Introduction

The United States grocery sector in 2025 has witnessed remarkable growth, driven by the expansion of both national and regional supermarket chains. Leveraging Web Scraping 10 Largest Grocery Chains in United States 2025, this report delivers an in-depth analysis of store numbers, geographic coverage, and overall market influence of the leading grocery brands. By incorporating methods to Scrape 10 Largest Supermarkets Chains Data in USA 2025, analysts can evaluate regional performance, identify emerging market trends, and understand shifting consumer preferences. This data-driven approach provides insights into strategic expansion opportunities, operational efficiency, and competitive positioning.

Understanding the grocery market’s dynamics is vital for investors, retail strategists, and supply chain managers seeking to optimize growth and profitability. Combining findings from Web Scraping Top 10 Supermarkets Chains Data in USA 2025 and other intelligence sources, the report offers a holistic overview of industry trends, market share distribution, and strategic insights. This comprehensive analysis equips stakeholders with actionable information to make informed decisions and capitalize on growth potential in the U.S. grocery landscape.

Overview of Top 10 Grocery Chains in the U.S.

| Rank |

Brand |

Number of Locations |

States Present In |

Cities Present In |

| 1 |

ALDI |

2,680 |

41 |

1,755 |

| 2 |

Albertsons |

2,410 |

37 |

1,230 |

| 3 |

Publix |

1,520 |

9 |

540 |

| 4 |

Kroger |

1,310 |

17 |

610 |

| 5 |

Food Lion |

1,180 |

11 |

585 |

| 6 |

Safeway |

940 |

19 |

525 |

| 7 |

Save A Lot |

710 |

31 |

530 |

| 8 |

IGA |

645 |

38 |

560 |

| 9 |

Trader Joe's |

620 |

44 |

460 |

| 10 |

Grocery Outlet |

545 |

11 |

440 |

Detailed Analysis of Each Grocery Chain

1. ALDI

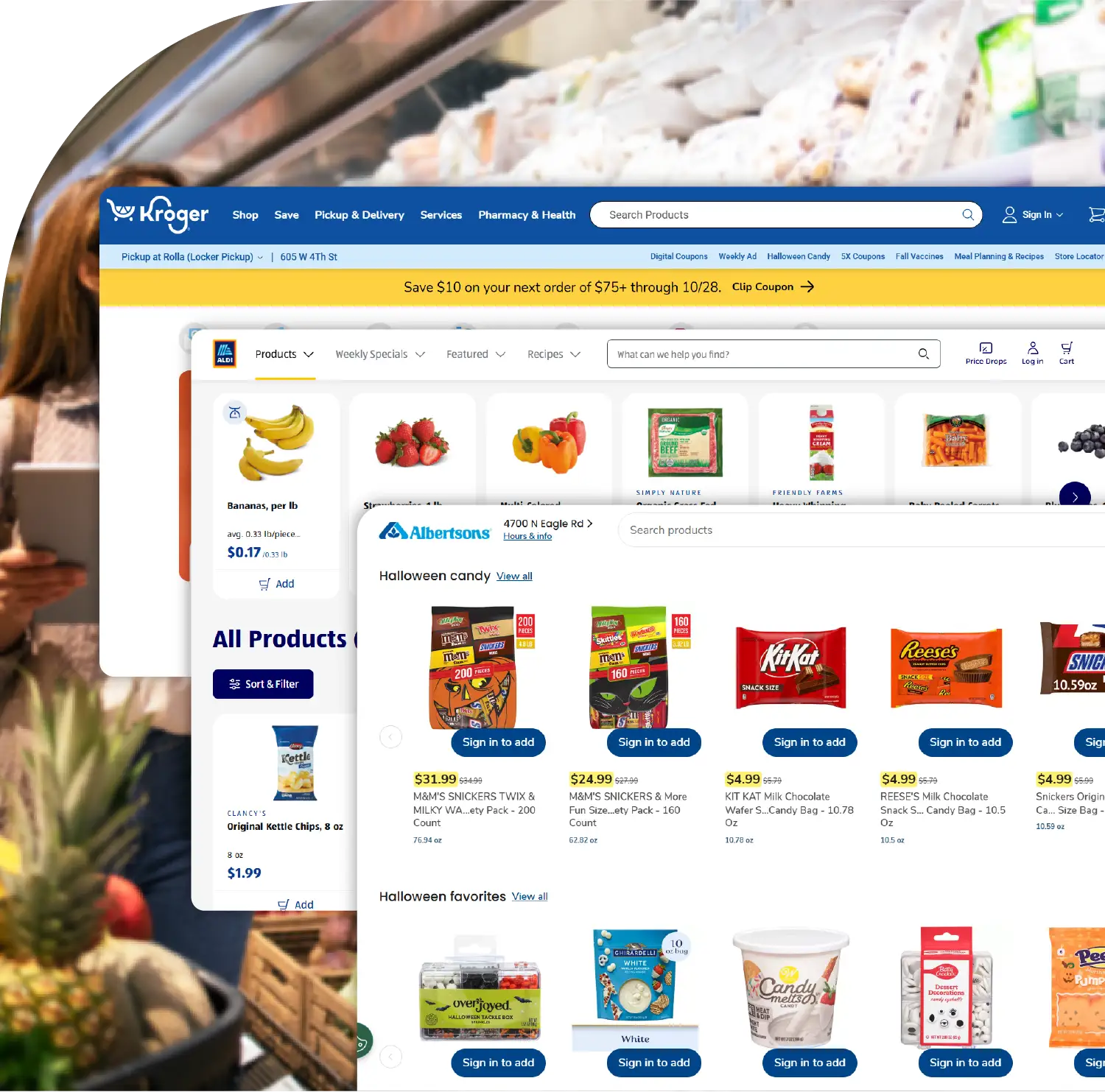

ALDI remains the largest grocery chain in the United States with 2,680 stores, dominating 41 states. Florida holds the largest share with 280 stores. Its discount pricing strategy and curated product selection continue to appeal to cost-conscious consumers. Using tools to Scrape Top 10 Grocery Chain Locations Data in USA 2025, businesses can evaluate market saturation and identify new areas for growth.

