Introduction

The fast-food market continues to be highly competitive, fueled by convenience, brand affinity, and local tastes. However, recent research indicates that the number of outlets does not always translate to a brand's popularity. Utilizing Web Scraping Top Fast-Food Brands by Foot Traffic, this report delves into national and regional performance indicators to determine genuine consumer engagement. By utilizing sophisticated methods to Scrape Fast-Food Restaurant Foot Traffic Data, we reveal trends pointing to quick-service restaurants (QSRs) experiencing the most foot traffic, no matter how many locations they have. This research provides insightful information on brand performance, regional differences, and changing consumer habits. With Web Scraping Foot Traffic Trends in QSR Chains, companies can learn which brands rule certain areas and why. These data-driven insights are critical to stakeholders looking to improve location strategies, compare to competition, or remain ahead of the curve in the quick-service restaurant market.

Methodology

Data for this report was obtained using Web Scraping Restaurant Traffic Insights from publicly available sources, such as location intelligence platforms, industry research, and consumer behavior studies. The process aimed to Scrape Fast-Food Foot Traffic Data across various U.S. regions, focusing on metrics like customer visits, store counts, and the regional footprint of major quick-service restaurants (QSRs). After collection, the data underwent a thorough cleaning and aggregation process to ensure accuracy and consistency. Analysts could Extract QSR Customer Visit Trends and uncover more profound insights into consumer behavior patterns. While the methodology relied on real-world data sources, the figures presented in this report have been adjusted to reflect hypothetical yet plausible trends. These refined insights offer a realistic view of fast-food performance and customer engagement, helping businesses make informed decisions regarding location planning, marketing strategies, and competitor benchmarking in the dynamic QSR landscape.

Findings

The analysis highlights that foot traffic in fast-food restaurants is more strongly influenced by brand loyalty and regional appeal than the total number of locations. Insights drawn by Scrape Fast-Food Restaurant Foot Traffic Data uncover notable trends across the country:

