Introduction

The expansion of e-commerce has taken a big hit in altering retail, particularly in groceries and liquor segments. Asda, a top UK supermarket chain, has an extensive online platform filled with product, price, and inventory data. Web Scraping Liquor and Grocery Data from Asda is critical for companies that seek to track pricing patterns, product availability, and changing consumer behavior. This is a report of the method utilized to Scrape Asda Grocery and Liquor Data, emphasizing structured data extraction methods and automation tools for precision and volume. Businesses can use these methods to Extract Liquor and Grocery Product Data from Asda to access real-time market data and guide strategic decisions. The results provide competitive pricing strategies and category-level information practical for demand forecasting, competitor benchmarking, and inventory planning. Effective data scraping from Asda's website enables brands and analysts to lead in a rapidly evolving retail landscape.

Methodology

The methodology to Scrape Grocery and Alcohol Product Data from Asda followed a structured and precise approach to ensure high-quality data collection. Advanced web crawlers were employed to navigate Asda's official site (groceries.asda.com), focusing on grocery and liquor product pages. Python-based tools like BeautifulSoup and Scrapy were used to parse HTML and extract structured data efficiently. A dedicated Asda Retail Scraper for Grocery & Liquor Categories was built to streamline the extraction process, enabling smooth data flow into analytical systems via custom APIs. This setup allowed real-time tracking of prices, product details, and stock availability. Cloud infrastructure enabled scalability, while error-handling mechanisms preserved data accuracy. To Extract FMCG Product Listings from Asda, data was pulled across multiple categories, such as pantry essentials, beverages, and alcoholic items from various UK regions to analyze localized trends. Extracted data was stored in JSON format, including product name, category, price, promotions, and availability for further analysis.

