Introduction

The United States grocery market is expected to undergo significant changes in 2025, driven by shifting consumer preferences, growing health consciousness, and increasing online shopping. The Department of Labor reported that the average American household spends approximately $4,000 per year on food purchased for consumption at home. Changes driven by inflation and food preferences have influenced spending patterns since 2009. This report spotlights Web Scraping Most Purchased Grocery Items in the USA, considering datasets and tools to show which products find a way into consumers' baskets.

Using Top-Selling Grocery Products Data Extraction USA, we provide you with pattern analysis in categories and pricing, as well as loyal consumer behaviors, to help identify the year's best grocery product performers. Additionally, we Extract Grocery Purchase Patterns in America to create visibility into change identification, for example, favoring plant-based, convenience, and organic products not previously considered. The insights we identify help change business strategy; utilizing the US Consumer Grocery Preferences Scraping API enhances supply chain and consumer marketing personalization. The importance of the US Consumer Grocery Preferences Scraping API lies in helping retailers make informed decisions and assess changes in consumer needs to meet their evolving purchasing preferences.

Methodology

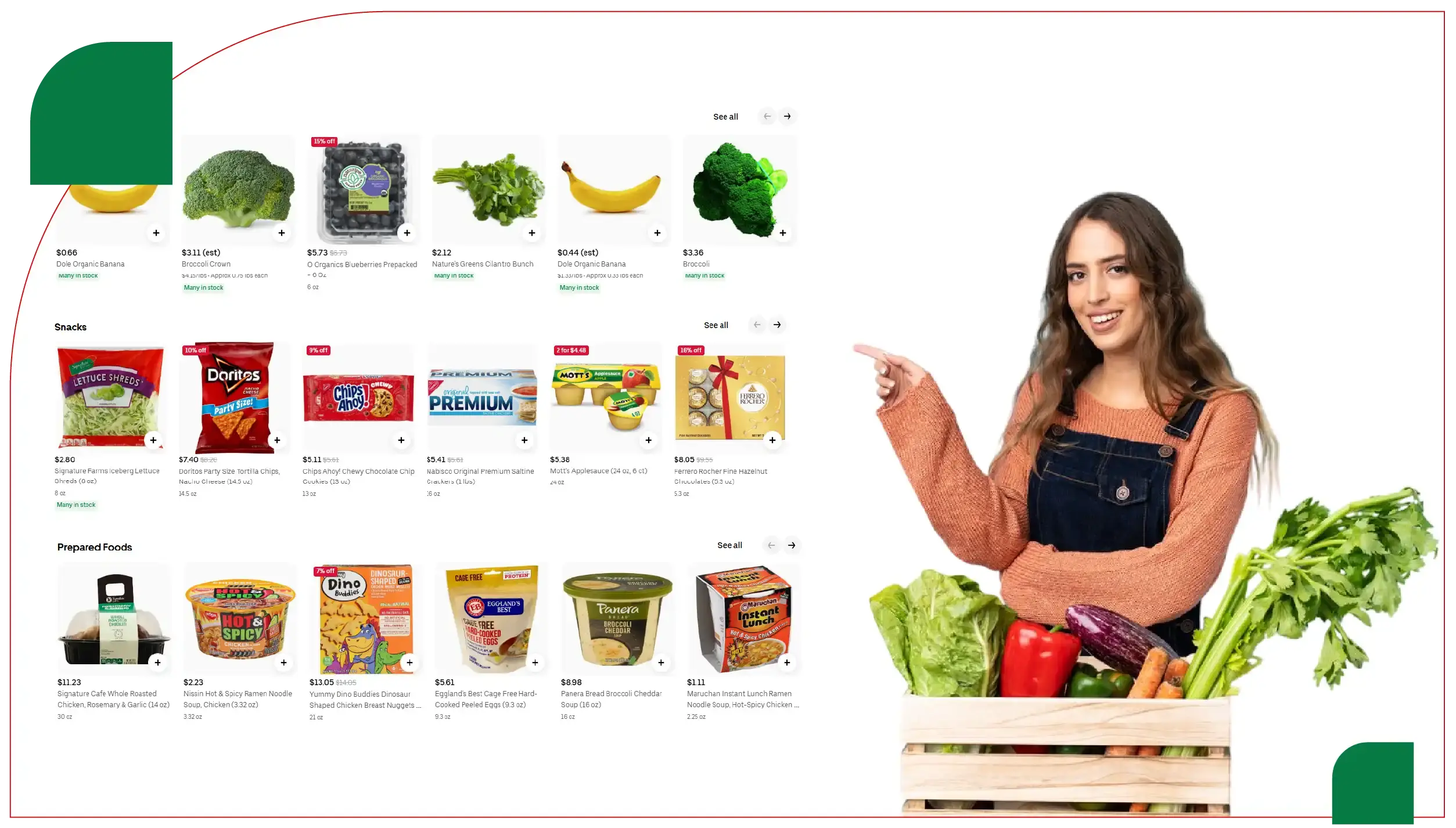

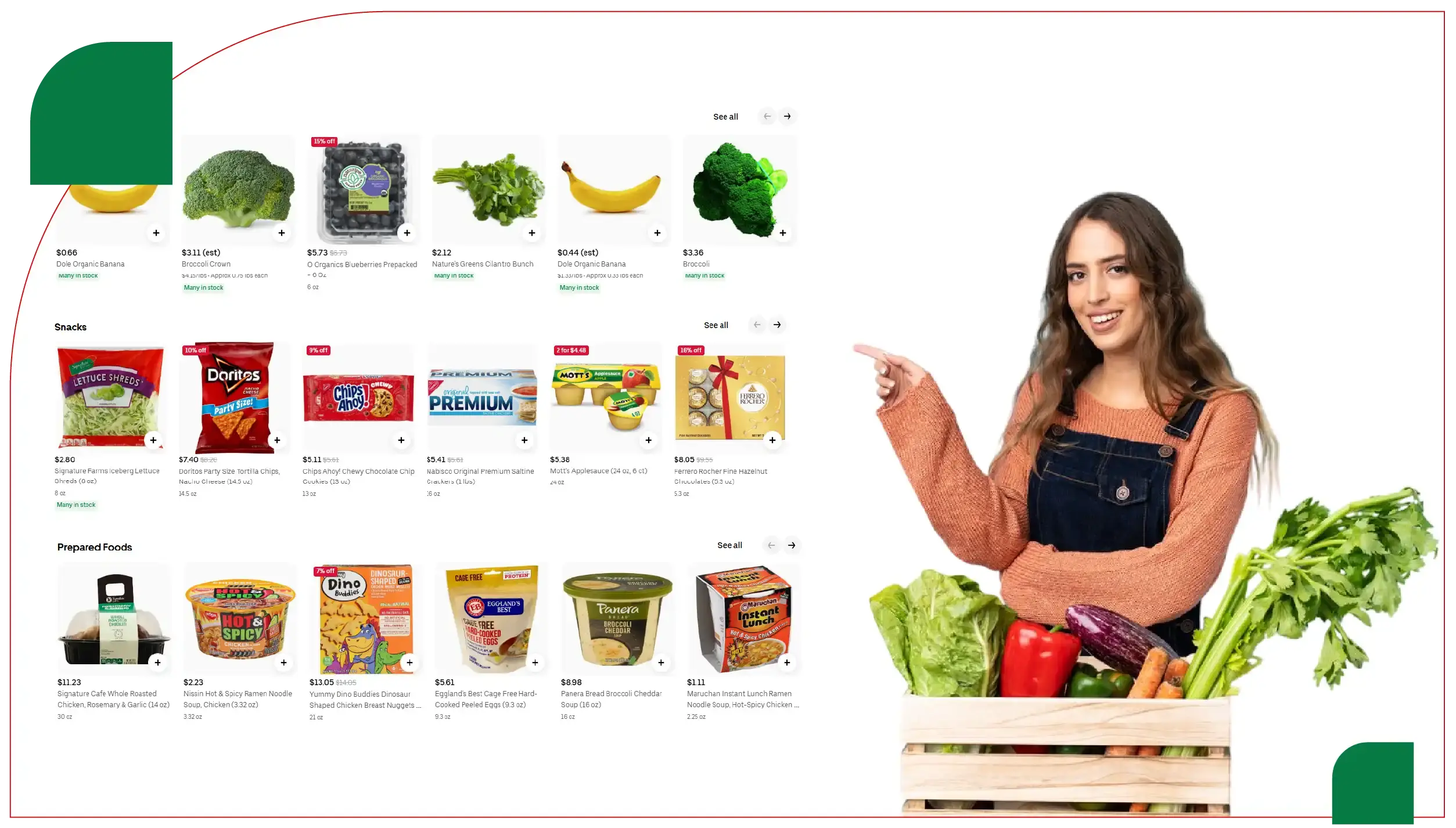

Data for this analysis were gathered using advanced web scraping tools, such as Beautiful Soup, Scrapy, and a custom API, to extract real-time insights from major grocery platforms, including Walmart, Kroger, Amazon Fresh, Instacart, and Whole Foods. The Top Grocery Products Dataset from US Supermarkets was analyzed to track sales volumes, category trends, and pricing dynamics. Additional data from Grocery App Data Scraping Services was integrated and cross-referenced for validation. To further ensure accuracy, insights were compared using a dedicated Grocery Delivery Scraping API Service. This report focuses on 2025 grocery sales patterns, drawing comparisons to past data to highlight evolving consumer behaviors and shifts in online grocery preferences.

Data Analysis

The following tables present the most purchased grocery items in the USA for 2025, based on Scraping American Grocery Purchase Patterns Insights. The data includes product categories, estimated sales, and key observations derived from the Grocery Price Dashboard.