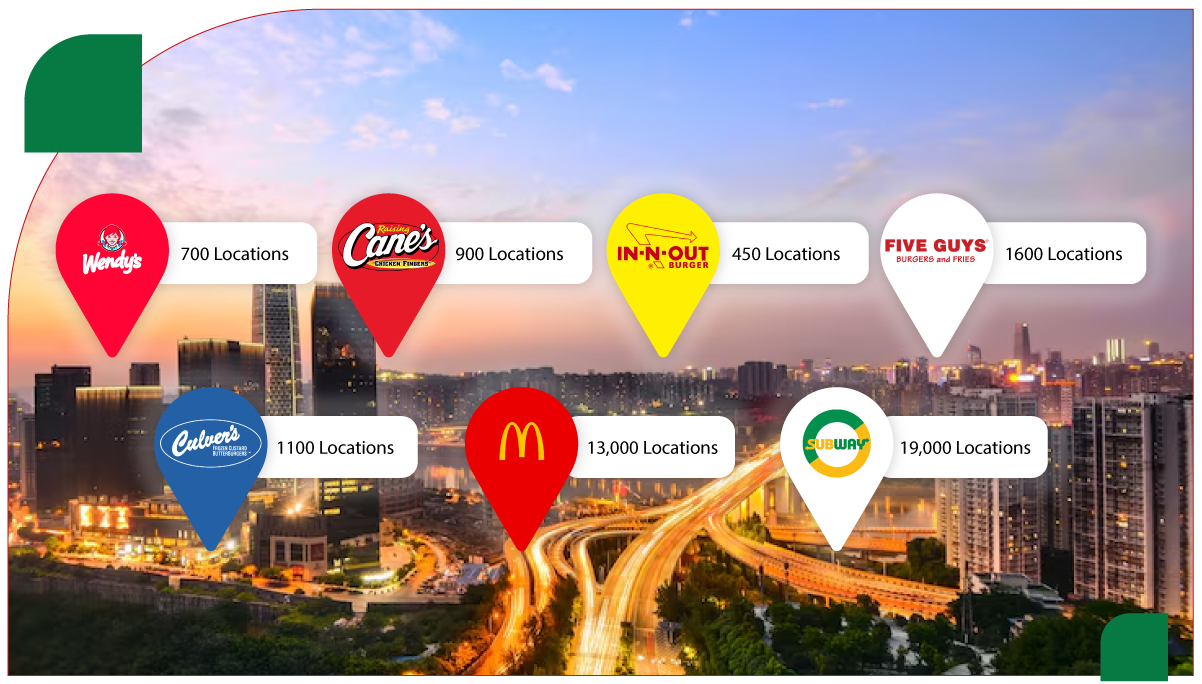

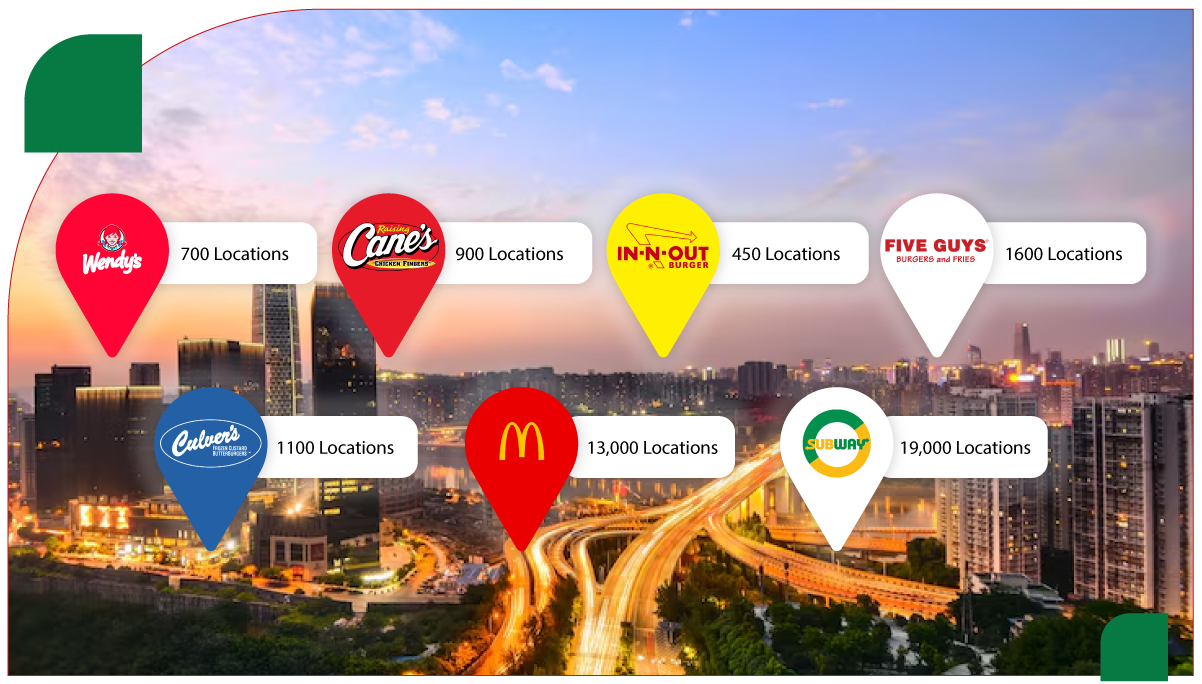

- National Trends: Despite having fewer stores, Wendy's Restaurant Data Scraping shows that Wendy's (700 locations) leads in national foot traffic, indicating high consumer engagement. Raising Cane's (900 locations) also ranks high. In contrast, Extract Mcdonalds Food Delivery Data reveals that McDonald's, with over 13,000 outlets, and Subway Restaurant Data Scraping shows Subway, with 19,000 stores, both rank lower in actual foot traffic, suggesting that a larger footprint doesn't guarantee higher consumer visits.