2. Albertsons

Albertsons operates 2,410 stores across 37 states, with California accounting for 590 locations. Its focus on customer loyalty programs and fresh produce has strengthened its market position. Analysts can leverage Web Scraping Major USA Supermarkets Data 2025 to understand purchasing trends and operational efficiency.

3. Publix

Publix, with 1,520 stores, is predominantly present in the Southeast, particularly Florida, which houses 910 locations. Its reputation for customer service and private-label offerings drives loyalty. Extract 10 Largest Grocery Chains in United States 2025 to analyze regional performance and expansion strategies.

4. Kroger

Kroger operates 1,310 stores in 17 states, with Texas leading with 210 stores. Its diverse store formats and integration of digital platforms enhance customer convenience. Companies can use Grocery App Data Scraping services to monitor consumer preferences and digital engagement.

5. Food Lion

Food Lion has 1,180 stores with North Carolina hosting 515 locations. Known for community-focused initiatives and competitive pricing, Food Lion benefits from robust regional demand. Grocery Delivery Scraping API Services provide insights into delivery trends and online order volumes.

6. Safeway

Safeway operates 940 stores in 19 states, with California leading with 250 stores. The chain emphasizes organic and specialty products. Monitoring Safeway through Grocery Price Dashboard allows businesses to track pricing trends and competitor strategies.

7. Save A Lot

Save A Lot has 710 stores, with Ohio accounting for 105 locations. It is popular for budget-friendly grocery options. Analysts can track regional expansion and performance through digital scraping platforms.

8. IGA

IGA operates 645 stores, with North Carolina having 70 stores. Its independent store model emphasizes local sourcing. Data insights from store locations can guide targeted marketing campaigns.

