Introduction

The global beverage market in 2025 reflects an era where taste, wellness, and innovation merge. Consumers are no longer content with traditional drink choices; instead, they seek beverages that align with personal health goals, sustainability values, and experiential consumption. Using Web Scraping Top 15 Beverage Industry Trends 2025, this research explores how structured data extraction empowers businesses to understand, anticipate, and respond to fast-evolving beverage preferences.

By implementing methods to Extract Top 15 Beverage Trends Insight 2025, analysts and marketers can monitor emerging products, pricing shifts, and regional flavor dynamics across restaurants, grocery platforms, and e-commerce channels. This report leverages web-scraped datasets from menus, online beverage retailers, and social mentions to uncover patterns shaping what and how people drink.

With the support of Top Beverage Industry Data Scraping 2025, our study provides a comprehensive overview of consumer preferences, pricing insights, and flavor innovations driving global beverage growth.

Methodology

The study applies a data-driven methodology that uses automated crawling and parsing techniques to extract structured datasets from multiple digital sources.

-

Data Collection

We used advanced crawlers to collect beverage listings, product ingredients, and prices from:

- Online beverage retailers

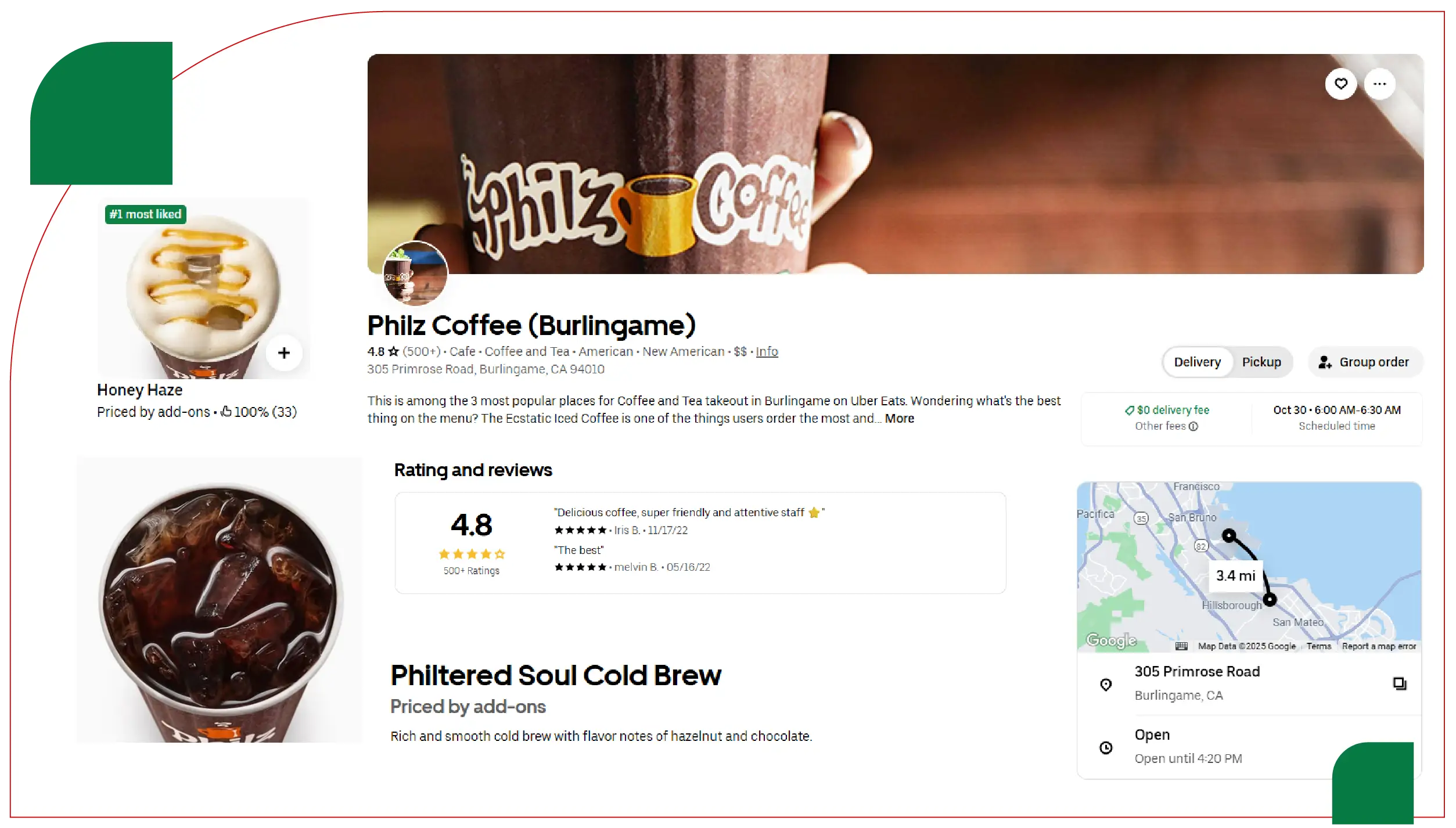

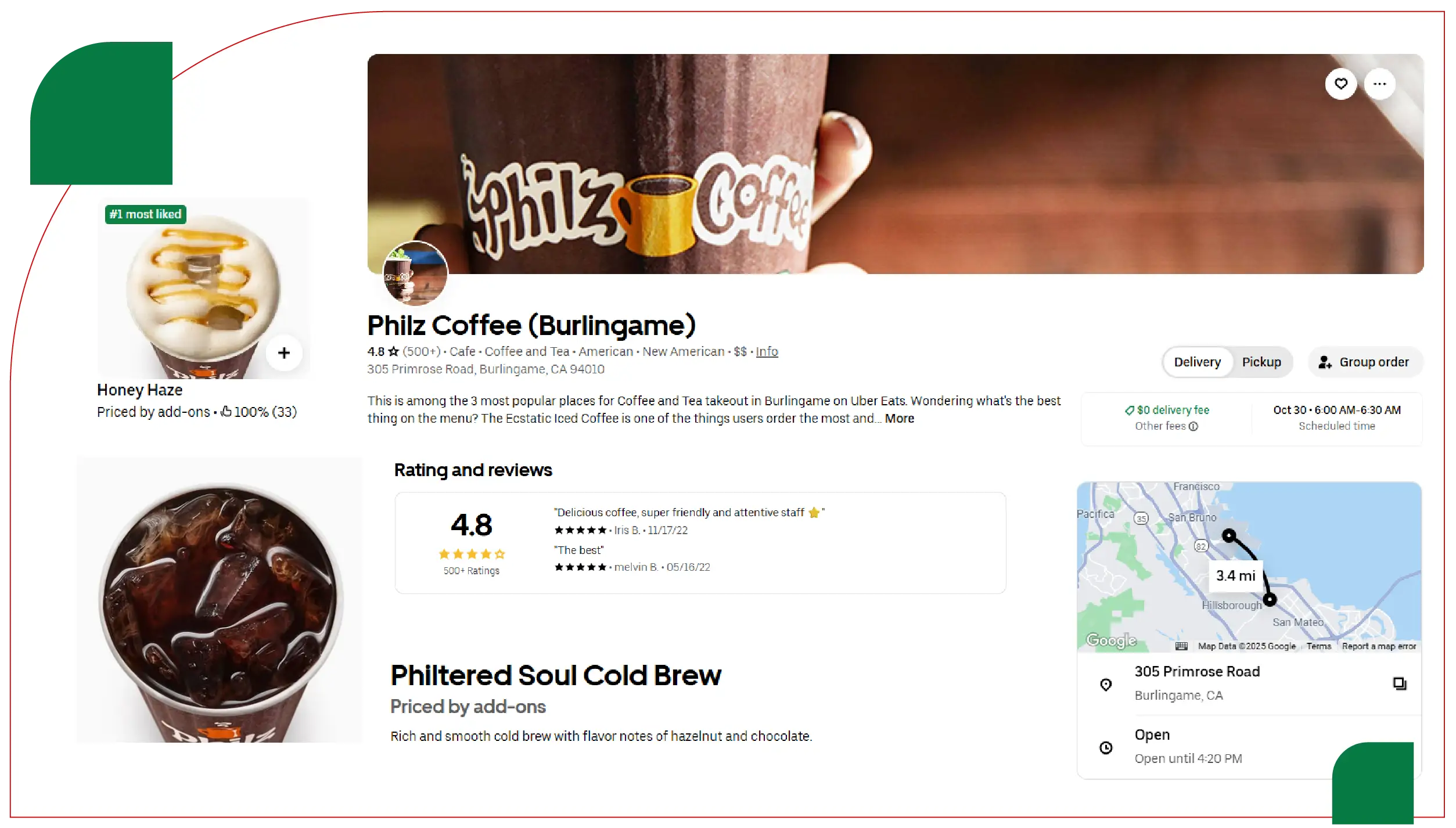

- Restaurant menus and café listings

- Food delivery platforms and quick-commerce apps

-

Data Extraction Techniques

Using Python-based scrapers and cloud-supported APIs, structured data was extracted in real time. Parameters included:

- Beverage name and type

- Flavor category and ingredients

- Average consumer price

- Popularity trends (based on frequency of listings)

This process also utilized a method to Scrape Top Beverage Industry Insights 2025 to capture contextual patterns such as seasonality, consumer demographics, and distribution channel variations.

-

Data Normalization

Collected datasets were normalized using standard beverage categories (coffee, tea, juice, alcohol, water, etc.) and enriched with metadata like country, vendor type, and consumer ratings.

-

Data Analysis

Our analysis focused on detecting demand fluctuations and identifying flavor patterns. Quantitative insights were visualized using time-series data, while qualitative content from menus and descriptions provided consumer sentiment mapping.

-

Validation

Extracted data underwent multi-source cross-verification to ensure accuracy. Anomalies and duplicates were removed through fuzzy matching and weighted scoring systems.

Key Observations from Beverage Data Scraping

- Wellness and Functionality Dominate: Functional drinks like kombucha, golden milk, and herbal waters are outperforming traditional categories.

- Caffeine Reimagined: Nitro coffee and matcha lead new “clean energy” beverage innovations.

- Zero-Proof Movement: Non-alcoholic cocktails and spirits are expanding fast among Gen Z and Millennial demographics.

- Hybridization of Flavors: Botanical, fermented, and savory profiles are blending into both alcoholic and non-alcoholic segments.

- Sustainability-Driven Choices: Oat and plant-based milks continue their growth in the dairy-alternative sector.

