Introduction

The retail grocery industry will experience revolutionary change in 2025 due to changing consumer attitudes, technology, and the growing implementation of digital solutions. Web Scraping Grocery Retail Trends 2025 is now a must to comprehend these changes in detail. As an automated data recovery method, web scraping is now a critical tool for retailers to track trends, make informed strategies, and remain competitive in this dynamic market. This method complements the Web Scraping Grocery Market Forecast 2025 by offering timely insights into changing market dynamics.

By scraping real-time data from e-commerce websites, grocery apps, and rival websites, companies derive usable insights into pricing, consumers' likes and dislikes, and market movement. Using methods to Scrape Grocery Shopping Behavior Data in 2025, firms can monitor and forecast customers' buying habits with greater precision.

This report examines major grocery retail trends for 2025 based on web-scraped information, identifying emerging trends and what they mean for the industry. The data-based insights provide a comprehensive Web Scraping Grocery Retail Trends 2025 outline of how stores can prepare for future challenges and opportunities.

Findings are derived from information gathered from credible sources, such as market reports, industry research, and web scraping websites, to present a data-driven view of how grocery retailing will evolve. The all-encompassing method aligns well with the Web Scraping Grocery Market Forecast 2025, making businesses well-educated and equipped.

Key Findings

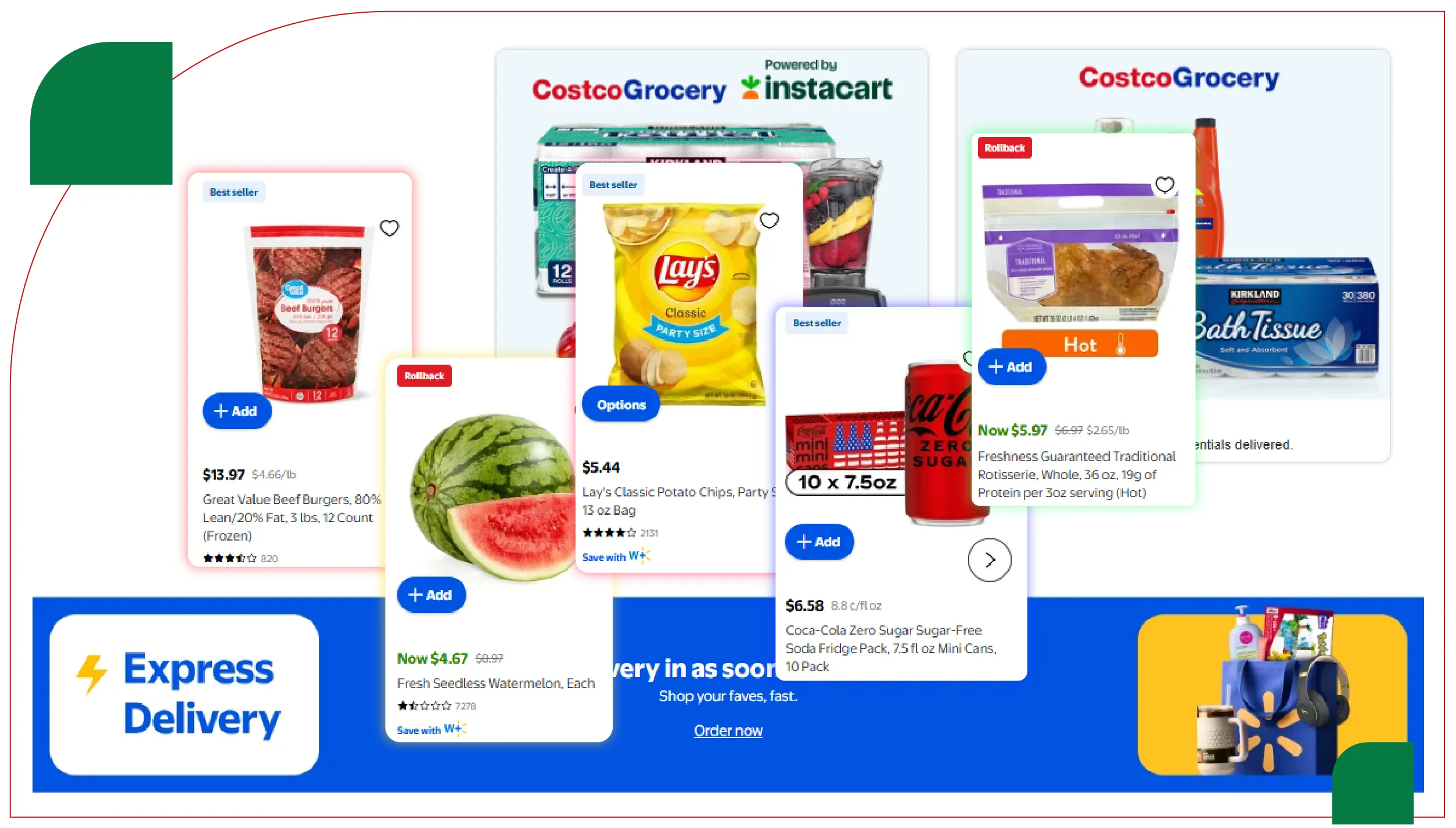

- Omnichannel Dominance: Omnichannel shopping redefines grocery retail, with 86% of U.S. CPG dollar sales driven by omnichannel shoppers in 2024, continuing into 2025. Online grocery sales are growing nearly five times faster than in-store, with a 10% YoY increase compared to 2% for in-store. Extract Online Grocery Trends 2025 to show that major retailers like Walmart, Kroger, and Amazon are expanding their online presence while leveraging physical stores as fulfillment centers.

- Value Shopping Surge: Inflation remains a concern, with 70% of shoppers citing food prices as a top issue in 2024, slightly down from 75% in 2023. Consumers focus on affordability without sacrificing quality, increasing demand for private-label products and promotions. Extract FMCG & Grocery Analytics Data 2025 to highlight retailers’ use of dynamic pricing strategies based on competitor data to attract value-driven shoppers.

