Introduction

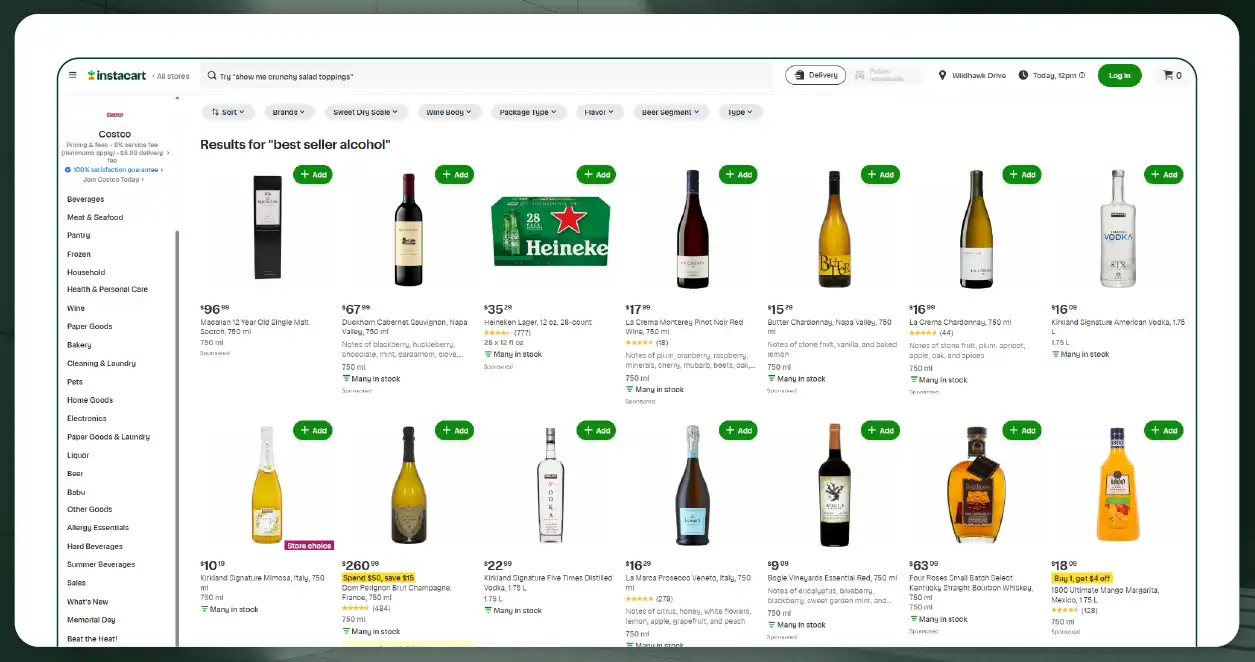

Data has rapidly grown from mere information to a strategic resource, particularly in the dynamically trending online grocery space, as more consumers switch to online platforms to fulfill their basic needs. Instacart has become a formidable player in grocery and liquor delivery across North America, and businesses recognize the great value in efforts to Extract Instacart Top-Selling grocery and Liquor Data to get a picture of what consumers are buying, when they are doing it, and many other valuable attributes.

From staples like organic milk and oatmeal to relaxing weekend specials like Wine and Tequila, high-performing products on Instacart create an obvious window into consumer habits and retailer positioning. Retailers, FMCG, and beverage distributor stakeholders utilize these insights from Extracting Instacart grocery & liquor data to position merchandising, optimize pricing, develop a product mix, change promotional options, etc.

In addition to Scraping Instacart's Trending Grocery & Liquor Data, companies can also gain insights by scraping preferred product offerings from the consumer platform. This allows them to stay a day, week, or month ahead of what's trending by season, region, and changing consumer choices related to dietary options and lifestyles. With efforts to Scrape Top-Rated Grocery & Alcohol Data from Instacart, businesses are gaining valuable sentiment considerations on Instacart's top-rated grocery and liquor data. The intent is to define sentiment to enhance the company's competitiveness within a rapidly changing and evolutionary marketplace for retailers or businesses through providing insight into their overall retail intelligence.