| Rank |

Beverage Trend |

Primary Consumer Motivation |

Average Price (USD) |

Market Growth (YoY %) |

| 1 |

Cold-Brew Tea |

Wellness & Hydration |

3.5 |

45% |

| 2 |

Functional Sparkling Water |

Energy & Clarity |

2.8 |

51% |

| 3 |

Nitro Coffee |

Clean Energy |

4.2 |

36% |

| 4 |

Oat & Plant-Based Milks |

Sustainability |

3.1 |

41% |

| 5 |

Kombucha Cocktails |

Gut Health & Social Drinking |

5.4 |

48% |

| 6 |

CBD-Infused Beverages |

Stress Relief |

6.0 |

38% |

| 7 |

Shrubs (Vinegar Drinks) |

Taste Experimentation |

4.5 |

33% |

| 8 |

Golden Milk Lattes |

Anti-Inflammatory |

4.0 |

29% |

| 9 |

Matcha Beverages |

Energy & Focus |

4.3 |

42% |

| 10 |

Botanical Tonics |

Premium Non-Alcoholic |

5.8 |

37% |

| 11 |

Non-Alcoholic Spirits |

Sober-Curious |

8.5 |

54% |

| 12 |

Bone Broth Drinks |

Protein & Recovery |

4.9 |

28% |

| 13 |

Spiced & Smoked Cocktails |

Culinary Experience |

9.0 |

32% |

| 14 |

Yerba Mate Drinks |

Natural Caffeine |

3.7 |

30% |

| 15 |

Hybrid Juices |

Nutrition & Taste |

3.2 |

25% |

Data Analysis and Insights

- The Rise of Functionality in Beverage Innovation - Functional drinks combining adaptogens, probiotics, and vitamins show the fastest growth. Web scraping reveals increased product descriptions using keywords such as energy, focus, and recovery across multiple beverage categories.

- Plant-Based and Sustainability Trends - Plant-based alternatives like oat and pea milk are seeing significant menu expansion, replacing dairy-based beverages. This aligns with sustainable consumption patterns observed across restaurant data obtained through process to Extract Beverage Consumption Trends in 2025.

- Flavor Complexity as a Differentiator - Flavor layering is central to beverage innovation. Data shows strong growth in beverages that blend sweet, umami, and floral elements—especially those tagged under smoked, matcha, and botanical profiles.

- Alcohol Alternatives and Zero-Proof Evolution - Scraped datasets highlight a 50% increase in non-alcoholic spirit listings. These beverages cater to sober-conscious consumers seeking social experiences without intoxication, reflecting the wider zero-proof movement.

- The Role of Cold and Ready-to-Drink (RTD) Formats - Demand for convenience is pushing cold-brew teas, nitro coffees, and pre-mixed functional drinks into mainstream grocery and online delivery platforms, supported by tools to Scrape Top Beverage Flavors Data 2025 analytics.

| Segment |

Share of Market (%) |

Avg. Growth Rate |

Example Drinks |

| Coffee-Based |

24% |

18% |

Nitro coffee, cold brew |

| Tea-Based |

18% |

22% |

Matcha, cold-brew tea |

| Alcoholic & Hybrid |

20% |

25% |

Kombucha cocktails, spiced drinks |

| Functional Wellness |

16% |

30% |

Golden milk, CBD drinks |

| Plant-Based Dairy |

12% |

20% |

Oat, almond milk |

| Energy & Herbal |

10% |

28% |

Yerba mate, herbal tonics |

Comprehensive Insights by Beverage Category

- Cold-Brew Tea - A leading wellness trend merging tea and hydration markets. Cold-brew teas are now standard in cafés and retail coolers due to their smooth, low-acidity profiles.

- Functional Sparkling Water - Beyond hydration, sparkling water now includes electrolytes and botanicals. Consumers view these as alternatives to alcohol, bridging health and pleasure.

- Nitro Coffee - Data indicates consistent year-over-year menu growth of nitro coffee, signaling its transition from niche to staple.

- Oat & Plant-Based Milks - Scraping data reveals a 41% menu growth, with oat milk appearing in both café menus and RTD beverages globally.

- Kombucha Cocktails - Combining probiotics and alcohol creates a functional twist to classic cocktails—an example of hybrid beverage innovation.

- CBD-Infused Beverages - CBD drinks are gaining popularity in urban centers, targeting relaxation and mood enhancement, particularly among Gen Z professionals.

- Shrubs (Vinegar Drinks) - These tangy beverages attract consumers who value artisanal, handcrafted drinks and digestive health.

- Golden Milk Lattes - Featuring turmeric and spices, these beverages merge functionality and indulgence, performing strongly in both café and grocery categories.

- Matcha Beverages - Matcha continues to expand beyond lattes into sparkling drinks and desserts. Its antioxidant and energizing benefits fuel consistent growth.

- Botanical Tonics - Florals and herbs like hibiscus and elderflower give non-alcoholic drinks an elegant, complex edge.