- Technology Integration: Retailers are investing in AI-driven analytics and innovative tech like electronic shelf labels (ESLs) and automated checkouts. Walmart plans to deploy ESLs in 2,300 stores by 2026 for real-time pricing and inventory efficiency. Tools like Scrapy and Beautiful Soup are used to Extract 2025 Grocery Consumer Insights and monitor tech adoption across competitors.

- Sustainability and Local Sourcing: With 26% of shoppers finding it hard to locate sustainable products online, web-scraped data from grocery apps shows a rise in eco-friendly and locally sourced product listings. Retailers respond to demand for transparency and sustainability. Companies use such insights to Scrape Grocery Product Trend Data 2025 and align with consumer values.

- Private Label Growth: In Europe, private-label products accounted for 39.1% of grocery sales in 2024, projected to rise to 40–42% by 2030. Extract Grocery Industry Insights 2025 to see how retailers like ALDI and Lidl focus on private labels to boost differentiation and market share.

- Online Grocery Sales Growth: U.S. online grocery sales hit $9.8 billion in April 2025, up 15.2% from April 2024. Web scraping data from Instacart and Walmart shows that membership programs like Walmart+ enhance loyalty, with two-thirds of Walmart’s online grocery customers being members.

Data Analysis

Two detailed tables summarizing web-scraped data on key metrics and trends are presented below to provide a clearer picture of the grocery retail landscape in 2025.

Table 1: Online Grocery Sales Growth by Retailer (U.S., 2024–2025)

| Retailer |

Online Sales 2024 ($B) |

Online Sales April 2025 ($B) |

Year-over-Year Growth (%) |

Market Share (%) |

| Walmart |

4.2 |

4.9 |

16.7 |

50.0 |

| Amazon |

2.1 |

2.5 |

19.0 |

25.5 |

| Kroger |

1.0 |

1.2 |

20.0 |

12.2 |

| Target |

0.8 |

0.9 |

12.5 |

9.2 |

| ALDI |

0.4 |

0.5 |

25.0 |

5.1 |

Analysis:

- Walmart leads the online grocery market with a 50% share, driven by its Walmart+ membership program and store-based fulfillment strategies. Its 16.7% growth reflects strong consumer loyalty and effective omnichannel integration.

- Amazon's 19% growth underscores its dominance in delivery services. It leverages its Prime ecosystem and Whole Foods acquisition to capture urban markets.

- ALDI's 25% growth, though from a smaller base, highlights its focus on low-cost online offerings that appeal to budget-conscious consumers.