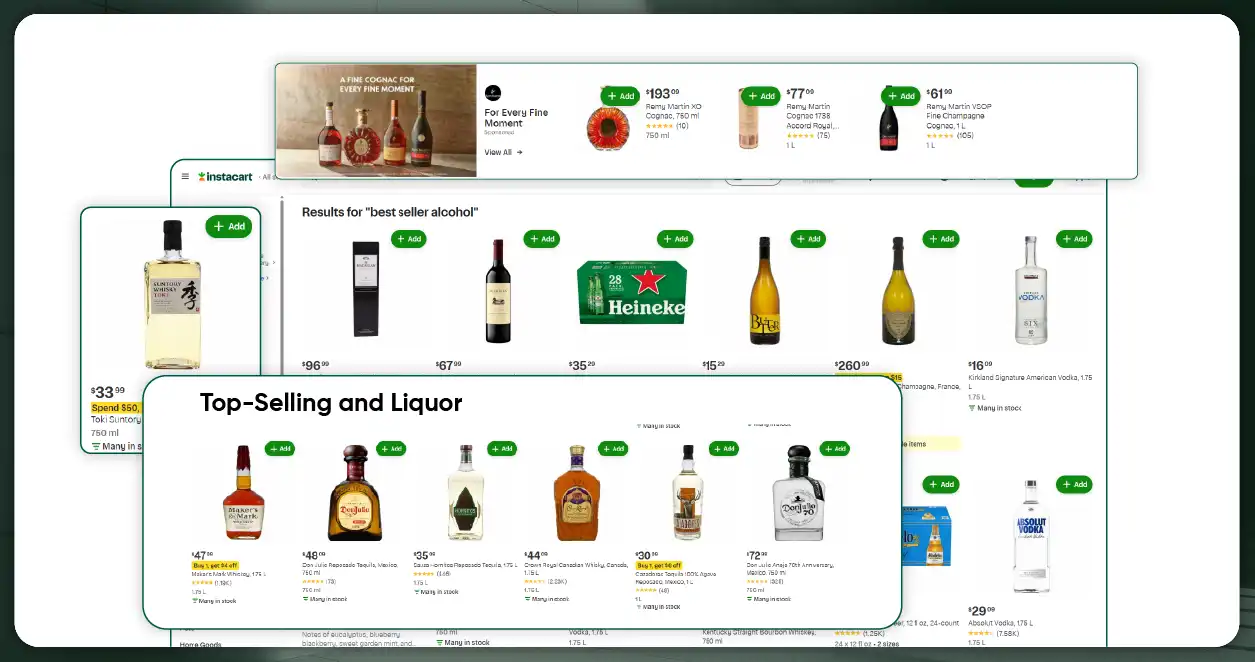

Liquor Data: Uncovering Premium Consumer Behavior

The liquor segment within Instacart's ecosystem provides a unique window into premium consumer habits. Top-selling liquor items often vary by location, day of the week, and time of year. Analyzing these fluctuations helps brands understand:

- Preferred alcohol types (whiskey vs. vodka vs. wine).

- Shifts toward craft or local brands.

- Effects of pricing tiers on purchase volumes.

- The impact of digital promotions and seasonal bundling (e.g., wine + cheese kits).

For alcohol brands, distributors, and analytics firms, this granular liquor data can shape targeted campaigns, store promotions, and localized delivery strategies.

Why Instacart Data Holds Strategic Value?

Instacart partners with over 1,400 retailers and delivers from more than 80,000 stores across 14,000 cities in the U.S. and Canada. This scale means that the top-selling products on Instacart offer a representative snapshot of consumer behavior in real time. Extracting Fast-Moving Grocery and Liquor from Instacart allows businesses to access rich, up-to-date insights into what customers purchase most frequently across multiple locations. By Scraping Instacart's Trending Grocery and Liquor Items, businesses can tap into valuable trends in categories such as dairy, snacks, beverages, pantry essentials, and liquor. This data empowers companies to:

- Benchmark product performance.