9. Trader Joe's

Trader Joe's operates 620 stores in 44 states, with California leading at 210 stores. The chain is known for specialty and organic items. Using analytics, businesses can study market trends and customer preferences.

10. Grocery Outlet

Grocery Outlet has 545 stores, predominantly in California with 285 stores. Its off-price model attracts cost-sensitive consumers. Tracking pricing and product assortment through Grocery Price Dashboard provides actionable intelligence.

Statewise Distribution of Top Grocery Chains

The U.S. grocery landscape is diverse, with certain states serving as hubs for multiple top brands. California, Florida, Texas, North Carolina, and Ohio consistently emerge as high-density regions for grocery chains. These locations are strategic due to population density, consumer spending patterns, and urbanization.

| State |

ALDI |

Albertsons |

Publix |

Kroger |

Food Lion |

Safeway |

Save A Lot |

IGA |

Trader Joe's |

Grocery Outlet |

| California |

380 |

590 |

150 |

140 |

120 |

250 |

90 |

55 |

210 |

285 |

| Florida |

280 |

220 |

910 |

95 |

85 |

50 |

70 |

40 |

35 |

20 |

| Texas |

250 |

180 |

120 |

210 |

100 |

40 |

65 |

35 |

30 |

25 |

| North Carolina |

210 |

130 |

85 |

80 |

515 |

40 |

60 |

70 |

25 |

15 |

| Ohio |

200 |

150 |

40 |

70 |

55 |

30 |

105 |

30 |

20 |

15 |

Market Insights and Trends

- National Leaders: ALDI and Albertsons lead national store presence, reflecting aggressive expansion strategies.

- Regional Strength: Publix dominates the Southeast, leveraging strong brand loyalty.

- Digital Advantage: Kroger's digital initiatives and delivery services strengthen its competitive edge.

- Local Influence: Regional chains like Food Lion and IGA maintain significant influence in local markets.

- Diverse Market Focus: Price-sensitive models such as Save A Lot and Grocery Outlet cater to budget-conscious consumers, while Trader Joe's focuses on niche organic and specialty products.

Digital Transformation and Grocery Analytics

The adoption of digital tools and analytics is transforming grocery retail. Chains are increasingly leveraging data insights for:

- Inventory management and stock optimization

- Personalized marketing and loyalty programs

- Delivery and e-commerce operations

- Price monitoring and competitive analysis

Grocery retailers utilize Grocery App Data Scraping services to capture consumer behavior trends and enhance operational efficiency.

Expansion Strategies and Regional Dominance

Top chains are pursuing both organic and strategic expansion. ALDI and Albertsons continue to open new locations in high-demand urban areas. Kroger and Safeway are focusing on digital integration and home delivery, while Publix leverages brand loyalty in the Southeast. Regional players like Food Lion and IGA maintain strong local influence through community-focused initiatives.

Consumer Preferences and Pricing Trends

Consumer behavior is driving changes in product assortment and pricing strategies. Discount chains such as ALDI and Save A Lot attract cost-conscious shoppers. Specialty chains like Trader Joe's emphasize organic and unique offerings. Analytics from Grocery Delivery Scraping API Services allow these chains to adjust pricing and inventory in real-time to meet market demand.

Conclusion

The grocery sector in 2025 showcases a wide range of strategies, from discount-focused retailers to premium specialty chains. Understanding these strategies is essential for businesses to stay competitive and meet consumer demands. Utilizing data from the Grocery Price Tracking Dashboard enables stakeholders to monitor pricing trends and adjust strategies accordingly. Insights from Grocery Pricing Data Intelligence help analyze market fluctuations and optimize revenue. Furthermore, Grocery Store Datasets provide valuable information on store locations, regional presence, and expansion opportunities. By leveraging these tools, investors, retailers, and supply chain managers can make informed decisions regarding market entry, expansion plans, pricing strategies, and product assortment, ensuring that they maintain a strong position in the evolving U.S. grocery landscape.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.