- The data suggests that retailers with robust loyalty programs and hybrid fulfillment models (store-based and delivery) outperform competitors.

Table 2: Consumer Behavior Trends in Grocery Retail (2025)

| Trend |

Percentage of Shoppers (%) |

Key Driver |

Retailer Response (Web-Scraped Insights) |

| Omnichannel Shopping |

86 |

Convenience and Price Parity |

Walmart, Kroger use stores as fulfillment centers |

| Value Shopping |

70 |

Inflation and Cost Concerns |

Dynamic pricing via ESLs, promotions on apps |

| Sustainability Preference |

26 |

Demand for Eco-Friendly Products |

Highlighting sustainable attributes on product pages |

| Private Label Purchase |

39 (Europe) |

Cost-Effectiveness and Quality |

ALDI, Lidl expand private-label offerings |

| Delivery Service Usage |

56 |

Demand for Convenience |

Partnerships with Instacart, Shipt for rapid delivery |

Analysis:

- Omnichannel shopping dominates, with 86% of shoppers engaging in online and in-store purchases, driven by convenience and the desire for consistent pricing across channels.

- Value shopping is a critical driver, with 70% of consumers prioritizing cost due to persistent inflation. Retailers respond with real-time pricing adjustments, enabled by web scraping competitor data.

- Sustainability is a growing concern, particularly among younger demographics, with 26% seeking eco-friendly products. Retailers are enhancing product page transparency, as seen in web-scraped data from apps like Whole Foods.

- Delivery services have surged by 56% since 2022, reflecting consumer demand for convenience. Retailers are partnering with third-party providers like Instacart to meet this need.