- Understand seasonal or regional buying patterns.

- Track brand popularity and promotional effectiveness.

- Build product assortments that reflect actual market demand.

Whether you're a beverage startup, a retail chain, or an AI company building a recommendation engine, access to the Instacart Grocery Store Dataset enhances forecasting, pricing strategy, and supply chain agility. This real-time data foundation equips companies to respond faster, plan better, and align more closely with shifting consumer preferences.

Why Does Extracting Instacart's Best-Selling Product Data Matter?

Instacart services over 600 retailers and 80,000+ stores, offering consumers access to a vast selection of groceries and alcoholic beverages. This massive footprint makes it a rich resource for understanding national and regional product demand. Businesses that extract this data gain insights into which products are trending, which brands are leading, and how consumer sentiment shifts in real-time.

- Real-Time Market Pulse: Extracting top-selling data offers a live feed into market dynamics. It helps companies track sales velocity and see what consumers purchase most often across different times, like holidays, weekends, or major sporting events. For example, a surge in beer and chips around the Super Bowl or a spike in wine sales during Thanksgiving is valuable data for marketing alignment and inventory forecasting. Businesses that Scrape Online Instacart Grocery Delivery App Data gain an immediate edge by reacting to these fast-changing demand signals in real time.

- Hyperlocal Product Trends: Instacart operates in thousands of cities across the U.S. and Canada, and product trends vary by location. While oat milk might be a top seller in San Francisco, traditional whole milk could dominate in smaller Midwestern towns. Extracting localized top-selling product data enables hyper-targeted marketing, personalized ad campaigns, and regional stock optimization. With Instacart Grocery Delivery Scraping API Services, retailers and CPG brands can capture city-specific and zip-code-level purchase data to fine-tune strategies and deliver more relevant consumer experiences.

- Strategic Brand Benchmarking: Knowing how consumer goods manufacturers and private label brands rank against competitors is crucial. By analyzing Instacart's top-selling product data, companies can benchmark their performance, identify whitespace opportunities, and adjust product attributes like size, packaging, or bundling based on what resonates with customers. This intelligence, enabled by Grocery App Data Scraping Services, supports informed decisions around marketing investments, product innovation, and competitive pricing.

- Consumer Behavior Analysis: Tracking Instacart's most purchased items over time helps analysts observe behavior patterns. For instance, if a growing number of consumers choose gluten-free or plant-based grocery items, it signals a shift in dietary preferences. In the liquor category, the rising popularity of hard seltzers and low-ABV drinks tells a story of changing drinking habits. Leveraging Web Scraping Quick Commerce Data gives brands a forward-looking view into these evolving trends, enabling them to adapt faster than traditional retail methods ever could.

Unveiling Instacart's Grocery Trends

Instacart's grocery category spans fresh produce, pantry staples, beverages, frozen goods, snacks, dairy products, baked items, and more. Understanding what's trending within each subcategory unlocks insights for different types of stakeholders:

- For Food Retailers: Top-selling grocery data helps them prioritize high-performing SKUs in their inventory, align promotions with in-demand items, and optimize their online and physical assortment mix.

- For CPG Brands: From cereal and pasta to frozen meals and condiments, packaged food brands gain clarity on which flavors, sizes, and packaging formats perform best. They can use this intelligence to fine-tune innovation strategies and plan product rollouts that match consumer expectations.

- For Nutritionists and Health Tech Companies: Grocery purchase trends reflect broader health trends. A spike in protein bars, keto snacks, or organic produce suggests a rising consumer interest in health and wellness. Health-focused platforms and meal planning apps can align their offerings accordingly.

- For Supply Chain Managers: Understanding the velocity of top-selling grocery items helps forecast demand and reduce stockouts or overstocks. Efficient supply chain planning leads to lower operational costs and better customer satisfaction.

Unlock powerful retail insights—partner with us to extract Instacart's top-selling grocery and liquor data today!