- Non-Alcoholic Spirits - Scraping reveals that zero-proof beverages are gaining shelf space in bars, particularly as consumer demand for moderation grows.

- Bone Broth & Sippable Soups - A savory alternative to sweet beverages, bone broth appeals to health-conscious consumers seeking protein and warmth.

- Spiced & Smoked Cocktails - These bold flavors highlight the trend of experiential drinking—turning beverages into sensory events.

- Yerba Mate & Herbal Energy Drinks - Herbal caffeine sources offer sustained energy without the crash, aligning with the clean-label trend.

- Hybrid Juices - The fusion of fruit and vegetable bases creates a balanced nutritional profile and a refreshing flavor spectrum.

Role of Data Scraping in Beverage Industry Forecasting

The beverage sector’s diversification demands advanced monitoring tools. Using method to Extract Real-Time Beverage Demand Data 2025, companies can track how beverage preferences shift across seasons, geographies, and demographics.

Integration with Food Delivery Data Scraping Services allows for the collection of menu-level data that reflects real-time consumption behaviors. This insight helps beverage brands align with what consumers are ordering and when.

Additionally, Restaurant Menu Data Scraping helps identify beverage innovation hotspots and cross-category collaborations (e.g., tea-cocktail hybrids).

By coupling these insights with Real-Time Food Delivery Scraping API Services, brands can instantly analyze demand fluctuations and promotional effectiveness.

Web Scraping Advantages

- Real-Time Market Tracking - Automated scraping enables real-time updates on beverage prices, menu inclusions, and regional flavor trends—empowering brands to stay ahead of competitors.

- Improved Product Development - Web-scraped datasets highlight what flavors or formats are gaining traction, guiding new beverage innovations aligned with consumer demand.

- Pricing Intelligence - Data extraction supports dynamic pricing models, ensuring that beverage companies optimize margins while remaining competitive across regions and delivery platforms.

- Consumer Sentiment Insights - Scraped reviews and menu mentions reveal evolving consumer perceptions, helping brands adjust marketing and communication strategies effectively.

- Strategic Forecasting - Historical trend data allows brands to predict seasonal surges and emerging beverage movements with higher accuracy.

Key Observations

- Cross-Category Blending: Tea-based cocktails, coffee tonics, and kombucha spirits represent hybrid beverage creativity.

- Sustainability Impact: Consumer preference for low-impact packaging and plant-based ingredients continues to grow.

- Functional Ingredients: Adaptogens, collagen, and probiotics are no longer niche—they’re mainstream.

- Digital Menu Transformation: Restaurants now update beverage menus dynamically, reflecting real-time availability and trends.

- Regional Specialization: Beverage scraping reveals unique market preferences—Asia leads in matcha, while North America favors functional sparkling waters.

Future Forecast and Opportunities

By 2026, personalization and bio-functional beverages will define the next growth wave. AI-enhanced data scraping tools will predict flavor trends and consumer behavior shifts.

Integrating beverage data with quick-commerce scraping systems will enable hyper-local product customization, ensuring better alignment between production and consumer interest.

Partnerships between beverage producers and digital data firms will likely intensify, leveraging predictive insights from structured datasets.

Conclusion

The insights derived from Web Scraping Top 15 Beverage Industry Trends 2025 reveal that beverage innovation is evolving faster than ever before. From cold-brew teas to zero-proof spirits, consumer demand is increasingly diverse and purpose-driven.

Businesses leveraging Liquor Price Web Scraping API Services can integrate real-time pricing and availability tracking into strategy dashboards. Similarly, Grocery Price Dashboard tools offer comparative pricing visibility across supermarkets and digital marketplaces.

Finally, adopting a Liquor Price Tracking Dashboard alongside beverage trend scraping allows producers, distributors, and retailers to make data-backed decisions, aligning innovation with market reality and consumer sentiment.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.