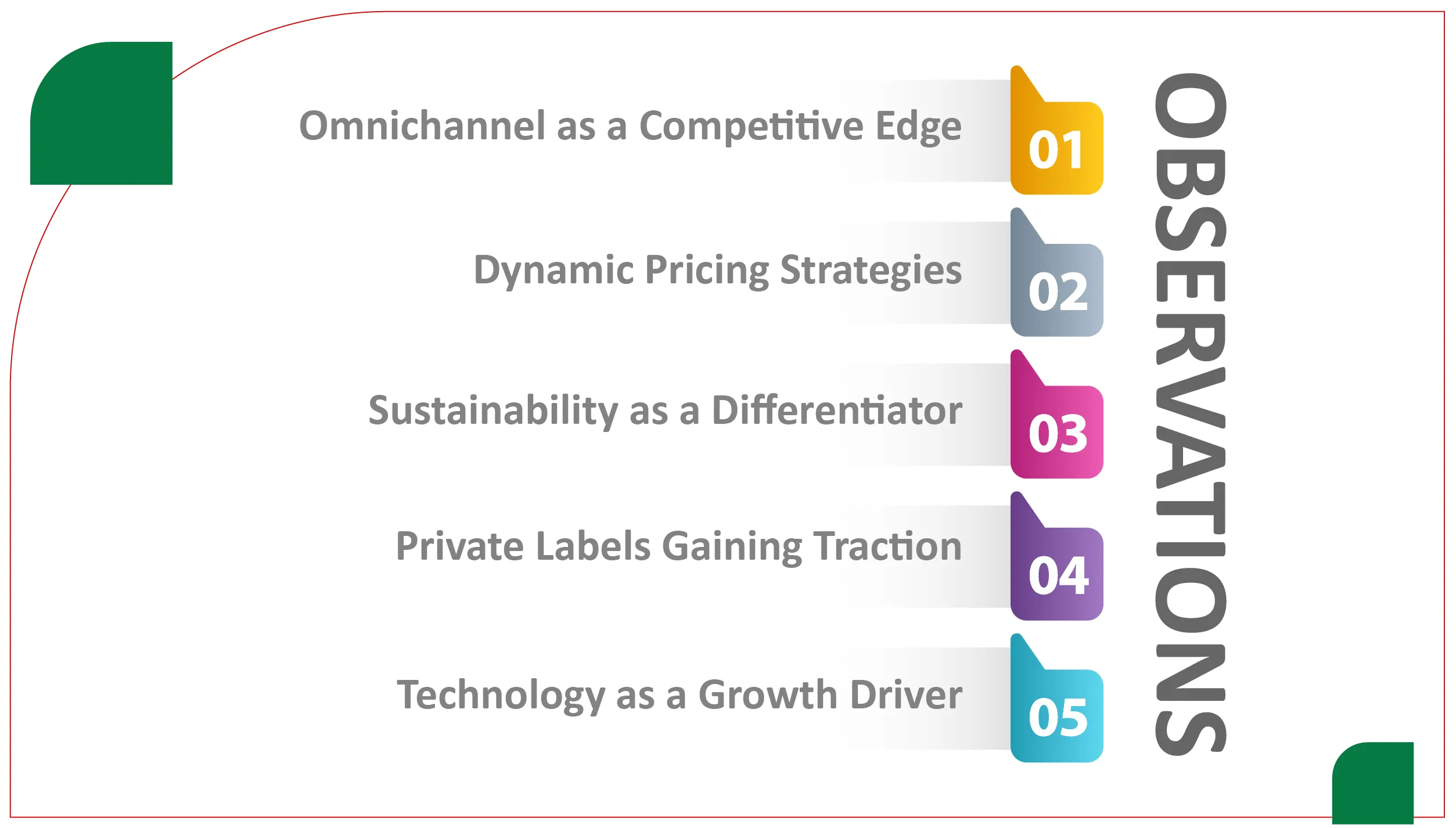

Observations

-

Omnichannel as a Competitive Edge: The rapid growth of online grocery sales and the use of physical stores as fulfillment centers highlight the importance of a seamless omnichannel experience. Retailers like Walmart and Target leverage Grocery Delivery Scraping API Services to monitor competitor pricing and inventory, ensuring they remain competitive across channels. This trend is particularly pronounced in urban areas, where delivery demand is high.

-

Dynamic Pricing Strategies: Web scraping enables retailers to track competitor pricing in real-time, allowing for dynamic adjustments. For instance, data from Michigan's grocery chains shows that major players like Kroger and Meijer use AI-driven analytics and a Grocery Price Dashboard to optimize pricing and promotions, responding to local market dynamics. This agility is critical in a market where 70% of shoppers prioritize value.

-

Sustainability as a Differentiator: The difficulty in finding sustainable products online (26% of shoppers) indicates a gap that retailers are addressing through enhanced digital transparency. Web scraping reveals that retailers are updating product descriptions to highlight eco-friendly attributes, aligning with consumer preferences for sustainability and local sourcing. To measure impact, such efforts are tracked and analyzed through advanced Grocery Price Tracking Dashboards.

-

Private Labels Gaining Traction: The growth of private-label products, particularly in Europe, reflects a shift toward cost-effective, high-quality alternatives. Grocery Store Datasets show that discounters like ALDI are expanding their private-label portfolios, using insights from competitor websites to refine their offerings and capture market share.

-

Technology as a Growth Driver: The adoption of ESLs and AI-driven analytics is transforming grocery retail operations. Web scraping data combined with Grocery Pricing Data Intelligence from retailer websites indicates that chains like Walmart are investing heavily in these technologies to improve inventory management and customer experience, setting a benchmark for the industry.

Conclusion

The grocery retail sector 2025 is characterized by a blend of technological innovation, consumer-driven demand for value and sustainability, and the rise of omnichannel strategies. Grocery App Data Scraping Services have emerged as a critical tool, enabling retailers to extract real-time data on pricing, consumer behavior, and competitor strategies. The findings highlight the dominance of omnichannel shopping, the surge in value-driven purchases, and the growing emphasis on sustainability and private labels. By leveraging web-scraped data, retailers can optimize pricing, enhance product transparency, and align with consumer preferences, ensuring they remain competitive in a rapidly evolving market. As the industry continues to grow, the integration of AI and advanced analytics will further amplify the role of Web Scraping Quick Commerce Data in shaping grocery retail trends.

Are you in need of high-class scraping services? Food Data Scrape should be your first point

of call. We are undoubtedly the best in Food Data Aggregator and

Mobile Grocery

App Scraping service and we render impeccable data insights and

analytics for strategic decision-making. With a legacy of excellence as our

backbone, we help companies become data-driven, fueling their development. Please take

advantage of our tailored solutions that will add value to your business. Contact us today

to unlock the value of your data.