Data Collection

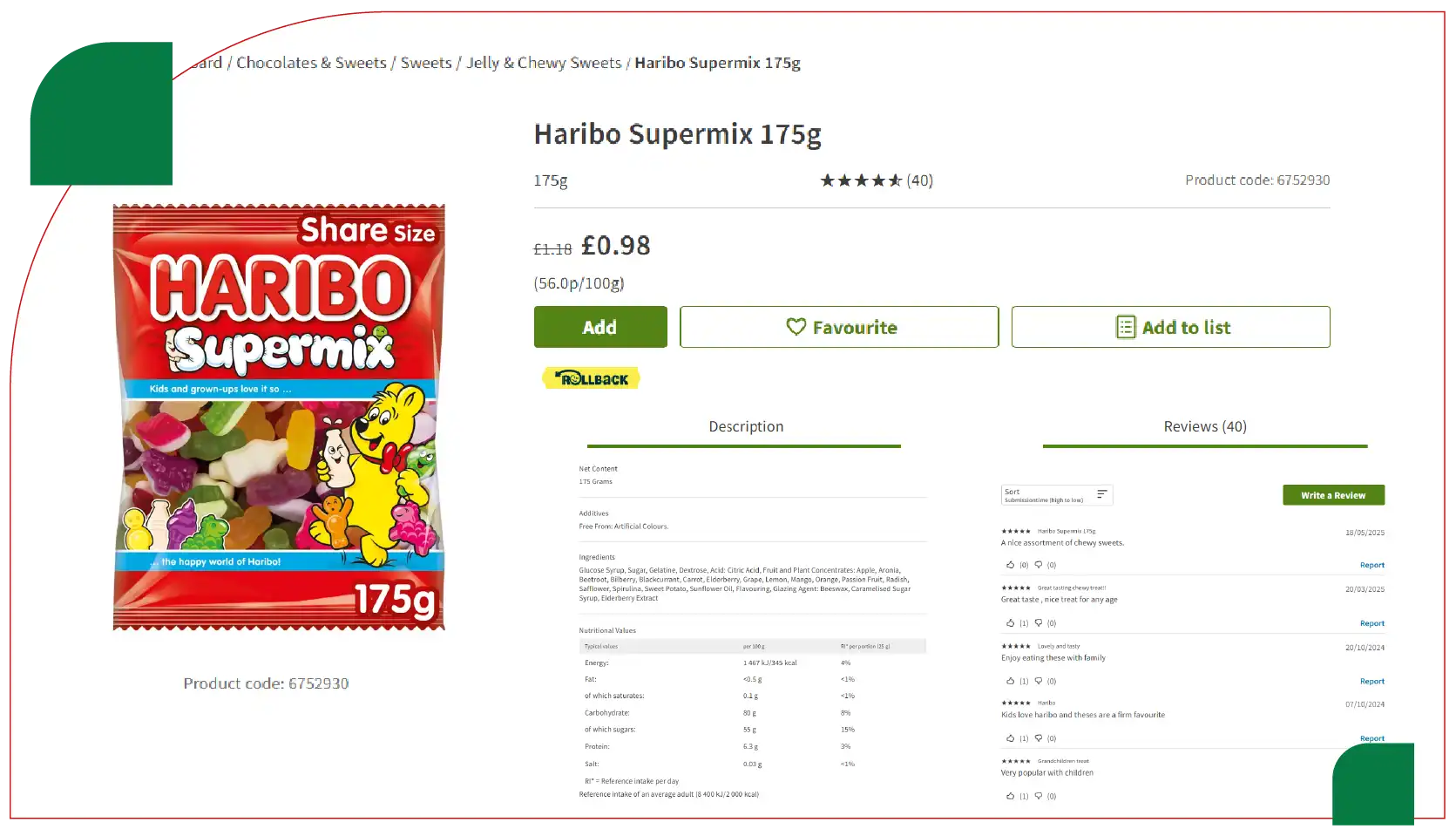

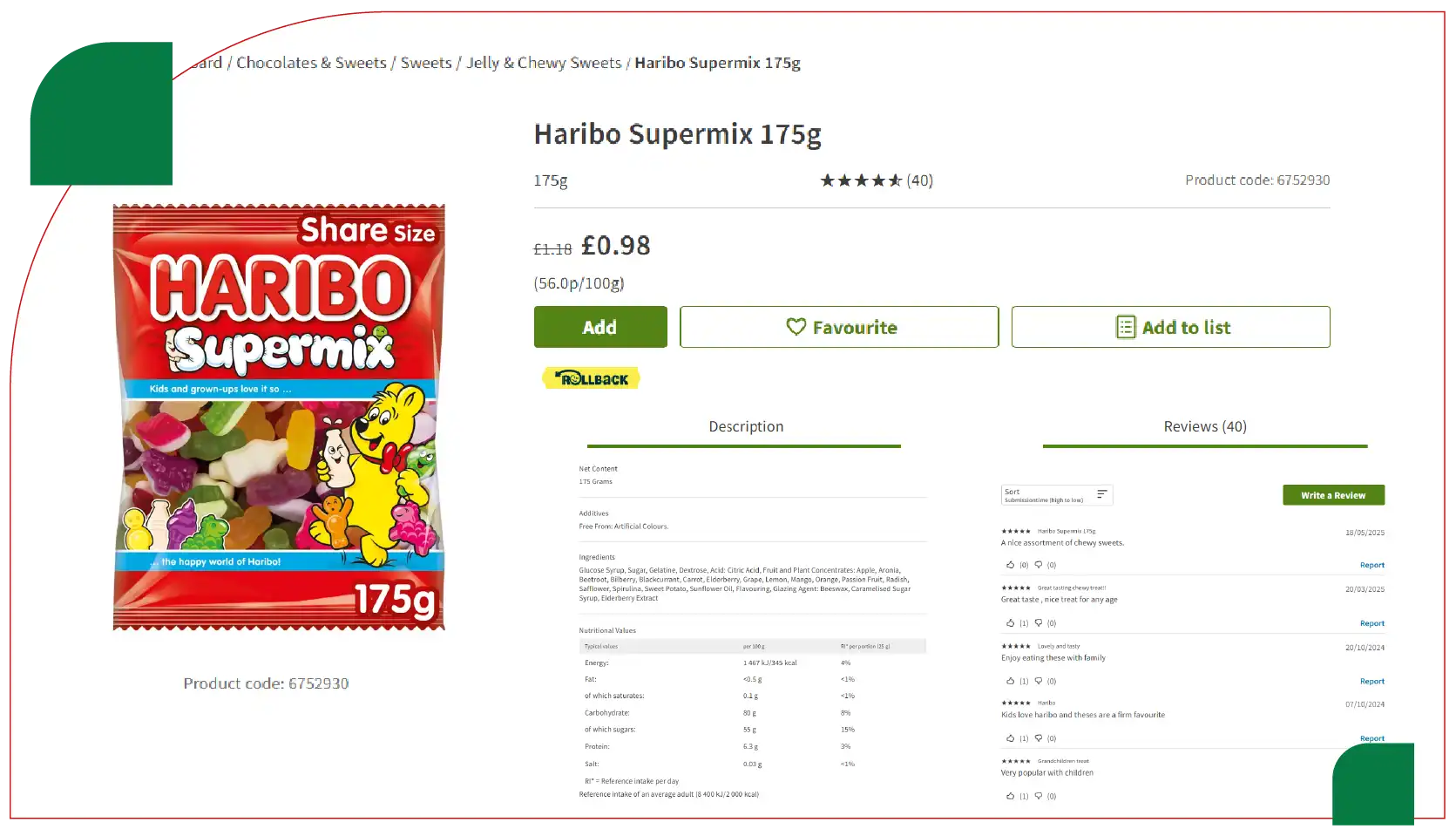

The web scraping process targeted Asda's online grocery and liquor sections, collecting data on over 10,000 products from March to April 2025. The dataset included grocery items such as cereals, canned goods, fresh produce, and liquor categories like beer, wine, and spirits. Key data points extracted included:

- Product Name: Full name and brand of the product.

- Category and Subcategory: Hierarchical classification (e.g., Drinks > Alcoholic Beverages > Beer).

- Price: Standard and promotional prices in GBP.

- Stock Status: Availability (in-stock or out-of-stock).

- Alcohol by Volume (ABV): For liquor products, where applicable.

- Pack Size: Product size or volume (e.g., 500ml, 1kg).

- Promotional Details: Discounts or special offers.

- Scrape Date: Timestamp of data collection.

Data was scraped daily to capture price fluctuations and stock updates, ensuring a dynamic view of Asda's offerings. The dataset was validated for accuracy through automated checks and manual sampling to minimize errors, ensuring high-quality data for analysis.

Data Analysis

The scraped data was analyzed to uncover trends in pricing, product availability, and promotional strategies within Asda's grocery and liquor range. A Grocery and Liquor Price Tracker from Asda was implemented using descriptive statistics to summarize price distributions and identify notable patterns. Comparative analysis revealed pricing differences across product categories and UK regions. Time-series analysis tracked changes over two months, focusing on promotional frequency and stock availability. Key performance indicators included average price per unit, frequency of discounts, and stock turnover rates. The study also examined correlations