The Liquor Lens: Extracting Alcohol Trends from Instacart

Unlike physical liquor stores with regional limitations, Instacart's liquor category offers a unique perspective into nationwide consumption patterns. With more states legalizing alcohol delivery, extracting this data offers even more value.

- Consumer Preferences in Real Time: The data showcases changing consumer preferences, from top-selling vodkas and whiskeys to trending craft beers and ready-to-drink cocktails. It offers alcohol distributors and beverage companies the clarity needed to develop products in emerging niches like hard kombucha, low-sugar wines, or non-alcoholic alternatives.

- Seasonal and Event-Based Trends: Alcohol consumption data spikes during certain seasons and events. By analyzing what liquor products are top sellers during summer barbecues, winter holidays, or events like St. Patrick's Day, brands can better align production, marketing, and distribution strategies.

- Brand Loyalty and Switching Behavior: Is Tito's still dominating the vodka category? Are younger consumers switching from beer to canned cocktails? Extracting Instacart liquor data reveals loyalty trends, cross-brand switching, and emerging challengers in a saturated market.

- Price and Volume Analysis: Are consumers favoring premium spirits or sticking to budget-friendly options? Data on top-selling price points and package sizes helps brands identify what sells in which income segments, making it easier to create localized offers and optimize profit margins.

How Businesses Use Top-Selling Data Strategically?

The utility of extracting Instacart's top-selling grocery and liquor data goes far beyond curiosity—it forms the basis for multi-dimensional strategies. Here's how various industries leverage it:

- Competitive Intelligence Teams: They use this data to compare brand share, pricing trends, and customer ratings across thousands of products. This information supports Grocery Pricing Data Intelligence, pricing strategies, product differentiation, and category planning. With insights from live platforms like Instacart, competitive teams can detect early signals and adjust quickly to shifting market dynamics.

- Marketing and Media Agencies: Agencies harness Instacart trend data to develop content calendars, influencer campaigns, and promotional offers that align with consumer behavior. It's data-driven storytelling at its best, backed by real Grocery Store Datasets that reflect the products shoppers engage with and buy the most.

- Product Development Teams: For innovation teams, seeing what flavors, ingredients, and product formats are flying off Instacart's shelves offers inspiration for new product development (NPD). It reduces reliance on gut-feeling innovation and grounds it in data-backed consumer demand.

- Retail Buyers and Merchandisers: Grocery chains and independent retailers often need to decide which products to stock. By referencing what's selling well on Instacart, they reduce the risk of introducing poor performers and increase shelf turnover.

- Alcohol Brands and Distributors: Distributors can plan delivery routes, promotions, and partnerships based on top liquor SKUs. New brands can also identify gaps or underserved categories in the alcohol segment and use that insight to enter the market strategically.

