering.

Demand by Eating Occasion

Scraped delivery order timestamps show club sandwiches are heavily associated with:

- Office lunch orders

- Hotel room service

- Airport dining

- Casual weekend brunch

Unlike burgers, which spike during dinner hours, clubs show more balanced mid-day demand curves. This makes them a strong anchor product for daypart optimization strategies.

With integrated Restaurant Data Intelligence, operators align staffing, prep timing, and inventory planning around predictable ordering cycles.

How CPG Brands Use Club Sandwich Data?

For packaged food companies, club sandwich scraping offers insight into:

- Popular protein combinations

- Sauce flavor trends

- Bread type preferences (white toast vs. multigrain)

- Cross-sell pairings (chips, fries, beverages)

This shifts product development from assumption-based planning to evidence-backed positioning.

Unlock actionable insights and boost your menu performance—book a demo of our data scraping services today!

Automation at Scale

To gather meaningful insight, scraping must operate continuously. High-quality systems capture:

- Daily menu updates

- Seasonal swaps

- Pricing changes

- Limited-time offers

- Review sentiment shifts

Automated pipelines allow analysts to monitor thousands of restaurant pages across geographies without manual tracking.

By combining structured scraping with machine learning clustering, brands can detect micro-patterns such as:

- Rising spicy chicken club variants

- Premium avocado club positioning

- Regional preference for grilled over crispy

Strategic Implications for Foodservice

The club sandwich does not win by novelty. It wins by execution.

Scraped data consistently shows higher ratings when:

- Bread is clearly described as toasted

- Protein cooking method is specified

- Texture contrast (crispy + fresh) is emphasized

- Portion size is communicated clearly

Restaurants that maintain core structure but experiment around the edges outperform those that radically alter the format.

In a crowded sandwich landscape, format clarity drives performance.

Why Continuous Monitoring Matters?

Market dynamics shift quickly. Ingredient costs fluctuate. Consumer preferences evolve. Competitive formats like burgers and wraps intensify pressure.

Through consistent scraping and dashboard tracking, operators gain:

- Real-time competitive benchmarking

- Menu gap identification

- Pricing optimization insight

- Ingredient substitution strategy guidance

The club sandwich may not dominate headlines, but it remains a stable contributor to revenue when engineered properly.

How Food Data Scrape Can Help You?

- Real-Time Market Monitoring

Our data scraping services continuously track restaurant menus, food delivery platforms, and pricing updates. You gain real-time visibility into product availability, pricing shifts, promotional activity, and competitor positioning — without manual tracking. - Competitive Benchmarking at Scale

We collect and structure competitor menu data across regions so you can compare pricing, ingredient usage, portion strategies, and combo bundling. This helps you identify white-space opportunities and refine your positioning strategy faster. - Ingredient & Trend Intelligence

By analyzing large-scale menu datasets, we uncover emerging ingredient patterns, protein shifts, and format variations. This allows you to align product innovation with real consumer demand instead of assumptions. - Pricing & Margin Optimization

Our structured datasets power advanced price monitoring and elasticity analysis. You can detect discount patterns, seasonal price fluctuations, and margin risks — enabling smarter revenue management decisions. - Custom Dashboards & Actionable Insights

We transform raw scraped data into clean, structured dashboards tailored to your KPIs. From performance tracking to predictive insights, you get decision-ready intelligence that supports growth across foodservice and retail.

Conclusion

Web scraping transforms the club sandwich from a static menu item into a measurable performance asset. Through automated data collection, brands understand how the format behaves across regions, dayparts, and price tiers.

When combined with advanced analytics, scraped insights evolve into actionable Food delivery Intelligence, helping operators make smarter decisions about positioning, pricing, and protein rotation.

Visualizing these patterns through a structured Food Price Dashboard allows leadership teams to track margin shifts and competitor pricing in real time.

Finally, large-scale Food Datasets built from restaurant and delivery platforms empower both foodservice and CPG brands to treat the club sandwich not as a fading trend, but as a stable format with strong structural rules and measurable commercial value.

The club sandwich doesn’t need reinvention. It needs precision. And precision starts with data.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.