Table 1: Top-Selling Grocery Items in 2025

| Rank |

Product Category |

Estimated Annual Sales (2025) |

Key Observations |

| 1 |

Fresh Produce |

$15 billion |

Organic fruits and vegetables lead due to demand for healthy, sustainable options. |

| 2 |

Milk (Dairy & Plant-Based) |

$12.5 billion |

Plant-based milk (e.g., oat, almond) now rivals traditional dairy in sales. |

| 3 |

Bread |

$11 billion |

Artisanal and gluten-free breads dominate, reflecting premium and health trends. |

| 4 |

Packaged Meats |

$9 billion |

Plant-based and organic meats gain traction alongside traditional deli meats. |

| 5 |

Soda & Sparkling Water |

$8.5 billion |

Healthier sparkling water and low-sugar sodas outpace traditional carbonated drinks. |

| 6 |

Salty Snacks |

$8 billion |

Low-sodium, baked, and organic snacks are increasingly popular. |

| 7 |

Frozen Meals |

$7 billion |

High-protein, low-calorie, and organic options drive growth in frozen foods. |

| 8 |

Cereal |

$6.5 billion |

High-fiber, low-sugar, and organic cereals appeal to health-conscious families. |

| 9 |

Eggs |

$2 billion |

Free-range and organic eggs see strong demand due to ethical concerns. |

| 10 |

Peanut Butter/Jelly |

$2 billion |

Organic and natural spreads gain popularity, especially among younger consumers. |

Table 2: Consumer Preferences and Market Trends (2025)

| Product Category |

Key Consumer Preferences (2025) |

Insights from Scraping |

| Fresh Produce |

Organic, locally sourced, non-GMO fruits and vegetables. |

Urban markets show higher demand for premium produce. |

| Milk |

Plant-based options (oat, almond, soy) and organic dairy. |

Vegan and lactose-intolerant consumers drive diversity. |

| Bread |

Artisanal, gluten-free, and whole-grain varieties. |

Health-conscious and premium buyers boost sales. |

| Packaged Meats |

Plant-based, organic, and antibiotic-free meats. |

Ethical and environmental concerns shape purchases. |

| Soda & Sparkling Water |

Low-sugar, zero-calorie, and natural sparkling water. |

Health trends reduce traditional soda consumption. |

| Salty Snacks |

Low-sodium, baked, and organic options. |

Consumers prioritize healthier snack alternatives. |

| Frozen Meals |

High-protein, low-calorie, and organic meals. |

Convenience remains key, with a focus on health. |

| Cereal |

High-fiber, low-sugar, and organic cereals. |

Parents seek healthier options for children. |

| Eggs |

Free-range, organic, and cage-free eggs. |

Ethical sourcing drives premium egg sales. |

| Peanut Butter/Jelly |

Natural, no-added-sugar, and organic spreads. |

Younger demographics prefer premium brands. |

Key Observations and Insights

1. Rise of Fresh Produce: In 2025, fresh produce tops the list, driven by consumer demand for organic and sustainable options. Extract Top-Selling Grocery Products in America to show a shift from soda (the 2009 leader) to healthier categories, reflecting dietary changes.

2. Plant-Based Milk Surge: Plant-based milk now rivals dairy, indicating strong growth in oat and almond milk sales, particularly among younger and health-conscious consumers.

3. Health-Conscious Snacking: Salty snacks and cereal remain popular, but low-sodium, high-fiber, and organic options dominate, as seen in Grocery Delivery Scraping API Services data.

4. Convenience with Health Focus: Frozen meals and packaged meats continue to sell well, but consumers prefer high-protein, organic, and plant-based variants, highlighting a balance between convenience and health.

5. Ethical and Sustainable Choices: Eggs and peanut butter/jelly see increased demand for free-range and organic options, driven by ethical and environmental concerns.

Key Findings

- Health and Sustainability Drive Purchases: Consumers in 2025 prioritize organic, plant-based, and sustainable products across categories, as evidenced by Grocery App Data Scraping Services. Retailers are adapting by expanding these offerings.

- Online Grocery Growth: With online grocery sales projected to exceed $150 billion in 2025, Grocery Delivery Scraping API Services are critical for tracking real-time trends and consumer preferences.

- Strategic Retail Tactics: Retailers continue to use strategic product placement (e.g., milk at the back) to drive impulse buys, but online platforms mitigate this through personalized recommendations.

- Dynamic Pricing Advantage: The Grocery Price Tracking Dashboard enables retailers to monitor competitor pricing and adjust strategies, enhancing competitiveness in a crowded market.

- Data-Driven Strategies: Grocery Store Datasets provide actionable insights for inventory optimization, pricing, and marketing, helping businesses align with consumer preferences.

Conclusion

Web scraping has uncovered major shifts in the U.S. grocery market in 2025, with fresh produce, plant-based milk, and health-oriented items leading consumer demand. Tools like the Grocery Price Tracking Dashboard help retailers react quickly to changing prices and shopper preferences. By leveraging detailed Grocery Store Datasets, businesses can better align with trends focused on health, sustainability, and convenience. These datasets support smarter decisions across product assortments and promotional strategies. In an increasingly competitive market, Grocery Pricing Data Intelligence plays a vital role in helping retailers stay ahead. This report emphasizes the importance of real-time, data-driven insights to navigate the evolving grocery landscape effectively and maintain a customer-first approach.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.