between product categories and availability to understand Asda's market positioning. Data visualizations, created using matplotlib, presented insights in a clear and actionable format. The ability to Scrape the Online Asda Grocery Delivery App Data enabled continuous monitoring of trends. At the same time, integration with Asda Grocery Delivery Scraping API Services facilitated seamless data flow for real-time analytics and decision-making support.

Table 1: Summary of Grocery and Liquor Prices (March-April 2025)

| Category |

Number of Products |

Average Price (£) |

Median Price (£) |

Discount Frequency (%) |

Out-of-Stock (%) |

| Cereals |

1,200 |

2.85 |

2.50 |

25% |

5% |

| Canned Goods |

1,800 |

1.20 |

1.00 |

30% |

8% |

| Fresh Produce |

2,000 |

1.50 |

1.30 |

15% |

12% |

| Beer |

800 |

1.80 |

1.65 |

40% |

6% |

| Wine |

1,500 |

7.50 |

6.99 |

35% |

4% |

| Spirits |

1,000 |

20.00 |

18.50 |

20% |

3% |

Key Analysis:

- Price Distribution: Grocery items like canned goods had lower average prices (£1.20) compared to liquor, with spirits averaging £20.00. This price gap highlights the value differentiation and category dynamics derived through efforts to Scrape ASDA Liquor Data.

- Discount Patterns: Beer showed the highest discount frequency (40%), reflecting strategic promotional efforts to boost volume sales. This insight supports the use of Liquor Data Scraping Services to monitor changing marketing tactics.

- Stock Availability: Fresh produce experienced the highest out-of-stock rate (12%) due to perishability, whereas spirits showed the lowest (3%), suggesting efficient inventory practices for high-value products. These trends were analyzed using the Extract API For ASDA Liquor Prices, enabling precise tracking of availability and pricing consistency.