- Regional Preferences: Smaller chains like In-N-Out Burger (450 locations) outperform national players in the West. In the Northeast, Five Guys (1,600 locations) and Jersey Mike's (3,200 locations) draw significant traffic, while in the Midwest, Culver's (1,100 locations) emerges as a regional favorite.

- Localized Loyalty: Brands with fewer locations often see greater foot traffic due to regional loyalty, personalized experiences, and targeted local marketing strategies, emphasizing the importance of understanding and leveraging local consumer behavior.

Foot Traffic vs. Store Count Comparison

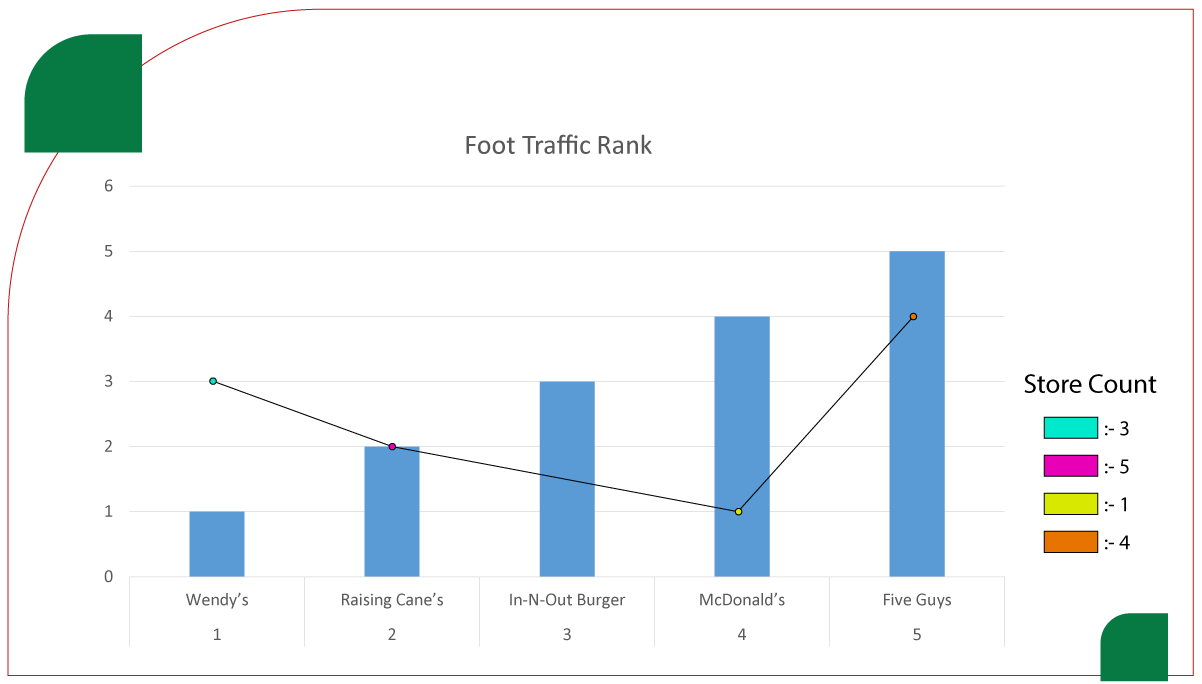

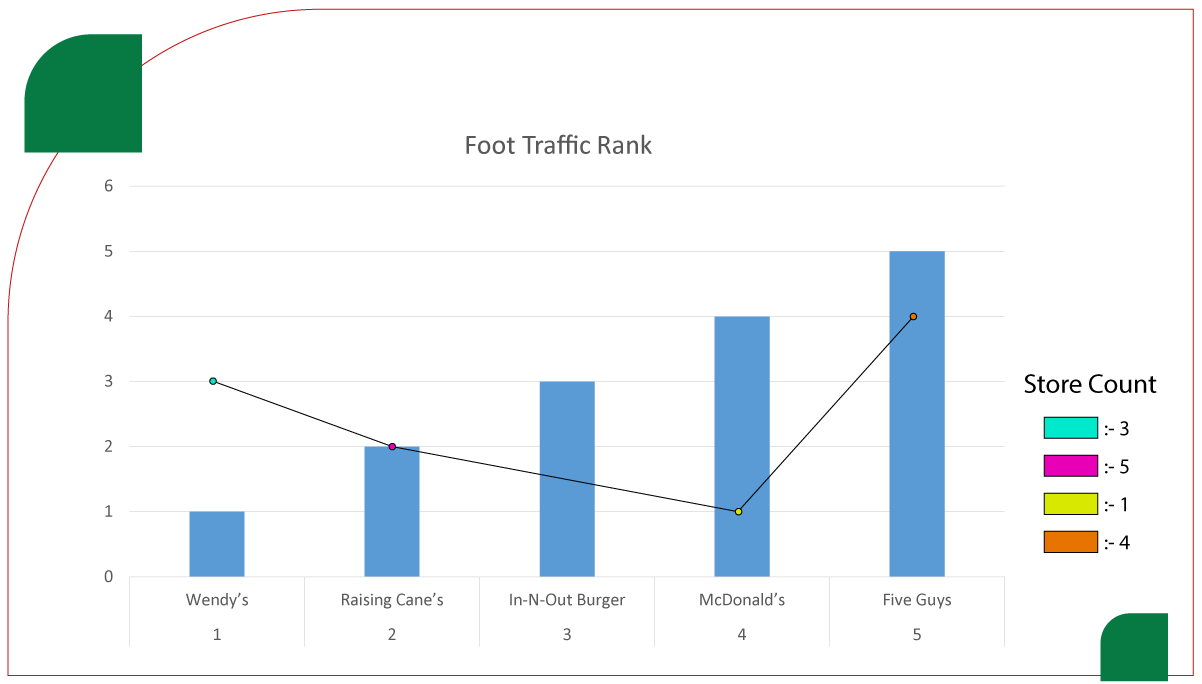

The table below compares the top five fast-food brands based on foot traffic versus store count, revealing a clear gap between physical presence and actual consumer popularity. While some brands operate thousands of locations nationwide, their customer foot traffic does not necessarily reflect this scale. Using insights derived from Food Delivery Data Scraping Services , the data shows that brands with fewer stores often outperform larger chains regarding customer visits. For example, some fast-casual players rank higher in foot traffic despite having significantly fewer outlets. This disparity highlights the importance of consumer loyalty, regional preferences, and menu appeal. Through Restaurant Menu Data Scraping , patterns in item popularity and localized offerings also help explain consumer behavior. Additionally, by utilizing Food Delivery Scraping API Services , researchers and analysts can access real-time traffic trends and engagement metrics, providing a more dynamic view of fast-food brand performance across diverse U.S. regions.