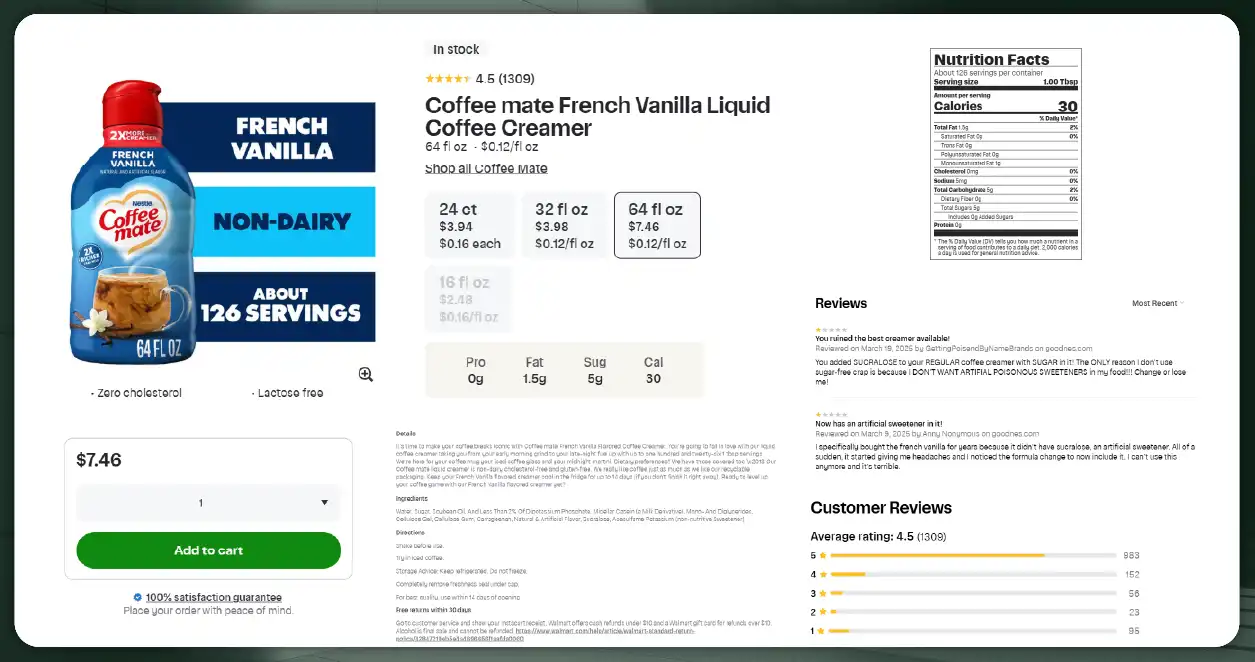

Going Beyond Top-Sellers: Data Pairing for Richer Insights

Extracting top-selling data from Instacart becomes even more powerful when paired with other data points:

- Ratings and Reviews: Add consumer sentiment to sales figures to understand the "why" behind a product's popularity.

- Price and Discount Tracking: Evaluate whether sales are driven by promotions or sustained brand loyalty.

- Basket Analysis: Understand what products are frequently bought together, which can fuel bundling strategies.

- Store-Level Trends: Analyze sales by retailer (e.g., Costco vs. Safeway vs. Kroger) to understand retailer-specific dynamics.

This holistic view gives businesses an advanced intelligence layer for precision decision-making.

How Food Data Scrape Can Help You?

- Real-Time Market Visibility: Our scraping solutions deliver live insights into top-selling grocery and liquor products, helping you respond instantly to changing consumer demands, seasonal shifts, and emerging trends.

- Competitor Benchmarking: We provide access to detailed competitor data—including pricing, product availability, and promotions—enabling you to fine-tune your strategies and maintain a competitive edge.

- Localized Consumer Insights: By extracting data across different regions and cities, we help you understand localized buying patterns, allowing for more innovative inventory planning and hyper-targeted marketing campaigns.

- Smart Pricing Optimization: Our services power intelligent pricing strategies through up-to-date product and pricing data from platforms like Instacart, helping you remain price competitive while maximizing margins.

- Data-Driven Innovation: Access to accurate and structured data allows you to identify product gaps, forecast demand, and innovate faster, whether launching a new SKU or expanding into new markets.

Conclusion

In the fast-paced world of digital grocery and liquor sales, shelf space is no longer physical—it's digital and driven by algorithms, consumer behavior, and data insights. Grocery Delivery Scraping API Services now play a critical role in accessing and interpreting this evolving landscape.

Extracting Instacart's top-selling grocery and liquor data isn't just a technical task—it's a strategic imperative. Businesses equipped with a Grocery Price Dashboard can visualize category trends, price shifts, and top performers across thousands of SKUs in real time. It enables businesses to get closer to the consumer, faster than ever before. Leveraging a Grocery Price Tracking Dashboard ensures companies stay informed about competitor pricing, promotional shifts, and regional preferences.

Whether you're a startup launching a new organic snack, a legacy liquor brand evaluating your position in the market, or a data analyst trying to predict the next big food trend, tapping into Instacart's live sales pulse opens a gateway to more brilliant, sharper business strategy. With the correct data, the future of retail becomes predictable and profitable.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.