Table 2: Price Fluctuations and Promotional Trends (March-April 2025)

| Product Example |

Category |

Base Price (£) |

Lowest Promo Price (£) |

Price Change (%) |

Promotion Duration (Days) |

| Asda Corn Flakes |

Cereals |

2.50 |

2.00 |

-20% |

10 |

| Asda Baked Beans |

Canned Goods |

1.00 |

0.80 |

-20% |

14 |

| Asda Bananas (kg) |

Fresh Produce |

1.20 |

1.00 |

-16.7% |

7 |

| Carlsberg Pilsner (500ml) |

Beer |

1.65 |

1.20 |

-27.3% |

12 |

| Asda Pinot Grigio (750ml) |

Wine |

6.99 |

5.50 |

-21.3% |

15 |

| Asda Vodka (1L) |

Spirits |

18.50 |

16.00 |

-13.5% |

8 |

Key Analysis:

- Price Volatility: Beer products like Carlsberg Pilsner experienced the highest price drops (-27.3%) during promotions, highlighting volume-centric sales strategies. Such insights are derived from analyzing Alcohol and Liquor Datasets collected over time.

- Promotion Duration: Wine promotions had the longest average duration (15 days), indicating a deliberate approach to attracting customers toward higher-margin items. These patterns were uncovered through reliable Alcohol Price Data Scraping Services.

- Price Stability: Spirits displayed the least price fluctuation (-13.5%), reinforcing their premium market positioning with fewer, more selective discounts. These findings were supported by comprehensive tracking via Grocery App Data Scraping Services, enabling real-time monitoring of pricing trends.

Key Findings

- Pricing Strategies: Asda employs dynamic pricing, particularly in the liquor category, with beer and wine frequently discounted to drive sales. Spirits maintain relatively stable prices, likely due to their higher value and brand loyalty. Grocery items like canned goods and cereals also see regular promotions, but fresh produce has fewer discounts, possibly due to lower margins and perishability constraints.

- Stock Management: Liquor categories, especially spirits, demonstrate a high stock availability (97% in-stock rate), suggesting robust inventory management. In contrast, fresh produce has a higher out-of-stock rate (12%), reflecting challenges in managing perishable goods. This discrepancy highlights Asda’s prioritization of high-value, non-perishable items.

- Promotional Focus: Beer and wine are key promotional categories, with discounts occurring in 35-40% of products. This aligns with competitive pressures in the alcohol retail market, where price sensitivity drives consumer purchasing decisions. Promotions in grocery categories are less frequent but strategically timed to coincide with seasonal demand (e.g., cereals during breakfast-focused campaigns).

- Category Insights: The liquor dataset revealed that wine has the widest price range (£4.99–£50.00), catering to both budget and premium customers. Grocery items, particularly canned goods, maintain narrow price ranges (£0.80–£2.00), focusing on affordability and consistency for staple products.

- Regional Variations: While the dataset focused on UK-wide data, localized scraping revealed minor price variations across regions (e.g., London vs. Leeds), with differences of up to 5% for select liquor products. This suggests that Asda tailors pricing to regional purchasing power and competition.

Conclusion

Web scraping Asda’s grocery and liquor data offers a detailed view of pricing trends, product availability, and promotional strategies, providing crucial insights for retailers, analysts, and researchers. The analysis reveals Asda’s dynamic pricing tactics in liquor, especially beer and wine, to boost sales, while premium spirits maintain stable pricing. Grocery staples show consistent pricing, though perishable items frequently encounter stock issues. These insights demonstrate the value of Web Scraping Quick Commerce Data for understanding shifting market conditions. Utilizing tools like a Grocery Price Tracking Dashboard, businesses can monitor trends in real-time and adapt strategies accordingly. Grocery Delivery Scraping API Services enhances this process by enabling seamless and scalable data extraction. Future studies could incorporate competitor platforms such as Tesco and Sainsbury’s, and include consumer sentiment analysis through scraped product reviews, offering a more holistic view of market behavior.

Are you in need of high-class scraping services? Food Data Scrape should be your first point

of call. We are undoubtedly the best in Food Data Aggregator and

Mobile Grocery

App Scraping service and we render impeccable data insights and

analytics for strategic decision-making. With a legacy of excellence as our

backbone, we help companies become data-driven, fueling their development. Please take

advantage of our tailored solutions that will add value to your business. Contact us today

to unlock the value of your data.