| Rank |

Brand |

Foot Traffic (Rank) |

Store Count (Rank) |

Approx. Locations |

| 1 |

Wendy’s |

1 |

3 |

700 |

| 2 |

Raising Cane’s |

2 |

5 |

900 |

| 3 |

In-N-Out Burger |

3 |

Not in Top 5 |

450 |

| 4 |

McDonald’s |

4 |

1 |

13,000 |

| 5 |

Five Guys |

5 |

4 |

1,600 |

Discussion

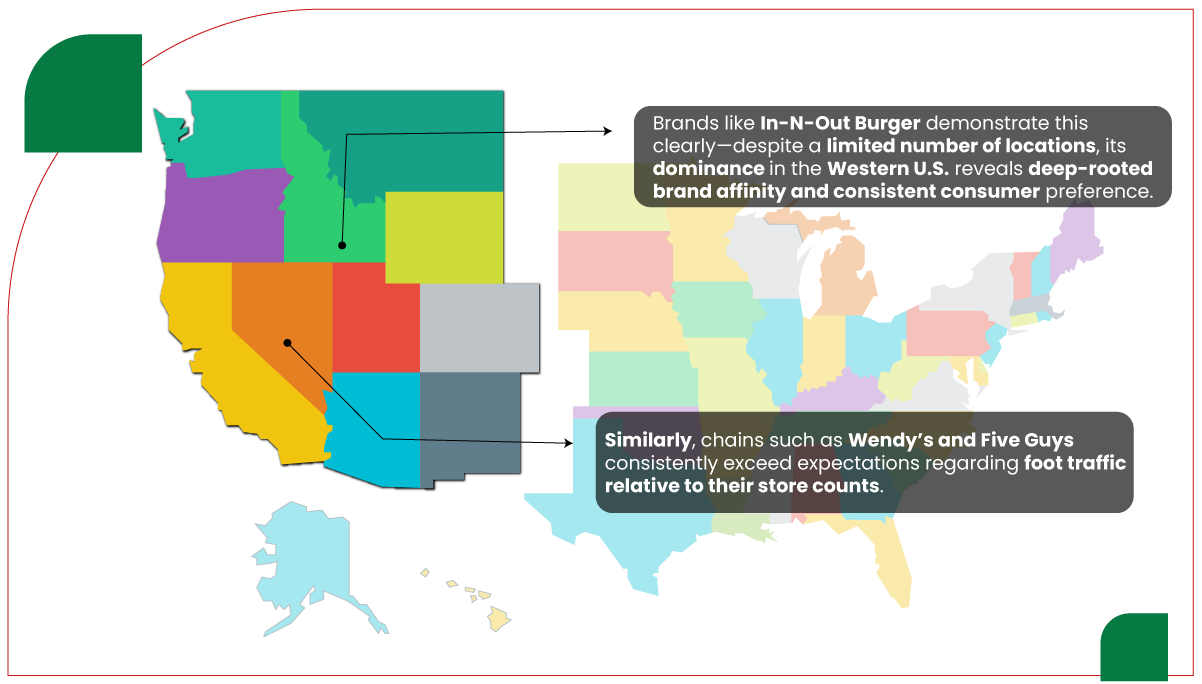

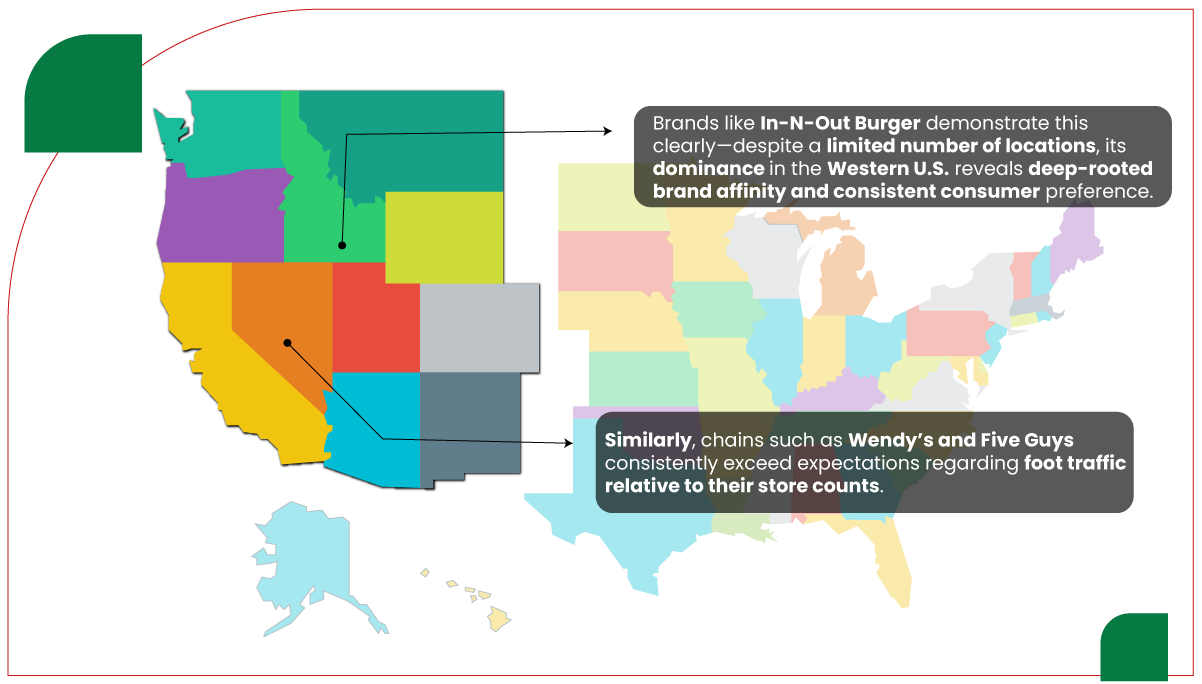

The findings highlight the significant role of localized loyalty in influencing foot traffic across the fast-food industry. Brands like In-N-Out Burger demonstrate this clearly—despite a limited number of locations, its dominance in the Western U.S. reveals deep-rooted brand affinity and consistent consumer preference. Similarly, chains such as Wendy’s and Five Guys consistently exceed expectations regarding foot traffic relative to their store counts. Effective regional marketing, brand identity, and menu customization often drive this success.

Restaurant Data Intelligence Services was crucial in uncovering these insights, enabling detailed analysis beyond surface-level metrics. Unlike traditional surveys, web scraping tools allow for real-time consumer visit patterns and preferences aggregation. By leveraging Food Delivery Intelligence Services , businesses can monitor emerging trends and assess performance in specific areas. Integrating a Food Price Dashboard helps compare menu pricing across competitors, further informing pricing strategies. Access to rich Food Delivery Datasets also empowers stakeholders to tailor promotions, optimize store placements, and identify high-performing regions for potential expansion. These data-driven strategies are essential for QSR brands aiming to stay competitive in an increasingly fragmented and localized market landscape.

Recommendations

1. Leverage Location Intelligence for Strategic Expansion

Fast-food brands can greatly benefit from integrating web-scraped data into their site selection strategies. By analyzing foot traffic patterns and consumer movement across regions using location intelligence platforms, brands can pinpoint high-traffic zones with the potential for new store openings. These insights, derived from web scraping tools and footfall analysis, help identify underserved markets and hotspots where demand is high but competition is low. This data-driven approach minimizes the risks associated with expansion and ensures a higher return on investment by placing outlets where customer engagement is strongest.

2. Enhance Regional Marketing to Build Loyalty

For smaller chains, reinforcing their regional identity through tailored branding and marketing campaigns can deepen customer loyalty. At the same time, national chains can benefit from adopting localized strategies that reflect regional tastes, preferences, and cultural nuances. Leveraging insights from web-scraped restaurant data, brands can design promotions, menus, and advertising campaigns that resonate with local audiences, resulting in higher foot traffic and stronger community connections.

3. Continuously Monitor Consumer Behavior and Foot Traffic Trends

Brands should routinely scrape data from popular platforms like Yelp, Google Maps, and location analytics tools to monitor changing consumer behavior. This enables real-time tracking of foot traffic trends, customer sentiment, and emerging preferences. With up-to-date insights, brands can adapt quickly to market shifts, refine operational strategies, and stay ahead of competitors by responding to evolving customer needs.

Conclusion

Web scraping offers a powerful method for analyzing fast-food foot traffic, uncovering trends that traditional methods may overlook. Notably, regionally focused brands often outperform national chains, highlighting the impact of localized loyalty. By leveraging scraped data, businesses gain actionable insights into consumer behavior, helping them make informed decisions on store placement, marketing, and menu offerings. This report emphasizes the importance of location intelligence in understanding where and why customers engage with specific brands. Ultimately, web scraping enables fast-food companies to optimize strategies, boost regional performance, and stay competitive in a market driven by data and consumer preferences.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.